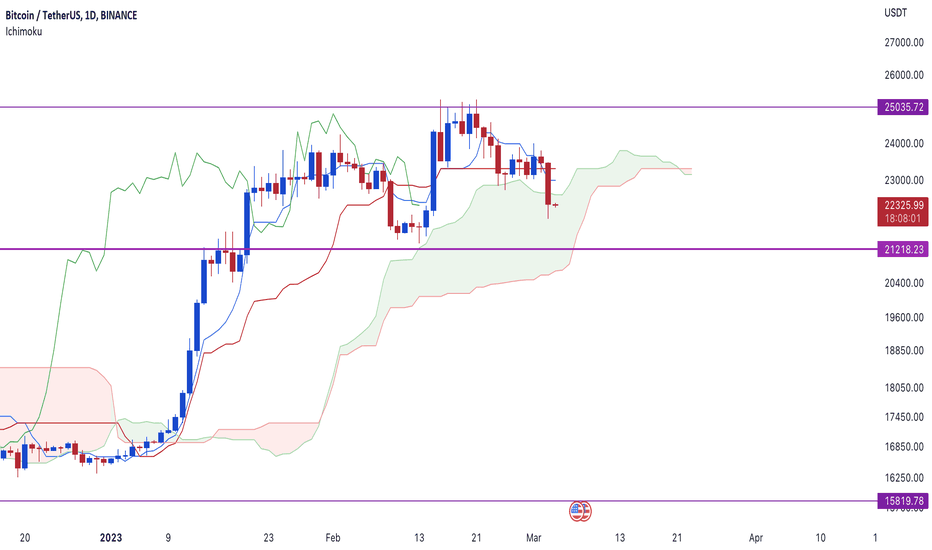

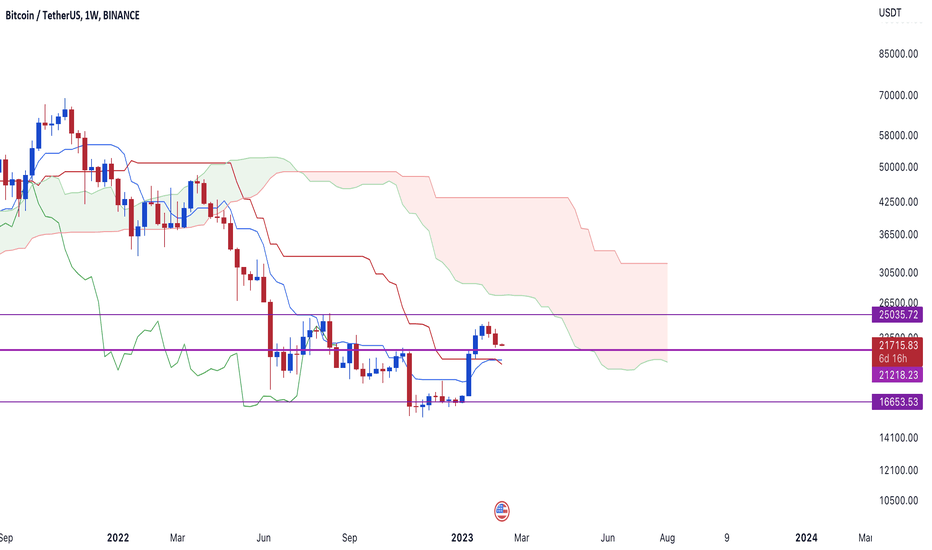

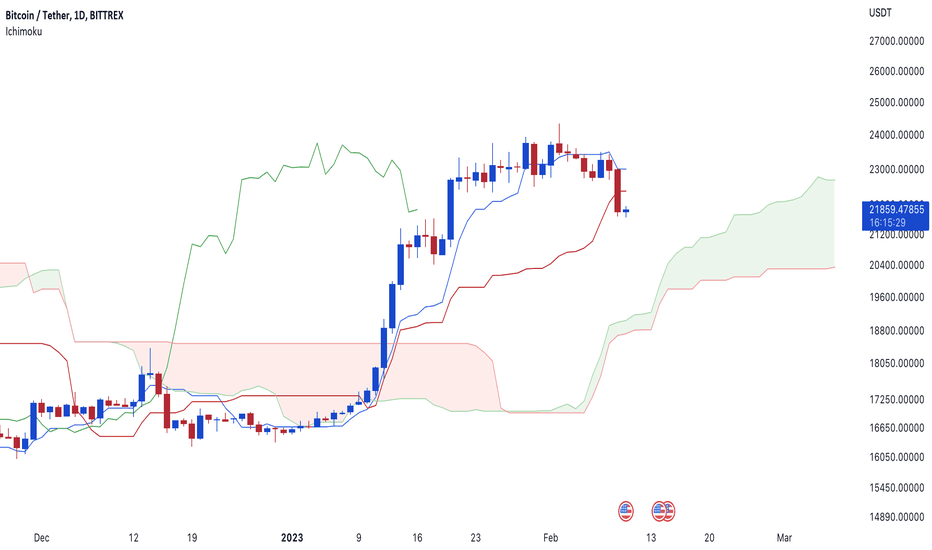

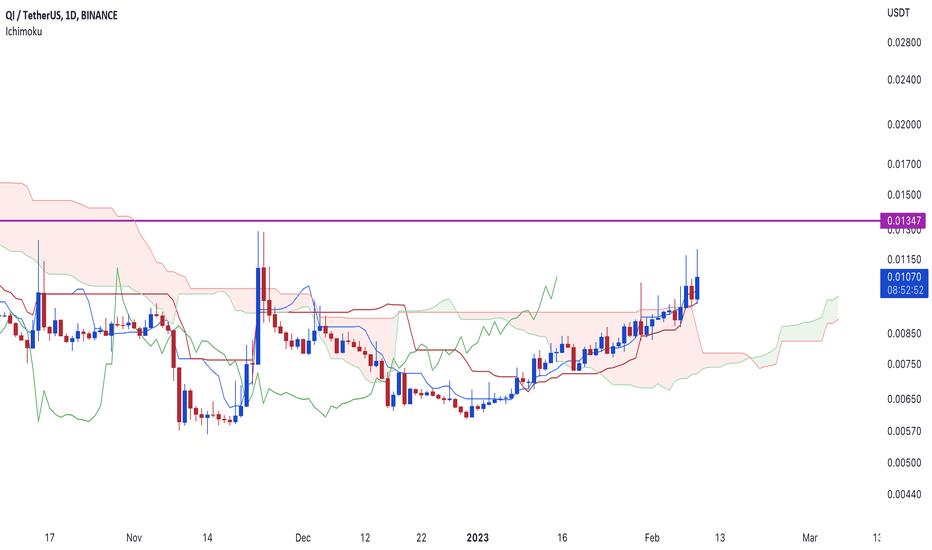

Ichimokukinkohyo

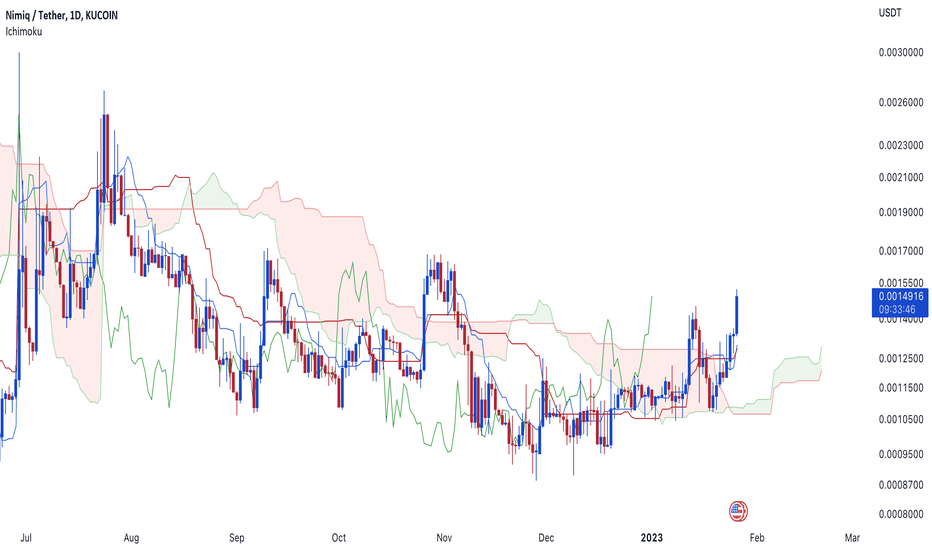

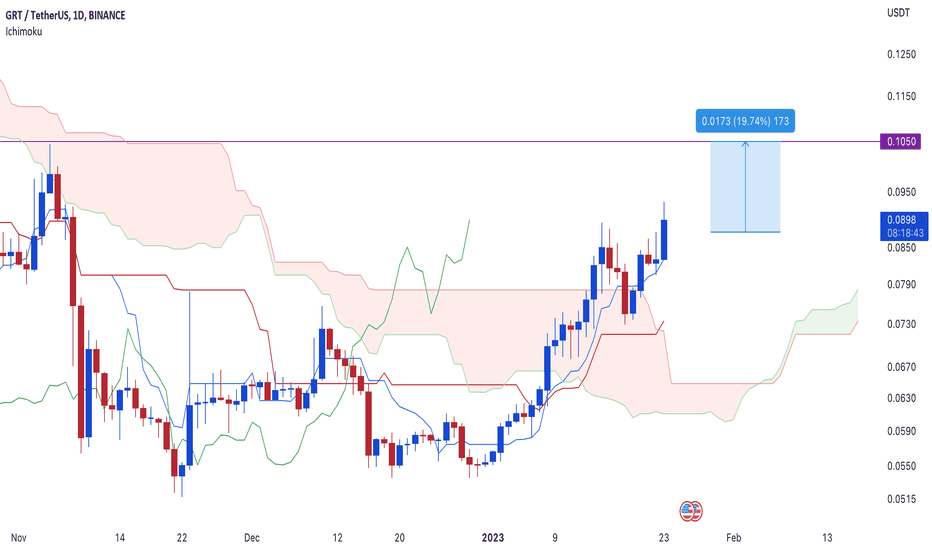

Time to RALLY! Don't sleep on this one 🔥Hey guys! Today I'm sharing a nice catch that is still early in the green market we're having in crypto! So this is RALLY a beautiful project and now let me share analysis per Ichimoku Cloud:

