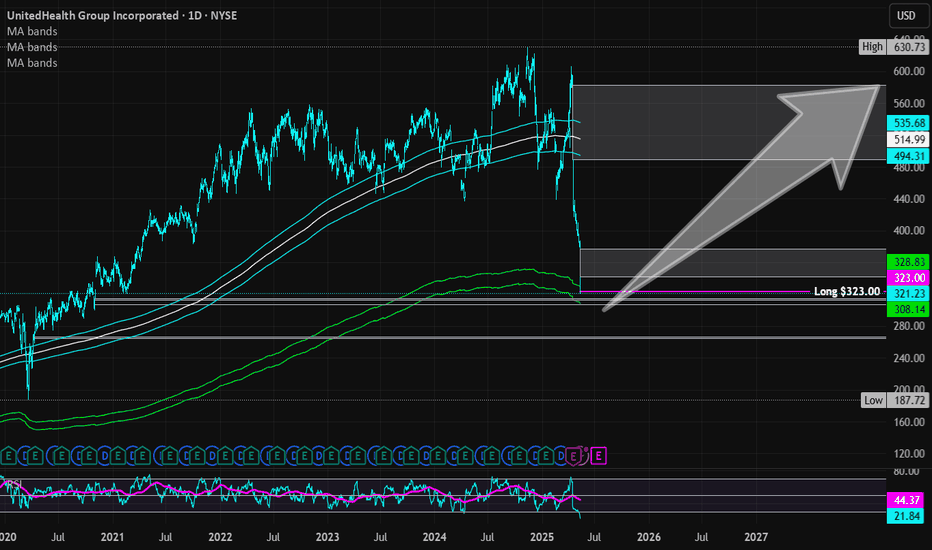

UnitedHealth Group | UNH | Long at $323.00UnitedHealth Group NYSE:UNH currently has a P/E near 15x, steady rising revenue (2024 = $400+ billion), EPS of 6.24x, dividend of 2.2%, and earnings are forecast to grow by 10.8% per year. The stock, however, has plummeted recently due to negative news, rising healthcare costs, CEO changes, and suspension of 2025 outlook. Every company has bumps, but I view solid companies like NYSE:UNH as pure opportunities for long-term investment - especially with America's aging population.

From a technical analysis perspective, the stock price has entered my "crash" simple moving average zone (which currently extends down near $307.00). Personally, this is the zone I am starting a position due to the odds of a future bounce from here. However, I am very aware that there is an open price gap near $265.00 that may get filled this year or early next. I could see a bounce in my crash zone to bring in the bulls and then a drop to that level to heighten the fear. That is another area I plan to grab more shares and build a strong position. But, in case it doesn't extend that low, I have started a position at $223.00, with future investments near $307.00 and below. I doubt this will be a quick turnaround stock - patience is where money is made.

Targets (into 2028):

$375.00

$475.00

$580.00

Healthcare

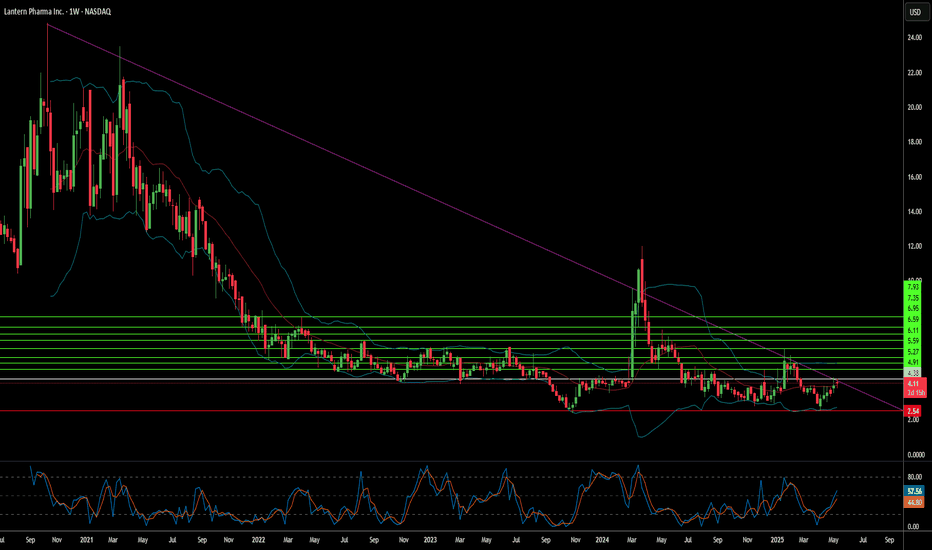

AI in Biotech: The Future of Cancer Therapy?Lantern Pharma Inc. is making waves in the biotech sector, leveraging its proprietary RADR® AI platform to accelerate the development of targeted cancer therapies. The company recently achieved significant milestones, including FDA clearance for a Phase 1b/2 trial of LP-184 in a difficult-to-treat non-small cell lung cancer (NSCLC) subset. This patient population, characterized by specific genetic mutations and poor response to existing treatments, represents a substantial unmet medical need and a multi-billion-dollar market opportunity. LP-184's mechanism, which selectively targets cancer cells overexpressing the PTGR1 enzyme, offers a precision approach aimed at improving efficacy while reducing toxicity.

LP-184's potential extends beyond NSCLC, having received multiple FDA Fast Track Designations for aggressive cancers like Triple-Negative Breast Cancer (TNBC) and Glioblastoma. Preclinical data support its activity in these areas, including synergy with other therapies and favorable properties like brain penetrance for CNS cancers. Furthermore, Lantern Pharma has demonstrated a commitment to rare pediatric cancers, securing Rare Pediatric Disease Designations for LP-184 in MRT, RMS, and hepatoblastoma, which could also yield valuable priority review vouchers.

The company's financial position, marked by strong liquidity according to InvestingPro data, supports its ongoing investment in R&D and its AI-driven pipeline. While reporting a net loss reflecting these investments, Lantern Pharma anticipates key data readouts in 2025 and actively seeks further funding. Analysts view the stock as potentially undervalued, with price targets suggesting future growth. Lantern Pharma's strategy of combining advanced AI with a deep understanding of cancer biology positions it to address high-need patient populations and potentially transform oncology drug development.

