Highprobability

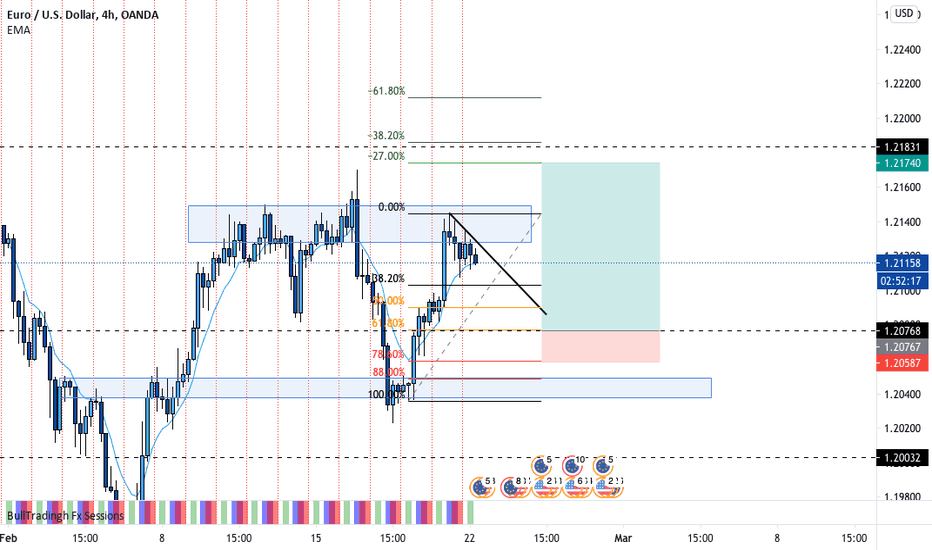

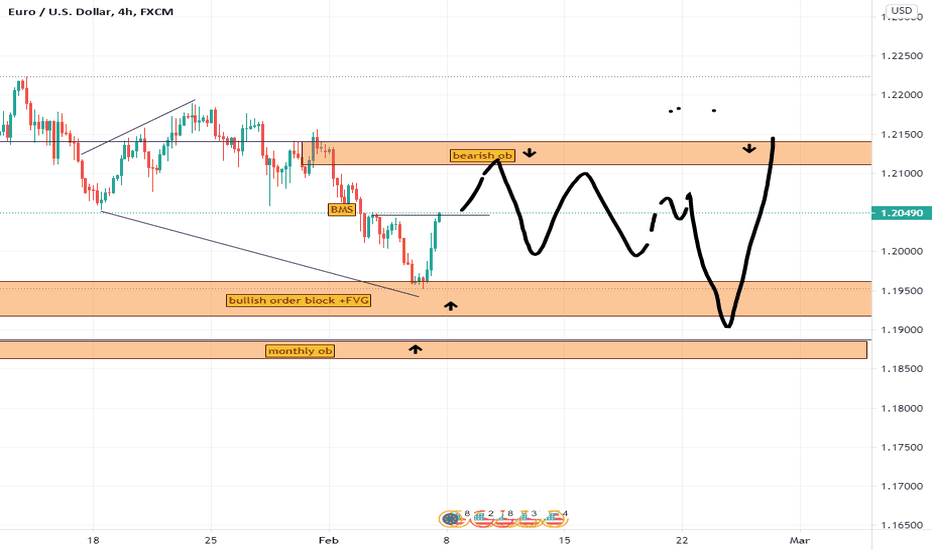

EUR/USD clean 1:5.5 risk reward high probability trade!Confluences:

