Berger paints to continue on the red streak!The stock seems to have fallen in an bearish impulsive wave between Sep-Oct 2023.

After this very fall the stock was in a complex triple three correction for almost 3 months.

The impulsive fall has been labeled as wave "A" and the stock has already begun the Wave "B" fall in the month of Jan.2024.

Wave "B" is projected going towards the INR 480 area.

580 will stand as a crucial resistance for the stock on the upside.

Indianstocks

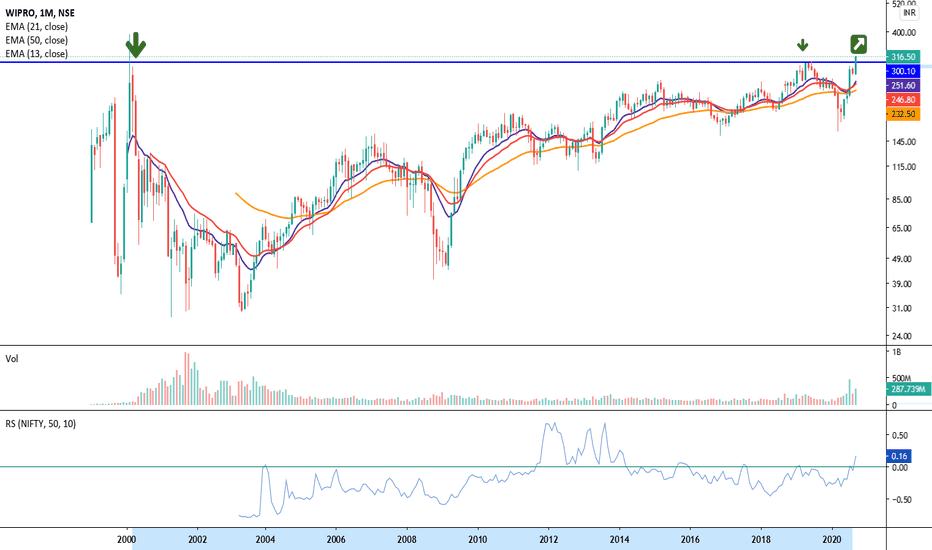

💎( NSE:Wipro) - Chart of the week > Decent volume

> Multi-year breakout

> IT flavour of the market

> Decent price action

>>> About the company<<<

> Wipro is one of the leading global IT, consulting and business process services company.

> It is the fourth largest Indian player in the global IT services industry, in terms of revenue, after Tata Consultancy Services (TCS), Infosys Limited (Infosys) and HCL Technologies Limited (HCL).

> Wipro was incorporated in 1945 as Western India Vegetables Product Limited and was predominantly a consumer care product manufacturer till 1980 after which it diversified into the IT services business.

> With effect from April 1, 2012 (FY2013), the company demerged its other divisions (consumer care and lighting, medical equipment and infrastructure

4engineering) into a separate company called Wipro Enterprises Limited (WEL), to enhance its focus and allow both businesses to pursue their individual growth strategies.

>Wipro’s operations can be broadly classified into IT Services, IT Products and India State Run Enterprise. Wipro derives most of its revenue from the IT Services segment (96.8% in FY2020) under which it provides IT and IT enabled services, which include digital strategy advisory, customer-centric design, technology consulting, IT consulting, custom application design, development, re-engineering and maintenance, systems integration, package implementation, cloud infrastructure services, analytics services, business process services, research and development and hardware and software design, to leading enterprises worldwide

