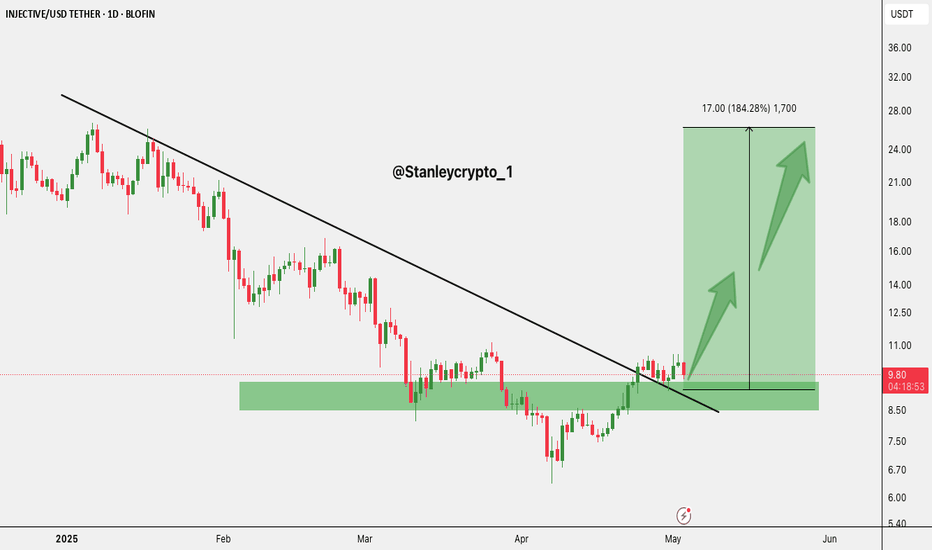

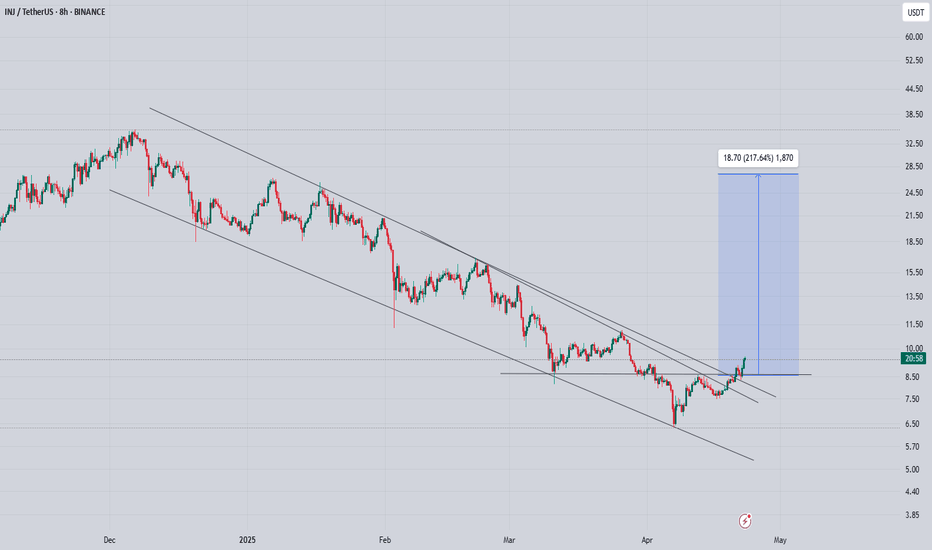

$INJ Breakout Alert!CRYPTOCAP:INJ breakout alert!

-It finally broke above the downtrend line after months of

consolidation.

-Retest and holding the key support zone around $8.50–

$9.00.

-Now, we are aiming for the next leg toward $26, a

Potential 184% move.

