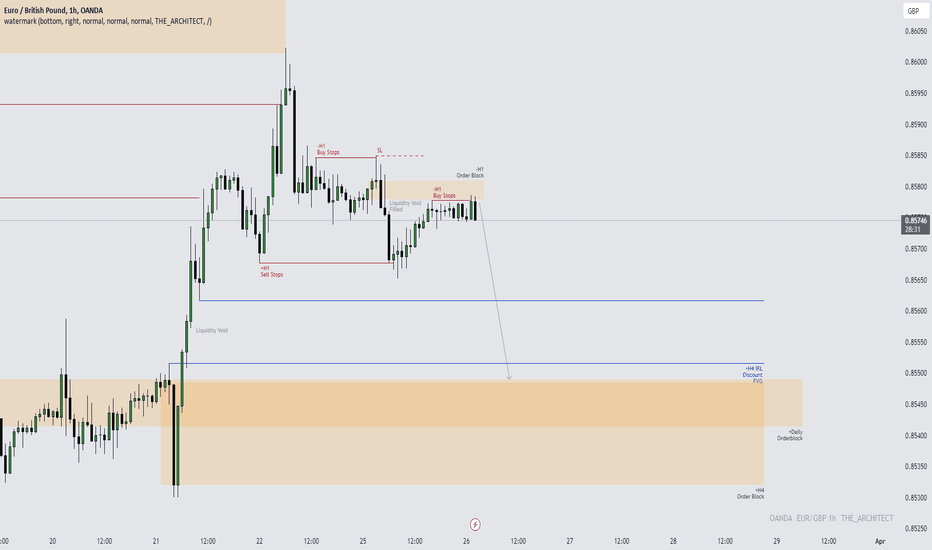

EURGBP: Exploring a Potential Sell OpportunityCurrently, EURGBP is exhibiting bearish institutional order flow , leading me to anticipate a continuation from the current H1 Bearish Order Block. The objective is for price to reach the Daily Bullish Order Block, our current Draw On Liquidity. This sell opportunity holds a high probability due to the presence of low resistance liquidity towards the downside, facilitating smooth movement through inefficiencies such as Liquidity Voids and Fair Value Gaps towards the Order Block.

I have considered taking a Risk Entry Trade off the H1 Order Block, with the Stop Loss positioned at the high of the Order Block.

Kind Regards,

The_Architect

Highprobability

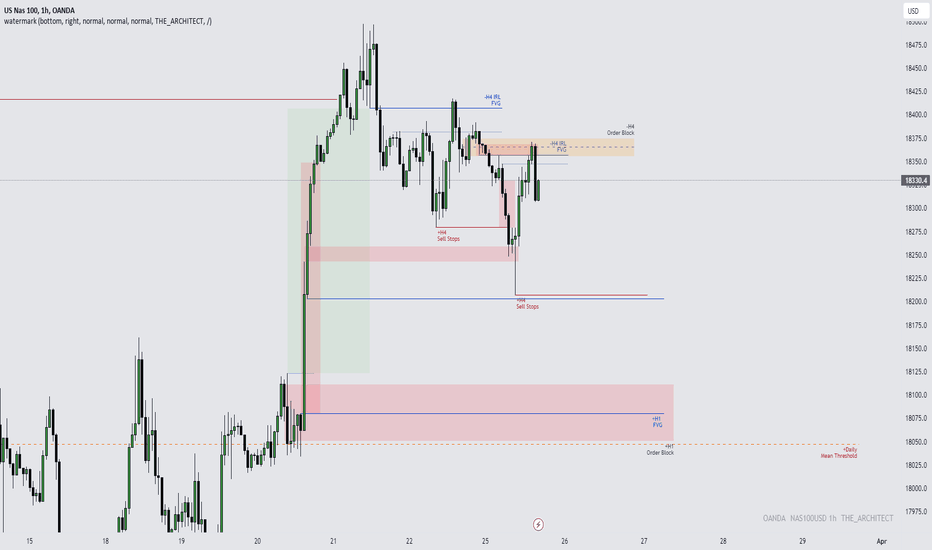

High Probability Trading Environments Part 2: Liquidity RunsIn this educational video, we'll explore the distinction between High Resistance Liquidity Runs and Low Resistance Liquidity Runs, crucial for identifying High Probability Trading Environments. Our analysis will focus on NAS100USD, providing insights into potential trading opportunities for the week ahead.

