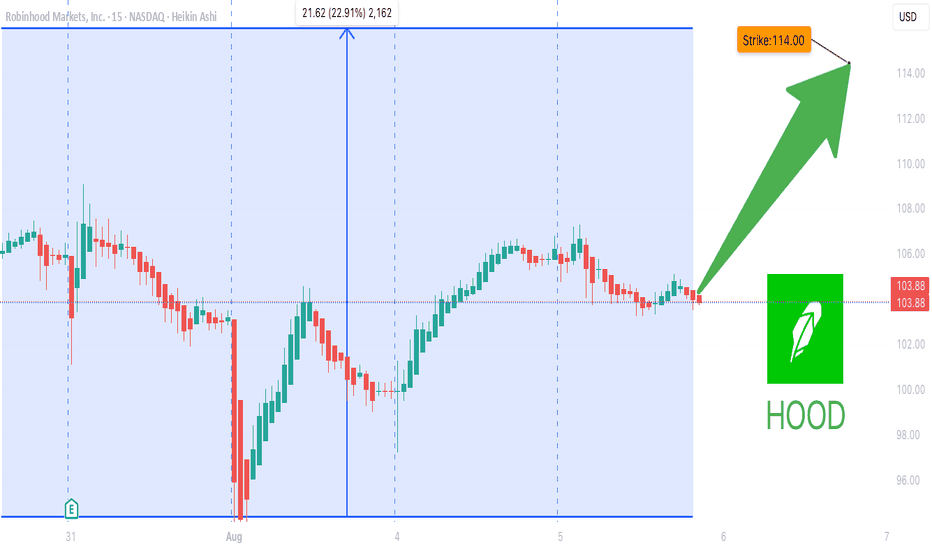

HOOD Lifetime Setup--Will You Miss It Again?### 🟢 **HOOD Options Flow Explodes: 2.05 Call/Put Ratio Sparks Bullish Firestorm 🔥**

**Will \$114 Be Breached This Week? Smart Money Thinks So.**

📈 **HOOD Weekly Options Breakdown – Aug 5, 2025**

---

#### 🔍 Market Snapshot:

* **Total Calls**: 178,756

* **Total Puts**: 87,243

* **C/P Ratio**: 2.05 → **BULLISH**

* **RSI**: Daily – 60.2, Weekly – 77.3 → **Uptrend Confirmed**

* **Volume**: 1.5x Previous Week → **Institutional Flow Detected**

* **Gamma Risk**: 🟡 Moderate

* **VIX**: 17.5 → Ideal for Weekly Plays

* **Time Decay**: 🔥 Accelerating

---

### 🧠 Consensus:

✅ All models confirm **strong bullish momentum**

⚠️ Some debate: Is rising volume accumulation or distribution?

---

### 🎯 Recommended Trade Setup:

> **Naked Call – HOOD \$114C (Exp: 2025-08-08)**

* **Entry**: \$0.79

* **Stop Loss**: \$0.40

* **Profit Target**:

* 🥇 Base: \$1.03 (+30%)

* 🥈 Stretch: \$1.58 (+100%)

* **Confidence Level**: 80%

* **Timing**: Enter @ market open

---

### 🔖 Tags (Hashtags for TradingView & Socials):

`#HOOD #OptionsFlow #CallOptions #BullishSentiment #WeeklyOptions #TradingStrategy #VolumeBreakout #RSI #Gamma #Robinhood #SmartMoneyMoves #HOODTradeIdea #TechnicalAnalysis #StockOptions #ViralTradeSetup`

