Ilovetrading

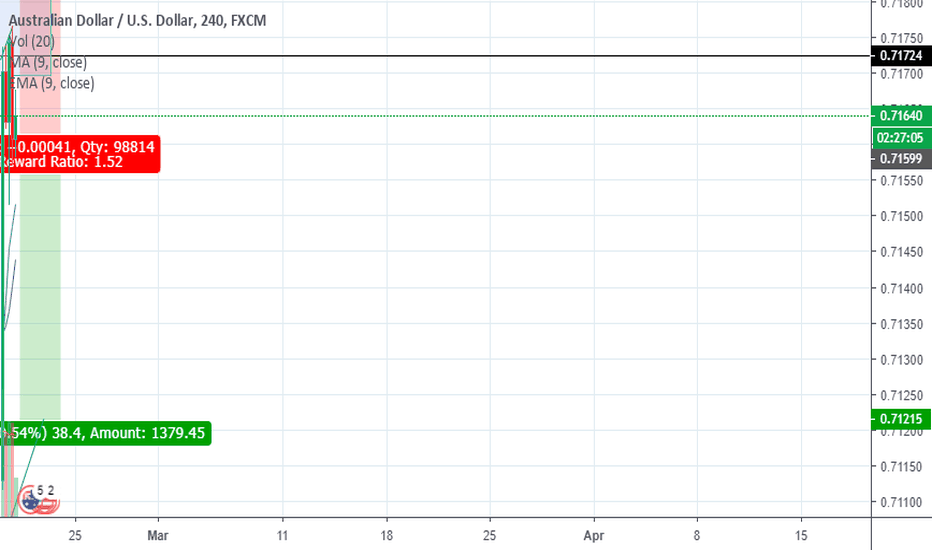

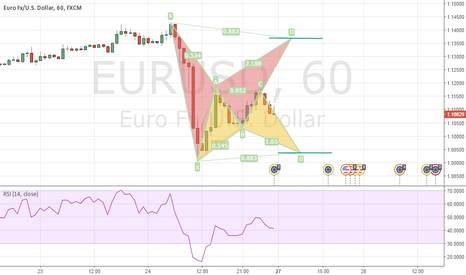

SRTF Analysis on EURUSD 1HR - Short TradeOANDA:EURUSD

Hey traders, Ill be publishing daily between 0800hrs - 1200hrs +0300GMT

My analysis is based on SRTF(Support, Resistance, TrendLine and Fibonacci)

Take a close look at the trends, Even though we have a higher high, 61.8% level is broken and we are moving bearish.

