Inducement

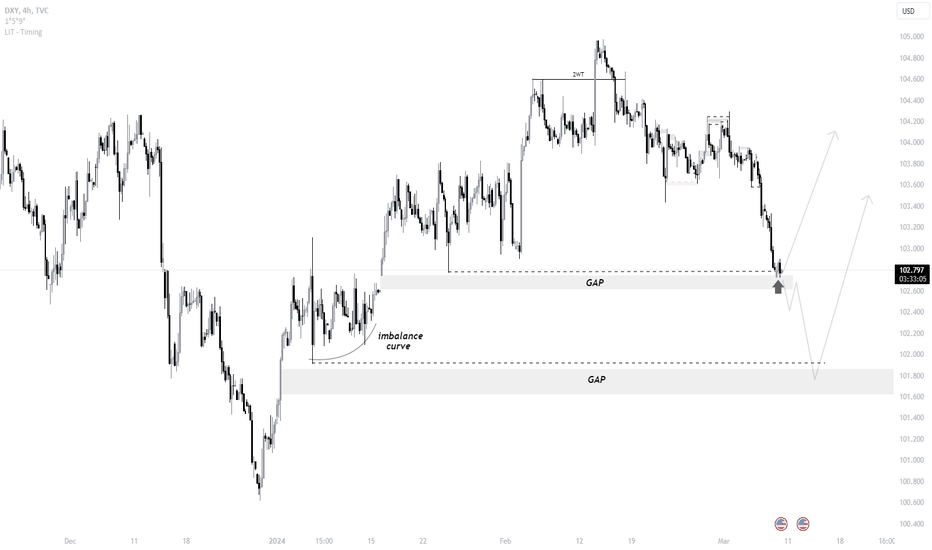

DXY OUTLOOK | 4hIn this case the gaps can be used as Demand. There was a medium inducement and there's a possibility it know starts going up but there is also an imbalance curve with a gap under which could get filled with the news. Keep that into consideration.

What do you think about DXY?

Write in comments

LQP = Liquidity Pool

2WT = 2 Way Trap

Arrows = Inducements

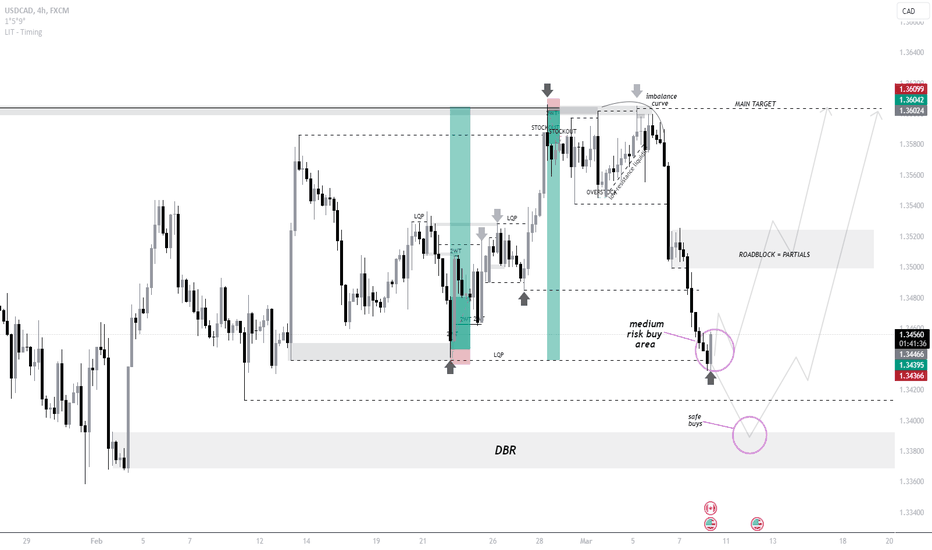

USDCAD OUTLOOK | 4hThe first buy area is medium safe because there was no major inducement.

The second one would be after a major inducement + HTF POI mitigation.

Take also into consideration what DXY does.

What do you think? Write in the comments.

