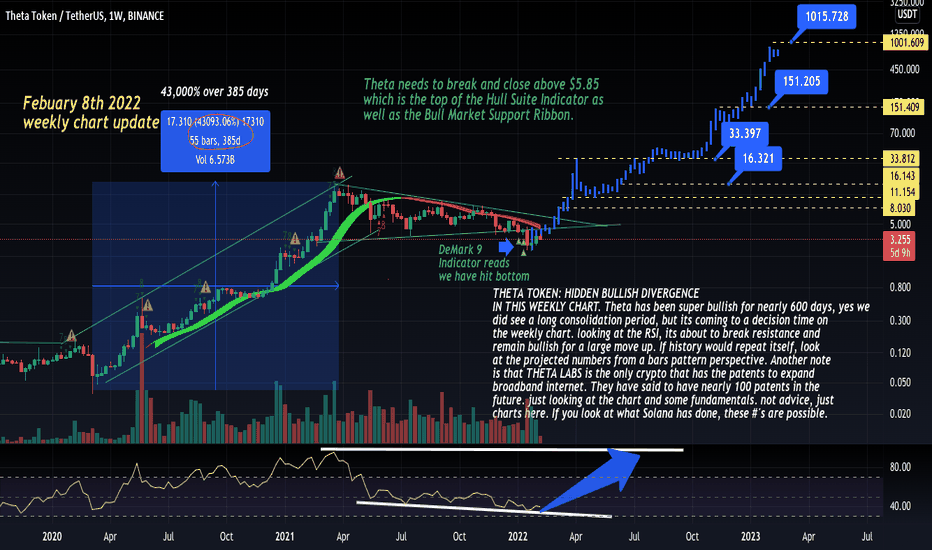

THETA TOKEN HAS HIDDEN BULLISH DIVERGENCETHETA TOKEN: HIDDEN BULLISH DIVERGENCE

IN THIS WEEKLY CHART. Theta has been super bullish for nearly 600 days, yes we

did see a long consolidation period, but its coming to a decision time on

the weekly chart. looking at the RSI, its about to break resistance and

remain bullish for a large move up. If history would repeat itself, look

at the projected numbers from a bars pattern perspective. Another note

is that THETA LABS is the only crypto that has the patents to expand

broadband internet. They have said to have nearly 100 patents in the

future. just looking at the chart and some fundamentals. not advice, just

charts here. If you look at what Solana has done, these #'s are possible.

look at the comments listed on the chart for more details.

HEX

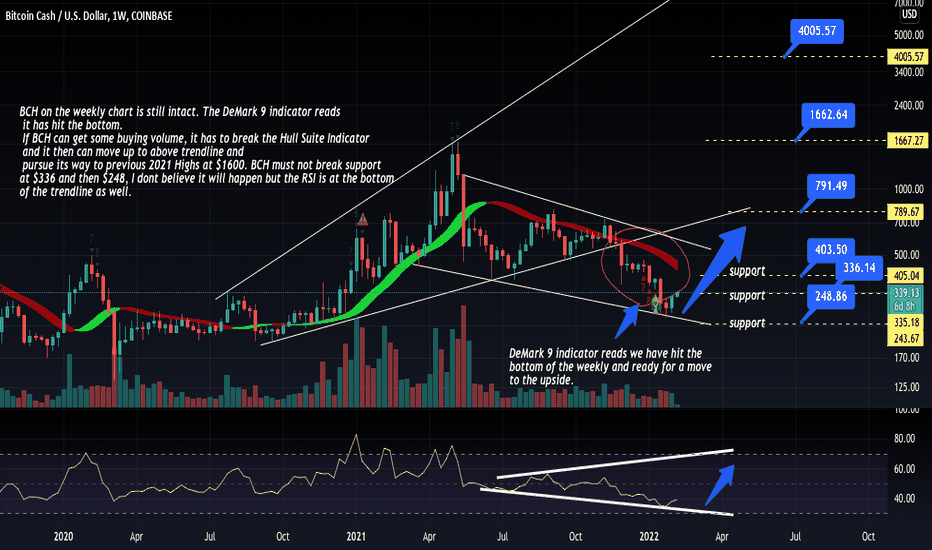

BCH weekly chart still Intact?BCH on the weekly chart is still intact. The DeMark 9 indicator reads

it has hit the bottom.

If BCH can get some buying volume, it has to break the Hull Suite Indicator

and it then can move up to above trendline and

pursue its way to previous 2021 Highs at $1600. BCH must not break support

at $336 and then $248, I dont believe it will happen but the RSI is at the bottom

of the trendline as well.

