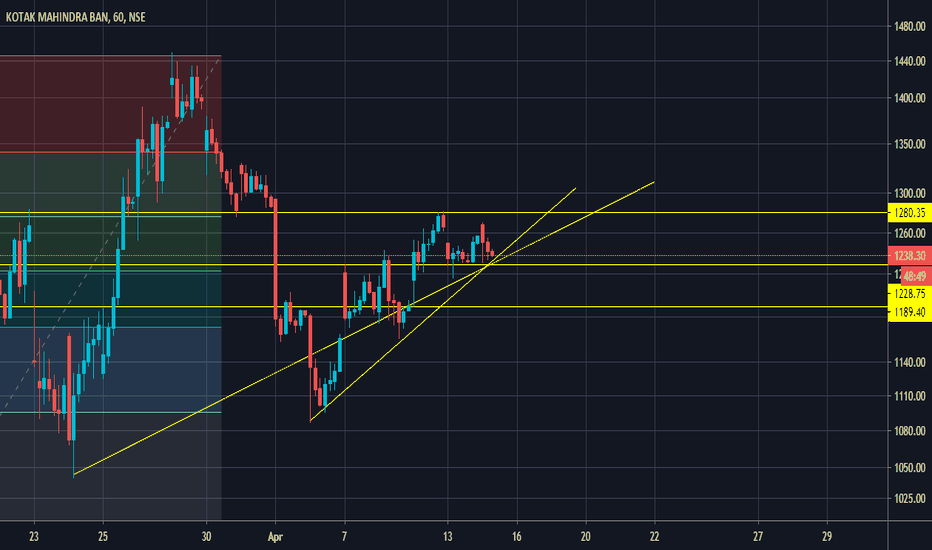

HOLD

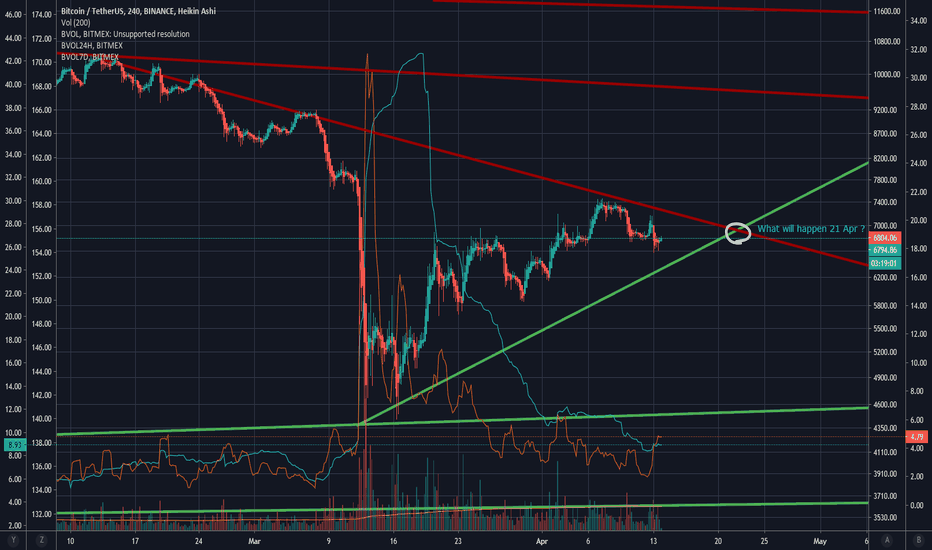

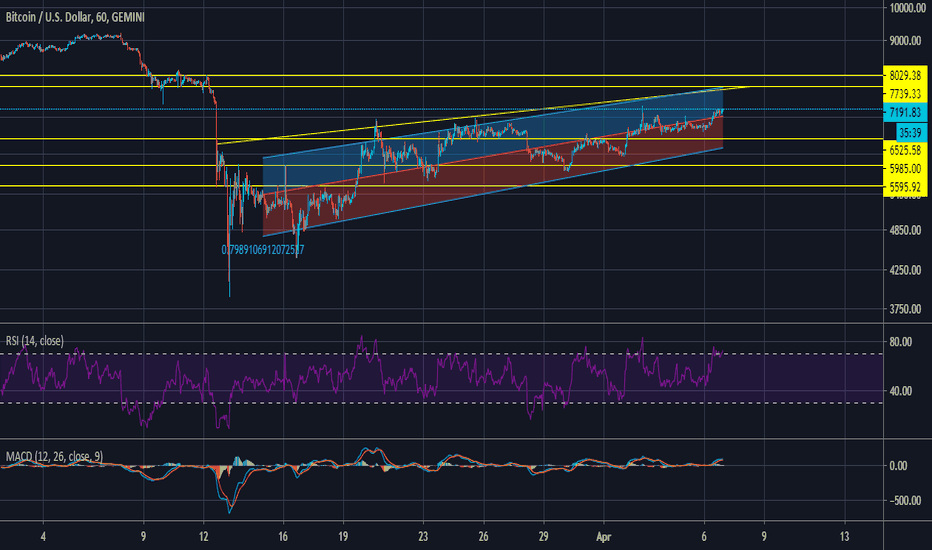

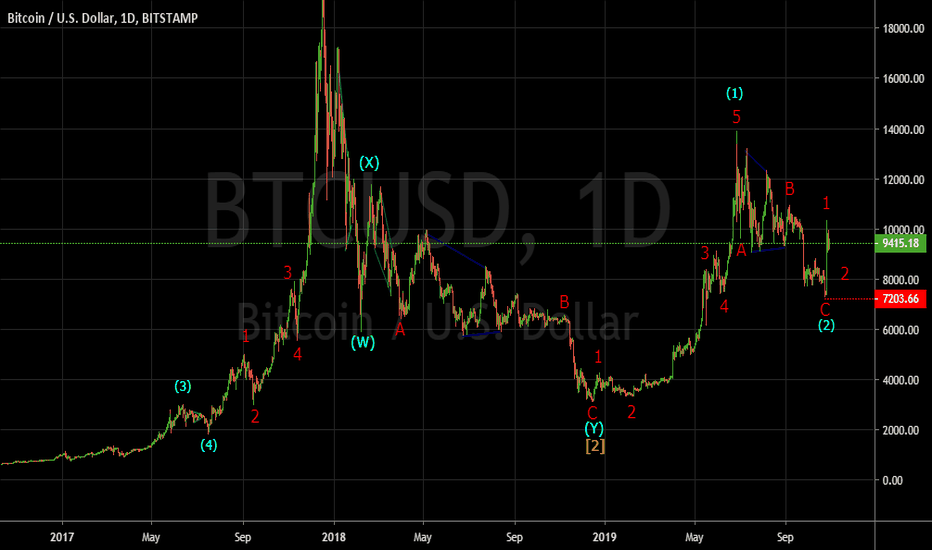

BTC/USDT What will happen on 21 Apr ?BINANCE:BTC/USDT What will happen on 21 Apr ?

Long to 8.2k breaking 1D MA 200 ?

Short to 6.2k remaining under 1D MA 200 ?

Buy & hold : FUD/FOMO intensifies ?

Breaking above 8.2k and remaining at this price for one month would attract investors for the halving incoming

Remaining at 6.2k would mean that BTC is becoming a stablecoin (and attract more investors ? ^^)

Buy & hold : BVOL increasing and go back to 4.5k ?

Nobody is able to predict the future.