By understanding these concepts, you'll gain valuable insights into positioning yourself effectively in the market. Be sure to watch to gain a comprehensive understanding of the key confluences that contribute to successful trading strategies.

Understanding Trend Analysis, SMT and ICT Concepts

Mastering High Probability Trading Environments Part 1

Kind Regards,

The_Architect

Mastering High Probability Trading EnvironmentsIn this educational video, we'll delve into High Probability Trading Environments and introduce a simple yet effective concept to confirm their presence . Understanding these environments will empower you to confidently navigate the market with consistency and success.

For a comprehensive understanding, I recommend watching my previous video on Understanding Trend Analysis, SMT, and ICT Concepts below.

If you have any questions, feel free to leave them in the comments section.

Happy trading!

The_Architect

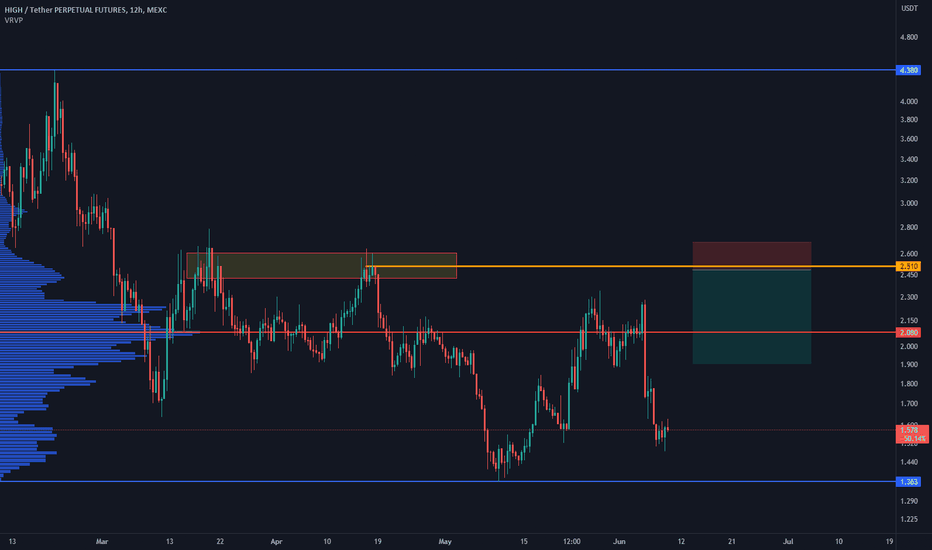

HIGH/USDT upwardtrajectory what next? 👀 🚀 HIGH Analysis💎 Paradisers, gear up for a thrilling trading prospect with #HIGHUSDT, strategically nestled in a crucial support zone, suggesting a bullish twist ahead.

💎 Diving into #HIGH's voyage, following a recoil from significant resistance, it's ascending from an essential support mark at $2.063. Maintaining this position is key for triggering a bullish wave. Eye the forthcoming target, resistance at $2.683, where overcoming it could elevate the price to $3.117.

💎 Should the momentum for AMEX:HIGH begin to diminish, be on the lookout for a bullish bounce off the robust support at $1.595. Yet, dropping below this essential level could hint at transitioning towards bearish realms.

