Institutional_trading

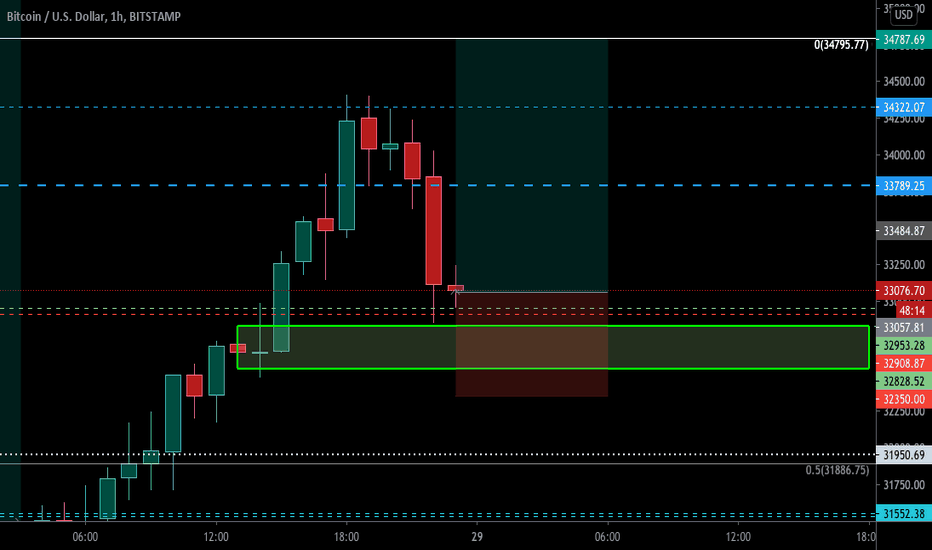

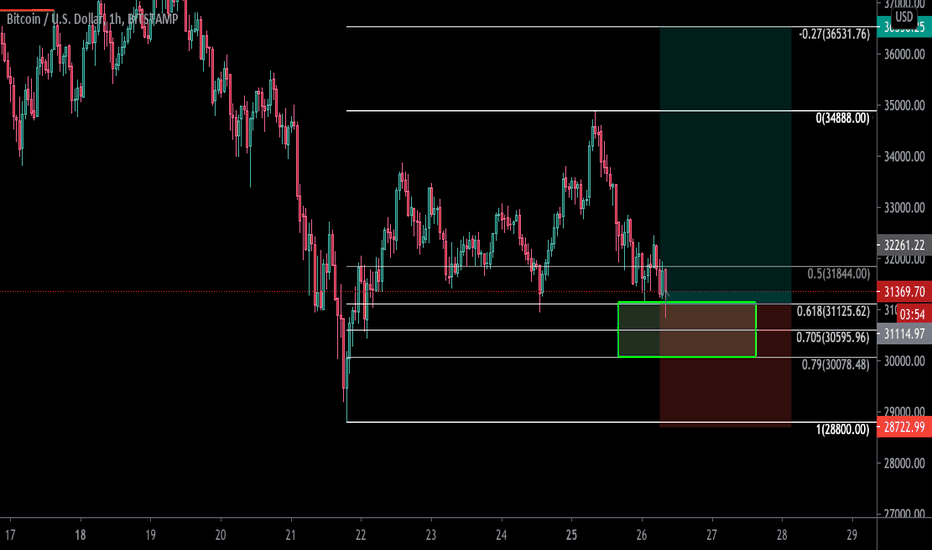

$BTC - BUY!! Hit's 1 HR Bullish Order Block - Aim for HighDescription and intention in chart. Green box is Bullish order block, It returned to it and start longing at that point. It shouldn't get below the order block but could have the potential to spike through it so leave the stop loss enough room for it to spike down but watch it so it doesn't gradually go down through the order block and if it does cancel the order.

