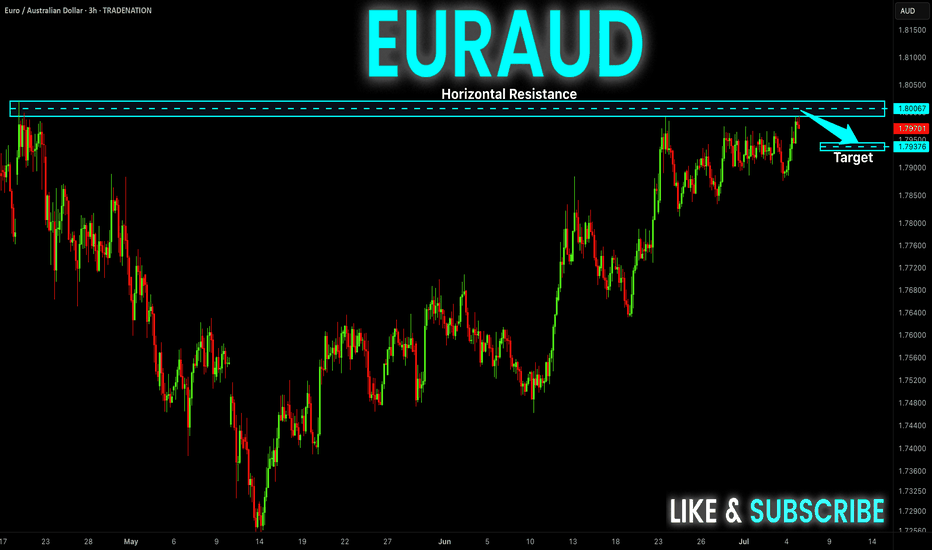

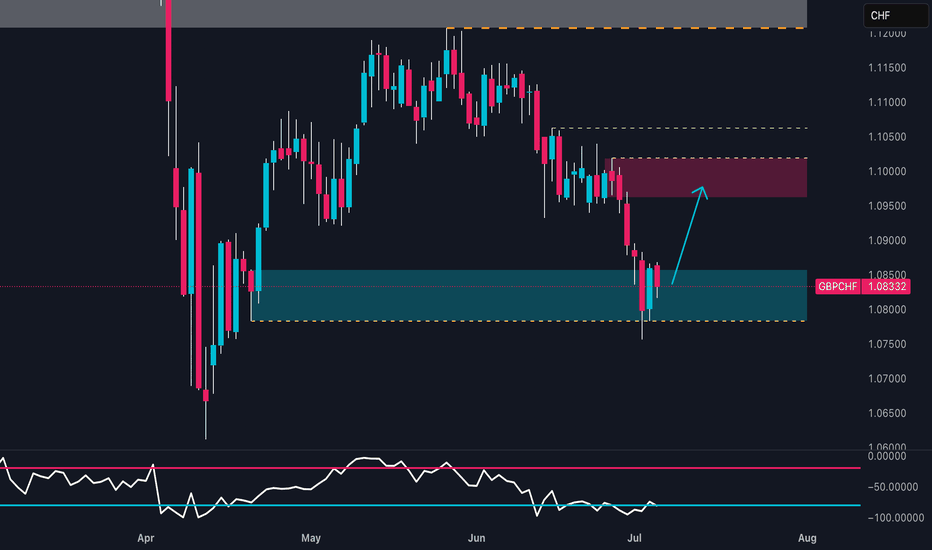

EUR-AUD Will Fall! Sell!

Hello,Traders!

EUR-AUD keeps trading in

A strong uptrend and the pair

Is locally overbought so as the

Pair is retesting a horizontal

Resistance of 1.8019 from

Where we will be expecting

A local pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Ict

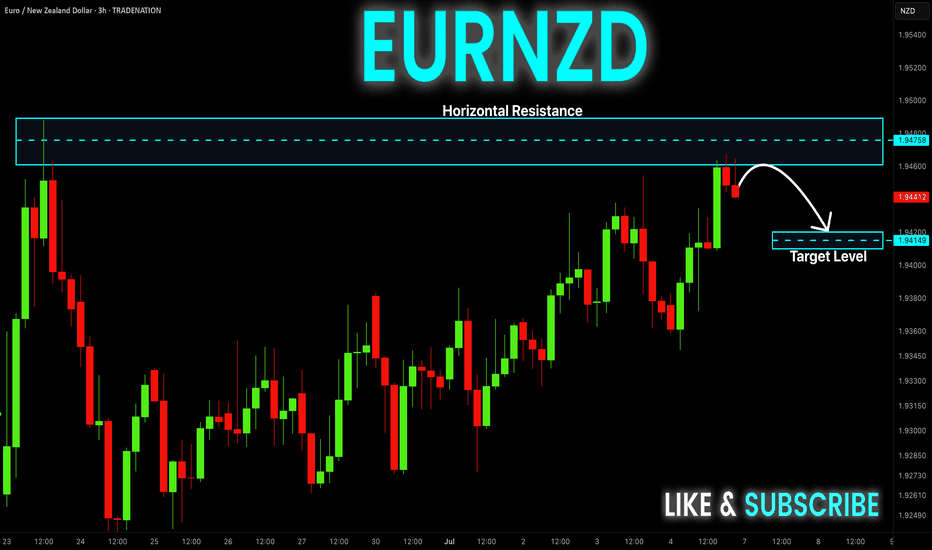

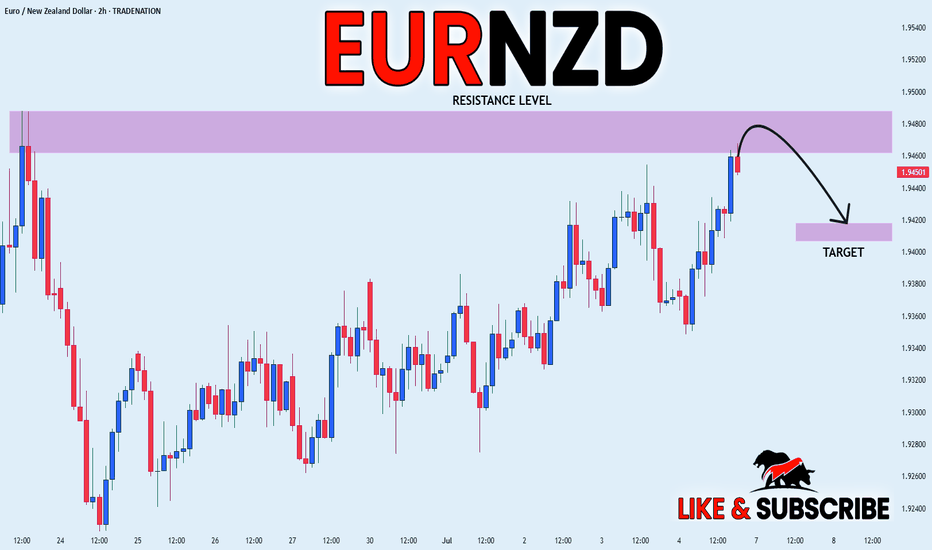

EUR-NZD Risky Short! Sell!

