HITECH : will HIT or MISS?Hi-Tech Pipes (HITECH)

Elliott Wave Structure: The chart suggests Wave 1 to Wave 4 is complete. Wave 5 is expected to resume the primary uptrend.

Demand Zone for Wave 4: ₹147-151 aligns with corrective Wave C. This area should attract strong buying.

Stop Loss Placement: Below ₹141, invalidating the Wave 4 demand zone.

Trade Plan:

Entry: Initial entry at CMP (₹166.44). Add positions between ₹147-151 if prices dip.

Target: Wave 5 target at ₹217-225, based on Fibonacci extensions.

Stop Loss: Set at ₹141 to minimize risk.

Risk-Reward:

Risk (₹141): ₹25 below CMP (₹166).

Reward (₹217): ₹51 above CMP.

R/R Ratio: 1:2 – suitable for medium-term trades.

Educational Tip: Confirm Elliott Wave patterns with low volume in Wave 4 and high volume in impulsive waves like Wave 5.

Hitechpipes

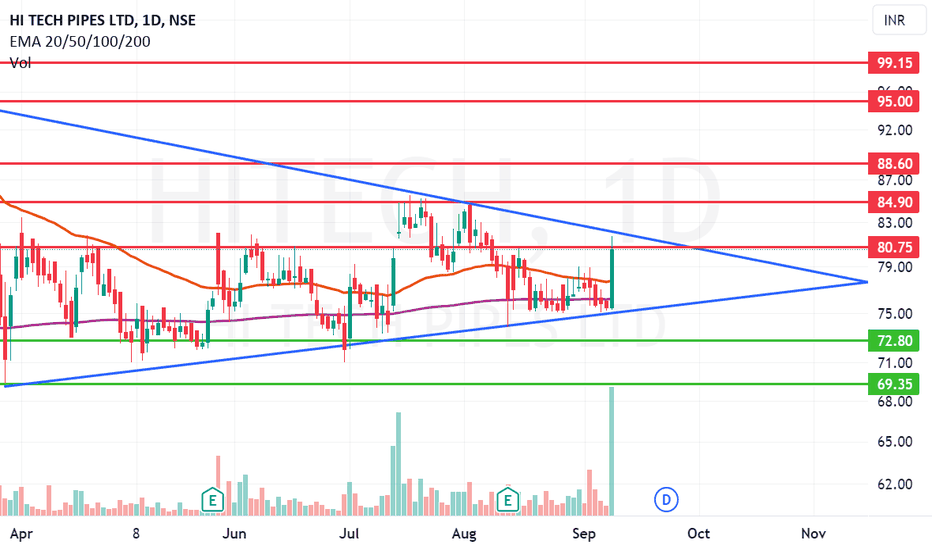

Hi-Tech Pipes breaks out with high volumeHi-Tech Pipes Ltd is a leading manufacturer and supplier of ERW (Electric Resistance Welding) Pipes. The company specialize in Steel Pipes and Tubes for a variety of industries, such as Infrastructure, Telecommunications, Defence, Railroads and many more.

Hi-Tech Pipes CMP is 80.50, The Negative aspects of the company are declining annual net profits, declining cash from operations annual and promoter holding decreasing. The Positive aspects of the company is low debt.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Entry after closing above 80.75. Targets in the stock will be 84.90 and 88.60. Long term targets in the stock will be 95 and 99.15. Stop loss in the stock should be maintained at closing below 72.80.