Wish you the best

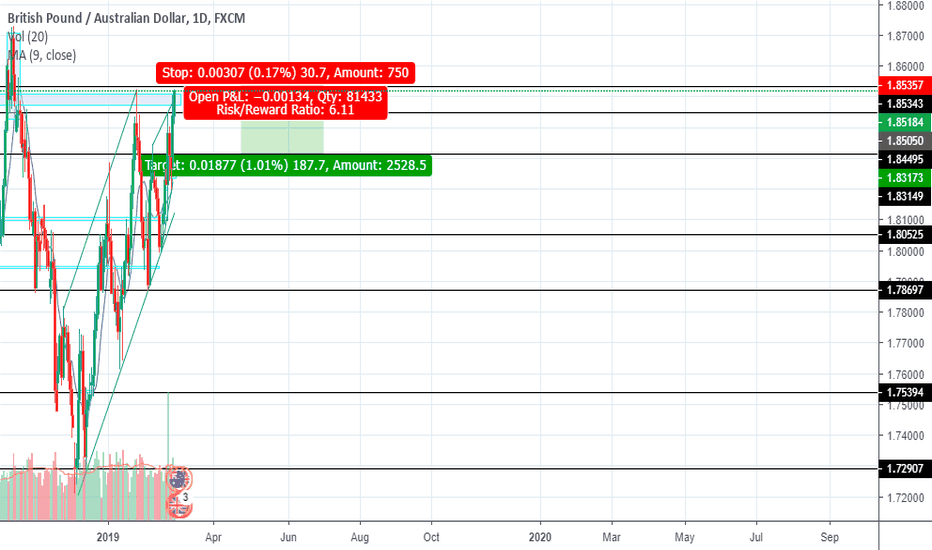

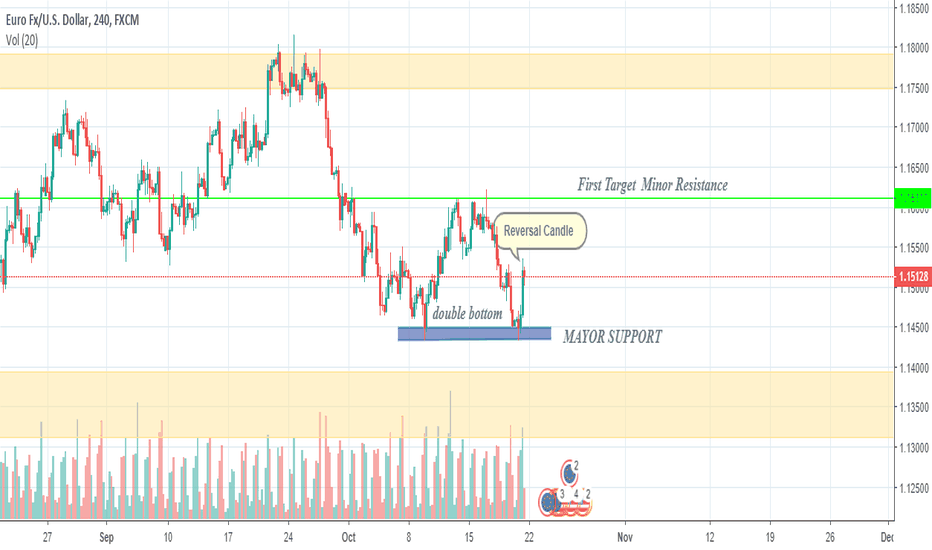

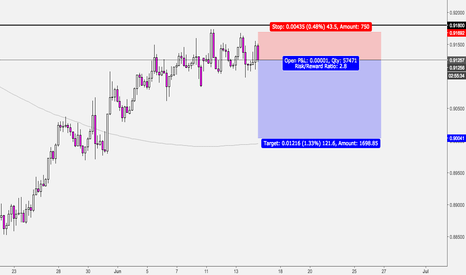

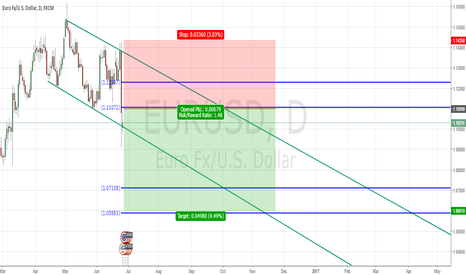

Euro/Usd double bottom formation on H4 Hey traders ,

the price has touched the lows of 1.14340 creating double bottom pattern (the W formation) without neckline , but the highs of 1.16138 are the new target profit reward .

On Friday the market for euro was very bullish and create a big reversal candle on 100pip mark to touch and closed on 1.15100.

So for Monday i predict another bull run and aim for the 'neckline' of 1.16137 the first pip's of the week ahead .

Hope to have a very profitable week .

The master is with you .

Pound Vs the Greenback could it Rally to 1.45!Another day in the in the battlefield the bulls and the bears go head to head. And we as the eyes wait to see the market formation looking for an entry to be in our favor patiently waiting for an opportunity to come. We look for patterns in the market to validate our analysis, what happens next in the coming weeks will determine the end results. As for I, I believe the Pound will rally breaking layers of resistance and touch 1.45 forming a head and shoulders pattern but in the meantime consolidation will linger.