Hello,Traders!

EUR-NZD made a retest

Of the local horizontal resistance

Of 1.9485 so despite the uptrend

We are locally bearish biased

And we will be expecting a

Local bearish correction

On Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

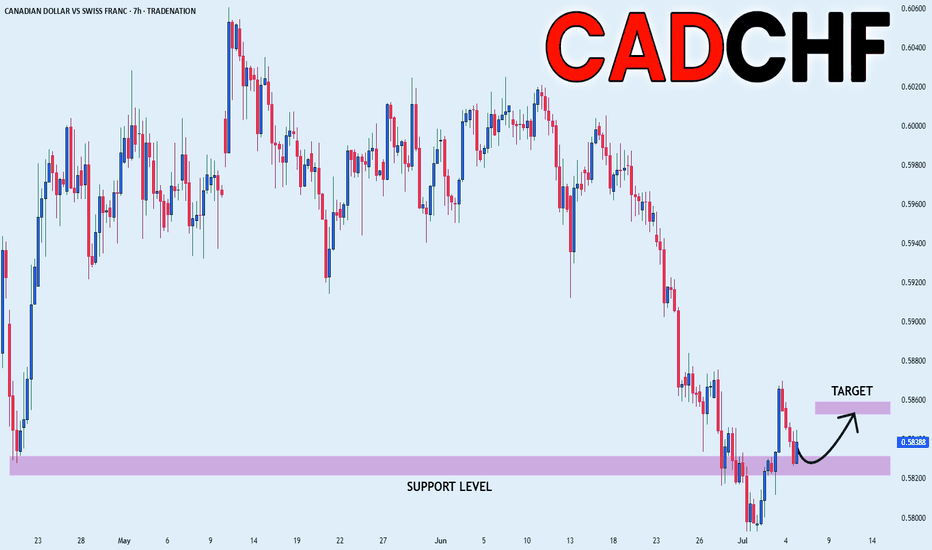

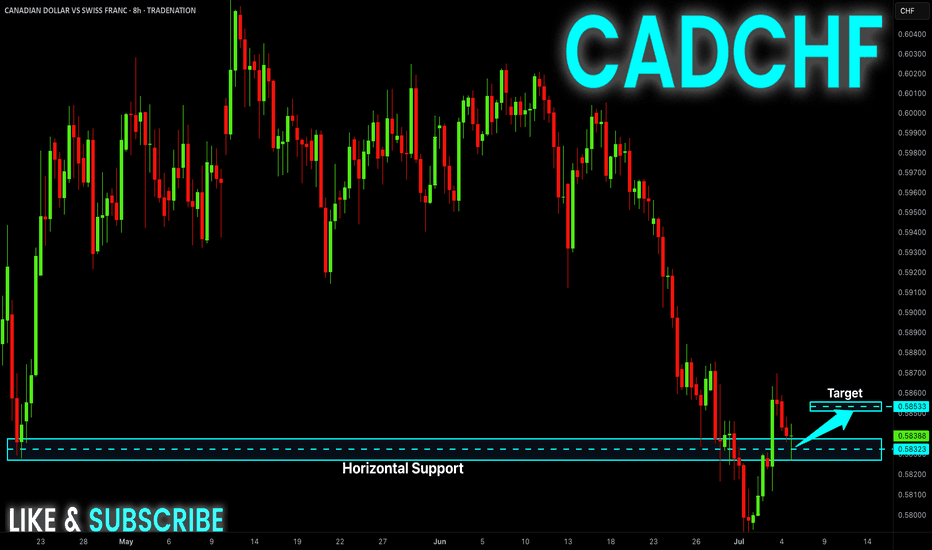

CAD_CHF GROWTH AHEAD|LONG|

✅CAD_CHF made a retest

Of the horizontal support

Of 0.5820 and we are already

Seeing a bullish reaction

So we will be expecting a

Further bullish move up

On Monday

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

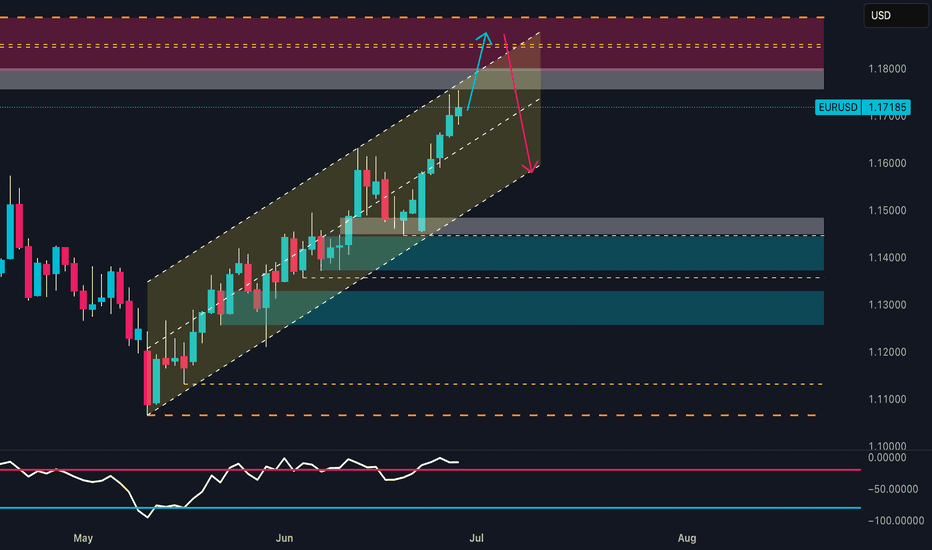

EUR/USD – Smart Money Trap at 1.18? Massive Rejection Ahead 1. Technical Context

The pair has been moving inside a well-defined bullish channel since May, forming higher highs and higher lows. Price is currently hovering around 1.1718, approaching the upper boundary of the channel and a key weekly supply zone (1.1750–1.1850).