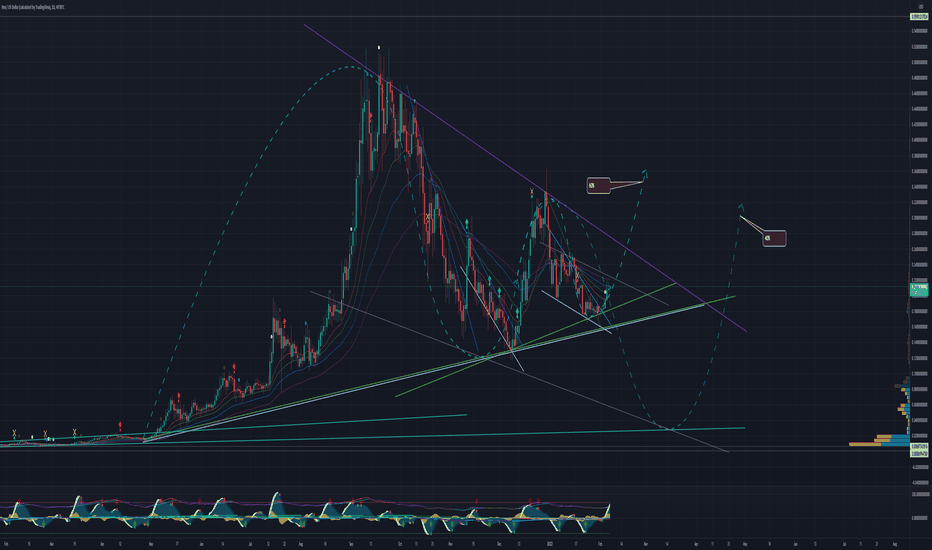

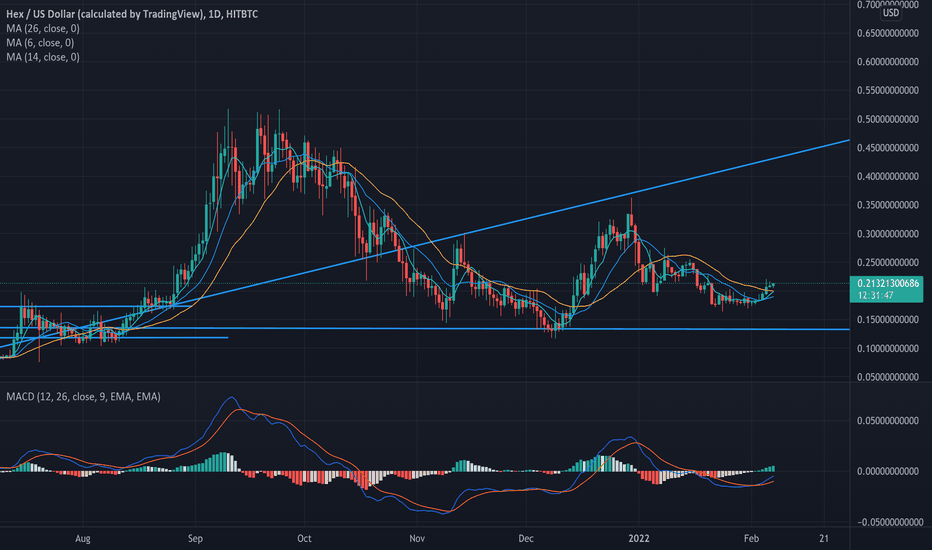

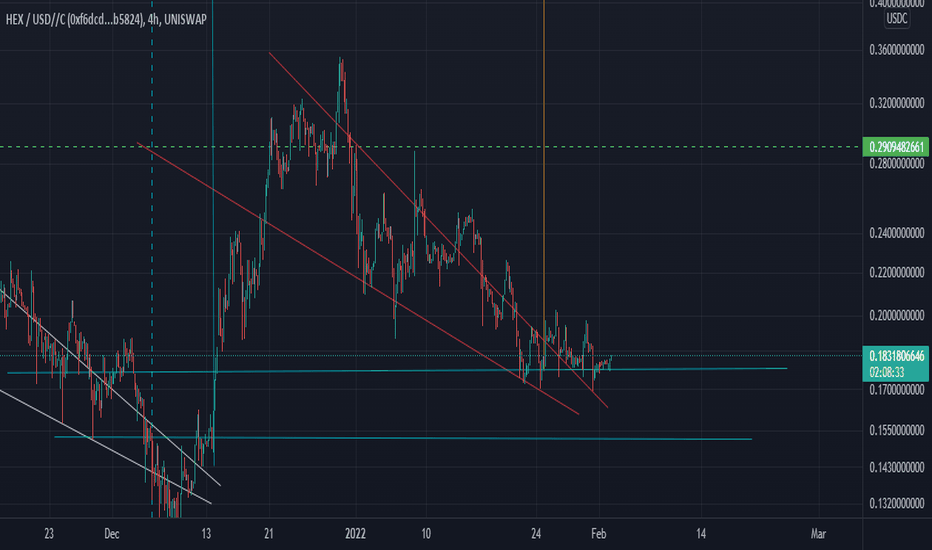

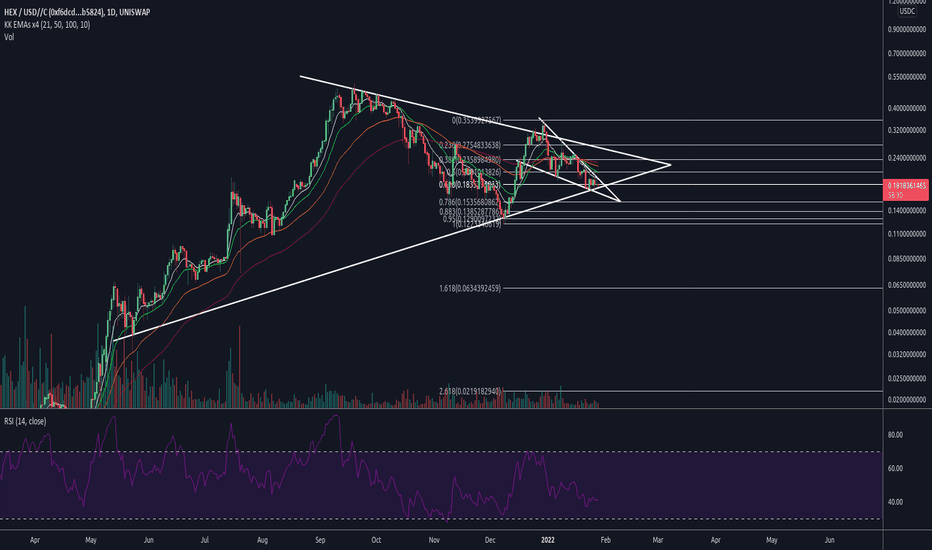

HEXUSD ForecastingHi fellow traders,

Since Hex is relatively young, hence it's harder to analyze. Once we have more data, we'll be able to do more accurate predictions. For now this all I got.

We have a huge symmetrical triangle forming. There are more bull flags forming in the short term. Overall I'm pretty bullish actually.

The blue dashed lines are possible price action trend trajectory. Higher the opacity, higher the chance of happening.

Hex patterns on the daily...Hi all, not an expert by any means, fairly new to reading charts (6 months) and for sure not financial advice.

I've applied a new trend line on the daily chart with a top middle and bottom, showing where price seems to find support or resistance. I have a feeling the long term trend line is broken (lets be honest is couldn't continue that way forever). I see the downward channel is still in play but the (new) longer term trend line is being honored. So I am keeping a close eye on the formation - expecting some kind of breakout from the downward channel in the near future.