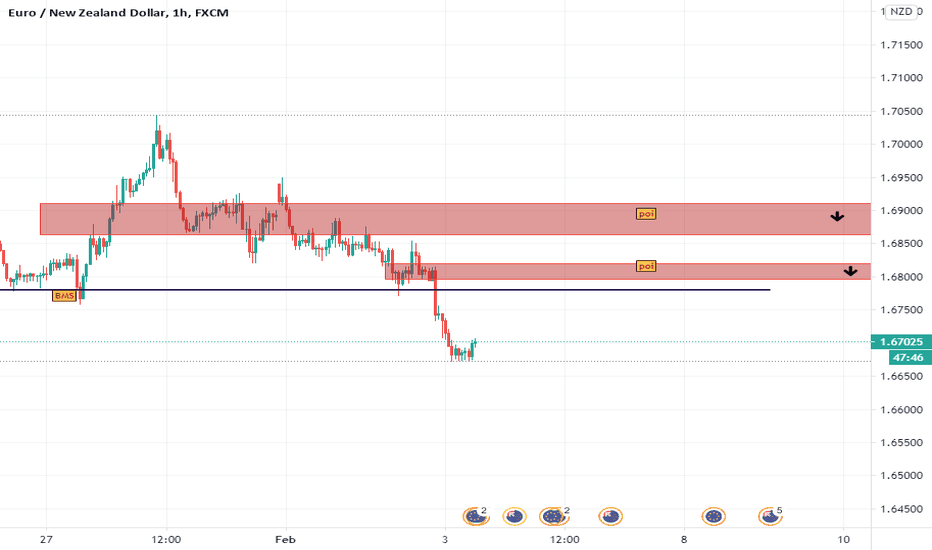

-Price failed to break the daily resistance, so I'd expect a retrace to the 61.8 daily fib level which overlaps perfectly with a reversal zone.

-I will buy then and take EU to the next zone taking partials at the major resistance line (considering the stop loss is low I can place a higher lot size)

-Stop loss will be at the 71.8 which lines up perfectly with the 2 4h wick rejections.