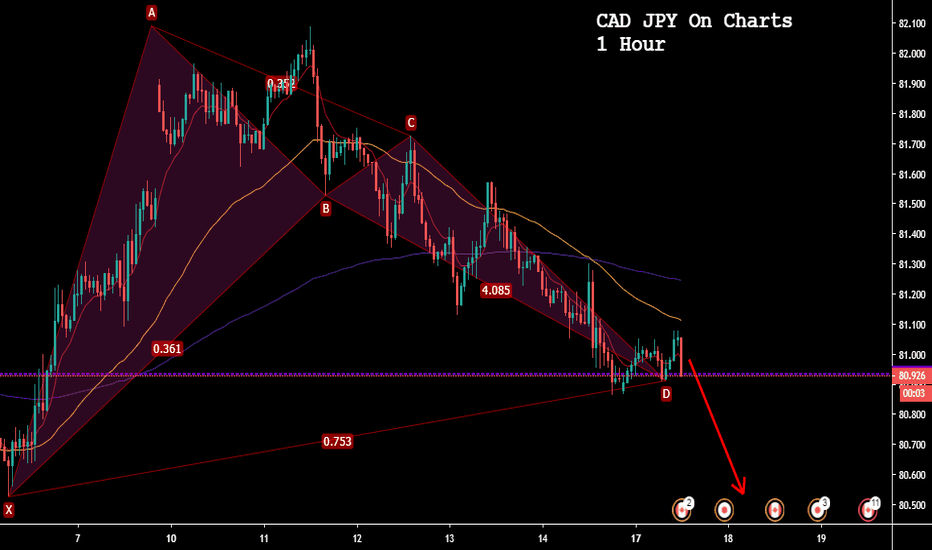

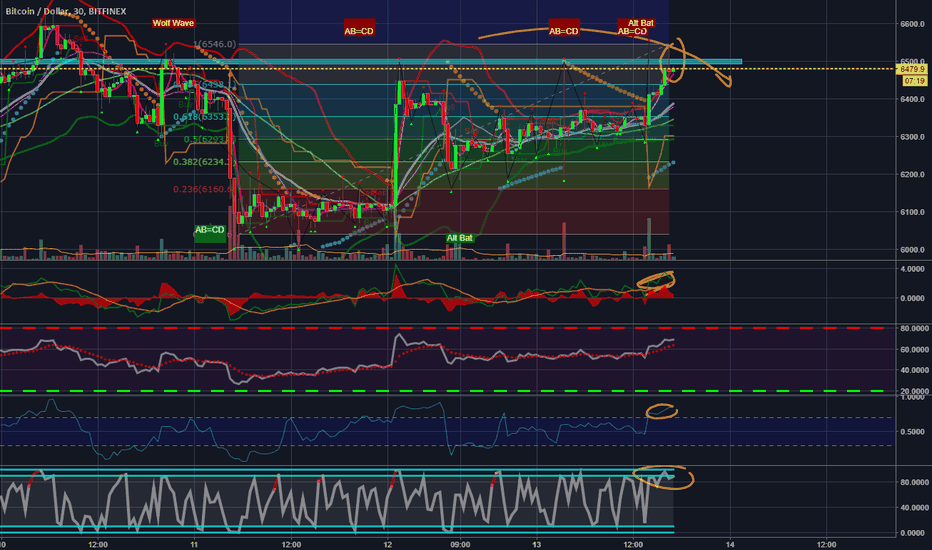

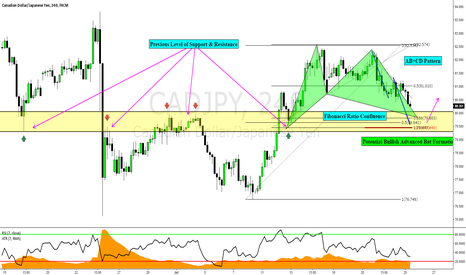

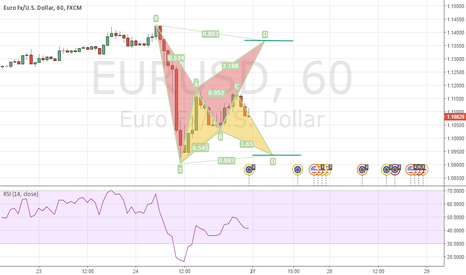

CADJPY: CTS Trade From This Morning's Training Lesson Each Monday I hold a private training lesson for our Transformation members and today the topic was the Combined Technical Scoring System (CTS)