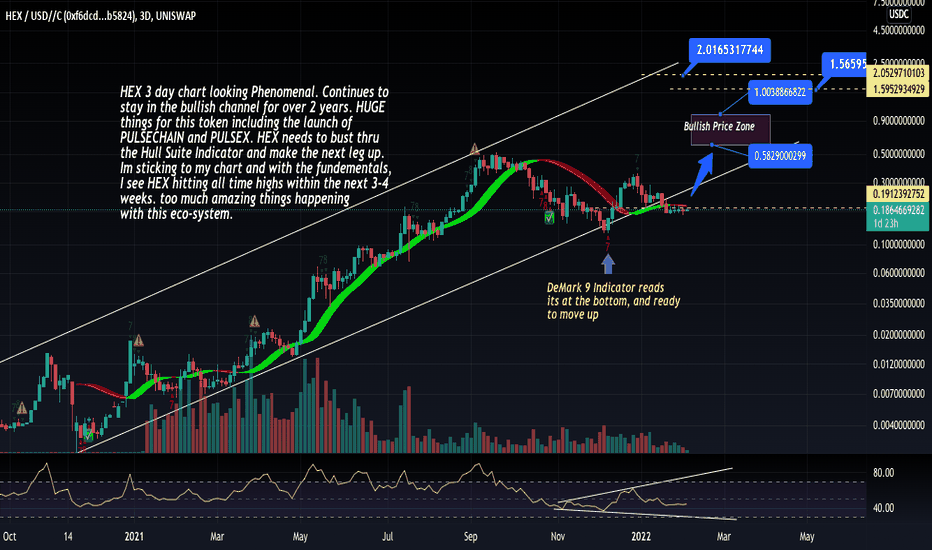

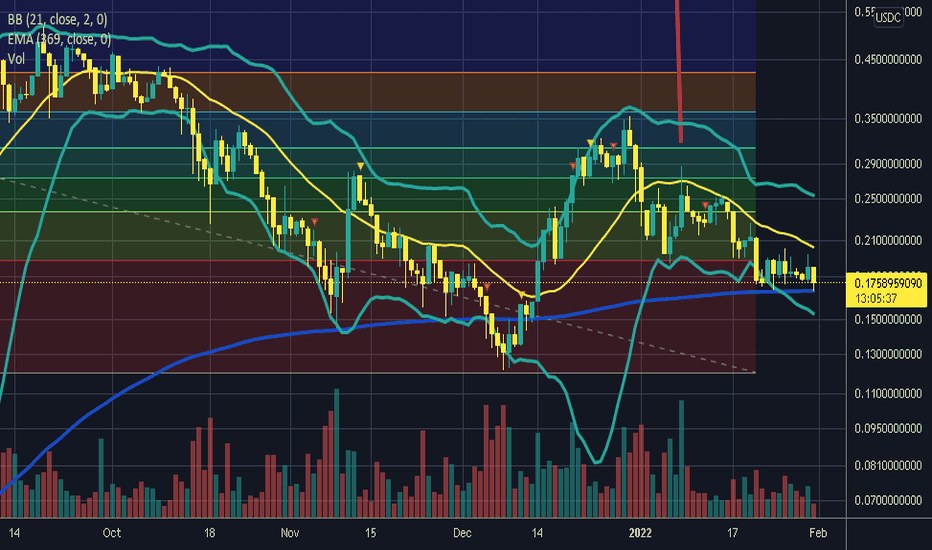

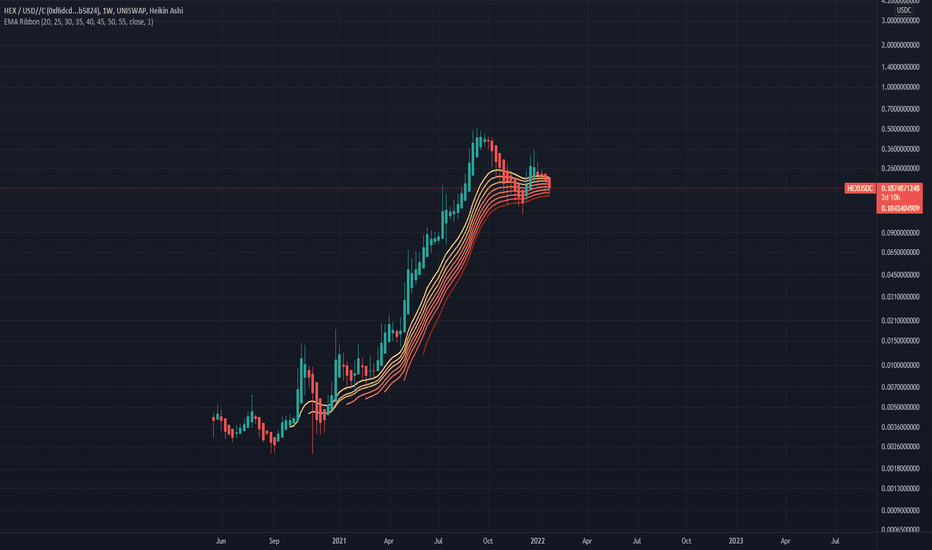

HEX 3 day chart looking bullish as everHEX 3 day chart looking Phenomenal. Continues to

stay in the bullish channel for over 2 years. HUGE

things for this token including the launch of

PULSECHAIN and PULSEX. HEX needs to bust thru

the Hull Suite Indicator and make the next leg up.

Im sticking to my chart and with the fundementals,

I see HEX hitting all time highs within the next 3-4

weeks. too much amazing things happening

with this eco-system.