Hoodlong

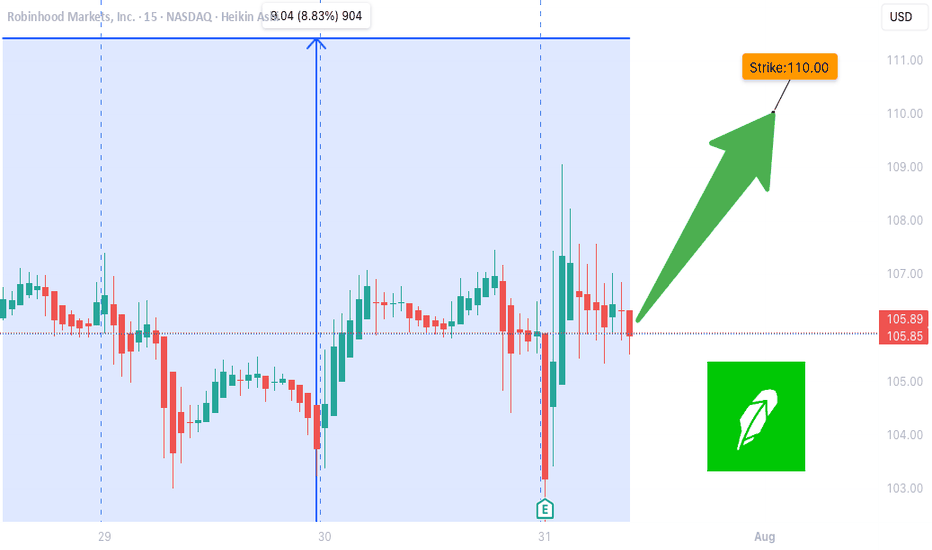

Hood Targeting The Hights

📈 **HOOD BULLISH SETUP - WEEKLY TRADE IDEA (08/03)** 📈

**Ticker:** \ NASDAQ:HOOD | **Bias:** 🟢 *Moderate Bullish*

🔁 **Call/Put Ratio:** 2.13 = **Strong Bullish Flow**

💼 **Volume:** 166K Calls vs. 78K Puts = Institutional Interest

📉 **Gamma Risk:** LOW | ⏳ **Time Decay:** Moderate

🔥 **TRADE SETUP** 🔥

• 💥 **Buy CALL @ \$109**

• 💰 *Entry:* \$0.85

• 🎯 *Target:* \$1.70 (100% ROI)

• 🛑 *Stop Loss:* \$0.43

• ⏰ *Expiry:* 08/08/25 (5DTE)

• 🧠 *Confidence:* 65%

• 📈 *Size:* 5 contracts

• 🕒 *Entry Timing:* Market Open

💡 **Why it matters:**

Despite mixed RSI and conflicting trend models, **massive call volume + low gamma risk** supports a short-term breakout play.

📌 **Watch for confirmation at open. Tight risk/reward. High upside if momentum holds.**

