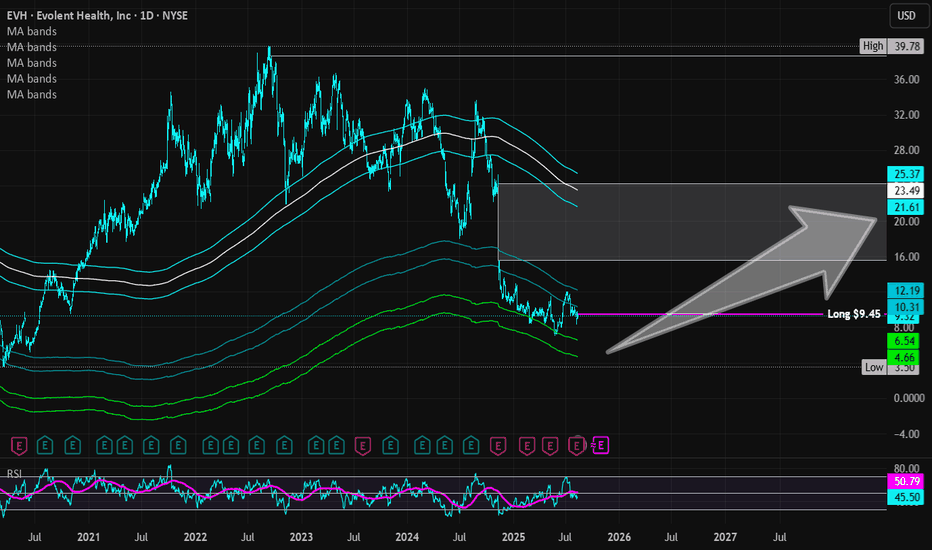

Evolent Health | EVH | Long at $9.45While 2025 is expected, and has been, a bad year for Evolent Heath NYSE:EVH , the growth prospects look very, very promising. However, I will caution that the price could almost be cut in half from its current trading value ($9.45) with another poor earnings in 2025. This definitely isn't an "it's only up from here" stock. The price entered my "crash" simple moving area (green lines) twice and a third time could occur before the end of the year ($4-$5 range as of this writeup).

Regardless of bottom predictions, earnings for NYSE:EVH are expected to rise from $1.9 billion in 2025 to $3.2 billion in 2028. EPS predicted to rise from $0.26 in 2025 to $1.18 in 2028. Debt-to-equity = 1.2x (okay, below 1 is best), Quick Ratio, or the ability to pays current bills is = 1x (okay, between 1.5 and 3 is best), and bankruptcy risk is relatively high (but reduced interest rates may help). Insiders have purchased over $11 million in shares this year with a cost average (~$23): much higher than it's current trading price.

So, while it seems there could be some short-term risks for Evolent Health, the future beyond 2025 is bright (based on company projections). Thus, at $9.45, NYSE:EVH is in a personal buy zone with potential downside risk near $4-5 in the near-term.

Targets into 2028:

$15.00 (+58.7%)

$20.00 (+111.6%)

Healthcaregroup

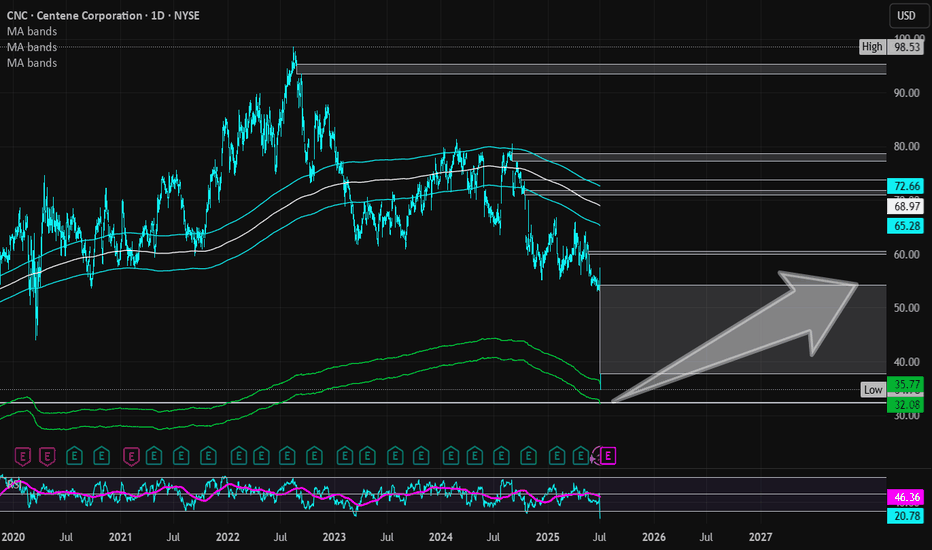

Centene Corp | CNC | Long at $35.00Centene Corp NYSE:CNC is a healthcare enterprise providing programs and services to under-insured and uninsured families, commercial organizations, and military families in the U.S. through Medicaid, Medicare, Commercial, and other segments. The stock dropped almost 40% this morning due to recent challenges, such as a $1.8B reduction in 2025 risk adjustment revenue and rising Medicaid costs (leading to withdrawal of 2025 earnings guidance). However, the company has a book value near $56, debt-to-equity of 0.7x (healthy), a current P/E of 5x, and a forward P/E of 9x.

