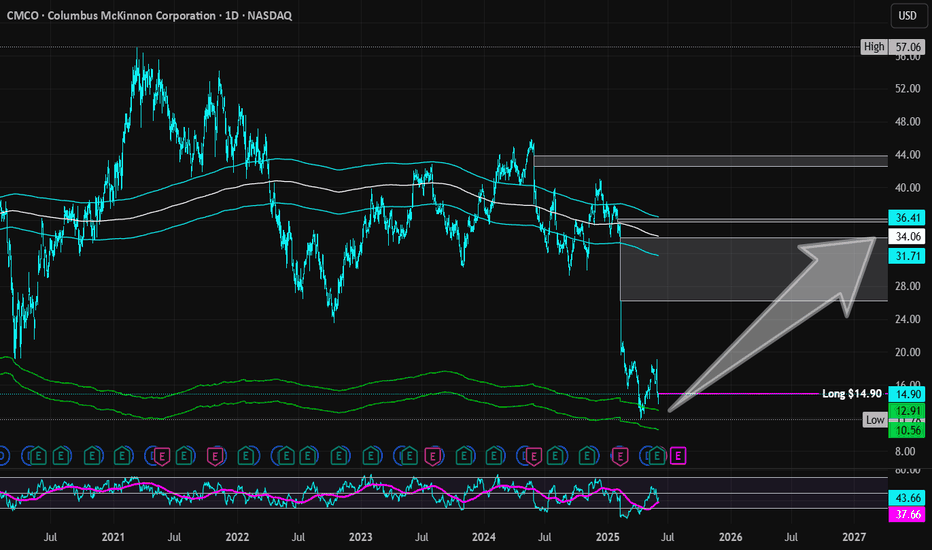

Columbus McKinnon Corp | CMCO | Long at $14.90Columbus McKinnon Corp NASDAQ:CMCO is a stock that is highly cyclical, moving in "boom and bust" cycles every 3-5 years. As indicated by its entry into my "crash" simple moving average area (currently between $11 and $13), it may be nearing the end of its bust cycle (time will tell). With a book value at $31, debt-to-equity of 0.6x (healthy), quick ratio over 1 (healthy), insiders buying over $1 million in the past 6 months, a 2% dividend yield, and earning forecast to grow after 2025, NASDAQ:CMCO may be a hidden gem for double-digit returns in the coming years. But every investment is a risk.

Thus, at $14.90, NASDAQ:CMCO is in a personal buy zone.

Targets:

$25.00 (+67.8%)

$30.00 (+101.3%)

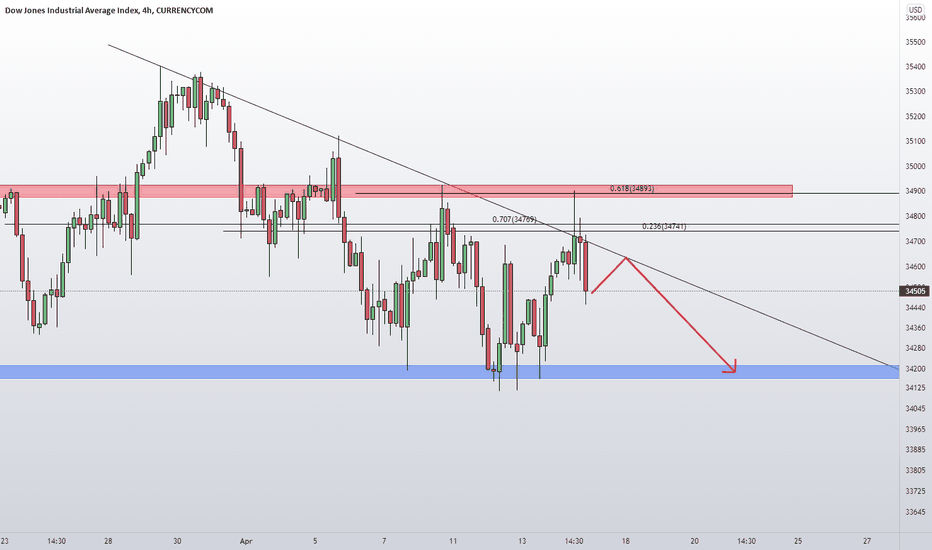

Industrialindex

US30HEY GUYS what do you think about DowJones ? Many reasons, including the Federal Reserve's actions, reduce the balance sheet, rising interest rates and declining corporate earnings can cause the industrial index to fall.

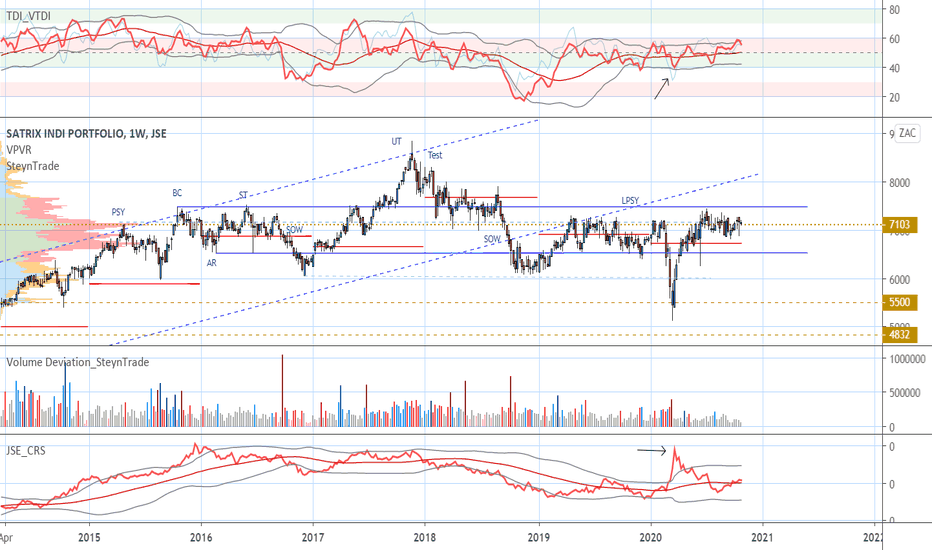

JSE Industrial Index: Still in Long-term Range

The JSE Industrial Index ( J211 ) has been in a trading range since 2016 and has broken the upward trend in the process. The covid drop interestingly was not backed by volume as seen by the lack of movement in the volume RSI and low volume spike. Price has recovered back into the trading range but has shown little enthusiasm to break out. The bounce has been on low volume . The covid drop also showed relative strength compared to the overall JSE. It seems as if the range-bound conditions may continue and we will have to wait for volume to return to see if this can be broken. For now, we are stuck around 70000 ( J211 ). With the low volume there does not seem to be many opportunities in the underlying stock right now.