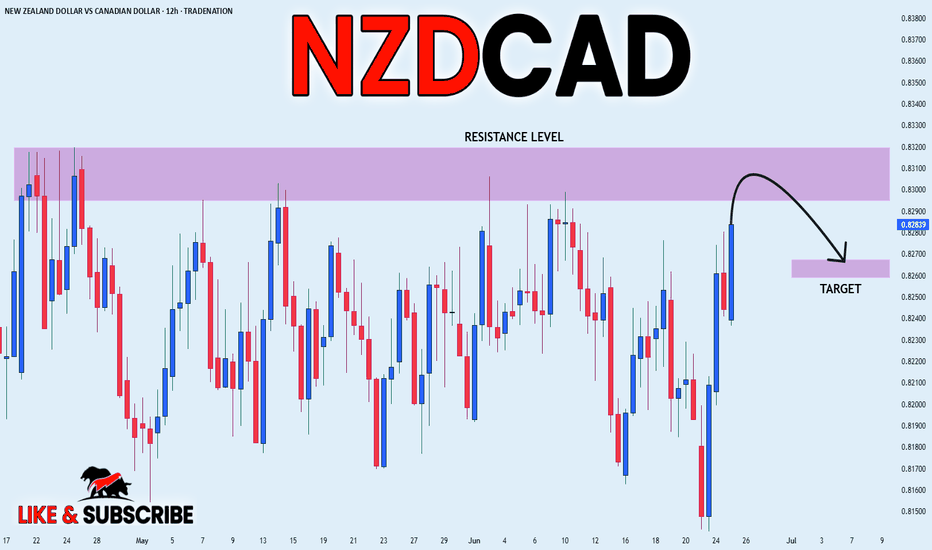

NZD_CAD SHORT FROM RESISTANCE|

✅NZD_CAD will soon retest a key resistance level of 0.8320

So I think that the pair will make a pullback

And go down to retest the demand level below at 0.8267

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Ict

GOLD Risky Short! Sell!

Hello,Traders!

GOLD made a bullish

Rebound but will soon

Hit a wide horizontal

Resistance of around 3,345$

And as we are locally bearish

Biased after the recent rising

Support breakout we will be

Expecting a bearish pullback

And a local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

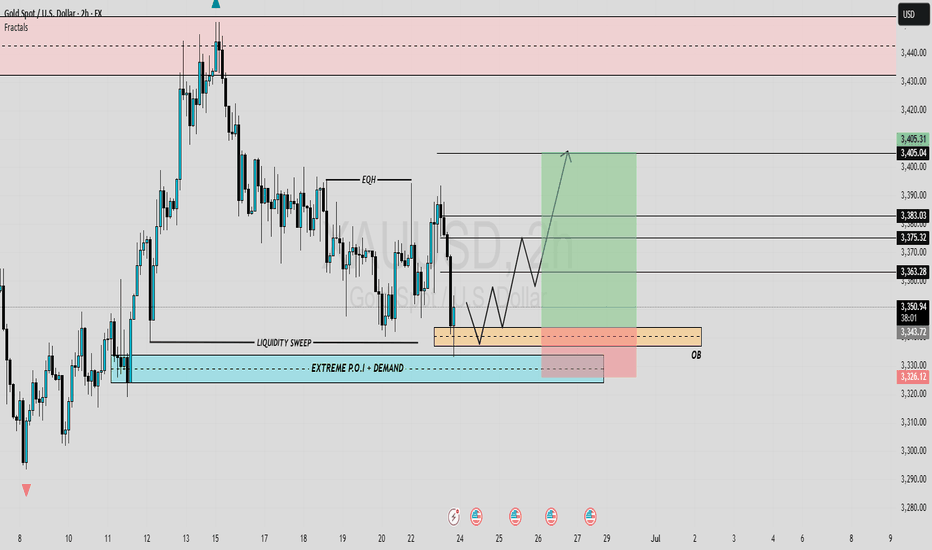

XAUUSD Bullish OutlookThis chart captures a highly strategic bullish setup on XAUUSD, rooted in Smart Money Concepts (SMC) and institutional trading principles. The market has performed a major liquidity sweep, dipping below previous lows to collect resting sell-side liquidity before reacting sharply from a key demand zone.

Why Bullish? The Confluences:

Liquidity Sweep:

Price manipulated below a significant structural low to trap late sellers and activate institutional orders. This move into deeper liquidity suggests the smart money is building long positions.

Extreme P.O.I. + Demand Zone:

The blue zone marks a high probability reversal area where demand outweighs supply. This zone is validated by historical reactions and refined to align with an Order Block (OB) a clear footprint of institutional accumulation.

Bullish Structure Anticipation:

After the reaction, price is expected to form a series of higher highs and higher lows, confirming bullish market structure. Multiple resistance levels are in sight, each one representing an objective for price to reach in its journey upward.

Entry Point: $3,343 – $3,330

Located inside the OB and demand zone, this is where price is likely to build a base for upward continuation.

Stop Loss: Below $3,324

TP1: $3,363 (first internal structure break)

TP2: $3,375 (mid range target)

TP3: $3,383 (structural high retest)

TP Final: $3,405 (liquidity target above EQH)

Remember confirmation is key before execution.

#GOLD 2H Technical Analysis Expected Move.

