India

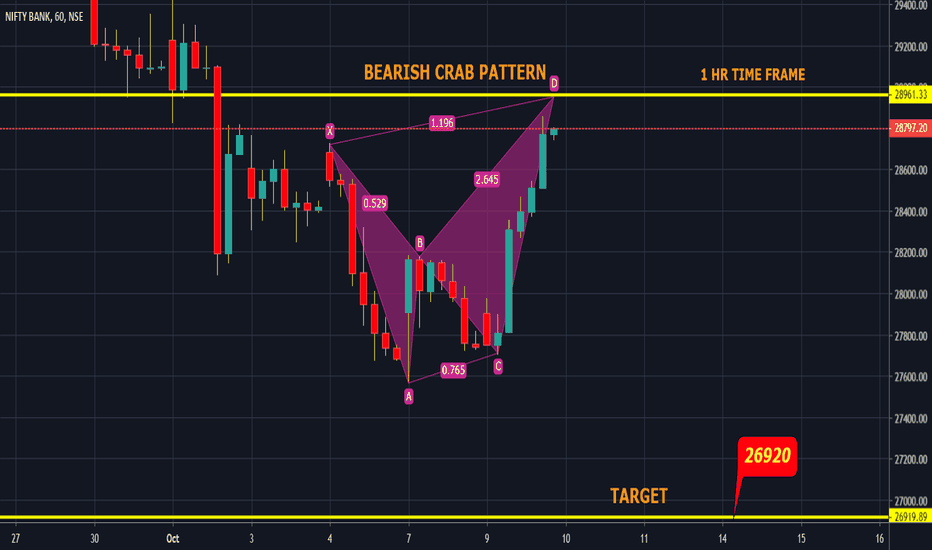

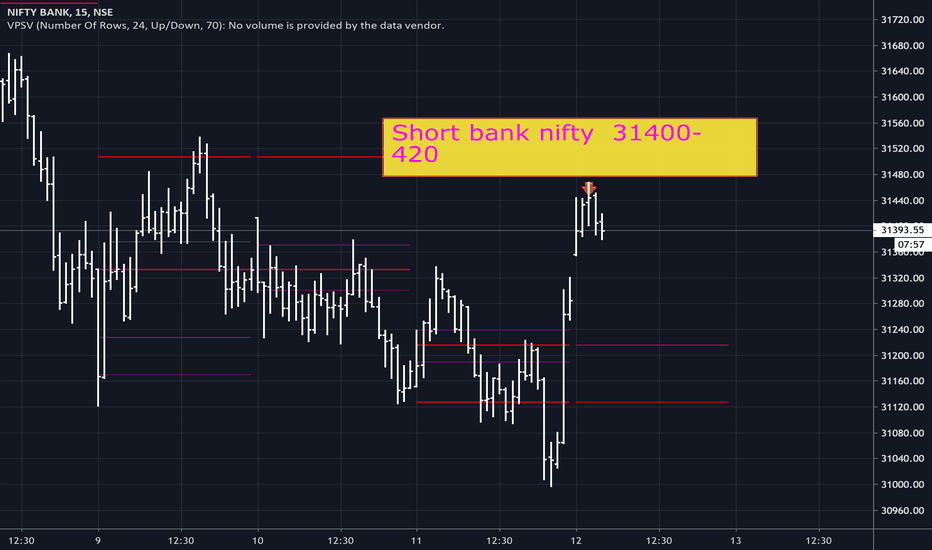

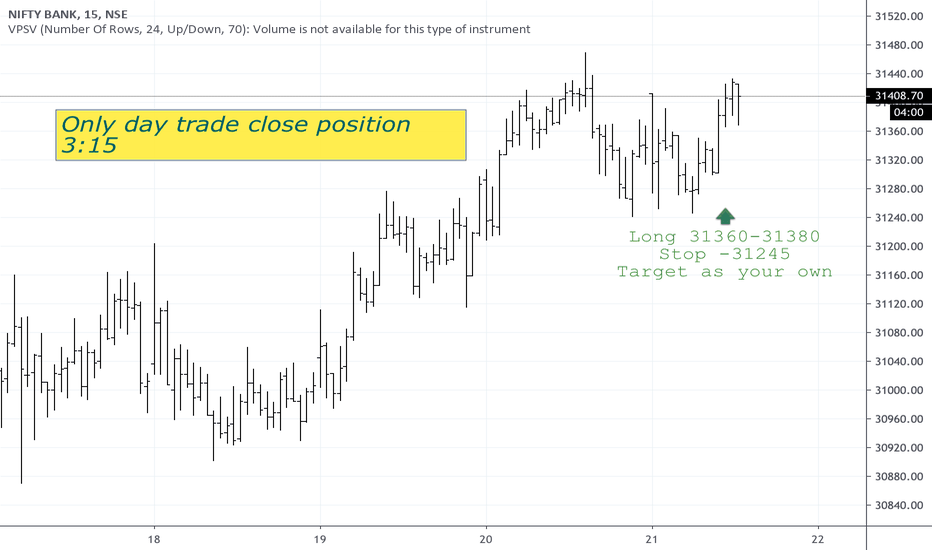

BANK NIFTY BEARISH CRAB PATTERN FORMED IN 1 HRHI EVERYONE!

MY VIEW ON BANK NIFTY IS FORMED BEARISH CRAB PATTERN FORMED IN 1 HR

TARGET 26920 IT WILL ACHIEVE WITHIN THIS OCT MONTHLY EXPIRY

GO FOR SELL

I RECOMMEND DO THIS TRADE IN OCT MONTH PE OPTIONS..LESS INVESMENT HUGE PROFIT IS THERE!

LET"S WE WAIT FOR 26920

THANK YOU EVERYONE..!

KEEP SUPPORTING..!