LQP = liquidity pool

DBR = Drop Base Rally Demand Zone

Arrows = Inducements

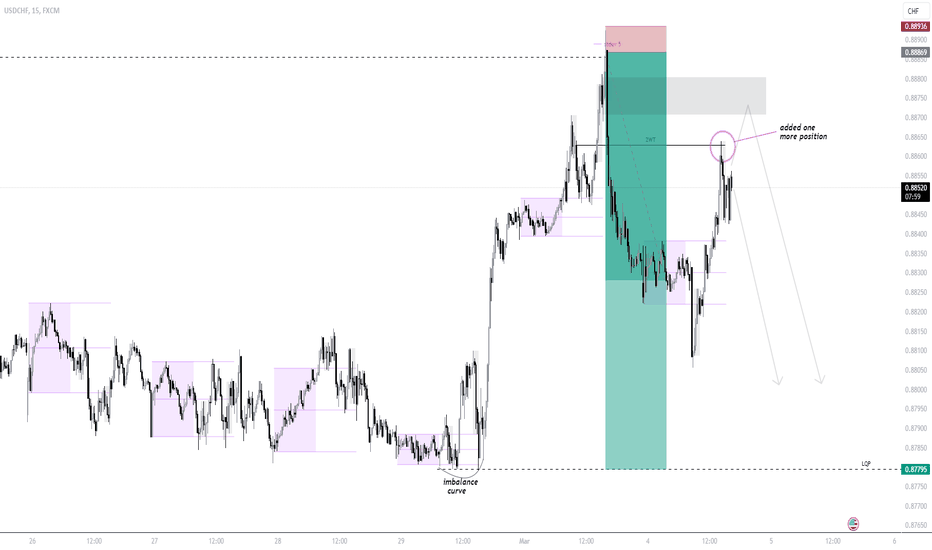

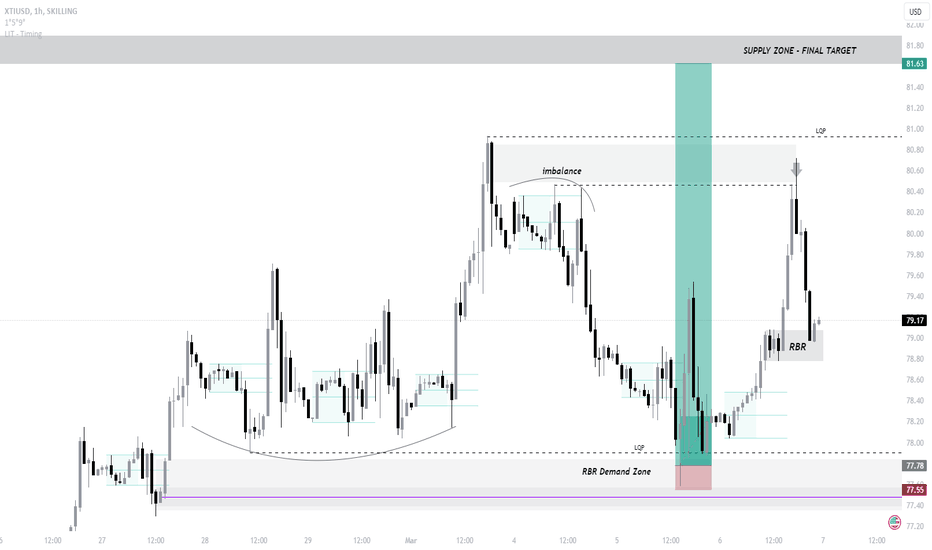

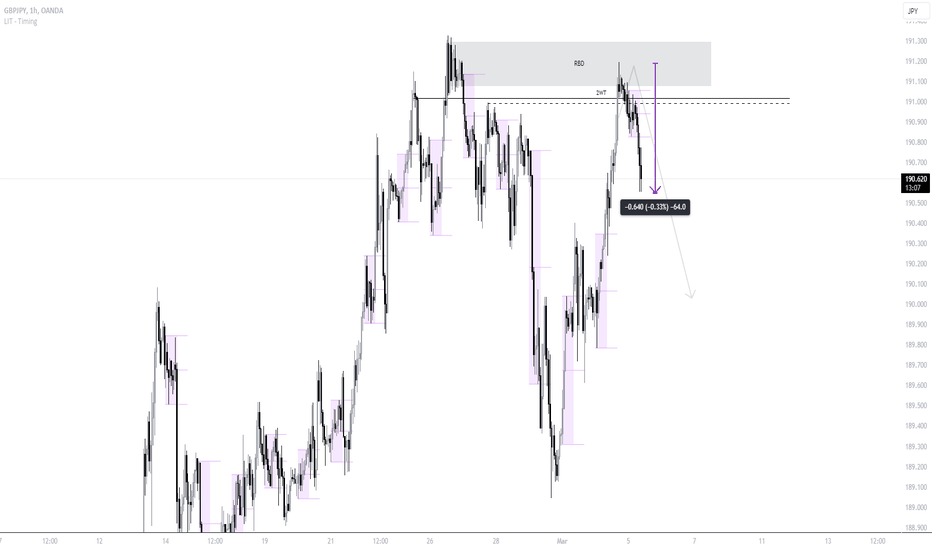

USDCHF OUTLOOK| 4HMy full target has been hit.

