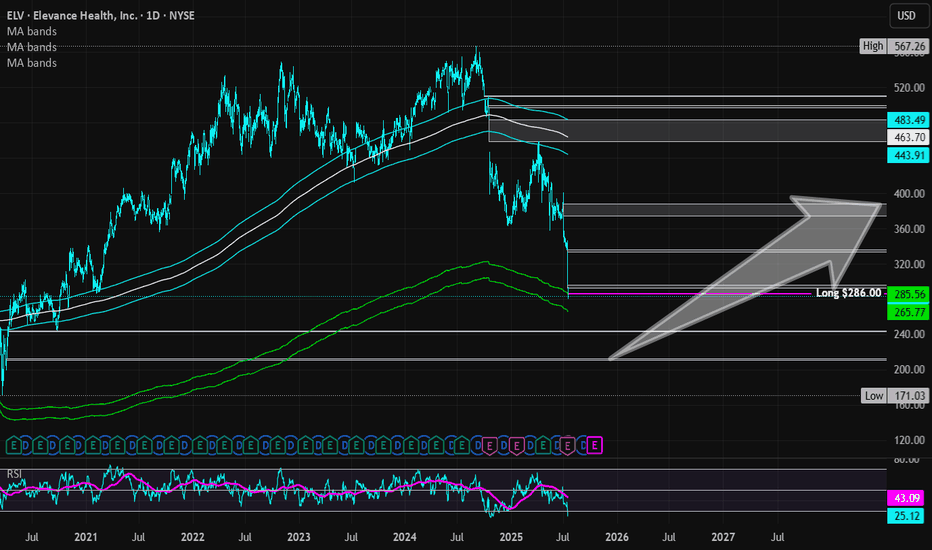

Elevance Health | ELV | Long at $286.00What are seeing in the healthcare and health insurance provider industry right now is destruction before a once-in-a-lifetime boom. The baby boomer generation is between 60 and 79 right now and the amount of healthcare service that will be needed to serve that population is staggering. Institutions are crushing them to get in - it's just near-term noise, in my opinion. My personal strategy is buy and hold every healthcare opportunity (i.e. NYSE:CNC , NYSE:UNH , NYSE:HUM etc).

Elevance Health NYSE:ELV just dropped heavily due to lower-than-expected Q2 2025 earnings, a cut in full-year profit guidance from $34.15-$34.85 to ~$30 EPS, and elevated medical costs in Medicaid and ACA plans. It's near-term pain (may last 1-2 years) which will highly likely lead to long-term growth. The price has touched my historical simple moving average "crash" band. I would not be shocked to see the price drop further into the $260s before a rise. However, the near-term doom could go further into the year. I am anticipating another drop to the "major crash" simple moving average band into the $190s and $220s to close out the remaining price gaps on the daily chart that occurred during the COVID crash. Not to say it will absolutely reach that area, but it's locations on the chart I have for additional buys.

Thus, at $286.00, NYSE:ELV is in a personal buy zone (starter position) with more opportunities to gather shares likely near $260 before a bounce. However, if the market or healthcare industry really turns, additional buys planned for $245 and $212 for a long-term hold.

Targets into 2028:

$335.00 (+17.1%)

$386.00 (+35.0%)