-Trend shift confirmed. Watch closely!🚀

DYRO, NFA

INJUSDT

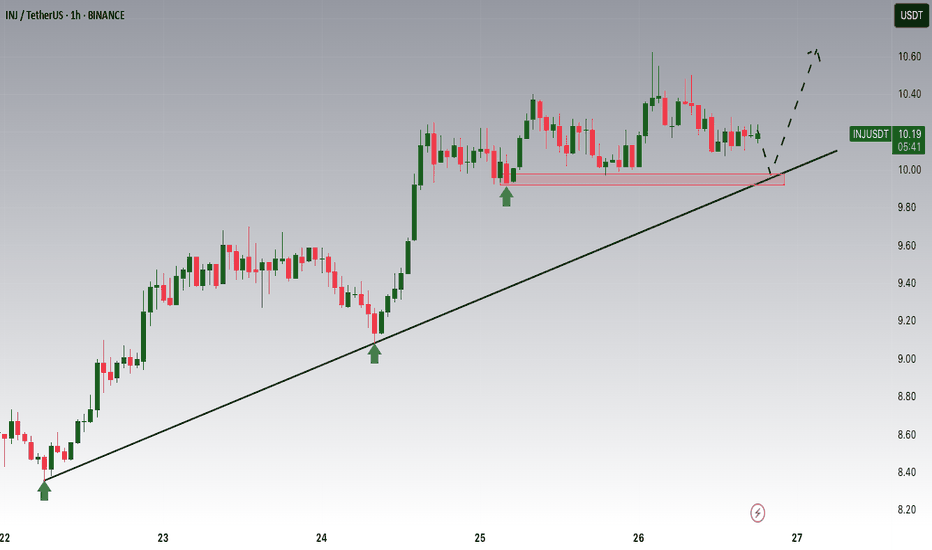

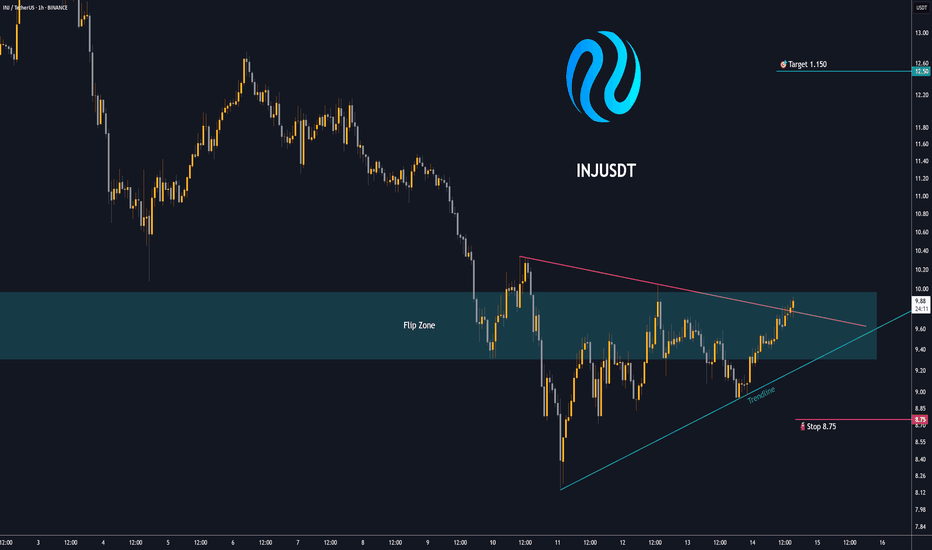

INJ Is Nearing An Important SupportHey Traders, in today's trading session we are monitoring INJ/USDT for a buying opportunity around 9.90 zone, INJ/USDT is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 9.90 support and resistance area.

Trade safe, Joe.

#INJ/USDT#INJ

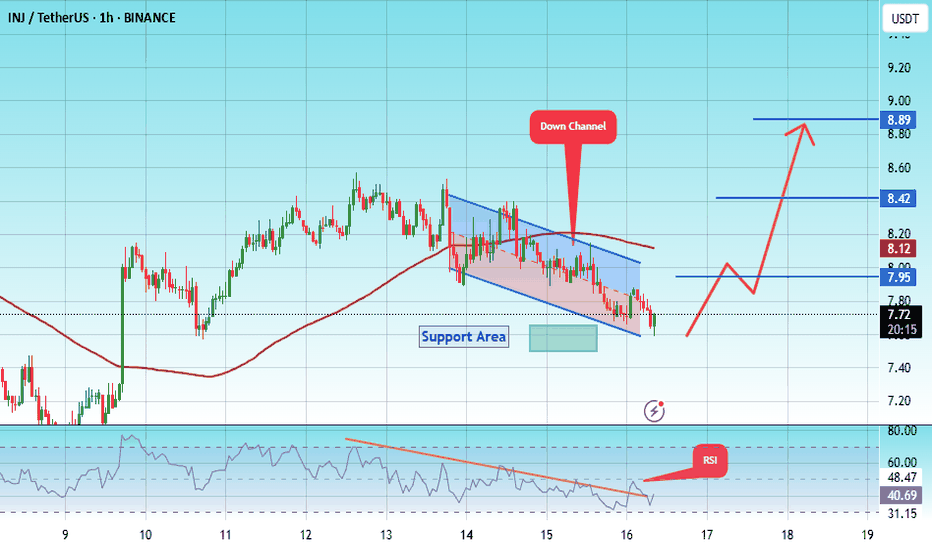

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 7.50.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 7.71

First target: 7.92

Second target: 8.42

Third target: 8.90

#INJ/USDT#INJ

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 8.25.

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 8.58

First target: 8.80

Second target: 9.03

Third target: 9.31

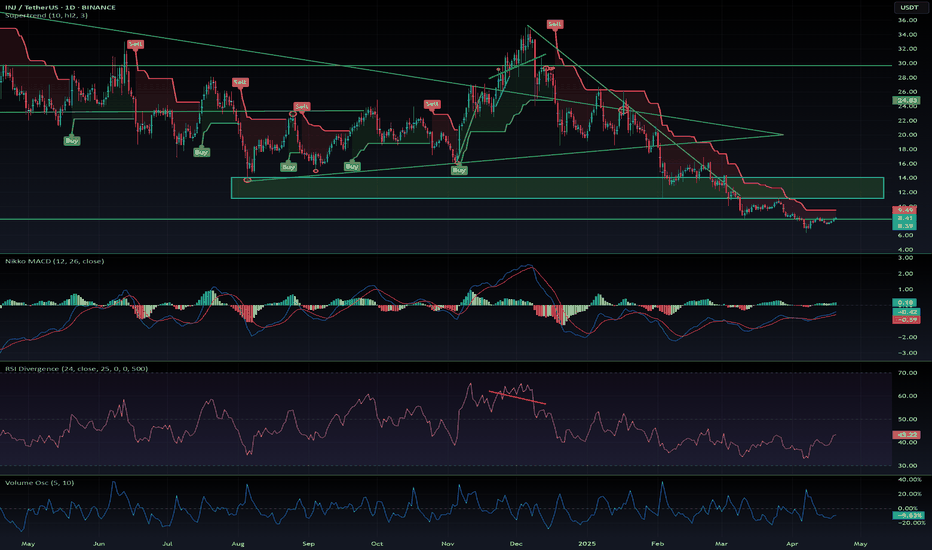

$INJ: Preparing for a Possible Impulsive Move UpCRYPTOCAP:INJ – Setting Up for a Potential Impulsive Move

After a sharp correction, CRYPTOCAP:INJ may be preparing for a strong rebound.