Good luck these weeks with the trades

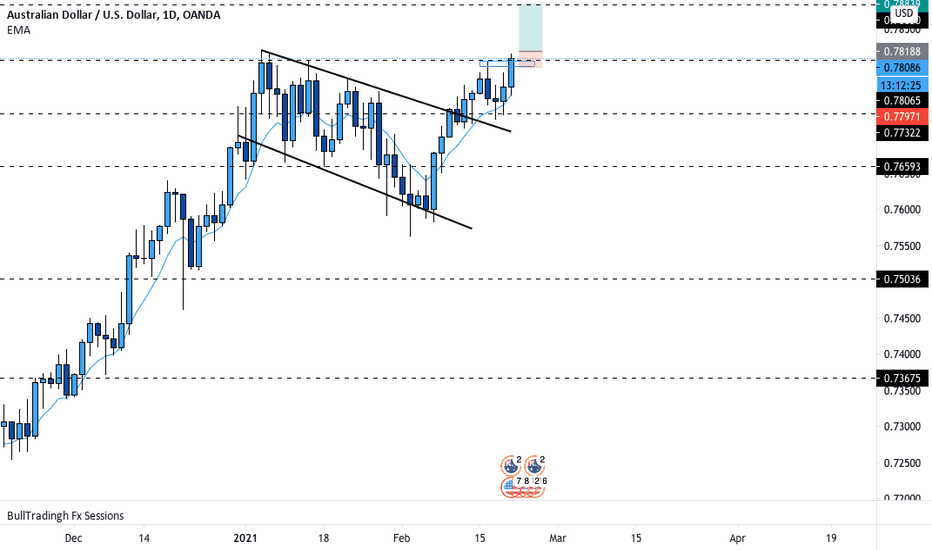

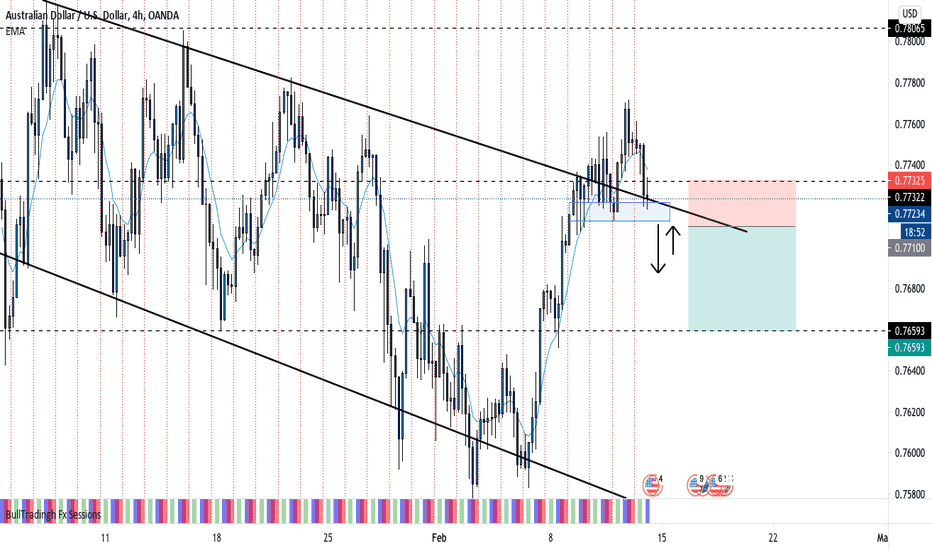

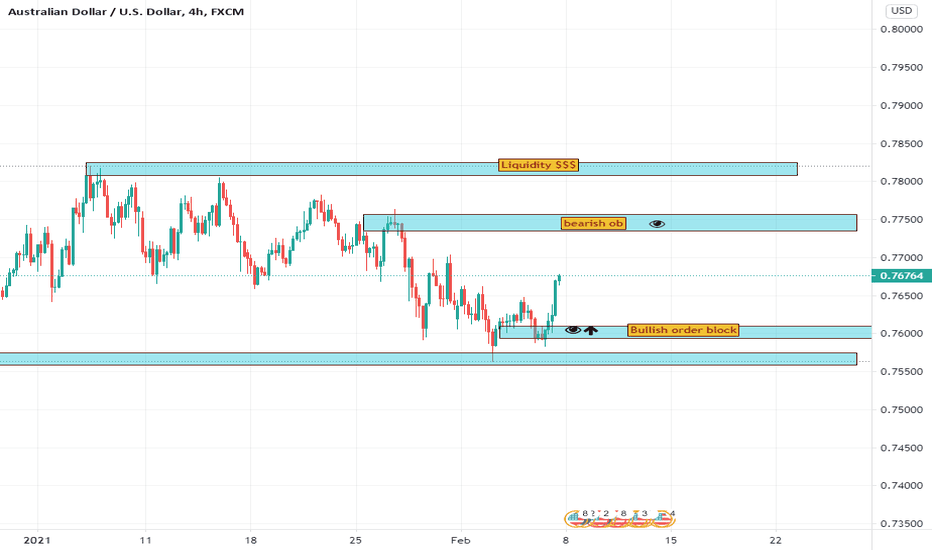

AUDUSD long position!Confluences:

-On the daily there is bullish price structure

-DXY is very weak

-When the 4hour candle closes, if it closes as a bullish Maribozu, I will wait for the rest of the key level and place a buy stop taking it to the next level

-If the zone acts as support, this trade becomes high probability

Good luck and tell me what you guys think!