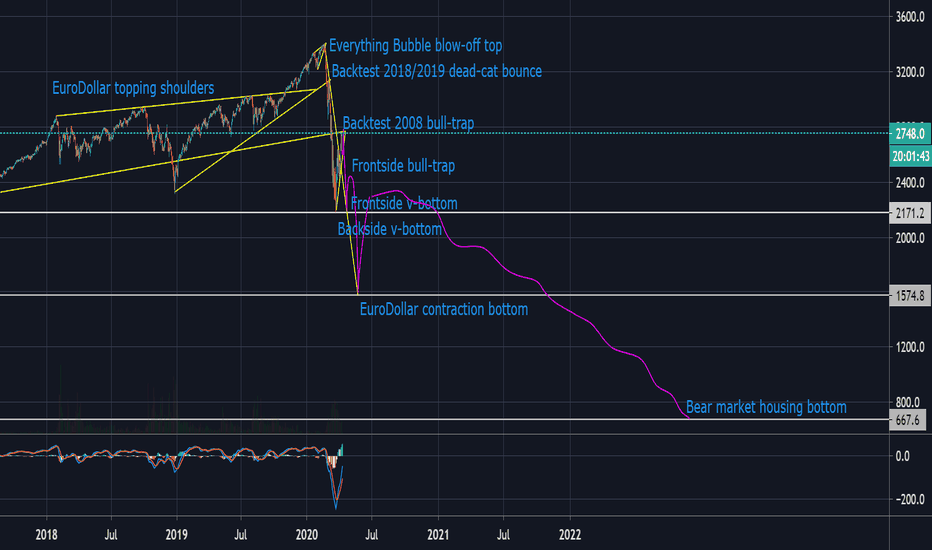

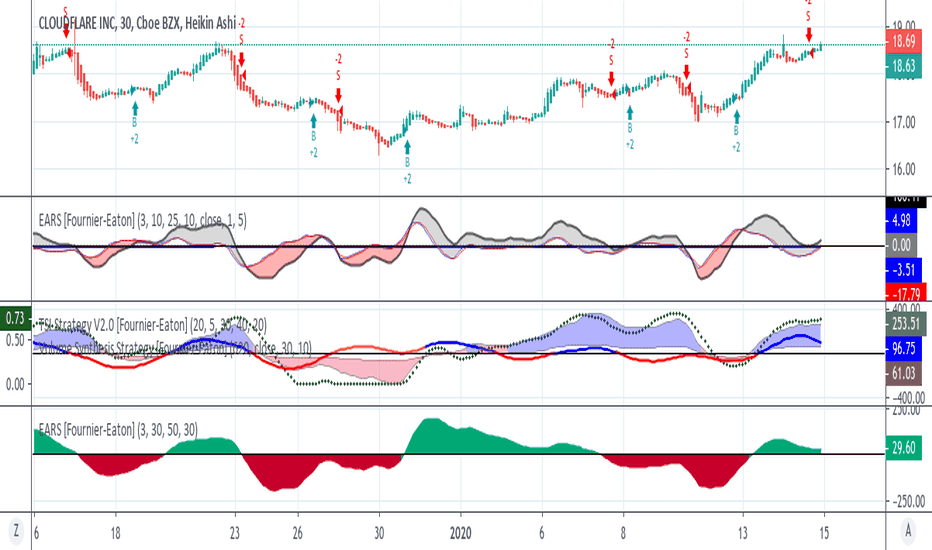

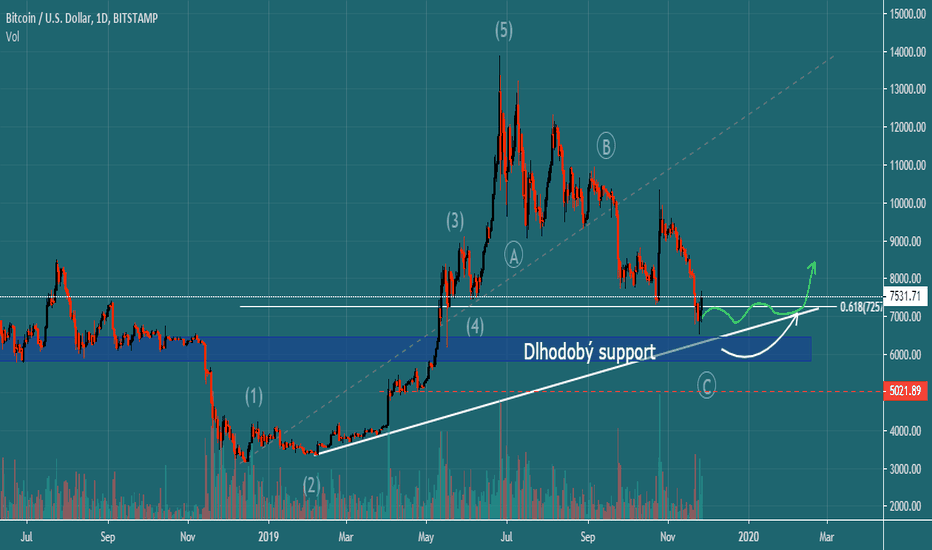

18.3.2020 - Bitcoin (BTC / USD)Hi Traders!