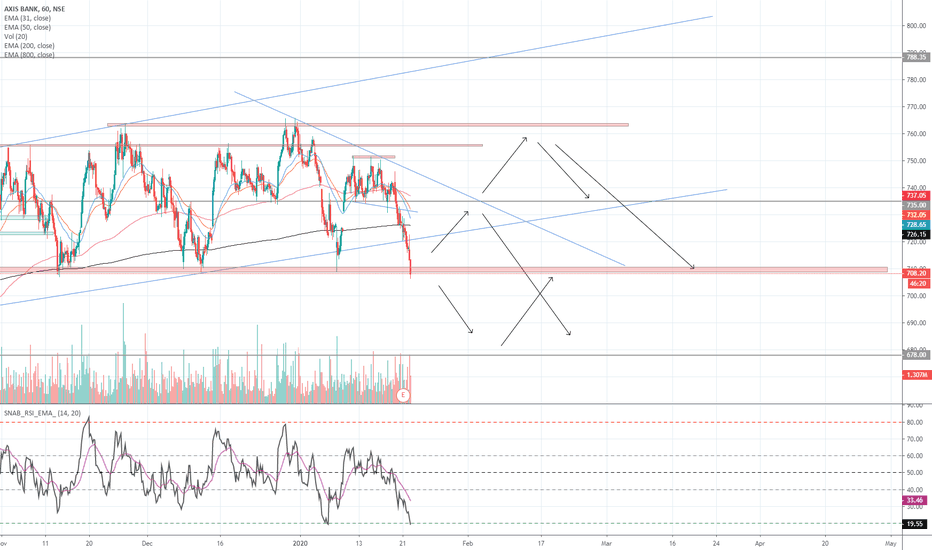

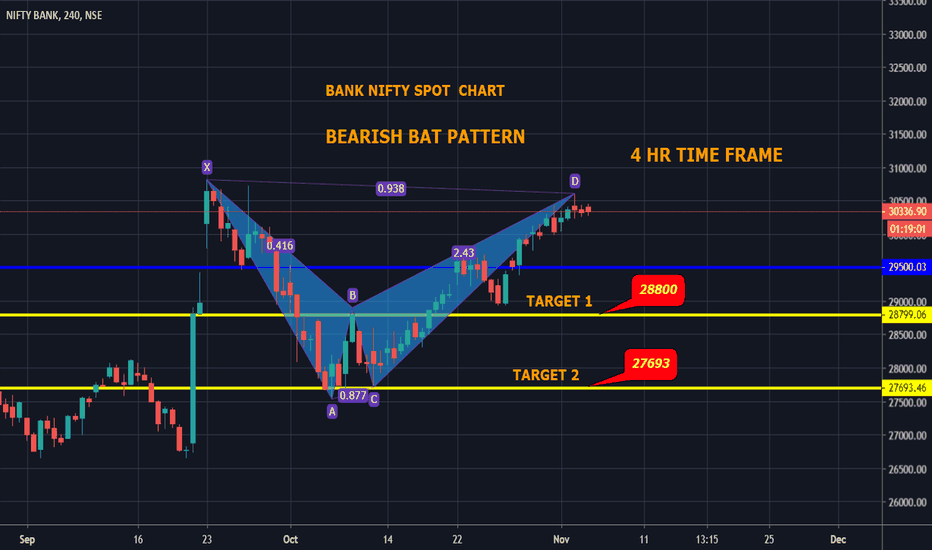

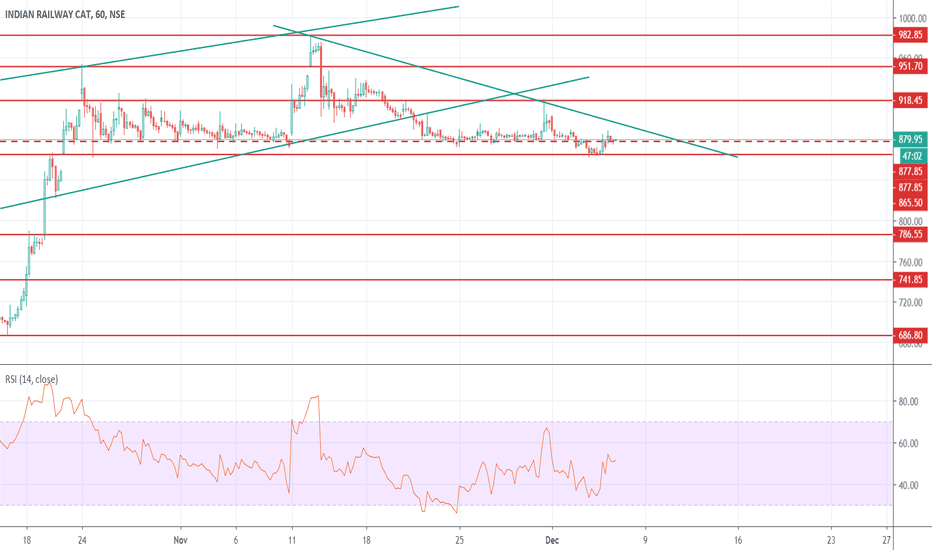