In a previous idea, I forecasted a bottom at $8.5 — and it dipped even lower to $7, fully retracing last year's pump.

The price broke below the bearish flag after a clear bearish divergence at the top. It also sliced through my green buy zone and is now sitting right on a critical support level at $8.40.

🚀 Signs of recovery are starting to show:

🔹 MACD is climbing and approaching the median line — a bullish crossover could ignite an impulsive rally.

🔹 Price is stabilizing above the key $8.40 support.

🔹 RSI is low and consolidating — signaling potential upside.

🔹 Volume is quiet — often a precursor to strong moves.

The target is to re-integrate the green liquidity zone, to prepare another explosive pump.

📅 Reminder: around this time last year, CRYPTOCAP:INJ pulled off a 4x rally. While past performance doesn't guarantee future results, the setup looks promising.

🧠 DYOR | This is not financial advice.

#INJ #CryptoAnalysis #Altcoins #TechnicalAnalysis #MACD #CryptoMarket #BreakoutSetup #DYOR

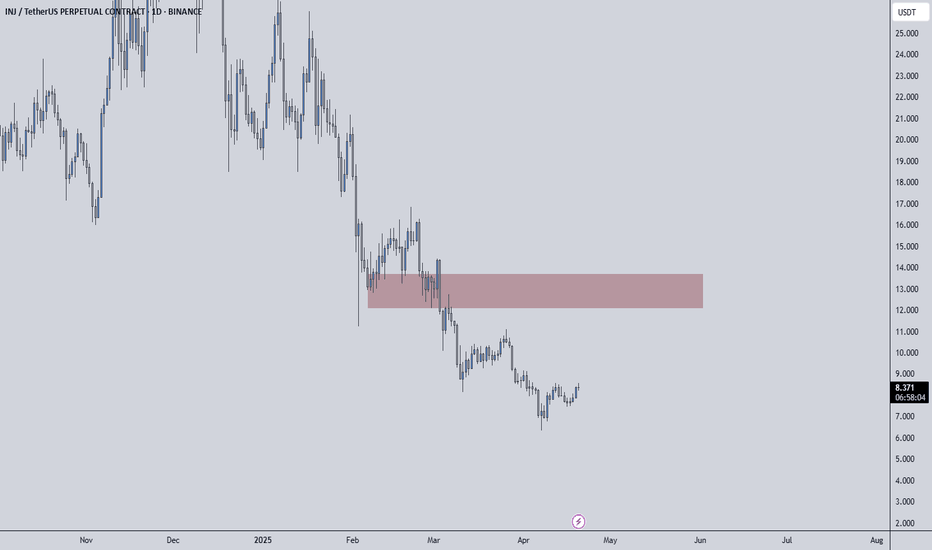

INJUSDT | One of Today’s Top Volume GainersINJUSDT has been catching attention again, leading the pack in trading volume today. We already shared an analysis earlier, and now there’s a fresh opportunity: the red box marked on your chart is another high‑probability zone to consider for shorts.

🔴 Short Setup at the Red Box

• Observe how price approaches the red box and look for signs of exhaustion on lower time frames.

• Wait for a clean breakdown in structure, confirmed by CDV divergence and rising selling volume. That’s your trigger to enter a short position.

• Place your stop just above the red box to keep risk defined and manageable.

🟢 What Could Flip This Bias

If INJ breaks above the red box with conviction – strong volume and a successful retest as support – I will shift gears and look for longs instead. No breakout, no long bias.

✨ Why You Want to Follow This

These resistance levels aren’t random. They come from years of watching market behavior and fine‑tuning entries that work. Most traders chase every spike and get caught. You’re trading with clear signals and confirmations – and that makes all the difference.

I will not insist on my short idea. If the levels suddenly break upwards and do not give a downward break on the low time frame, I will not evaluate it. If they break upwards with volume and give a retest, I will look long.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