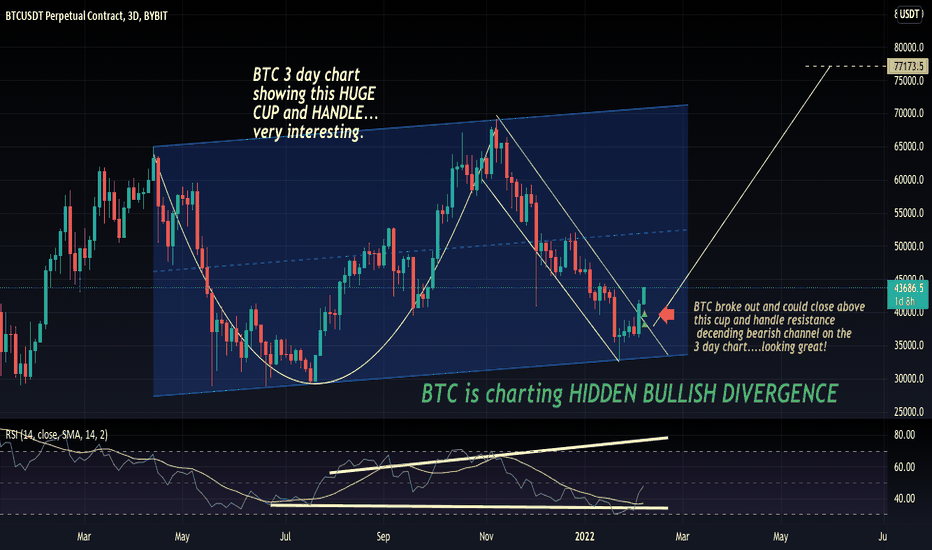

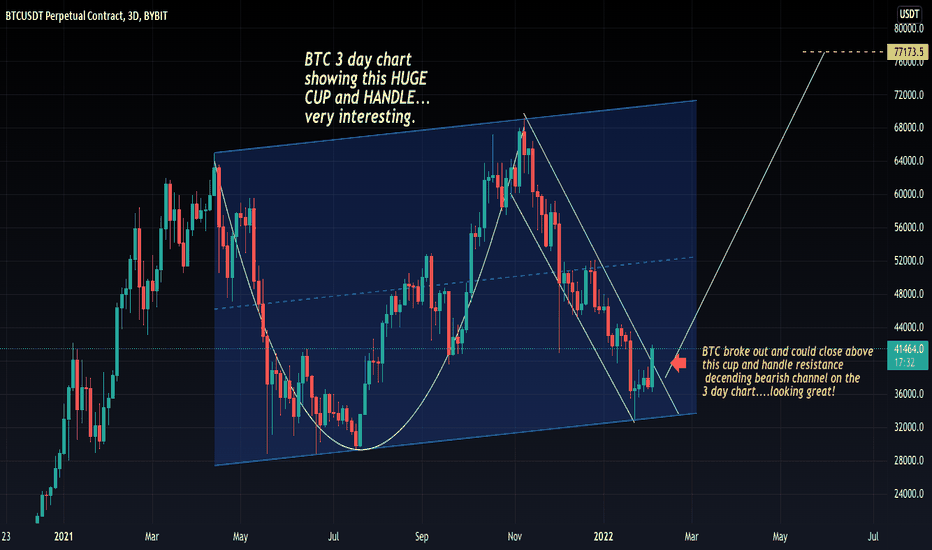

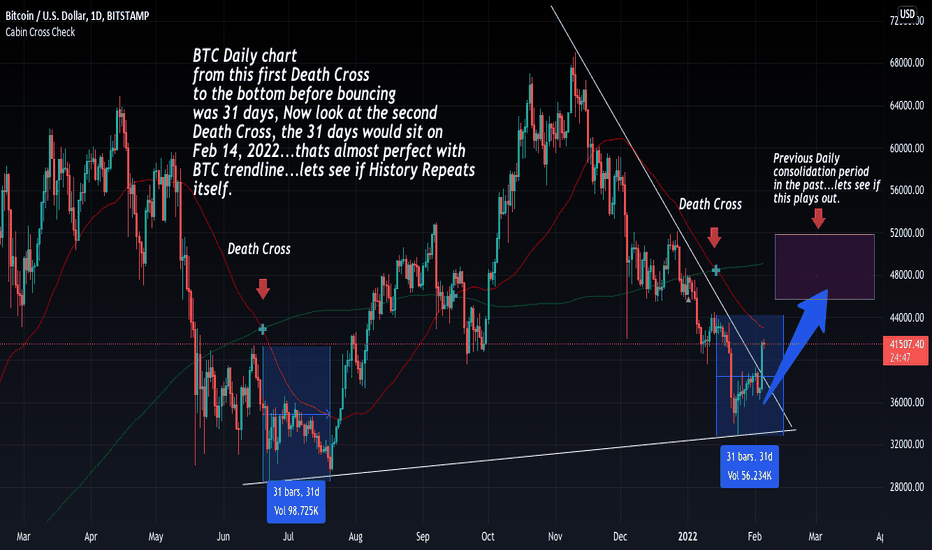

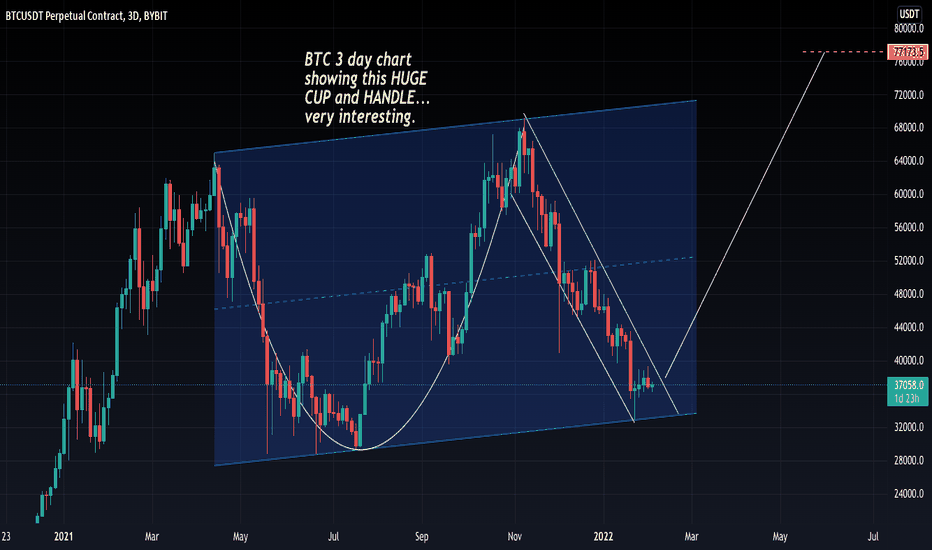

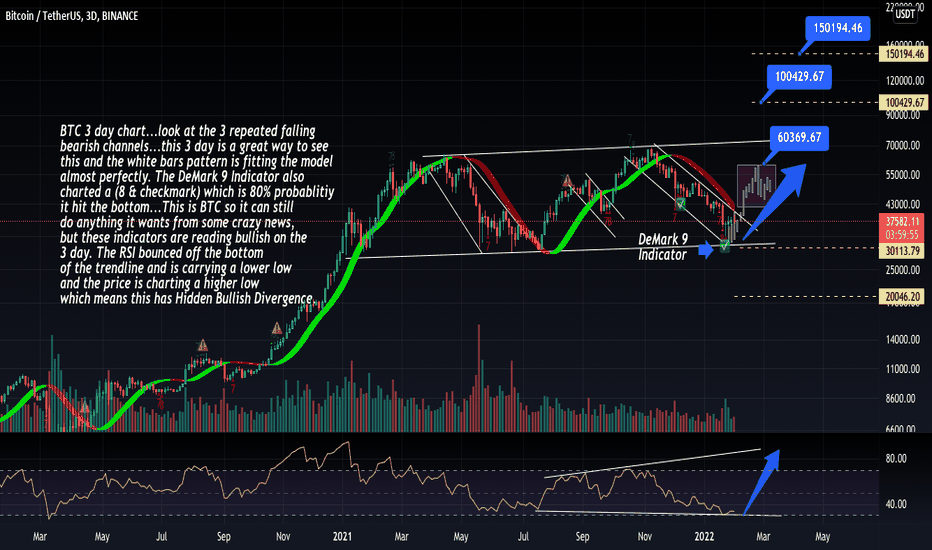

BTC 3 day chart looking bullish?BTC 3 day chart...look at the 3 repeated falling

bearish channels...this 3 day is a great way to see

this and the white bars pattern is fitting the model

almost perfectly. The DeMark 9 Indicator also

charted a (8 & checkmark) which is 80% probablitiy

it hit the bottom...This is BTC so it can still

do anything it wants from some crazy news,

but these indicators are reading bullish on the

3 day. The RSI bounced off the bottom

of the trendline and is carrying a lower low

and the price is charting a higher low

