Hedera Foundation Token $HBAR Token Surged 96% Hedera's CRYPTOCAP:HBAR token has experienced a whirlwind of activity, soaring by 96% within 24 hours on the heels of a misinterpreted announcement regarding BlackRock's involvement. While excitement surged over the tokenization of a BlackRock money market fund on the Hedera blockchain, clarifications soon tempered the frenzy, leading to an 18% drop in CRYPTOCAP:HBAR 's price.

Misconceptions and Reality:

The catalyst for CRYPTOCAP:HBAR 's meteoric rise stemmed from a misinterpreted announcement by the HBAR Foundation X, suggesting a partnership between BlackRock, Archax, and Ownera in tokenizing a BlackRock fund. However, subsequent clarifications revealed that BlackRock was merely aware of the move on-chain, with Archax taking the initiative to tokenize BlackRock's ICS US Treasury Fund. The discrepancy between perception and reality underscores the importance of clear communication in the crypto space to mitigate misinformation and prevent market overreactions.

Community Reaction and Clarifications:

Crypto influencers and industry observers initially seized upon the announcement, believing BlackRock's direct involvement in the tokenization project. However, voices of skepticism, including Cardano Ghost Fund DAO founder Chris O'Connor, highlighted the need for accurate interpretation and cautioned against premature conclusions. Clarifications from Archax co-founder Graham Rodford shed light on the nature of the collaboration, emphasizing that all parties involved were aware of the tokenization initiative, but BlackRock's role was limited to awareness rather than active participation.

Market Volatility and Long-term Prospects:

HBAR's rollercoaster ride, marked by a surge followed by a correction, underscores the inherent volatility of the crypto market and the susceptibility to speculative fervor. Despite the setback, HBAR's price remains elevated, reflecting sustained interest in the token and optimism surrounding its potential. The recent approval of significant funds for Hedera network development further underscores the platform's commitment to growth and innovation, laying the groundwork for future advancements and ecosystem expansion.