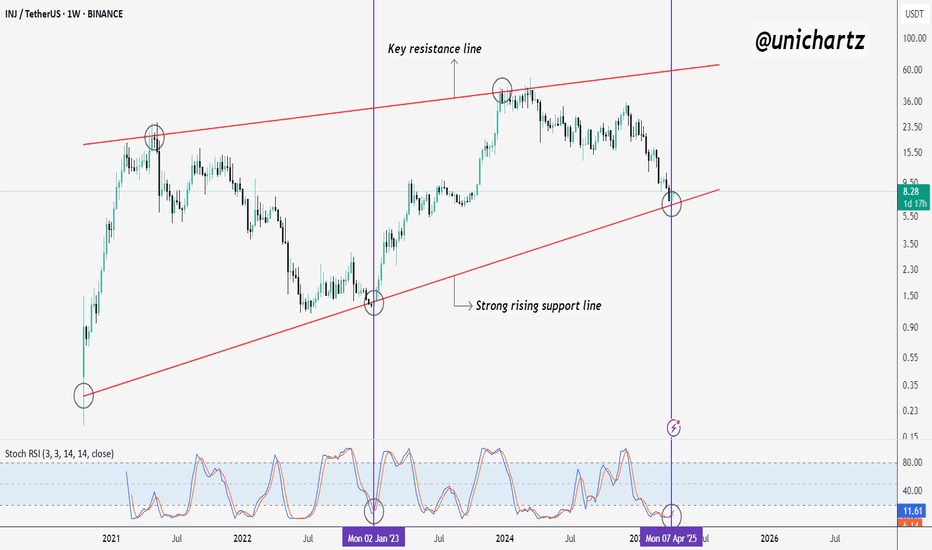

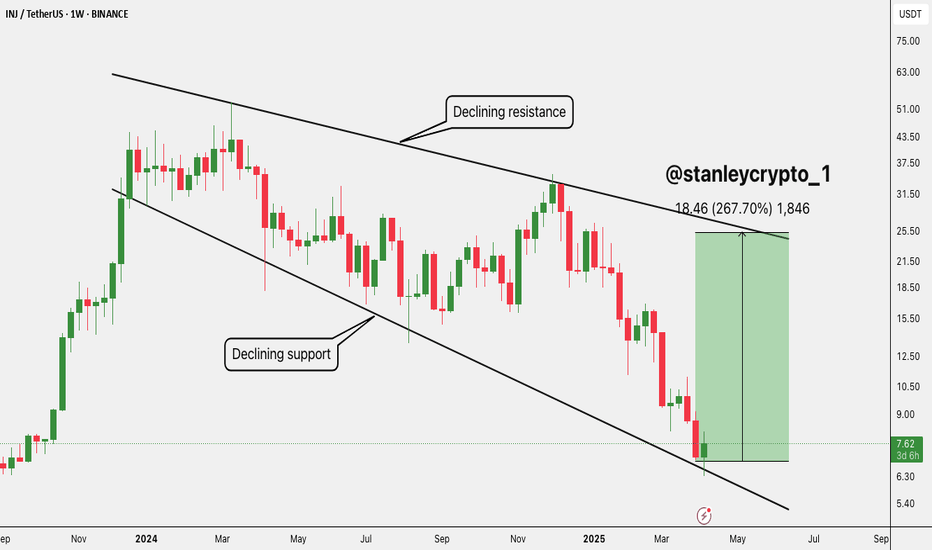

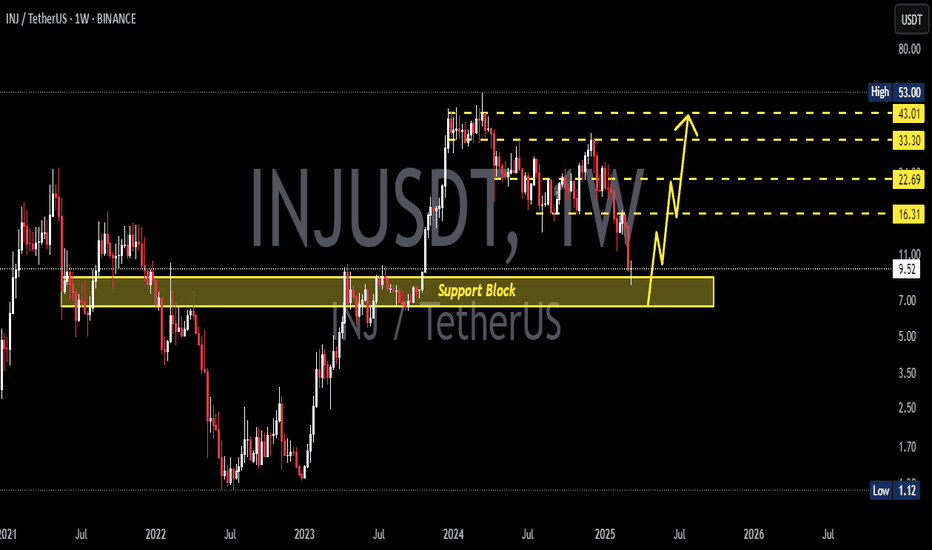

INJ at Key Support – Will History Repeat?INJ/USDT Weekly Chart Analysis

INJ is currently trading at a crucial technical level, touching the strong rising support line of a long-term ascending channel. Historically, this trendline has acted as a reliable base for strong upward reversals.

The Stochastic RSI is also deeply oversold, similar to the levels seen during previous bottoms in early 2022 and early 2023 — both of which led to significant rallies.

If the support holds, INJ could be poised for another upward move toward the key resistance line of the channel.

However, a breakdown below this support would invalidate the structure and could lead to further downside.

TradeCityPro | INJ: Key Triggers Amid Downtrend and Volume Shift👋 Welcome to TradeCity Pro!

In this analysis, I want to review the INJ coin for you—one of the attractive crypto networks, which with a market cap of $783 million, is ranked 73rd on CoinMarketCap.