During the lesson I talked to them about my personal journey & how I went from a very conservative CTS trader to someone who no longer requires a score. With that being said I've ingrained the process into my daily evaluation of a price chart & this was the example that I used to show them how I still use it without actually using it (if that makes sense)

Anyway, what we have above is a level of potential structure support that has been tested a few time is the recent past as both support & resistance. We also have an AB=CD patter, Fibonacci Ratio confluence & a potential advanced Bat Formation resting in that zone as well. This makes for a great example of taking the clues that the market provided with and putting them together in order to find quality trading opportunities.

Akil Stokes

Chief Currency Analyst & Head Trading Coach

www.TradeEmpowered.com -The Premier Online Trading Education Company

Trade Empowered on YouTube goo.gl

Facebook: goo.gl

Twitter: goo.gl

@AkilStokesRTM (Instagram, Periscope, Snap Chat & StockTwits)

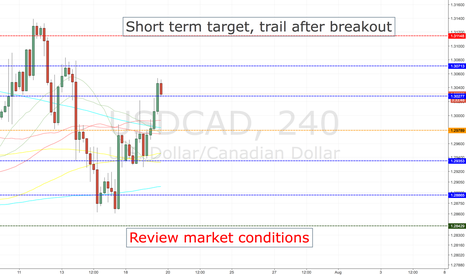

USDCAD VOLUME, OPEN INTEREST, LEVELS, UPDATE (WATCH TEXT)THIS IS NOT ANALYSIS, I HAVE PREPARED AN OPTION LEVELS TO SHARE WITH YOU, THAT CAN BE USED TO FILTER OUT LEVELS THAT YOU ARE USING IN YOUR ANALYSIS

Volume Put / Open Interest Put / Level

0 / 8 / 1.44928

0 / 20 / 1.43885

0 / 4500 / 1.41844

0 / 43 / 1.40845

0 / 91 / 1.39860

0 / 251 / 1.38889

0 / 387 / 1.37931

0 / 1426 / 1.36986

0 / 322 / 1.36054

10 / 1380 / 1.35135

15 / 478 / 1.34228

15 / 1378 / 1.33333

85 / 580 / 1.32449

92 / 1133 / 1.31577

34 / 1240 / 1.30715

87 / 796 / 1.29865

70 / 574 / 1.29024

23 / 238 / 1.28194

0 / 185 / 1.27374

0 / 301 / 1.26563

0 / 28 / 1.25763

0 / 4 / 1.24191

Volume Call / Open interest Call / Level

0 / 48 / 1.32469

3 / 118 / 1.31594

52 / 460 / 1.30730

72 / 786 / 1.29878

63 / 1420 / 1.29038

145 / 1469 / 1.28208

82 / 1074 / 1.27391

15 / 648 / 1.26583

3 / 572 / 1.25787

0 / 782 / 1.25000

0 / 324 / 1.24224

0 / 320 / 1.23457

0 / 260 / 1.22699

0 / 76 / 1.21951

0 / 50 / 1.21212

0 / 48 / 1.20482

0 / 7 / 1.19760

0 / 1 / 1.19048

0 / 4 / 1.18343

0 / 7 / 1.17647

0 / 24 / 1.16959

0 / 26 / 1.16279

0 / 17 / 1.14943

0 / 6 / 1.14286

0 / 4 / 1.13636

0 / 15 / 1.12360