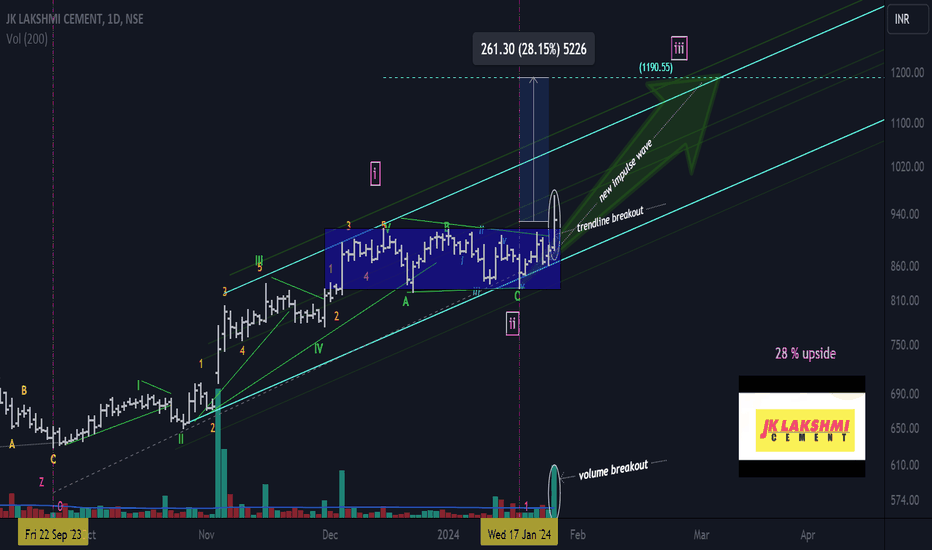

JKLAKSHMI can rise 25-30% from current levelsThis cement stock can be expected to move towards INR 1190 levels in wave iii of III.

The stock has been maintaining its impulsive counts without much violations and is in very bullish structure.

The stock was seen rising in a wave i of I from Sep-Dec 2023.

Wave ii was a very shallow "FLAT"(labeled ABC) achieving a mere 23.6% retracement of the impulse, which is a sign of strength.

The stock gained 5% on Thursday's session along with a 2month range breakout of price as well as a volume breakout. These signs add to the healthy uptrend continuing for the coming months as well in this stock making it a great pick in the cement space.

On the down 880 will be a crucial support to rely upon.

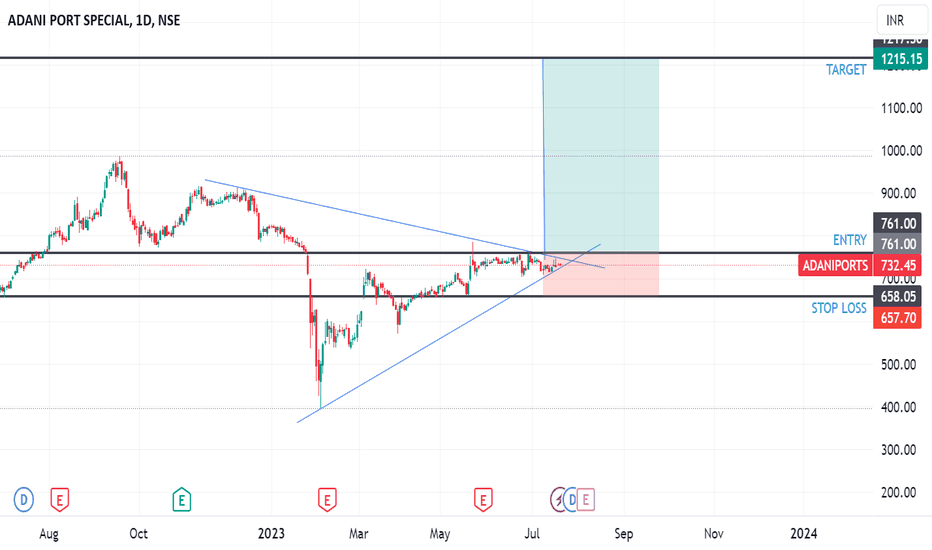

ADANI PORTS LONG TERM VIEWAdani Ports is forming a Symmetrical Triangle on Daily Time Frame

Entry is above 761.30

Stop Loss is at 657.05

Target is 1215

(Please note that entry & stop loss is on candle closing basis)

This View is purely based on Technical Analysis and is for educational purposes only.