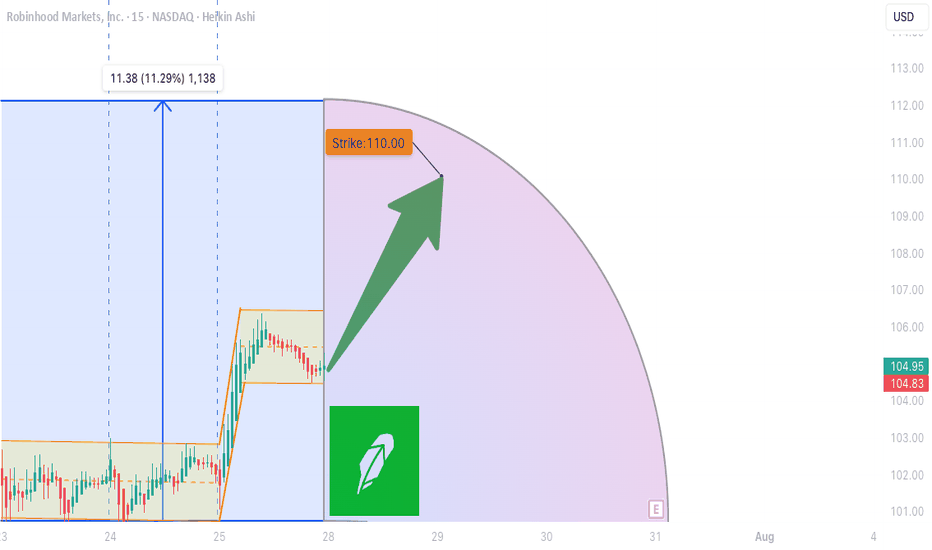

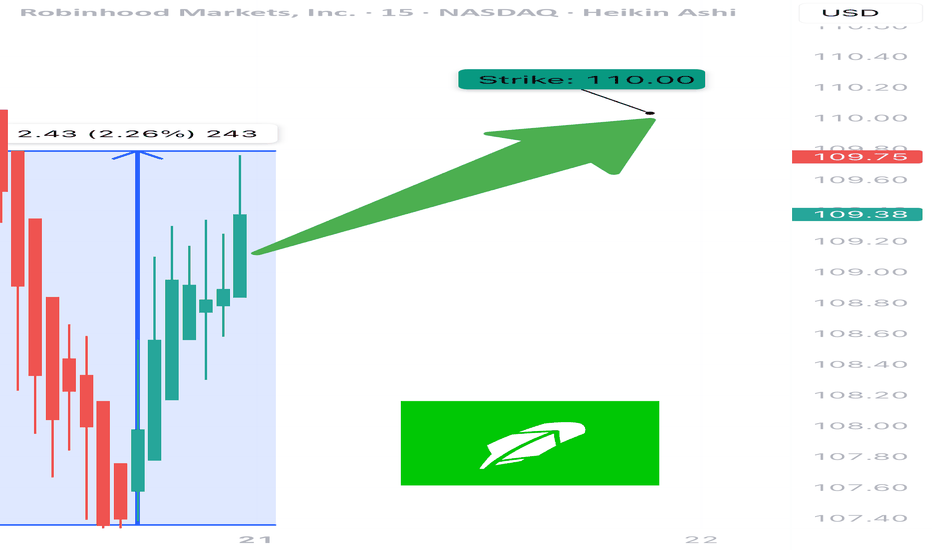

HOOD WEEKLY OPTIONS TRADE (7/31/25)

### ⚡️HOOD WEEKLY OPTIONS TRADE (7/31/25)

📈 **Setup Summary**

→ Weekly RSI: ✅ Rising

→ Daily RSI: ❌ Falling (⚠️ Short-term pullback risk)

→ Call/Put Ratio: 🔥 **1.89** (Bullish flow)

→ Volume: 📉 Weak — fading conviction

→ Gamma Risk: 🔥 High (1DTE)

---

💥 **TRADE IDEA**

🟢 Direction: **CALL**

🎯 Strike: **\$110.00**

💰 Entry: **\$0.82**

🚀 Target: **\$1.62** (+100%)

🛑 Stop: **\$0.41**

📆 Expiry: **Aug 1 (1DTE)**

🎯 Entry: Market Open

📊 Confidence: **65%**

---

🧠 **Quick Insight:**

Mixed signals = *Scalper’s Playground*

✅ Weekly trend favors upside

⚠️ Weak volume & daily RSI divergence = TRADE LIGHT

---

📌 Posted: 2025-07-31 @ 11:53 AM ET

\#HOOD #OptionsTrading #WeeklyPlay #GammaScalp #TradingViewViral #HighRiskHighReward

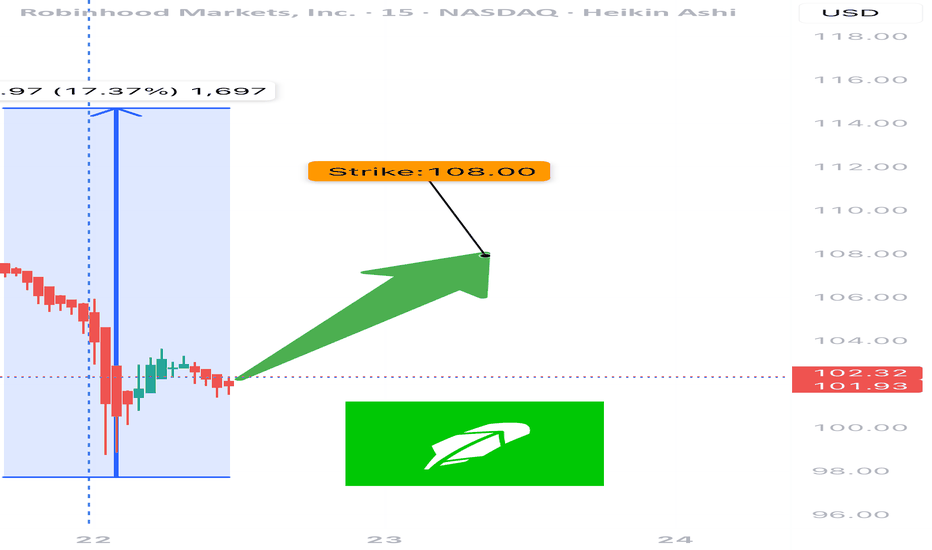

HOOD WEEKLY TRADE IDEA (07/27/2025)

