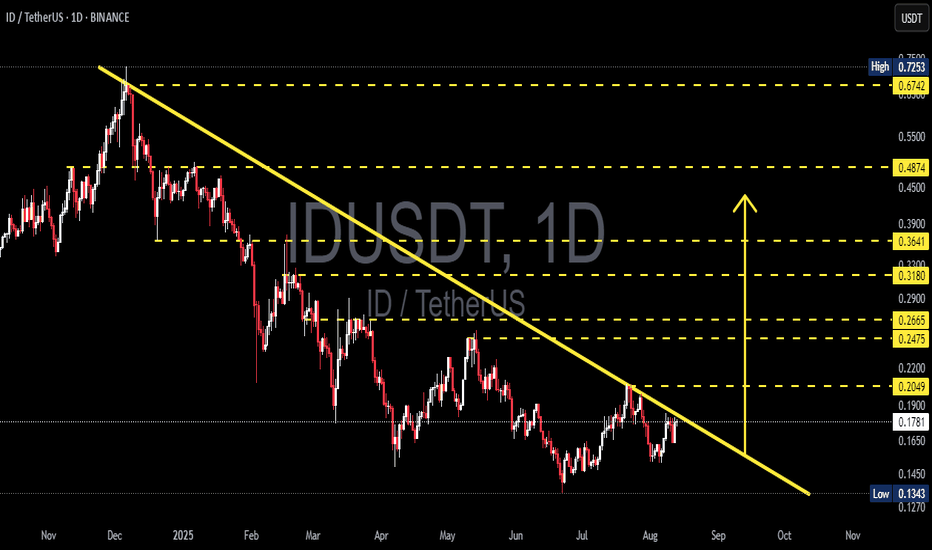

ID/USDT — Final Battle at the Multi-Month Downtrend Line!📌 Market Structure Overview

Since peaking in late 2024, ID/USDT has been trapped under a relentless multi-month downtrend line lasting almost 10 months. Every rally attempt has been shut down at this descending wall.

Now, the market is at a critical inflection point — price is pressing right against the trendline and sitting in the decision zone between 0.190–0.205.

A breakout here would not only be a technical victory for the bulls but could also trigger a shift in market psychology from seller dominance to buyer control.

---

📊 Key Levels to Watch

Major Resistances: 0.2049 → 0.2475 → 0.2665 → 0.3180 → 0.3641 → 0.4874 → 0.6742

Supports: 0.177–0.180 → 0.165 → 0.134–0.145 (major demand zone)

---

📐 Pattern & Sentiment Analysis

The dominant structure is a classic Descending Trendline Resistance, showing consistent lower highs under seller pressure.

However, there’s an early sign of sentiment shift — a higher low compared to the July bottom, suggesting that buyers are stepping in earlier and absorbing supply.

If price can close a daily candle above the trendline and 0.2049, we could see the start of a trend reversal rally toward higher resistance levels.

---

🚀 Bullish Scenario

1. Trigger: Daily close above the trendline + 0.2049.

2. Confirmation: Retest of 0.19–0.205 holds as new support.

3. Upside Targets:

Initial: 0.2475

Mid-term: 0.2665 → 0.3180

Extended: 0.3641 (psychological zone)

4. Invalidation: Closing back below 0.190 or losing 0.177–0.180.

---

📉 Bearish Scenario

1. Trigger: Sharp rejection from the trendline/0.19–0.205 zone.

2. Downside Targets:

First: 0.177–0.180

Next: 0.165

Extreme: 0.134–0.145 (historical low)

3. Invalidation: Sustained breakout above 0.205 with strong volume.

---

⚖️ Perspective & Risk Management

This is a “make or break” moment for ID/USDT.

Don’t rely solely on intraday spikes — wait for a confirmed daily close to avoid fakeouts.

Use the above S/R levels as tiered take-profit zones and for placing protective stops.

#IDUSDT #ID #Crypto #PriceAction #TechnicalAnalysis #DowntrendBreak #Breakout #SupportResistance #CryptoTrading