➡️ Potential scenario:

A short bullish extension toward 1.1780–1.1820 to trigger stop hunts, followed by a bearish rejection toward 1.1500, and potentially 1.1380.

The daily RSI is overbought (>70), suggesting a likely short-term correction.

2. Retail Sentiment

80% of retail traders are short, with an average entry around 1.1318.

This signals a liquidity cluster above current highs, increasing the likelihood of a fake bullish breakout followed by a sell-off.

➡️ Contrarian insight: Retail heavily short → market may push higher first to wipe them out before reversing lower.

3. COT Report – USD Index (DXY)

Non-commercials (speculators) increased their short exposure on USD (+3,134).

Commercials cut their short positions (-1,994), indicating a potential bottoming on the dollar.

➡️ Conclusion: USD strength could return soon → bearish pressure for EUR/USD.

4. COT Report – EUR FX

Non-commercials increased longs on EUR (+2,980) and sharply reduced shorts (-6,602) → market is now heavily net long.

Commercials remain net short (581,664 vs 417,363 longs).

➡️ Over-leveraged spec longs → vulnerable to downside squeeze if macro sentiment shifts.

5. Seasonality

June tends to be mildly bullish for EUR/USD.

July historically shows even stronger upward performance over the last 5–10 years.

➡️ Shorts are high risk in the very short term, but a bearish setup is likely in the second half of July, especially if price action confirms.

6. Trading Outlook

📍 Short-Term Bias: Neutral to bullish toward 1.1780–1.1820

📍 Mid-Term Bias: Bearish on rejection from supply area and break of channel

🎯 Key Levels:

1.1780–1.1850: critical decision zone (liquidity + weekly supply)

1.1500: first key support

1.1380: next downside target (demand zone + previous POC)

📌 Final Conclusion

The most likely play is a short setup from 1.1780–1.1850 on strong rejection, supported by:

Extreme retail positioning (80% short),

COT pointing to USD recovery,

Extended technical structure,

Overbought RSI on the daily chart.

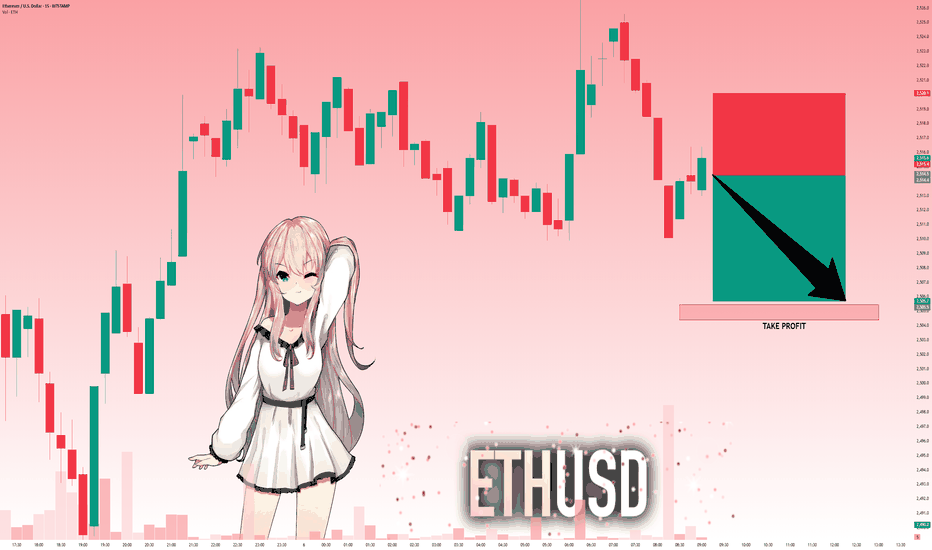

ETHUSD: Next Move Is Down! Short!

My dear friends,

Today we will analyse ETHUSD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 2,514.4 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

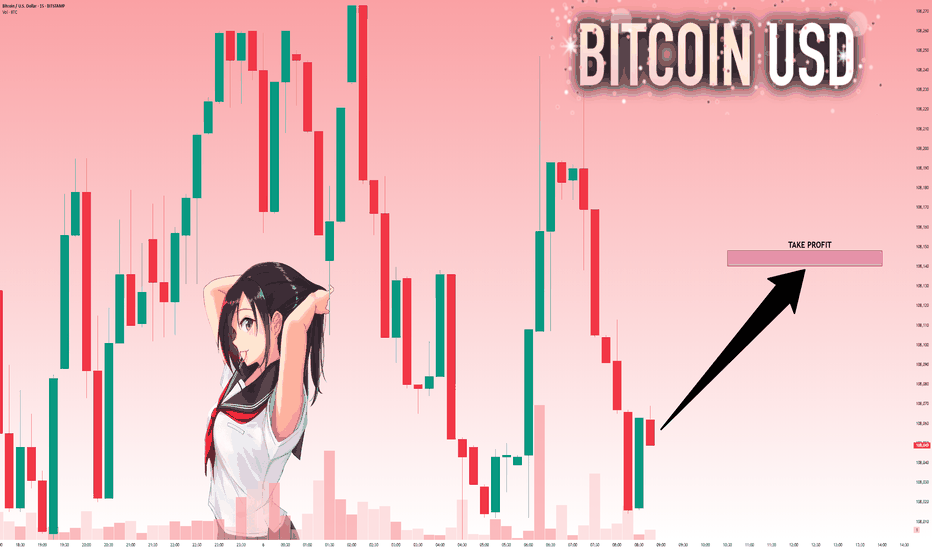

BTCUSD: Target Is Up! Long!

