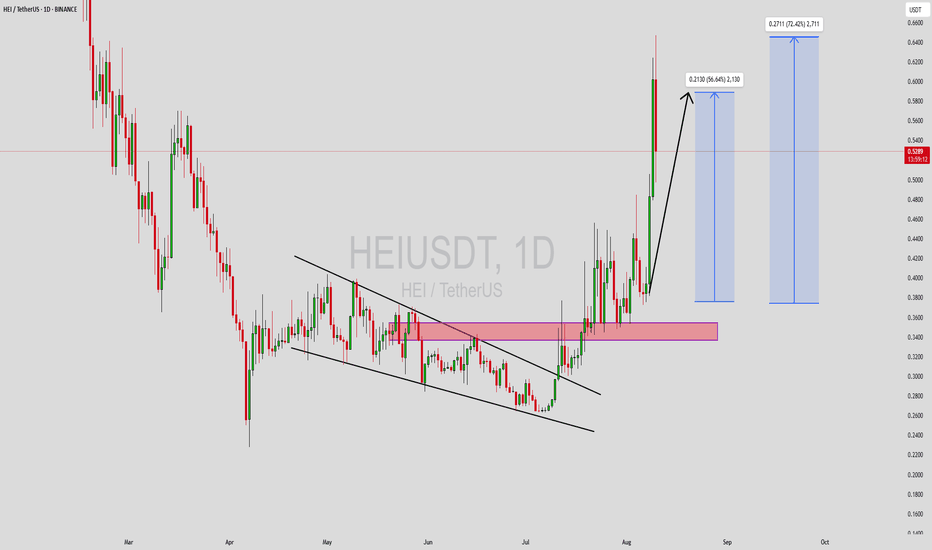

HEIUSDT Forming Falling WedgeHEIUSDT is showing a falling wedge pattern, one of the most reliable bullish reversal setups in technical analysis. This formation often appears after a downtrend, where price action forms lower highs and lower lows within converging trendlines, signaling that bearish momentum is losing strength. As the range narrows, buying pressure tends to build, paving the way for an upside breakout.

Currently, the volume profile is solid, reflecting steady market activity and growing investor interest. The falling wedge on HEIUSDT suggests that sellers are struggling to push prices lower, while buyers are quietly accumulating. Once a breakout above the upper resistance trendline is confirmed with higher volume, it could trigger a sharp rally, potentially delivering 60% to 70%+ gains in the near term.

Market sentiment for this pair is improving, and the technicals align with a scenario where the trend may shift from bearish to bullish. Traders will be watching closely for a breakout candle and a sustained move above key resistance levels, which could accelerate momentum and invite more investors into the move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

HEIBTC

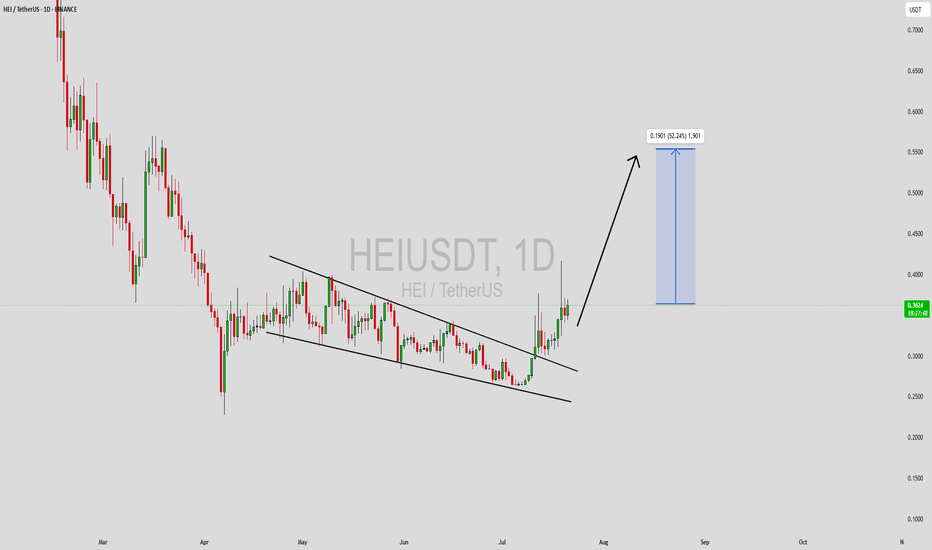

HEIUSDT Forming Falling WedgeHEIUSDT is currently showing a textbook falling wedge pattern—a bullish reversal setup that often precedes sharp upside breakouts. This formation is defined by converging downward-sloping trendlines, signaling weakening selling pressure and the potential for a trend reversal. As HEI trades closer to the wedge’s apex with rising volume, market participants are beginning to anticipate a breakout that could lead to significant upward momentum. A confirmed breakout above the upper trendline would validate this bullish outlook and trigger renewed interest from traders.

Technically, falling wedge patterns are known for offering high-probability setups, especially when backed by volume growth and strong investor sentiment. HEI’s recent price action suggests accumulation at support zones, with bulls defending key levels repeatedly. This behavior indicates that smart money could be positioning for a move higher. Based on historical breakouts from similar wedge structures, a price gain of 40% to 50%+ is a realistic target in the short to mid-term.

Investor interest in HEI is gradually increasing, as seen through improving volume metrics and social media buzz. As more traders recognize this setup, the potential for a breakout rally becomes stronger. HEI’s fundamentals and potential utility within its ecosystem further support a bullish case, making it a coin to watch closely in the coming weeks. If the breakout confirms, it could attract significant trading volume and price momentum.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!