The buy area is medium safe because even though most of my criteria has been met there was no major inducement. You can look for longs there but not blindly buy.

In case the DBR gets exceeded you can pretty safely sell at that are after retracing.

What do you think?

DBR = Drop Base Rally Demand Zone

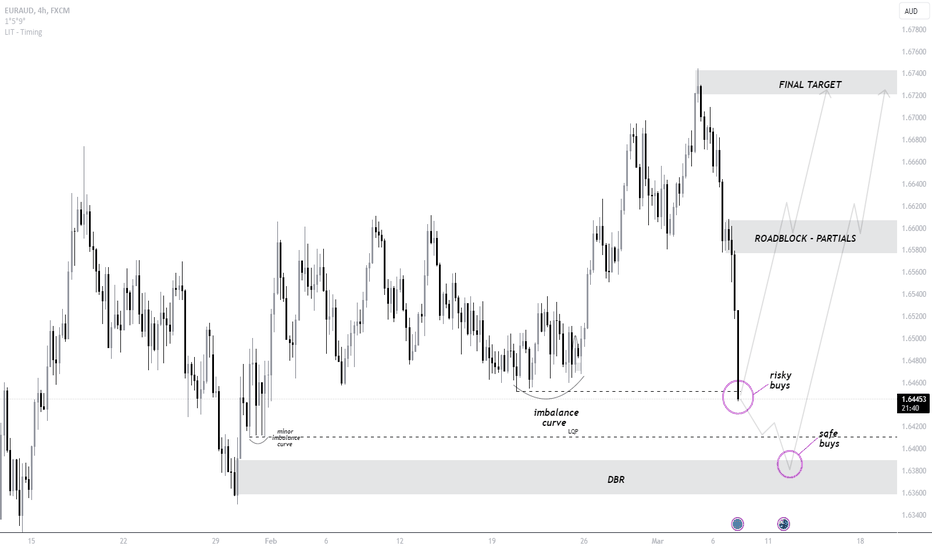

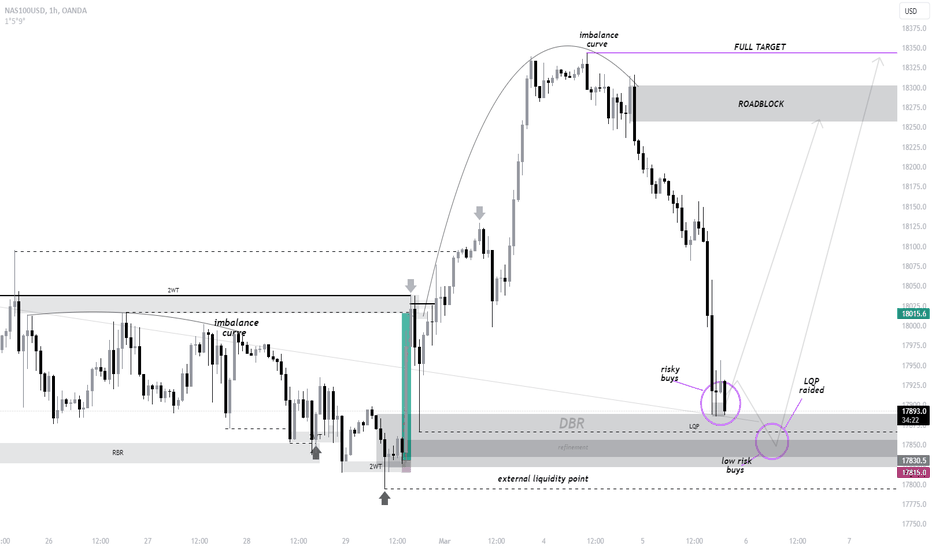

EURAUD OUTLOOK & TRADE IDEA | 4HRisky buys, although there was already a lot of liquidity and orders taken there might be some imbalance left. (minor imbalance - left bottom corner). There was no major POI to be mitigated under the imbalance. The safer option is buying in the 4H DBR.