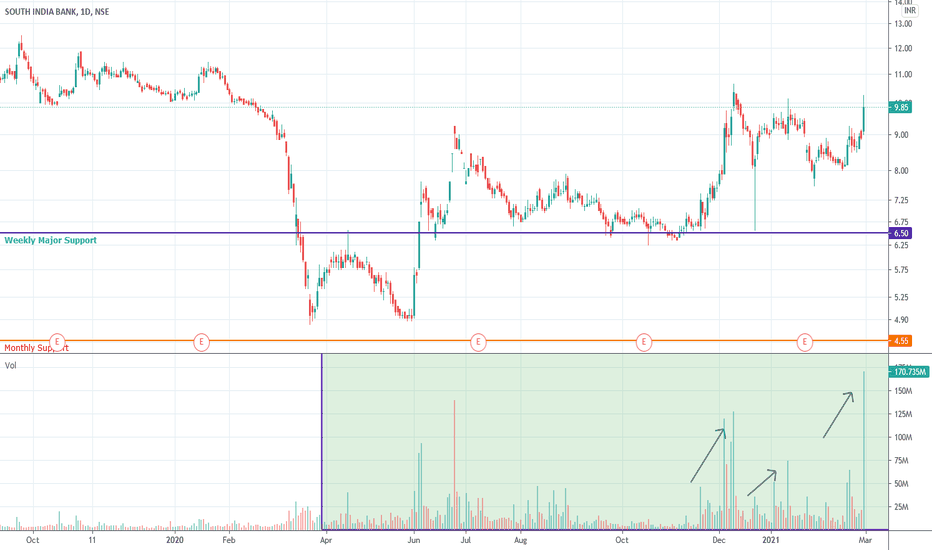

NSE: SOUTHBANK - Volume profile suggest strong players entering NSE:SOUTHBANK

South Indian Bank Limited is a major private sector bank headquartered at Thrissur in Kerala, India. South Indian Bank has 871 branches, 4 service branches, 53 extension counters and 20 Regional Offices spread across India. The bank has also set up more than 1,500 ATMs and 91 Cash Deposit Machines NSE:SOUTHBANK

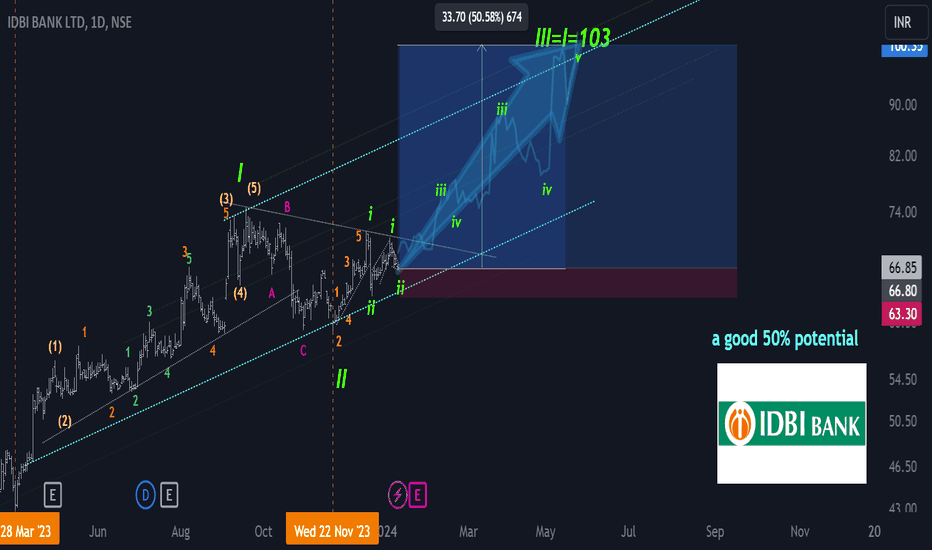

IDBI can give a good run from here.The stock was seen rising in an impulsive 'wave I' structure between March-Sep 2023.

Wave II happened between Sep-Nov and wave II managed to retrace 38.2% of wave I.

The stock since completing the wave II correction in Nov has displayed two impulsive waves making the labelling as I-II-i-ii-i-ii and hence creating room for many legs to unfold going down the months in 2024.

The bigger Wave III target is projected to be around INR 100 mark providing an upside potential of around 50% from CMP.

On the downside, INR 64 can be used as a 'SL'.