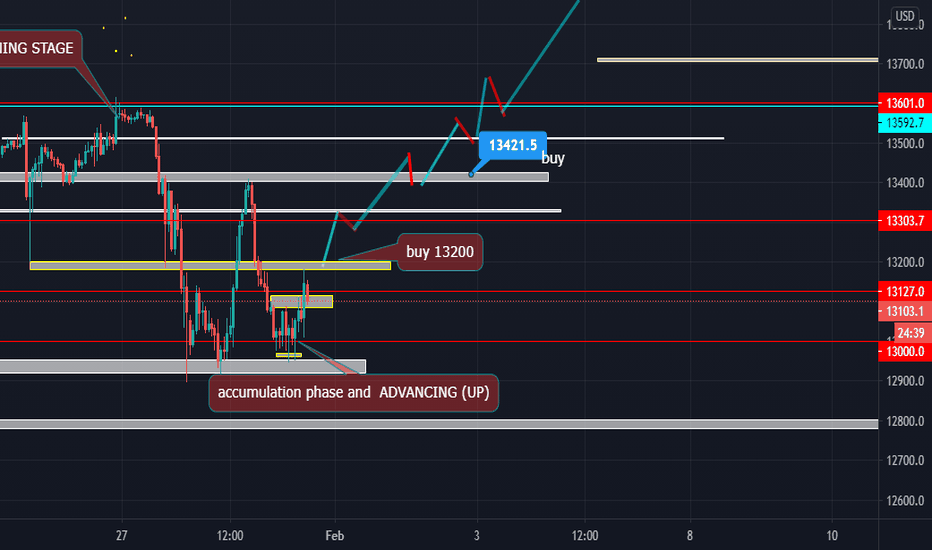

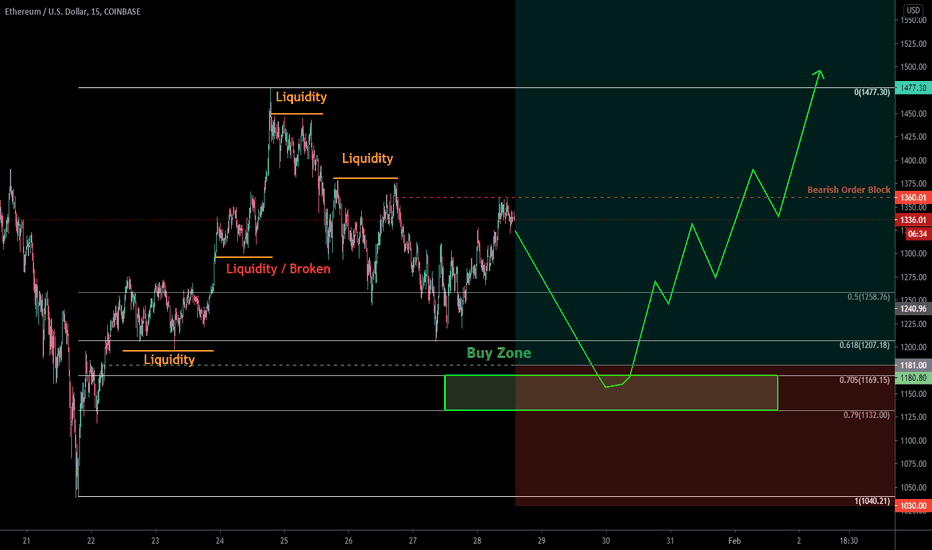

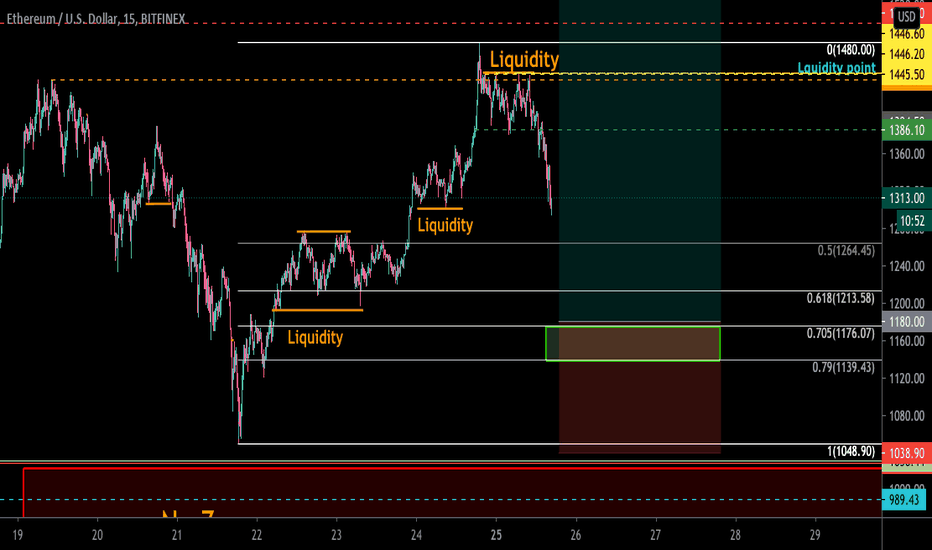

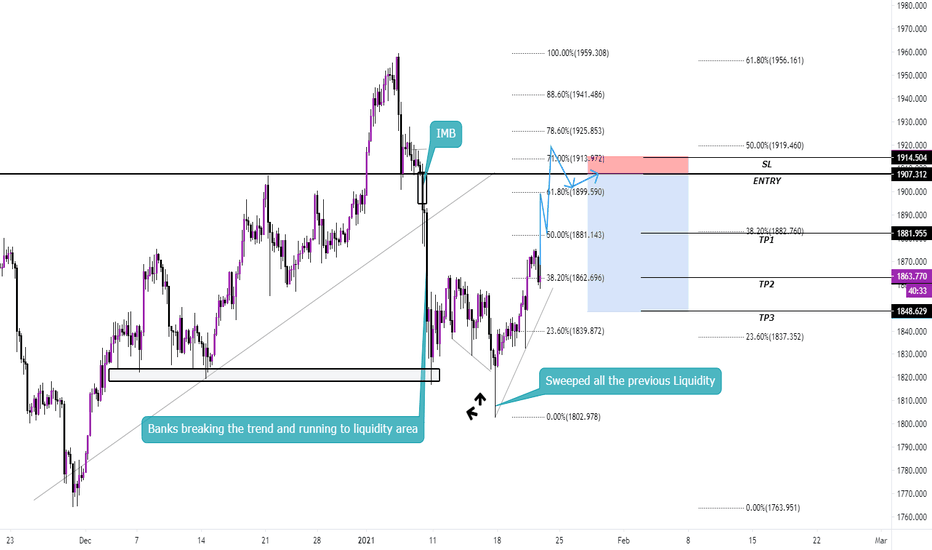

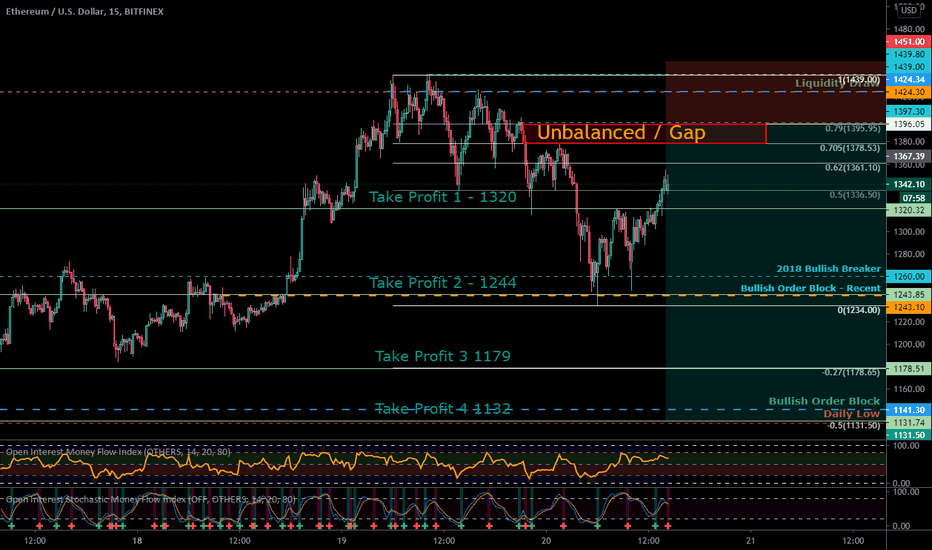

$ETH - Original Idea Stands - 1 more Drop - 1180 BUY ZONE - SMTI've drawn This out in Multiple different exchanges on Tradingview. Bitfinex and COINBASE are the ones I'm going to share. Both have the same liquidity point just below the most recent low and also the spike below that... that is where the liquidity lies. That is the institutions way of thinking and that is where they want a huge discount without scaring the market too much. Because if they scare it too much, no one will buy back into it. So they have to keep the cycle going. They've set it up so that there's also buy side liquidity but we just hit a bearish order block before breaching this intermediate high, meaning it will push the price down. On both exchanges there is a Bullish order Block just below the liquidity level at $1,180. As soon as it reaches