The history of cryptocurrencies will certainly remember the last week as a tragic one and therefore we will discuss bitcoin again today.

In the last analysis, we also marked the lower trend line on the chart. Probably, no one expected it to be tested just a couple of days later. At the moment, we are probably on the strongest trend line and on key levels.

There are 3 strong supports awaiting:

1. Last LOW - $ 3,234

2. 2017 Swing - $ 2,976

3. Swing LOW from 2017 - $ 1,801

Where's the bottom?

This is probably the basic question often followed by another question - when is the best time to buy? However, no one knows the answer to these two questions. Bitcoin and cryptocurrencies are experiencing economic collapse for the first time in their history. Although Bitcoin came into existence in 2008 (during the last financial crisis), it was of no value at that time and trading volumes were practically close to nothing.

The crypto fundament is now secondary, as well as halving. On the Internet, there is a growing belief that the price cannot fall further due to the mining process. The truth is, in the short-term the price may still decrease.

What's next?

At the moment it's best to simply wait and possibly buy for a long-term hold. Problems in the world won't be solved quickly. The most important thing, for now, is to keep the trend line. If we break it downwards, we would follow the listed supports, where we would set up purchase orders.

May the crypto be with you!

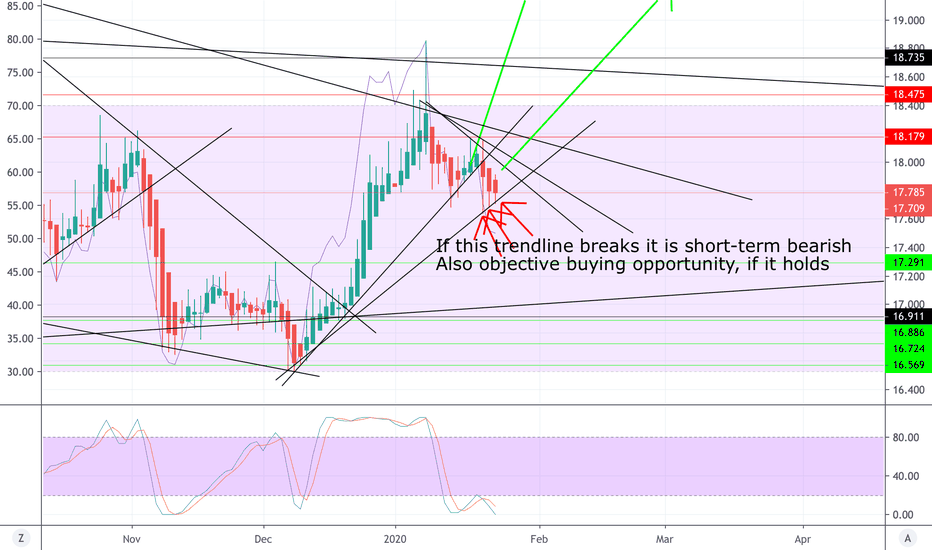

Second Trendline HoldingSilver technically broke down from the initial up trend line but seems to be bouncing up off a less significant trendline the last several days. Breaking the trendline is bearish in the short run. With that being said Silver is a major long term buy for many fundamental reasons qe, negative rates, inflation, gold/silver ratio and silver in the long run will catch up to Gold. Also remember other than the trend-line this is an area of strong support.

S&P 500, ride the pg.SPX so strong since 2009, probably a number of reason why but the why doesn't really matter. Although the chart looks very extended it's too strong to short imo. This kind of chart tends to trigger a psychological bias in us that it 'must' be about to turn around. In reality it might not. Bad news doesn't seem to dent it so it's not immediately obvious what will turn the tables. Trying to guess at that and time a short is not a smart trade. Better to hold it if you have it, or buy dips along the trend line. If the trend line breaks, maybe time to reassess.

