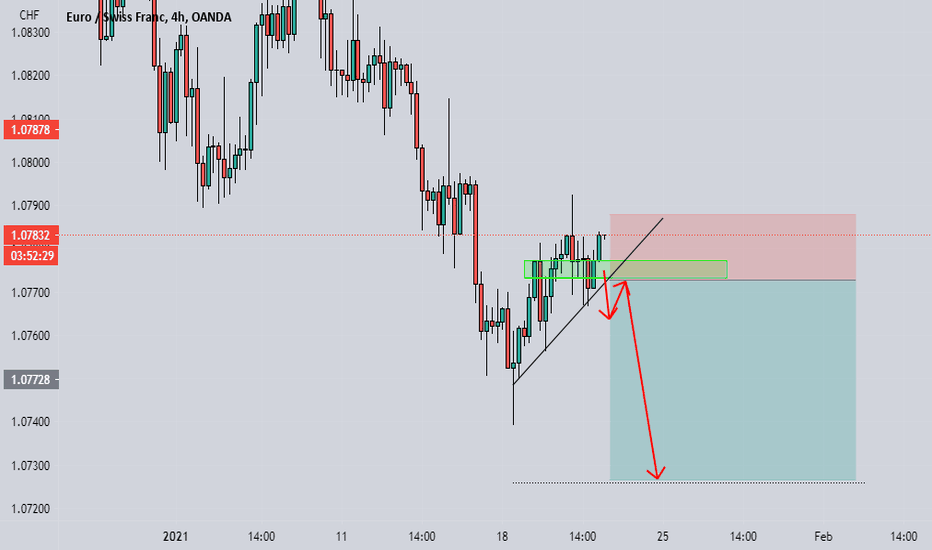

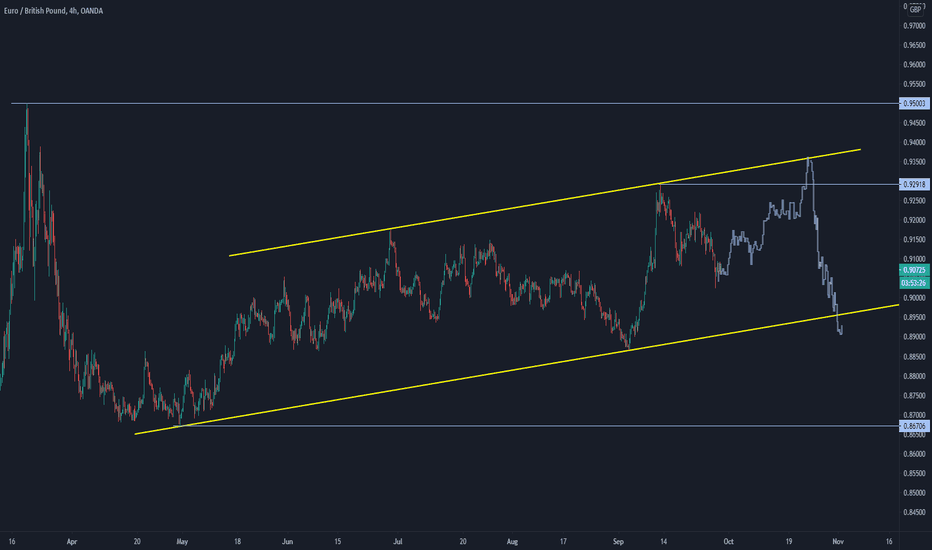

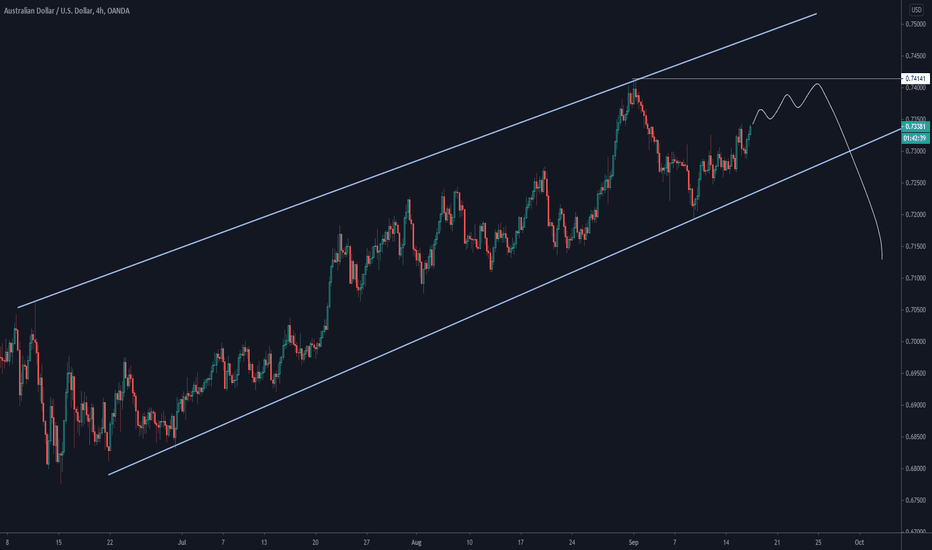

EURCHF short swing setup.On the weekly timeframe market has rejected the upper boundary of an ascending channel with a bearish engulfing candle.On the daily market has broke below daily support with a strong bearish impulse which has been followed by a nice correction, now we are expecting to see a continuation to the downside and market to form a new lower low from a daily perspective. At the moment on the 4hr timeframe market is still bullish during the correction, we are waiting for new bearish structure to form and a break of this counter trendline, if all of our other rules are met we will be looking for one of our valid entries to short.