that level expect a very bullish movement upwards or even a spike deep into it maybe hitting 1150 before finally going back up. But like I said, There's buy side liquidity set up already as well. Ethereum is ripe for a new high. it'll hit $2,000 (or close to it, my take profit is the full 100% extension whish is $1,915) Jusy=t wait, we'll have ourselves a good February. Treat your special someone on Valentines day with these gains when this happens. It's not an "IF" it's a "WHEN" this happens. All Related Ideas have been pointing toward the same direction. I haven't been off track in my analysis.

(Bitfinex chart)

$ETH - How Low Can You Go? $1,175-ish, I think? So after drawing the fib From the previous fall to the new high, I was actually see the top make a "resistance" line form. And Samart Money always tells me that those resistance lines will be broken. I just thought sooner than later, So I was Scalping at the top getting 40-50 tpips about 3 times when I realized it could drop. So I stopped scalping. (And I should just the damn sell button on MT4) I realize there are two liquidity levels that it could fall under. The first is nearby, the second is just above the 70.5% retracement level (my favorite level because it always hits it or comes really nearly) So My gut is telling me we're going to see it drop below both of those liquidity levels (What I mean by liquidity levels is that those levels appear to be "safe support" levels, when in actuality the big institutions know that and know you'll buy at those levels that I have marked in gold lines one the left, while instead they drive the price deeper cause in you to go negative and they receive and buy at a discounted rate, "discount" is relative to the price at the time. I’m) So I'm thinking 1180 is a safe place for a buy limit if you're buying on an exchange. But, if you

're trading futures or CFD's like me, you want to be more precise, so I'm thinking 1175-1176 ish. I don't know just yet and I'll have to wait and see what happens when/if it gets there.

Depiction of price on the way down.