My dear friends,

Today we will analyse BTCUSD together☺️

The market is at an inflection zone and price has now reached an area around 108,067 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 108,140. Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

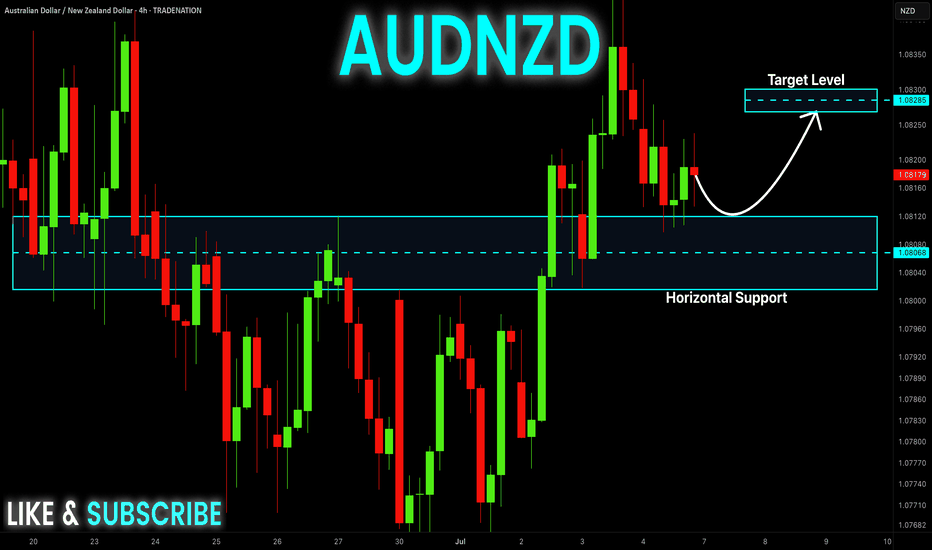

AUD-NZD Local Long! Buy!

Hello,Traders!

AUD-NZD is already making

A bullish rebound from the

Horizontal support of 1.0810

So we are locally bullish biased

And we will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

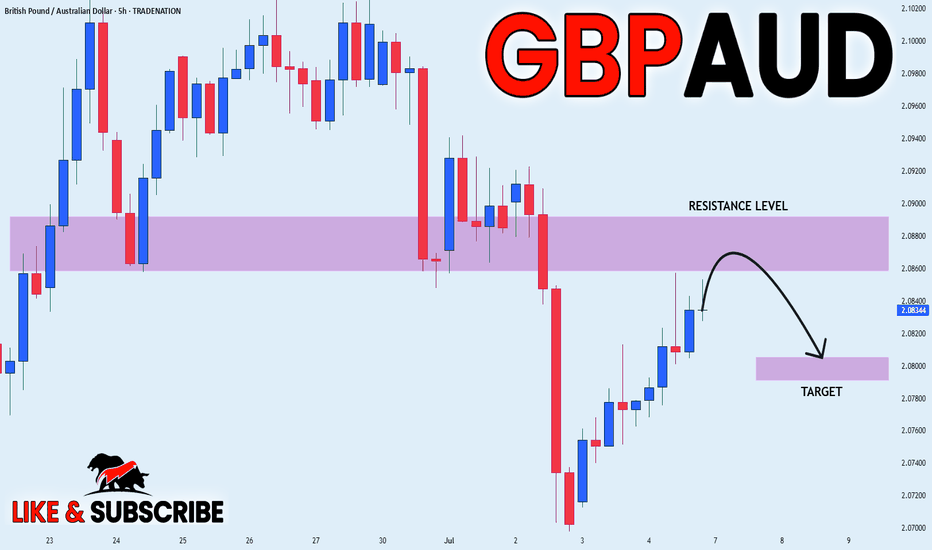

GBP_AUD BEARISH BIAS|SHORT|

✅GBP_AUD is going up to retest

A horizontal resistance of 2.0892

Which makes me locally bearish biased

And I think that we will see a pullback

And a move down from the level

Towards the target below at 2.0805

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

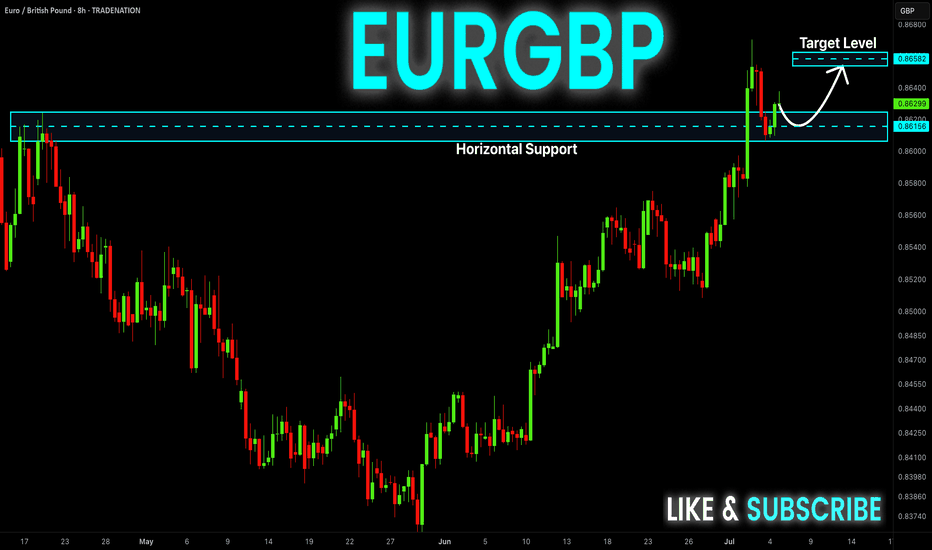

GBP/CHF Headed to 1.10 – But Bulls Might Regret It📉 1. Price Action & Technical Structure (D1)

Key demand zone tested with bullish reaction:

Price reacted strongly around the 1.0790–1.0840 structural demand area, previously the origin of a significant bullish impulse. The latest daily candle closed above the previous swing low, suggesting a potential technical rebound.

Immediate target:

The 1.0980–1.1010 zone, aligning with:

A clear supply area

RSI bouncing from oversold territory

A visible imbalance left unfilled

Technical bias: Short-term LONG to fill the imbalance before a potential institutional-driven short setup at supply.

2. Retail Sentiment

86% of traders are LONG, with an average entry of 1.0997

Only 14% are SHORT, with lower volume and better pricing

Current price: 1.0833, meaning most long traders are in drawdown

Contrarian view:

The heavy long positioning creates a liquidity pool between 1.0990–1.1010, making that zone highly attractive for institutional distribution and liquidation of retail longs, especially if accompanied by a structural shift.

🎯 Operational impact:

Supports a technical long to 1.10, but high risk of reversal once that level is reached.

3. COT Report

GBP (British Pound – CME)

Non-commercials:

Long: -6,434 → massive unwind of bullish exposure

Short: +2,028 → rising bearish bets

Net positioning is increasingly bearish

Commercials:

Long: +7,459 → increasing coverage against GBP weakness

Short: -569 → slight reduction

Positioning is mixed, but commercials are taking defensive long positions

GBP interpretation:

Bearish pressure rising from institutional speculators, despite some commercial support.

