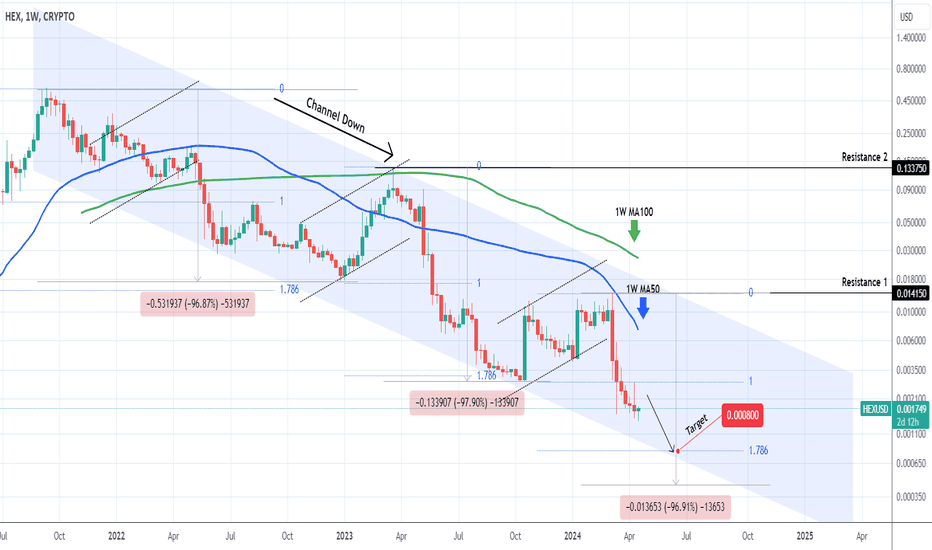

HEXUSD The downtrend is intact. Lower prices to be expected.HEXUSD has been trading within a long-term Channel Down since September 2021 and the current weekly rise doesn't seem to be able to alter that. It will be the first green 1W candle after 6 red in a row.

The pattern so far gives roughly -97% Bearish Legs to the 1.786 Fibonacci extension and then Bullish Legs towards the top of the Channel Down. As a result, we expect prices to at least 0.000800 (Fib 1.786) before we can consider again a medium-term rebound in the form of a Channel Up (dotted).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Hexsignals

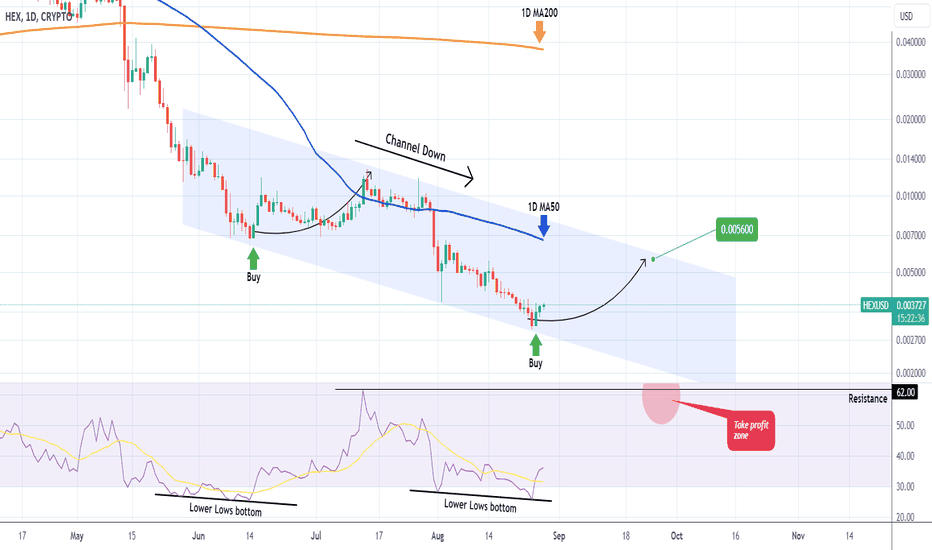

HEXUSD Buy signal within the Channel Down.HEXUSD completed 2 straight 1D green candles after reaching the bottom of the Channel Down pattern. The 1D RSI completed a Lower Lows pattern similar to the June 14 bottom sequence that was the last major buy signal for HEX. As a result, we turn bullish on this crypto, targeting the top (Lower Highs trend-line) of the Channel Down at 0.0056. If however the 1D RSI reaches the Resistance zone earlier, we will take profit at the given price.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

