HOLD

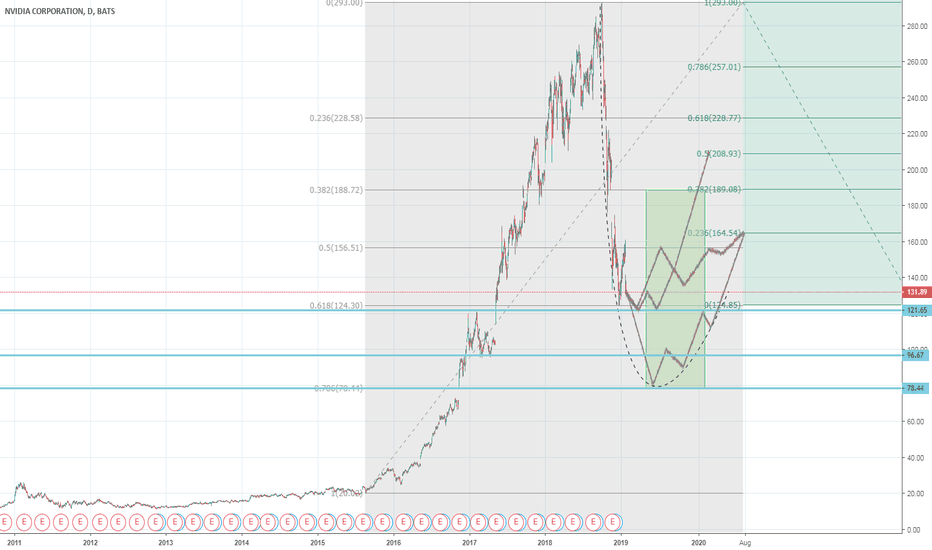

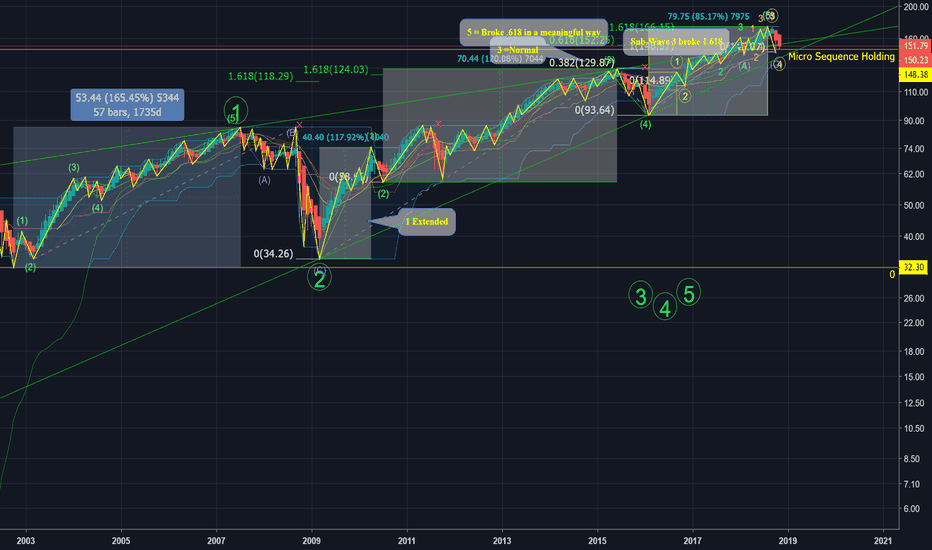

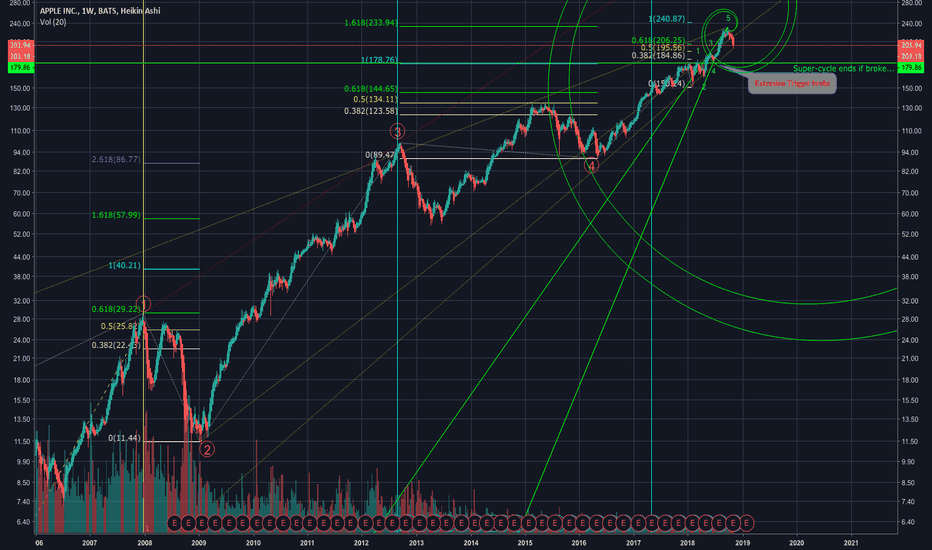

NVDA nearing a generational buy zoneNVDA has investments in all of the major cutting edge tech areas. Industries like AI, self-driving, crypto, competitive gaming, and more. Very likely the stock will recover in the long term, however, investors want to know what to do today to maximize future gains.

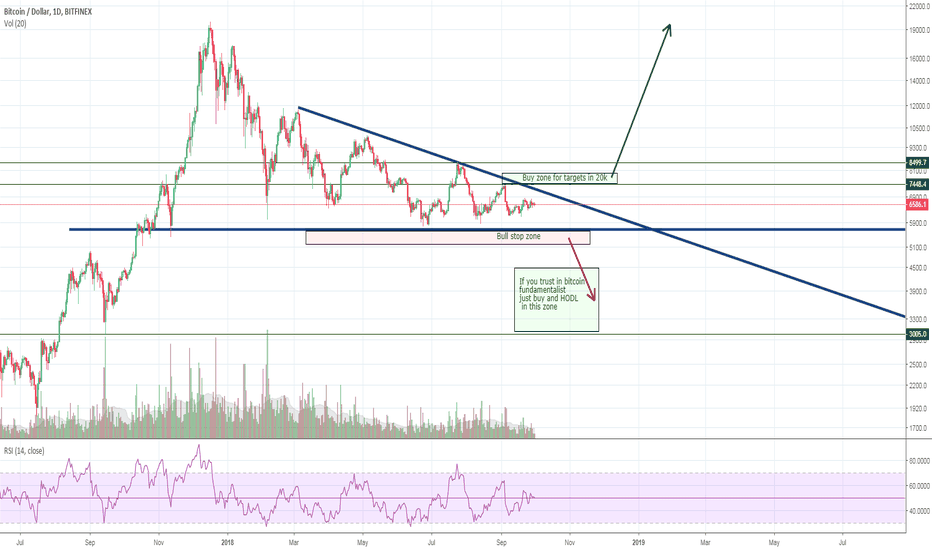

A very simple analysis using fib retracements suggests potential trading range of $75 - $180 (notably a huge range). Much of where the price drifts will be dictated by the narrative and future earning guidance. Some may recall in 2016 the stock was trading in a tight range between $90 and - $100 and notable short-seller Andrew Left had initiated a short in the range before. I imagine he has since closed that position, but it brings to perspective the wide range and sentiment this name has experienced in the last two years.

The current trend is very bearish, and if previous gaps are filled to the downside its likely the stock doesn't find a bottom until it retests that $90-$100 range. I've drawn three different ghost feeds to demonstrate where I believe the price-path will be depending on positive, neutral and negative developments in the key factors driving price right now over the next 12 months.

If I was currently holding a long position I would be inclined to sell call spreads and/or buy puts. As I'm long term bullish on the name, I would be willing to cut these hedges at signs of heavy buying at key resistance. I would also re-balance my position nearer to $100, unless extreme weakness makes a double digit entry likely. Similarly, I would look to initiate a position by scaling in at key price levels like $120, $100, $90 and every $10 interval below $90 placing most of the position weight in the $90 - $100 area. Prudent use of short call options could provide short term capital while locking in decent entry zones as well.

For those that have been short, kudos, this must have been a profitable trade. There is likely some room to the downside left, but scaling out and covering at these same price points could reduce future drawn down risk and should be considered.

In summary, I think the company will be fine in the long term but near term there is substantial delta risk that should be handled accordingly.