**🚨 HOOD WEEKLY TRADE IDEA (07/27/2025) 🚨**

**BULLISH OPTIONS FLOW MEETS EVENT RISK CAUTION**

📊 **Options Flow Snapshot:**

📈 **Call Volume > Put Volume**

🧮 **Call/Put Ratio: 2.30** → **Institutional Bullish Flow**

📈 **Momentum Readings:**

* 🟢 **Daily RSI: Bullish**

* 🟡 **Weekly RSI: Mixed to Weak**

➡️ *Momentum is short-term positive, but not confirmed long-term*

📉 **Volume Insight:**

* **Only 0.7x** last week’s volume

➡️ *Lack of participation = ⚠️ caution*

🌪️ **Volatility Environment:**

* ✅ **Low VIX = Great Entry Timing**

* ❗ Fed Meeting ahead = Binary Event Risk

---

🔍 **Model Consensus:**

All 5 models (Grok, Claude, Gemini, Meta, DeepSeek) say:

🟢 **Moderately Bullish Bias**

✅ Bullish options flow

✅ Daily RSI uptrend

⚠️ Weak volume + Fed caution

---

💥 **TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Long Call

* **Strike**: \$110

* **Expiry**: Aug 1, 2025

* **Entry**: ≤ \$2.90

* **Profit Target**: \$5.80 (🟢 100%)

* **Stop Loss**: \$1.47 (🔻50%)

📆 Entry: **Market Open Monday**

📦 Size: 1 Contract

📈 Risk-Reward Ratio: \~1:2

---

🧠 **Key Risks:**

* 📉 Volume Weakness = No confirmation

* ⚠️ **FED Event Risk** = Watch for Wednesday volatility

* ⏳ Theta decay as expiry nears

---

📌 **JSON TRADE DETAILS (for bots/scripts):**

```json

{

"instrument": "HOOD",

"direction": "call",

"strike": 110.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 5.80,

"stop_loss": 1.47,

"size": 1,

"entry_price": 2.90,

"entry_timing": "open",

"signal_publish_time": "2025-07-27 15:09:35 EDT"

}

```

---

🔥 Stay sharp. Ride the flow, respect the risk.

👀 Watch volume + Fed headlines!

💬 Tag your team: \ NASDAQ:HOOD Bulls loading?

\#HOOD #OptionsTrading #UnusualOptions #FedWeek #WeeklyTradeSetup #TradingView #StockMarket

HOOD Weekly Options Setup – July 22, 2025

🔥 NASDAQ:HOOD Weekly Options Setup – July 22, 2025

Moderate Bullish Flow | RSI Divergence | 3DTE Tactical Setup

⸻

🧠 Summary Thesis:

While the call/put ratio (1.42) and favorable VIX (16.9) suggest bullish sentiment, fading RSI and neutral volume raise tactical caution. This setup is not for passive traders — it’s for those managing risk and chasing reward with intention.

⸻

📊 Trade Details

• Instrument: NASDAQ:HOOD

• Direction: CALL (Long)

• Strike: 108.00

• Entry: $0.89

• Target: $1.50 – $2.00

• Stop Loss: $0.45

• Expiry: 07/25/25 (3DTE)

• Position Size: 2.5% of portfolio

• Confidence: 65%

• Entry Timing: Market Open

⸻

🔍 Technical + Options Context

Signal Type Status

📈 Call/Put Ratio ✅ Bullish (1.42)

💨 VIX ✅ Favorable (16.9)

🔻 RSI ❌ Falling – Weak Momentum

🔇 Volume Ratio ⚠️ Neutral (1.0x)

⚡ Gamma Risk ⚠️ Moderate – 3DTE decay

⸻

📍 Chart Focus

• Resistance Zone: $108–$109

• Put Wall Support: $100 (OI heavy)

• Watch for: RSI divergence, gamma squeeze attempts

⸻

📢 Engagement Hook / Caption (Use on TV or X):

” NASDAQ:HOOD bulls are pushing 108C into expiry. Volume’s flat, RSI’s falling — but gamma might still flip the board. Risk-defined lotto or fade?”