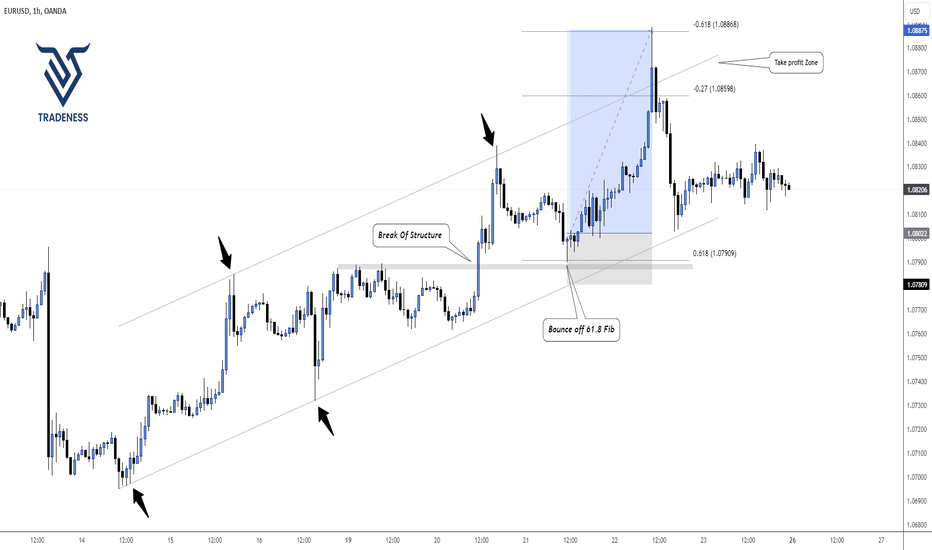

How to Find a High Probability Trade in an Uptrend Hey Traders,

We'll show you how you can find an easy trade with a high risk-to-reward ratio using some basic concepts.

- Step One: Spot an uptrend where you have higher highs and higher lows.

- Step two: Spot the last break of structure.

- Step three: Use the Fibonacci tool and connect it from the recent lows to the recent highs.

- Step Four: Watch prices coming back to the broken structure that lines up with any Fibonacci level. ( Focus on the 50% - 61.8% - 78.6% Levels )

- Step Five: Wait for a clear bullish candle and then enter with stoploss structure

- Step Six: Take partial profits at the recent highs and the Fibonacci extensions ( - 0.27 & -0.618 )

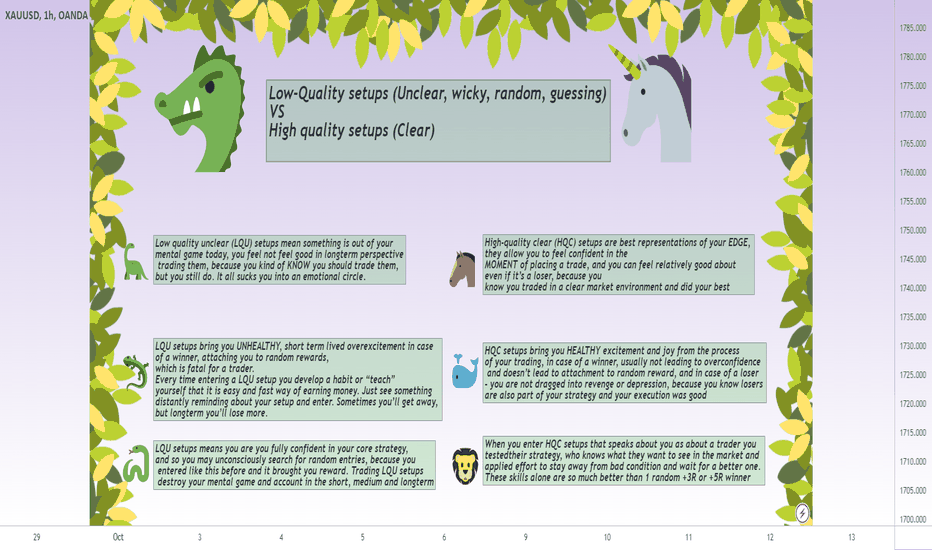

📕Low-Quality setups (UNCLEAR) VS High quality (CLEAR) setups📕High quality (Clear) vs Low Quality (Unclear, wicky, random, guessing)

Setups in Our Trading

High quality clear (HQC) setups are best representations of your EDGE, they allow you to feel confident in the MOMENT of placing a trade, and you can feel relatively good about it even if it’s a loser, because you know you traded in clear market environment and did your best

HQC setups bring you HEALTHY excitement and joy from the process of your trading, in case of a winner, usually not leading to overconfidence and doesn’t lead to attachment to random reward, and in case of a loser - you are not dragged into revenge or depression, because you know losers are also part of your strategy and your execution was good

When you enter HQC setups that speaks about you as about a trader you tested their strategy, who knows what they want to see in the market and applied effort to stay away from bad condition and wait for a better one. These skills alone are so much better than 1 random +3R or +5R winner

Low quality unclear (LQU) setups mean something is out of your mental game today, you feel not feel good in longterm perspective trading them, because you kind of KNOW you should trade them, but you still do. It all sucks you into an emotional circle.

LQU setups bring you UNHEALTHY , short term lived overexcitement in case of a winner, attaching you to random rewards, which is fatal for a trader. Every time entering a LQU setup you develop a habit or “teach” yourself that it is easy and fast way of earning money. Just see something distantly reminding about your setup and enter. Sometimes you’ll get away, but longterm you’ll lose more.

