Ihsg

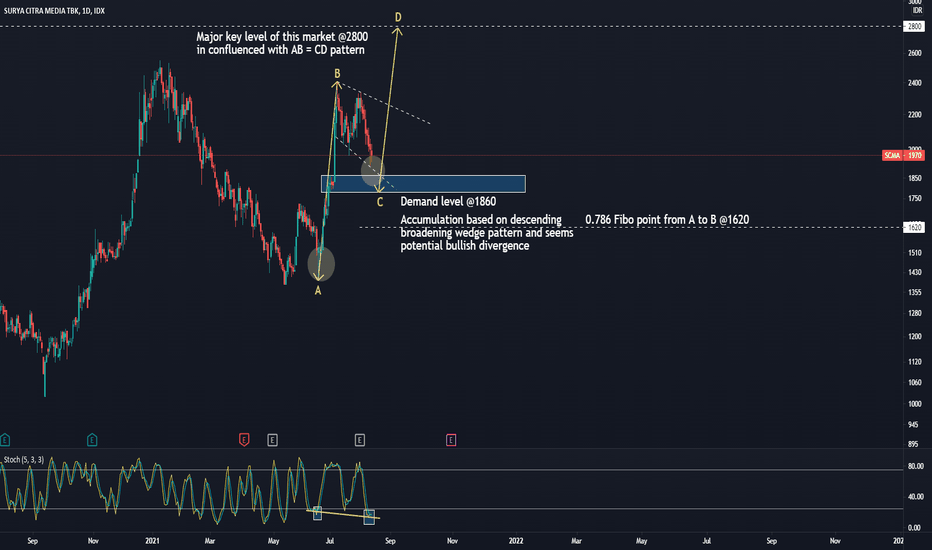

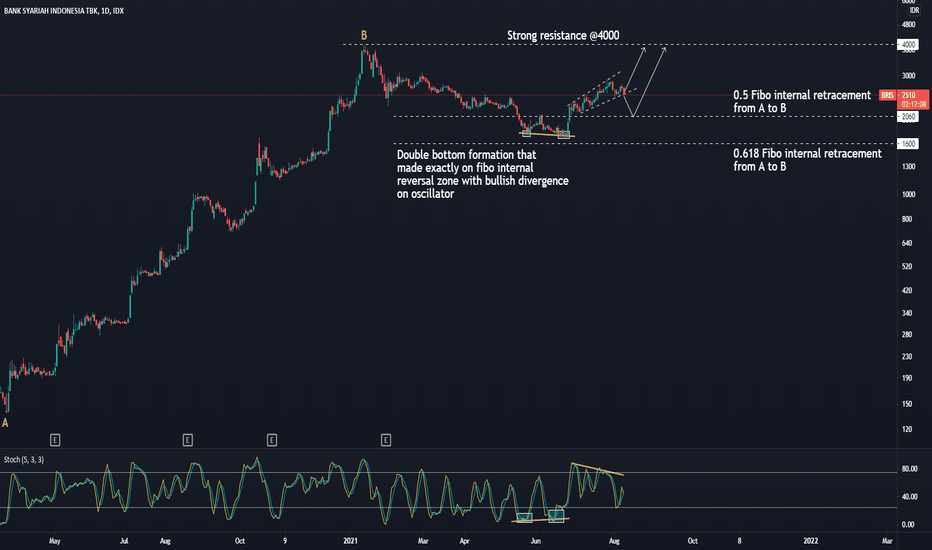

Bullish Bias on BRISA mega merger Indonesia's owned state company seems to continue their bullish run after made a corrective movement that stopped with the double bottom formation exactly at fibo internal retracement zone from their primary bullish trend (A to B). 4000 would be a sweet spot as the target price of this market. Buy on weakness should be your consideration as long as the price not to going down and close below 1600 as it's invalidation value