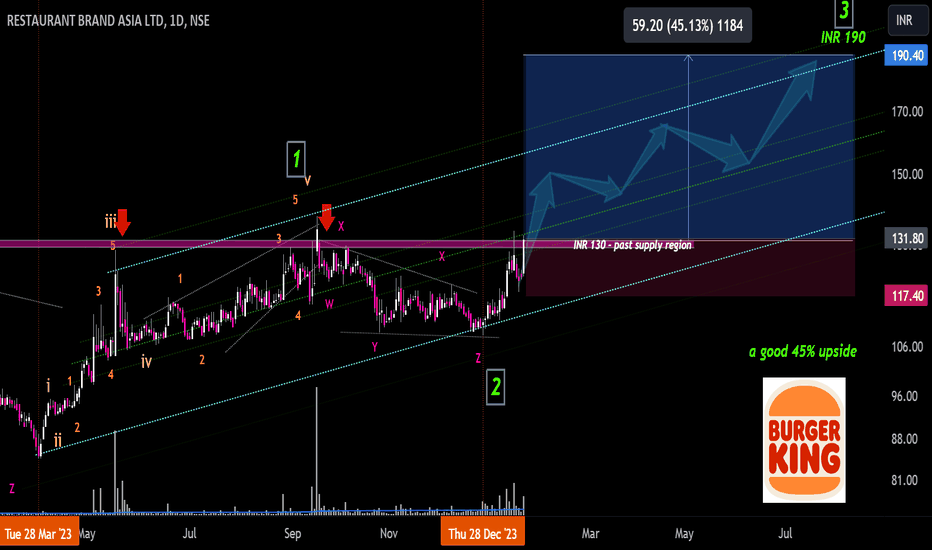

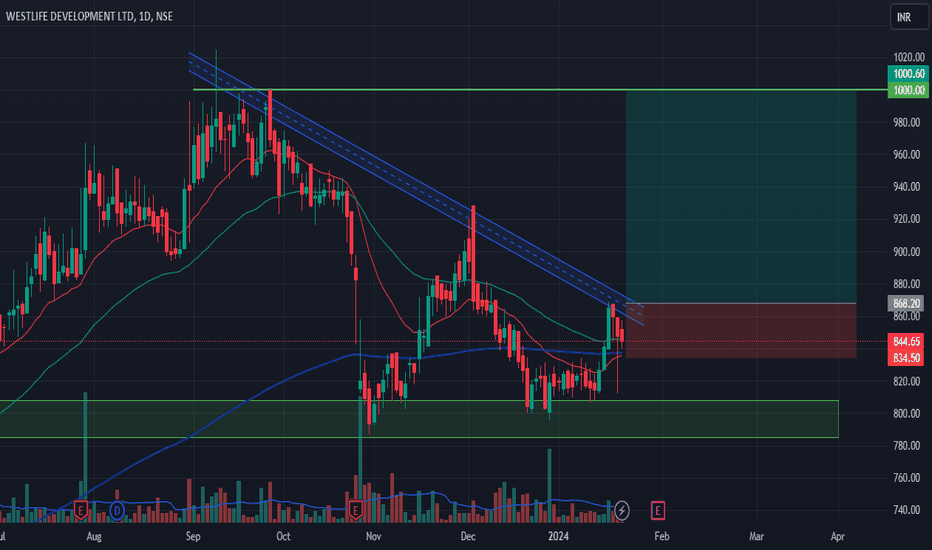

Good Setup spotted in Burger King India!"Restaurant Brands Asia Limited" earlier known as "Burger King India" is currently showing a good setup and an upside potential of 45% from CMP.

The stock had rallied nearly 60% between March-Sep 2023. This very rise was impulsive in nature and therefore labeled as wave 1 on the chart. Between Sep-Dec the stock went through a triple three correction(WXYXZ) and retraced nearly 50% of the impulse. This retracement was in fact was the wave 2.

The stock currently is in Wave 3 structure and could rally towards INR 190 mark.

On the downside the swing low of 118.1 becomes a crucial structural support for the stock and could be used as a "SL".