1D - It broke through Kumo from below to above which is a strong bullish reversal sign, specially in the long term for the Daily Timeframe! So this is really great news!

4h - Kumo is getting thicker which means the uptrend is getting stronger and acts a support. Kijun-sen has been pretty flat all the way warning about retracements along the way but you can consider these as opportunities to enter and ride the upcoming Daily Timeframe uptrend that's just starting out! Tenkan sen is pretty strong pointing upwards!

1h Our entry trigger timeframe would be here: It hit a resistance from 0.0142 to 0.0159, if we see a breakout from this resistance, you go long! ♥ That would be the safe set up for this!

Happy trading & stay shiny! ✨

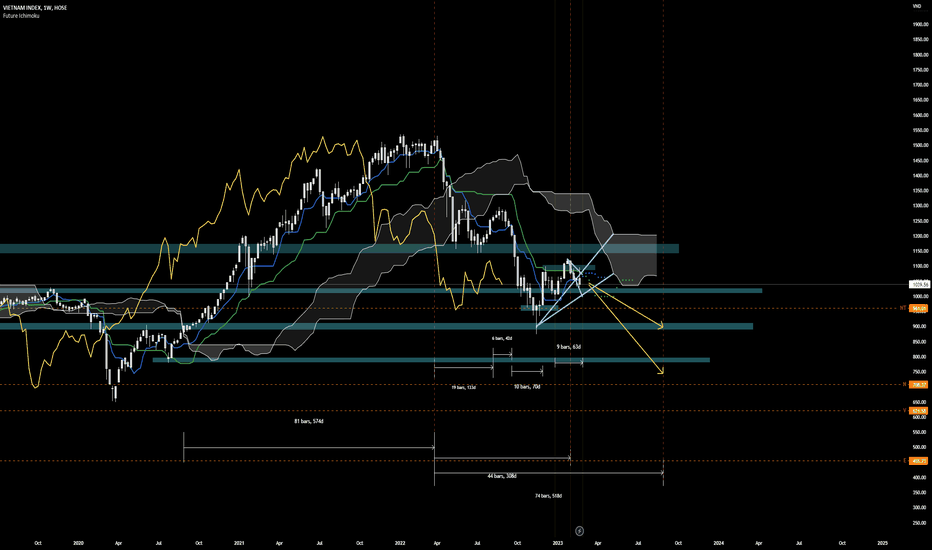

VNINDEX Ichimoku Kinko Hyo AnalysisMonthly:

Tenkan-sen; Kijun-sen dead cross

Chiko break candles

Kumo flat

Bearish Kyushu Ashi

Weekly:

Kijun-sen down

Tenkan-sen flat

Chiko below canldes

Candles below Tenkan-sen and Kijun-sen

Daily:

Tenkan-sen; Kijun-sen dead cross

Chiko broke the candles

Price is under Tenkan-sen; Kijun-sen and between forecast line

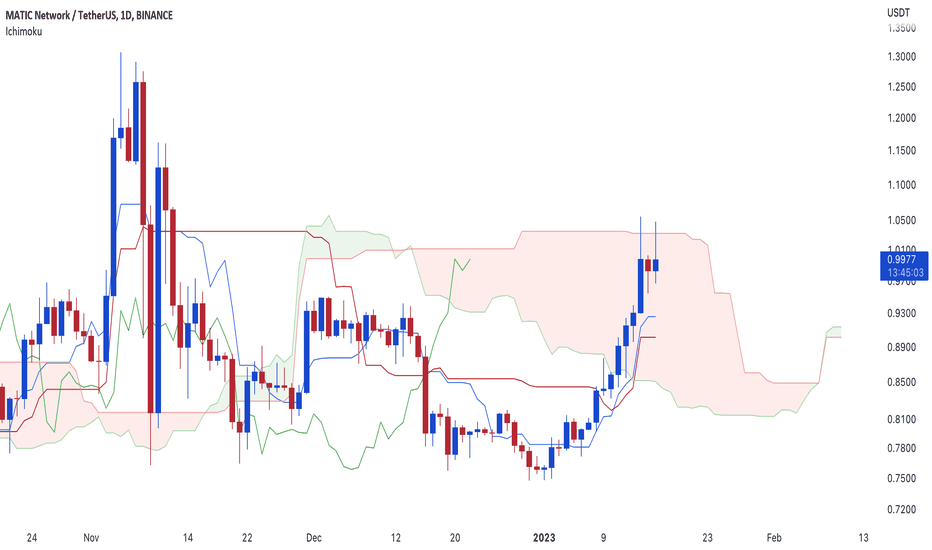

Ichimoku Analysis MATICClosing above 1.035 could get us to 50% Profit in it. There is a bullish kumo crossover already.

TRENTHello & welcome to this study on daily time frame

As per Ichimoku it is seeing a rejection near a cloud with future kumo still bearish. It could now do a pullback till 1250 (with interim support near 1290) as long as it remains below 1340.

From the daily base line support (expected retracement level from here) a fresh rally could take place for 1450 (provided 1250 holds)

Immediate short term bearish

Medium term bullish

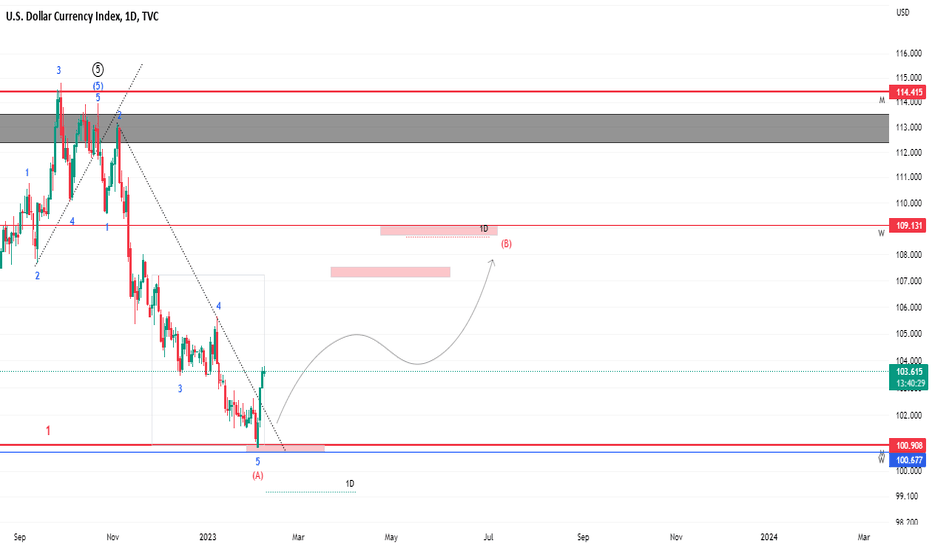

DXYIt seems that wave 5 is over, which can be a part of wave A or 1 of the corrective phase.

The index has reacted well to the areas determined for the completion of wave A and until the bottom of the hypothetical wave 5 has not been broken, this analysis is valid.

The red boxes are the ideal areas for the end of the hypothetical wave B.

Happy dollar days are coming..