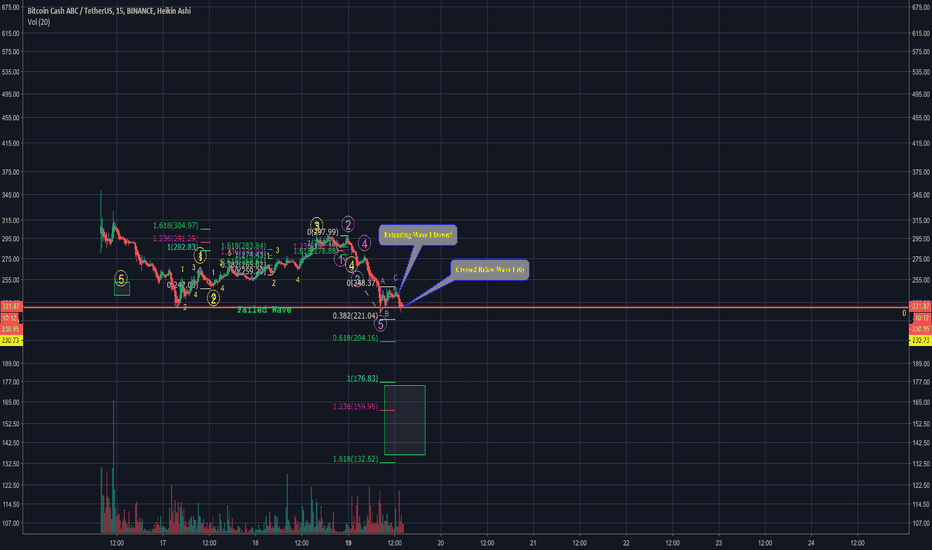

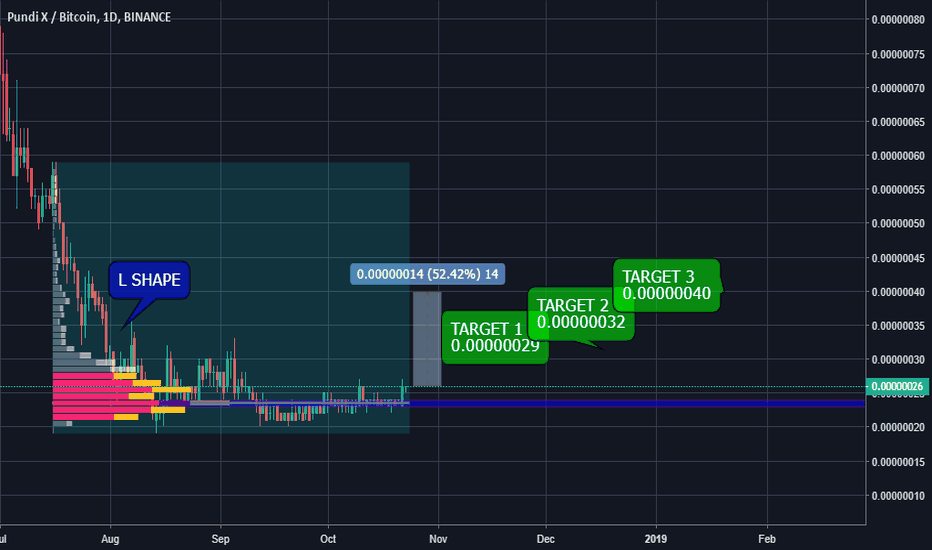

BCHABC - Wave FailureBINANCE:BCHABCUSDT

BINANCE:BCHSVUSDT

ABC vs. SV since fork:

BCHABC:

BCHABC Failed Wave:

BCHABC Wave Down:

BCHABC - SELL

Target: $175-$140

Will update.