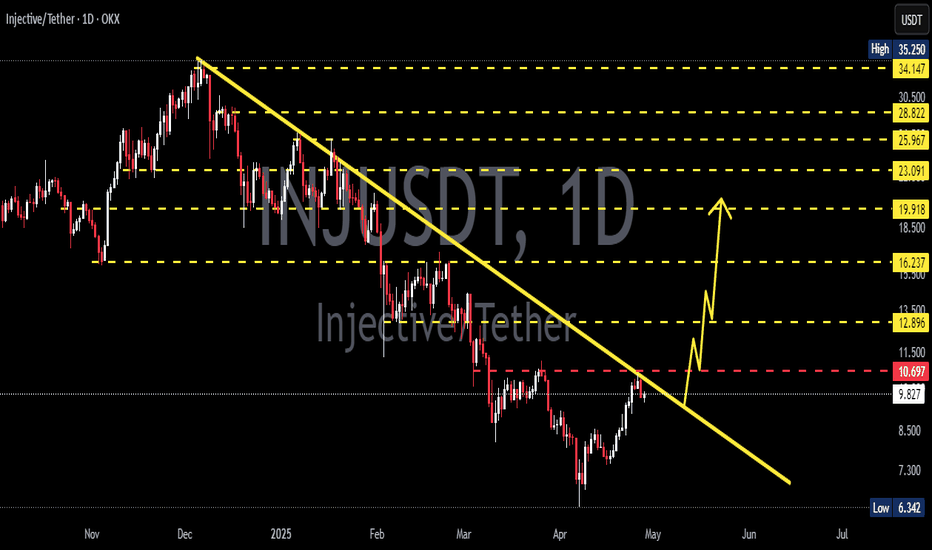

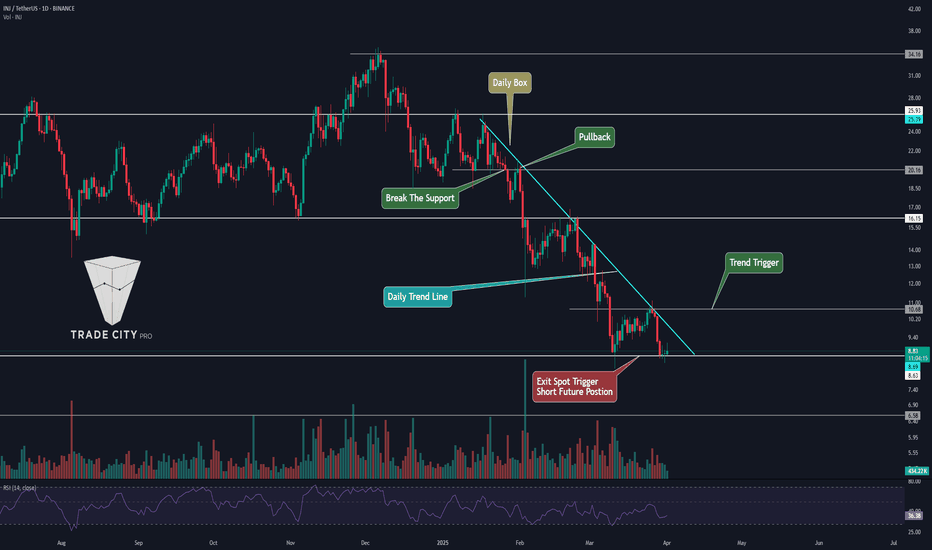

📅 Daily Time Frame

In the daily time frame, as you can see, we have a downtrend that started after the price was rejected from the 25.43 top, and after breaking 16.04, the main bearish leg of the price began and dropped down to the 6.94 zone.

🔽 This bearish move has followed a trendline that we can also observe in most altcoins. Currently, market volume is decreasing, and it can be said that the price is diverging from the volume—and if this divergence is activated, the price will reverse trend.

✔️ The first trigger for a trend reversal is the break of the trendline. Given the volume divergence, if this happens and the trendline breaks, we can consider the break of the 8.96 trigger as the main reversal confirmation.

📈 If the price stabilizes above the 8.96 zone, it can move upward and start an uptrend. The next resistance for the price would be 16.04. However, for a spot buy, the 25.43 trigger is the most important one, which the price is still far from.

💥 On the other hand, if the 6.94 zone is broken, the price will move downward and may start another bearish leg. But an important point is that there’s a very strong support at the 5.65 zone, and if the price moves downward, it may be supported by this area—so it's better to confirm the next bearish leg with a break of 5.65.

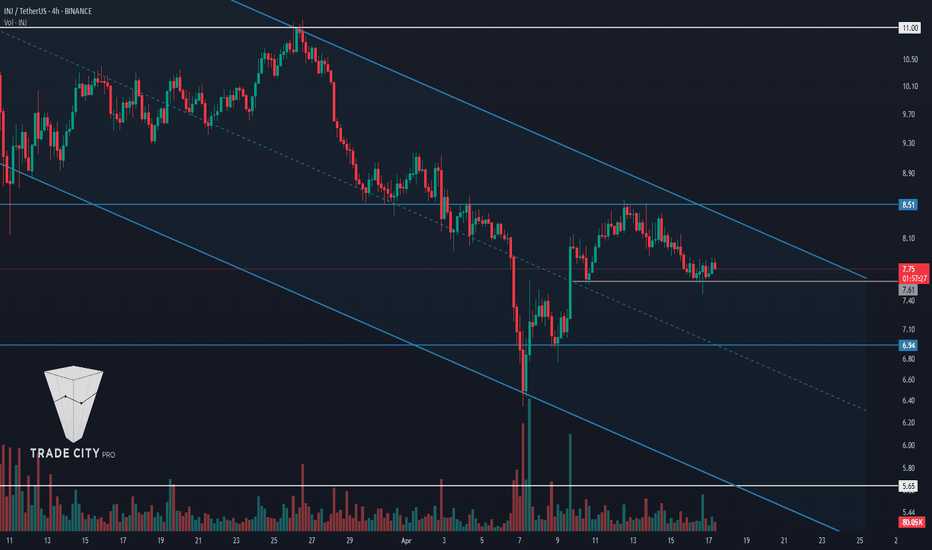

⏳ 4-Hour Time Frame

Let’s move on to the 4-hour time frame to examine suitable triggers for futures positions.

🧩 As you can see in the 4-hour time frame, there’s a descending channel in which the price is moving, and it is currently near the top of the channel.