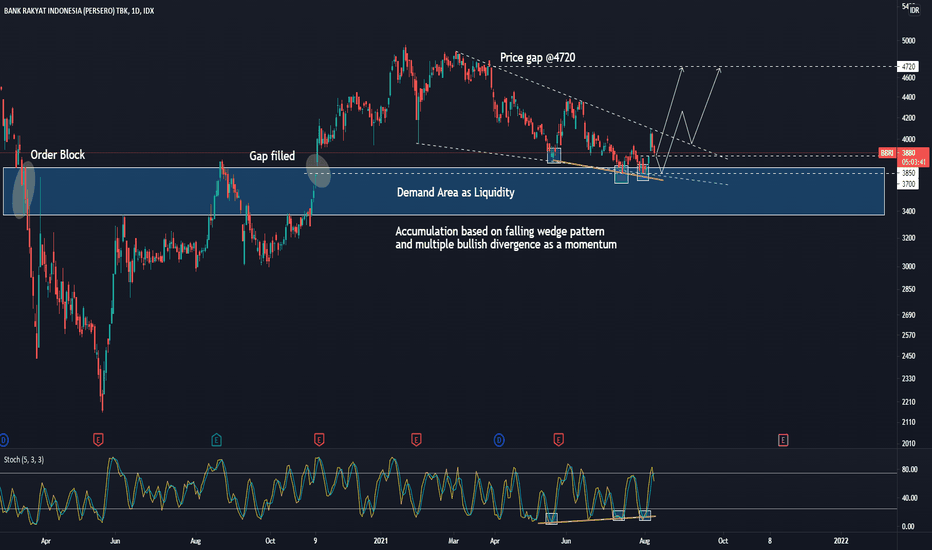

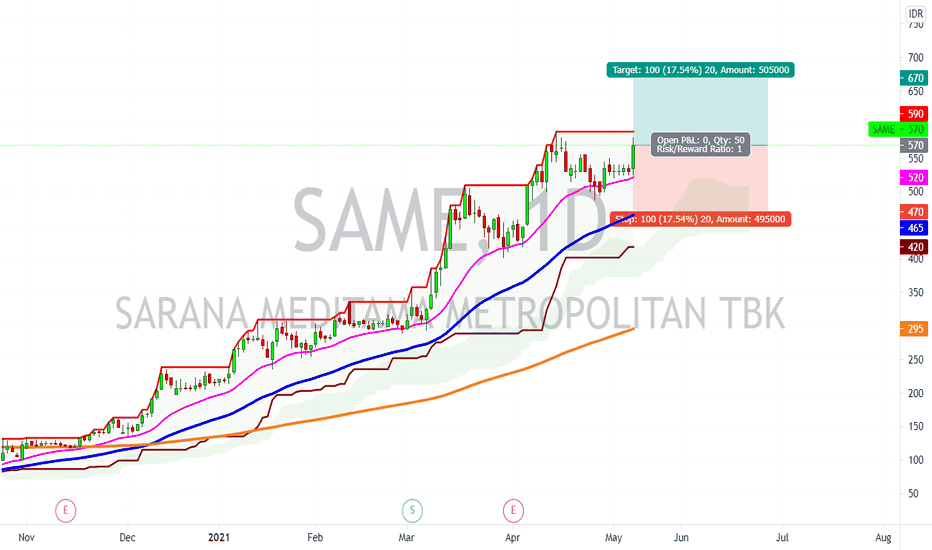

Bullish Bias on BBRIAs wee see that this market formed a huge falling wedge as an indication of big accumulation with several bullish momentum confluence as writen on the price chart, this market would meet it's price target at 4720. Buy on weakness should be your consideration. Invalidation start if the price goes down and close below 3370