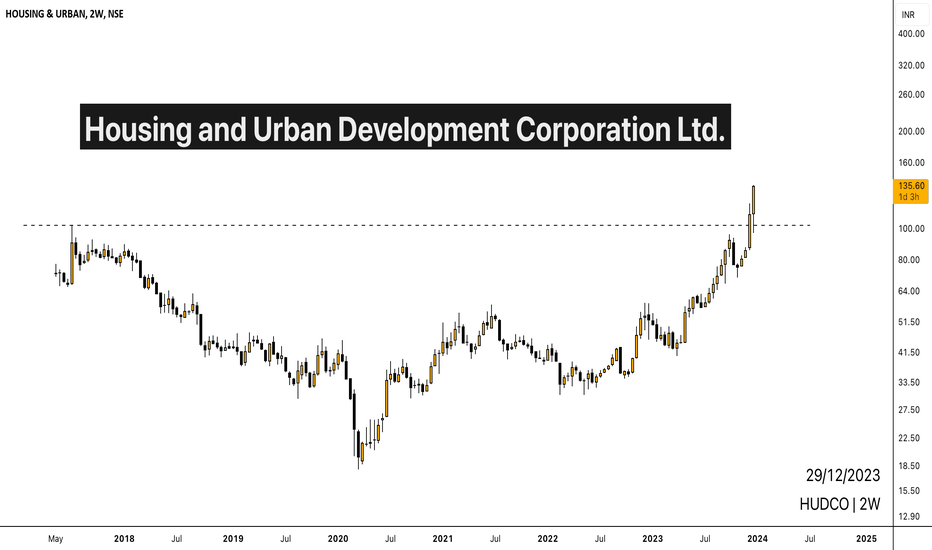

#HUDCO made a new ATH after more than 6 years Stock made a new ATH after more than 6 years and today Stock is up >19%.

Such stocks tend to go much higher.

Anyone looking for a long-term investment, then this can be a good stock to add to long-term portfolio.

If market gives a chance, can add to stock also at ₹100-₹110 levels.

Also, this stock has been consistently giving dividends as well.

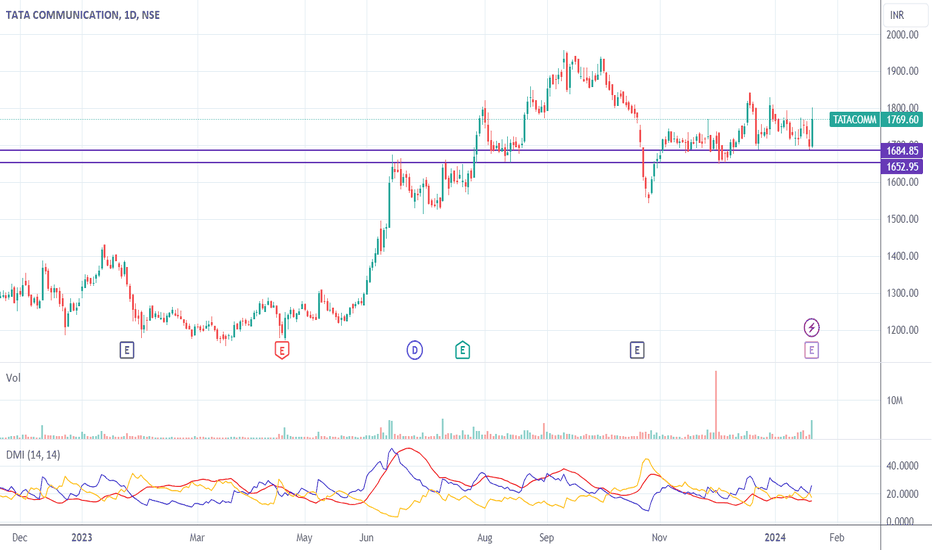

Tata Comm to move like OFSS?Tata Communications has posted fast revenue growth in the latest earnings release. OFSS moved up 28% in a single day after stellar results.

Tata Communications has consolidated in this range for a while and looks good to move up from here if it crosses today's high price. DMI also looks bullish

