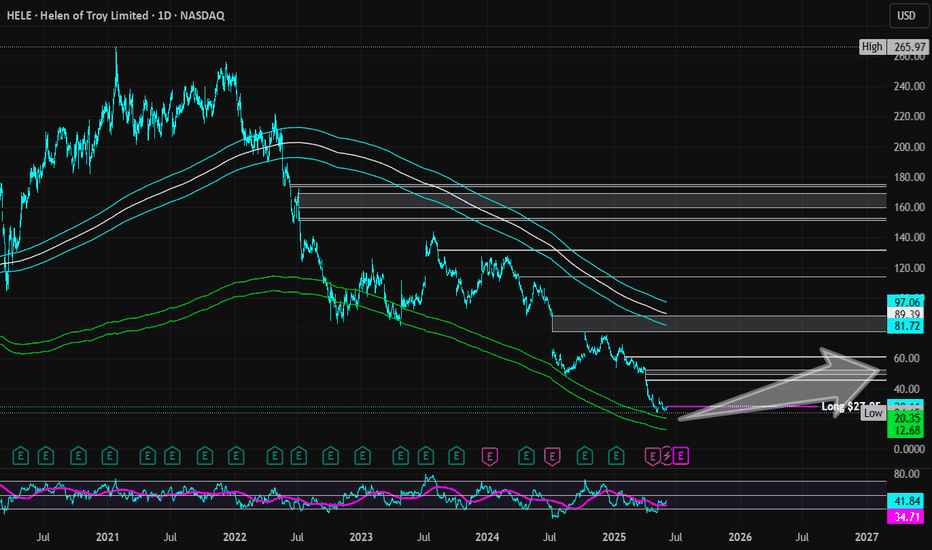

Helen of Troy | HELE | Long at $27.95Helen of Troy NASDAQ:HELE , owner of brands such as OXO, Hydro Flask, Osprey, Vicks, Olive & June, etc, has witnessed an immense decline in share price since its peak in 2021 when it hit just over $265. Now, trading in the $20s... Growth has been a problem for this company (now and future projections) and a major turnaround is needed. However, NASDAQ:HELE is implementing several growth strategies for 2025-2030 under its Elevate for Growth plan and Project Pegasus, so they are very aware of the need to re-inspire investor confidence. They also announced last month the appointment of an interim CEO and CFO. With a 22M float and 12% short interest, this could get interesting.

Excluding the current growth issue, the fundamentals of NASDAQ:HELE are quite strong:

P/E Ratio: 5x (undervalued)

Book Value: ~$70.00 a share (undervalued)

Debt-to-Equity: 0.6x (healthy)

Quick Ratio: Over 1 (healthy)

From a technical analysis perspective, it may have just formed a double-bottom near $24-$25, but a quick drop between $10-$20 is absolutely possible if bad economic news emerges.

At $27.95, NASDAQ:HELE is in a personal buy zone with a caution regarding the US economy and this company's ability to turn things around moving forward.

Targets:

$40.00 (+43.1%)

$52.00 (+86.0%)

Helenoftroy

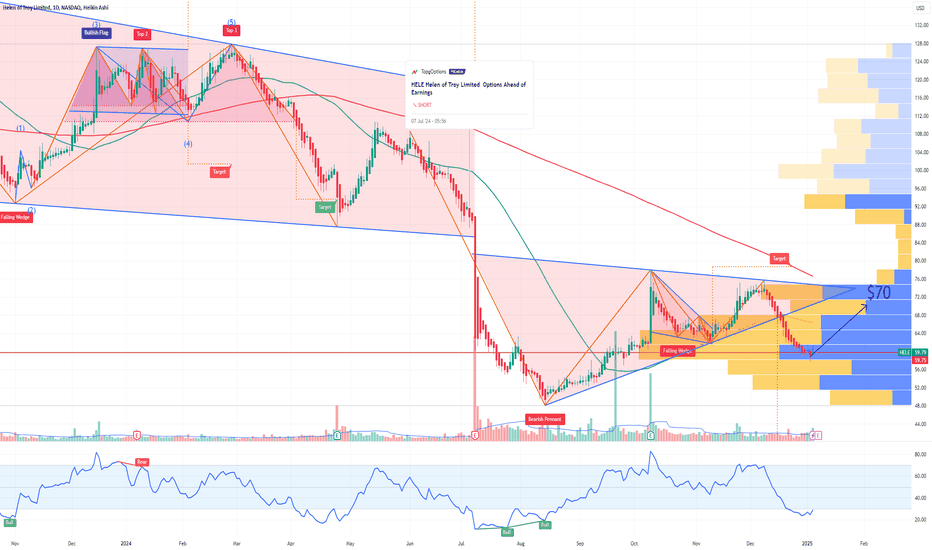

HELE Helen of Troy Limited Options Ahead of EarningsIf you haven`t sold HELE before the previous earnings:

Now analyzing the options chain and the chart patterns of HELE Helen of Troy Limited prior to the earnings report this week,

I would consider purchasing the 70usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $1.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

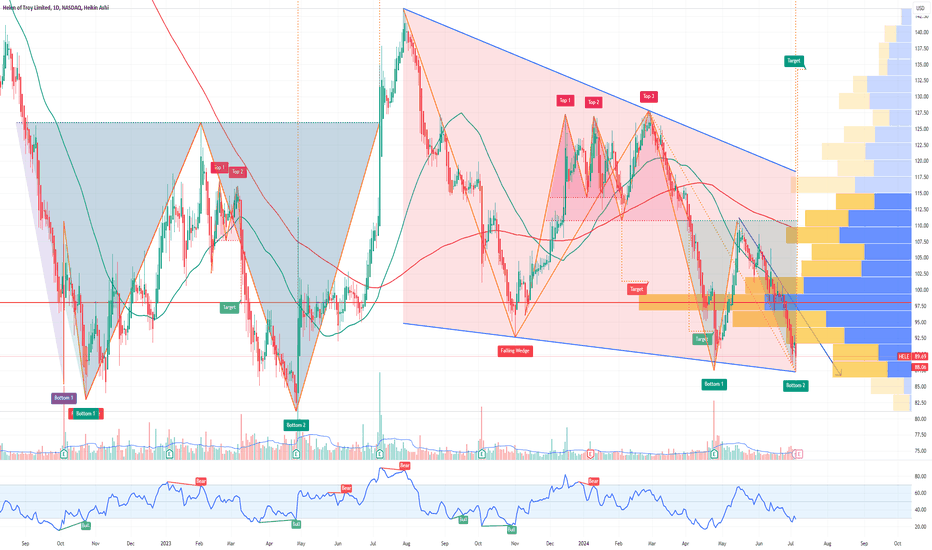

HELE Helen of Troy Limited Options Ahead of EarningsAnalyzing the options chain and the chart patterns of VIST Vista Energy prior to the earnings report this week,

I would consider purchasing the 90usd strike price Calls with

an expiration date of 2024-9-20,

for a premium of approximately $7.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

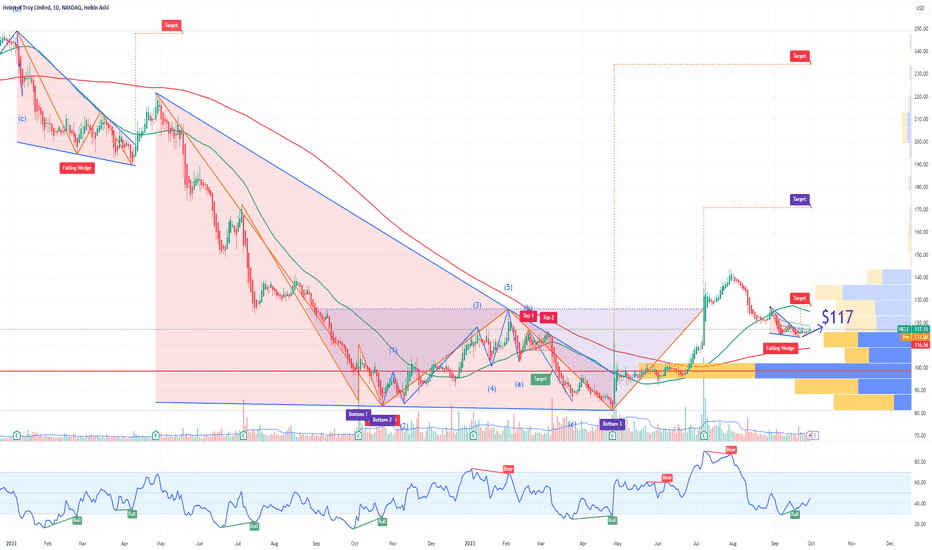

HELE Helen of Troy Limited Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MTN Vail Resorts prior to the earnings report this week,

I would consider purchasing the 117usd strike price Calls with

an expiration date of 2023-10-6,

for a premium of approximately $5.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.