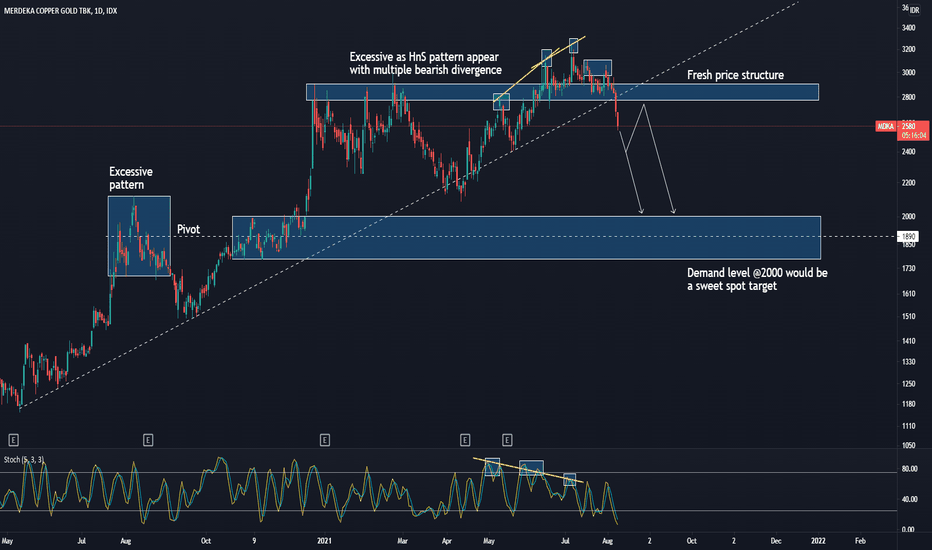

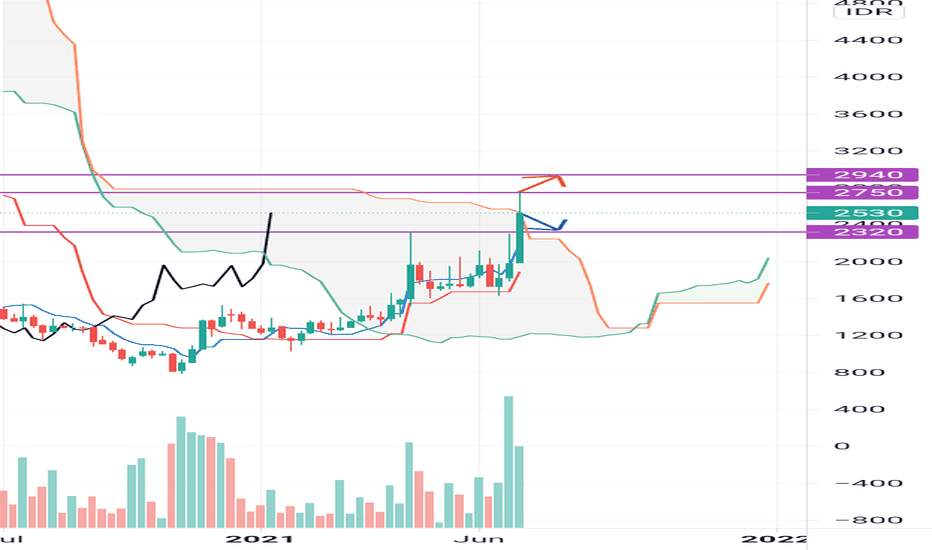

Bearish Bias on MDKAThe gold and copper company would still weakening since the HnS pattern appear to break it's bullish trendline with multiple bearish divergence. 2000 would be a sweet spot target of this market. Sell short should be your consideration if trade on cfd market and patient to wait to start accumulation on price target (demand level) as you trade on a spot market. Invalidation start if the price close on above 2900 and get back to the bullish trendline again

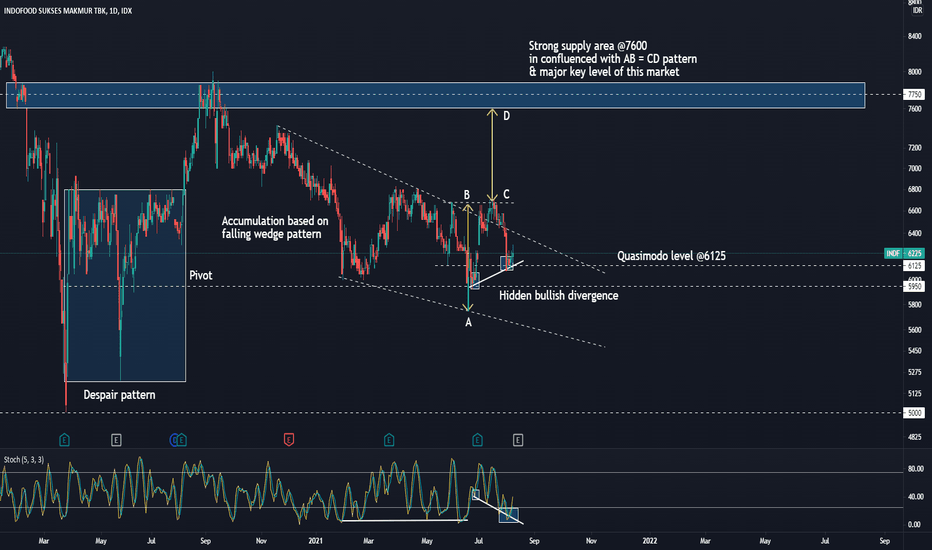

Bullish Bias on INDFI got an idea of this market since we could see a long accumulation based on falling wedge pattern and others confluence that we have. 6700 would be a sweet spot target based on several reason from the chart. Buy on weakness should be your consideration and 5600 would be an invalidation value