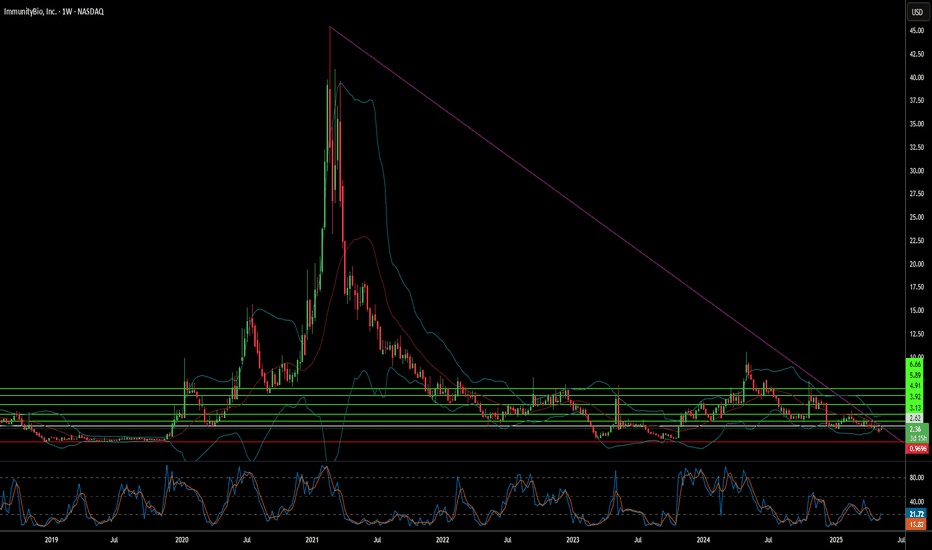

ImmunityBio: Catalyst for a New Era?ImmunityBio, Inc. is rapidly emerging as a significant force in the biotechnology sector, propelled by the success and expanding potential of its lead immunotherapy asset, ANKTIVA® (nogapendekin alfa inbakicept-pmln). The company achieved a pivotal milestone with the FDA approval of ANKTIVA in combination with BCG for treating BCG-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ. This approval addresses a critical need and leverages ANKTIVA's unique mechanism as a first-in-class IL-15 agonist, designed to activate key immune cells and induce durable responses. Building on this success, ImmunityBio is actively pursuing global market access, submitting applications to the EMA and MHRA for potential approval in Europe and the UK by 2026.

Beyond regulatory progress, ImmunityBio proactively tackles challenges in patient care, notably addressing the U.S. shortage of TICE® BCG. Through an FDA-authorized Expanded Access Program, the company supplies recombinant BCG (rBCG), providing a vital alternative source and expanding treatment access, particularly in underserved areas. This initiative supports patients and establishes a new market channel for ImmunityBio's therapies. Commercially, ANKTIVA's U.S. launch gains momentum, facilitated by a permanent J-code that simplifies billing and broadens insurance coverage, reaching over 240 million lives.

ImmunityBio's strategic vision extends to other major cancer types. The company is advancing ANKTIVA's potential in non-small cell lung cancer (NSCLC) through a confirmatory Phase 3 trial with BeiGene. This collaboration follows promising Phase 2 data demonstrating ANKTIVA's ability to rescue checkpoint inhibitor activity in patients who have progressed on prior therapies, showing prolonged overall survival. This highlights ANKTIVA's broader potential as a foundational cytokine therapy capable of addressing lymphopenia and restoring immune function across various tumors. ImmunityBio's recent financial performance reflects this clinical and commercial traction, marked by a significant revenue increase driven by ANKTIVA sales and positive investor sentiment.

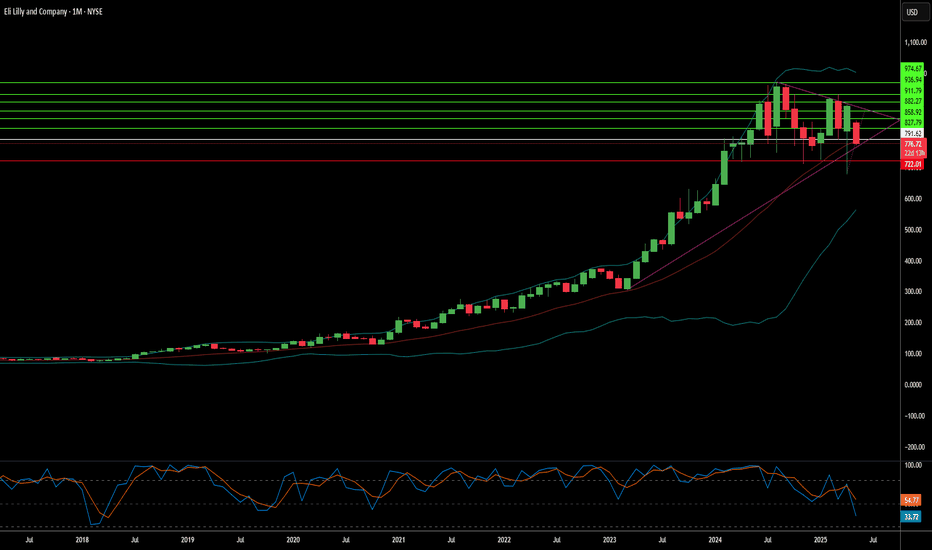

Can Lilly Redefine Weight Loss Market Leadership?Eli Lilly is rapidly emerging as a dominant force in the burgeoning weight loss drug market, presenting a significant challenge to incumbent leader Novo Nordisk. Lilly has demonstrated remarkable commercial success despite its key therapy, Zepbound (tirzepatide), entering the market well after Novo Nordisk's Wegovy (semaglutide). Zepbound's substantial revenue in 2024 underscores its rapid adoption and strong competitive standing, leading market analysts to project Eli Lilly's obesity drug sales will surpass Novo Nordisk's within the next few years. This swift ascent highlights the impact of a highly effective product in a market with immense unmet demand.

The success of Eli Lilly's tirzepatide, the active ingredient in both Zepbound and the diabetes treatment Mounjaro, stems from its dual mechanism targeting GLP-1 and GIP receptors, offering potentially enhanced clinical benefits. The company's market position was further solidified by a recent U.S. federal court ruling that upheld the FDA's decision to remove tirzepatide from the drug shortage list. This legal victory effectively halts compounding pharmacies from producing unauthorized, cheaper versions of Zepbound and Mounjaro, thereby protecting Lilly's market exclusivity and ensuring the integrity of the supply chain for the approved product.

Looking ahead, Eli Lilly's pipeline includes the promising oral GLP-1 receptor agonist, orforglipron. Positive Phase 3 trial results indicate its potential as a convenient, non-injectable alternative with comparable efficacy to existing therapies. As a small molecule, orforglipron offers potential advantages in manufacturing scalability and cost, which could significantly expand access globally if approved. Eli Lilly is actively increasing its manufacturing capacity to meet anticipated demand for its incretin therapies, positioning itself to capitalize on the vast and growing global market for weight management solutions.

