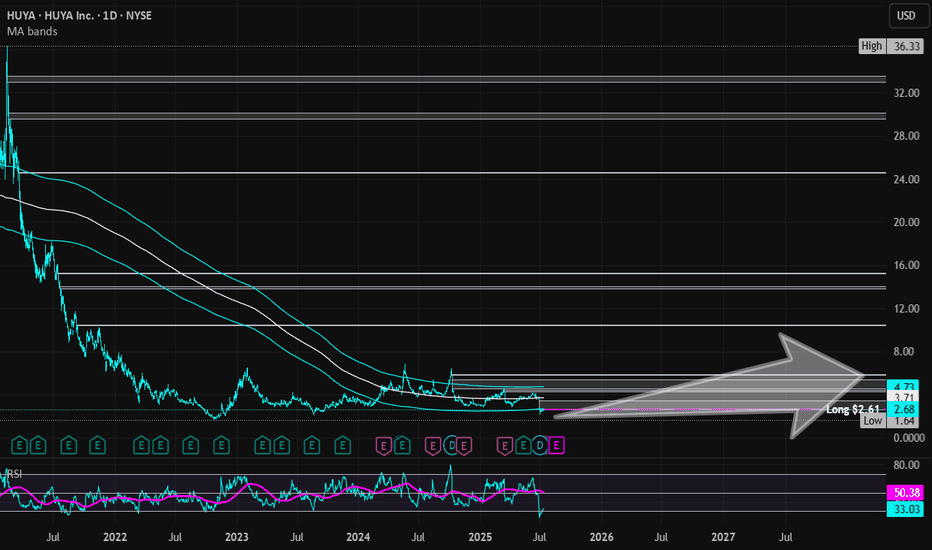

HUYA | HUYA | Long at $2.61HUYA NYSE:HUYA operates game live streaming platforms in China. This stock got my attention based on the reported fundamentals and price position, but moderate "Chinese delisting" risks exist given the US's new political administration.

Book Value = $3.23 (Undervalued)

Forward P/E = 4.1x (Growth)

Debt-to-equity = 0x (Healthy)

Quick Ratio = 1.56x (Healthy)

Altman's Z Score = <1.8 (Bankruptcy risk is relatively high)

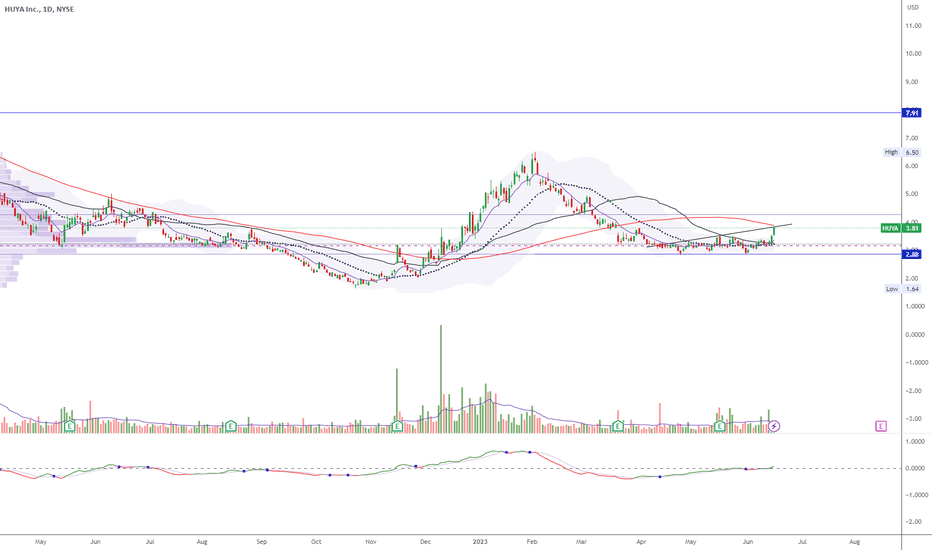

From a technical analysis perspective, the stock price momentum has shifted upward based on the historical simple moving average. The price often consolidates within and slightly outside of this simple moving average band before progressing higher (after a long period of selling). While near term-declines are a risk, a longer-term hold (if the fundamentals do not change and delisting doesn't occur) may pay off given the value, growth, and overall health of the company.

Thus, at $2.61, NYSE:HUYA is in a personal buy zone.