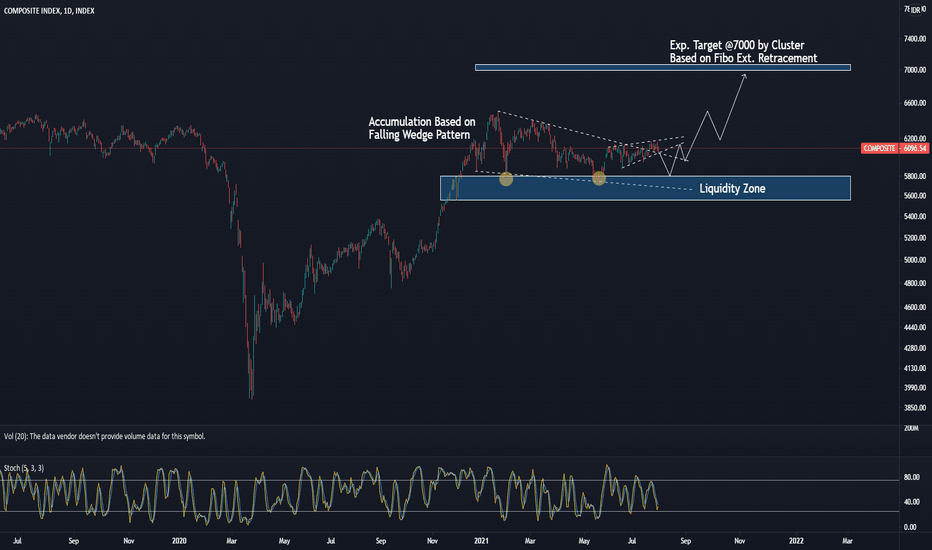

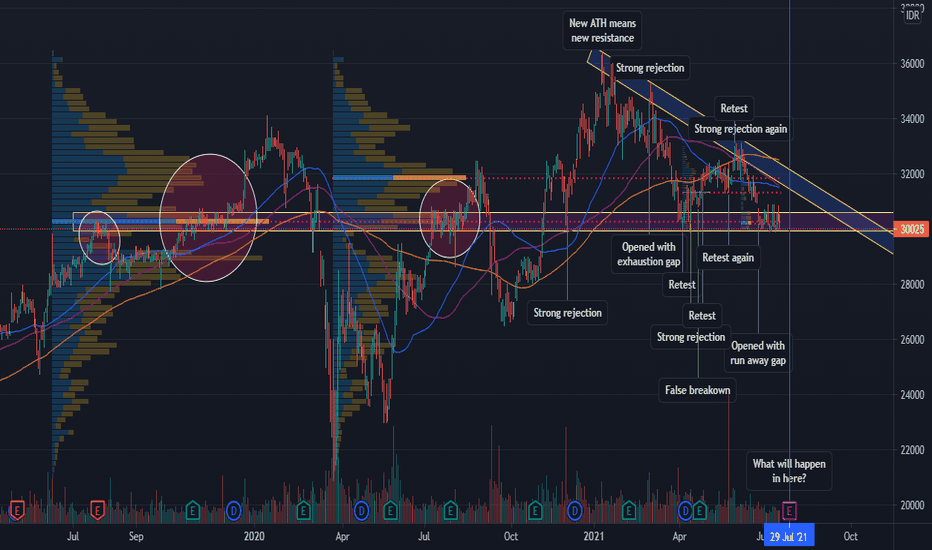

Long Hope for IDX Composite (IHSG)**Market Action DIscount Everything**

I got an idea based on price action analysis that JKSE (IHSG) would still maintain their bullish biases (momentum). We would see that the market formed a falling wedge pattern from 21st Jan of this year 'till this time, indicating that this market would make a continuation on their bullish trend. This signal was also confluenced by the order block on 20 Nov 'till 02 Dec 20 that remain a liquidity zone for the price, since we got 2 price rejection on 01 Feb and 20 May on this year. The last but not least, we may see that this market would reach their target price @7000 as their all time high price based on fibonacci external retracement cluster.

Short term note: Since we see that the market formed a mini raising wedge pattern on the edge of the faliing wedge, i expect that we gonna get a minor price correction before the market price goes high to the expected target.