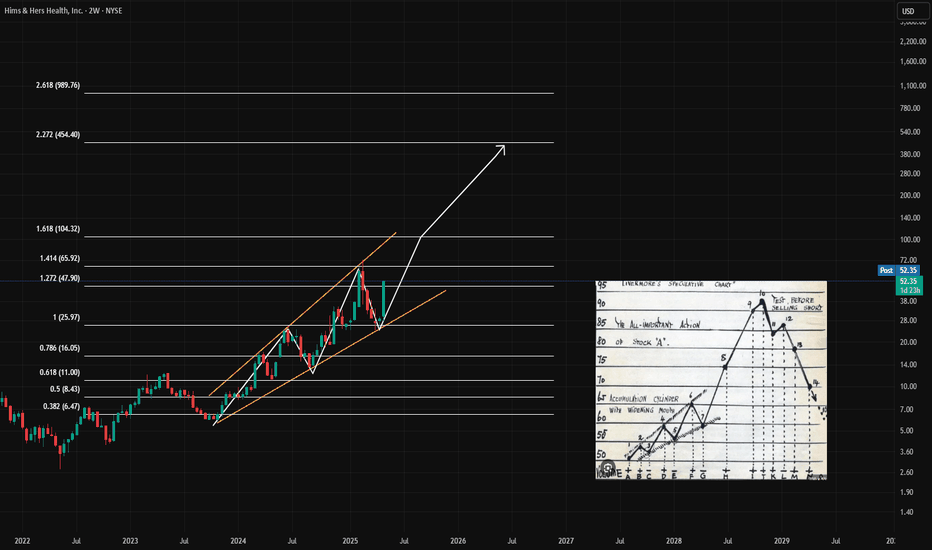

$OSCR is BREAKING OUT! 82% UPSIDENYSE:OSCR is BREAKING OUT! 82% UPSIDE

Oscar crushed recent earnings and now is getting the attention then deserve!

They are massively undervalued and a disruptor of the health insurance industry.

$15 Falling Wedge Breakout =

$28 Measured Move (MM)

Not financial advice

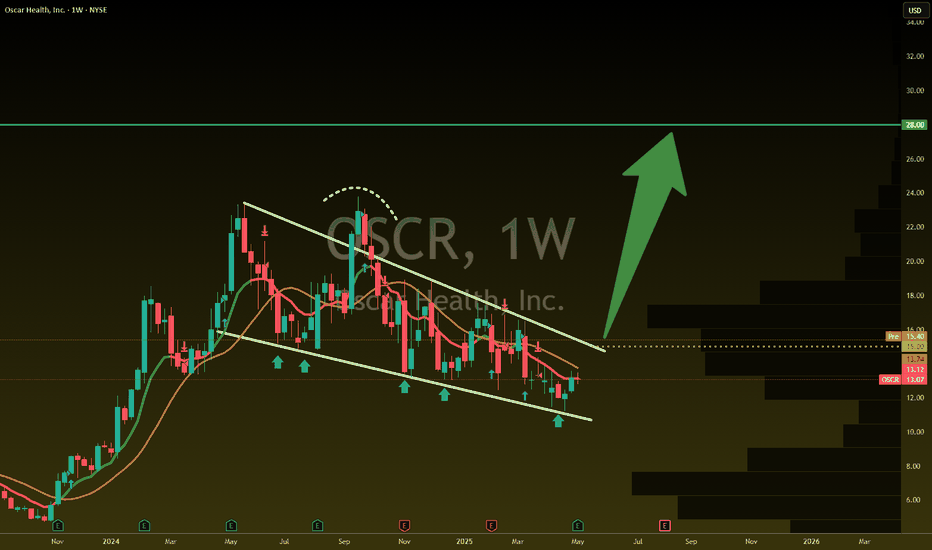

MODERNA $305 | Bidding at $220 and $150 Informed Players and speculators at Sub $100 levels are booking gains

we wait for additional drwadowns and re accomodation ACCUMULATION of designated Bankers for the next run up OR cycle

Vaccine COViD was intense HiV was the sell on News..

we await next Drama and Biden Policy on Healthcare etc..

for now Watch or Chrun at key leves (eyeball the box)

Acadia Healthcare Company | ACHC | Long at $21.98Acadia Healthcare's NASDAQ:ACHC stock has fallen nearly -76% in a year, primarily due to weak 2024 results, missed revenue and EPS expectations, and a soft 2025 revenue guidance. Ongoing federal investigations into billing practices and lawsuits have further eroded investor confidence. However, it is currently trading at a price-to-earnings ratio of 7.42x and earnings are forecast to grow 7.07% per year. The profitable company is trading at a good value compared to other healthcare companies. Debt-to-equity is relatively low (0.64x), but legal risks (DOJ probe, lawsuits) strain margins.

The stock has entered my "major crash" simple moving average territory and there is a lot of downward / selling pressure. But, more often than not, this area (which... I caution... still extends down near $16) can often signal a temporary or longer-term bottom. Personally, this is a buy area ($16-$21) even if it turns into a short-term bounce in 2025. But I believe the overall market moves in the S&P 500, etc. will guide this stock more than anything at this point (unless more bad news about the company emerges).

One thing to note is that there are open price gaps on the daily chart near $17, $10, and $8. These gaps, which often (but not always) get closed in the lifetime of a stock, are a potential signal for further declines - at least at some point. There could be a drop near $16, then a $10-$20 bullish price increase after that, followed by more declines (trapping investors). Time will tell, but NASDAQ:ACHC is currently attractively valued. From a technical analysis standpoint, it is in a personal "buy zone", even if purely for a swing trade.

Targets:

$27.00

$33.00

$39.00

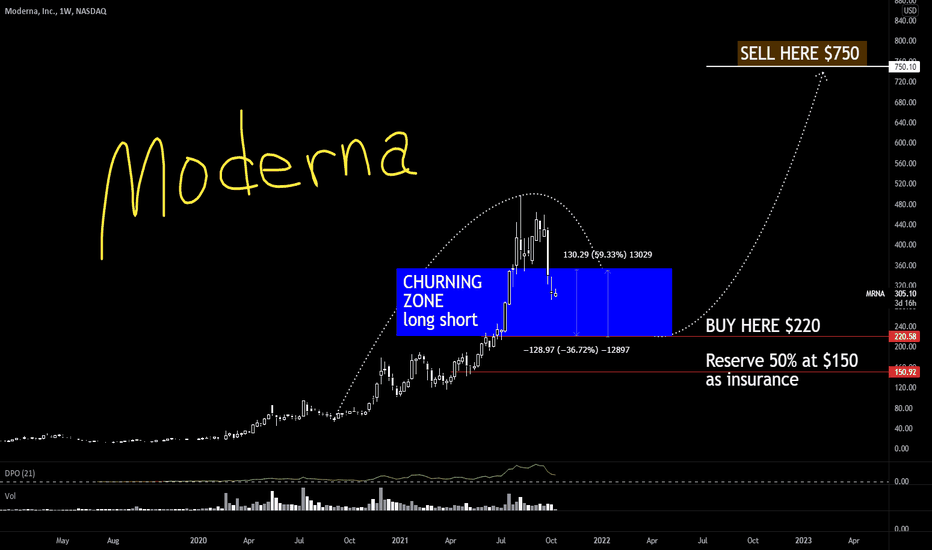

AGL (Long) - Bucking the overall market trendAs I was scrolling through many many charts, I realized its very difficult these days to find a stock that trades on its own accord, without copying the (very volatile) path of the overall market. But I managed to find one which showed almost no correlation to the recent frenzy - NYSE:AGL

Fundamentals

The underlying fundamentals of NYSE:AGL are difficul t to say the least, though getting better - hence the recent bump in the share price on the back of a few upgrades from analysts

With a P/S of 0.4 we can confidently say the valuation is low, but we can't really blame the investors for taking the share price down - despite an amazing growth rate (from 4.3bn in 2023 to 6bn in 2024), the firm is unable to keep its costs and cash position in check

With 6bn in revenue , the firm wasn't able to turn a positive gross profit(!)