Impulsecorrectioncontinuation

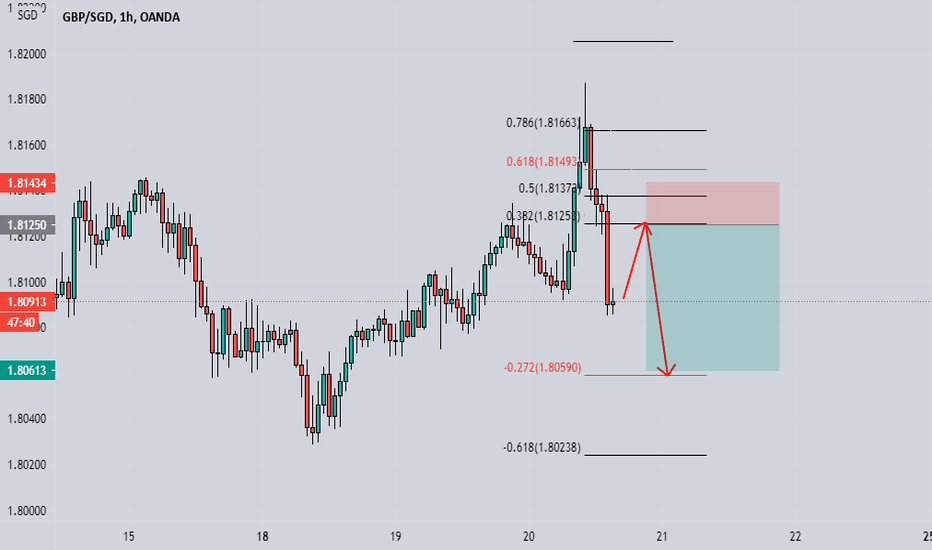

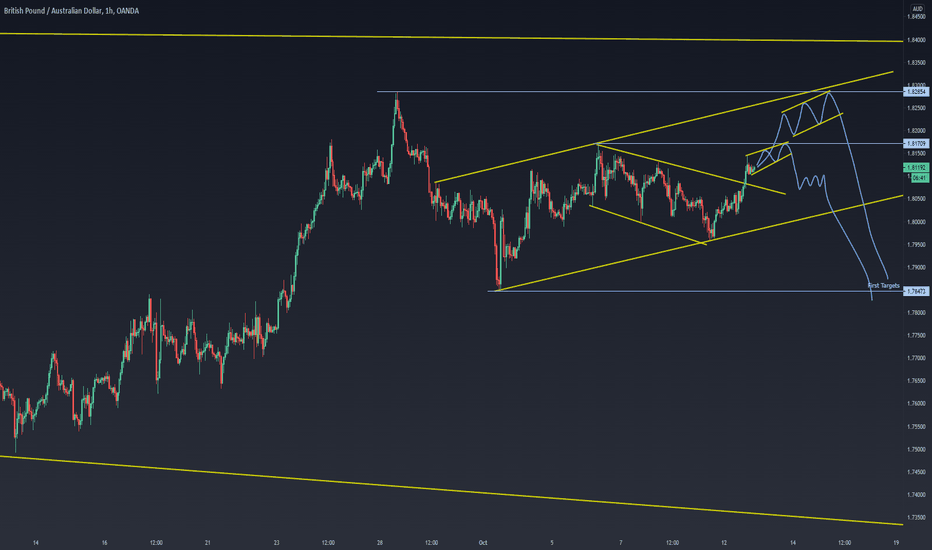

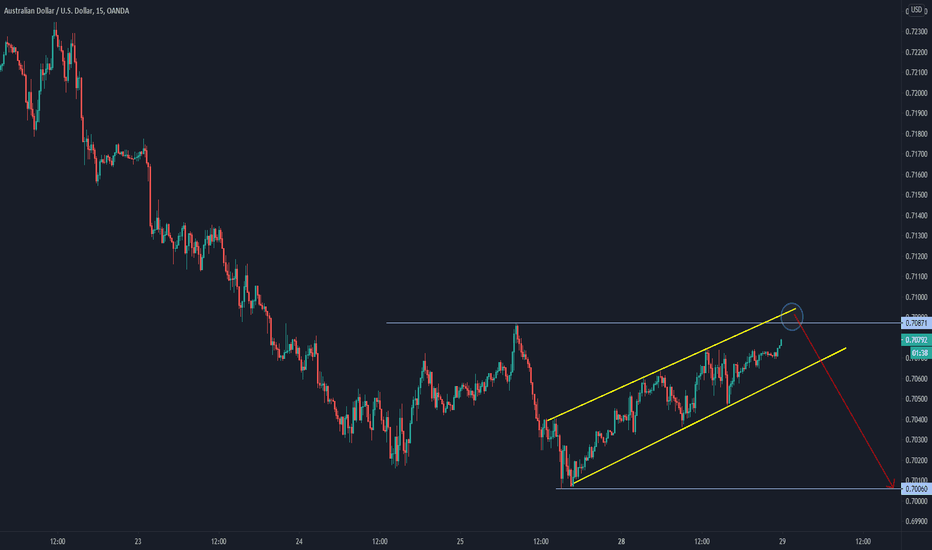

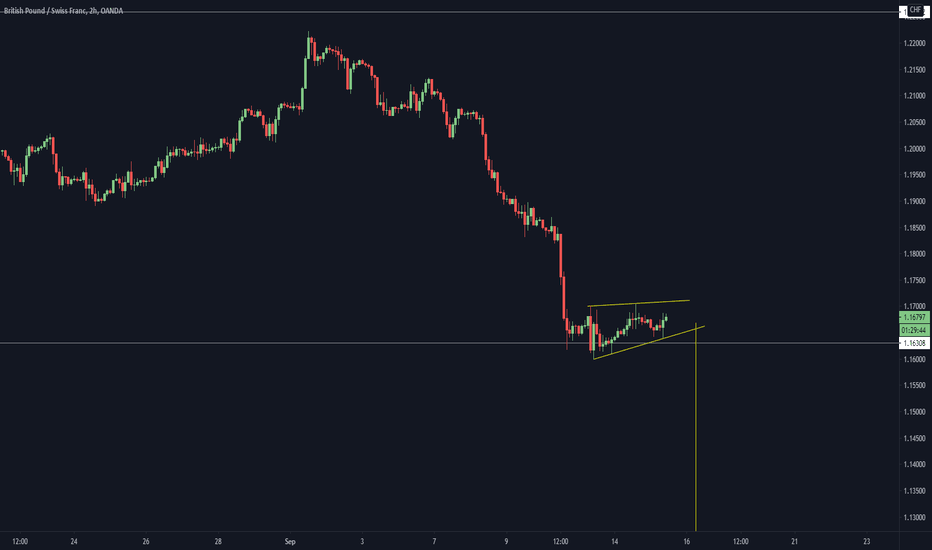

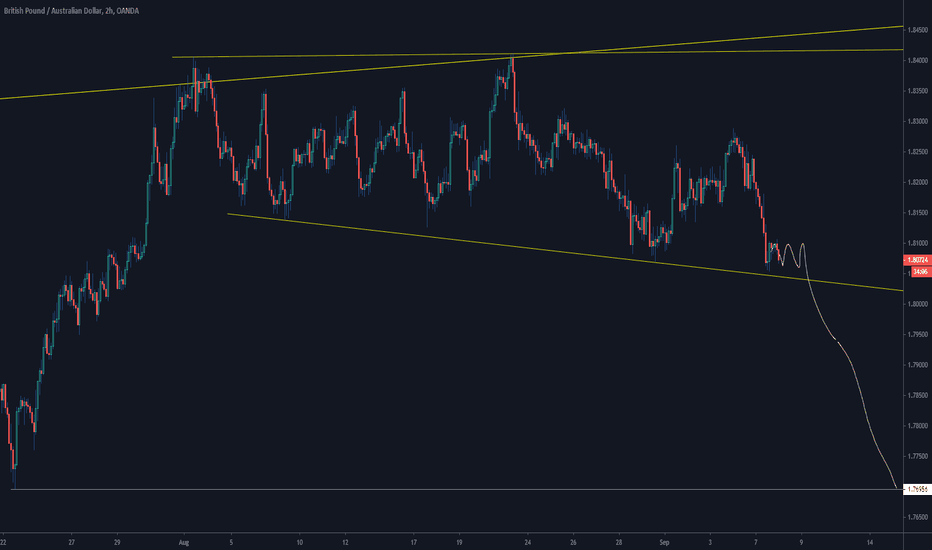

GBPSGD short intraday setupAfter catching the bullish move this morning, GBP has pulled back massively, on the 1hr TF we can see market has broke bullish structure with a massive bearish impulse, we are waiting to see a nice slow correction to the 0,382 fib which is also aligning nicely with structure(which will also form a big head and shoulders) then we can drop down to lower TF and look to capitalise on the second bearish impulse.