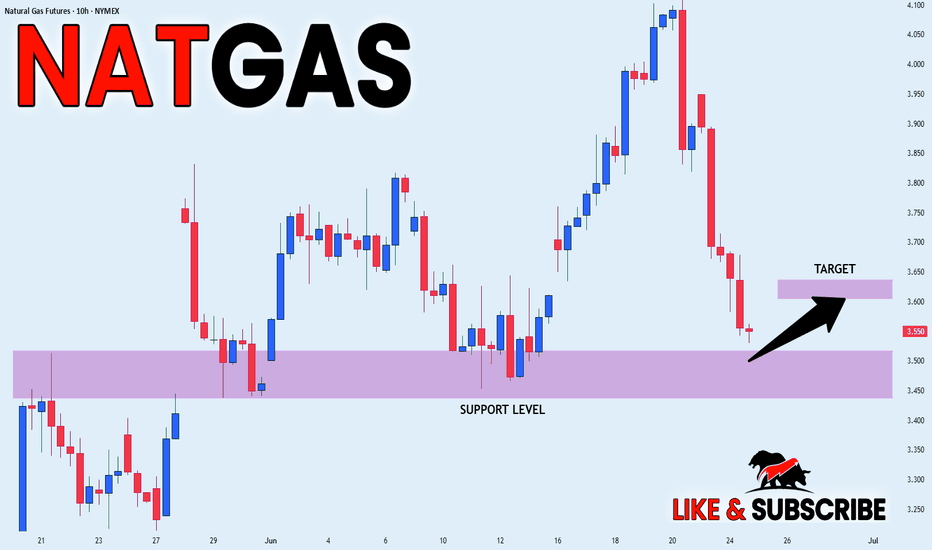

NATGAS SUPPORT AHEAD|LONG|

✅NATGAS is going down now

But a strong support level is ahead at 3.450$

Thus I am expecting a rebound

And a move up towards the target of 3.600$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

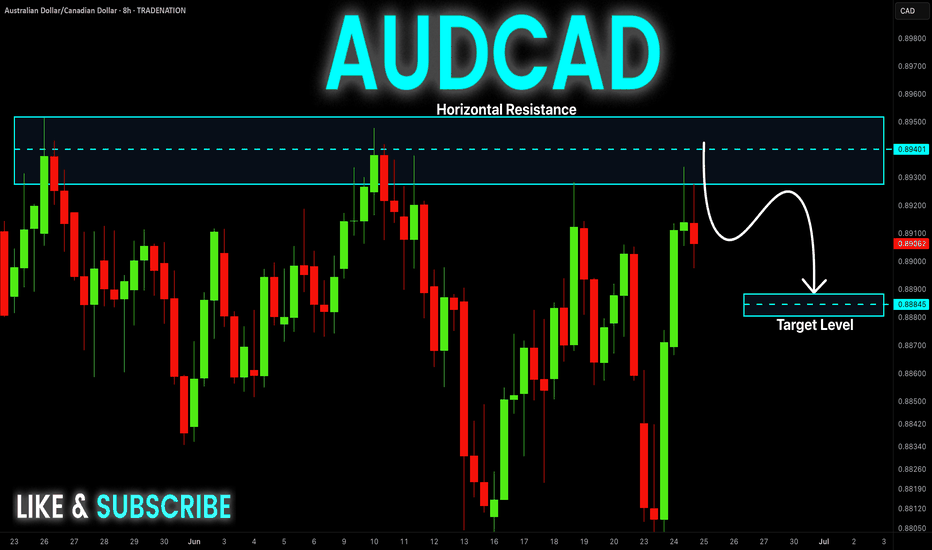

AUD-CAD Will Go Down! Sell!

Hello,Traders!

AUD-CAD made a retest

Of the wide horizontal

Resistance around 0.8934

And we are already seeing a

Local bearish reaction so

We will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

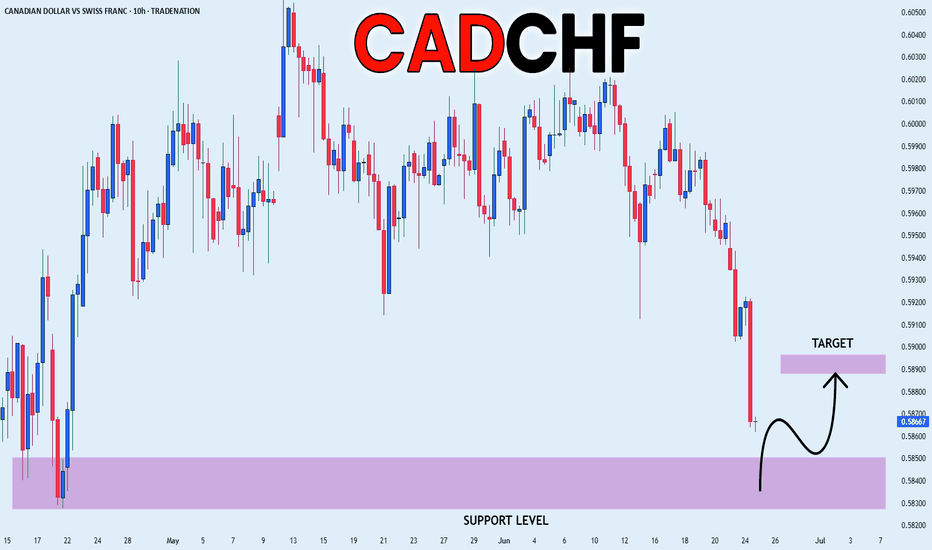

CAD_CHF RETESTING LOWS|LONG|

✅CAD_CHF will be retesting a support level soon around 0.5830

Which is a deeps low for the pair

From where I am expecting a bullish reaction

With the price going up but we need

To wait for a reversal pattern to form

Before entering the trade, so that we

Get a higher success probability of the trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