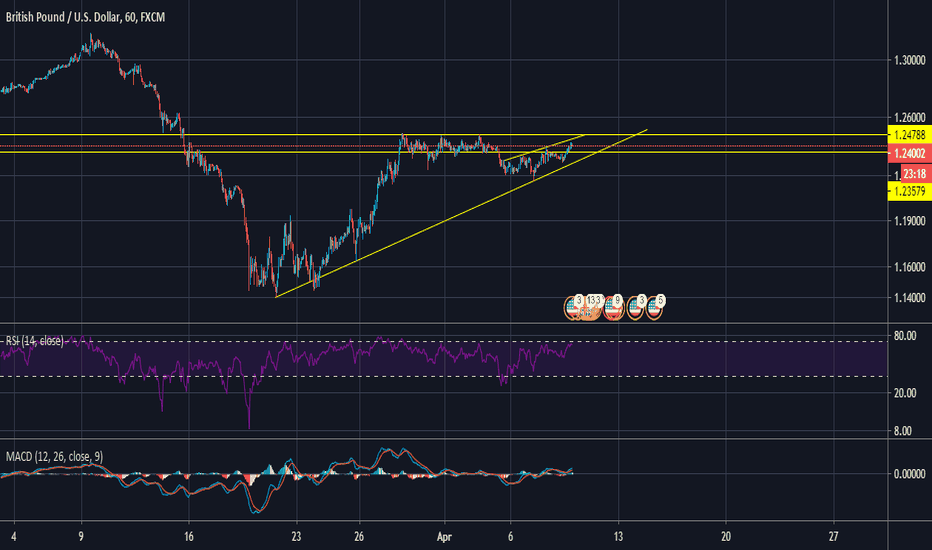

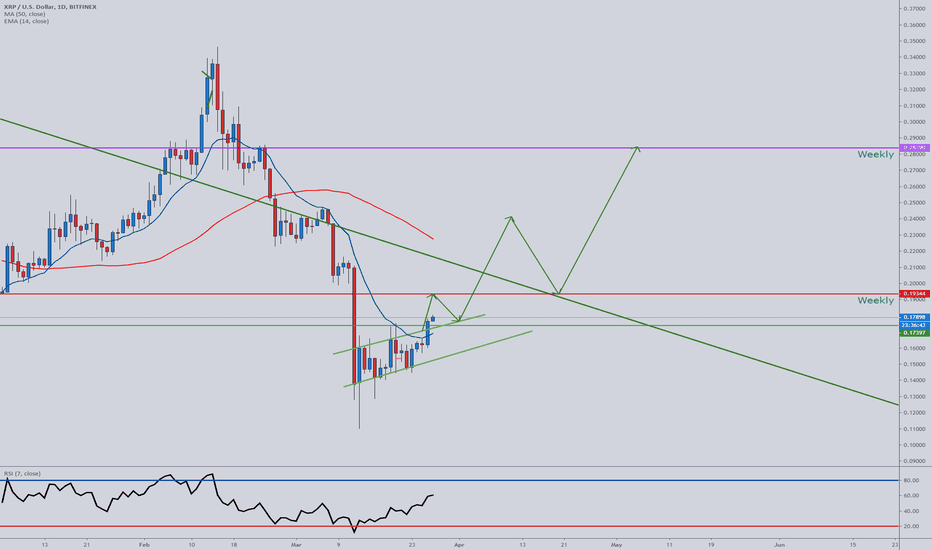

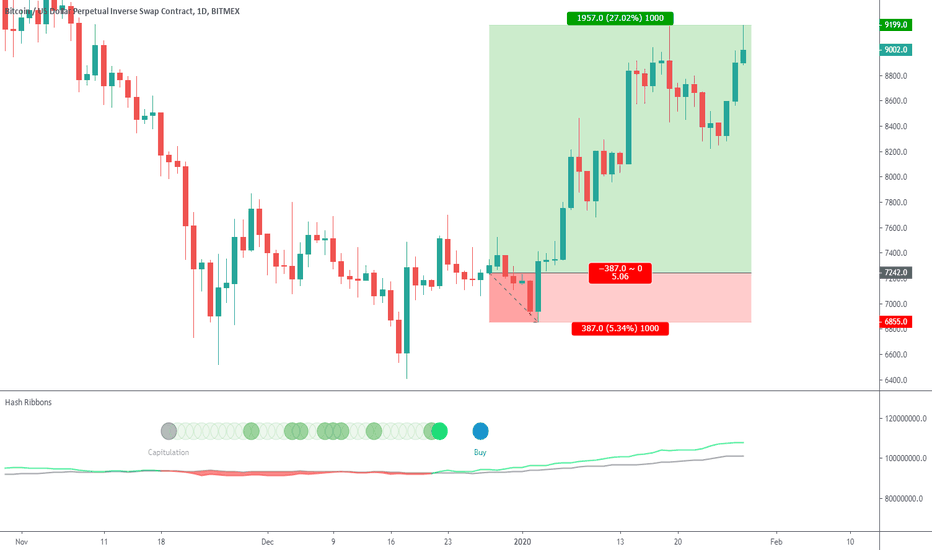

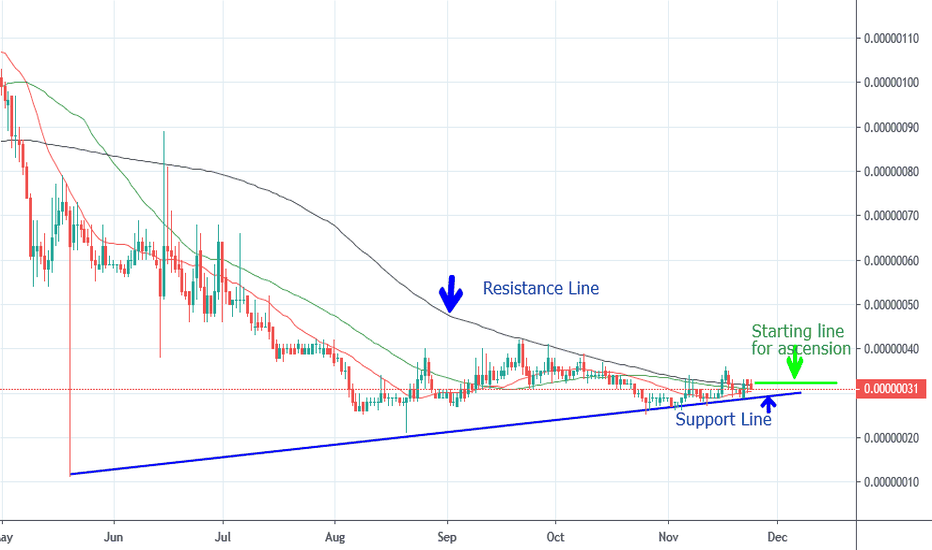

27.11.2019 - Bitcoin (BTC / USD)Hi Traders!

What's going on with Bitcoin? You probably wonder why we are sinking so much and what's going on? Today's analysis is devoted to Bitcoin and its daily chart. Again, we will present a few possible scenarios.

To begin the analysis we need to say that there are currently many possibilities for future development. Few expected a record 42% pump to be completely cleared. We also got a confirmation that the institutions were short on Bitcoin last week so they had known what was going to happen. How to deal with the whole situation now?

1. The best option

The best thing that we could await is the scenario that we are currently at the bottom and we would go higher. We cleared more than 65% of the entire growth and that's a sufficient retracement. Only in 35% of cases in cryptocurrencies, the chart reaches such retracement. In addition, we've tested a key level of $ 6400, which is a long-term “point of control”. From this point of view, the chart has passed the test and could point upwards.

2. Consolidation

This option seems more likely. Rarely happens that after such a rapid fall an immediate growth comes. The chart usually recovers for a few weeks. In this case (indicated by a green arrow on the chart). Institutions tend to buy Bitcoin in large numbers via OTC at this time, and the market is flooded with negative information. We can see something similar now.

3. The bottom is yet to come

No one knows where the real bottom is. Neither the best trader nor the best analyst can pinpoint this. Even at this point, we can be at the bottom. Where could we go in case of continuous decline? Quite many talk about the level of $ 5000.

Our recommendation? It may be too late to go short and too early to go long. How to figure the situation out? Buy more for the long-term portfolio.

May the crypto be with you!