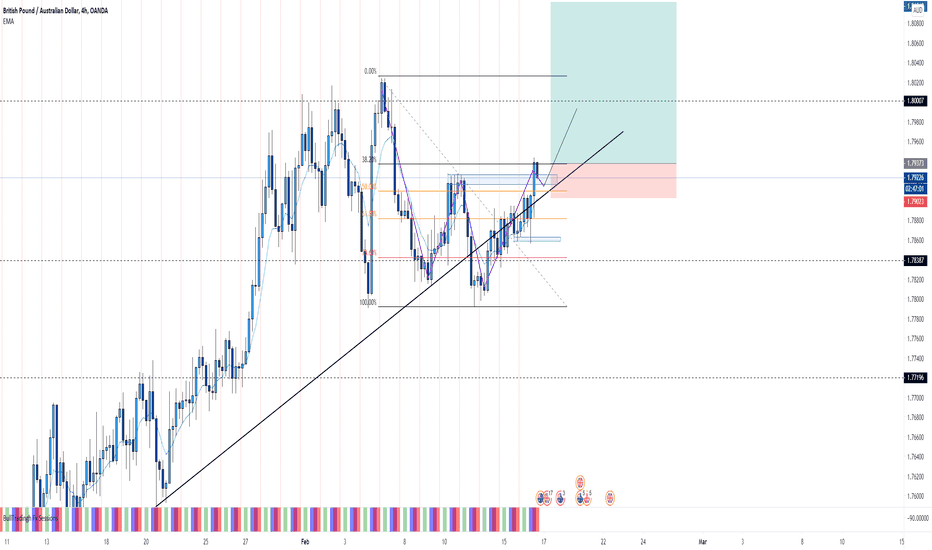

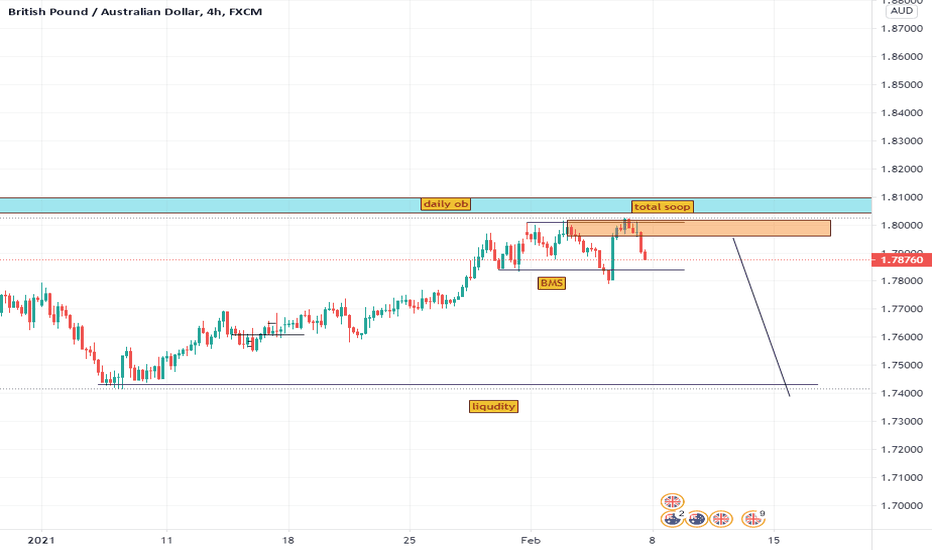

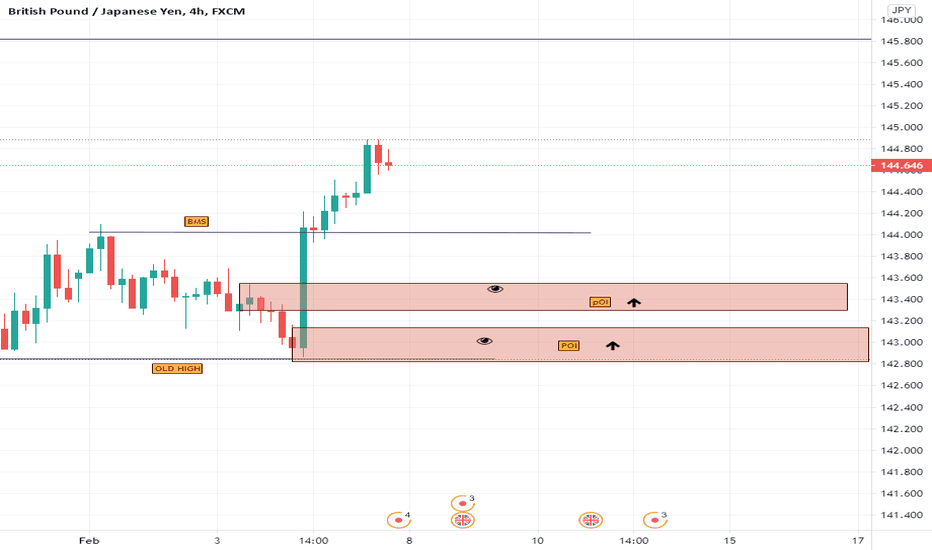

GBPAUD long SWING TRADEConfluences:

-W pattern

-Price respecting fib levels

-Price re-entered previous daily trendline

-Enter on continuation with a buy stop

-Good Risk-Reward

-AUDUSD hasn't retraced in a while so weak AUD should correlate with GBPAUD going higher, also the pound has been really strong lately