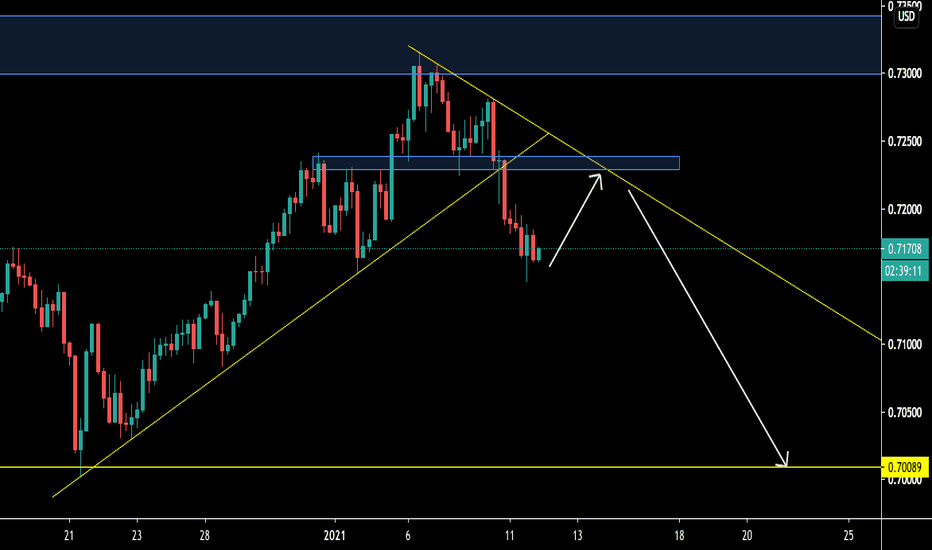

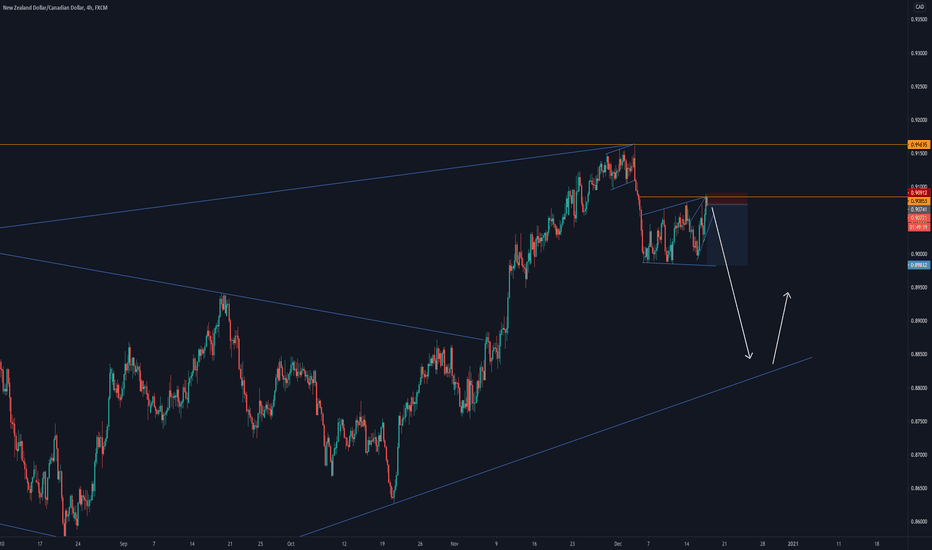

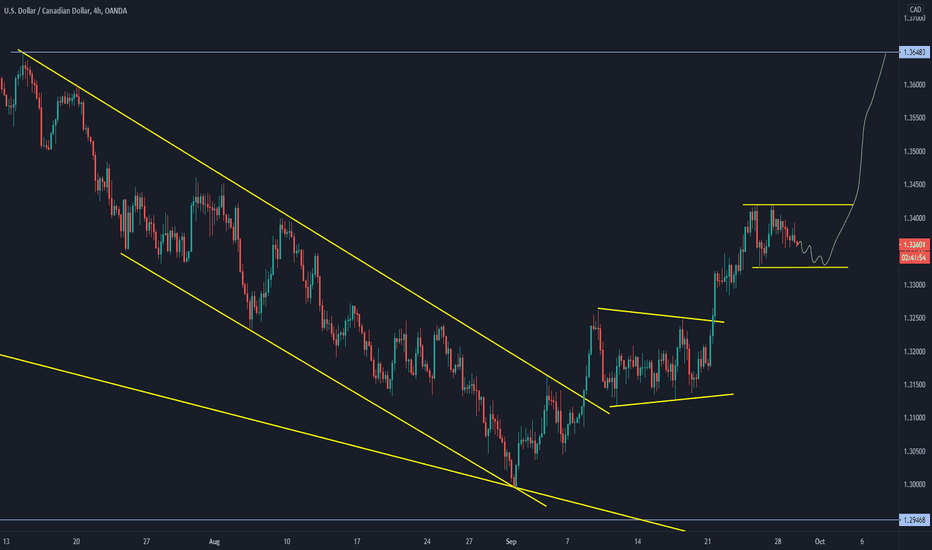

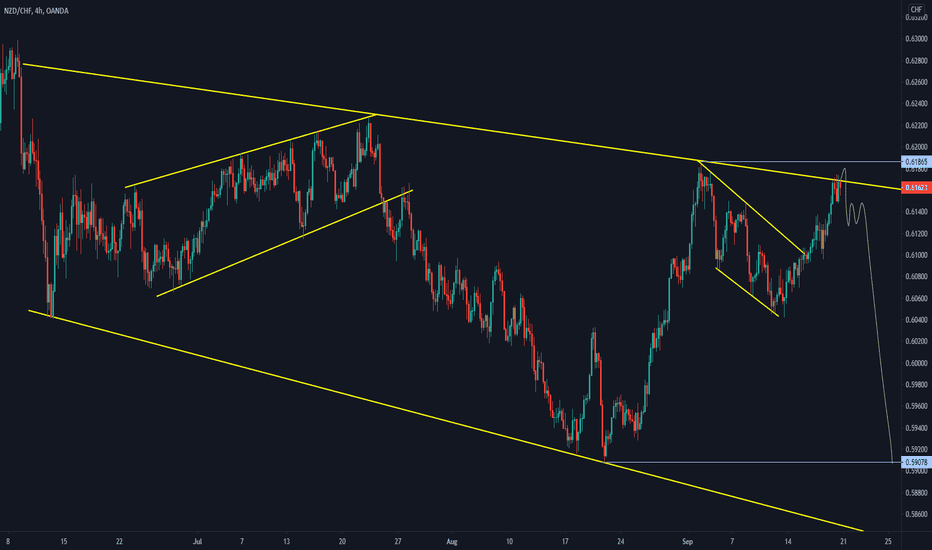

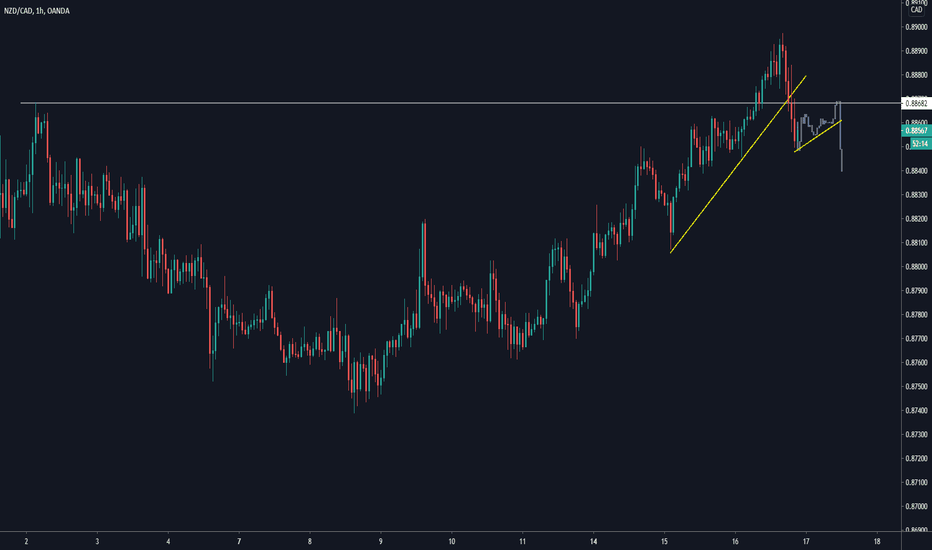