CHF (Swiss Franc – CME)

Non-commercials:

Long: +327

Short: +1,215

Net positioning still heavily short, but shorts increasing again

Commercials:

Long: +1,909

Short: +307

Commercials are accumulating long CHF positions (bullish sign)

CHF interpretation:

Divergence between commercials (bullish CHF) and speculators (still short) → shift may be underway.

4. July Seasonality

GBP:

Historically strong in July, especially the last 2 years (+3.5%)

Positive tendency across 10y/15y/20y averages

CHF:

Also seasonally positive in July, but underperforms GBP across most timeframes (except 2Y where CHF is also strong)

Operational impact:

Favors short-term bullish GBP/CHF bias, supported by seasonal momentum.

✅ Final Outlook

Current short-term bias is bullish, driven by:

Clear technical rebound

Visible imbalance toward 1.10

Seasonal divergence in favor of GBP

However, excessive retail long positioning + COT speculative pressure on GBP suggest this rally could be a distribution phase, offering an optimal short opportunity at 1.10.

EUR_AUD LOCAL CORRECTION|SHORT|

✅EUR_AUD is set to retest a

Strong resistance level above at 1.8020

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 1.7940

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

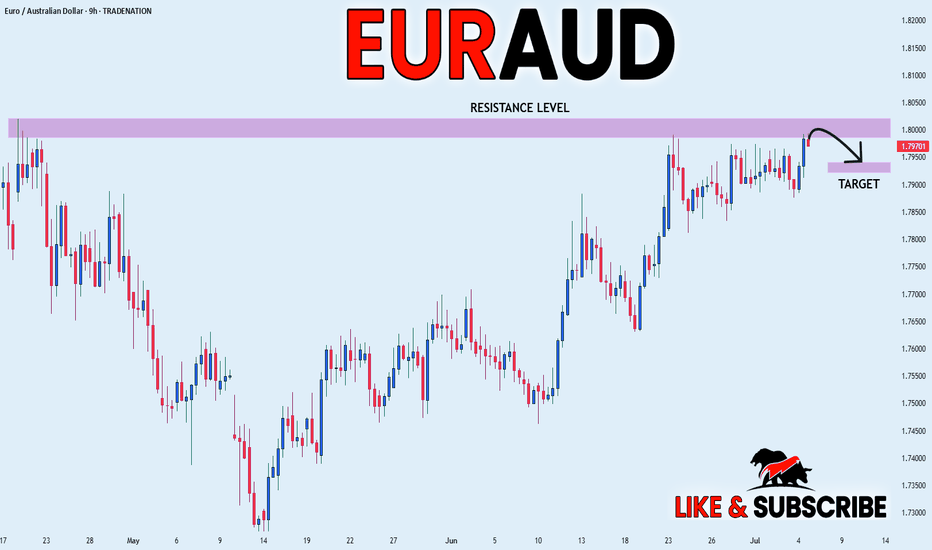

EUR-GBP Will Grow! Buy!

Hello,Traders!

EUR-GBP keeps trading in

A strong uptrend and the

Pair made a retest and a

Rebound from the horizontal

Support level around 0.8621

So we are bullish biased and

We will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

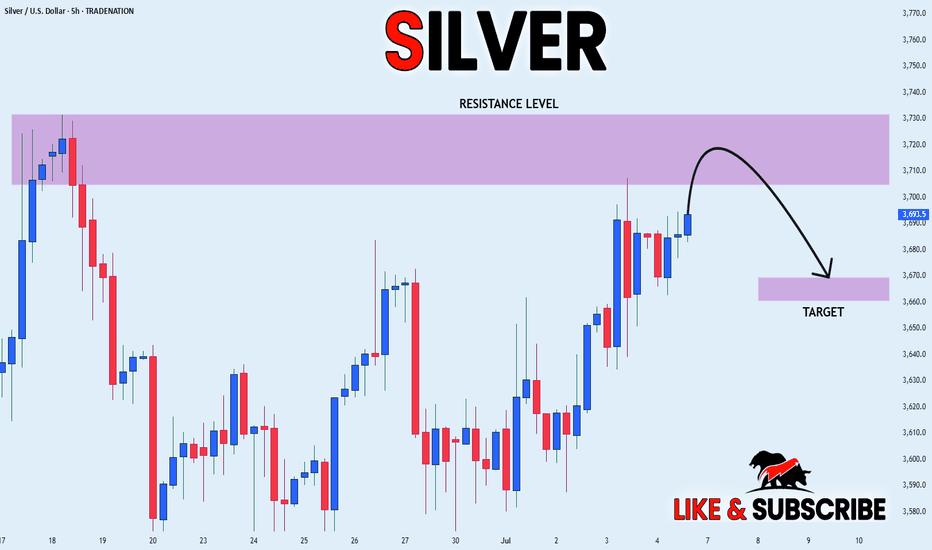

SILVER RESISTANCE AHEAD|SHORT|

✅SILVER has been growing recently

And the pair seems locally overbought

So as the pair is approaching a

Horizontal resistance of 3730$

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

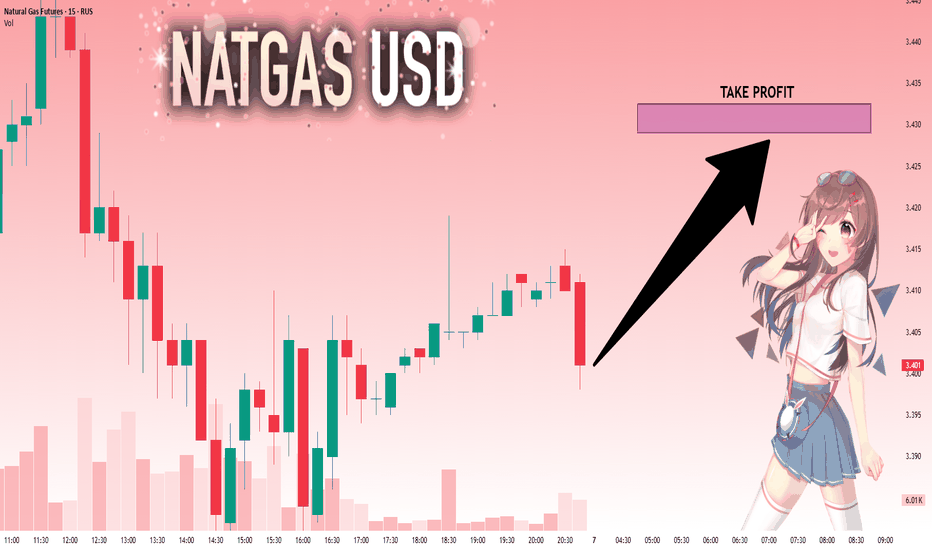

NG1!: Move Up Expected! Long!