Regards,

Happy Cuan

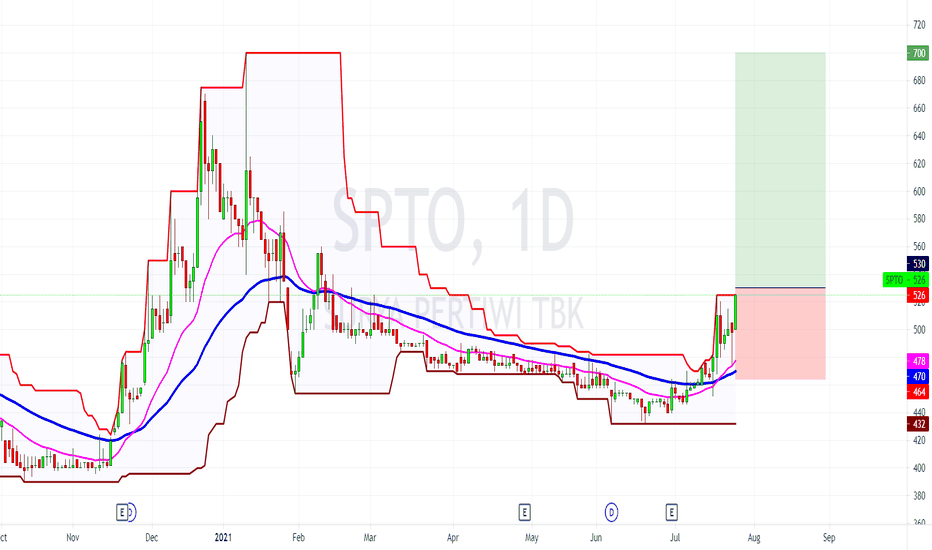

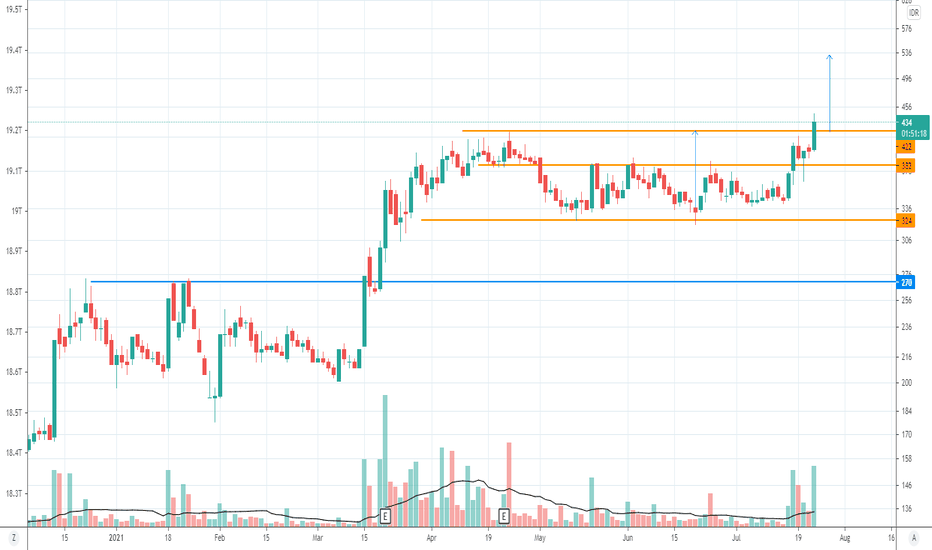

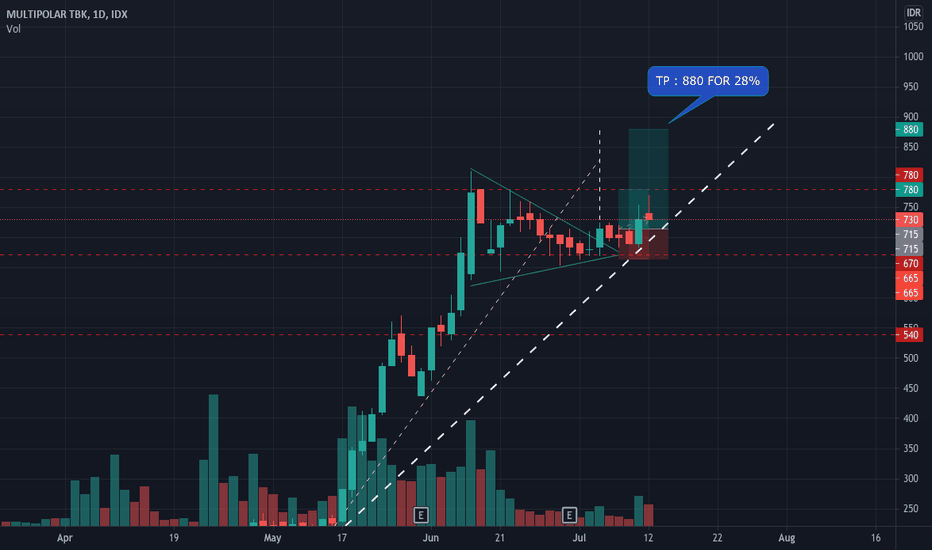

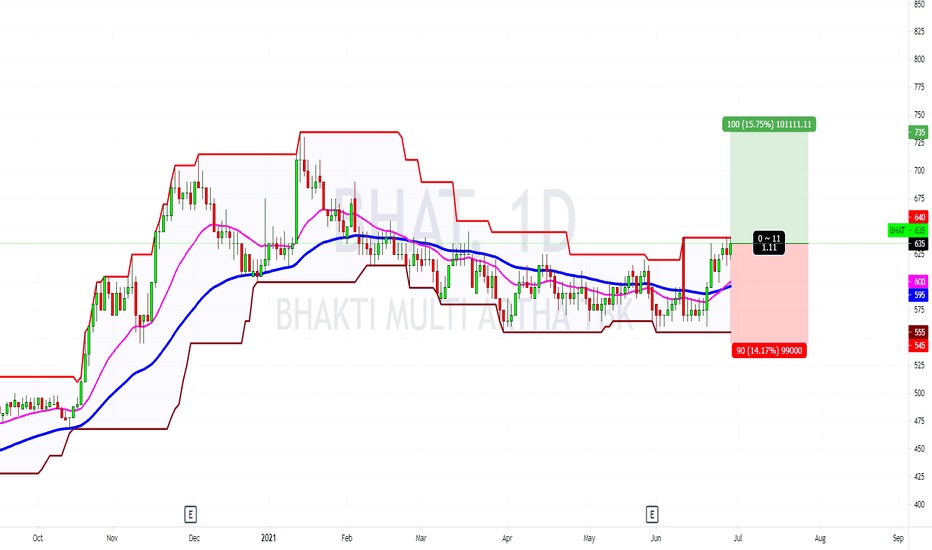

idx: SPTO daily, buy: 530idx: SPTO daily, buy: 530

volume pembelian: 15

resiko: Rp . 100.000,-

R/R ratio: 2.58

sl: 464

tp: 700

#sahamindonesia #ihsg #idx

#idxchannel #belajarSaham #tradingSaham