🔼 For a long position, if the channel top is broken, we can enter a position with the activation of the 8.51 trigger. If the price tests this zone multiple times, the position can become much more reliable, and the possibility of a sharp bullish move increases.

📊 The important point is that buying volume should increase as the price moves toward 8.51, because for a trend reversal, volume must converge with price.

📉 For a short position, the first trigger is the break of the 7.61 zone, which is a good trigger because the price is being rejected from the channel top, and there is a possibility that the price moves toward the midline or bottom of the channel.

🎲 The main trigger for the short position is the break of 6.94, which is a very important low, and breaking this zone can lead to a sharp move down to the 5.65 zone.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

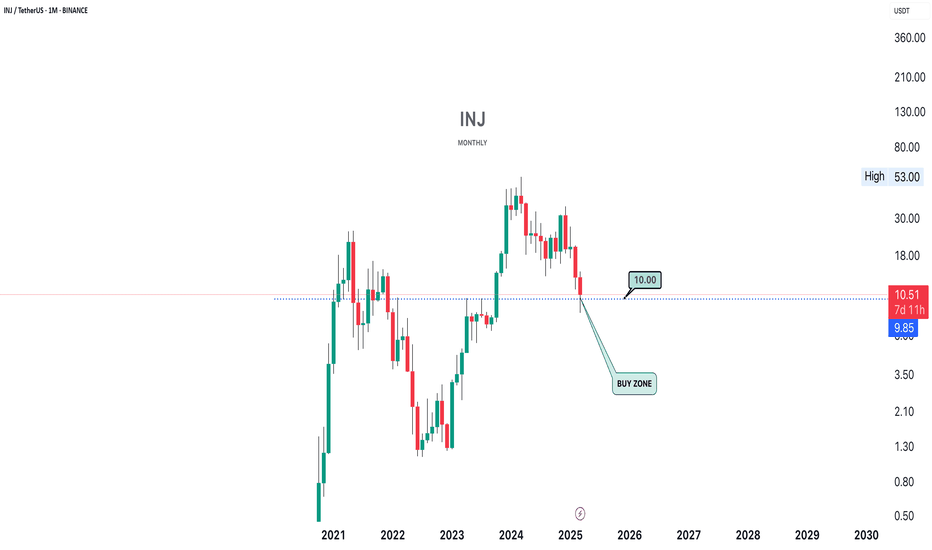

INJ Analysis: 300% Profit Potential (1W)AI Sector Symbol Analysis: 300% Potential

The AI sector symbol is currently undergoing a significant correction, and it seems to be forming a diametric pattern, with the price now in Wave D. This wave could potentially end within the green buy zone, after which we expect the price to transition into Wave E.

It's important to note that this analysis is based on a weekly timeframe, meaning it will take time to unfold. Additionally, the entry zone is quite large, so a gradual REBUY strategy is recommended to manage risk effectively.

Target Levels are clearly marked on the chart, offering clear points of interest for traders.

However, be cautious: A weekly candle close below the invalidation level will invalidate this setup, so always monitor closely.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

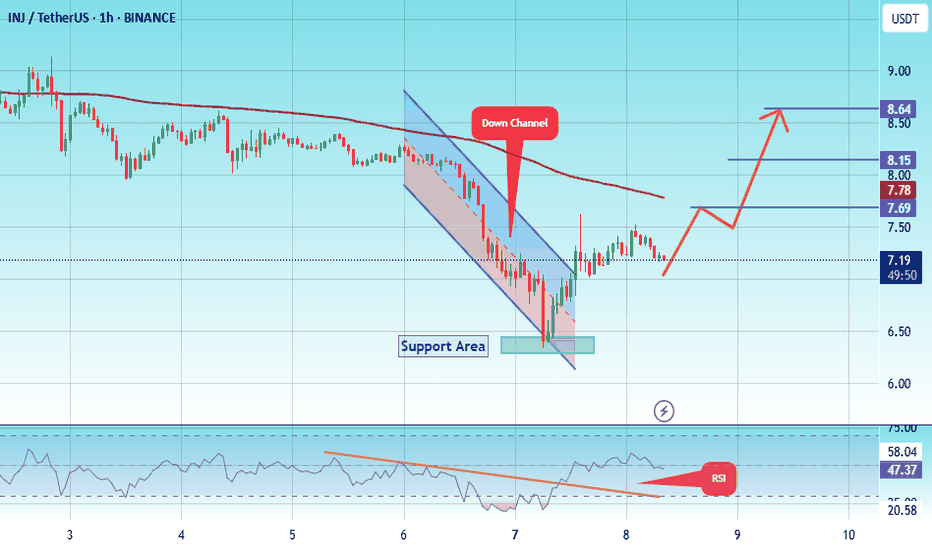

#INJ/USDT#INJ

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 7.20.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 Moving Average.

Entry price: 7.20

First target: 7.70

Second target: 8.15

Third target: 8.64

TradeCityPro | INJUSDT Best Trade Setup of the Week?👋 Welcome to TradeCityPro Channel!

Let's analyze and review one of the most popular cryptocurrency coins, which is in a more favorable situation than the majority of altcoins together!

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Time Frame

On the weekly time frame, I see that the seventh period is stable, inj, and compared to the majority of altcoins that have their own low price levels, it is in a better space and is engaged in its own supports!

After breaking the primary trend ceiling, namely 9.28, we experienced a sharp upward movement and formed a historical ceiling at $53, and after forming a distribution box and breaking the important floor of 16.20 and pulling back to it, we experienced a continued decline.