💥 Entry: $0.89 | Target: $1.50+ | Expiry: 07/25/25 | Confidence: 65%

⸻

🎯 Who This Trade Is For:

• Short-term option scalpers looking for 1.5–2x payoff

• Traders able to manage theta/gamma into late-week expiry

• Chartists watching RSI divergence vs options flow tension

⸻

💬 Want a debit spread version, an OTM gamma scalp, or my top 3 lotto setups this week? Drop a comment or DM. I share daily flow breakdowns and AI-verified trade ideas.

⸻

This format hits all key signals:

• Informative enough for serious traders

• Viral hook for social platforms

• Clear CTA for engagement & leads

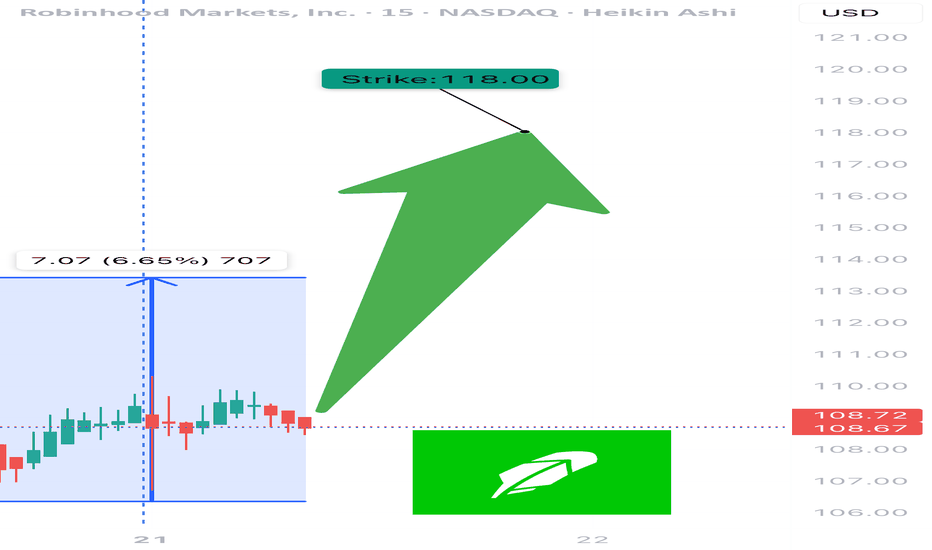

HOOD WEEKLY TRADE IDEA – JULY 21, 2025

🪙 NASDAQ:HOOD WEEKLY TRADE IDEA – JULY 21, 2025 🪙

📈 Flow is bullish, RSI is aligned, and the options market is betting big on upside.

⸻

📊 Trade Setup

🔹 Type: Long Call Option

🎯 Strike: $118.00

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry Price: $0.68

🎯 Profit Target: $1.36 (💯% Gain)

🛑 Stop Loss: $0.41 (~40% Risk)

📈 Confidence: 75%

🕰️ Entry Timing: Monday Open

📦 Size: 1 Contract (Adjust to risk tolerance)

⸻

🔥 Why This Trade?

✅ Call/Put Ratio = 1.83 → Bullish sentiment

✅ Strong Open Interest at $116 and $118 strikes → Institutions leaning long

🧠 RSI aligned → Technical confirmation of trend

💥 VIX stable → Favors long premium trades

📈 All models rate this as bullish, despite weak volume

⸻

⚠️ Key Risks

🔸 Volume light – fewer confirmations from broader market

⏳ Only 4 DTE → Theta risk accelerates fast after Wednesday

🛑 Tight stop is key – don’t hold through a drift

📉 Exit before Friday’s decay spike unless target is in sight

⸻

💡 Execution Tips

🔹 Get in early Monday — best pricing pre-momentum

🔹 Trail if up >30–50% early in the week

🔹 Exit by Thursday EOD unless strong momentum

⸻

🏁 Verdict:

Momentum + Flow + Technicals align.

Just don’t let the time decay catch you sleeping.

NASDAQ:HOOD 118C – Risk $0.41 to Target $1.36 💥

Clean setup. Strong structure. Watch volume confirmation midweek.