Entry - Above 1800

Stop Loss - 1680

Target - 1960

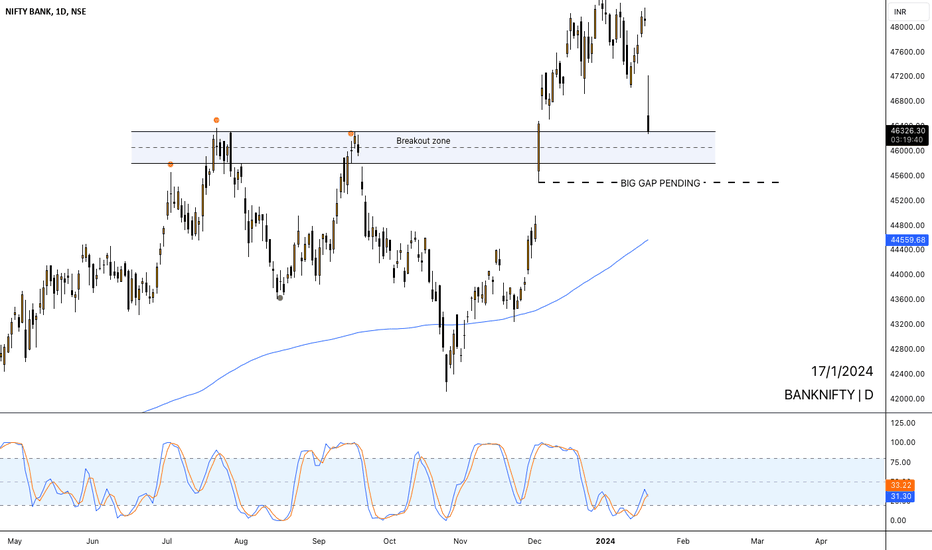

#Banknifty Higher timeframe Major update#Banknifty

Higher timeframe Update

There are 2 zones that I am eyeing for potential botton.

1) 45800-46300: This is a breakout zone and Banknifty has already tapped it. We can see some consolidation in this zone before any major move either side.

2) 44950-45490: Big gap pending zone. Market rarely leaves such gaps/ inefficiencies open. If this is mitigated, it would be very bullish overall for Banknifty.

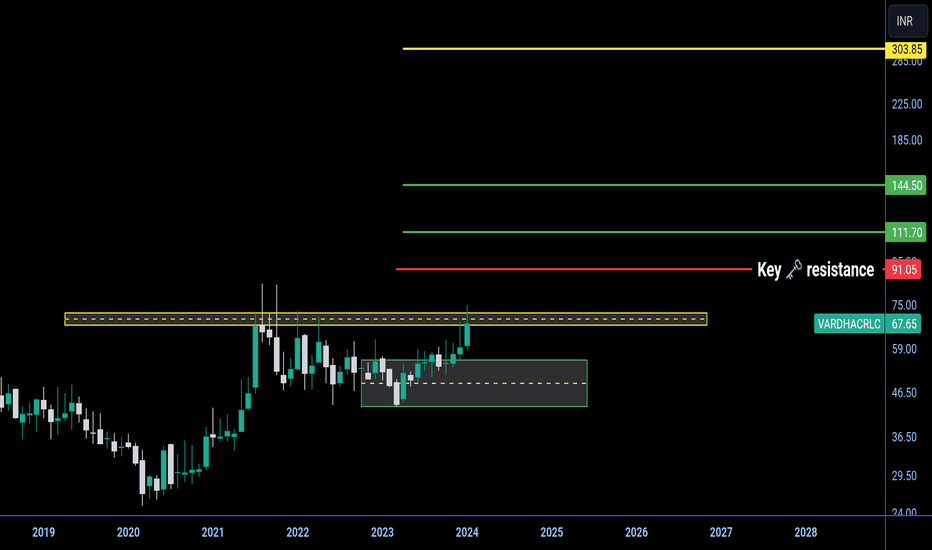

Vardhman Acrylics Ltd :-: analysis ⏰ VARDHACRLC📌 DYOR ( do your own research 🔎 ) 📍 NFA

Above yellow 🟡 close 📌 beginning of upward ⬆️ momentum

It's small cap stock with high :-: promoters / with good dividend 📌

₹92 is key resistance 📌 we see some pressure :-: above it ☑️ never visit box below yellow 🟡