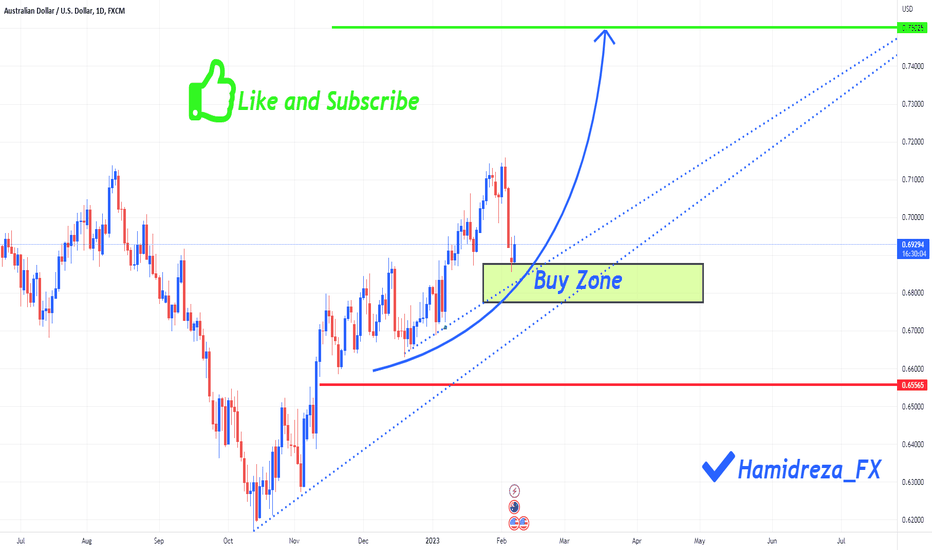

💡 Don't miss the great Buy opportunity in AUDUSDHello to all

It seems that the rise of the Australian dollar against the US dollar will continue and I think it will reach at least $0.75. Until the drawn trend lines are not broken, you can think about buying.

If you like my analysis, support me by liking and following.