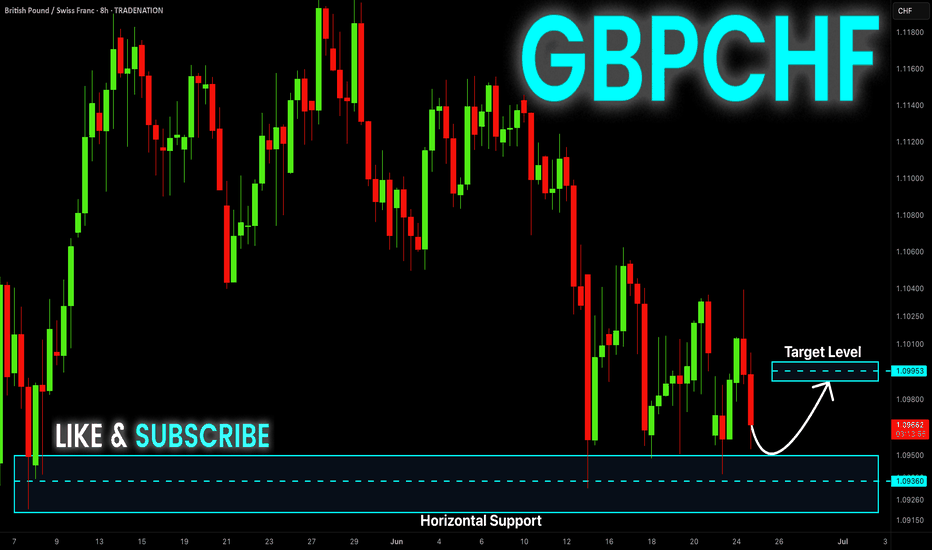

GBP-CHF Support Ahead! Buy!

Hello,Traders!

GBP-CHF is going down now

And the pair will soon hit a

Horizontal support level below

Around 1.0933 from where

We will be expecting a

Local rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

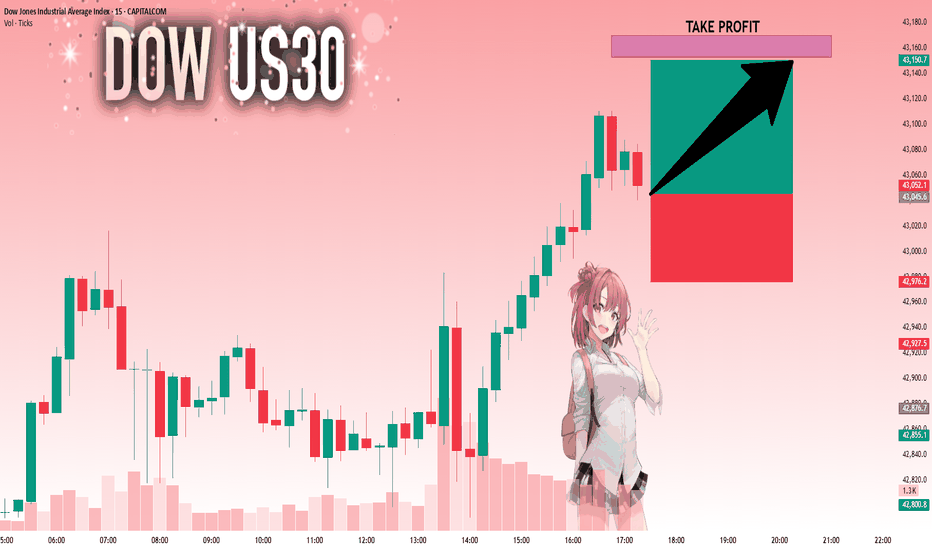

US30: The Market Is Looking Up! Long!

My dear friends,

Today we will analyse US30 together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 43,045.6 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 43,152.9.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