LQU setups means you are you fully confident in your core strategy, and so you may unconsciously search for random entries, because you entered like this before and it brought you reward. Trading LQU setups is destroying your mental game and account in the short, medium and longterm

Picture attribution Frame Border PNGs by Vecteezy

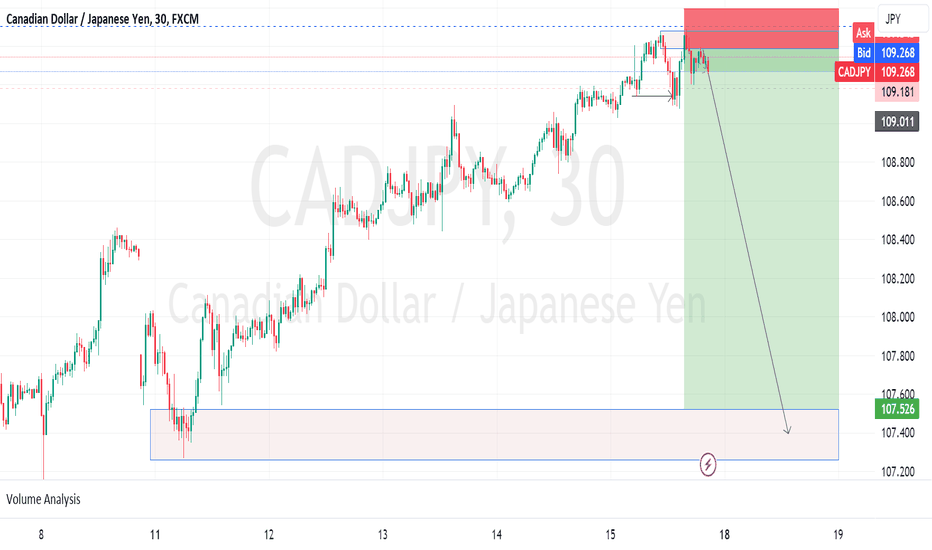

CADJPY - High probability Shorting opportunity CADJPY makes a change of character at a previous supply area; followed by a double top at the same zone, signalling a possible change in trend direction. A short position at 109.390 with a stop loss order slightly above the zone at 109.500 and take profits at 107.500 would be a profitable trading opportunity.

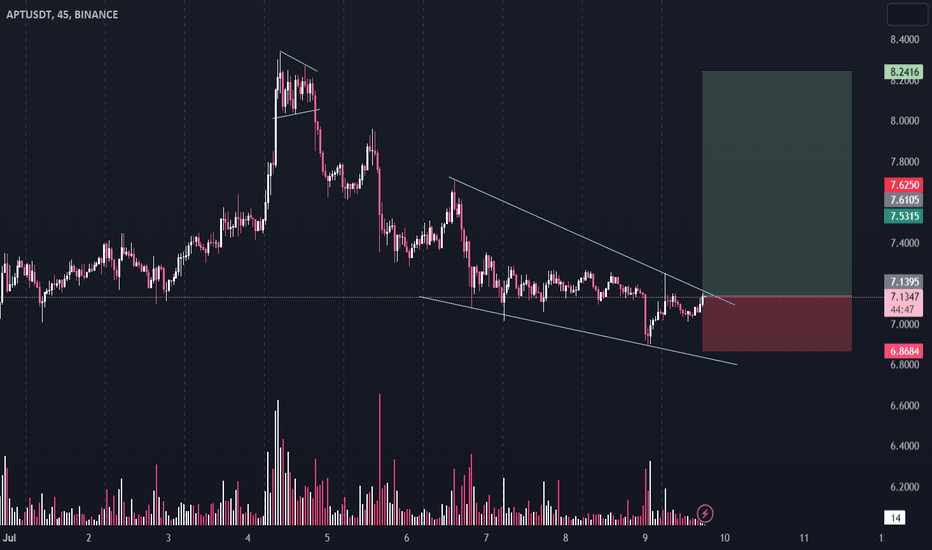

APTUSDT - Bullish breakout setup"Adding to the bullish sentiment, APTUSDT is on the verge of a trendline breakout, further enhancing the potential for a significant upward move.

