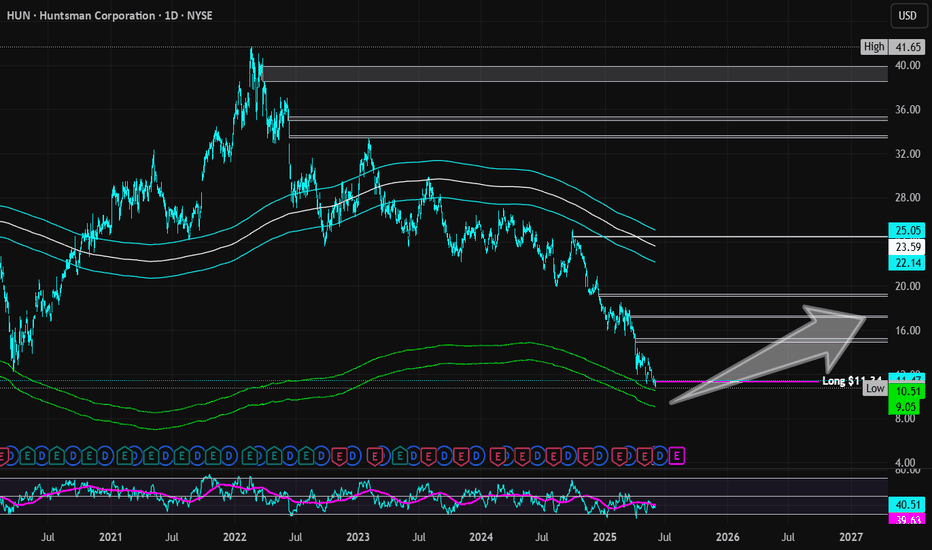

Huntsman Corporation | HUN | Long at $11.34The stock price for Huntsman Corp NYSE:HUN , a manufacturer of organic chemical products, has dropped significantly since its peak in 2022 ($41.65). This was due to lower sales volumes, weak demand in construction and transportation, higher input costs, and European operational challenges, including a $75M hit from closing a German Maleic Anhydride facility. This year (2025) is anticipated to be its worst earnings year, and the stock is priced as such. However, this stock is historically cyclical, and the company expects recovery / growth again in 2026. Moving forward, earnings are forecast to grow and the company is trading at good value compared to peers and the industry. While many headwinds may still exist with tariffs, etc., insider are grabbing shares and large options positions (very bullish). With a book value of $17, debt-to-equity at 0.8x, quick ratio under 1, etc., the company appears healthy.

From a technical analysis perspective, the stock price just barely missed my "crash" simple moving average area (currently between $9.00 and $10.50). It may reach those levels and below in 2025, for which I will add another position as long as fundamentals do not change. This moving average area often signifies "bottom" territory and historically, the stock has rebounded from this area. While my entry at $11.34 may be a little early, predicting true bottoms isn't my trading method and I hope to strengthen the position at lower trading prices.

Targets:

$15.00 (+32.2%)

$17.25 (+49.9%)

Huntsman

#HUN Resistance turned Support and testing 50 dma.Late September 2015, #HUN gapped down through the 14 USD level. The stock has tested this level a couple of times and it acted as a strong resistance. In April 2015, #HUN bullishly breached resistance for the first time and now #HUN is dropping lower and testing back the key 14 USD level. Will it hold as support this time? Price is testing the 50 day moving average in this potential support zone. If it holds; there is some nice upside in this stock.

Risk/Reward = 4