-Take profit will be in the second zone, I'll take partials at the first zone

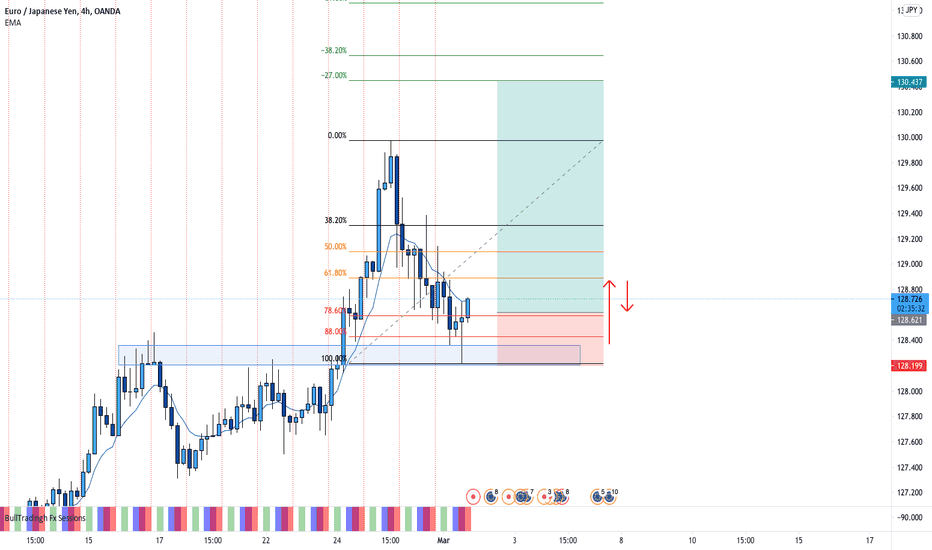

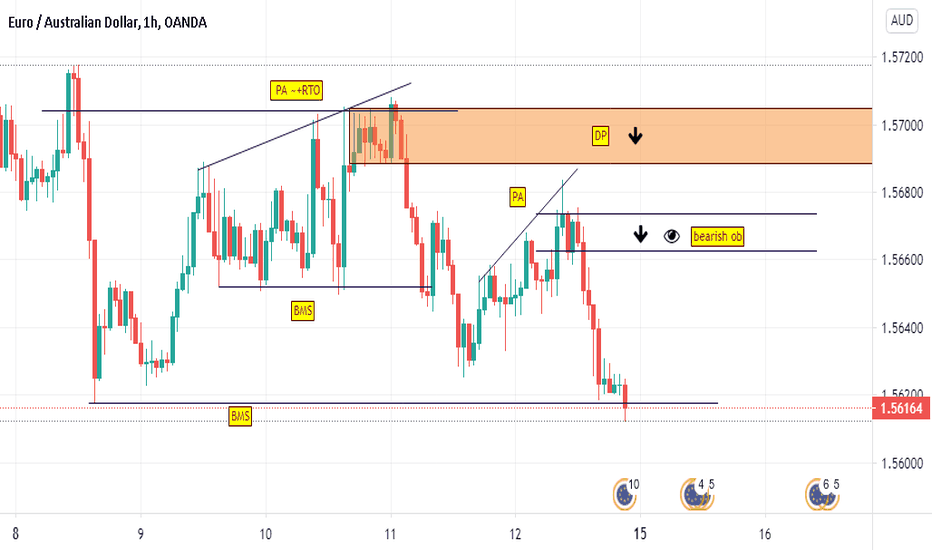

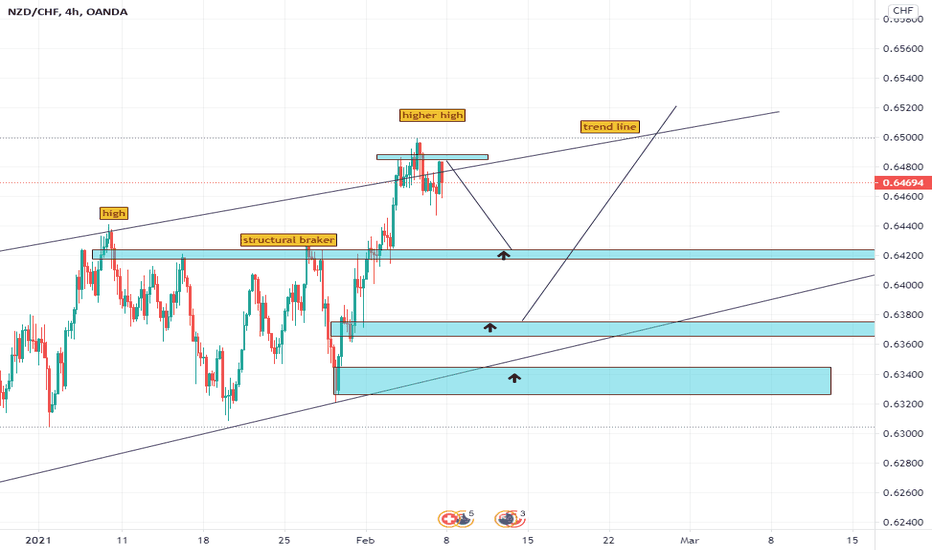

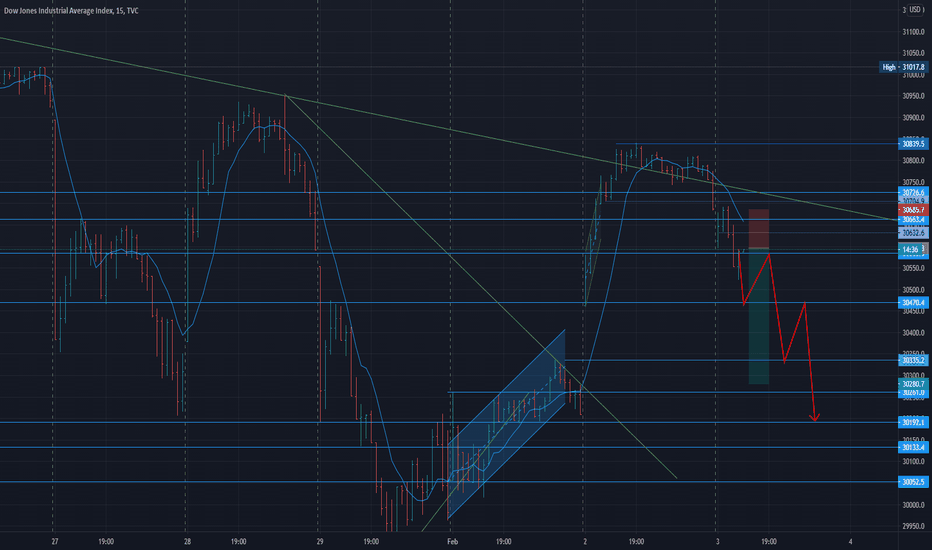

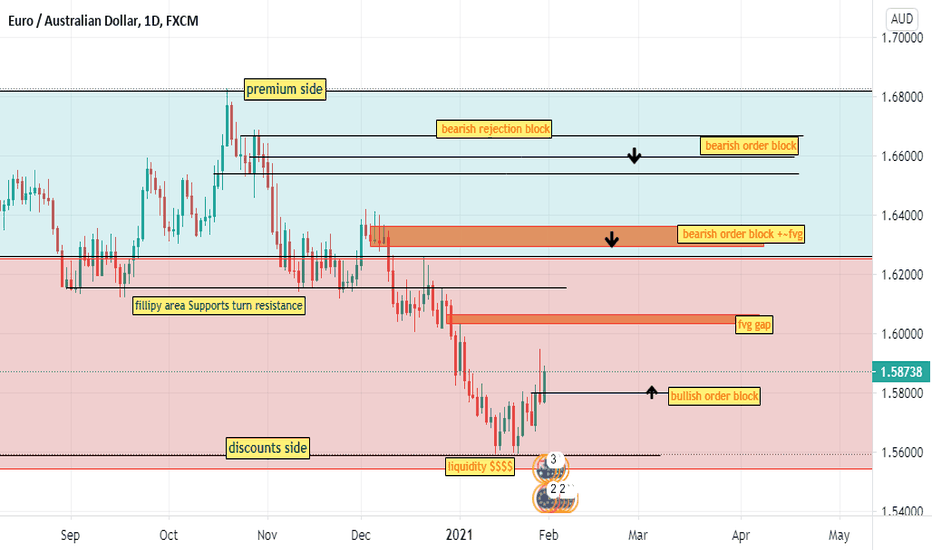

bearish top down analysis According to sessional tendency EURUSD is bearish but Cot graph show the commercial increase their long and price action show the strong bullish move .but on1.21500 have FVG and fresh Bearish order block is strong level to looking sell . But i like to see price will go to in consolidation then watching total soap..