So, I wouldn't look at it yet as a long-term play, though if the firm can put its finances in order, it could be a large player in the definitely-not-getting-smaller space of senior healthcare

But the short-term momentum is intruiging

Technicals

First thing to note is that fascinating bifurcation from the broader market (see the relative strength indicator on the weekly); NYSE:AGL was nicely treading 6% higher today while AMEX:SPY was bleeding 7% - I appreciate stocks like that during these volatile days

Plus,it has momentum - a couple of upgrade sent the stock surging and there is a gap to fill, which I would like to take advantage off

Other than that, it doesn't really scream buy, so I am not going to sell it as a high-conviction play (no usual accumulation patterns :/) - I am currently looking at it as a diversification play with a momentum tailwind

Trade

I bought it on the recent pop higher and plan to hold until it breaks the little bottom it created after it surged (red line)

I don't plan to marry the stock for longer, I will give it one chance and if it breaks, then I retreat - potential holding time is about a month , or about 5 U-turns in the US tariff policy

The stock can be still entered with the same stop/loss but a slightly worse risk/reward

Follow me for more analysis & Feel free to ask any questions you have, I am happy to help

If you like my content, Please leave a like, comment or a donation, it motivates me to keep producing ideas, thank you :)

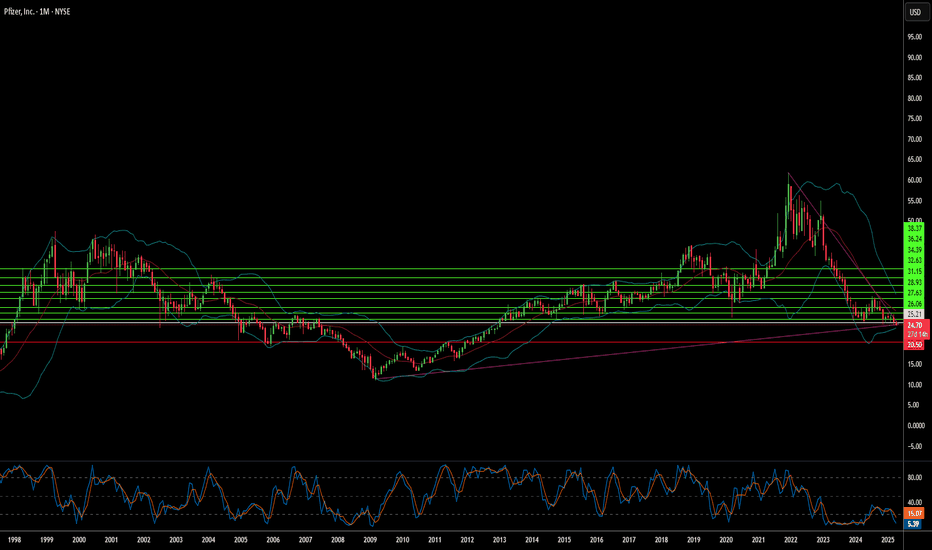

The Collaborative Edge: Pfizer's Innovation Secret? Pfizer's success in the biopharmaceutical industry hinges on its internal capabilities and a strategic embrace of external collaboration. This proactive approach, spanning diverse technological frontiers, fuels innovation across its operations. From partnering with QuantumBasel and D-Wave to optimize production planning using quantum annealing, to collaborating with XtalPi to revolutionize drug discovery through AI-powered crystal structure prediction, Pfizer demonstrates the tangible benefits of cross-industry partnerships. These initiatives showcase a commitment to exploring cutting-edge technologies to enhance efficiency and accelerate the identification of promising drug candidates, ultimately improving patient outcomes and strengthening Pfizer's competitive position.

The article highlights specific examples of Pfizer's collaborative endeavors. The Pfizer Healthcare Hub in Freiburg acts as a catalyst, connecting internal needs with external innovation. The successful proof of technology in production planning using quantum annealing resulted in significant time and resource savings. Furthermore, the partnership with XtalPi has dramatically reduced the timeframe for determining the 3-D structure of potential drug molecules, enabling faster and more efficient drug screening. These collaborations exemplify Pfizer's strategic focus on leveraging specialized expertise and advanced technologies from external partners to overcome complex challenges in the pharmaceutical value chain.

Beyond these specific projects, Pfizer actively engages with the broader quantum computing landscape, recognizing its transformative potential for drug design, clinical studies, and personalized medicine. Collaborations with technology giants like IBM and fellow pharmaceutical companies underscore the industry-wide interest in harnessing the power of quantum computing. While the technology is still in its early stages, Pfizer's proactive participation in this collaborative ecosystem positions it at the forefront of future healthcare breakthroughs. This commitment to synergy, from basic research to market research, underscores a fundamental belief in the power of working together to drive meaningful advancements in the pharmaceutical industry.

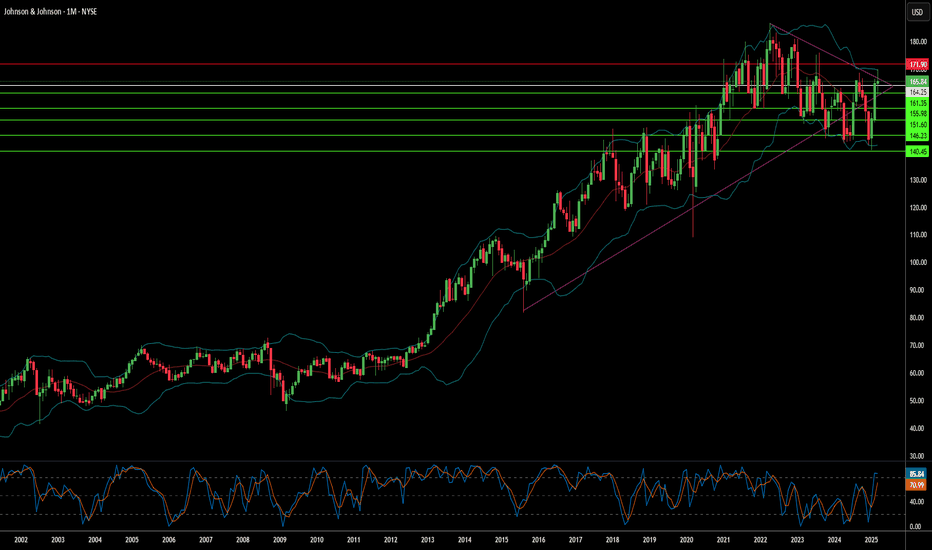

Cracks Appearing in J&J's Armor?Johnson & Johnson, a long-established leader in the global healthcare sector, confronts substantial challenges that raise significant questions about its future trajectory and stock valuation. Foremost among these is the persistent and massive litigation surrounding its talc-based baby powder. With tens of thousands of lawsuits alleging links to cancer, the company's strategy to manage this liability via bankruptcy has been repeatedly struck down by courts, most recently rejecting a $10 billion settlement proposal. This forces J&J to potentially face over 60,000 individual claims in court, introducing immense financial uncertainty and the prospect of staggering legal costs and damages.