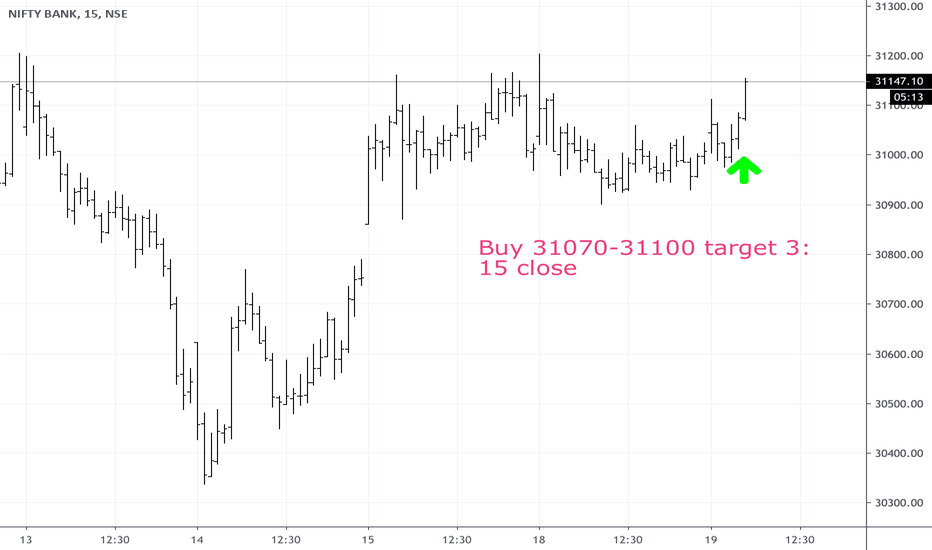

BANK NIFTY SPOT CHART BEARISH BAT FORMATION IN 4 HR TIME FRAMEHI EVERYONE!

