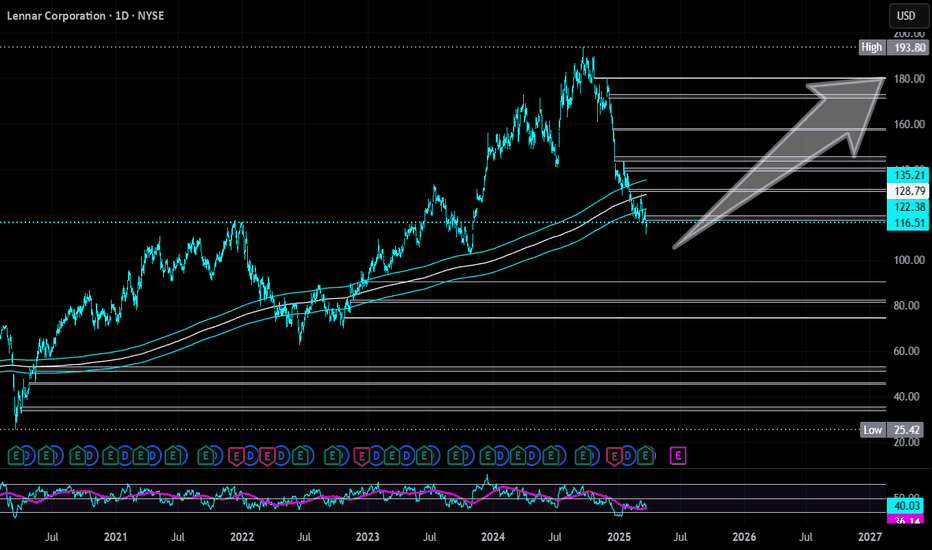

Lennar Corp | LEN | Long at $116.48Across the US, there is a pent-up demand for housing (for the vast majority of locations). While the media likes to selectively report home sales dropping for certain regions, it is more due to mortgage rates and seasonality than demand. Mortgage rates are anticipated to come down over the next 1-2 years and home builders will step in to pick-up the lack of inventory. Healthy companies like Lennar Corp NYSE:LEN , with a P/E of 8x, dividend of 1.68%, very low debt-to-equity (0.17x), etc are likely to prosper, but always stay cautious with the dreaded "recession" announcement if it creeps in...

Thus, at $116.48, NYSE:LEN is in a personal buy-zone. In the near-term, I do see the potential for the price to dip near $100 as tariff and other economic red flags continue to be in focus.

Targets:

$131.00

$145.00

$157.00

$180.00

Homebuilding

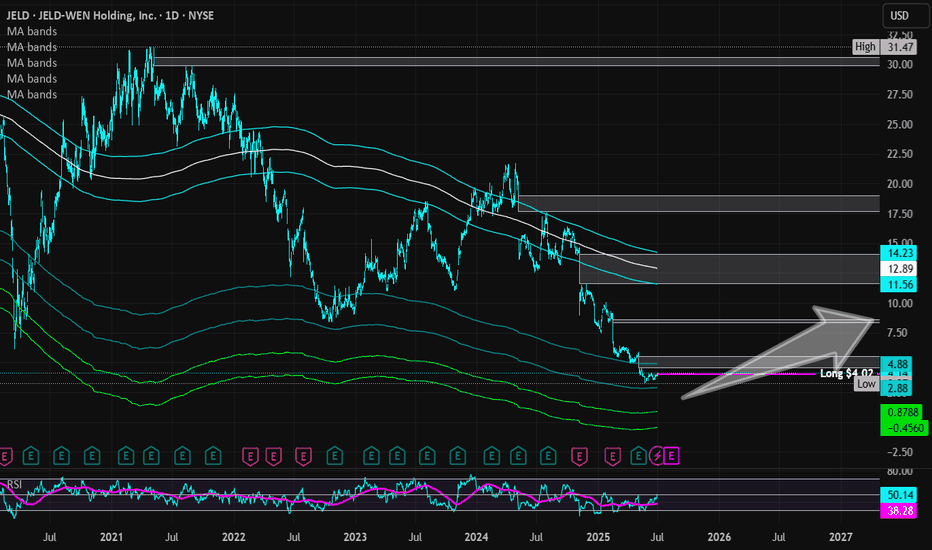

JELD-WEN Holdings | JELD | Long at $4.02JELD-WEN Holdings NYSE:JELD designs, manufactures, and sells wood, metal, and composite materials doors, windows, and related building products in North America and Europe. The stock has taken quite a beating since the rise in interest rates, and I think a reversal *may* be in sight in the next year as rates are slowly lowered - even if the market is forward-thinking and purely anticipating a new housing boom (which I highly doubt given the current home prices). Regardless, there is risk with this stock since it has relatively high debt (debt-to-equity of 2.61x). A Quick Ratio of 1.1 and Altman's Z Score of 1.9 puts NYSE:JELD near a medium level of bankruptcy risk. The company has pretty good cash reserves and a forward P/E of 10x (current is negative), so growth is anticipated. Book value of $5.31.