-AB

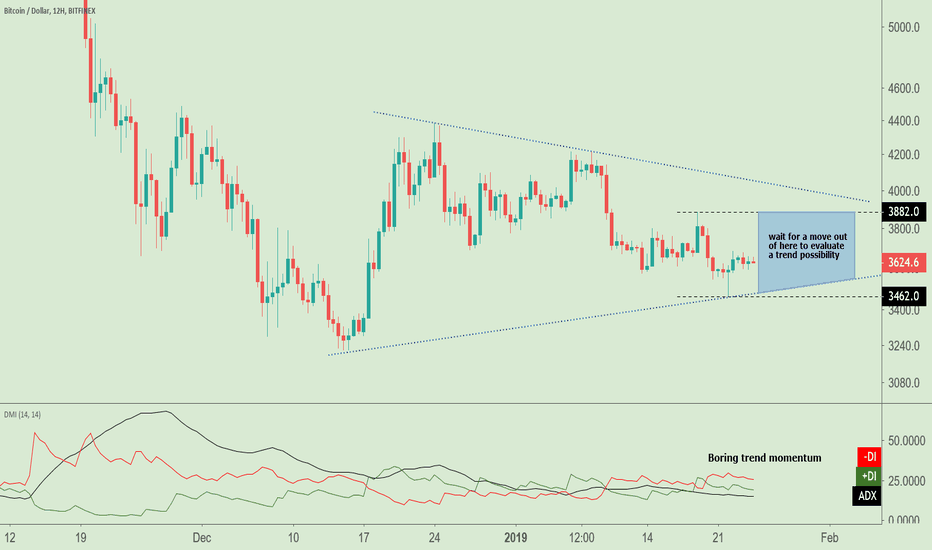

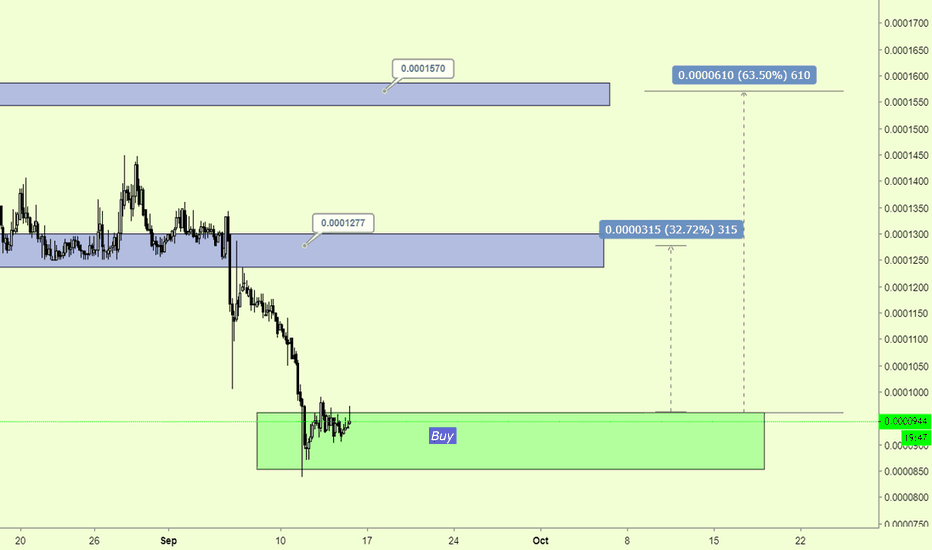

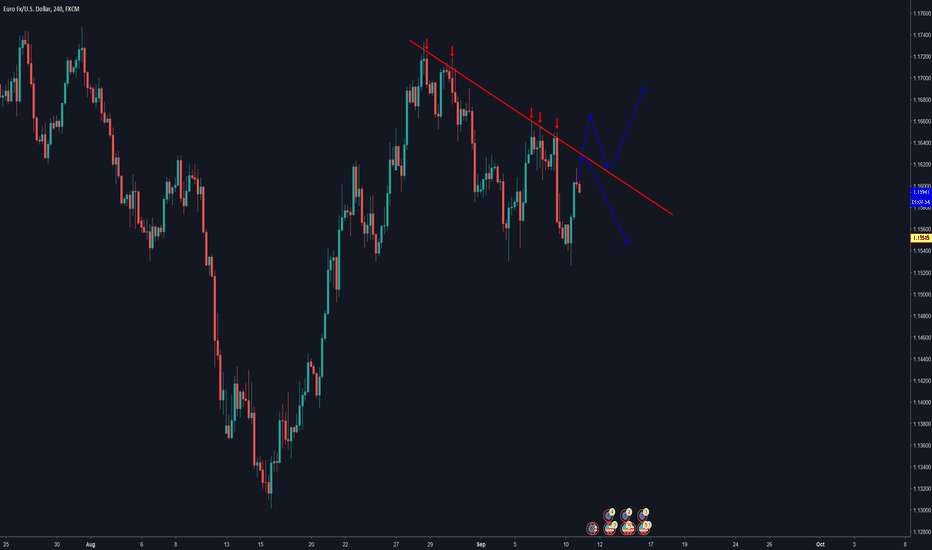

Yawn...Low momentum is still the call here for ETHUSD.

More range-bound to lower trading ahead.

With near-term Fibonacci resistance holding, and no momentum to break to the upside, look for more selling interest to come to market this week. The recommendation is to hold until there are bullish signals coming across the internal indicators, otherwise wait for more downside opportunity.