Technical Outlook

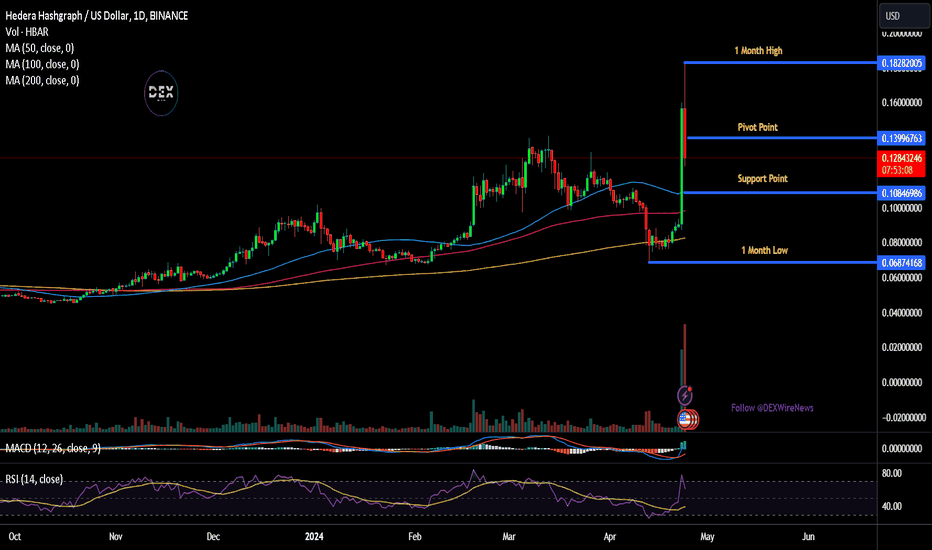

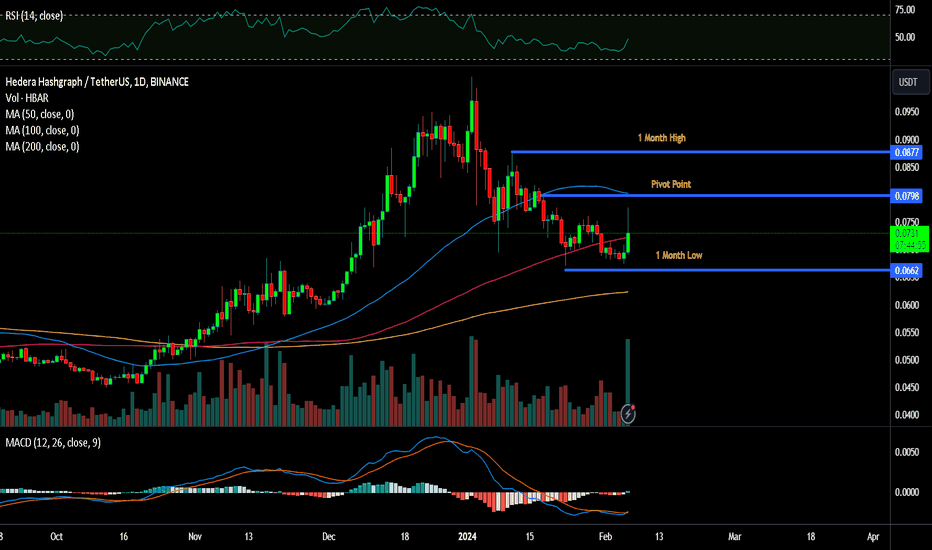

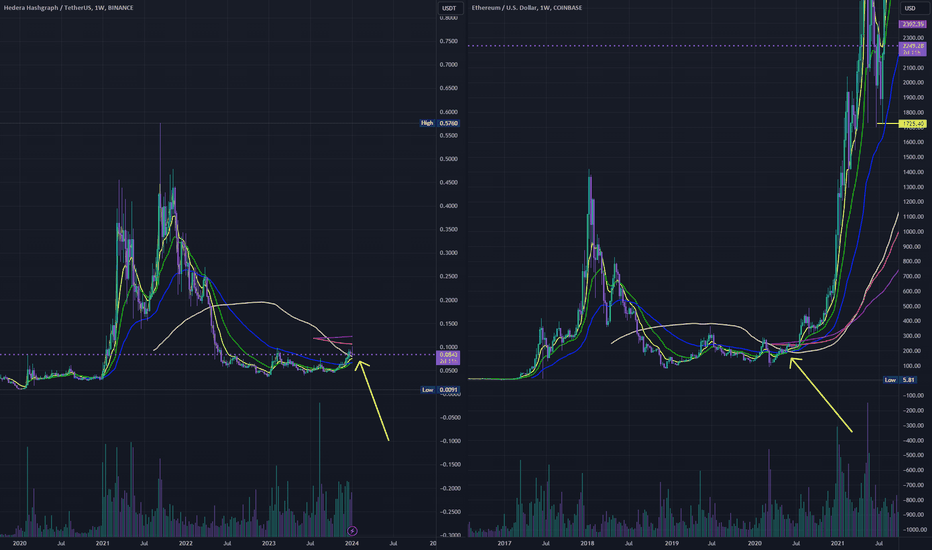

CRYPTOCAP:HBAR token is still poised for a reversal trend despite dipping by 18%. The crypto asset is trading with a Relative Strength Index (RSI) of 60.70 giving room for further surge or price consolidation.

Hederahashgraph

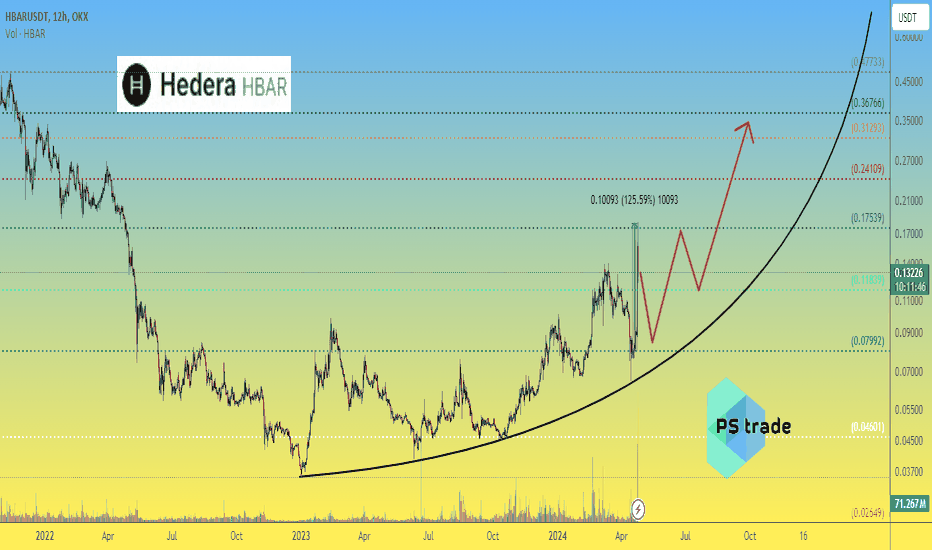

Hedera HBAR price artificially "pumped", wait a minute..and readYesterday, on 23 April, HBAR Foundation, the company that developed the #Hedera blockchain, tokenised the US Treasury Money Market Fund (MMF) from BlackRock.

After this "announcement", the CRYPTOCAP:HBAR token grew by +125%.

Based on the "announcement," the crypto community decided that BlackRock had entered into a partnership agreement with Hedera. This was indicated by the attached pictures and videos with company logos on Twitter.

However, BlackRock did not take any part in the MMF tokenisation. This "coincidence" caused confusion on social media and a good sharp #HBARUSDT price pump

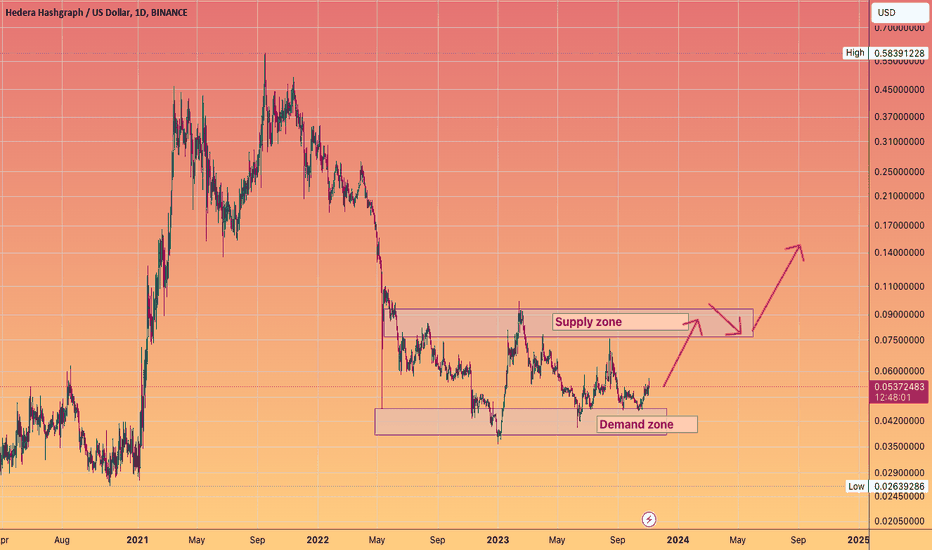

Personally, we would not buy HBAR now, but would wait for confirmation. If this is not a well-planned manipulative "coincidence" but a real event, then the #HBARUSD price should not be fall below $0.08-0.09

You can buy HBAR there, of course, if you believe in the prospects of this project, with expectations of at least x4-x5 growth.