Compounding these concerns is mounting scrutiny over the company's historical and recent marketing practices. A federal judge recently imposed a $1.64 billion penalty against J&J's pharmaceutical arm for misleading marketing of HIV medications, citing a "deliberate and calculated scheme." This follows earlier multi-million dollar settlements related to alleged improper financial inducements paid to surgeons for orthopaedic implants by its DePuy subsidiary, and tax disputes in India over questionable "professional sponsorship" expenses tied to similar activities. These incidents depict recurring legal and ethical entanglements with significant financial penalties and reputational harm.

Taken together, the unresolved talc litigation, substantial financial penalties from marketing violations, and persistent questions regarding ethical conduct create considerable headwinds for Johnson & Johnson. The cumulative impact of ongoing legal battles, potential future liabilities, and damage to its corporate image threatens to drain resources, divert management focus from core operations, and erode investor confidence. These converging factors present tangible risks that could exert significant downward pressure on the company's stock price moving forward.

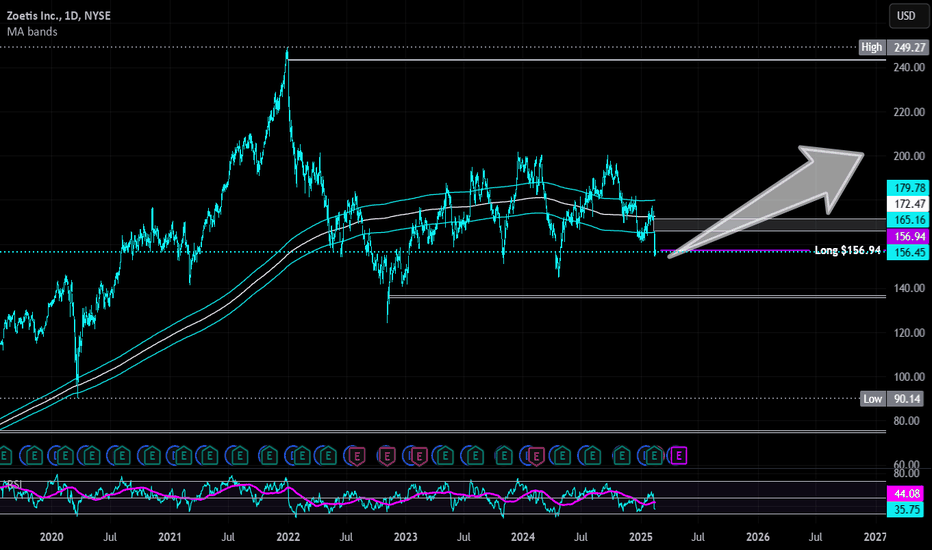

Zoetis | ZTS | Long at $156.94Zoetis NYSE:ZTS , the largest global animal health company, generated more than $9 billion in revenue in 2024 and earnings have grown 9.3% per year over the past 5 years. Free cash flow for FY2024 was over $2.2 billion. Dividend consistently raised every year for the past for years (currently 1.28%). The growth of the company isn't expected to slow any time soon, and I believe the animal health care market will grow right alongside the human health care market - if not potentially faster (people love their pets).

Thus, at $156.94, NYSE:ZTS is in a personal buy zone. There may be some near-term risk with the potential for a daily price-gap close near $136.00, but I personally view that as an even better buy opportunity (unless fundamentals change).

Targets

$170.00

$180.00

$200.00

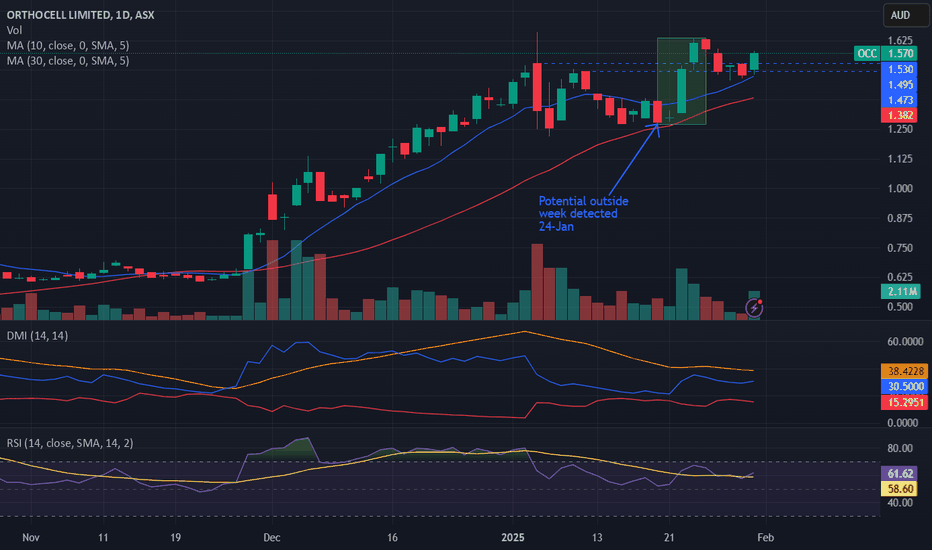

Potential outside week and bullish potential for OCCEntry conditions:

(i) higher share price for ASX:OCC above the level of the potential outside week noted on 23rd January (i.e.: above the level of $1.635).

Stop loss for the trade would be:

(i) below the low of the outside week on 20th January (i.e.: below $1.27), should the trade activate.

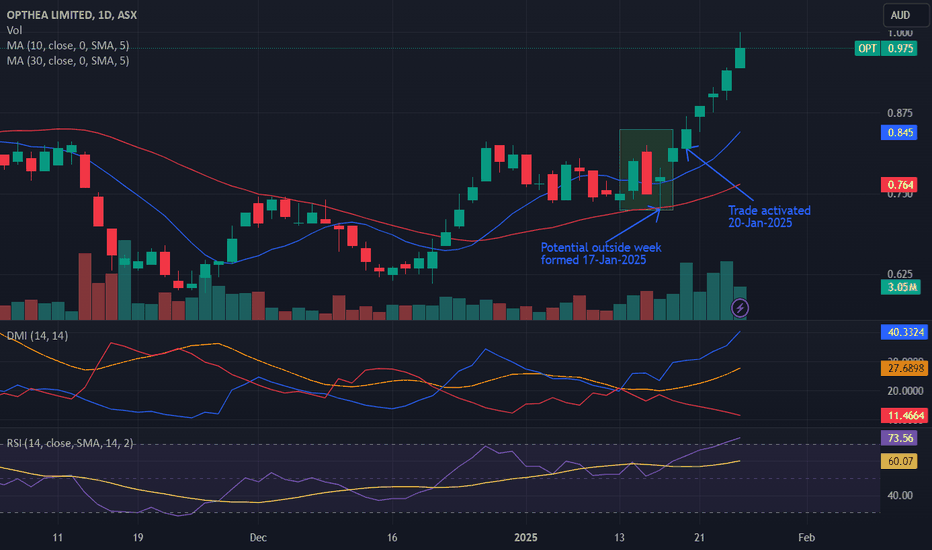

Potential outside week and bullish potential for OPTEntry conditions:

(i) higher share price for ASX:OPT above the level of the potential outside week noted on 17th January (i.e.: above the level of $0.85).