My dear friends,

Today we will analyse NG1! together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 3.403 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 3.429.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

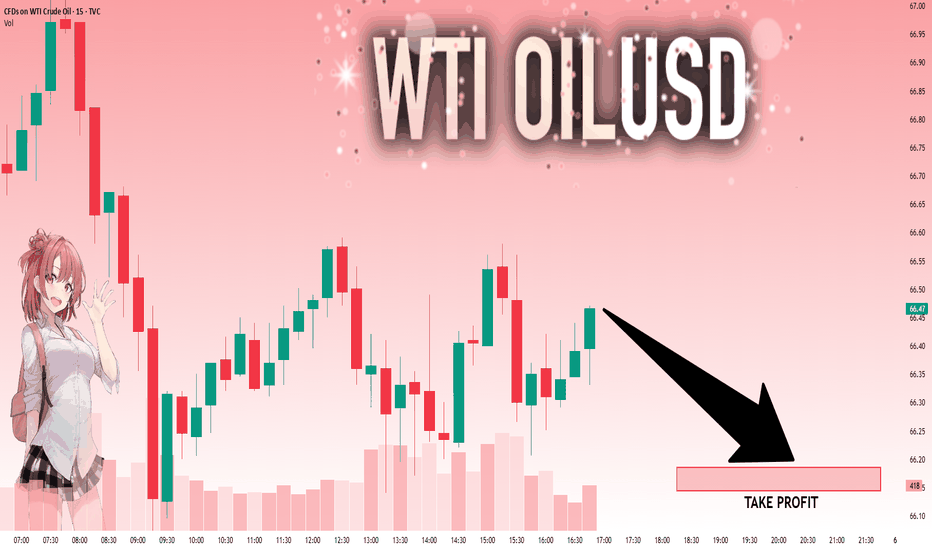

USOIL: Local Bearish Bias! Short!

My dear friends,

Today we will analyse USOIL together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 66.47 will confirm the new direction downwards with the target being the next key level of 66.19.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

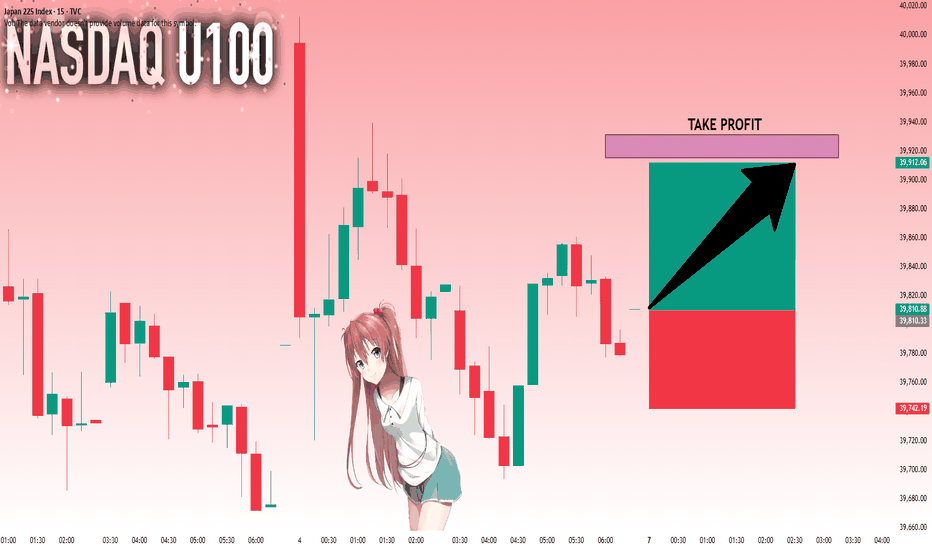

NI225: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse NI225 together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 39,810.33 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