It may be a few years before this stock recovers. But the price has entered my "crash" simple moving average area (currently between $32 and $36) and there is a price gap on the daily chart between $32 and $33 that will likely be closed before a move higher. Long-term, and potentially a new political administration, new life may enter this stock once again as the baby boom generation requires more healthcare services. But holding is not for the faint of heart...

Thus, at $35.00, NYSE:CNC is in a personal buy zone with a likely continued dip into the low $30s or high $20s before a slow move higher (where I will be accumulating more shares). Full disclosure: I am also a position holder in the $60s and cost averaging down.

Targets into 2028:

$45.00 (+28.6%)

$54.00 (+54.3%)

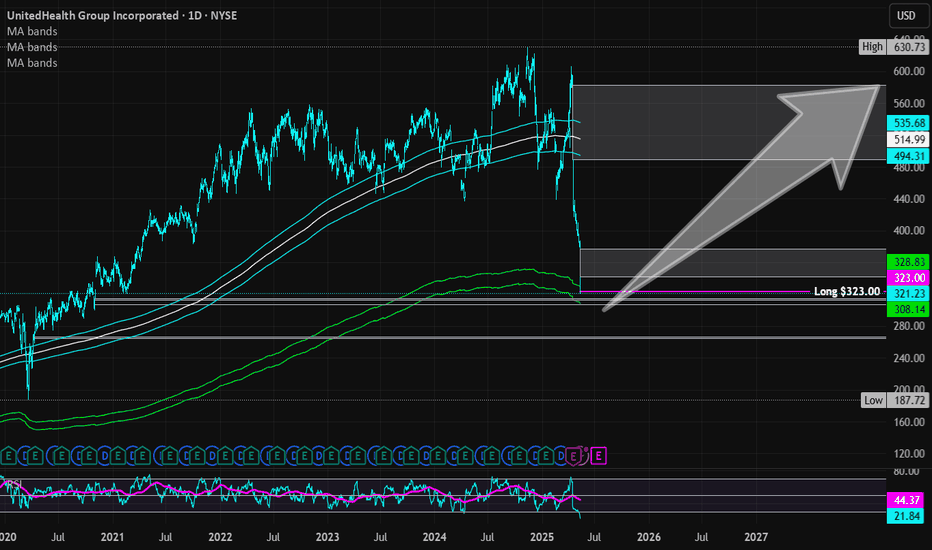

UnitedHealth Group | UNH | Long at $323.00UnitedHealth Group NYSE:UNH currently has a P/E near 15x, steady rising revenue (2024 = $400+ billion), EPS of 6.24x, dividend of 2.2%, and earnings are forecast to grow by 10.8% per year. The stock, however, has plummeted recently due to negative news, rising healthcare costs, CEO changes, and suspension of 2025 outlook. Every company has bumps, but I view solid companies like NYSE:UNH as pure opportunities for long-term investment - especially with America's aging population.

From a technical analysis perspective, the stock price has entered my "crash" simple moving average zone (which currently extends down near $307.00). Personally, this is the zone I am starting a position due to the odds of a future bounce from here. However, I am very aware that there is an open price gap near $265.00 that may get filled this year or early next. I could see a bounce in my crash zone to bring in the bulls and then a drop to that level to heighten the fear. That is another area I plan to grab more shares and build a strong position. But, in case it doesn't extend that low, I have started a position at $223.00, with future investments near $307.00 and below. I doubt this will be a quick turnaround stock - patience is where money is made.

Targets (into 2028):

$375.00

$475.00

$580.00

TARGET REACHED: Life Health struck our target 1 at R21.34 W Formation formed, we then had some high volatility around the price.

Luckily, the stop loss would have been below the pattern.

The indicators were all showing bullish signs.

7>21>200

RSI>50

Target struck at R21.34

ABOUT THE COMPANY

Life Healthcare Group Holdings Limited was founded in 1983 and is headquartered in Johannesburg, South Africa.

Life Healthcare is one of the largest private healthcare providers in South Africa, operating 66 hospitals and healthcare facilities across the country.

The company employs over 19,000 people and serves over 4 million patients per year.

Life Healthcare provides a wide range of medical services, including acute hospital care, mental health services, renal dialysis, and oncology care.

Life Healthcare has a partnership with the South African National Blood Service to support blood donation drives and increase awareness about the importance of blood donation.