We have now reached support again, which was previously a very important resistance, and now, as a result, it is probably not lost, but the weekly candle is a very good and bearish candle! Don't forget to save your profit, your strategy booklet and your positions, otherwise you will have made a 450% move without adding anything to your capital!

📉 Daily Time Frame

On the daily time frame, our trend is completely bearish as you can see and the events are completely accompanied by the formation of a downward bottom and top, but we are likely to suffer for a while.

After getting rejected from 34.16 and forming a box between 20.16 and 25.93 and losing the bottom, it made a move and then while pulling back with low volume and the next conversion to red, it became an inverted Sharpe, we experienced a decline!

Currently, we are forming a box between 8.63 and 10.68, and for selling and short positions, you can do this by breaking 8.63, and for the trigger spot risk and buying, if you feel the price is good, it is better to wait for the trend to break and do the trigger at 10.68. Let it structure.

✍️ Final Thoughts

Stay level headed, trade with precision, and let’s capitalize on the market’s top opportunities!

This is our analysis, not financial advice always do your own research.

What do you think? Share your ideas below and pass this along to friends! ❤️

INJ | ALTCOINS | Bottom Likely CLOSEIn the previous cycle, INJ made a near full retracement after the bullish cycle.

This would put us round here, to which we are already fairly close:

To make it a little easier to reference, I'll use the Elliot wave tool (although these are not Elliot waves).

In short, the bottom is likely very close for INJ - but accumulation / sideways phase may take another while.

_______________________

BINANCE:INJUSDT

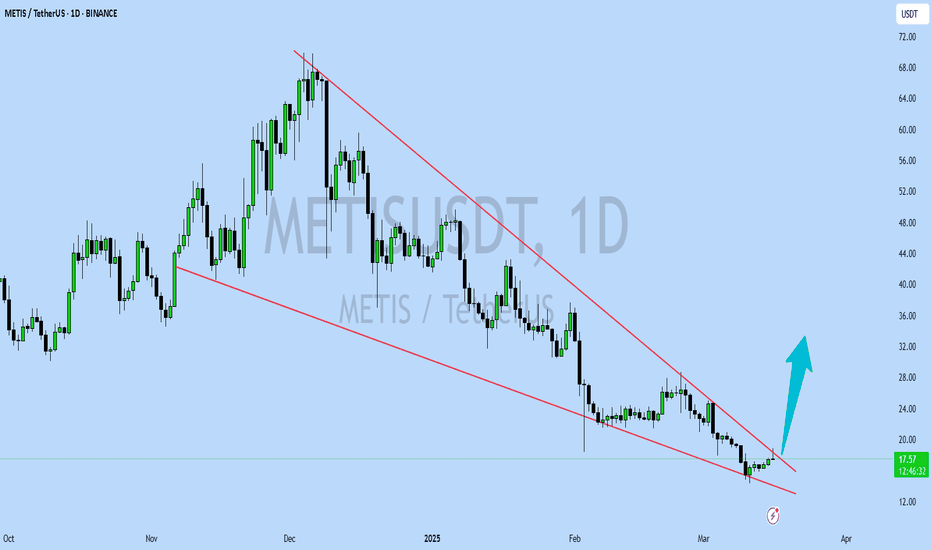

METISUSDT UPDATEMETISUSDT is a cryptocurrency trading at $17.57. Its target price is $32.00, indicating a potential 80%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about METISUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. METISUSDT is poised for a potential breakout and substantial gains.

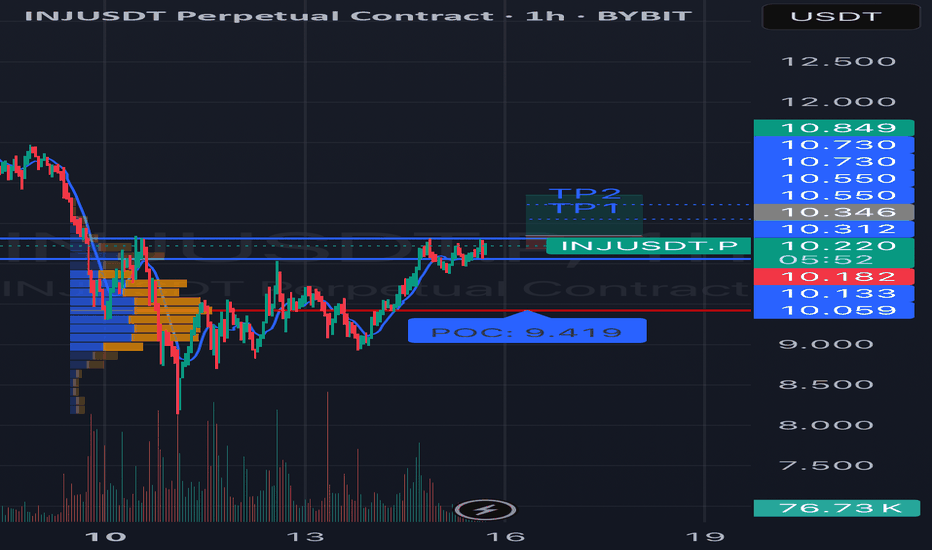

#INJUSDT is setting up for a breakout Long BYBIT:INJUSDT.P from $10,346

🛡 Stop loss $10,182

1h Timeframe

⚡ Plan:

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $10,550

💎 TP 2: $10,730

💎 TP 3: $10,849

🚀 BYBIT:INJUSDT.P is setting up for a breakout—preparing for an upward move!

