What if you have infosys in your portfolio? Many of you must be having Infosys in your portfolio. Even I have it. There is a short term pain for all of you but here is some data that can help you in making your decision. I will be holding it but it is not necessary that you should do the same.

Is the long term story in the company intact?

Ans: Yes.

Why will I be holding majority of my Infosys share?

Because it is a premier Indian IT services company. For me the growth has diluted but not the story. Secondly my entry point is quiet low. Infosys, TCS and Reliance in the reverse order where the first shares that I bought in my account. There is chance of recession in West and IT sector may get affected due to it as a whole. Off late I am not very very happy with some Management moves by Infosys at a deep level. I feel that TCS and LTIM and few other IT firms like Tech Mahindra and HCL Tech may out pace Infosys in a short run. But Infosys is too big an organization and can definitely surprise us by giving a great result next quarter or after next one or Two Quarters.

I have expressed my opinion. You can take a call based on your judgement.

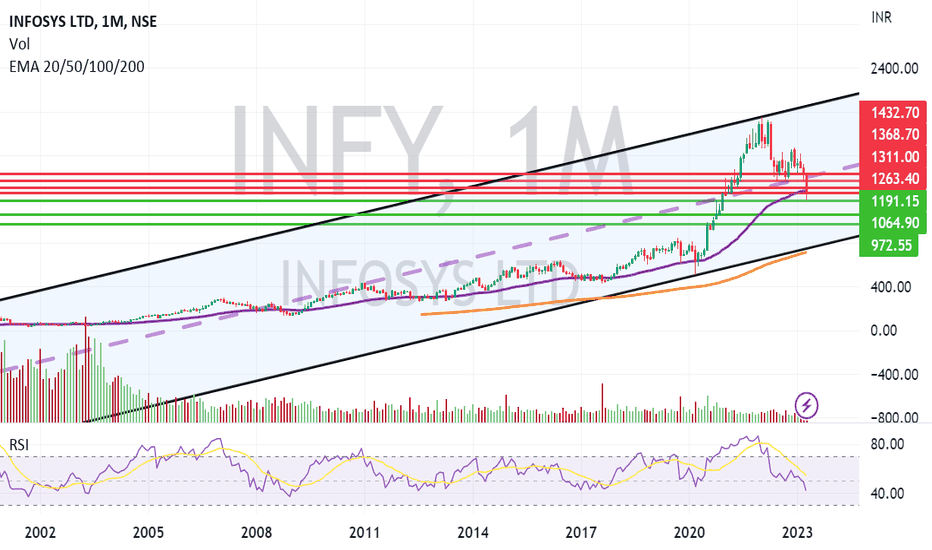

The Chart covers almost 25 year channel of Infosys.

Support levels are: 1191, 1064 and 972.

Resistance levels: 1263, 1311, 1368 and finally 1432.