MY VIEW ON BANK NIFTY SELL DUE TO BEARISH BAT PATTERN FORMATION IN 4 HR TIME FRAME

GO POSITION BANK NIFTY FUTURES SELL ORELSE BANK NIFTY MONTHLY EXPIRY ATM PE OPTION STRIKE PRICE BUY

TARGET 1-28800

TARGET 2-27700

THANK YOU!

KEEP SUPPORTING!!

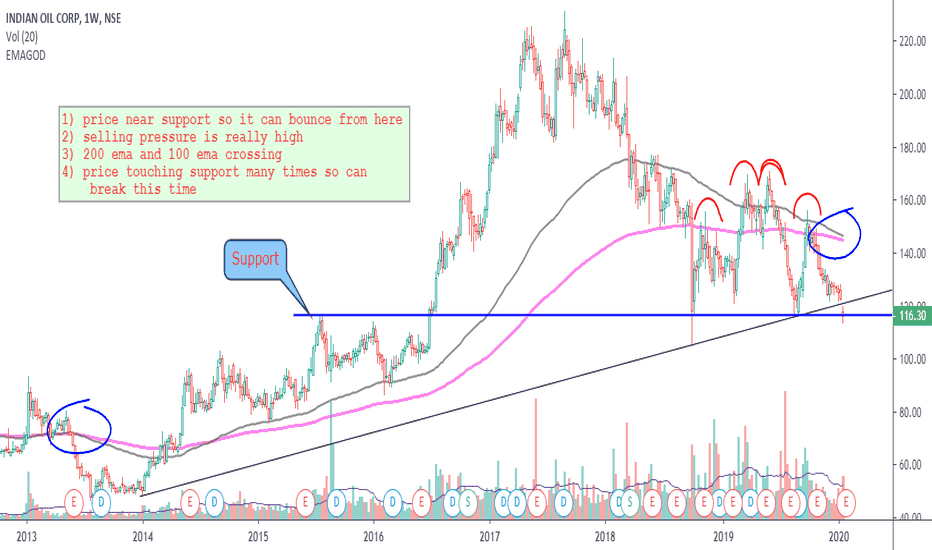

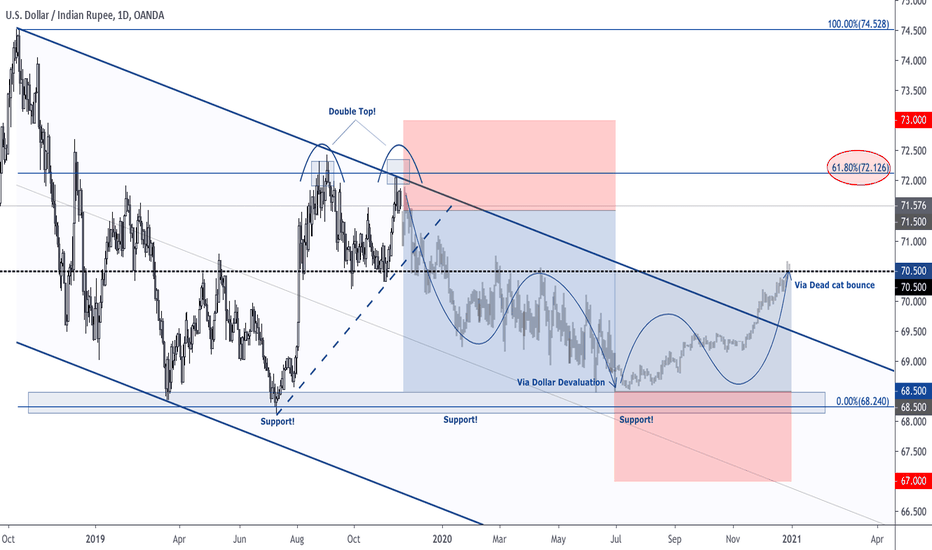

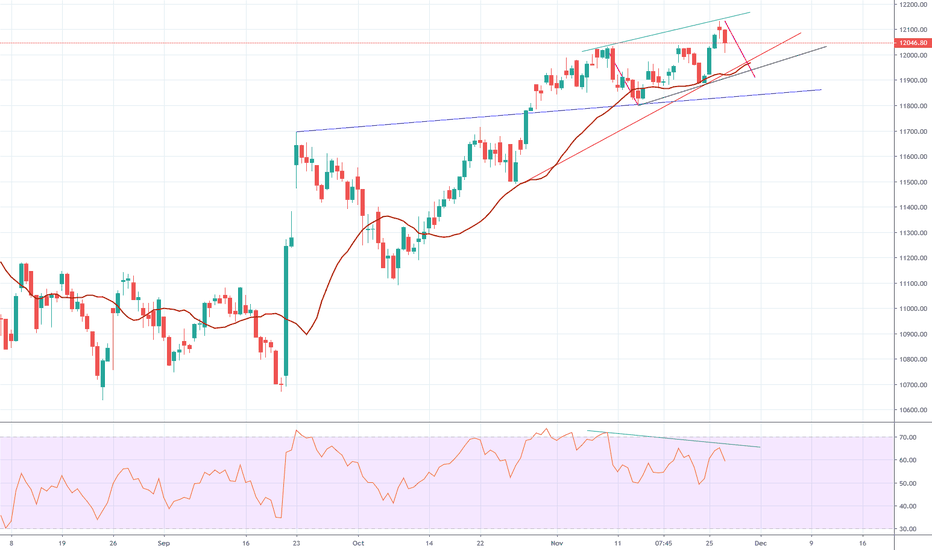

Large Swing In Play For USDINR in 2020Here we are tracking the 2020 macro map for USDINR, a high yielding EM currency. The expansion in volatility here will come from CB coordination, and being short USDINR which generally would also support a view for better risk appetite means it acts a great portfolio hedge for those looking for high carry.

On the INR side, macro figures are starting to indicate further upside although still stuck in low gears. The tax cuts from the fiscal side doing some of the heavy lifting thanks to Modi (India's version of Trump). Inflation is subdue with a lot more slack left in the labour market and a cheap commodity board.

Should investors see the deficit handled appropriately then all boxes are checked for capital flows into India. Demand for INR looks set to improve and combined with the USD devaluation theme it makes a great few months for INR to see some appreciation.

Risks to my thesis come from US-China protectionism, private capex not picking up (low odds after the attractive tax cuts) and to a lesser extent if RBI push the INR down by accumulating.

ZIL/BTC Small BreakoutThere’s a small breakout in ZIL. The retest of support is around 84-86 Sats. If ZIL were to breach the wedge then it would be a sell, but we are in anticipation of a bounce in this support range instead. Ideally we would like confirmation but for now it’s a Nuetral-Long