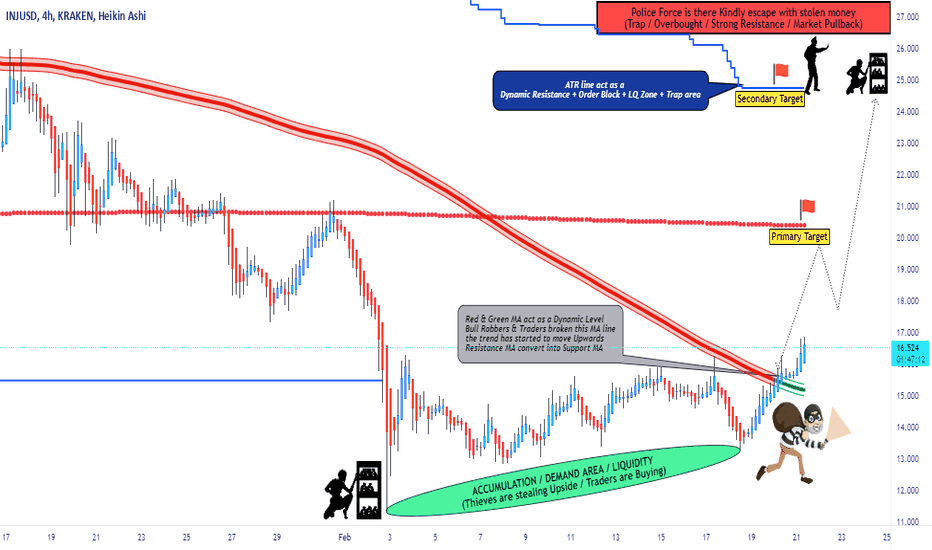

INJ/USD "Injective Protocol vs Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the INJ/USD "Injective Protocol vs U.S Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (13.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 20.500 (or) Escape Before the Target

Secondary Target - 25.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

INJ/USD "Injective Protocol vs Dollar" Crypto Market is currently experiencing a bullish trend,., driven by several key factors.

🟣Fundamental Analysis

1. Project Overview: Injective is a blockchain built for finance, offering high transaction throughput, interoperability, and financial primitives.

2. Tokenomics: INJ is the native asset, used for transaction fees, staking, and governance.

3. Development Activity: Injective has a strong development team, with frequent updates and improvements.

🔴Macro Economics

1. Inflation: Global inflation trends may impact investor sentiment and cryptocurrency prices.

2. Interest Rates: Changes in interest rates can influence cryptocurrency prices, as investors may seek alternative investments.

3. Global Economic Trends: Economic uncertainty and market volatility can drive investors towards cryptocurrencies like INJ.

🟤On-Chain Analysis

1. Network Congestion: INJ's network congestion is relatively low, indicating a healthy network.

2. Transaction Volume: The transaction volume on the INJ network is stable, showing consistent activity.

🔵Market Sentimental Analysis

1. Investor Sentiment: Currently leaning towards a bullish outlook, driven by increasing adoption and positive market trends.

2. Market Positioning: Investors are optimistic about INJ's potential, with some expecting a breakout above $18.

3. Next Trend Move: Potential for an upward movement, with some analysts expecting a retest of the $18 zone before the next leg up.

🟢Positioning

1. Long Positions: 58.2%

2. Short Positions: 41.8%

🟠Overall Summary Outlook

Considering the current price of 16.500, INJ/USD is expected to maintain its upward momentum, driven by increasing adoption and positive market trends. However, investors should be cautious of potential price volatility and market fluctuations.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

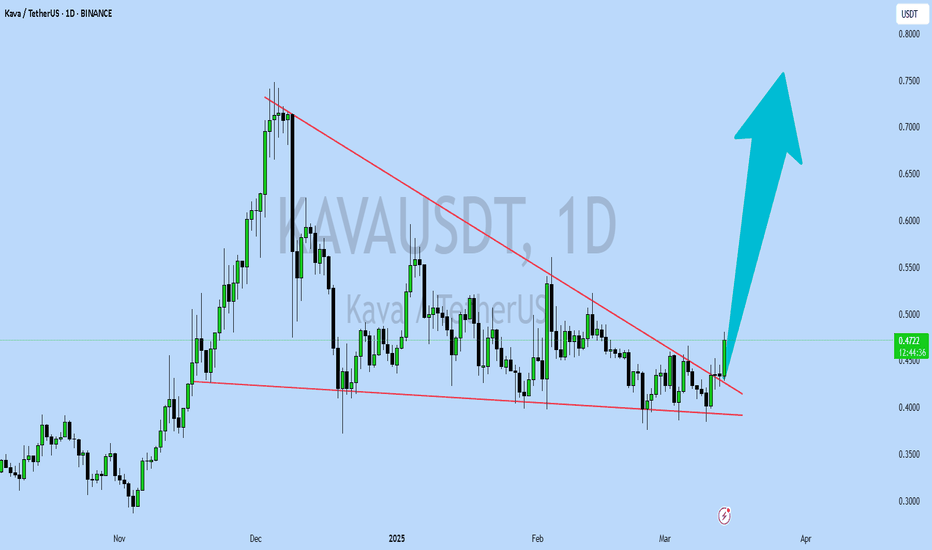

KAVAUSDT UPDATEKAVAUSDT is a cryptocurrency trading at $0.4711. Its target price is $0.7500, indicating a potential 70%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about KAVAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. KAVAUSDT is poised for a potential breakout and substantial gains.