Traders closely monitoring this setup anticipate a surge in buying pressure as the price breaches the key resistance level. With a well-defined risk-to-reward ratio of 1:5, savvy investors are positioning themselves to capitalize on the anticipated breakout, aiming for substantial gains.

As the market eagerly awaits the breakout confirmation, APTUSDT presents an enticing opportunity for traders seeking to ride the bullish wave and maximize their returns."

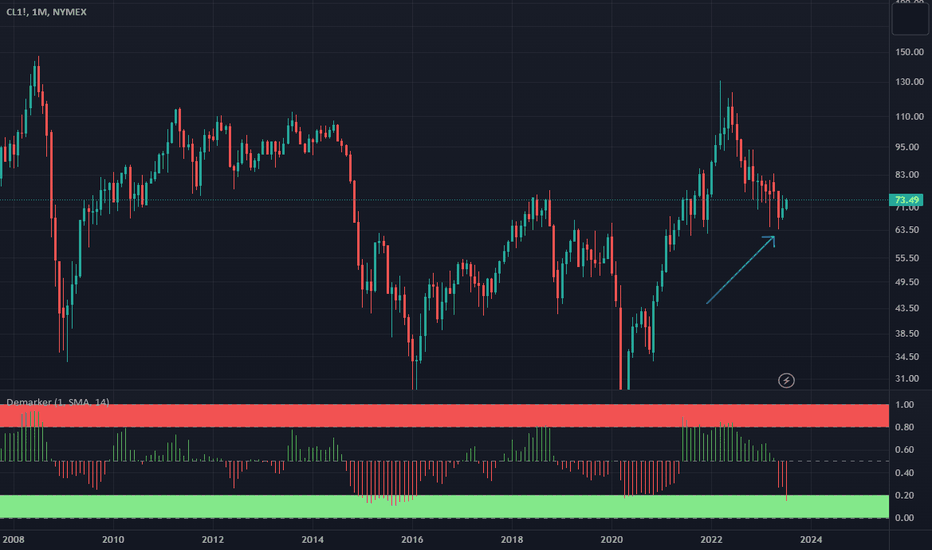

Bottom For oil was May 2023. Oil prices are prepared for strong growth to the upside. NYMEX:CL1! made its bottom in May of 2023.

Three reasons for this case to be made.

Russia cutting OPEC+ production by 500,000. The original balance from OEPC+ was 450,000 barrels of surplus. No Suprise that they cut it by exactly 500,000.

U.S. Now focused on SPR replenishing as opposed to releases.

Strong GDP solidifies no recession, and high employment solidifies strength in the consumer.

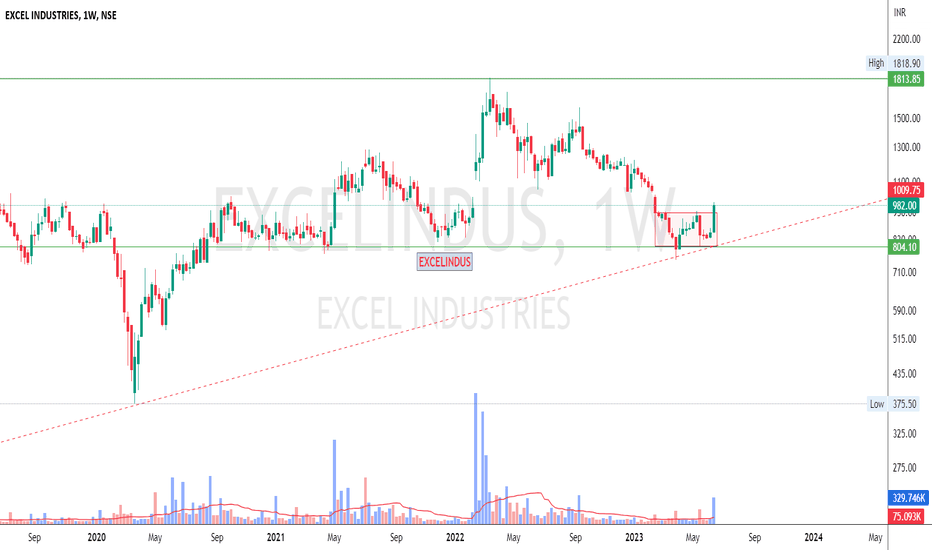

EXCELINDUS Swing Trade SetupThis will be my personal trade Setup, This is not an advice of any kind to initiate trade according to this setup. This is for only for my learning purpose and maintaining my trading journal.