Stop loss for the trade would be:

(i) below the low of the outside week on 13th/16th January (i.e.: below $0.725), should the trade activate.

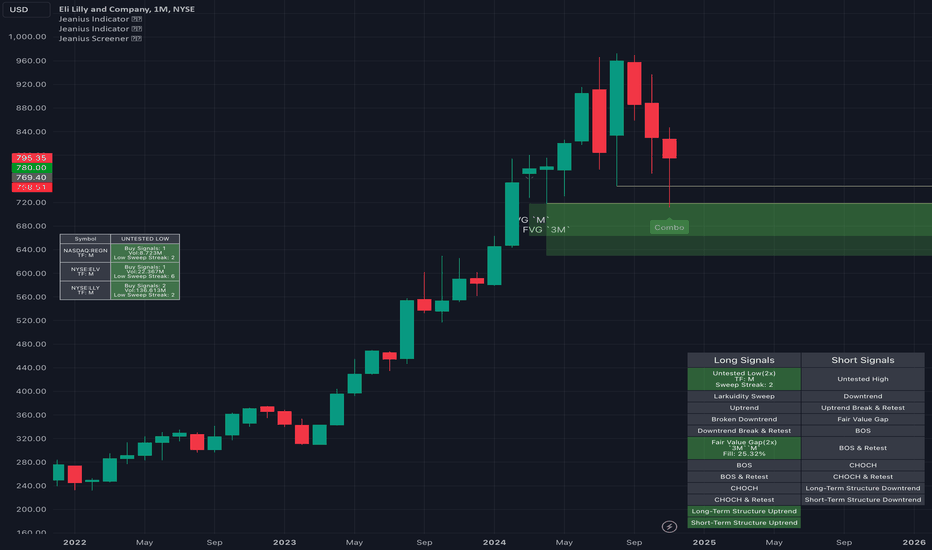

$LLY Long-Term BuyHealthcare could possibly be the next rotation coming out of this tech bull run. Using the Trade Jeanie (Jeanius Screener/Indicator), I was able to see the current technical buy signals happening on NYSE:LLY :

Inside a HTF fair value gap (3M timeframe)

Took out an untested low (liquidity)

The Jeanius Indicator shows green 'Combo' labels every time this same combination of signals happened

The Jeanius Screener lets me filter my favorite tickers to see which ones are currently taking out untested lows or liquidity

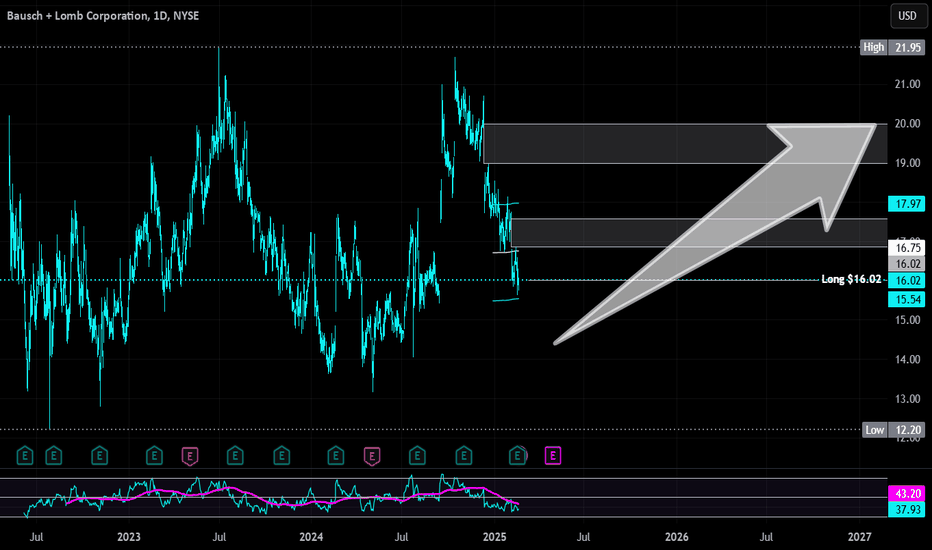

Bausch + Lomb | BLCO | Long at $16.02Bausch + Lomb NYSE:BLCO , a strong name in the eye health world, is trading within my historical simple moving average area and appears to be gaining upward momentum. I usually do not like to enter companies this earlier (more data is always better), but this company has very strong earnings and a solid track record. Earnings are forecasted to grow 57% per year and it's trading at a good value compared to its peers (price-to-book: 0.87x, price-to-sales: 1.17x). Low debt-to-equity (0.74x). Product exposure is across the globe and revenue was $4.8 billion in FY2024. Profitability has fluctuated over the years, and tariffs or other global trade issues are always a concern. Also, it's very early in this stock's history to gauge future performance. I would not exclude a call to the $14.00 area in the near-term, so there absolutely risks with this pick.

But, at $16.02, NYSE:BLCO is in a personal buy zone.

Targets:

$17.50

$20.00

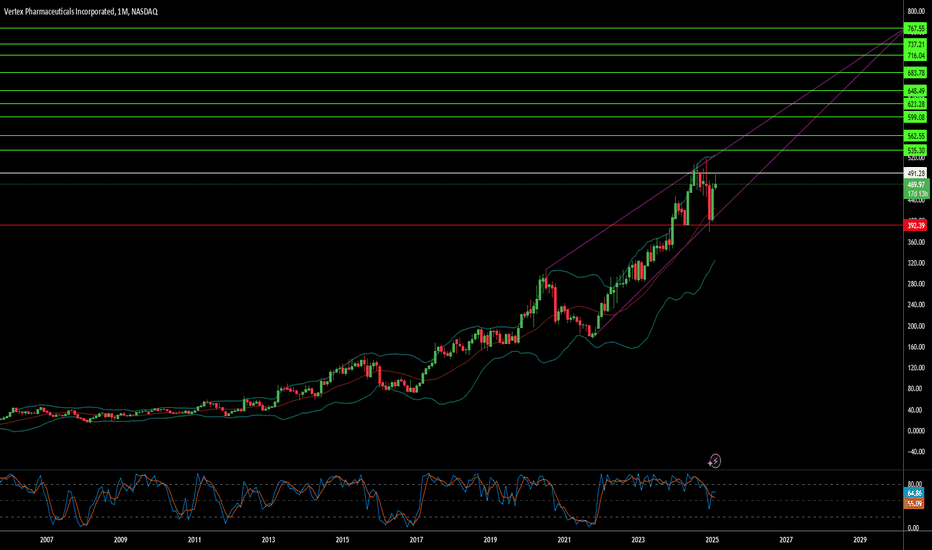

Can Pain Be Managed Without Addiction?Vertex Pharmaceuticals has achieved a monumental breakthrough in pain management, securing FDA approval for Journavx, the first new class of painkiller in over 20 years. This non-opioid drug introduces a paradigm shift, targeting pain signals directly at the source without the addictive risks associated with traditional analgesics. The significance of this development cannot be overstated, as it promises a new era where acute pain can be treated effectively and safely, potentially altering the landscape of medical treatment for millions.