best of luck any quarries you may ask ..also check my previous analysis

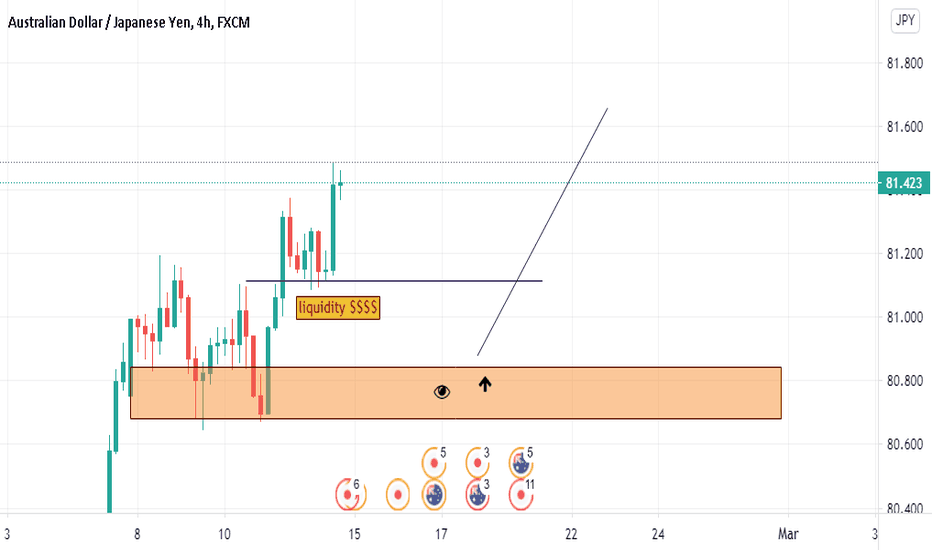

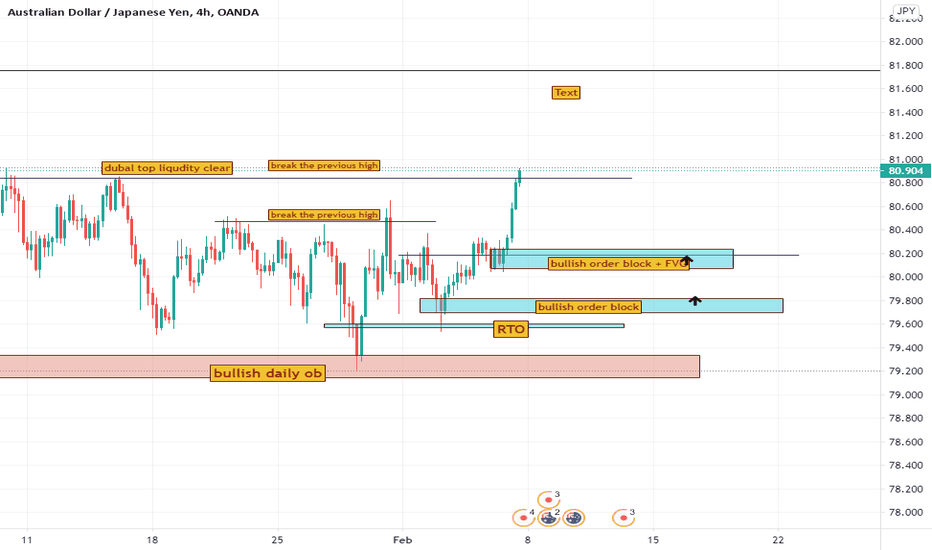

bullish top down analysis according to sessional tendency February is bullish for the AUD. COT report and graph show the Commercial are silently increase their longs and close their short .. price action show the bullishness of Audusd because of high demand on institutional level (daily ob ).. best of luck check my previous analysis