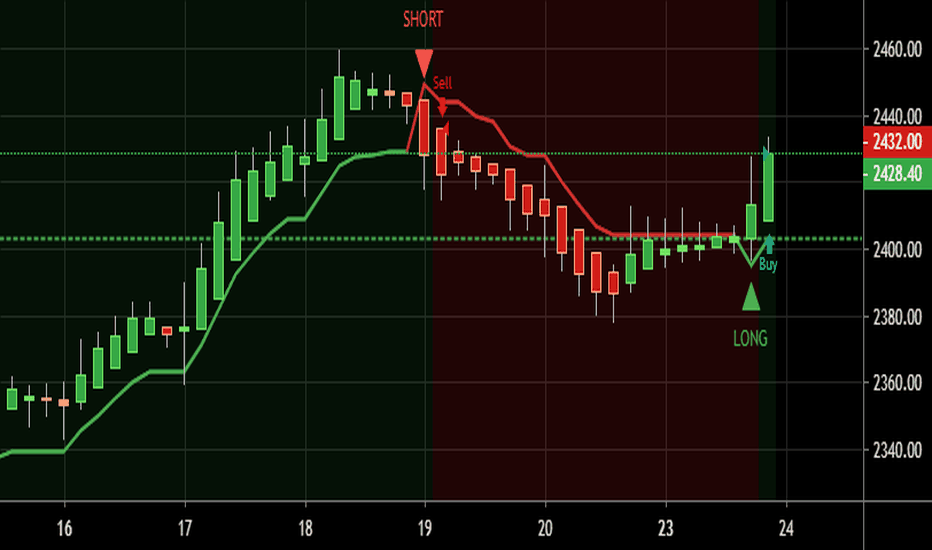

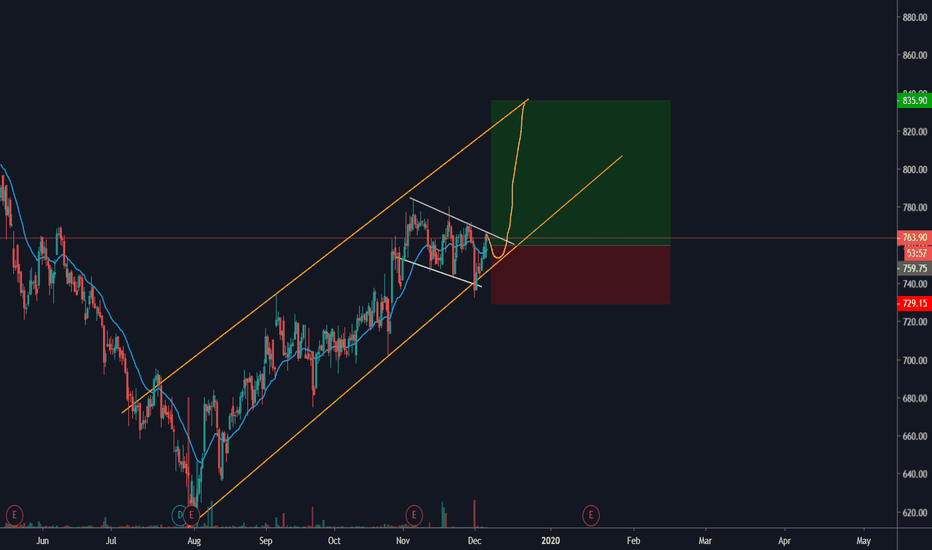

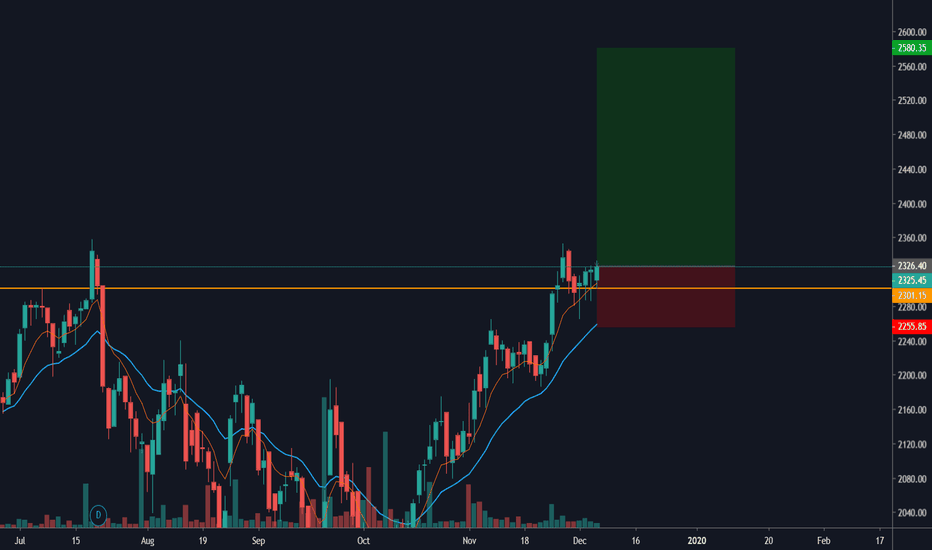

HDFC LONG MONTHLY LOOKS BULLISH HDFC LONG 1:4 TRADE

MONTHLY LOOKS BULLISH

DAILY IS CONSOLIDATING WELL

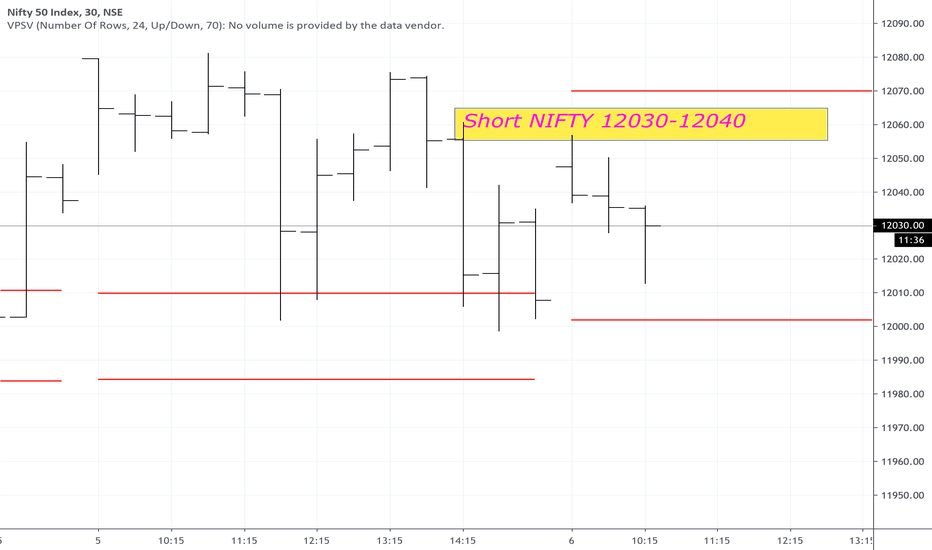

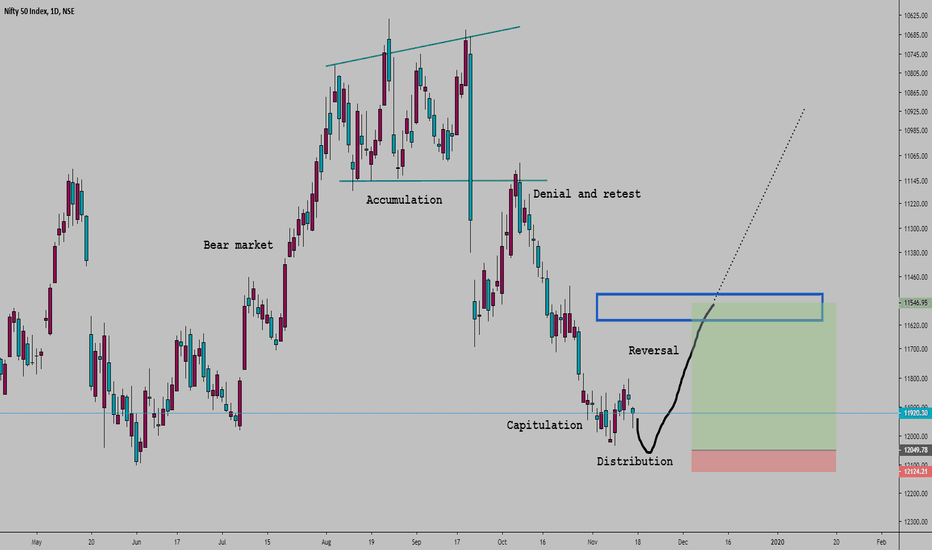

India is on the verge of collapsingFUD & HOPES all mixed up, not just changing every week now.

On a daily basis.

Different sources even say opposite things.

Trade war & HKG good or bad news on the same day.

No direction it's all coinflip.

India has a weaker rupee and a weak industrial output.

So a catalyst to reverse. There is enough FUD to sell.

Maybe US indices push it higher, I am long DJI.

If DJI pullsback Nifty should too and I'll get money there.

No call on the Nifty or India long term.