P.S.: you need to prepare your psyche and critical thinking for the bull run 24-25)

Because in 2017, "such" tweets came out almost every day and kindly pumped various coins.

Hbar just hit the breakout target of the teal channelAfter the bullish news connecting hedara hashgraph with blackrock hbar saw a massive bullish impulse today reaching the full breakout target of this teal channel and then some. If it does an inverse Bart move here expect it to go considerably higher but for now the initial target has been hit so pullbacks, corrections, or consolidations are always possible before the enxt leg up. *not financial advice*

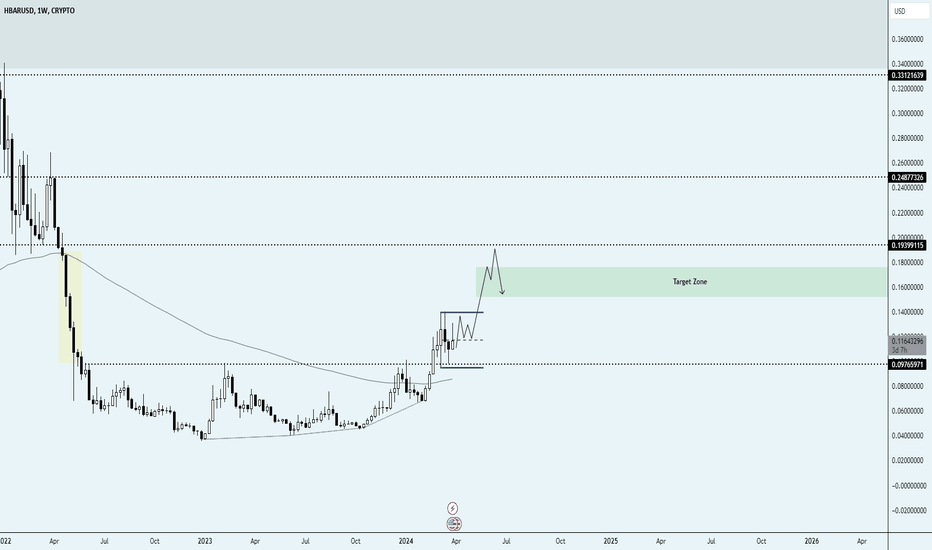

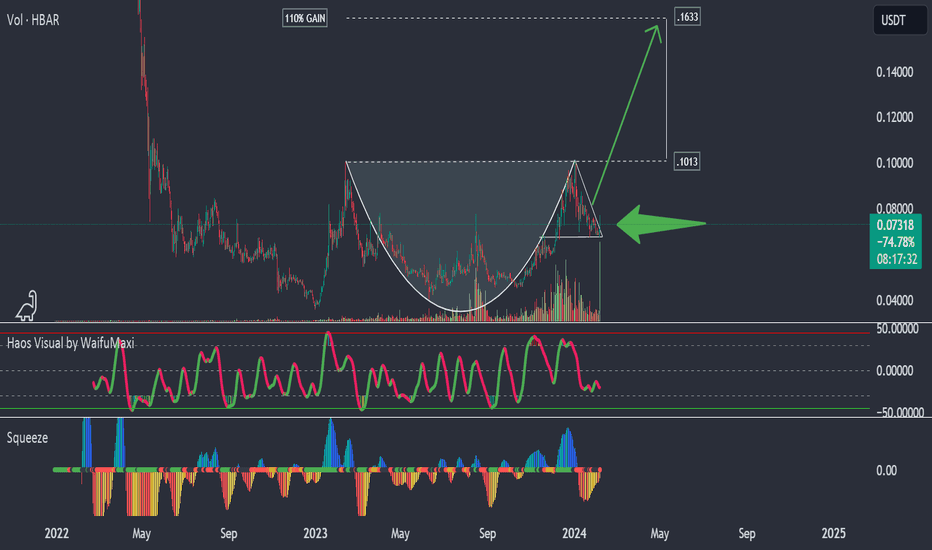

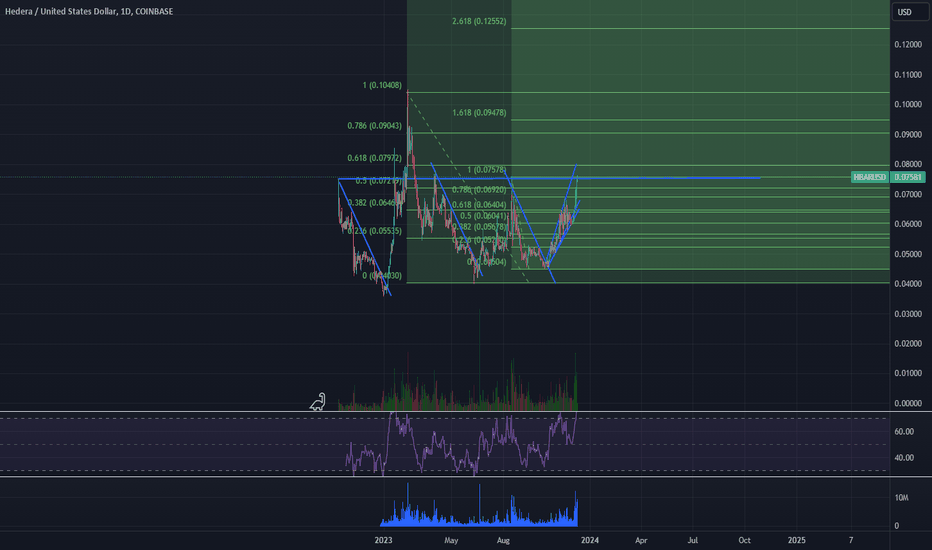

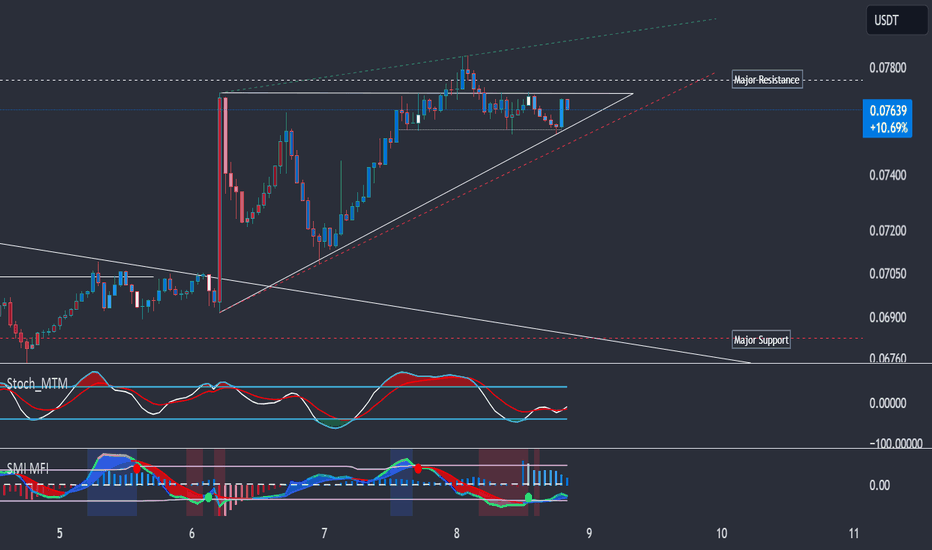

Hedera ($HBAR) I am anticipating a range breakout to greenHbar is consolidating inside of a macro range and has been for 3 weeks now.

This is not a bad thing, it's good in fact. It was recently broken out of a major resistance area at 0.09 (give or take), which is major and now all price is doing is consolidating right above.