🎯 ₹111

🎯 ₹144

🎯 ₹300

Below green 💚 box 📍 danger ⚡

Just save my idea 💡 follow and give boosting 🚀 and pls share 🤝

Follow upcoming updates ..... 🧵 👇

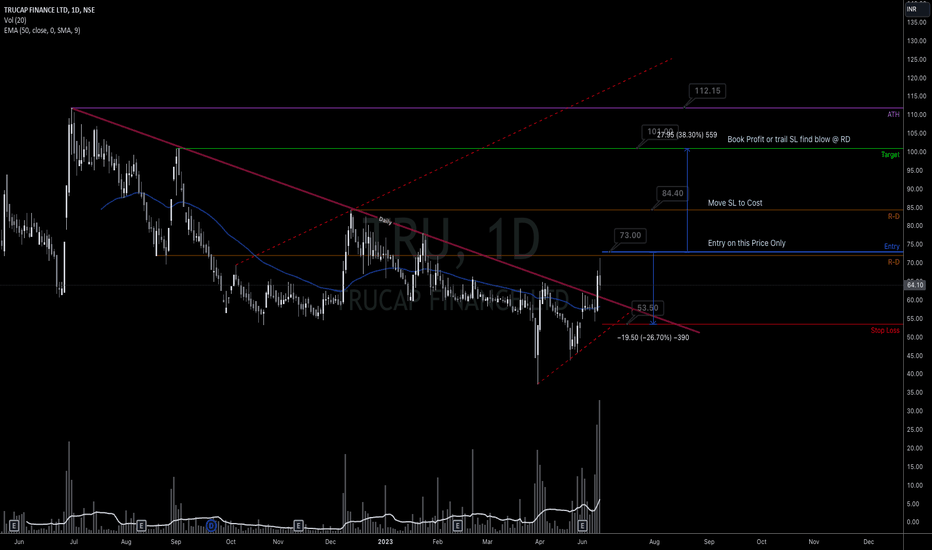

Swing Trade : TRUCAP FINANCEBased on the observation I've shared, Let's break down the chart says :

Trend Line: I noticed that there is a one-year-long trend line that was pierced on the 28th of June. This indicates that the price broke above the trend line, which can be interpreted as a bullish signal.

Higher Highs: I observed that the price has been forming higher highs from the previous swing low. This pattern of higher highs signifies a short-term bullish trend, indicating that buyers are currently in control.

Volumes: The volumes traded in the market seem to confirm the presence of strong participants. Higher volumes usually indicate increased activity and interest from traders and investors, further supporting the bullish case.

Rejection on Daily Horizontal Level (RD): It seems that the price encountered rejection at a daily horizontal level, suggesting the presence of resistance at that level. This rejection implies that there are sellers who are pushing the price down.

Considering these observations, it appears that there are both bullish and bearish factors influencing the market. Aggressive buyers may consider entering on a price dip if they believe the bullish trend will continue. Alternatively, some market participants may choose to wait for the price to breach the current high level for confirmation before entering.

Please remember that the information provided is solely for educational purposes and should not be construed as financial advice. It is always prudent to consult with a professional or financial advisor before making any financial decisions.

For educational purposes only. Not financial advice. Consult a professional before making financial decisions. #Disclaimer

#NiVYAMi

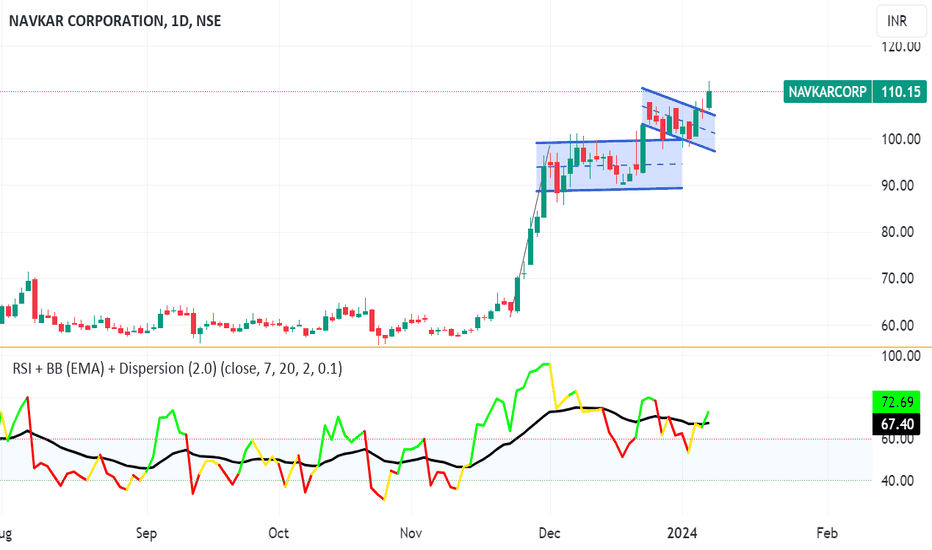

NAVKAR CORP - SWING TRADE IDEA - 15-20% ROI.Stock is in uptrend in all the Higher time frames, bullish flag breakout and consolidation and then BO is seen.

The stock is poised for an up move of 15% from current market price.