Journavx operates by selectively inhibiting NaV1.8, a sodium channel vital for pain signaling, thus preventing pain signals from reaching the brain. This mechanism not only offers relief but does so without the side effects that have long plagued opioid use. The implications for healthcare are profound, offering doctors and patients alike a tool that can redefine how we approach pain management in clinical settings. Vertex's success with Journavx showcases the company's commitment to pioneering treatments that address some of the most pressing needs in modern medicine.

Financially, this approval has bolstered Vertex's market position, evidenced by a significant uptick in stock performance following the announcement. With a revenue projection for 2025 set between $11.75 and $12.0 billion, Vertex is not just riding the wave of this single approval but is also expanding its therapeutic horizons. The strategic leadership transitions announced alongside this approval signal a robust plan for future innovation, challenging investors and healthcare professionals to think about the evolving landscape of drug development and patient care.

This moment invites us to ponder the future of pharmaceuticals - one where efficacy does not compromise safety, where innovation in treatment could lead to broader societal benefits by reducing dependency on addictive substances. Vertex's journey with Journavx might just be the beginning of a new chapter in medical science, urging us to envision a world where pain management is humane and humane-centered.

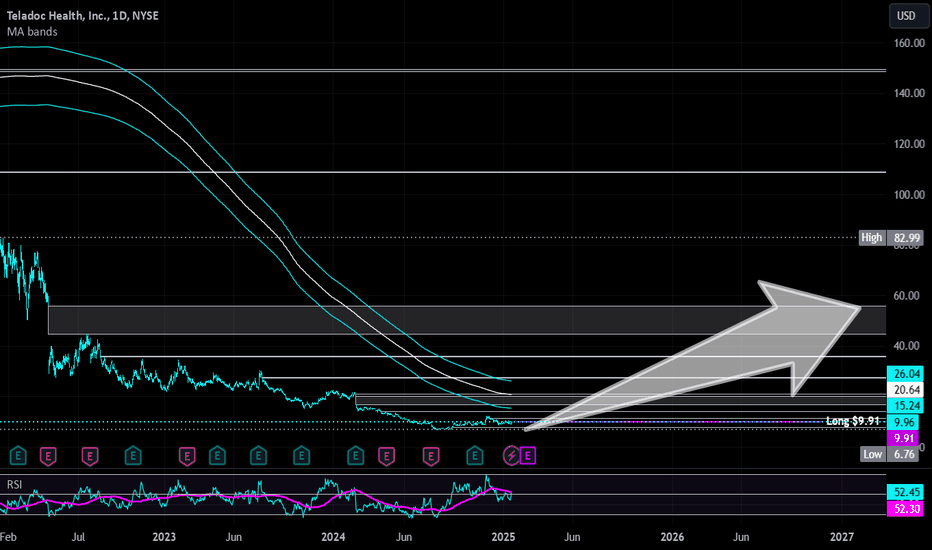

Teladoc Health | TDOC | Long at $9.91Teladoc Health NYSE:TDOC - Initial position started at $9.91 with the potential for the price gap in the $7's to be closed in the near future (likely another entry there unless fundamentals change)

Pros:

User base of over 90 million and growing

Revenue grew from $555 million in 2019 to $2.6 billion through Q3 of 2024

Positive free cash flow since 2021

Low debt (debt to equity ratio around 1x)

AI integration and partnership with Amazon and Brightline

Historical simply moving average is approaching price, which often leads to a jump or change in downward momentum in the longer-term

Cons:

Currently unprofitable and not forecast to become profitable over the next 3 years

Lots of insider selling and exercising of options

No dividend

Daily price gap in the $7 dollar range which may close prior to move up

Targets through 2027 :

$14.20

$20.00

$27.00

$35.00

$55.00 (long-term, positive outlook)

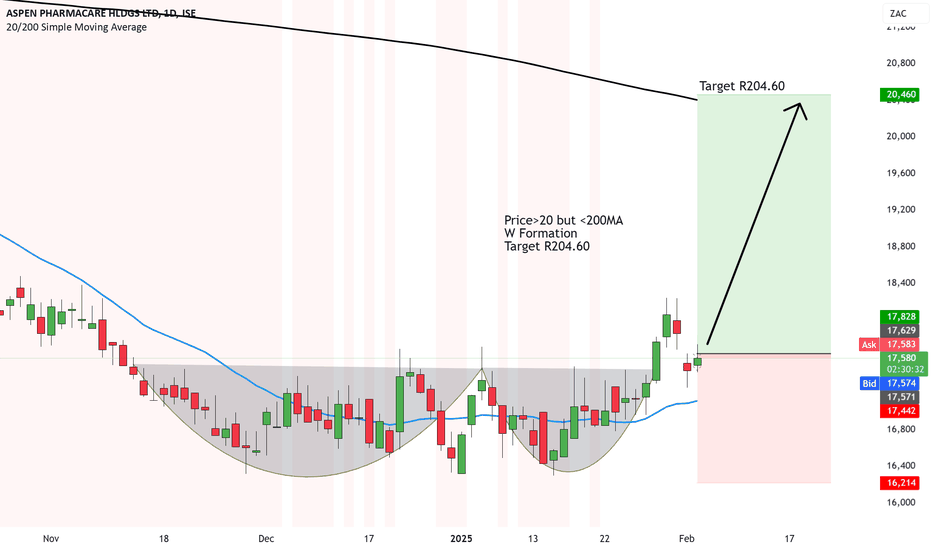

Aspen showing upside to R204 despite Trump pulling funds from SAOk this isn't the best formation.

We have the price above 20MA but still below 200MA.

On the other hand, we have a solid bottom formed and a W Formation along with a Box Formation with it.

So with the pull back and the retest, we could get a bounce up which will send the price to potentially R204.60

Even though Trump has pulled funding from South AFrica due to the Expropriation Bill being announced, this will pull funds from Healthcare, to developments and more...

But it seems like the Fair value of Aspen is underpriced and the market is likely to turn up from here. SO I am bullish for now.