Targets into 2028:

$3.45 (+32.2%)

$5.80 (+122.2%)

Huyalong

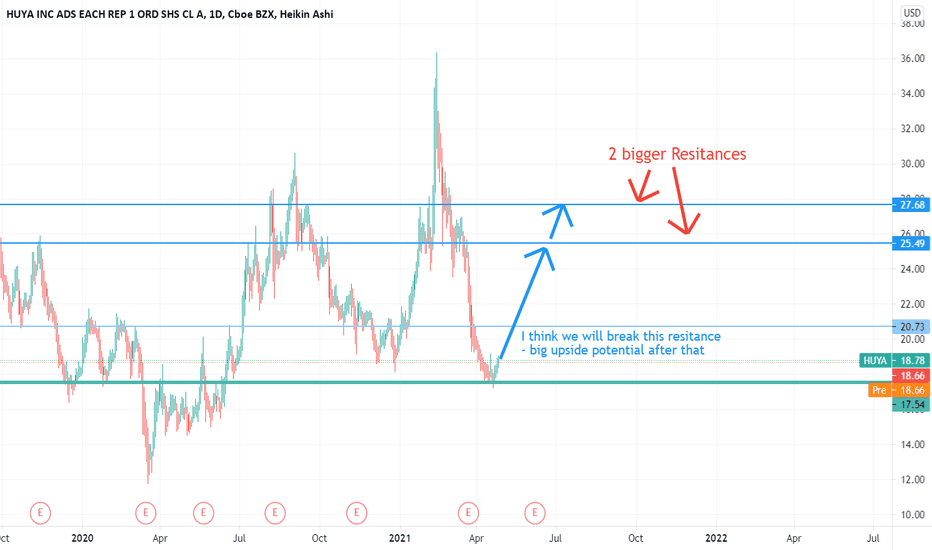

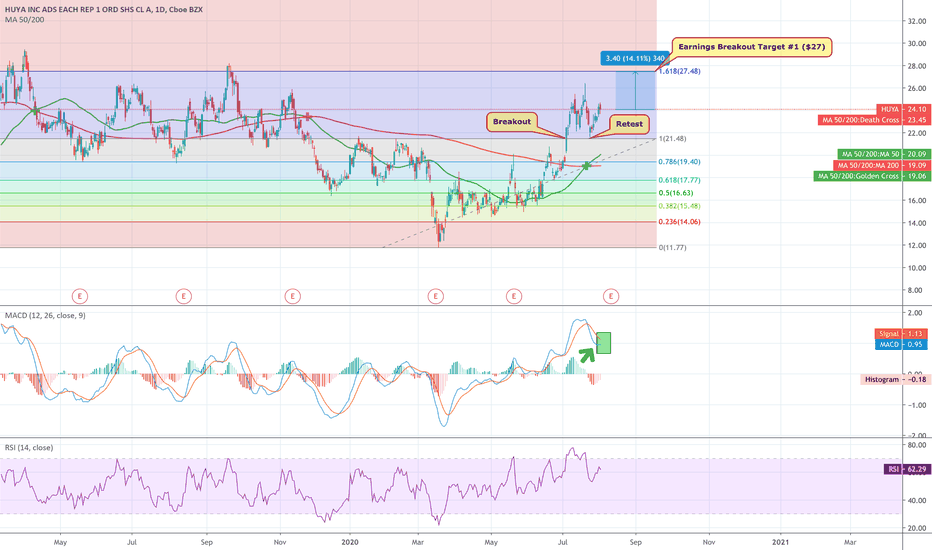

HUYA - 65% Potential to 28 USD! THE NEW GAMESTOP?In my opinion Huya could be a big Trade in the next weeks/months.

Reasons:

-The Gaming/E-Sports Streaming Industry is set to triple in the next two years

-The Interest on Wallstreetbets is growing

-Technically it seems to have a trend reversal

-if the merger with Doyu happens they have a complete monopoly (also a risk because of the Chinese government)

-the numbers were good, but the chart didn't react

-high short interest

More details on Wallstreetbets(cant post the link here)

So the fundamentals look very good, that's why I think it's also an interesting long term play, but besides that I was very surprised to see some posts on Wallstreetsbets about it in my opinion that's a very bullish signal, the posts performed extremely well, and I can't find a reason why this shouldn't be the next big WSB play.

--- If the WSB interest really will grow like that, there is a way bigger growth possible.

Excuse my German school English.