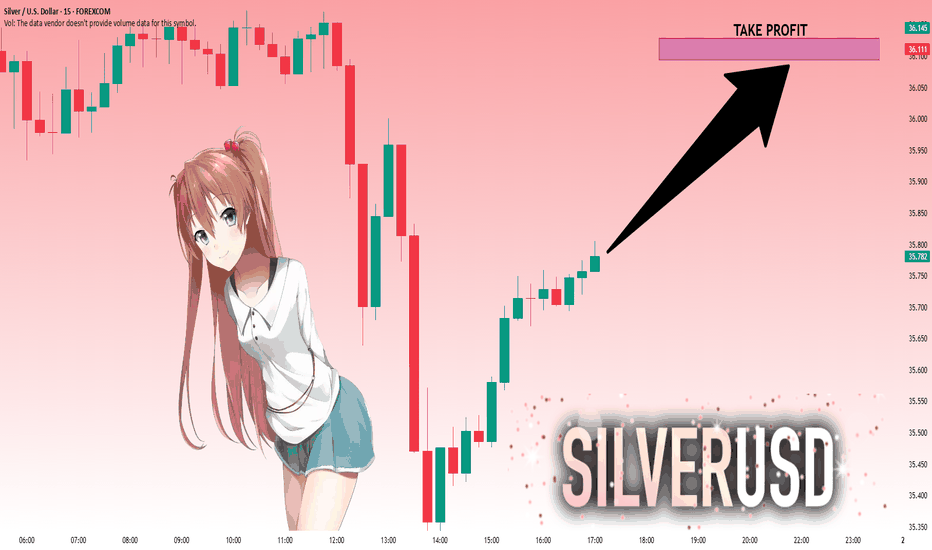

SILVER: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 35.758 will confirm the new direction upwards with the target being the next key level of 36.094 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

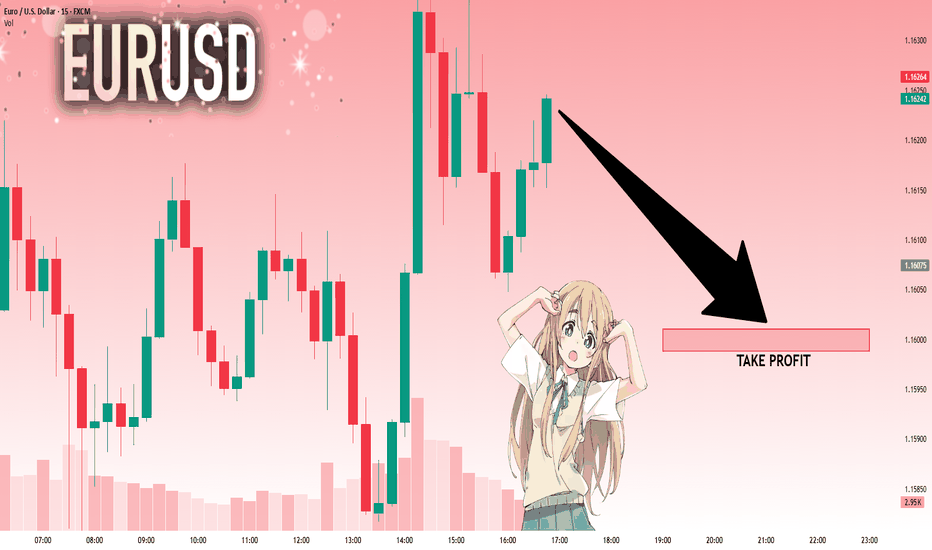

EURUSD: Bears Are Winning! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 1.16242 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

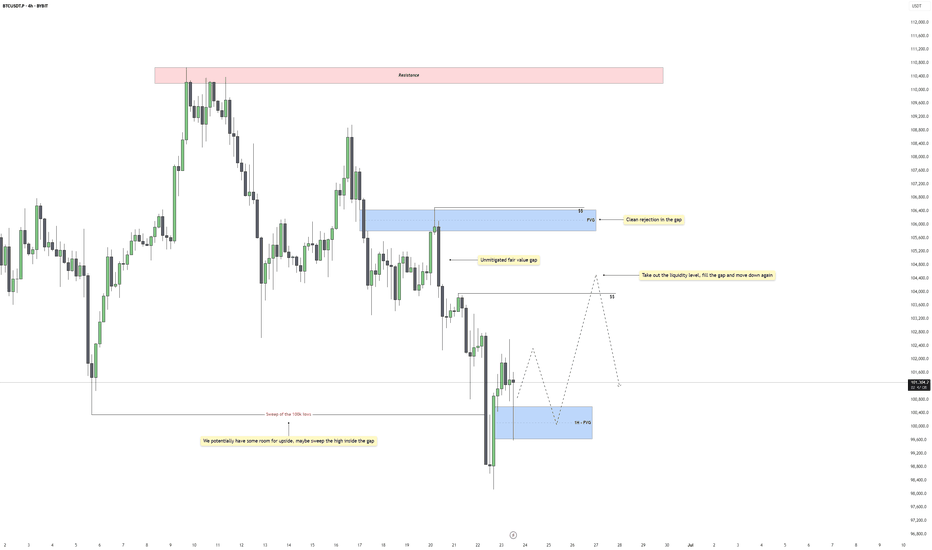

Bitcoin - Bounce Incoming or Breakdown to 97.5k?Market Context

Bitcoin recently swept the 100k lows, clearing out built-up liquidity beneath that level. This move formed a strong reaction candle, suggesting interest from buyers and confirming the presence of resting demand. The sweep aligns with the concept of smart money targeting obvious liquidity pools before shifting direction. It also marks a potential short-term low, at least temporarily.

Short-Term Structure and FVG Setup

Following the sweep, price tapped into a clean 1H fair value gap and has been respecting it so far. This is our immediate line in the sand. As long as this gap holds, we’re dealing with a scenario of temporary bullish order flow. The market structure on lower timeframes suggests the potential for a short-term rebound, possibly into the inefficiencies left above.

Upside Target and Gap Fill Potential

If price continues to hold the 1H FVG, we could see a push higher that targets unfilled gaps above, particularly the one where we saw a clean rejection previously. There’s a clear inducement just above recent highs, so a sweep of those could be used to fill that imbalance. This would align with the idea of running internal liquidity before reversing or stalling at supply.