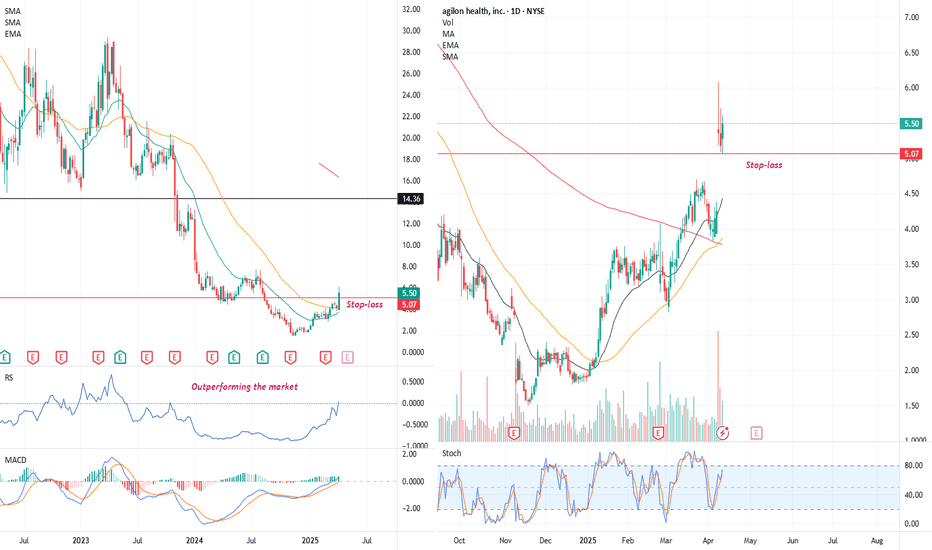

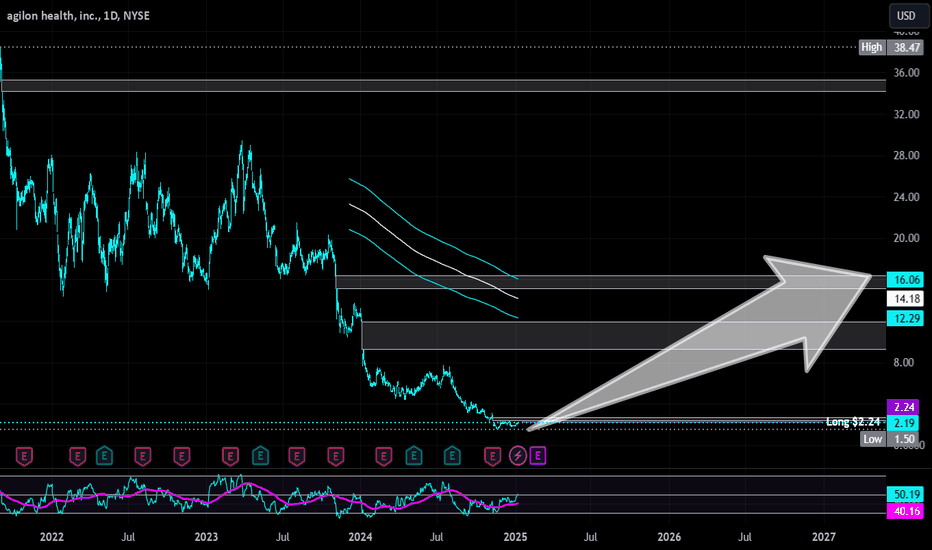

Agilon Health | AGL | Long at $2.24Agilon Health NYSE:AGL

Pros:

Revenue consistently grew from 2019 ($794 million) to 2023 ($4.3 billion) and through three quarters of 2024 ($5.6 billion). Expected to reach $8.7 billion by 2027.

Current debt-to-equity ratio 0.06 (very low)

Sufficient cash reserves to fund operations and strategic initiatives

Strong membership growth (525,000 as of Q3 2024, a 37% year-over-year increase)

Recent insider buying ($2 - $3) and awarding of options

Cons:

Rising medical costs - currently unprofitable and not forecast to become profitable over the next 3 years

No dividend

Targets (into 2027):

$2.72

$4.00

$5.00

$7.00

$11.50

$16.00

BUY Rating: SBC Medical Group – A Compelling Growth StorySBC Medical Group Holdings (NASDAQ: SBC), a leader in end-to-end solutions for aesthetic clinics, has earned a "BUY" rating, reflecting its robust growth trajectory and strategic expansion initiatives. The company’s recent performance and forward-looking plans justify its valuation, presenting an attractive opportunity for investors.

Valuation and Market Position

Compared with SBC’s current price with a valuation target of $11, underscores its growth potential. Despite facing challenges like fluctuating exchange rates and integration costs from recent acquisitions, the company’s fundamentals remain strong. SBC’s market capitalisation stands at $697 million, supported by an annual revenue estimate of $217 million for 2024, reflecting a year-over-year growth of 12%.

While SBC operates in the competitive medical aesthetics space, its comprehensive suite of consulting, marketing, and equipment leasing services distinguishes it from peers. The company’s ability to generate steady revenue and expand profit margins highlights its efficiency in leveraging its unique business model.

International Expansion Driving Growth

A pivotal driver of SBC's growth is its strategic acquisition of Aesthetic Healthcare Holdings (AHH) in Singapore. AHH operates 21 outlets under established brands like SkinGo! and The Chelsea Clinics. Singapore's business-friendly regulatory environment, strong economic growth, and status as a regional hub make it an ideal base for SBC’s expansion into Southeast Asia.

Singapore’s GDP growth and high levels of U.S. foreign direct investment further validate SBC’s choice to focus on the region. This acquisition not only accelerates SBC's regional footprint but also positions the company to capitalise on the growing demand for aesthetic services across Asia.

Financial Highlights

SBC’s Q3 2024 revenue reached $53.1 million, a 12.3% year-over-year increase, with gross profit rising to $43.2 million and margins improving to 81.5% from 70.9% in the prior year. This growth was driven by a shift toward higher-margin revenue streams, including royalty income (29.6% of revenue) and procurement services (33.1%).

The company’s decision to discontinue its lower-margin management services business has further enhanced its profitability. Net income for the quarter was $2.8 million, or $0.03 per share, with strong contributions from franchisee expansion and increased demand for aesthetic treatments.

Financial Flexibility

SBC's financial position is robust, with $137.4 million in cash and equivalents and less than $15 million in long-term debt as of Q3 2024. This financial flexibility enables the company to fund its growth strategies, including further acquisitions and geographic expansion.

Strategic Initiatives

Beyond its international expansion, SBC has entered partnerships to enhance customer loyalty and corporate wellness offerings. Its alliance with MEDIROM Healthcare in Japan integrates the loyalty programs of both companies, providing access to over 4 million members. SBC also launched SBC Wellness to offer corporate clients improved employee benefits, tapping into the growing demand for wellness services.

Growth Catalysts

The rising global acceptance of aesthetic medicine, coupled with SBC’s established expertise in high-demand procedures such as liposuction, breast augmentation, and eyelid surgery, positions the company for continued growth. With low market penetration for these services in Japan (estimated at 10%), there is significant upside as demand grows among younger and middle-aged demographics.

Risks and Outlook

While SBC faces risks such as foreign exchange fluctuations and potential challenges in integrating new acquisitions, its strong balance sheet and strategic focus mitigate these concerns. As the company continues to execute its growth initiatives, share price appreciation and valuation multiple expansion are likely.

Conclusion

SBC Medical Group Holdings presents a compelling investment opportunity, with a clear path to growth through strategic international expansion, enhanced profitability, and innovative partnerships. Its current valuation offers an attractive entry point for investors seeking exposure to the growing medical aesthetics sector. With strong financials and a proven business model, SBC is well-positioned to deliver long-term shareholder value.