A bear case here is a terrible earnings call in August 2025 due to the housing market slowing (i.e. people pausing home purchases/builds/repairs expecting interest rates to drop soon). That may plummet the stock near $1.00 or below, which would be a tremendous deal, *unless* the company fundamentals change (like bankruptcy).

Without a crystal ball, yet understanding the forward-thinking aspects of the market, NYSE:JELD is in a personal buy-zone at $4.02 with some risks.

Targets into 2027:

$5.40 (+34.3%)

$8.50 (+111.4%)

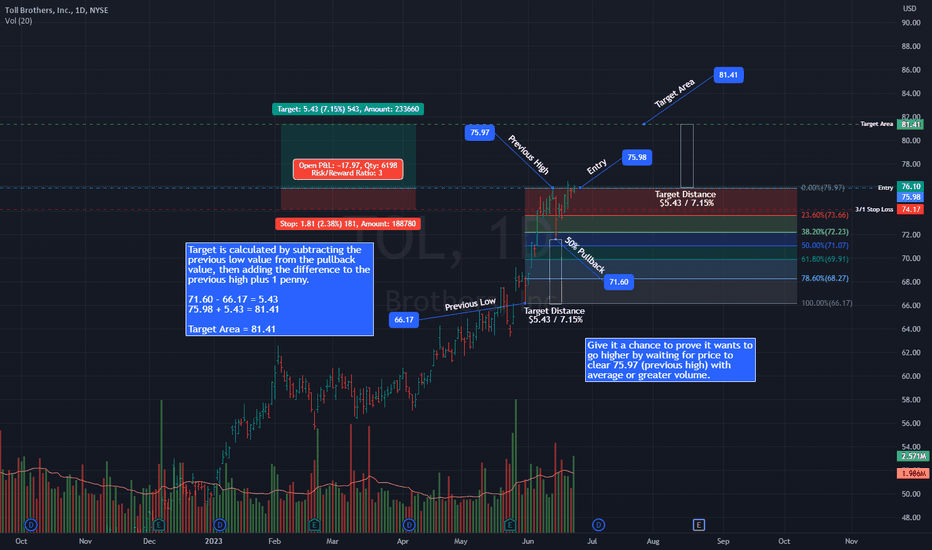

TOL: Entry, Volume, Target, StopEntry: with price above 75.97

Volume: with average or greater volume

Target: 81.41 area

Stop: Depending on your risk tolerance; Based on an entry of 75.98, 74.17 gets you 3/1 Reward to Risk Ratio.

This swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

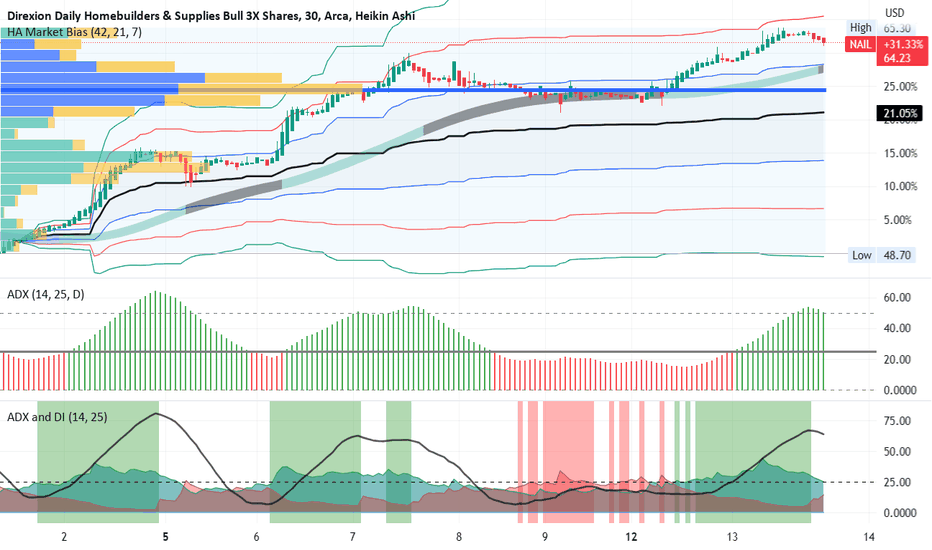

NAIL- an ETF of Homebuilders 3X leveragedNAIL- is an ETF of Homebuilders; It is 3X leveraged. Price is up over 30% in the first two weeks \

of June. It is shown here on the 30-minute chart with the "Market Bias" indicator which shows

uptrends in green and pull-back zones in gray. Presently, price is pulling back - when the gray

colored trend indicator changes back to green, an optimal entry can be made.The ADX indicator

has topped out as part of the early pullback. When the ADX goes below 25 and then crosses 25

from below, an entry can be made. An ADX over 50 and rising suggests that it is too late for

an entry and not to chase but rather wait for a pullback.

Overall, NAIL's price is now in early pullback by the "Market Bias: trend indicator and the ADX

which shows now a decreasing trend directional strength. Price is more than one standard

deviation above the mean anchored VWAP which is an level that professional traders want

to sell from. Because of all of this I will wait for an entry on NAIL until a pullback is completed

and the uptrend bullish continuation is seen.