Preparation for another leg up imo.

Green is target, but expecting higher (point of breakdown area denoted to the left of the chart).

Levels above for future reference, but not relevant right now.

Cheers,

vatsik

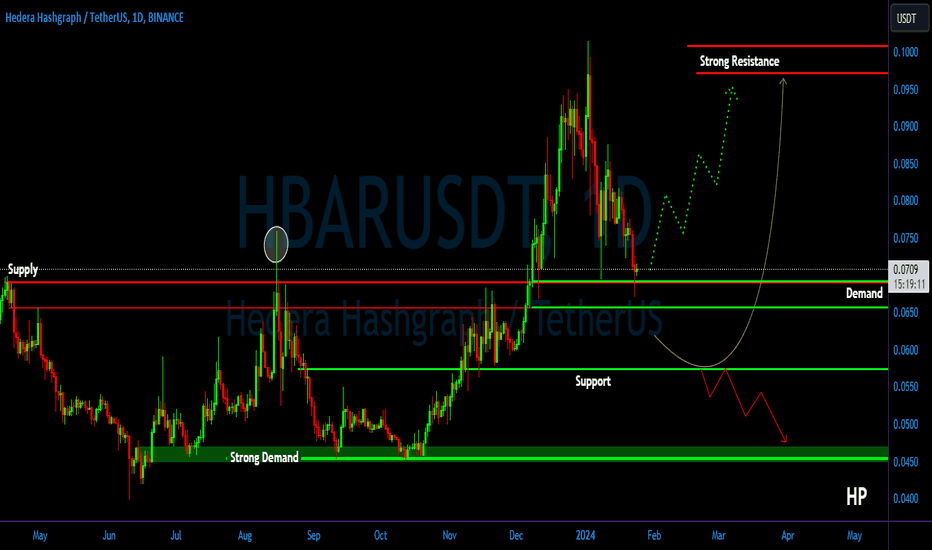

HBAR/USDT Keep an eye on the support, Potential Bouncing!💎 HBAR has recently experienced notable market dynamics. There is potential for HBAR to undergo a backtest on the support area around $0.099.

💎 If HBAR reaches this level, it needs to bounce to resume its upward trajectory, with the next target being the resistance area. A successful breakout above this resistance probability could pave the way for reaching our target area.

💎 However, if HBAR fails to maintain support and bounces, it could be a concerning sign. This failure may lead to a breakdown below the support area, potentially pushing the price back towards the demand zone.

💎 At the demand zone, a bounce is necessary for HBAR to reclaim support and continue its upward movement. Failure to do so may result in continued downward movement, pushing the price lower.