Price is in uptrend reversed from Trendline.

Also price broke from box with with volume.

CMP: 982

Nearby Support: 802

Nearby Resistance: 1120, 1161.

The final shooting star for the AUDAUDUSD presented a shooting star at a key area of confluence on Wednesday. Price failed to break this confirmed evening star. Thus creating a volatile indecision bearish engulfing at the high. I will short upon a retest of the high or the presentation of a reversal candlestick on the back of the trendline if broken. Price is still pushing for its highest point. ADX is still very bullish for now.

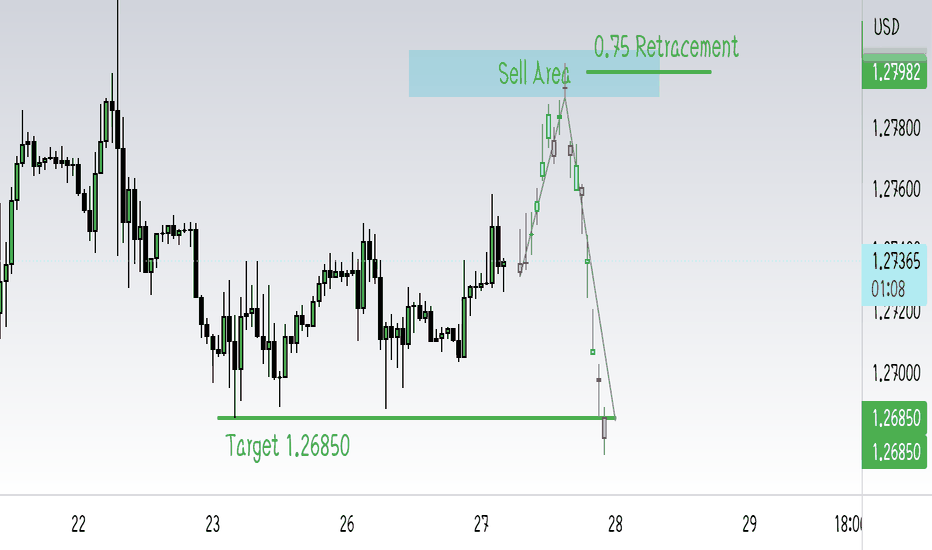

highstreet short setup Hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied. Please also refer to the Important Risk Notice linked below.

HIGH : CH COIN 2HIGH is the coin 2 after NEO that we follow for the coming time in the trend of Chinese coins.

We will follow this coin in case this coin is able to break out in the coming time.

Trend view list of coins that are connected to china trends.