What do you think?

LQP = Liquidity Pool

DBR = Drop Base Rally Demand Zone

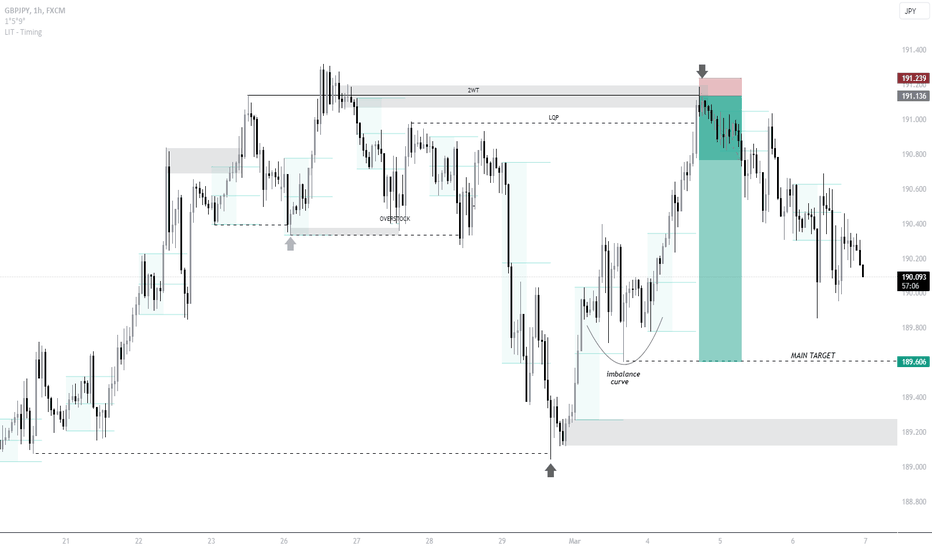

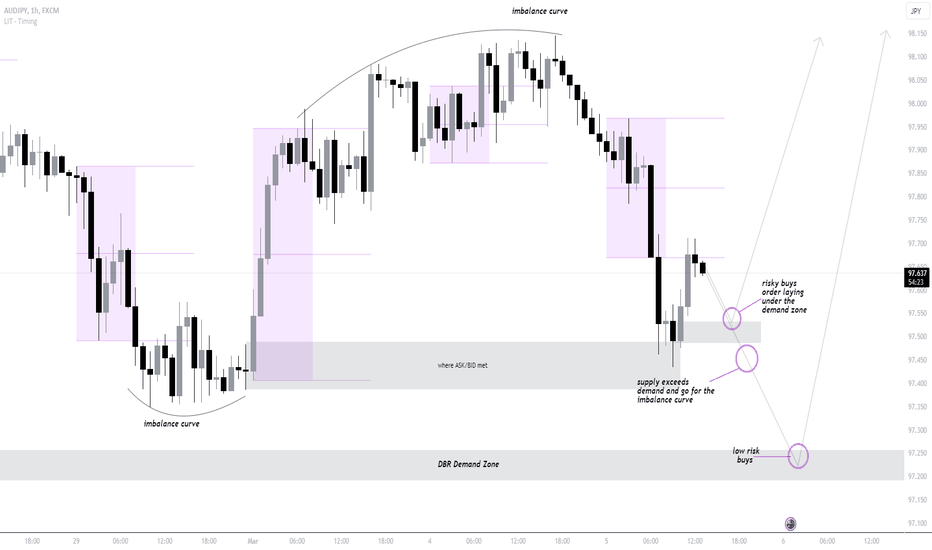

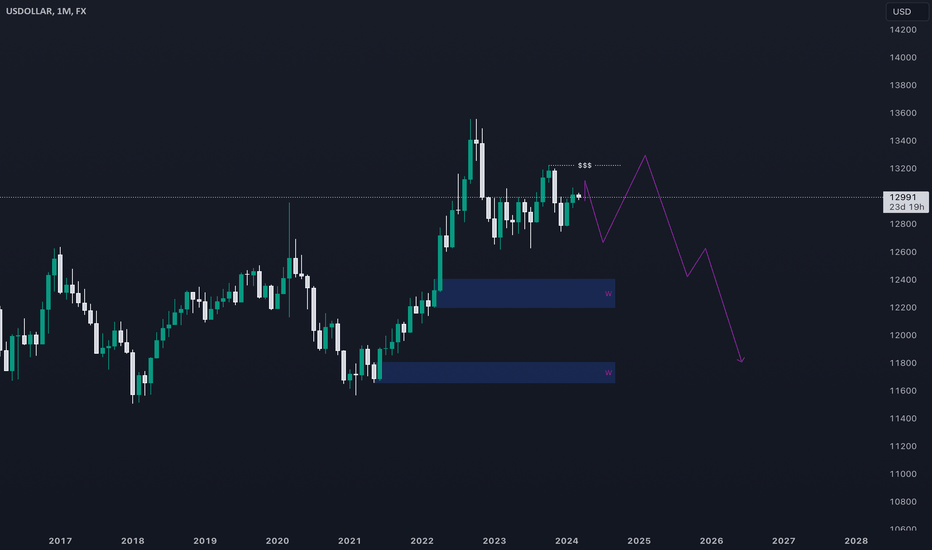

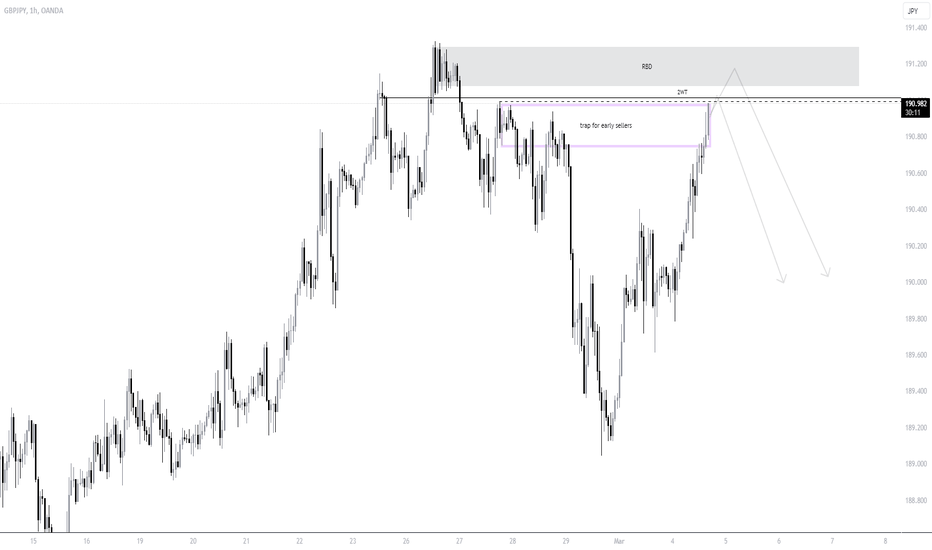

GBPJPY OUTLOOK & TRADE IDEA | 30mMedium risk buys in this area. Why medium risk? There was no inducement. There might be enough demand tho and it's a pretty good are to look for buys.

Scenario 2 - in case that supply exceeds demand (S>D) you can pretty safely look for sells off the DBR demand area.

What do you think? Comment below.