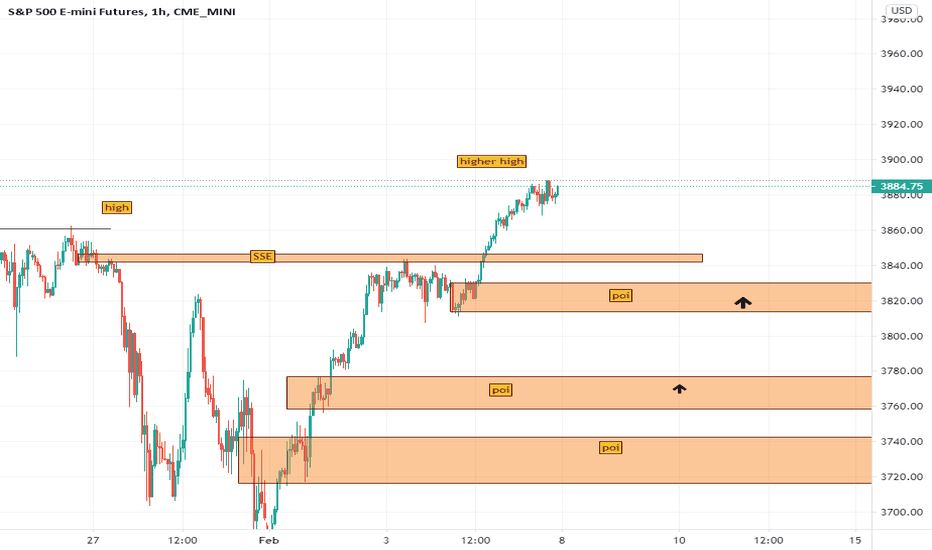

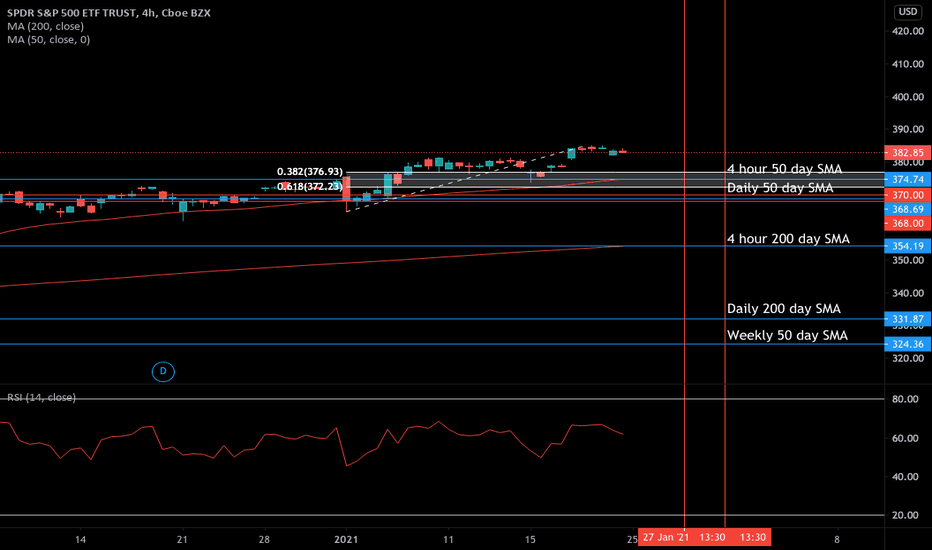

92%-95% PoP SPY Credit Spread with 4% return (2 trade idea)Hello all, hope everything is well. This week I’m looking at the SPY and looking to grow capital invested by 3-5 percent per trade with 92% - 95% percent probability of profit.

-Current price is: $382.88

-VIX is at: 21.90

-Credit spread sell strike: $370 Exp 1/27 and $367 Exp 1/29

-Is price trading above 50 day SMA on the 4 -hour, daily, and weekly chart?: Yes

-Is price trading above 200 day SMA on the 4-hour, daily, and weekly chart?: Yes

-Percent OTM if held to DOE upon entering, is: 93% - 95% of being OTM if held to DOE

-Technical analysis: With just reaching all-time highs I expect to see a pullback early to mid-week. Looking at the 4-hour chart we see that the $374-$378 price zone has been a key zone for SPY in the previous week. I’d like to see the price come back down to that zone and look to sell a put credit spread with $10-$13 away from our sell strick or 92-95 percent probability of profit if held to the day of expiration.