HIGH,NEO,QTUM,FLM,EOS,BCH,AMB,VET,ONT,TRX,FIL,XLM

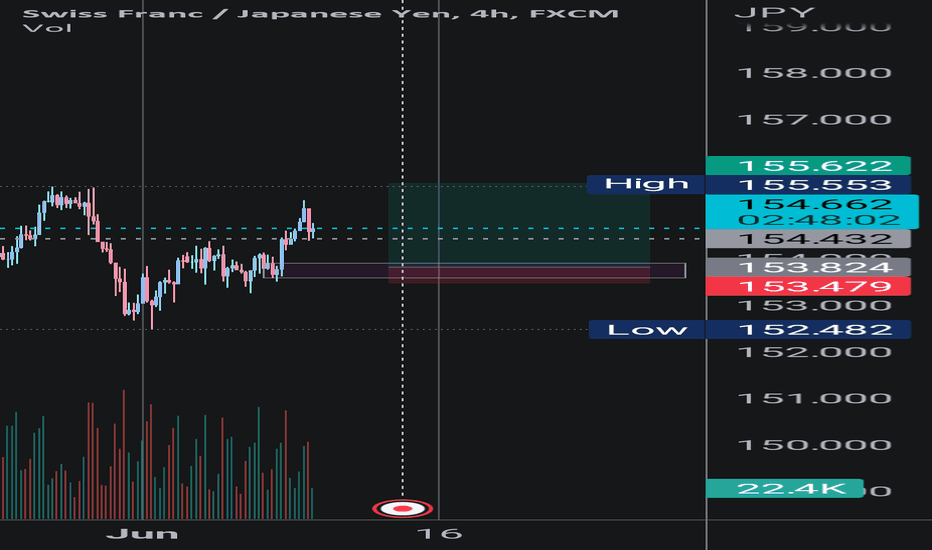

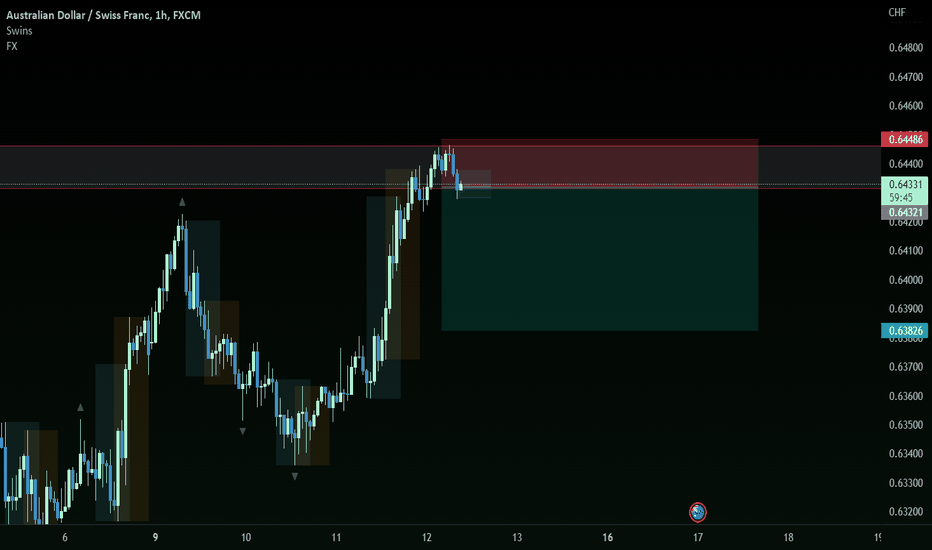

AUD CHF SHORT#14

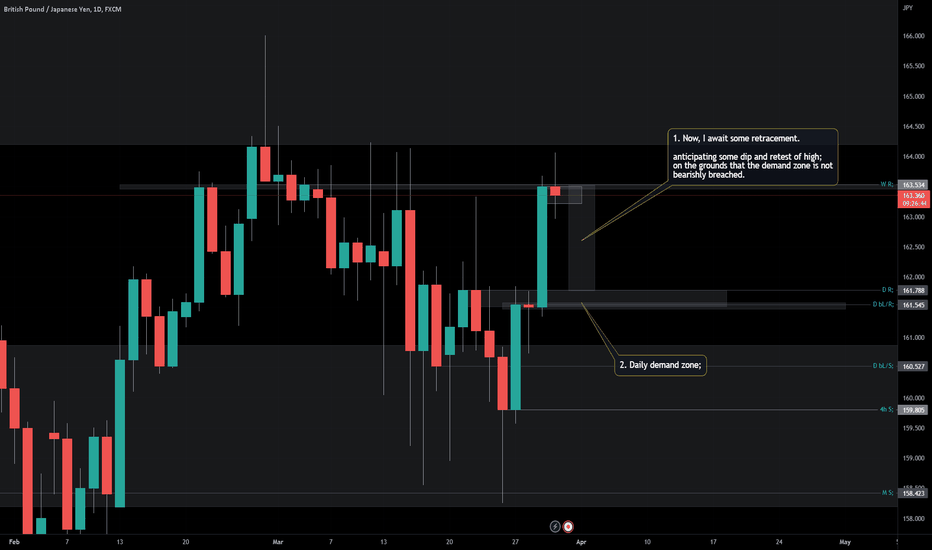

EUR JPY SHORT

AUD CHF SHORT

RR 1:3

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

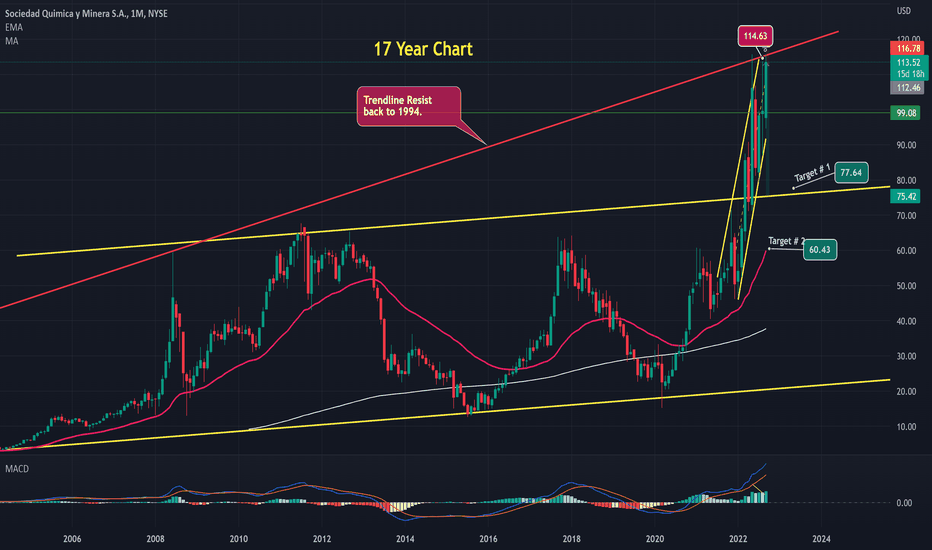

BEST SHORT Opportunity in the markets!! SQM SHORT!!This chart is up against ATH and MAJOR Overhead Resistance lines extending back to 1996. This stock has been overbought for quite some time and has continued to move higher while markets have traded generally lower. I fully expect this one to play catch up soon.

Notice the large Yellow Parallel Trend Channel that price broke out of in March 2022. Price has gone nearly Parabolic since then and is losing steam as it hits overhead resistance. Although not shown here the Price is outside of the Bollinger Bands for >5 MONTHS now