which means this has Hidden Bullish Divergence.

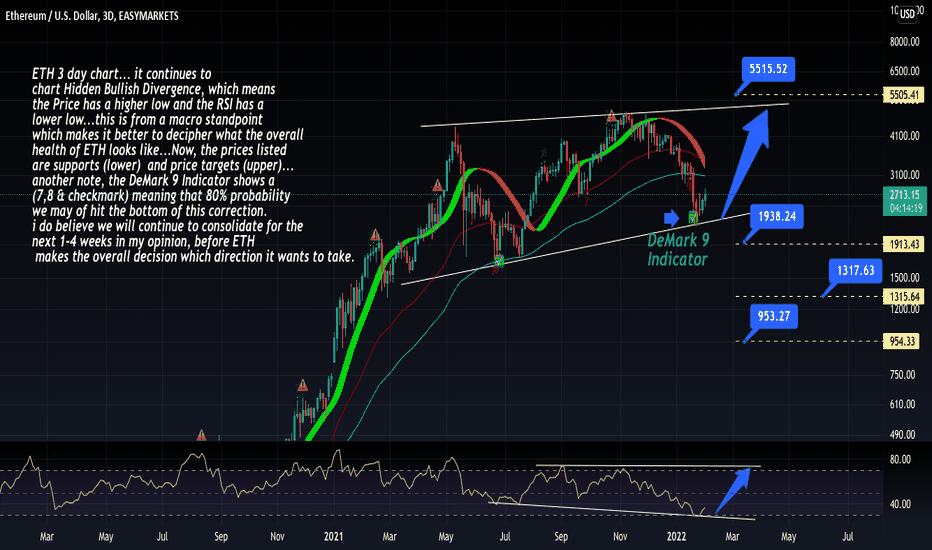

ETH 3 day chart looking bullish?ETH 3 day chart... it continues to

chart Hidden Bullish Divergence, which means

the Price has a higher low and the RSI has a

lower low...this is from a macro standpoint

which makes it better to decipher what the overall

health of ETH looks like...Now, the prices listed

are supports (lower) and price targets (upper)...

another note, the DeMark 9 Indicator shows a

(7,8 & checkmark) meaning that 80% probability

we may of hit the bottom of this correction.

i do believe we will continue to consolidate for the

next 1-4 weeks in my opinion, before ETH

makes the overall decision which direction it wants to take.