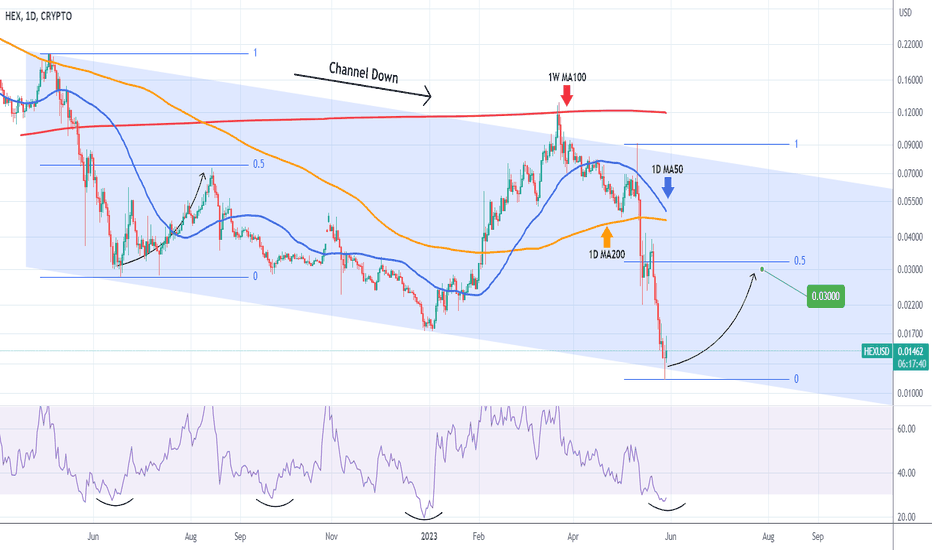

HEXUSD Buy signal targeting 0.0300HEXUSD hit the bottom of its 1 year Channel Down with the 1D RSI oversold below 30.00. This has been a strong buy signal on all three previous occasions inside this pattern. With the 1D MA200 (orange trend-line) as the medium-term Resistance, we will target (slightly below) the 0.5 Fibonacci retracement level (at least) at 0.0300, similar to what took place on August 14 2022.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

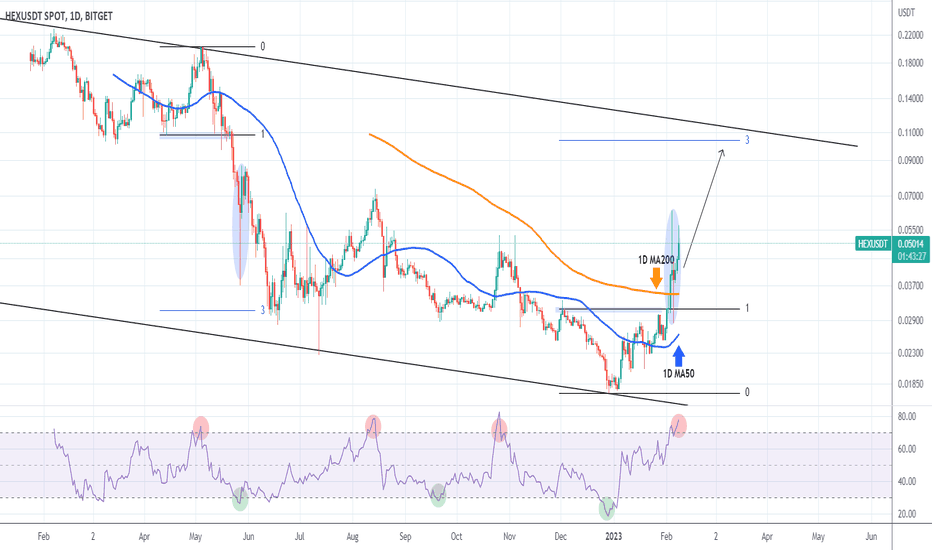

HEXUSDT going straight to 0.1000 based on this!HEXUSDT is recovering from the extreme volatility of February 04-05, keeping the 1D MA200 (orange trend-line) intact. Despite a largely overbought 1D RSI, the last time we saw such a huge 2 day volatility was during May 27-28 2022. That proved out to be just a pause before a continuation of that bearish leg towards the bottom of the long-term Channel Down.