Bearish Breakdown Scenario

On the flip side, if price breaks down from the 1H FVG without reclaiming structure, the entire bullish idea invalidates. In that case, I expect price to gravitate back toward the 97.5k zone. This would be a logical area for deeper mitigation and potential reaccumulation, especially since it sits below the current consolidation. The failure to hold the gap would signal weak demand and continuation of the broader bearish leg.

Scouting Liquidity and Price Flow

Right now, the main idea is tied to how price behaves around the short-term 1H FVG. That is the pivot. Hold it, and we should see some form of liquidity run into the unfilled gap above. Lose it, and the next wave of downside should unlock, pushing us closer to 97.5k. Either way, liquidity remains the core driver in both directions.

Conclusion

Price has swept major downside liquidity and is now reacting to a key imbalance. As long as the 1H fair value gap holds, I expect short-term upside targeting unfilled inefficiencies and internal highs. A failure to hold would shift the bias back to the downside, with the 97.5k range as the next probable draw on liquidity.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

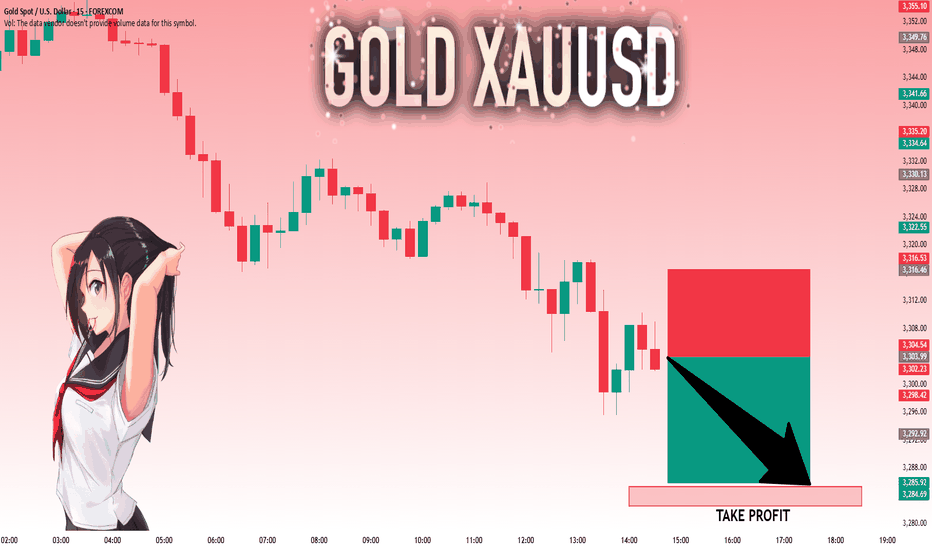

GOLD: Next Move Is Down! Short!

My dear friends,

Today we will analyse GOLD together☺️

The market is at an inflection zone and price has now reached an area around 3,303.99 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 3,285.33..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

XAUUSD Daily Sniper Plan – June 24, 2025“Snipers wait. Structure tells the story.”

Hello traders! The market is stuck between the FOMC high at 3452 and the confirmed low at 3340. Price is compressing under H1 supply and above a key liquidity pocket. Here's your full plan with all sniper zones — now including a decision zone for intraday confirmation.

📰 Macro + Fundamental Context

Powell Testimony + multiple FOMC speeches today → high potential for dollar-driven volatility.

Inflation concerns and hawkish tone expected → short-term gold bearish pressure unless structure reclaims 3415+.

Smart money likely hunting liquidity both below 3340 and above 3400.

🔸 HTF Structure Summary (D1 → H4 → H1)

D1: Consolidation between 3452 and 3340. No new BOS.

H4: LL formed at 3340. LH not confirmed. Market is compressing under resistance.

H1: CHoCH + BOS confirmed. Current price sits in mid-range.

🔍 Sniper Entry Zones

🟥 Sell Zone 1: 3382–3395

H1 supply zone with previous rejection.

Includes order block + FVG.

Valid for new short entries if price returns and rejects.

🟥 Sell Zone 2: 3406–3420

High-risk spike zone from FOMC.

Only valid during fast, news-driven price movement.

Not a default entry unless confirmed rejection.

🟨 Decision Zone (Flip Area): 3360–3372

This is the key intraday flip level.

If price stays below, sell zones remain valid.

If price closes above, short bias is invalid and market may aim higher.

Use this zone to confirm bias before entering from either side.

🟩 Buy Zone 1: 3335–3345

Strong demand under equal lows.

OB + small imbalance on M15.

Valid for intraday long setups if confirmed with bullish price action.

🟦 Buy Zone 2: 3305–3285

H4 demand zone with major liquidity below.

Deep reversal area — only valid if price breaks 3340.

Smart money may be waiting here.

📌 Key Levels Summary

Zone Type Price Range Explanation

🔺 Premium OB 3450–3480 Daily supply zone

🟥 Sell Zone 1 3382–3395 Active H1 supply

🟥 Sell Zone 2 3406–3420 FOMC wick inducement

🟨 Flip Zone 3360–3372 Decision area — confirm bias

🟩 Buy Zone 1 3335–3345 Demand under equal lows

🟦 Buy Zone 2 3305–3285 H4 demand + deep liquidity

📣 Final Notes

📌 The market is at a critical moment. The flip zone (3360–3372) will decide tomorrow’s control: bear continuation or deeper retracement.