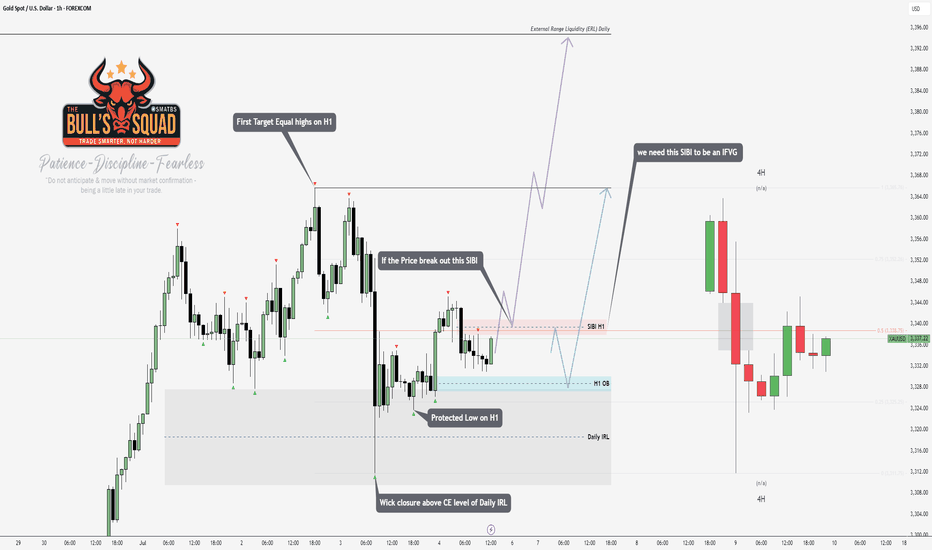

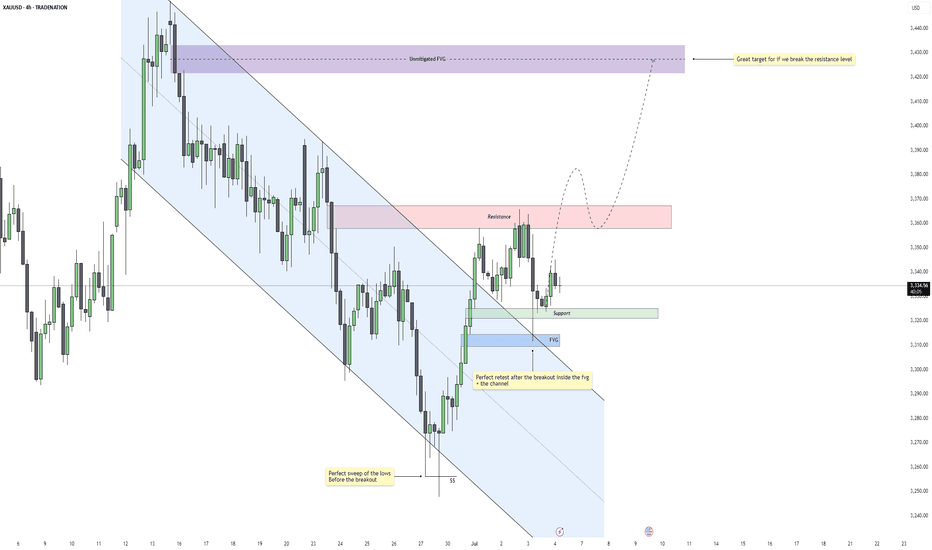

Gold – Is $3430 the Next Target After This Breakout?Gold recently completed a clean sweep of the 4H swing lows, taking out downside liquidity just before breaking out of a well-defined descending channel. This move marked a shift in momentum and structure, suggesting that the bearish leg may have concluded and the market is now transitioning into a more bullish phase.

Breakout Confirmation and Retest Zone

Following the breakout, price retraced and tapped directly into a confluence area where a fair value gap aligns with the upper boundary of the broken channel. This acted as a high-probability retest zone, and the reaction was strong. The market respected this structure perfectly, adding conviction to the breakout's validity.

Support and Resistance Dynamics

Currently, price is hovering between a nearby support level and a short-term resistance zone above. The support is holding firm after the retest, while the resistance is capping upward momentum for now. This is a healthy consolidation following the breakout, and it provides a clear structure for monitoring continuation.

Imbalance Target and Flow Outlook

Should the market gain enough strength to break through the overhead resistance, there is a large unmitigated imbalance further above that stands as a strong magnet. It represents a clean fair value gap left behind during the previous selloff and could be the next major draw if bullish momentum continues.

Overall Flow and Trade Logic

The sequence is very clean: sweep of liquidity, bullish breakout, efficient retest, and now consolidation above support. As long as price continues to form higher lows and respect the current structure, the probability of further upside remains favorable. Patience around the resistance area will be key for confirmation.

Conclusion

Gold is displaying a textbook reversal setup driven by liquidity and structure. If the current support continues to hold and buyers reclaim control above resistance, the path toward the upper imbalance becomes highly probable. The market is aligned for continuation, with bullish momentum building gradually.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

CAD-CHF Local Long! Buy!

Hello,Traders!

CAD-CHF made a retest

Of the horizontal support

Of 0.5832 so we are locally

Bullish biased and we will be

Expecting a local bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_NZD LOCAL SHORT|

✅EUR_NZD is set to retest a

Strong resistance level above at 1.9488

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 1.9420

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

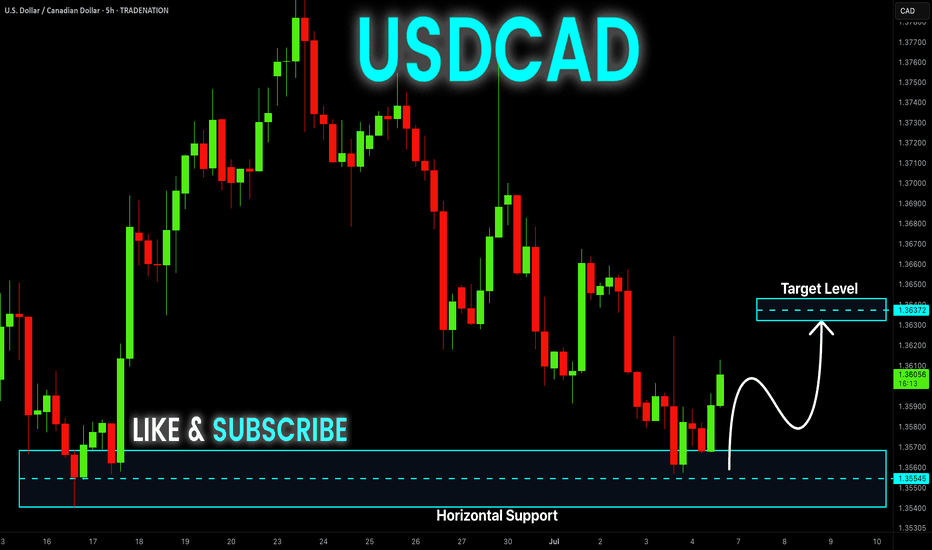

USD-CAD Local Rebound! Buy!

Hello,Traders!