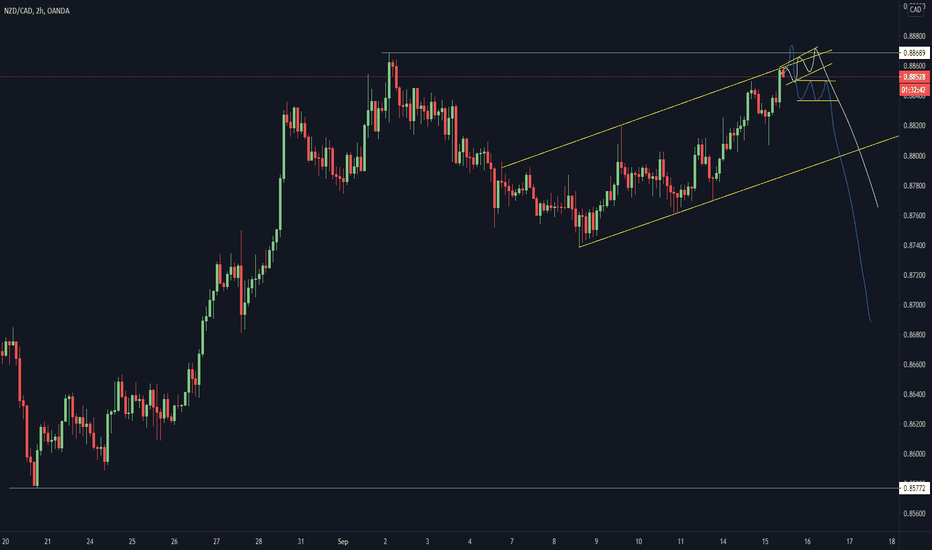

NZD/CAD SHORT - BEAR FLAGJust got triggered into NZD/CAD short. Very clear structure on the HTF's and this LTF flag showed its signal that its complete. Expecting to break this bear flag and reach the lower trend line. Theres potential for a large swing trade. Swing target is at the beginning of the HTF ascending structure.