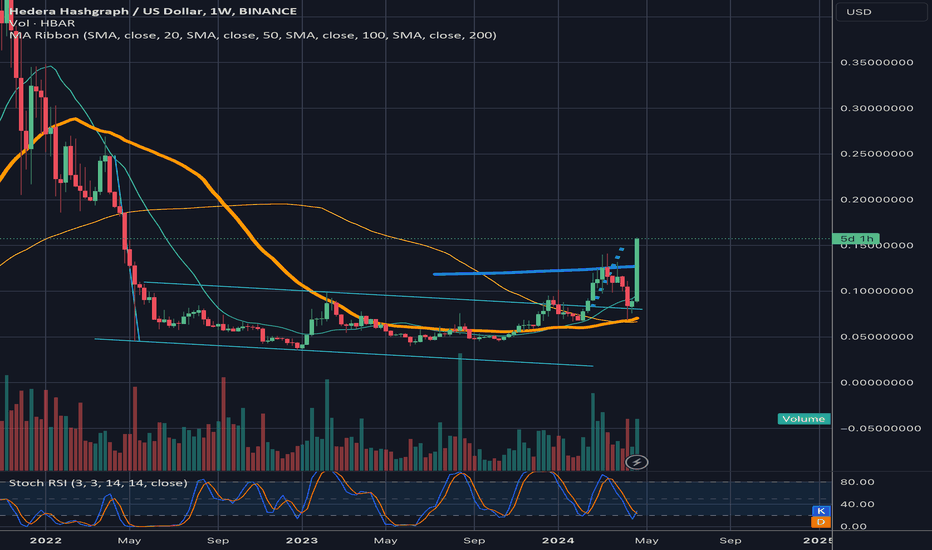

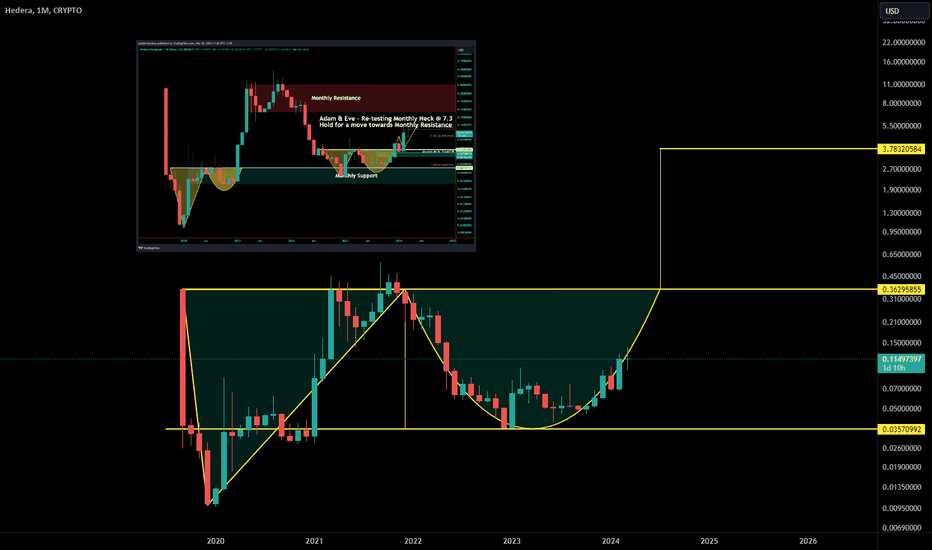

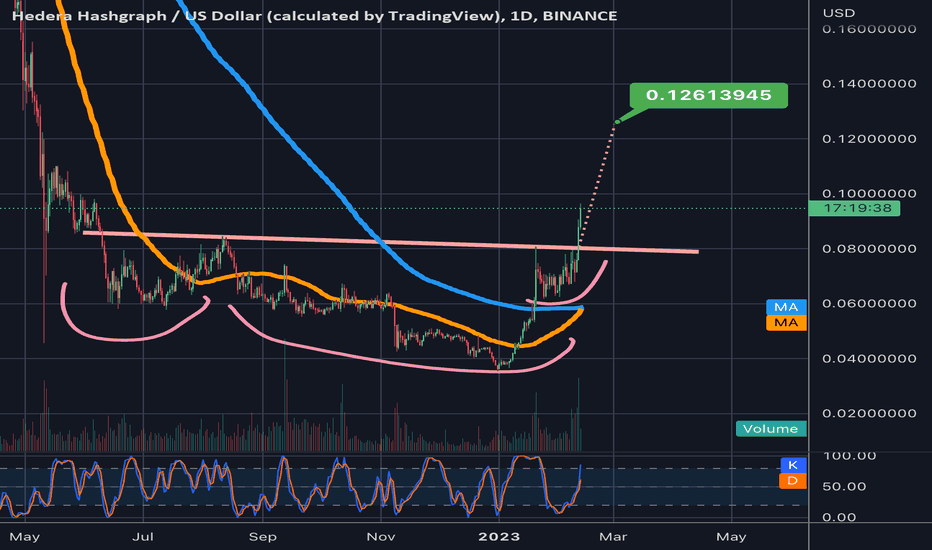

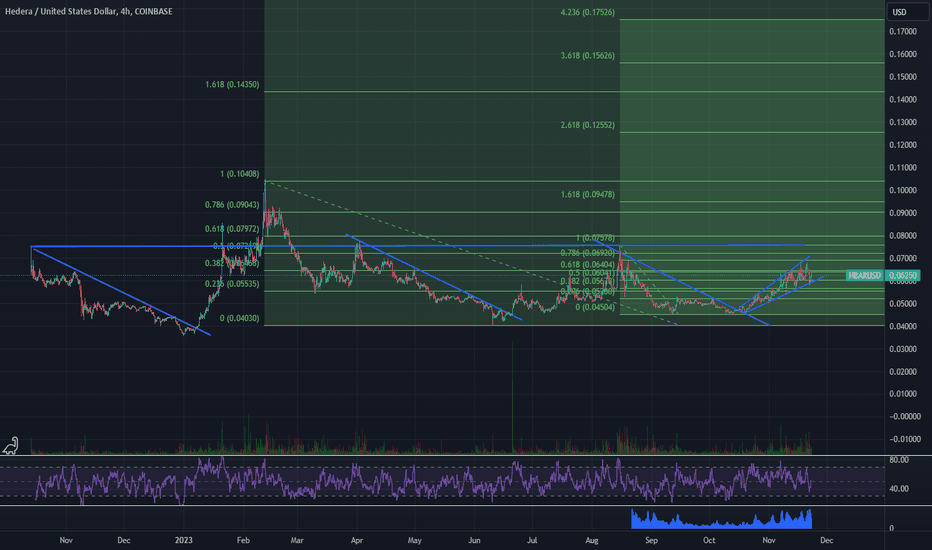

HBAR triggering an inv h&s + golden cross?It certainly looks as though hbar is already validating the breakout from this inverse head and shoulders pattern…however with price action this far above the 50 and 200mas at the time of its golden cross, there’s always a likelihood it may dump back down to the MAs at the time of the cross or shortly thereafter, even dipping back below the neckline temporarily to shake some weak hands that long in this zone…of course it could validate and just continue up to the target from here as well…if it does try to dip back down to the MAs to test them for support and even dip back below the neckline, probability favors that it will likely break above the neckline once again before too long an d then validate at that point if it doesn’t already validate after this first break of the neckline. Of course if we see price flip the 200ma back to solid resistance, then probability will favor this pattern becoming a fakeout…but until then probability favors it validating. *not financial advice*