⸻

#HOOD #OptionsTrading #CallOptions #WeeklySetup #TradingViewIdeas #GammaFlow #BullishFlow #UnusualOptionsActivity #ThetaRisk #Robinhood

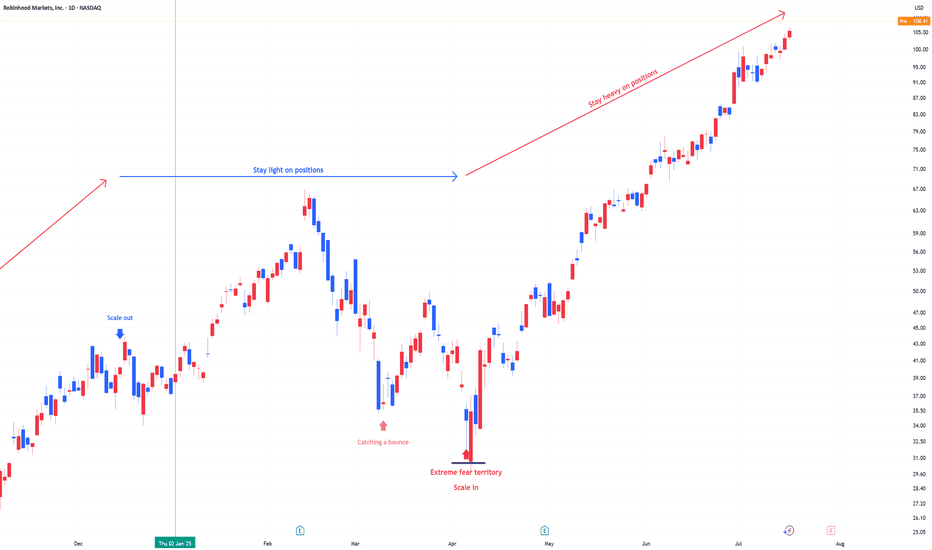

$HOOD Swing Trade – Riding the Rocket or Chasing the Wick?

🚀 NASDAQ:HOOD Swing Trade – Riding the Rocket or Chasing the Wick? 📈

📅 Posted: July 18, 2025

💡 Strong momentum, but no institutional push – is this the top or just getting started?

⸻

🧠 Multi-AI Model Summary

Model Consensus 🟢 Cautiously Bullish

RSI (Daily): 78.5 → 🚨 Overbought territory

5D/10D Perf: +8.49% / +9.29% → 🔥 Hot trend

Options Flow: Neutral (1:1 call/put) → 💤 No strong hands

Volume: Avg (1.0x) → ❌ Weak confirmation

VIX: Low (<20) → ✅ Swing-friendly environment

“Momentum is there, but it’s skating on thin volume. Institutions are silent. Proceed with caution.”

⸻

🎯 Trade Setup – HOOD Call Option

• Strike: $110.00

• Expiry: August 1, 2025

• Entry Price (Premium): $6.30

• Profit Target: $8.10 (≈ +28.6%)

• Stop Loss: $3.80 (≈ -40%)

• Size: 1 contract

• Confidence: 65%

• Entry Timing: At market open

• Key Watch Zone: Needs breakout above $108 with rising volume for confirmation

⸻

⚠️ Risk Radar

• 📉 RSI 78.5 = high pullback risk

• 🧊 Volume lacks institutional bite

• 📊 Neutral options flow = market unsure

• 🔄 No trade? → If price opens flat or drops below $106 with low volume — sit out

⸻

🧪 Strategy Tip

This is a momentum-chaser’s trade, not a conviction play. If you’re in, monitor aggressively. Take partial profits if momentum fades.

⸻

📊 TRADE SNAPSHOT

{

"instrument": "HOOD",

"direction": "call",

"strike": 110.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 8.10,

"stop_loss": 3.80,

"size": 1,

"entry_price": 6.30,

"entry_timing": "open",

"signal_publish_time": "2025-07-18 14:04:07 UTC-04:00"

}

⸻

🔁 Like + Repost if you’re watching HOOD’s next move

💬 Comment below: Momentum magic or rug risk?

Robinhood Dives Into Election Betting, Its Ambition Might be BigRobinhood has just launched election contracts, allowing users to trade on the outcome of the 2024 U.S. presidential election between Kamala Harris and Donald Trump.

The new contracts rolled out to a limited number of customers on October 28. Customers enable margin and options trading and need to be approved for a Robinhood Derivatives account.

With contracts set at $1.00 for correct predictions and $0.00 for incorrect, the payouts will be determined post-election certification in early 2025.