#investorsaham #investasisaham #investor

#sahamCuan #sahamIDX #sahamIHSG

#sahamProfit #sahamSyariah #teknikalAnalisis

#sahamTrend #investasi #saham

#sahamBlueChip #sahamGorengan #sahamLQ45

#pasarSaham #bursaefekindonesia #BEI

#bursaSaham #yuknabungSaham #sahamHarian

#sahampemula #edukasisaham #dividen

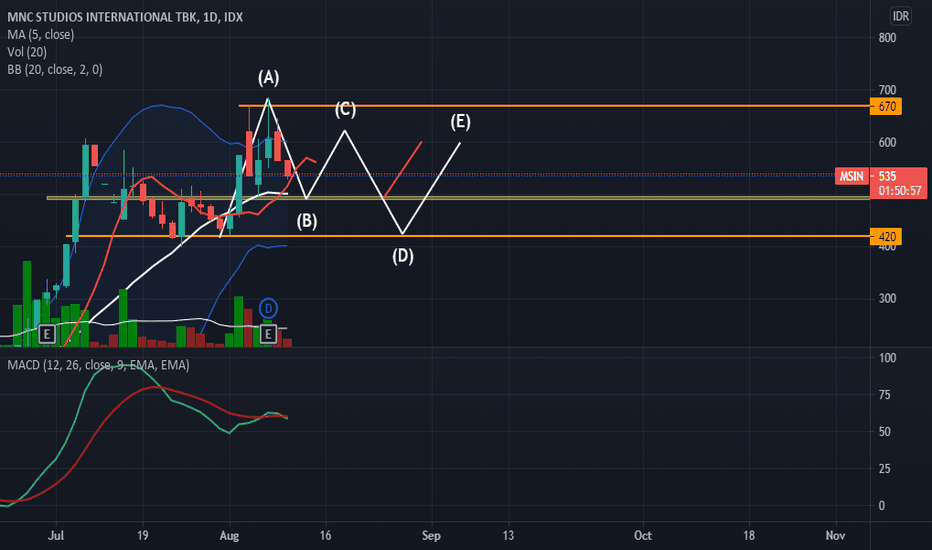

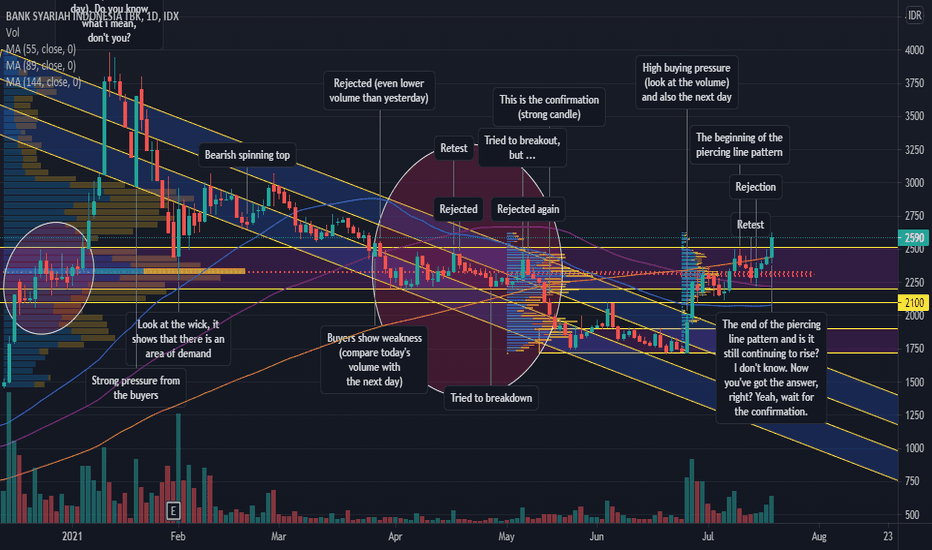