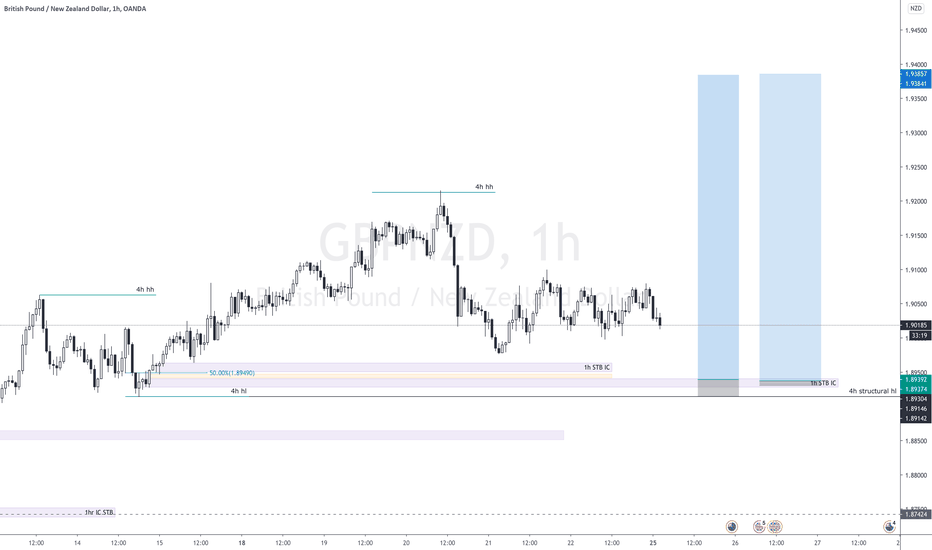

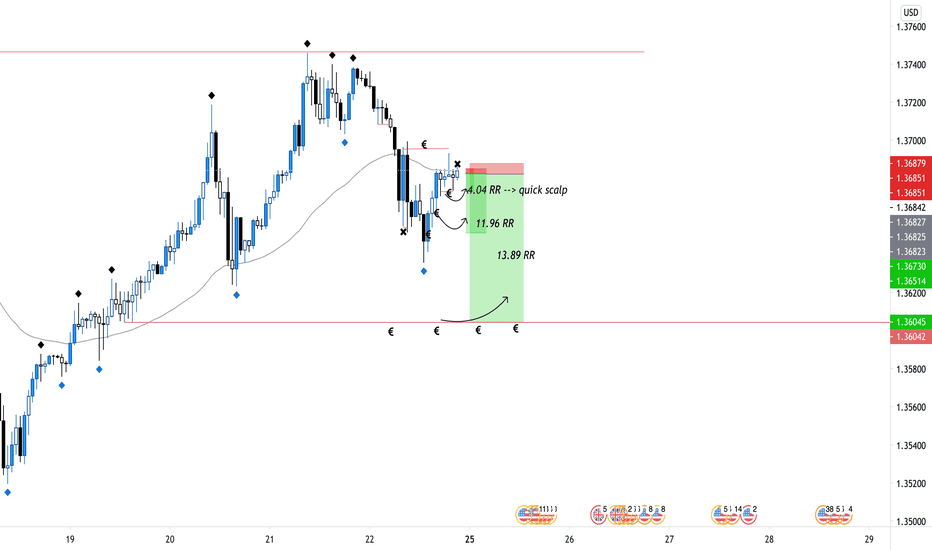

GBP/USD Institutional TradingHello everyone!

I am sharing this possible next trend for the British Pound against the United States Dollar.

We observe that there are many zones were liquidity has not been taken yet (at the bottom of

the wicks marked with €), while many of them were hit (x). This is why institution are probable to point towards that liquidity pool

in order to gain from other retailers stop losses.

Analysis were performed on the smaller timeframes as well.

Personally I am aiming for at least 3 clear entries as I reported on the charts with a very little stop loss.

Since we do not have all the tools that big institution have I advise you not to jump as soon in the trade, but wait indeed for confirmations.