That bearish leg hit the 3.0 Fibonacci extension with ease. Since we are currently on a bullish leg since the start of the year, a Fib 3.0 continuation will take HEX as high as 0.1000. That is our medium-term target.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

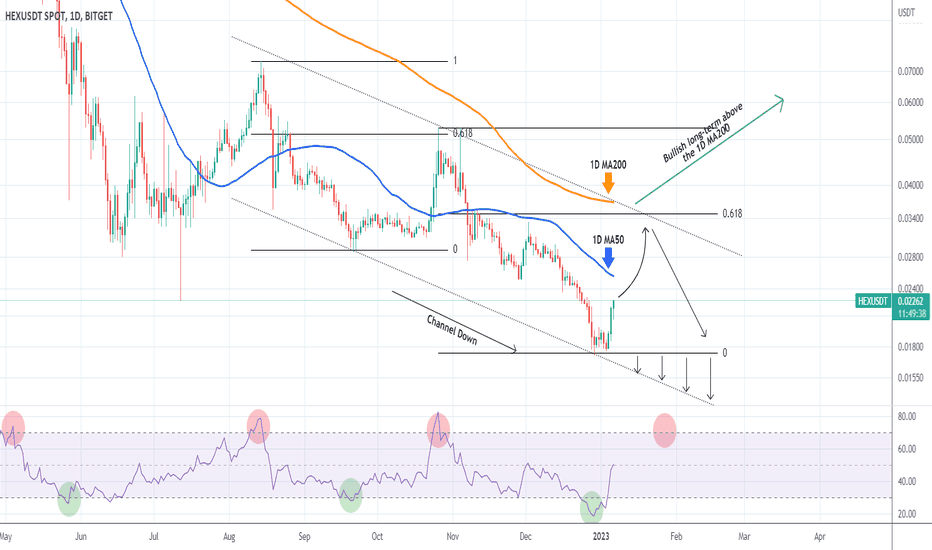

HEXUSDT One of the best buys in the market right nowHEX (HEXUSDT) is on a strong 3-day rise after it hit the bottom (Lower Lows trend-line) of the Channel Down pattern that started on the August 14 2022 High. We have used the 1D MA50 (blue trend-line) as a short-term target before and this is what we are after again. On the medium-term we expect a Lower High of the Channel Down to be formed on the 0.618 Fibonacci retracement level, ideally as close to the 1D MA200 (orange trend-line) as possible, which is the long-term Resistance.

A 1D candle closing above the 1D MA200, constitutes a bullish break-out long-term and the return of HEX to the Bull Market. On the other hand, an early break below the December 29 Bottom would be a bearish signal targeting the Lower Lows trend-line of the Channel Down.

Notice how the oversold (green circle) and overbought (red circle) levels on the 1D RSI can be ideal buy and sell entries respectively. Such an oversold RSI signal was flashed last week.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

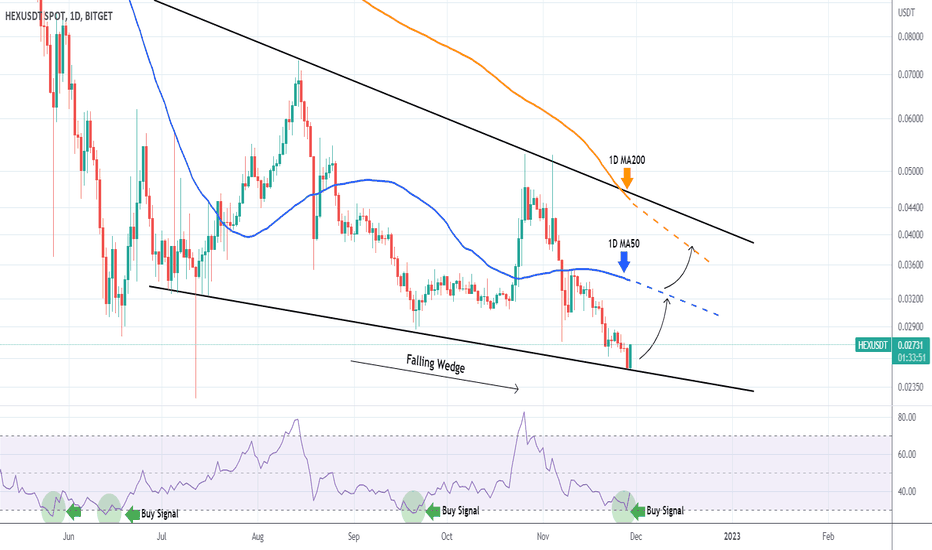

HEXUSDT Bullish signalHEX (HEXUSDT) has been trading within a Falling Wedge pattern since July. Today it is on a strong 1D candle with the RSI rebounding on the 30.000 oversold barrier. Having priced a new Lower Low at the bottom of the Falling Wedge, this move has the potential to hit the 1D MA50 (blue trend-line) on the short-term and the 1D MA200 (orange trend-line) on the medium-term, before making a new Lower High on the Wedge.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