Canopy Growth Corp. Stock PricesThis shows the stock prices of Canada's largest medical marijuana company.

Health

Canopy Growth Corp. Stock Prices This tracks Canada's largest medical marijuana company's stock prices.

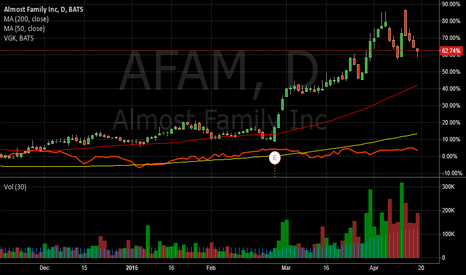

Almost Family Does 38.2% RetracementAlmost Family has done a 38.2% Fibonacci Retracement.

Almost Family has grown EPS by +1340% quarter over quarter, and EPS forecasts for this company are rising fast.

This company has had an EPS surprise for the last 8 quarters!

The company has an excellent P/S of 0.8.

The catalyst for growth is that Americans are living longer and that means more home health care services are needed.

According to a 2014 report by Transparency Market Research, the global home health care market is expected to explode to $303.6 billion in 2020, up from $176.1 billion in 2013, growing at a compound rate of more than 8% per year.

Source: www.guerillastocktrading.com

COKE - ShortShorting Coca-Cola bottling company.

Why?

Price is near 52 week high.

Recent strong rally in price, on no news.

Price stopped accelerating upward, slowing/stopping (bulls are done).

Consumer sentiment for sugary beverages continues to fall.

Biggest sales are Europe which is currently burning the Euro.

Price targets

* 100

* 91

I'm not confident on the price targets, but I am fairly confident on the overall direction turning from up to down.

US Market Sideways to Downside Risk in 2015Intermarket Study for 2014

Utilities - XLU - and Health Care - XLV - Outperformed in 2014, and these two sectors saw the biggest % gains later in the year. Health Care and Utilities are considered economically insensitive sectors, and tend to outperform when the market is at risk of a pullback or a sideways markets. Historically, economically-sensitive sectors like consumer cyclical, industrial and energy stocks tend to outperform the stock market in a healthy uptrend.