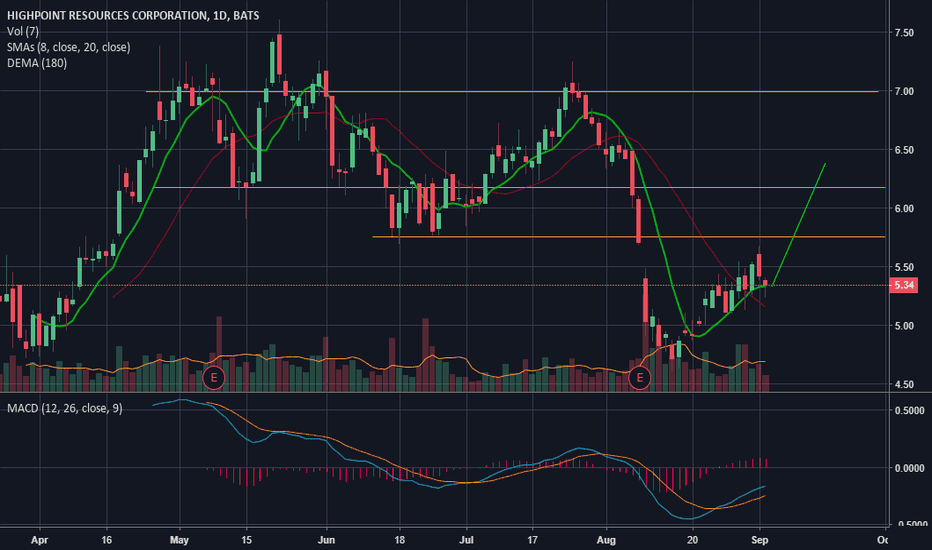

HPR bout to get some cprIf you know what I mean, watch out if this thing can hold gains to be made! Have to watch out though September has been a beasty bear of a month lately, where them gains at?

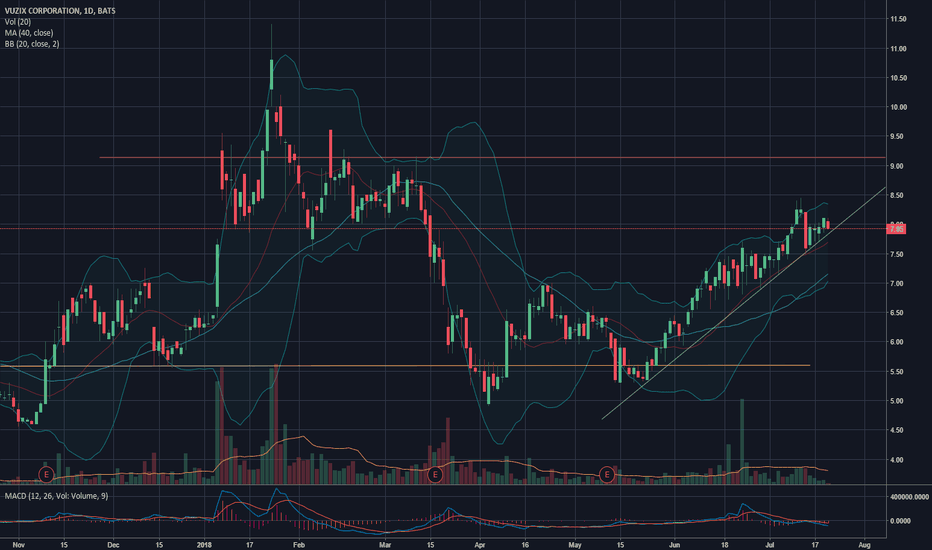

VUZI - Stunna Shades of the FutureSeems like VUZI is on a bull run, solidified by the successful completion and pass of the FCC emissions requirements for it's Blade Smart Glasses on July 6th. It's started it's volume manufacturing, and will probably start its sales campaign soon. A company like this can easily be acquired by Google, or another huge tech company.

"Volume manufacturing of the Vuzix Blade Smart Glasses from our West Henrietta, NY facility has commenced. With FCC and EU certifications processes now complete we can commence broad shipping of our Vuzix Blade Smart Glasses to the application and enterprise Vuzix Blade Edge developer communities located within the USA, Canada and Europe," said Paul Travers, President and Chief Executive Officer at Vuzix.

There seems to be good support in the $5.50 range and resistance in the $9.00-$9.50 range. Anything under $6.50 might be a good buy, but if you can pick up this stock at sub $5.50, that would be ideal. HOLD for now- let's see what happens when it gets to $8.25

Happy Trading!