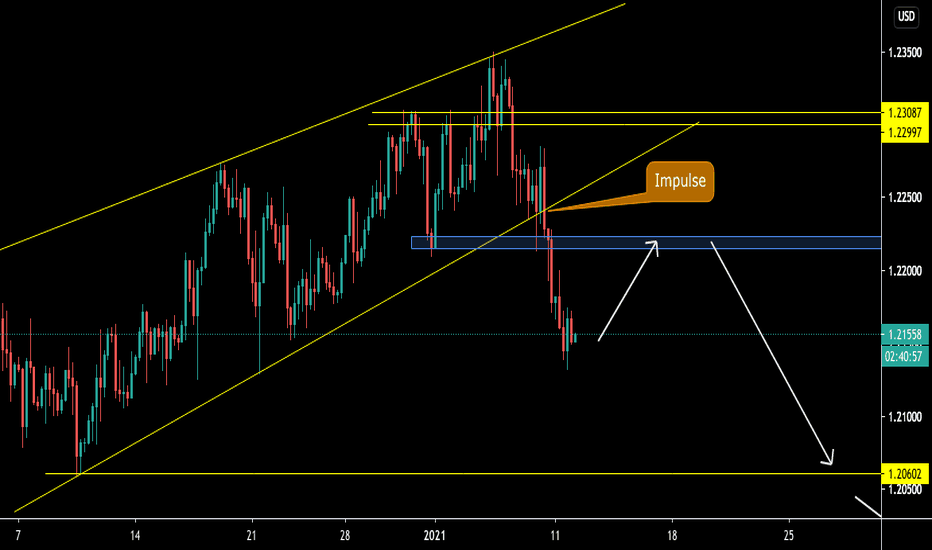

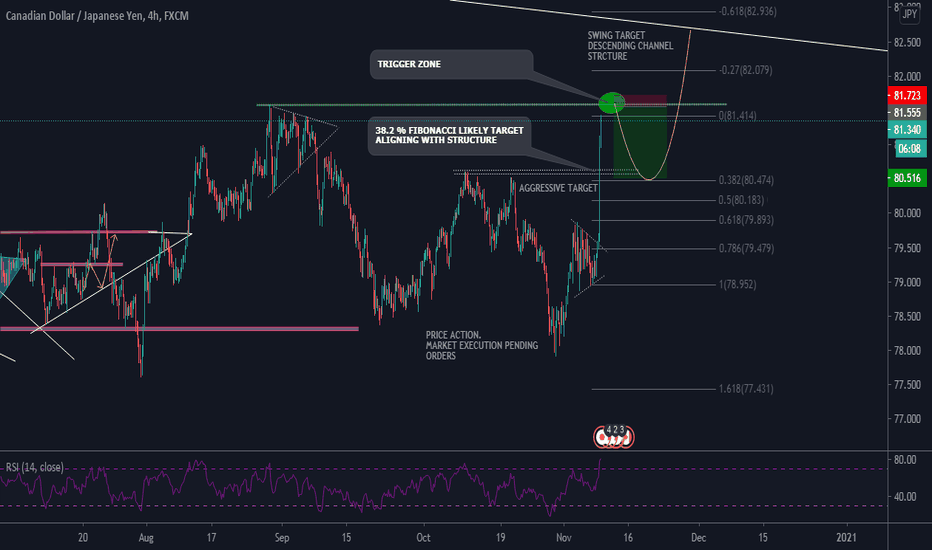

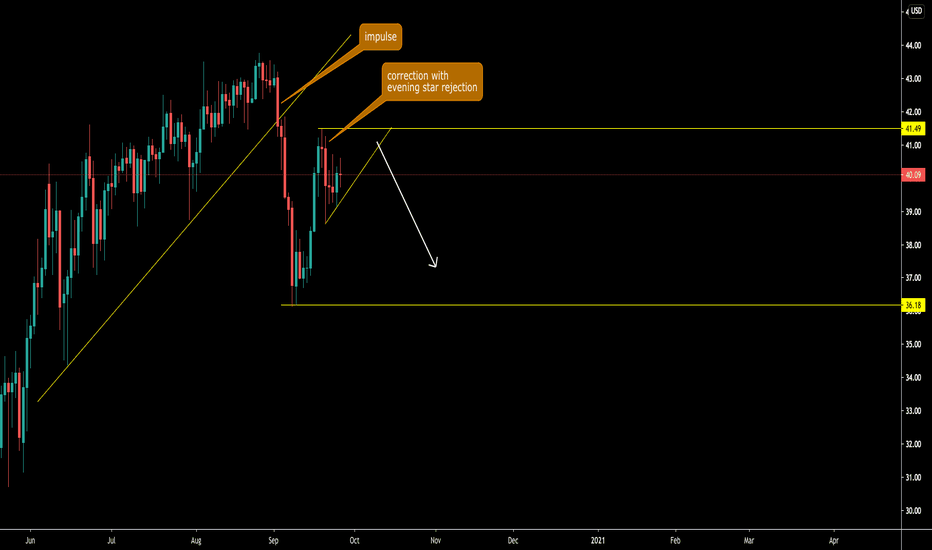

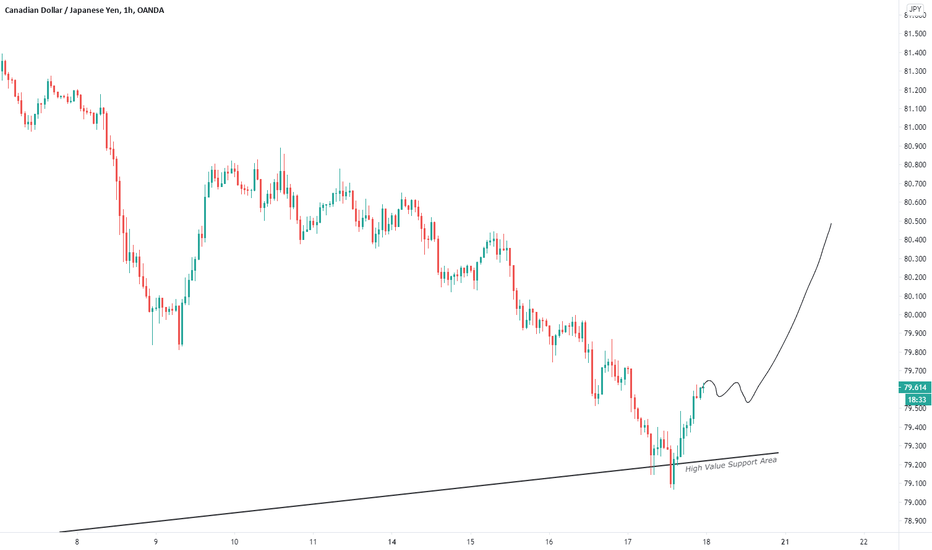

CADJPY 81.348 + 2.82 % SHORT IDEA * PRICE ACTION & CORRECTIONHEY EVERYONE

At it once more here's one on the CANADIAN DOLLAR / YEN the pair just spiked with the bulls now showing signs of slowing down in momentum as the pair approaches resistance level 81.554, waiting to watch price on this one as I've set a trigger zone where i'll be watching price before looking for that correction to the down side it possible the pair may not hit this trigger zone but strategies are in place if this happens as always for entries we scale down to smaller time-frames to determine entries and so forth.

many stars must align with the plan before executing the trade, kindly follow your rules.

LET'S SEE HOW IT GOES..

HAPPY TRADING EVERYONE & LET YOUR WINS RUN...

_________________________________________________________________________________________________________________________

ENTRY & SL - FOLLOW YOUR RULES

here's some of my rules if they help.

1. look at structure be it descending channels, pennants and so forth.

2. RSI is overbought/oversold so will be looking for a pull back to structure before continuation.

3. will be looking for entries from 30M , 1H, 2H & 4H time-frames if taking the trade long term.

4. aggressive trades can be executed on the pull back

5. price action must definitely align with the plan.'

6. structure definitely

7. the 20 EMA must be respected as support / see a bounce at this structure

8. FIBONACCI EXTENSIONS AS GUIDELINES FOR SL & TP'S .

9. CANDLE STICK PATTERNS.

so i will most like's enter this one in a bit but i hope this idea assists in any way on your trading plan.

RISK-MANAGEMENT

PERIOD - SWING TRADE

__________________________________________________________________________________________________________________________

If this idea helps with your trading plan kindly leave a like definitely appreciate it.