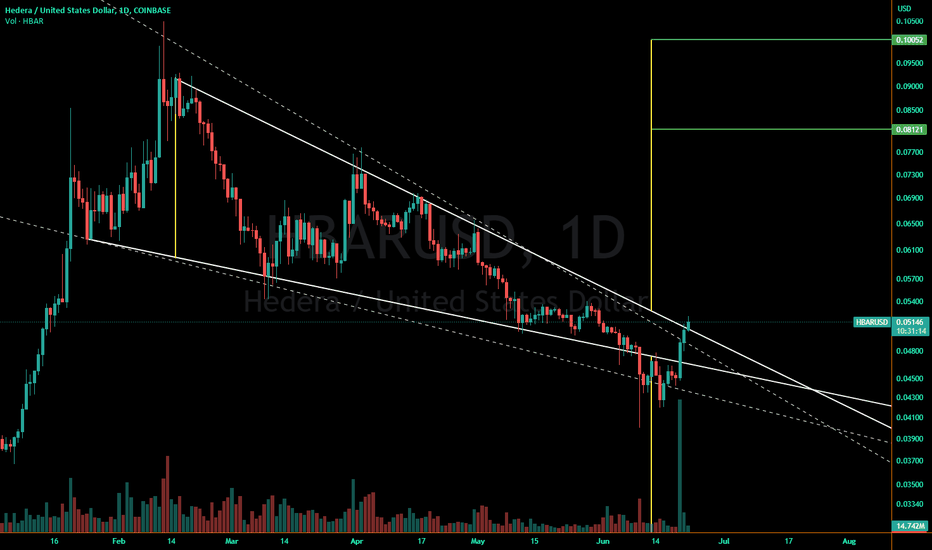

Likely Breakout to 8-10 cents after failed BreakdownHBAR recently saw a failed breakdown its 4h falling wedge (dotted) and its daily falling wedge (solid).

Since then it has risen back to wedge top, breaking wedge top on the 4h and now attempting to do so on the daily. We also saw the largest daily green volume bar ever printed on Coinbase when it moved back up into the wedge, though that is likely somewhat related to exchanges shutting down or traders moving assets over to CB from Binance US.

Highly unlikely we do not get and maintain a bullish breakout now after having failed the bearish breakdown, unless Bitcoin shows a strong rejection at 30k. In that case, potentially we see it drop back down to daily wedge bottom before trying again.

Targets of 8 and 10 cents approx, are based on the daily wedge's 1x and 1.5x measured moves.

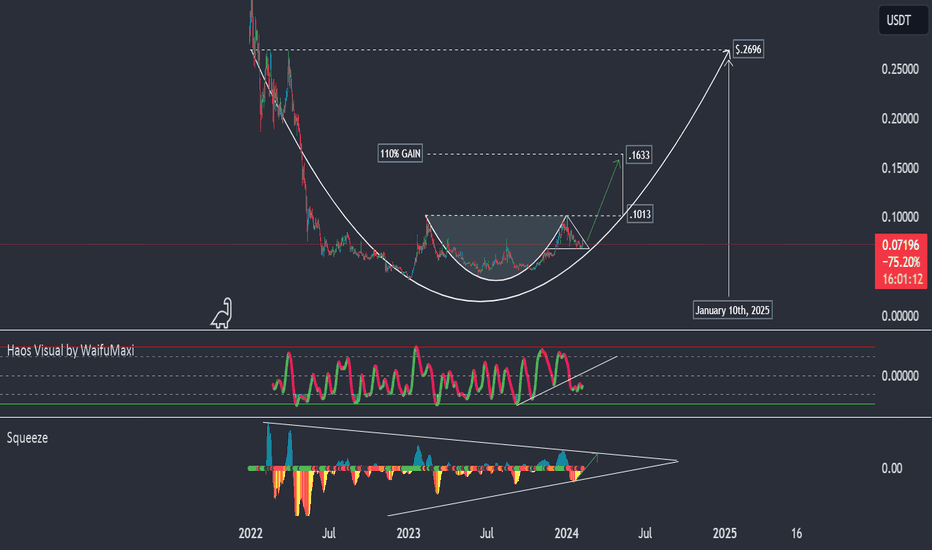

HBAR breaks out 10.44% in the early hours.As I've posted previously, HBAR is in a massive cup & handle chart pattern on the daily chart, and this morning popped up a massive 10.44% in the early hours, but this is just the beginning of what I believe we are going to see over the next few weeks/months.

The gains in HBAR are going to be EPIC heading into summer, as crypto investors and trader's alike are going to realize just how undervalued HBAR is in the utility crypto sphere.

Good luck traders, and always use a stop.