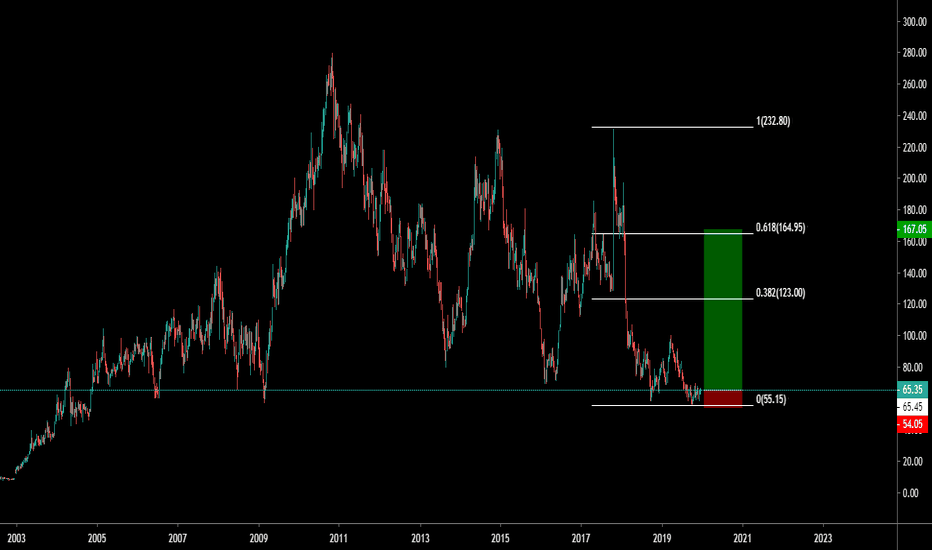

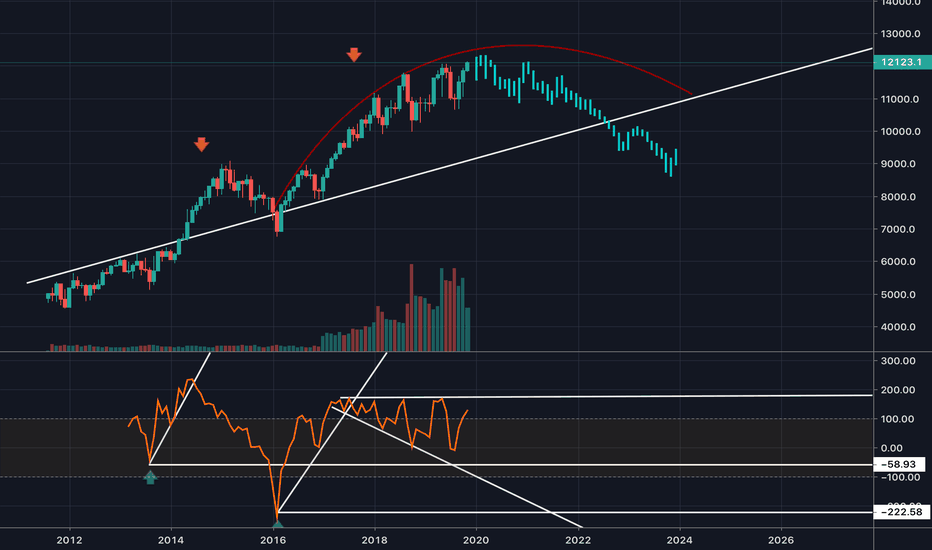

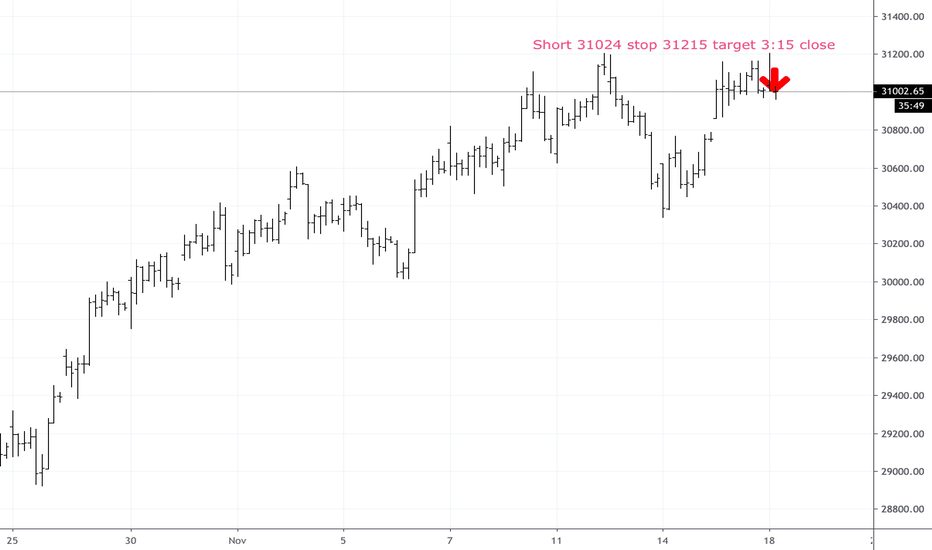

Indian stock market acting strong...The indian stock market index is at the brink of breaking out massively here, in this currency adjusted chart. If it manages to move over this trendline resistance it can confirm a quarterly timeframe trend pointing to a large advance in the coming 12 quarters, as shown on chart. Emerging market stocks become interesting with potential weakness in the dollar going forward, and rising oil prices. The big slump in energy prices certainly helps equities going forward, with a delated effect, as explained by @timwest in his publications, since transportation and energy are one of the key inputs of the economy.

I'd keep an eye on it and look for good valuation indian companies, if there's a breakout in this chart.

Cheers,

Ivan Labrie.