Contracts are available only for Yes positions, except that a No position can be placed to close out an existing Yes position. Customers may not simultaneously hold a Yes position for both candidates.

This launch follows recent regulatory developments, such as the D.C. Circuit's approval for Kalshi and Interactive Brokers to offer similar contracts.

While the CFTC voiced concerns about election integrity, the court permitted Kalshi to move forward, opening the door for Robinhood.

I don’t think Robinhood cares much about making money off Election contracts a week before the election — I think they are going for something much, much bigger…which is a marketplace to bet on anything, marking a potential shift beyond traditional stock and crypto markets.

In my view, this signals a strategic pivot for Robinhood toward a broader, all-encompassing platform where users may eventually wager on global events, similar to derivative markets.

Paired with recent rollouts like index options, futures, and a new trading platform, Robinhood’s rapid innovation rate is noteworthy.

Their agility demonstrates a keen ability to stay relevant in an evolving financial landscape, and if successful, this could redefine event-based trading.

Will this direction lead to a major expansion beyond traditional asset classes? Robinhood’s progress here will be intriguing to watch.

Robinhood is showing some impressive innovation here, and if this new product performs well, it could really boost the company’s diversification.

But back to the stock itself—after a 126% jump year-to-date, is now still a good time to buy?

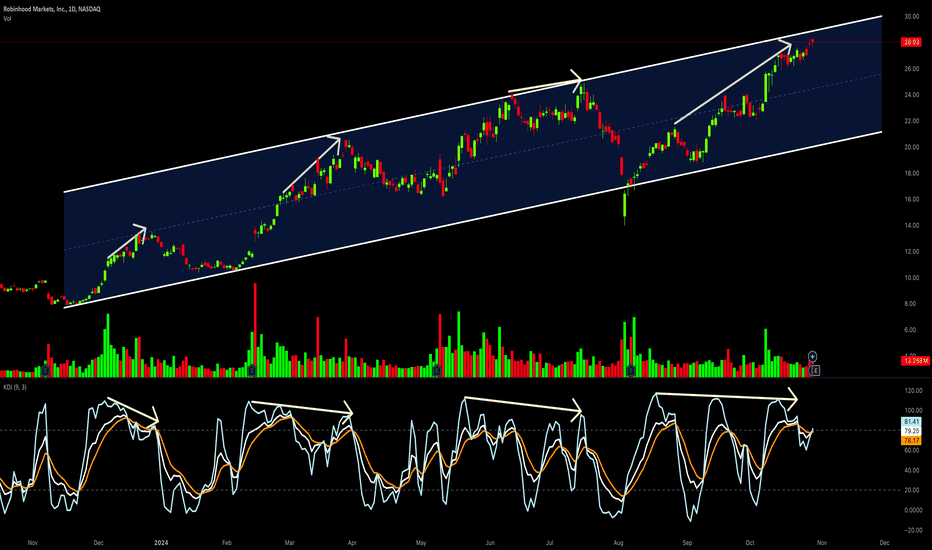

Technically, In the long term, the current stock price is in an upward trend, but in the short term, the price has reached the upper edge of the bullish channel, making it susceptible to be rejected for a pullback. Furthermore, compared to the previous increases, the recent uptrend momentum has significantly weakened, further confirming the high risk of a short-term pullback.

Moreover, according to historical patterns, before each pullback in this uptrend, there tends to be a KDJ bearish divergence. The reemergence of this divergence currently suggests inadequate upward momentum, indicating that a short-term pullback in prices may occur at any time.

Therefore, although the Robinhood's presidential election contracts is highly favorable, from a rational perspective, it is advisable to entry after a short-term pullback.

