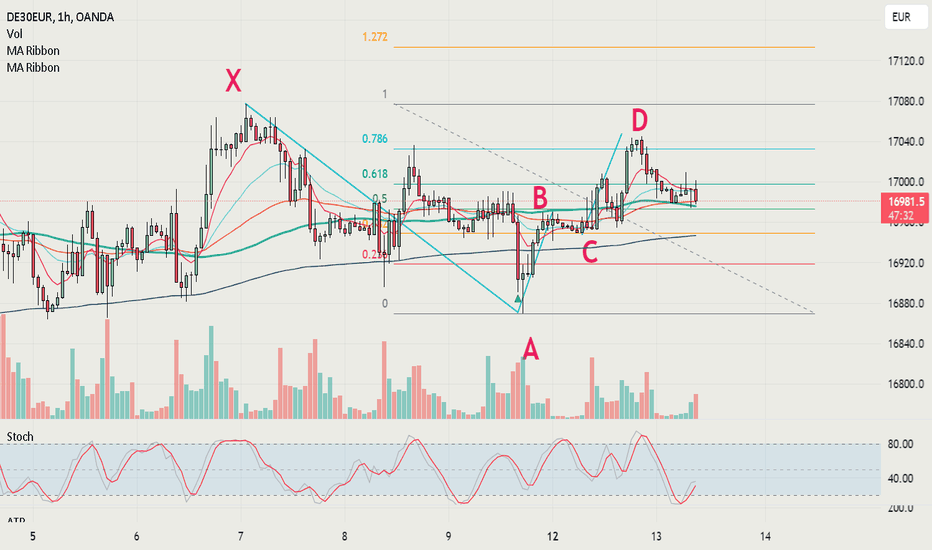

Countertrend Gartley 222 (AB=CD) in DAX, entry at 78%Something I was observing for, but didn't enter.

One way to trade Gartleys is to enter directly at the 78% retracement lever with a stop behind the previous high/low. (Point X) There was no good signal bar at 30 min, 1 hour nor the 2 hour chart so this was a viable way. In this case, one-to-one was already reached.

Larry Pesavento suggests for targets the 38% and the e 68% retracements of the AD leg.

In this case, as it's a countertrend trade maybe this is the better option, target 1 was already reached in this chart.

With the trend, you can even aim for the 161% extension of the AD leg which gives a huge risk-to-reward opportunity. I prefer these.