LQP = Liquidity Pool

DBR = Drop Base Rally demand zone

2WT = 2 Way Trap

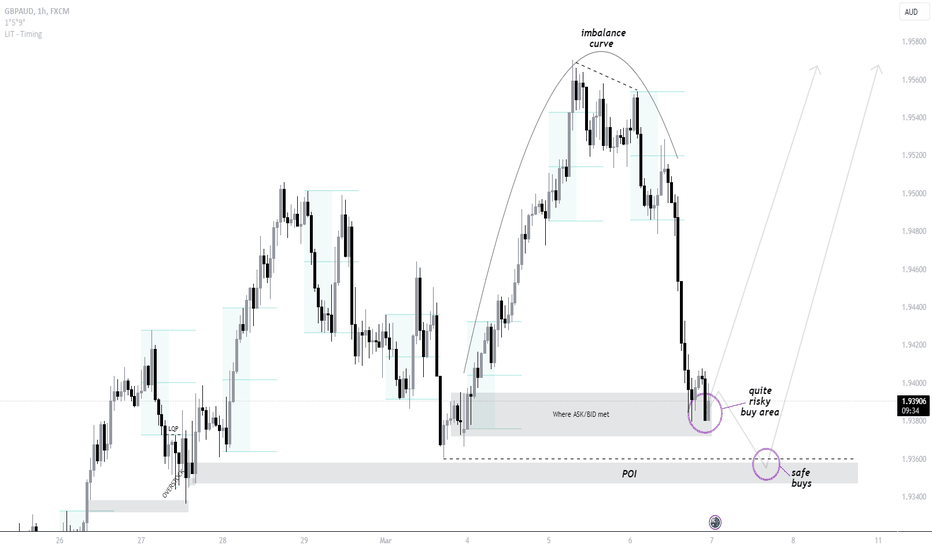

GBPAUD OUTLOOK & TRADE IDEA | 1h The first buy are is quite risky because there was no major inducement but it's still a pretty valid area to look for some buys.

The second one would be pretty safe because excluding the overextenstion there would also be a major inducement.

The target would be the low resistance liquidity are which is also a imbalance curve.

Share your view in the comments!

EURUSD 1H OUTLOOK AND TRADE UPDATEMy trades hit full TP. Now I'm bearish, started to scale shorts. I have multiple reasons to be bearish but I don't predict - I react. I accept whatever market gives me. Let's see how it goes.

2WT = 2 Way Trap

LQP = Liquidity Pool

Arrows = Inducements (Minor, Medium, Major different colors)

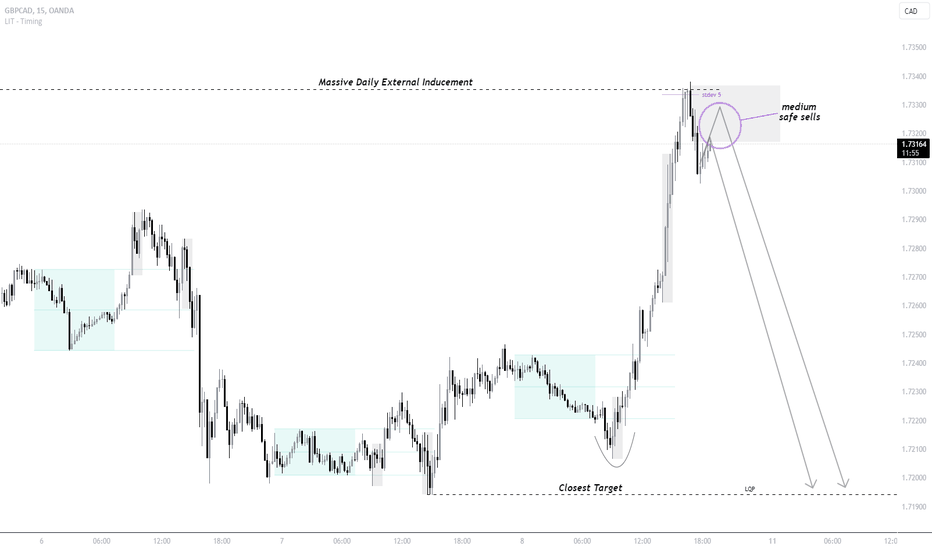

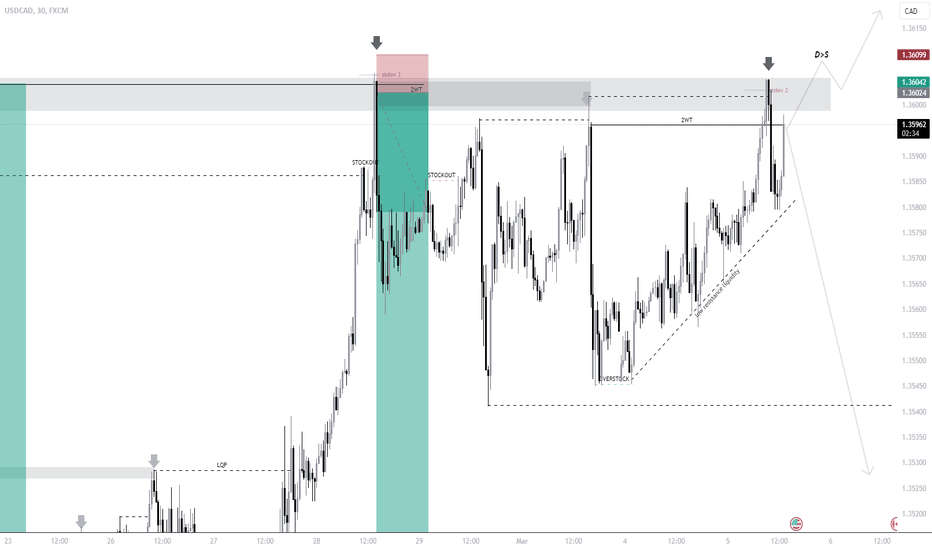

USDCAD low term view | 30mUSDCAD looks still like it accumulating for selling but with the current price action everything can happen.

