Howmet Aerospace: Navigating Geopolitics to New Heights?Howmet Aerospace (HWM) has emerged as a formidable player in the aerospace sector, demonstrating exceptional resilience and growth amidst global uncertainties. The company's robust performance, marked by record revenues and significant earnings per share increases, stems from dual tailwinds: surging demand in commercial aerospace and heightened global defense spending. Howmet's diversified portfolio, which includes advanced engine components, fasteners, and forged wheels, positions it uniquely to capitalize on these trends. Its strategic focus on lightweight, high-performance parts for fuel-efficient aircraft like the Boeing 787 and Airbus A320neo, alongside critical components for defense programs such as the F-35 fighter jet, underpins its premium market valuation and investor confidence.

The company's trajectory is deeply intertwined with the prevailing geopolitical landscape. Escalating international rivalries, particularly between the U.S. and China, coupled with regional conflicts, are driving an unprecedented surge in global military expenditures. European defense budgets are expanding significantly, fueled by the conflict in Ukraine and broader security concerns, leading to increased demand for advanced military hardware incorporating Howmet’s specialized components. Simultaneously, while commercial aviation navigates challenges like airspace restrictions and volatile fuel costs, the imperative for fuel-efficient aircraft, driven by both environmental regulations and economic realities, solidifies Howmet’s role in the industry’s strategic evolution.

Howmet's success also reflects its adept navigation of complex geostrategic challenges, including trade protectionism. The company has proactively addressed potential tariff impacts, demonstrating a capacity to mitigate risks through strategic clauses and renegotiation, thereby protecting its supply chain and operational efficiency. Despite its premium valuation, Howmet’s strong fundamentals, disciplined capital allocation, and commitment to shareholder returns highlight its financial health. The company's innovative solutions, crucial for enhancing the performance and cost-effectiveness of next-generation aircraft, solidify its integral position within the global aerospace and defense ecosystem, making it a compelling consideration for discerning investors.

Howmet

Howmet Aerospace Surges 15% As it Leads the S&P 500 GainersHowmet Aerospace's stock soared early Tuesday, breaking out as the company reported strong earnings, optimistic guidance, and significant hikes to its dividend and buyback program. The Boeing supplier, known for its engine components and metal parts, posted a 52% increase in earnings to 67 cents per share on an adjusted basis, surpassing FactSet's estimate of 60 cents. Revenue rose 14% to $1.88 billion, topping analyst projections of $1.834 billion.

Robust Earnings and Revenue Growth

The strong financial performance in Q2 was driven by a 27% jump in commercial aerospace revenue, fueled by strong travel demand and an aging aircraft fleet. Howmet Aerospace CEO John Plant highlighted the "extremely high" backlog at aircraft original equipment manufacturers (OEMs) as a key factor, noting that these manufacturers struggle to deliver jets consistently.

Defense aerospace revenue also increased by 11% for the quarter, while commercial transportation revenue saw a slight decline of 4%. In addition to Boeing, Howmet Aerospace supplies to RTX unit Pratt & Whitney and Lockheed Martin's F-35 Lightning II.

Upgraded Outlook and Shareholder Returns

Reflecting its strong quarter, Howmet Aerospace ( NYSE:HWM ) has raised its 2024 adjusted earnings per share guidance to $2.53-$2.57 from the previous $2.31-$2.39. The company now expects 2024 revenue between $7.4 billion and $7.48 billion, up from the prior guidance of $7.225 billion to $7.375 billion. This new outlook surpasses FactSet's earnings forecast of $2.39 per share on $7.32 billion in revenue.

Moreover, Howmet Aerospace ( NYSE:HWM ) increased the midpoint of its 2024 free cash flow guidance by $70 million, to $870 million. For Q3, the company anticipates EPS of 63-65 cents on revenue of $1.845 billion-$1.865 billion, ahead of analyst views of 60 cents EPS and $1.81 billion in sales.

In a significant move to enhance shareholder value, Howmet Aerospace ( NYSE:HWM ) bought back $60 million worth of stock during the quarter and increased its stock repurchase plan by $2 billion, bringing it to $2.487 billion. The company also hiked its quarterly dividend by 60% to 8 cents per share, with the new dividend for Q3 to be paid out on August 26 to shareholders on record as of August 9.

Market Reaction and Future Prospects

Following these announcements, Howmet Aerospace ( NYSE:HWM ) stock surged nearly 15% early Tuesday, achieving a new record high above $90 and leading S&P 500 gainers. The stock has rallied 53% so far this year through Monday's close, reflecting investor confidence in the company's robust performance and future prospects.

Pittsburgh-based Howmet reported net income of $266 million, or 65 cents a share, for the quarter, up from $193 million, or 46 cents a share, a year earlier. Excluding one-time items, adjusted earnings per share came to 67 cents, ahead of the 60-cent FactSet consensus. Sales rose to $1.88 billion from $1.648 billion, also surpassing the $1.834 billion FactSet consensus.