Healthinsurance

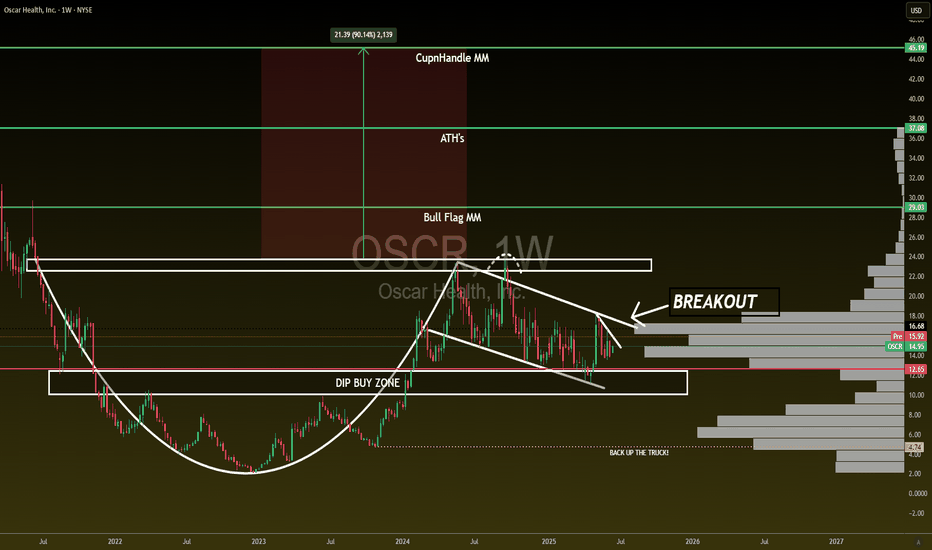

🏥💡 Oscar Health (OSCR) Analysis 📈🔍Market Disruption:

Oscar Health NYSE:OSCR is at the forefront of revolutionizing the health insurance industry through technological innovation, significantly enhancing market reach and member experience.

Expansion Plans:

In 2024, Oscar Health aims to introduce new technology-enabled plans across 165 new counties spanning 11 states. These initiatives prioritize accessibility, affordability, and personalized member experiences, aimed at driving premium growth.

Innovative Programs:

The company's +Oscar program, catering to 500,000 lives, fosters improved healthcare access and quality through innovative partnerships, such as the collaboration with Stanford Health Plan.

Investor Sentiment:

Bullish sentiment surrounds OSCR, with long positions taken by sell-side firms and institutional investors like The Vanguard Group and Millennium Management LLC. Upgraded price targets from Bank of America Securities and Wells Fargo further bolster this positive sentiment.

Robust Performance:

OSCR's performance demonstrates strength, including a remarkable 40% year-over-year increase in total health plan membership, reaching 1.44 million, and a substantial 46% revenue growth to $2.1 billion in the latest quarter.

CEO Endorsement:

CEO Mark Bertolini highlighted strong membership retention, an increased Net Promoter Score (NPS) of 60%, and improved core ratios during the latest earnings call, further affirming OSCR's positive trajectory.

Investment Outlook:

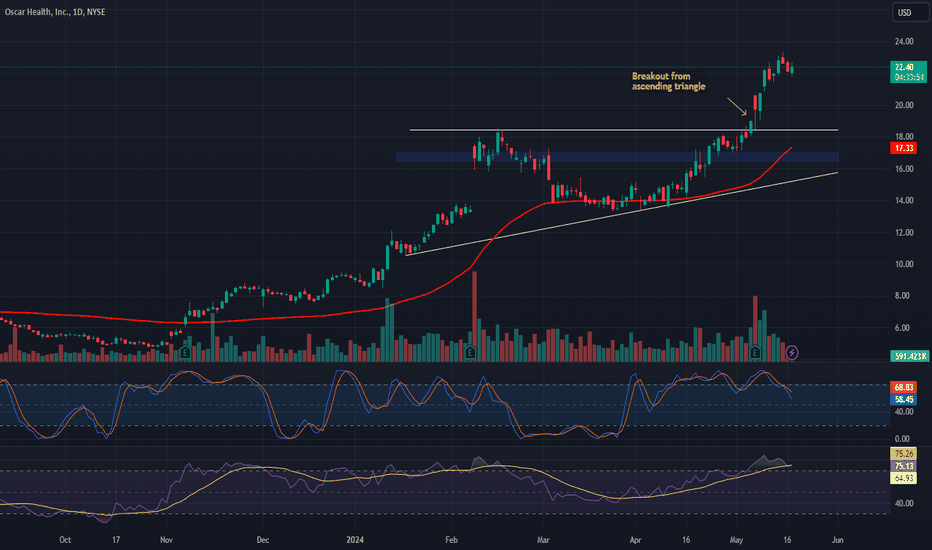

Bullish Outlook: Given these positive indicators, a bullish stance on OSCR above $16.50-$17.00 appears justified.

Upside Potential: With an upside target set at $34.00-$35.00, OSCR's growth potential in the health insurance market is poised for significant expansion.

📊🔍 Stay attuned to Oscar Health's progress for potential investment opportunities! #OSCR #HealthInsurance 🏥💼