Two scenarios in my head. First one that is less probable is - demand exceeds supply and continues going up. Second one is that the price will be trading away the external inducement to the OVERSTOCK and liquidity areas.

What do you think?

2WT = 2 Way Trap

D>S = Demand exceeds Supply

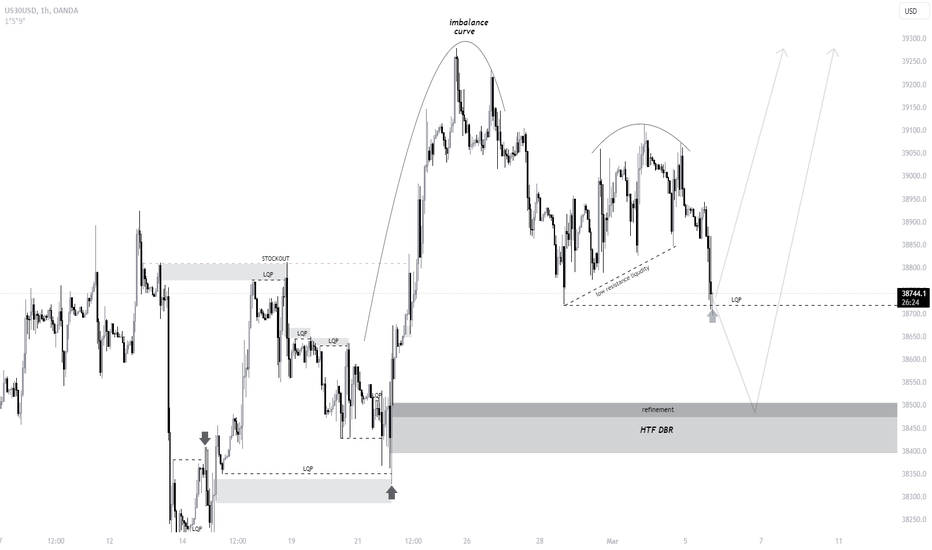

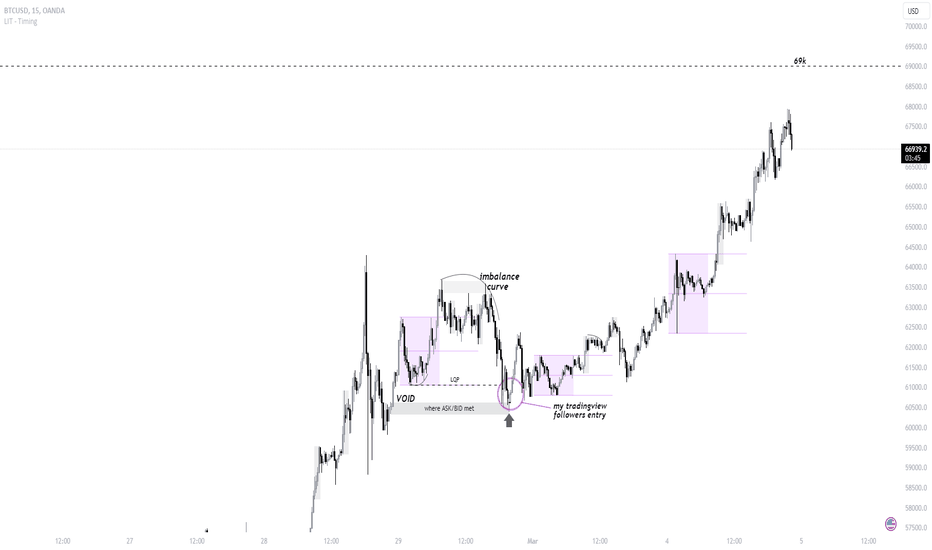

BTCUSD short term view | m15BTCUSD presented the resistance manipulation module. I don't think it will just start dropping out of nowhere because I assume a lot of people started getting into shorts. I think it will either take the early sellers out first and drop or just continue going up.