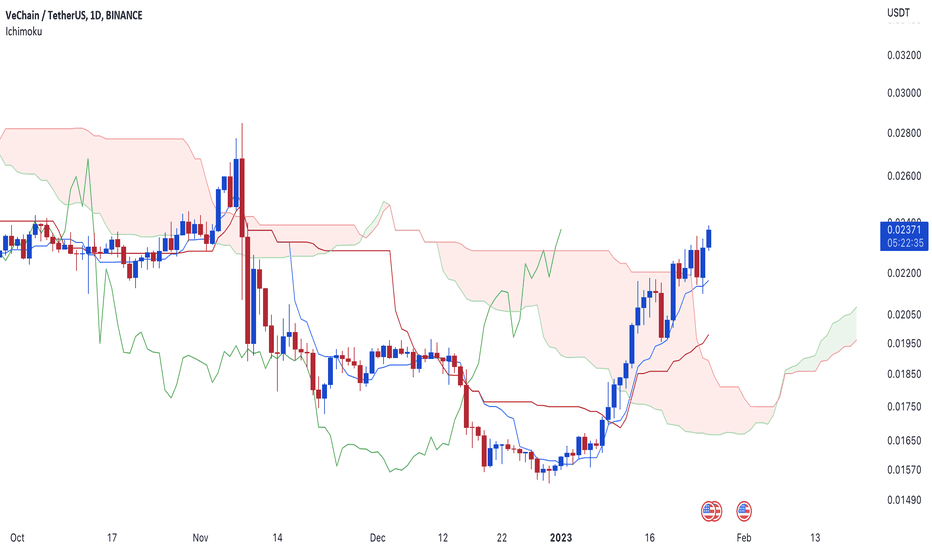

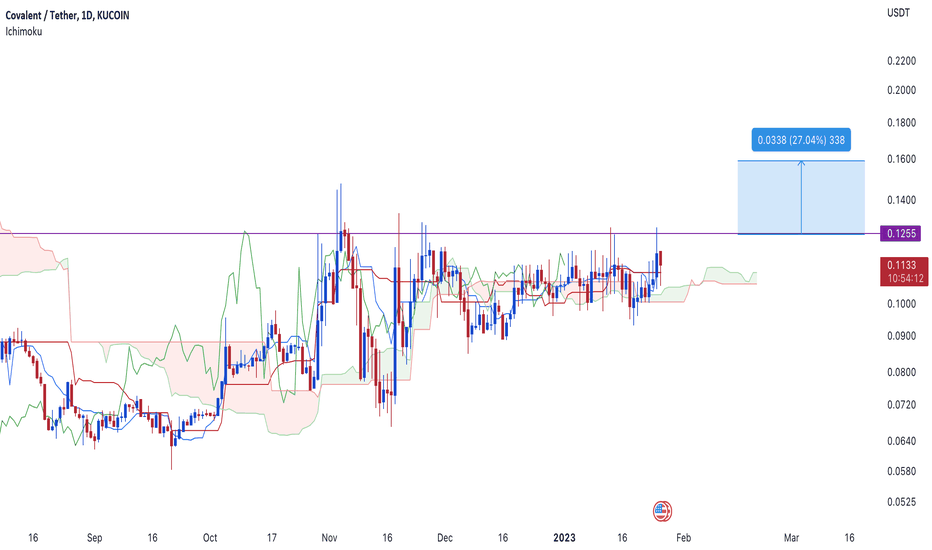

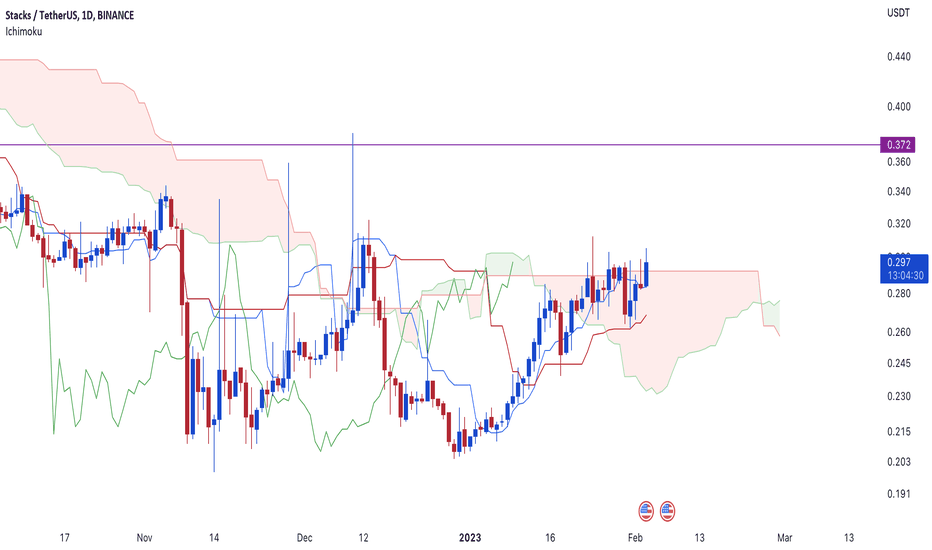

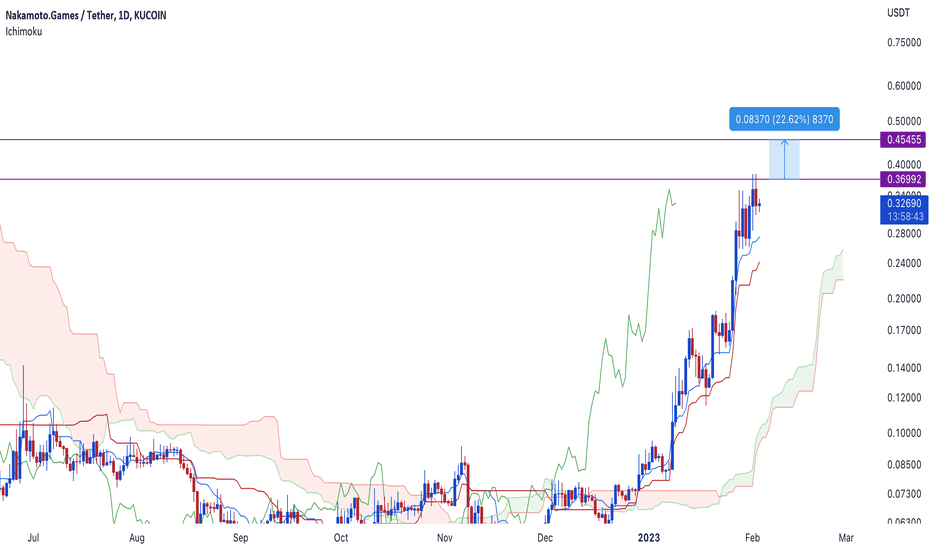

Ichimoku Analysis for CQTwill catch up soon with rest. Hope to get 20% Profit once closing goes above 0.1255