indicating that price is > 2 STD away from the mean average MONTHLY Price. This is a Reversion to the MEAN counter trend trade with the 1st Target Price the broken Resistance now acting as support. 2nd Target Price would be the Monthly EMA 39.

SHORT Entry = $112.46. SL is confirmation close > $116.78. Target # 1 = $77.64. Target # 2 = $60.43. This is a 8.5:1 Reward:Risk ratio to the 1st Target. Even greater to the 2nd Target.

Trade has a >85% Probability of turning out EXACTLY as described!! See my prior posts on similar setups in AMD and SPX.

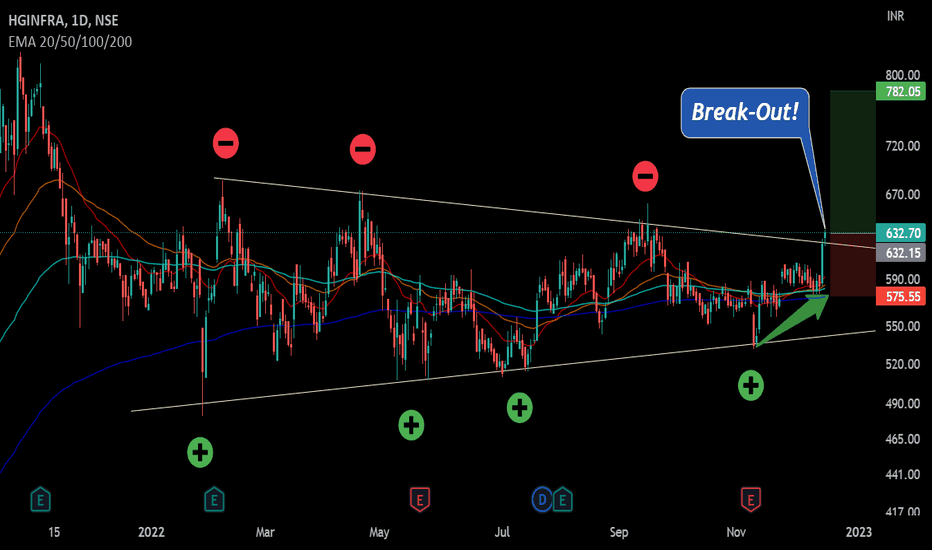

Triangle Break-Out in 1 DTF//HGINFRA+++The Triangle is broken with good candle and also sustained in today's session.

++The Supports(+) and Resistances(-) are also perfectly respected.

+Lets follow the Price Action in keeping the SL(Under 14 Dec candle) and Target R:R should be (2.5)> .

Happy #Christmas Trading Mates!