Watch price at the zone. Let the structure speak. Trade only where the logic is clean.

👁 Good luck in the market tomorrow, traders!

— GoldFxMinds

🟨 Disclosure: I am part of TradeNation’s Influencer Program and receive a monthly fee for using their TradingView charts in educational work.

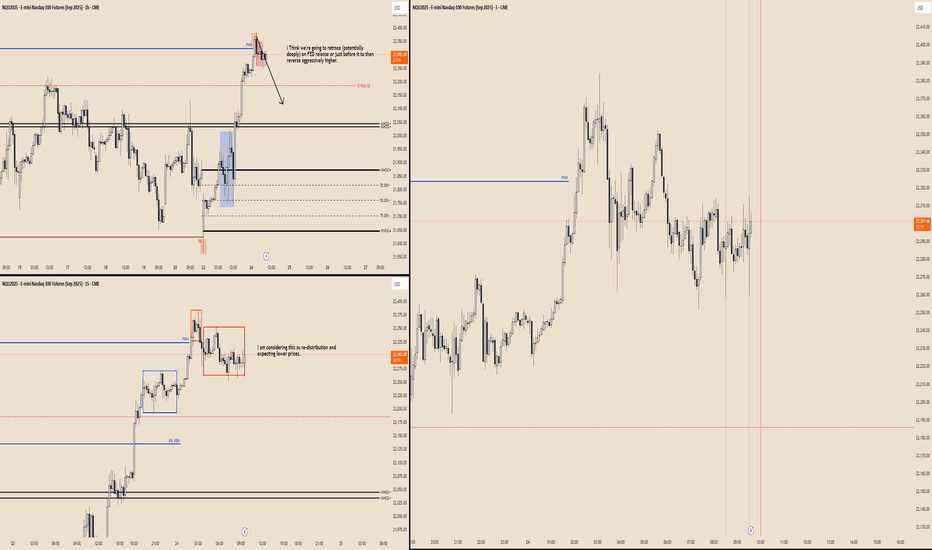

Nasdaq Deep Bearish RetraceI Think we're going to retrace (potentially deeply) on FED release or just before it to then reverse aggressively higher.

I am considering the current "range" on m15 as re-distribution and expecting lower prices on Fed release or just prior before continuation higher that may be delayed till tomorrow next FED.

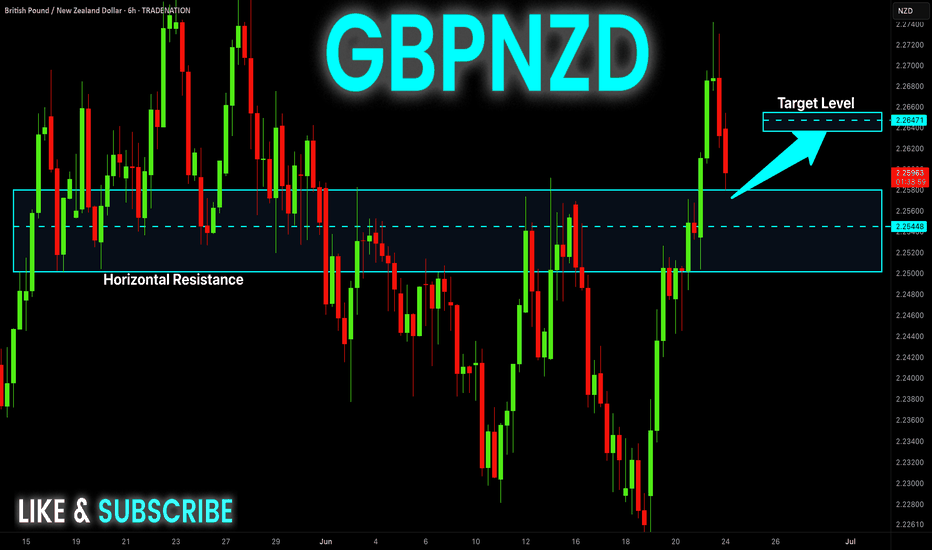

GBP-NZD Long From Demand Ahead! Buy!

Hello,Traders!

GBP-NZD is making a bearish

Correction but will soon

Retest a wide demand area

Around 2.2539 from where

We will be expecting a

Local rebound a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_USD RIKSY SHORT|

✅NZD_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching a horizontal resistance of 0.6020