CEO John Plant remains optimistic about the future, stating, "The outlook for commercial aerospace continues to be robust, with strong travel demand and an aging aircraft fleet, leading to an extremely high backlog at the aircraft OEMs." He acknowledged challenges in the consistent delivery of aircraft but emphasized that the company has raised guidance for all metrics due to the strong quarter.

Segment Performance

By segment, Howmet Aerospace reported significant growth:

Engine-products sales: Rose to $933 million from $821 million, driven by growth in commercial aerospace, defense aerospace, oil and gas, and industrial gas-turbine markets.

- Fastening-systems sales: Increased by 20% to $394 million from $329 million, primarily due to the commercial aerospace market, including wide-body aircraft recovery.

- Engineered-structures sales: Rose 38% to $275 million, driven by growth in commercial aerospace and defense aerospace markets.

- Forged-wheels segment: Sales fell 7% to $278 million due to lower volumes in commercial transportation and a decline in aluminum and other inflationary costs.

Separated from aluminum maker Arconic Inc. in 2020, Howmet Aerospace ( NYSE:HWM ) has established itself as a critical player in the aerospace industry, providing essential components and maintaining a strong market position.

Technical Outlook

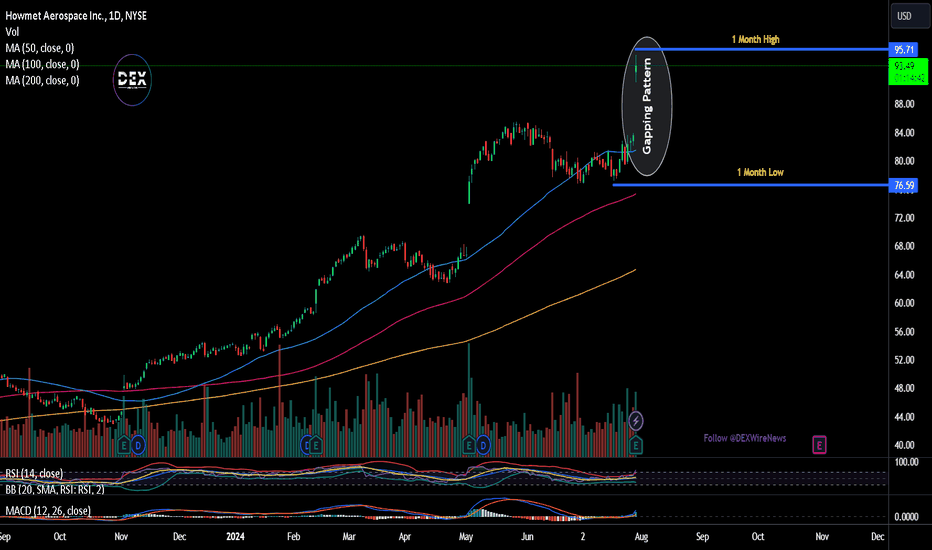

Howmet Aerospace ( NYSE:HWM ) stock has experienced a 13% increase as of the present trading period, positioning it above the oversold region with a Relative Strength Index (RSI) of 74.43, indicating the potential for further upward movement. The daily price chart displays a gapping pattern, a phenomenon observed when a significant price movement occurs in a trading pair with minimal or no trading activity in between. In the case of Howmet Aerospace, the occurrence of the gapping pattern can be attributed to the positive earnings beat news.

Conclusion

Howmet Aerospace's impressive Q2 performance, upgraded guidance, and enhanced shareholder returns program underscore its robust growth and market resilience. With strong demand in commercial and defense aerospace, the company is well-positioned to continue its upward trajectory, offering a promising outlook for investors and stakeholders alike.

Howmet Aerospace: Hugely Undervalued with Promising Upside(Pt.1)Howmet manufactures components for the aerospace, ground transportation, defense, and industrial sectors including aluminum sheet, plate, extrusions, and other specialized parts.

November's Q3 earnings report showed a 37% decrease in revenue Y.O.Y compared to Q3 2019. This was likely due to the pandemic's impact on commercial air travel and aircraft manufacturing as well as Boeing's decision to halt production of the 737 Max.

Currently trading just under $25.60, it is massively undervalued given its high profile contracts with giants like Boeing, Airbus, and Daimler. Distribution of the vaccine and a return to normalcy with increased air travel will raise demand for its products used in commercial aircraft production. Boeing also recently announced that it has resumed production of its 737 Max model, which will help Howmet's aerospace division further.

The global economic recovery and subsequent rise in household income(followed by consumer spending), will likely lead to a bump in new car purchases and production. This would bolster its already strong ground transportation division.

The Daily Chart shows decently high volume and a strong uptrend. With the 50 day moving average of closing prices recently crossing above(and staying above) the 200 day moving average, things look very promising.