USD-CAD is trading in a

Strong downtrend but

The pair made a retest

Of the horizontal support

Level of 1.3540 from where

We are already seeing a

Bullish rebound and we

Will be expecting a

Further move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

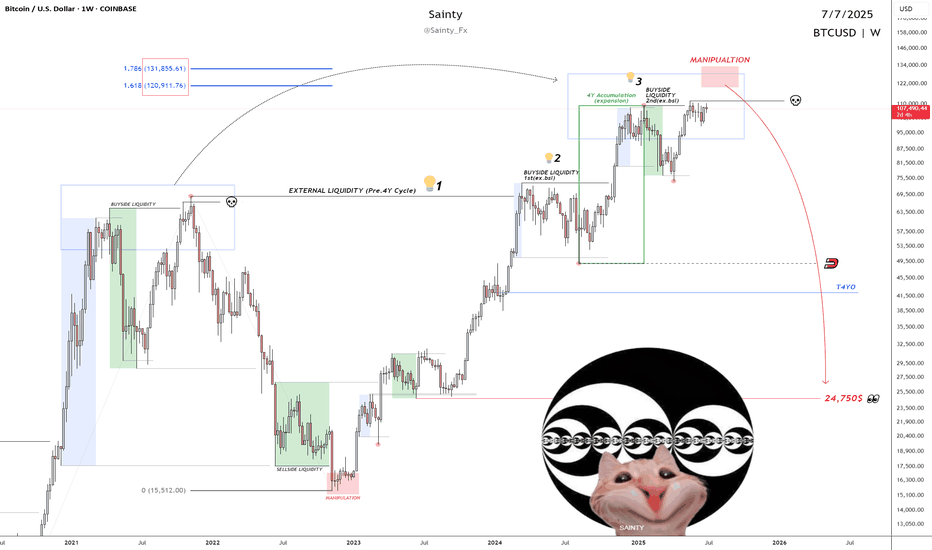

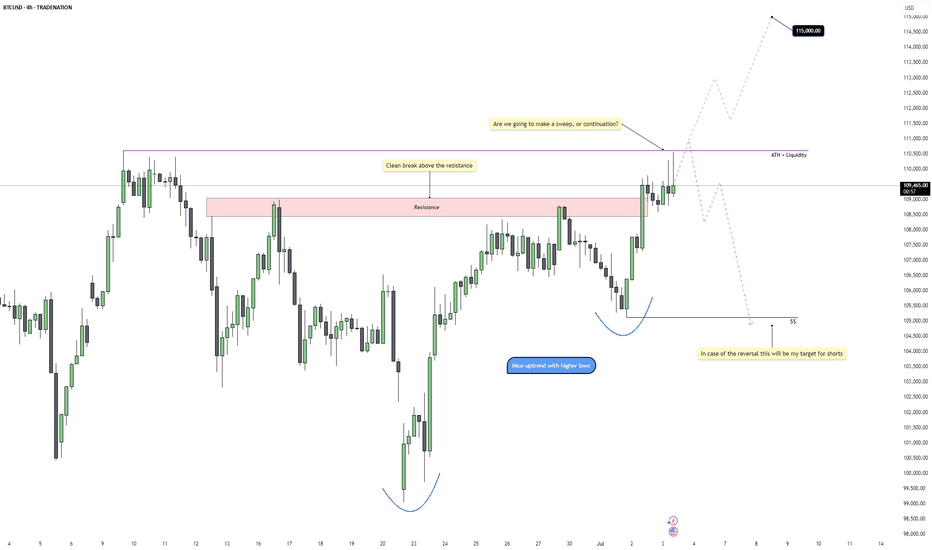

Bitcoin – ATH Sweep or Breakout?Bitcoin is pushing into a critical decision point as it challenges the previous all-time high near 110k. After a strong push out of a rounded bottom formation with clean higher lows, price has now broken above the last visible resistance area and is hovering just under the ATH liquidity. This rally has been aggressive, but the reaction here will determine whether this move becomes an extended breakout or a classic trap.

Liquidity and Key Resistance

The ATH zone around 110k carries a large pool of liquidity, and price is now testing it for the first time since the breakout. We’ve already had a clean break above the prior resistance zone, but we haven’t yet seen a confirmed close above ATH with convincing volume. If price manages to close strongly above this level on the 4H or daily chart, that would be a sign that bulls are in full control. Until then, the possibility of a sweep and rejection remains firmly on the table.

Sweep Scenario and Downside Levels

If we fail to close convincingly above the ATH and instead see a wick through followed by a strong reversal, that would confirm the sweep. In that case, I’d expect short setups to activate quickly, with downside targets sitting around 105k. This level marks the structure support below the most recent breakout, and would be a logical point for price to rebalance before continuing any broader uptrend. A rejection from current levels would also trap late longs and provide fuel for a quick retracement.

Bullish Breakout Scenario

If we do get that proper breakout above 110k, backed by strong volume and continuation candles, the upside opens fast. There’s very little structure above the ATH, so price could move cleanly up into the next round psychological target around 115k. This move would confirm continuation of the higher timeframe trend and offer short-term breakout retests for potential long re-entries.

Volume and Candle Confirmation Are Crucial

At this stage, the setup is binary and all about confirmation. A clean 4H or daily close above ATH with follow-through volume will flip the bias fully bullish. But if we get signs of exhaustion and a failed breakout attempt, the sweep setup becomes highly probable. Waiting for confirmation here is key, rather than trying to front-run the move.

Conclusion

Bitcoin is sitting right at a high-stakes level. We either continue into price discovery toward 115k if momentum follows through, or we see a classic liquidity sweep and rejection back into 105k. The clean structure and recent higher lows support both sides of the argument, but execution will depend on how price reacts around the ATH. Either way, this zone is the key pivot for the next major swing.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

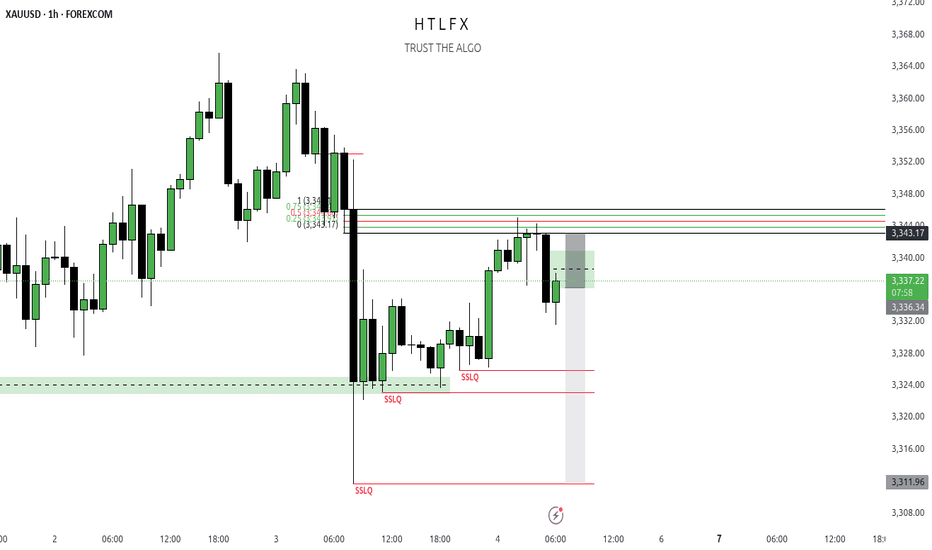

Gold HFTHTF trade using fib 0.5 respected + Dealing range on the LTF

waiting for retracement didn't happen gold is stronger today so the best is to look at HTF nice SIBI waiting for the purg targeting SSLQ be carfull 4th of july so market will close early and maybe we don't reach our target so take profit maybe we gonna face reversal so too risky