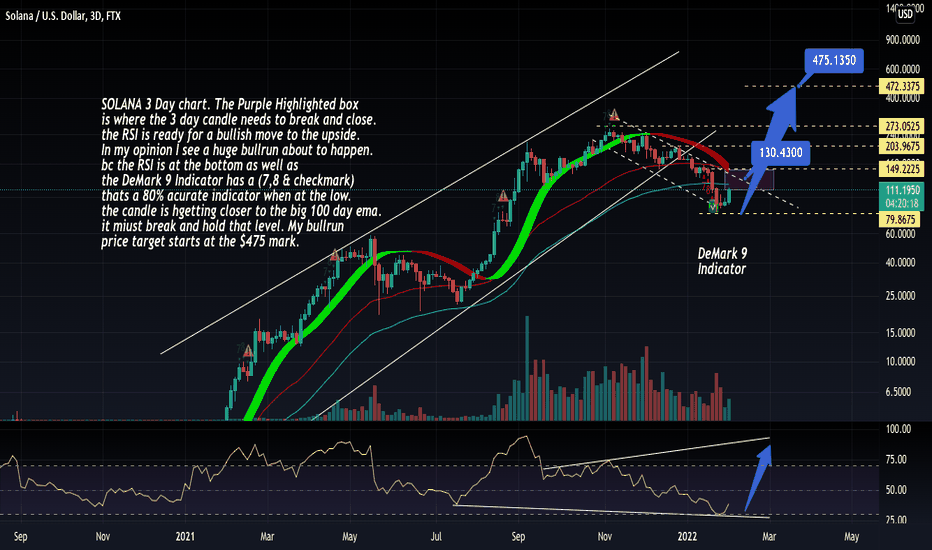

SOLANA 3 day chart looking bullishSOLANA 3 Day chart. The Purple Highlighted box

is where the 3 day candle needs to break and close.

the RSI is ready for a bullish move to the upside.

In my opinion I see a huge bullrun about to happen.

bc the RSI is at the bottom as well as

the DeMark 9 Indicator has a (7,8 & checkmark)

thats a 80% acurate indicator when at the low.

the candle is hgetting closer to the big 100 day ema.

it miust break and hold that level. My bullrun

price target starts at the $475 mark.

HEX quick updateIn the past couple of months ,HEX chart already looked like AIDS .Now AIDS got Cancer to .It`s bad . I`s very bad...Price got rejected from daily 21 EMA multiple times .

This EMA is sloping down on every time frame. Even on the weekly . This is full blown-bear market.

Price is resting on.17-.18c ,which, as you already know from my last updates ,is support .

This support was tested over and over again and now I expect to break in a big way!

Target1: 0.085c

Invalidation :23.5c.Anything under .23c (and thats on a weekly candle close) is a dead cat bounce and price will most probably fall into a death spiral.

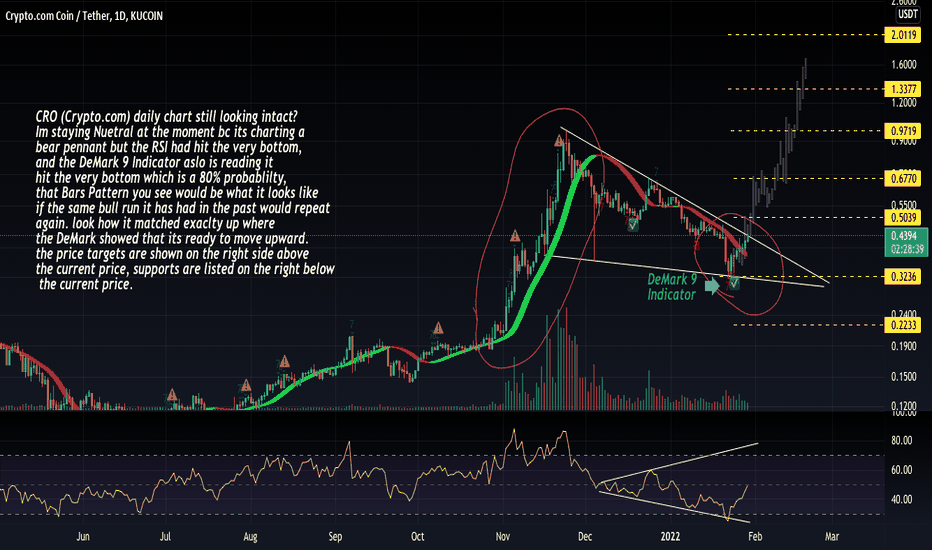

CRO daily chart still intact?CRO (Crypto.com) daily chart still looking intact?