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

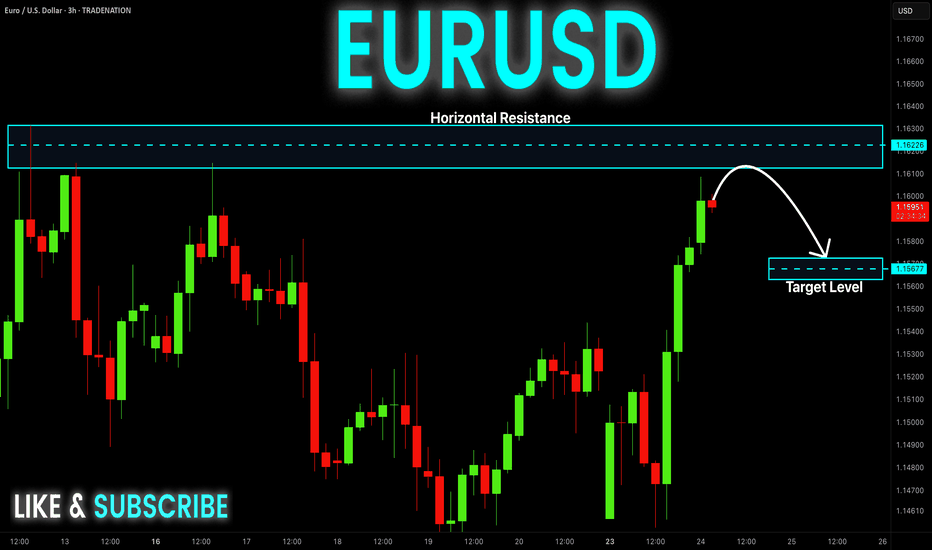

EUR-USD Risky Short! Sell!

Hello,Traders!

EUR-USD made a nice bullish

Move up and has almost reached

A horizontal resistance level

Of 1.1631 and the pair is locally

Overbought so after the retest

A local bearish correction

Is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Growth Ahead! Buy!

Hello,Traders!

GOLD is trading along the

Rising support and is already

Making a bullish rebound so

As we are bullish biased due

To the strong uptrend we

Will be expecting a further

Bullish move up on Gold

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

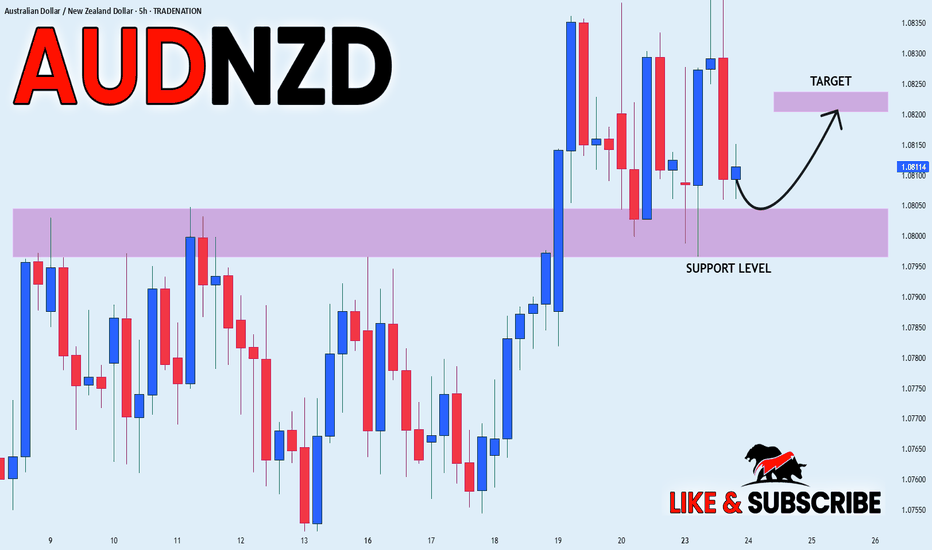

AUD_NZD LOCAL LONG|

✅AUD_NZD has retested a key support level of 1.0800

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 1.0820 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

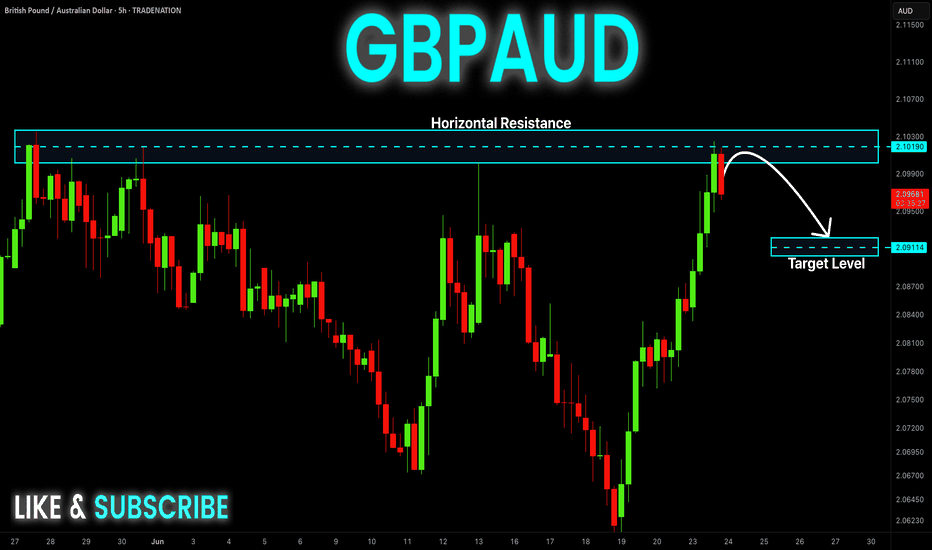

GBP-AUD Local Short! Sell!

Hello,Traders!