What do you think?

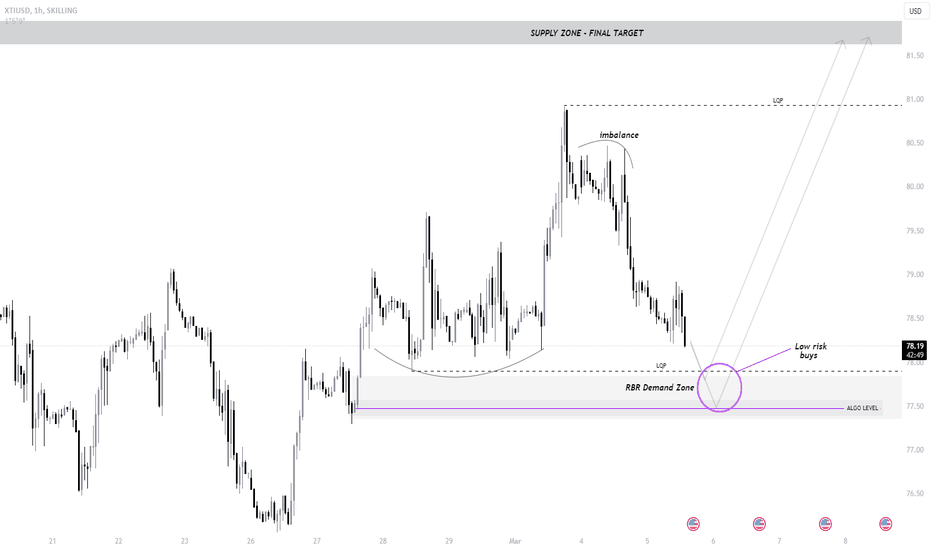

USDOLLAR, Monthly viewHello everyone, this is my overall analysis of USDOLLAR. I believe we will have a high in order to take the inducement, and then we will see a long term drop up to the extreme order block. This view is my base idea for the lower timeframes and other major pairs. I will publish W, D, 4H, 1H and 15min as well as major and important pairs. This is my first main analysis. I will also include Gold, Bitcoin , Etherium. Let’s see how much money we can make from trading.

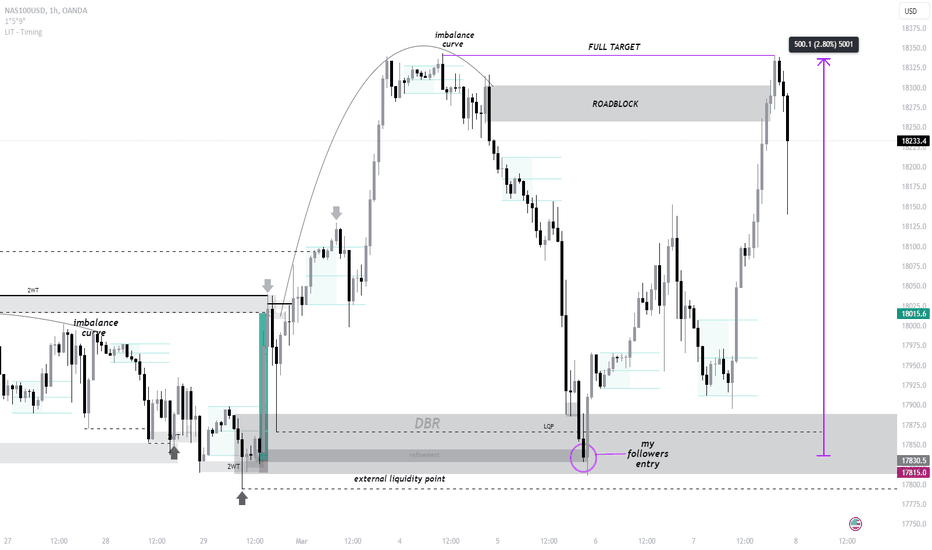

BTCUSD TRADE UPDATE | FULL TP HIT We hit full target :)

From a psychological perspective people are most likely trying to catch the top of the BTC bullish movements which often leads to more movements to the other side that all the people are expecting.

After 69K I might look at shorts but for now only bullish.

What do you think about bitcoin?