One may consider entry at CMP - 110 , target supply zones at 121, 125, 133, 137 zones.

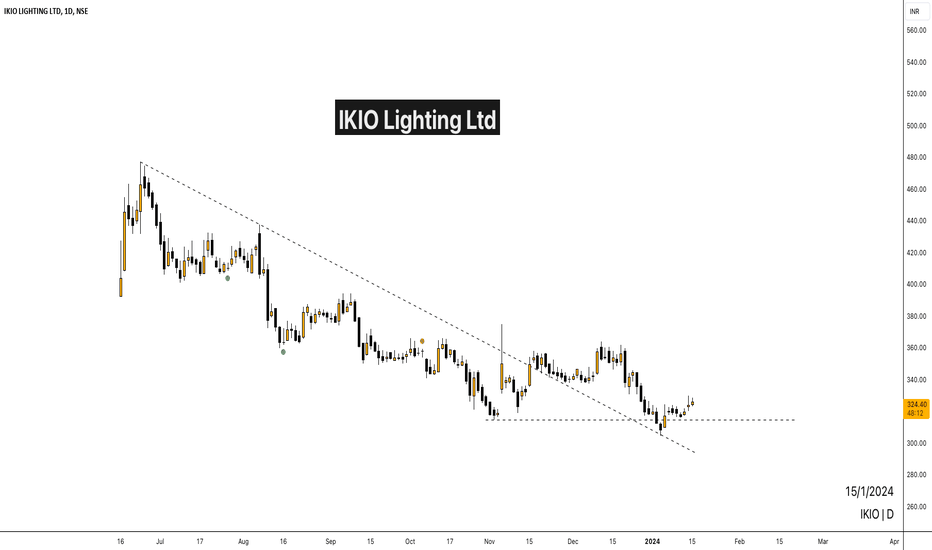

#IKIO - Base formation happening#IKIO

Bought some IKIO Lightings Ltd shares @₹324.15/-

Stock available at a discount of >17% from stock listing price in Jun’23

Small-Cap Company has good fundamentals; can give good returns.

I would be worried only if stock breaks recent lows, else relaxed on this one.

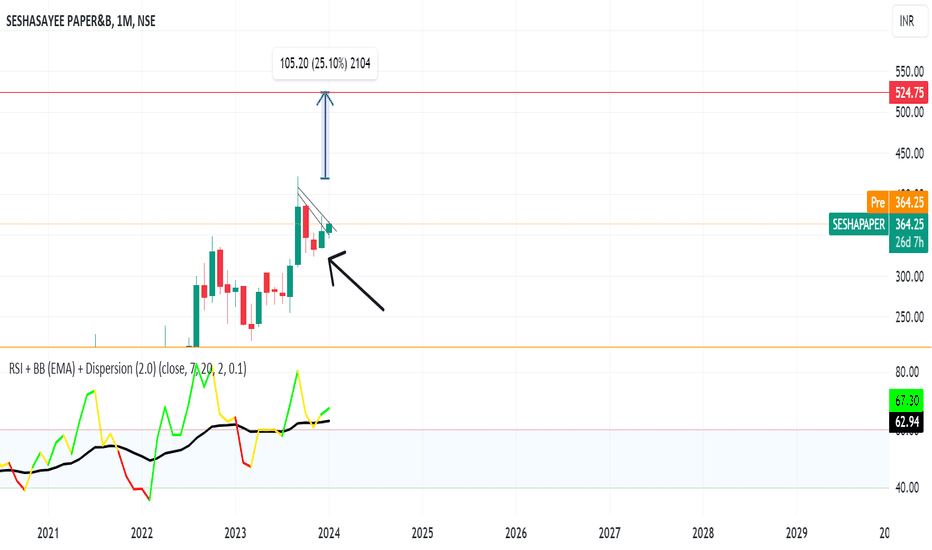

Seshasayee Paper Board - Short Term Idea, 25-30% ROI.The stock is in strong uptrend in all larger time frames. Poised for a daily breakout - part of Monthly reversal.

Monthly - Strong buying candle seen in September, which could not be defeated by sellers in Oct and Nov and Dec shows a hammer, which is a sign of reversal. All being inside candles.

One can enter at current market price and hold for target of 530 in the short term.

For swing immediate 10% upside is seen, target at 415-420.