GBP-AUD made a retest of

The horizontal resistance

Of 2.1037 from where we

Are already seeing a bearish

Pullback so we will be

Expecting a further local

Move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

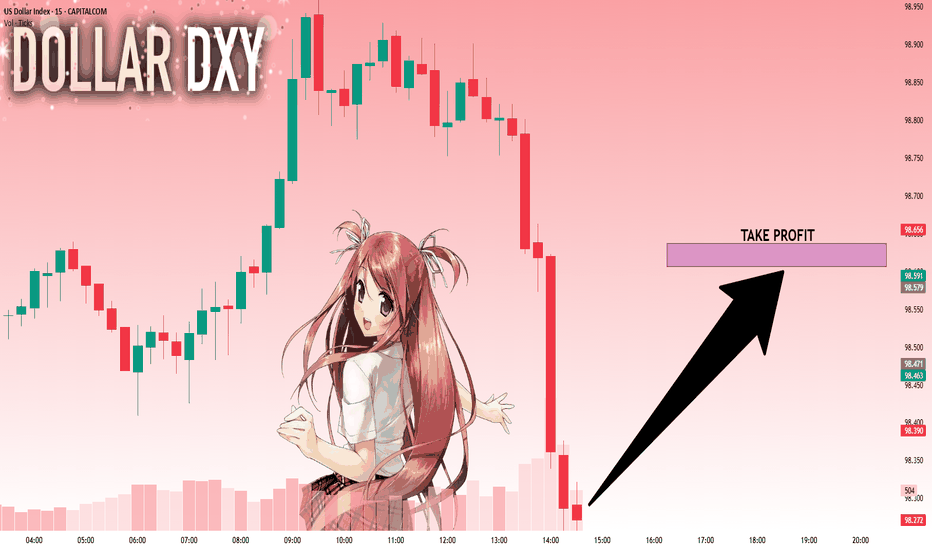

DXY: Target Is Up! Long!

My dear friends,

Today we will analyse DXY together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 98.274 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 98.606 .Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

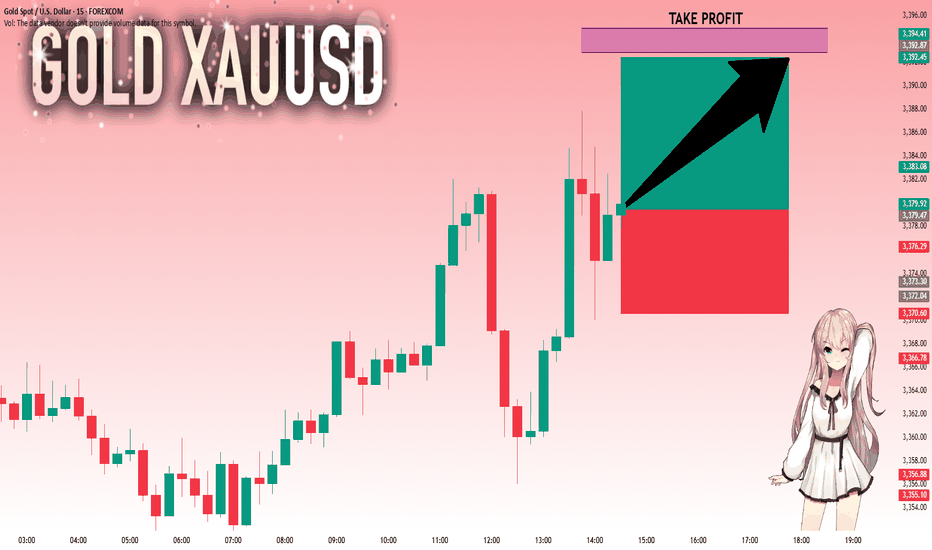

GOLD: Move Up Expected! Long!

My dear friends,

Today we will analyse GOLD together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 3,379.47 will confirm the new direction upwards with the target being the next key level of 3,392.86 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

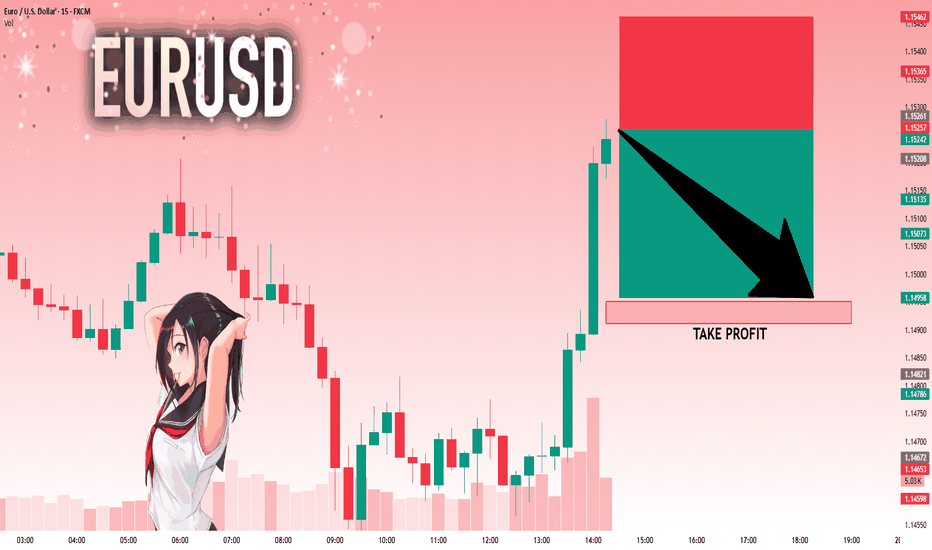

EURUSD: Local Bearish Bias! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 1.15261 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️