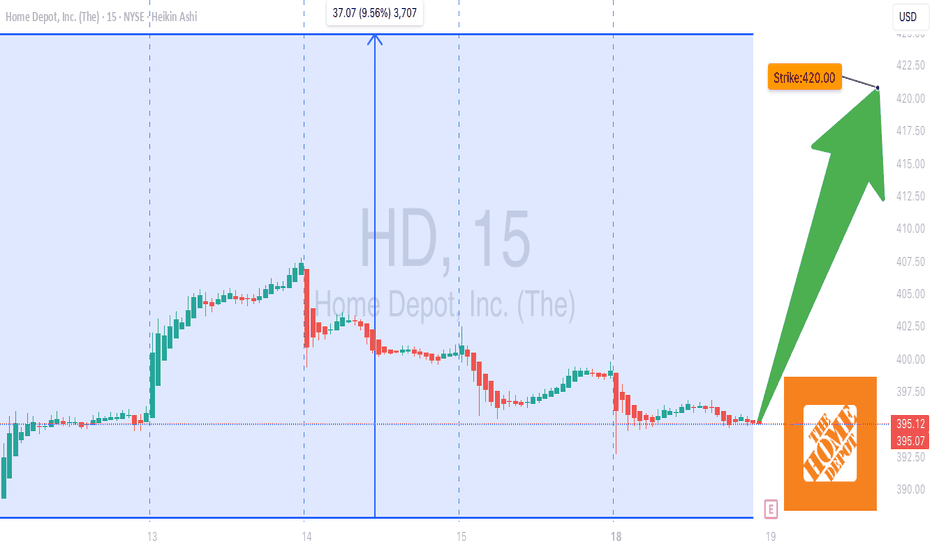

Home Depot 420C Call Setup– Big Move Expected on Earnings

# 🛠️ HD Earnings Options Play – 8/22 BMO

📊 **Market Context**

* Revenue Growth: +9.4% TTM 📈

* Gross Margin: 33.3%, Operating Margin: 12.9%, Profit Margin: 9%

* Forward EPS: \$15.60, Consensus Buy Rating

* Technical Momentum: +7.7% price drift past 2 weeks, key support \$380 / resistance \$420

* Options Flow: Call-heavy volume at \$420 strike, moderate bullish skew

* IV Rank: 65%, priced for \~3.5% post-earnings move

---

## 🎯 Trade Setup (Pre-Earnings Call)

* **Instrument**: HD

* **Direction**: CALL (LONG)

* **Strike**: \$420.00

* **Expiry**: 2025-08-22

* **Entry Price**: \$0.83

* **Profit Target**: \$3.32 (\~300% potential)

* **Stop Loss**: \$0.42 (50% of premium)

* **Size**: 2 contracts

* **Confidence**: 75%

* **Entry Timing**: Pre-earnings close

* **Earnings Date/Time**: 8/22 BMO

* **Expected Move**: \$5.00

---

## 🧠 Key Notes & Risk Management

* **Position Sizing**: Limit exposure to manageable portfolio risk

* **Exit Scenarios**:

* Profit Target → \$1.66 or \$3.32

* Stop Loss → \$0.42

* Time Exit → Close within 2 hours post-earnings if neither triggered

* **Gamma & Volatility Risk**: Moderate due to pre-earnings timing

---

# ⚡ HD 420C EARNINGS PLAY ⚡

🎯 Entry: \$0.83 → Target: \$3.32

🛑 Stop: \$0.42

📅 Exp: 8/22 BMO

📈 Bias: Moderate Bullish (75%) 🐂

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "HD",

"direction": "call",

"strike": 420.00,

"expiry": "2025-08-22",

"confidence": 75,

"profit_target": 3.32,

"stop_loss": 0.42,

"size": 2,

"entry_price": 0.83,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-08-22",

"earnings_time": "BMO",

"expected_move": 5.0,

"iv_rank": 0.65,

"signal_publish_time": "2025-08-18 14:00:30 UTC-04:00"

}

```