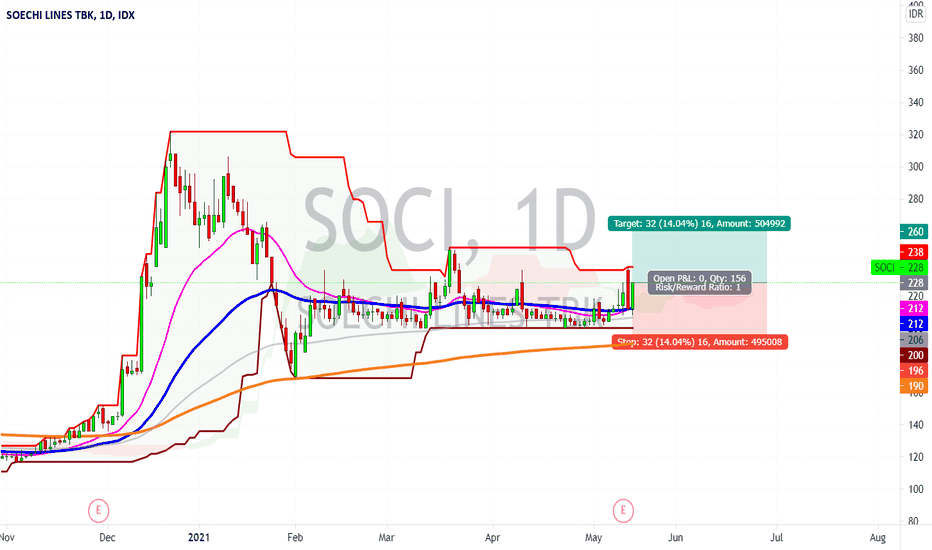

The piercing line pattern on BRIS?😱Look at the 3 candles before today, it was rejected at the moving average of 89 and broke out through a moving average of 144 (continues to strengthen, can be). Even he couldn't break through 3 volume profiles at once, which means, is this a strong signal to start the uptrend again? I don't know either, so let's wait for the confirmation signal.