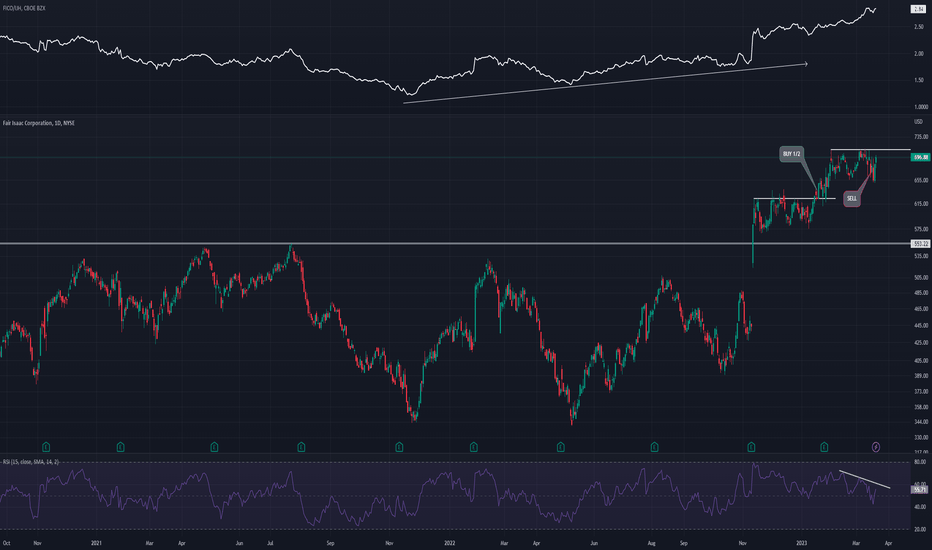

Will $FICO continue its ascend? After the bottom in May of 2022, the price gapped up and broke through its resistance in $550.

Then formed a base to digest this move before continuing its trend up, this was my signal to buy as it broke out above $636. After that it didn't follow through and its RSI signaled weakness so I sold.

I don't like to hold positions that aren't going anywhere even if I'm on profit.

Still, its relative strength againts its benchmark ( AMEX:IJH ) shows leadership and the price is still near highs so, I'll wait and see if it can breakout this base-over-base.

The RS ratio already broke out, the price could follow.

If not, I won't buy it again.