HIMS WEEKLY BULLISH PLAY — 07/23/2025

🩺 HIMS WEEKLY BULLISH PLAY — 07/23/2025

📈 Momentum Up, Flow Bullish, Time Tight — Let’s Ride It

⸻

🔍 MARKET SNAPSHOT

5-model AI consensus = ✅ BULLISH

Why?

• 📈 Weekly RSI = 58.2 (Rising) — Clear momentum

• ⚖️ Call/Put Ratio = 1.63 — Big call volume (45K+)

• 📉 Volume = 0.9x — ⚠️ Slight institutional hesitation

• 🌪️ VIX = 16.0 — Low volatility = smoother execution

⸻

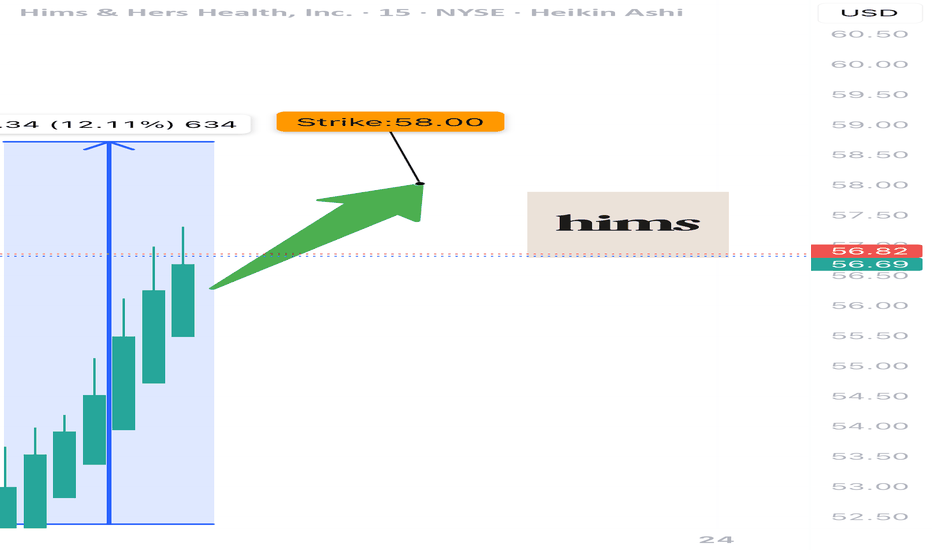

🎯 TRADE IDEA — CALL OPTION PLAY

{

"instrument": "HIMS",

"direction": "CALL",

"strike": 58.00,

"entry_price": 0.86,

"profit_target": 1.72,

"stop_loss": 0.43,

"expiry": "2025-07-25",

"confidence": 75%,

"entry_timing": "Open",

"size": 1 contract

}

⸻

📊 TRADE PLAN

🔹 🔸

🎯 Strike 58 CALL

💵 Entry 0.86

🎯 Profit Target 1.72 (+100%)

🛑 Stop Loss 0.43 (tight risk)

📅 Expiry July 25 (2DTE)

⚡ Confidence 75%

📈 Size Suggestion Risk 2–3% of capital

⚠️ Key Risks Low volume + high gamma exposure

⸻

🧠 MODEL TAKEAWAYS

✅ RSI and momentum are clearly aligned upward

✅ Call flow = bullish commitment

⚠️ Volume is light → watch for momentum stalls

⚠️ Gamma risk = manage tight, exit fast

⸻

💬 Drop a 🧠 if you’re tracking

📈 Drop a 💥 if you’re in this call

🛎️ Trade tight — expiration Friday, HIMS is moving on momentum not mass

#HIMS #OptionsTrading #CallOptions #BullishPlay #MomentumTrade #ZeroDTE #GammaScalp #AITrading #HealthcareStocks

Himsherhealth

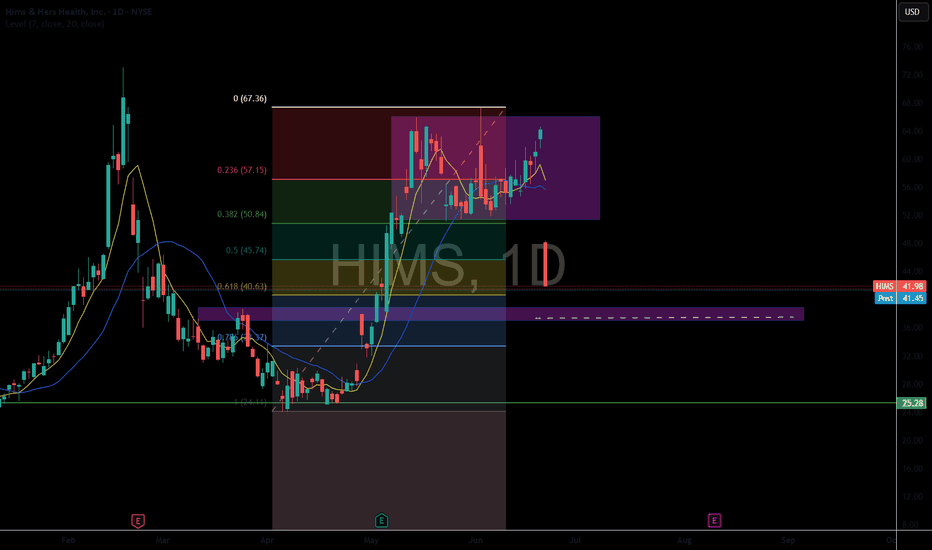

HIMS puked up its Wegovy today!Hims & Hers Health

HIMS

shares were down more than 34.63% in Monday trading, while Novo Nordisk

NVO stock was down over 5% after Novo Nordisk said it has halted its collaboration with Hims & Hers on the sale of weight loss drugs, including Wegovy.

The two companies launched a collaboration in April to bundle Wegovy through Hims & Hers' telehealth platform.

Novo Nordisk said direct access to the drug would no longer be available through Hims & Hers Health because the company "has failed to adhere to the law which prohibits mass sales of compounded drugs under the false guise of 'personalization' and are disseminating deceptive marketing that put patient safety at risk."

This stock failed to catch a bid despite the equity markets strong.