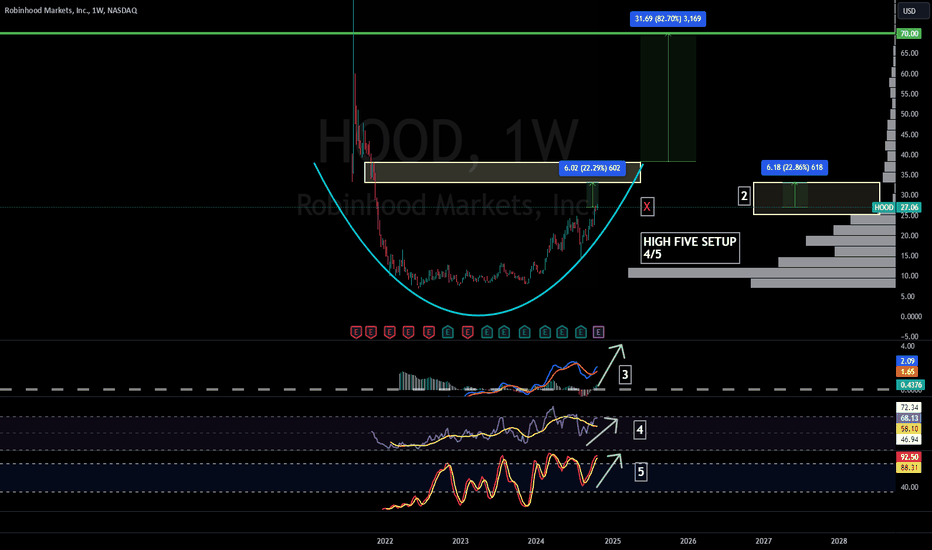

ROBINHOOD TO $70?! Let's break it down.NASDAQ:HOOD TO $70?! Let's break it down.

5 REASONS WHY:

1⃣ 4/5 ON THE "High Five Setup" trade strategy

2⃣ Strong fundamentals and AMAZING Sentiment

3⃣ The forming of a CUP N HANDLE pattern. Measure Move: $70

4⃣ Growth Beast! Newer generations are on board!

5⃣ Continue to grow their products and offer great deals for people to switch. Like the HOOD week, which had up to 3% match. They got me to move because the deal was too good to pass up!

Stay tuned for more!🔔

Like ❤️ Follow 🤳 Share 🔂

When does NASDAQ:HOOD get to $70 per share?! Drop a comment below.

Not financial advice.

#tradingstrategy #TradingTips

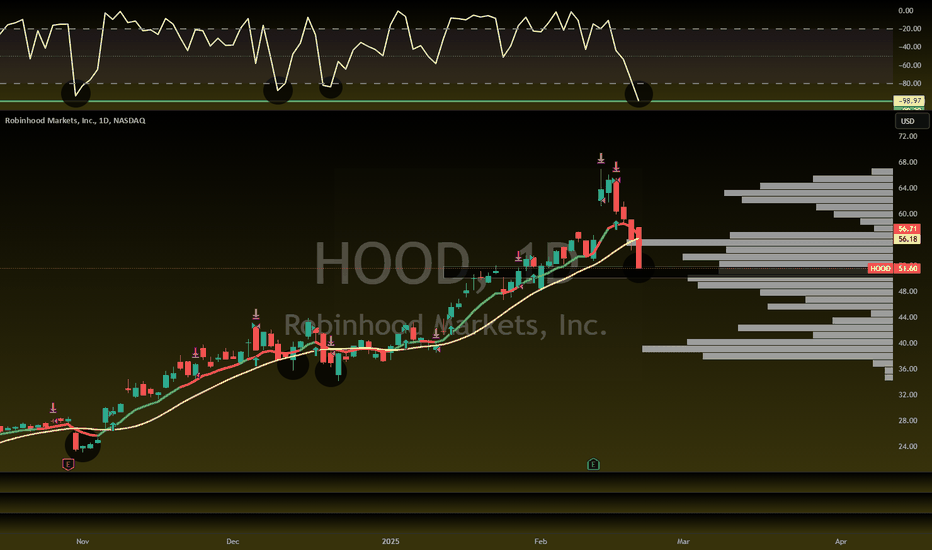

HOOD - Is someone loading the boat?We see the long base.

It looks like accumulation to me.

The Pitchforks L-MLH shows good support in the angle price is flowing.

Now that price climbed above the 200 D. MA, it's even more worth putting HOOD on the watch list, or even start to buying in.

In such situations, where it looks good, but no clear indication by my strategy fires, I reverse pyramid my position, for example like:

1. Buy = 50%

2. Buy = 25%

3. Buy = 12.5%

...and so on, until I have my full stake on the plate.

And of course I look for profit taking on the way up, selling 1., then 2. then 3. ....

And I always try to optimize with Options Strategies. So, what ever happens, I sleep like a Baby §8-)