Im staying Nuetral at the moment bc its charting a

bear pennant but the RSI had hit the very bottom,

and the DeMark 9 Indicator aslo is reading it

hit the very bottom which is a 80% probablilty,

that Bars Pattern you see would be what it looks like

if the same bull run it has had in the past would repeat

again. look how it matched exaclty up where

the DeMark showed that its ready to move upward.

the price targets are shown on the right side above

the current price, supports are listed on the right below

the current price. Im actually leaning more bullish

than bearish...I see us begin to move upward from now to the next 4 wweks

for a bull run..

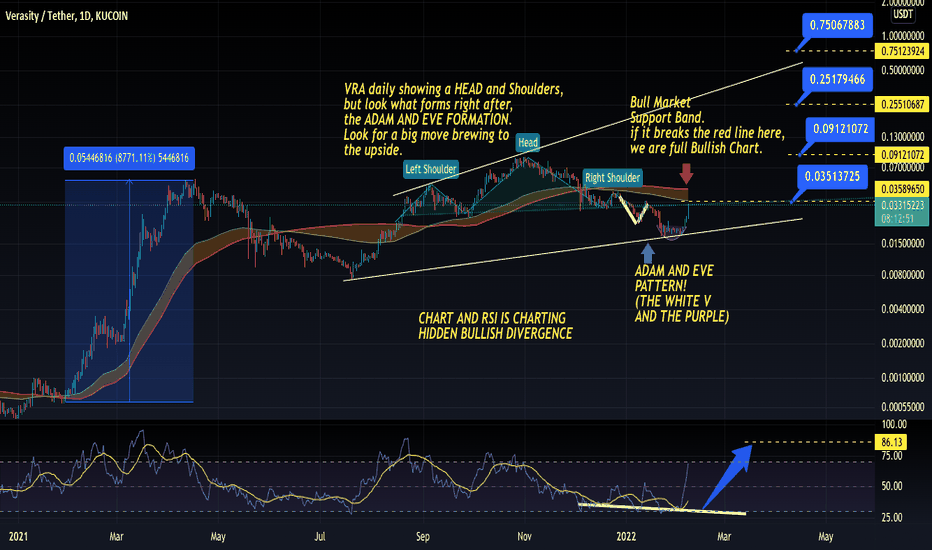

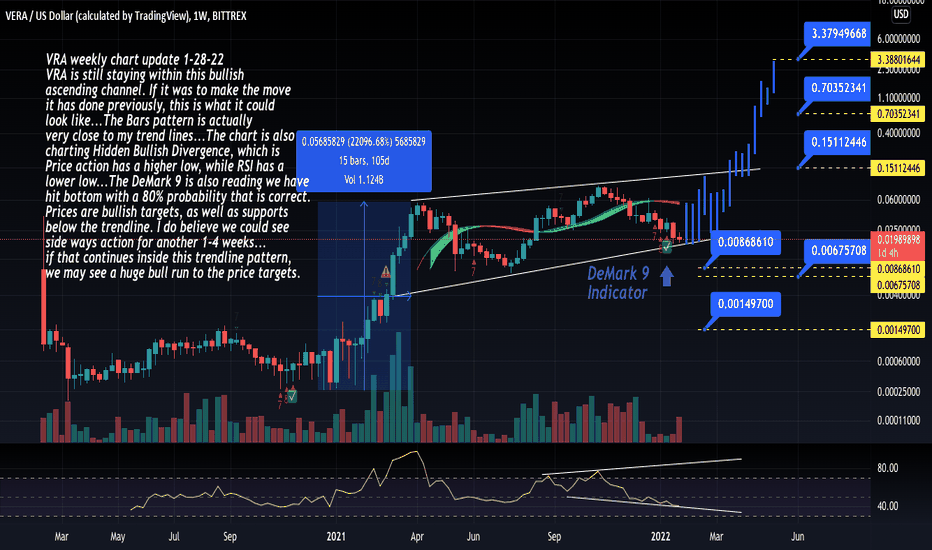

VRA weekly chart is it intact for a bullrun?VRA weekly chart update 1-28-22

VRA is still staying within this bullish

ascending channel. If it was to make the move

it has done previously, this is what it could

look like...The Bars pattern is actually

very close to my trend lines...The chart is also

charting Hidden Bullish Divergence, which is

Price action has a higher low, while RSI has a

lower low...The DeMark 9 is also reading we have

hit bottom with a 80% probability that is correct.

Prices are bullish targets, as well as supports

below the trendline. I do believe we could see

side ways action for another 1-4 weeks...

if that continues inside this trendline pattern,

we may see a huge bull run to the price targets.