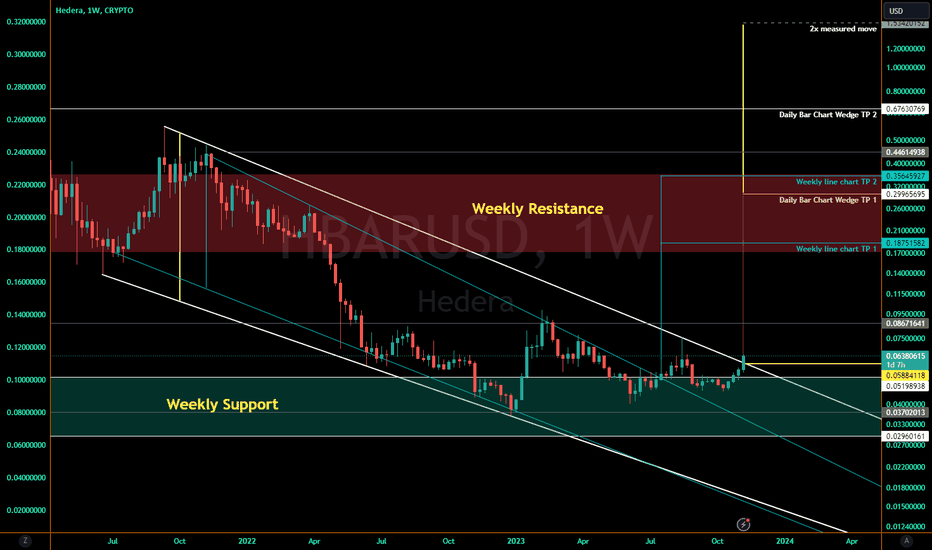

HBAR Weekly/Daily Falling Wedge BreakoutsHBAR is breaking out of the daily bar chart's falling wedge after having already broken out of a weekly line chart's falling wedge, both here on the weekly candle chart.

Initial targets are near top and bottom of weekly resistance. A move down could re-test wedge top, and this weekly candle needs to close above the wedge (already has daily closes but want to see a weekly close above).

See my related idea here, where I think we need to get and hold above 10-12 cents prior to going for weekly resistance:

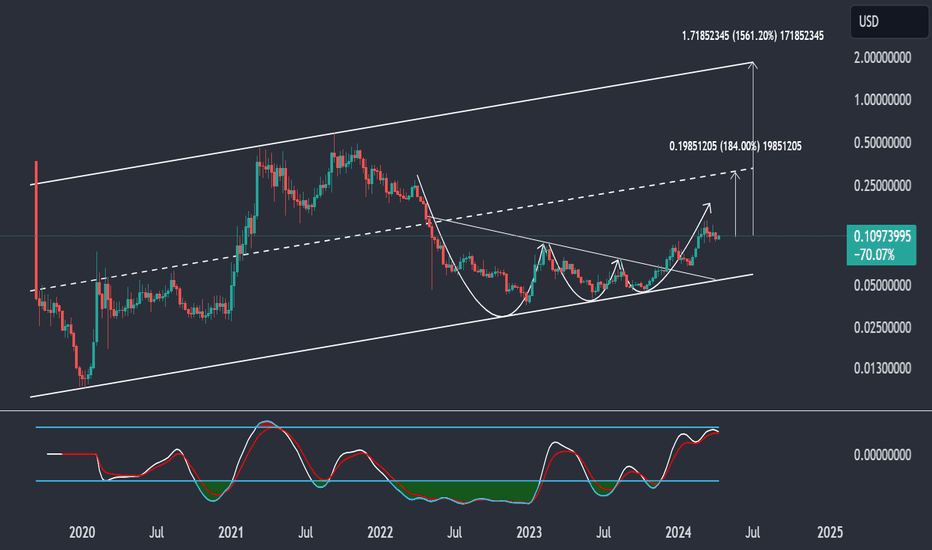

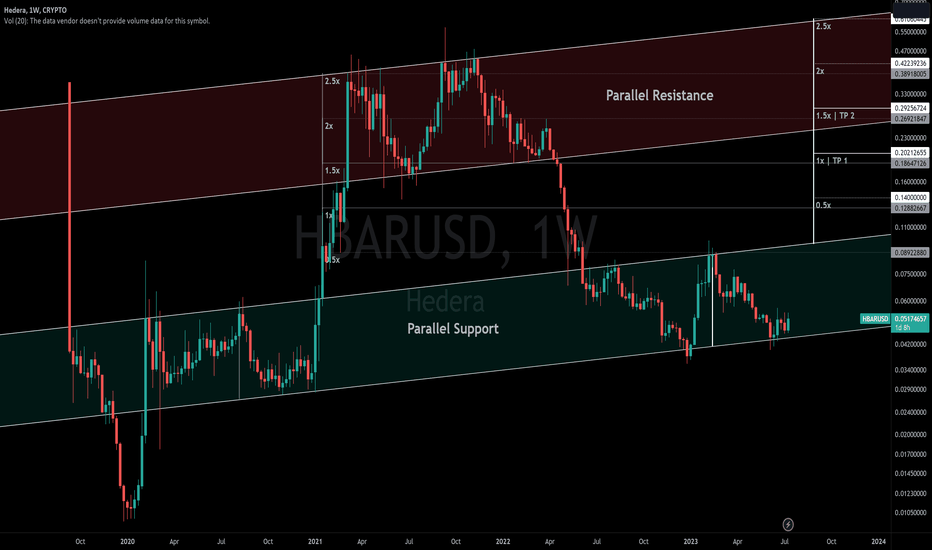

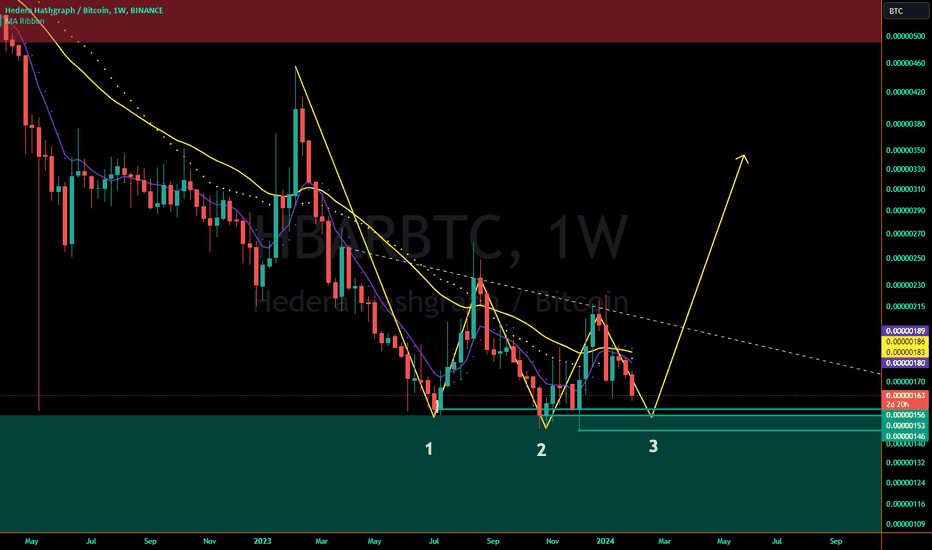

HBAR to Repeat its Prior Move?This is a simple theory that COINBASE:HBARUSD can be divided into two parallel uptrends on the weekly:

one that acts as support

another that acts as resistance

When it first broke out of parallel support, it made a 2.5x measured move up, and then dropped back down near the 1.5x measurement, forming what would become parallel resistance after making a higher set of highs, dropping back down to 1.5x, and then losing it to fall back into parallel support.

After falling into parallel support, it tested the top of it and failed to move above, causing it to drop down to the bottom. When it did this it moved below support's bottom, but when it failed to remain below, it saw a strong and fast move back to the top of parallel support for another attempt to move above. This also failed, leading to a move back down towards the bottom.

Now that it has made 3 attempts at bottom, each attempt weaker than the previous, it should be ready for a 3rd attempt at the top of parallel support.

I expect it will break above it, as it has already failed to break below.

TP 1 and 2 are likely targets if it does this, but we could also see a repeat of its prior move sending COINBASE:HBARUSD back into and towards the top of its parallel resistance.

An example of how they are similar:

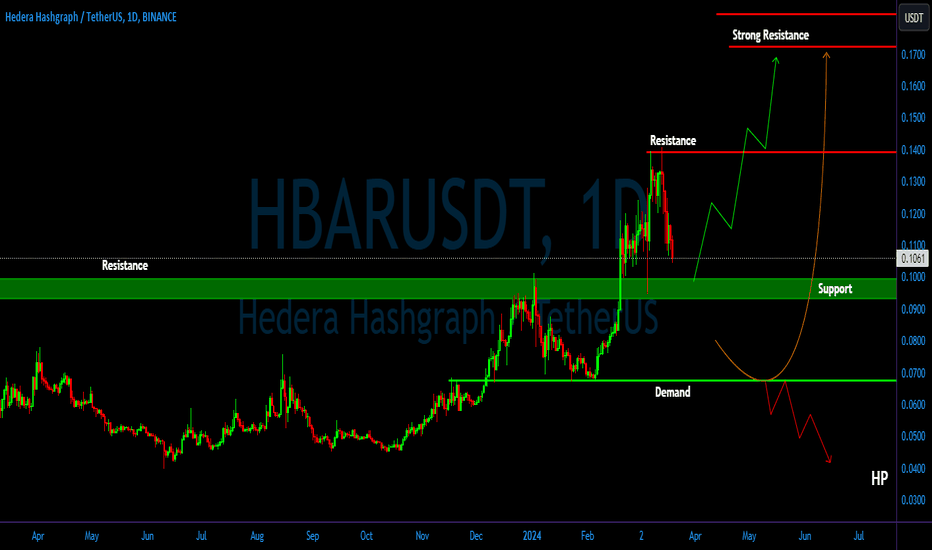

HBAR/USDT Keep an eye in key area. Could HBAR Bounce from here ?💎 HBAR has recently experienced significant market developments. Positioned at a critical demand zone, HBAR needs to secure a bounce from this level to resume its upward trajectory.

💎 A positive indication would be observed in the daily close, with a bullish candle rejection, probability signaling HBAR's attempt to resume upward movement and reach our targeted strong resistance area.

💎 However, failure to sustain at this demand level could be concerning, as it would signify a breach of a crucial area. This could prompt a reversal to downward movement, with the next support level located at 0.057.

💎 To continue upward momentum, HBAR needs to bounce from the support area and reclaim the region above the demand area. In the absence of positive signals, a prolonged sideways movement may lead to HBAR losing support, initiating a downward movement towards the robust demand area.

Hedera Floats $250M Web3 Venture Fund in Saudi ArabiaHedera ( CRYPTOCAP:HBAR ) has launched a $250 million fund for DeepTech as it seeks to drive Web3 education and adoption in Saudi Arabia. The open-source Proof-of-Stake (PoS) public ledger has announced a multi-year strategic partnership with the Saudi Arabian government.

According to the announcement, the PoS blockchain has entered into a core alliance with the Saudi Ministry of Investment. The five-year agreement is worth $250 million and includes the Hedera Fund-Saudi collaboration, as well as the launch of DeepTech Venture Studio.

The DeepTech Studio is part of a five-year plan and will be established in Saudi Arabia's capital city, Riyadh. Its focus is closely linked with Saudi's goal to diversify its income from oil and gain traction amongst international companies. The Studio will play a crucial part in developing innovative solutions in industries like Artificial Intelligence (AI) and quantum computing.

This launch comes amidst other milestones for the protocol, including significant growth and big partnership deals. Hedera Hashgraph's native cryptocurrency, CRYPTOCAP:HBAR , was allocated around 5 billion for the ecosystem's development and the advancement of decentralized governance. A portion of the fund was directed to existing initiatives, including the CRYPTOCAP:HBAR Foundation, the Hashgraph Association, and the DLT Science Foundation.

Less than four weeks ago, the Hedera ( CRYPTOCAP:HBAR ) developer team talked about the integration of Hitachi U.S. in relation to potential inclusion in the governance council. The addition of Hitachi, one of the largest even for the Hedera Fund ecosystem, made the former the newest member of Hedera ( CRYPTOCAP:HBAR ) Council. The move is poised to boost the practical application of Web3.0 technologies.