FX:GBPUSD

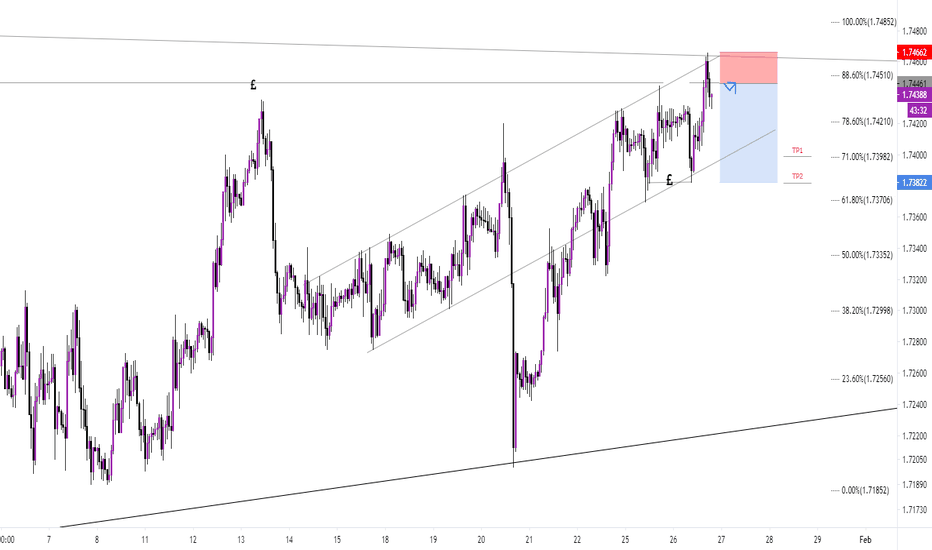

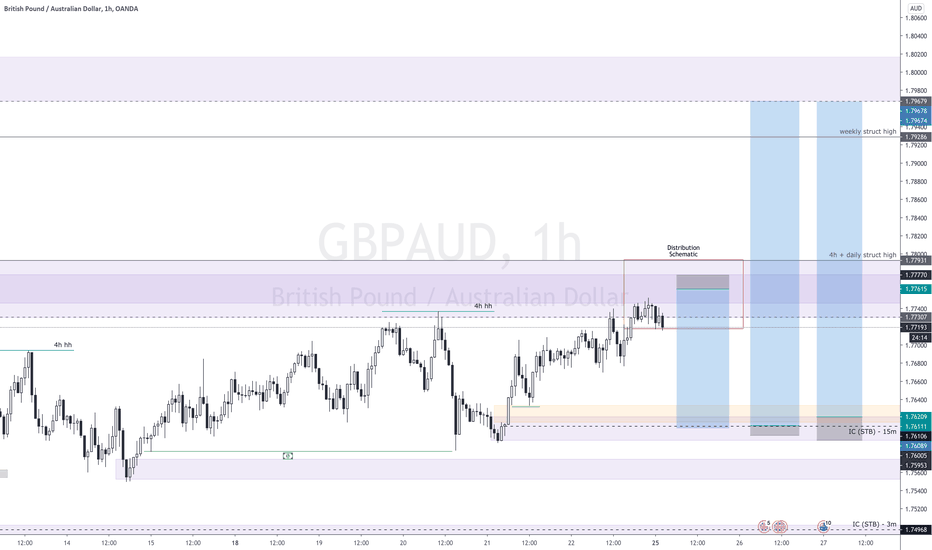

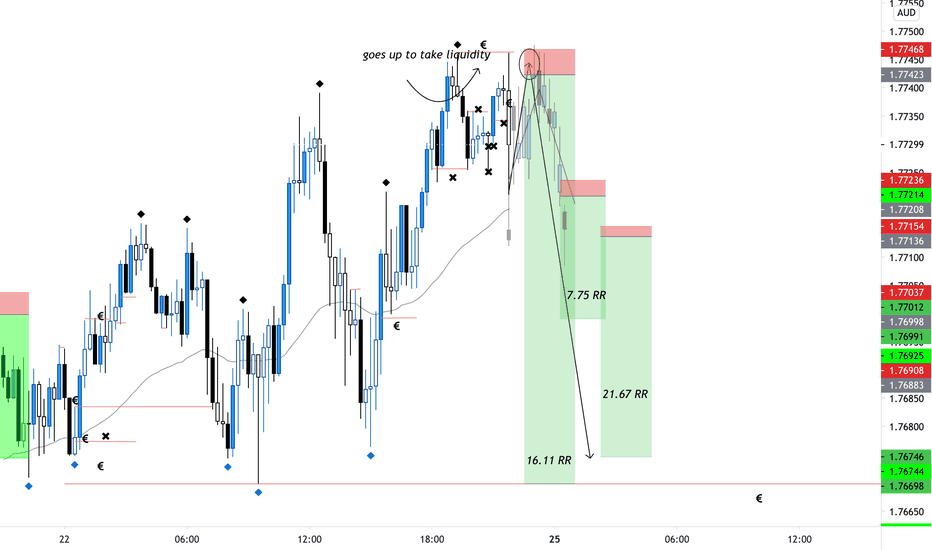

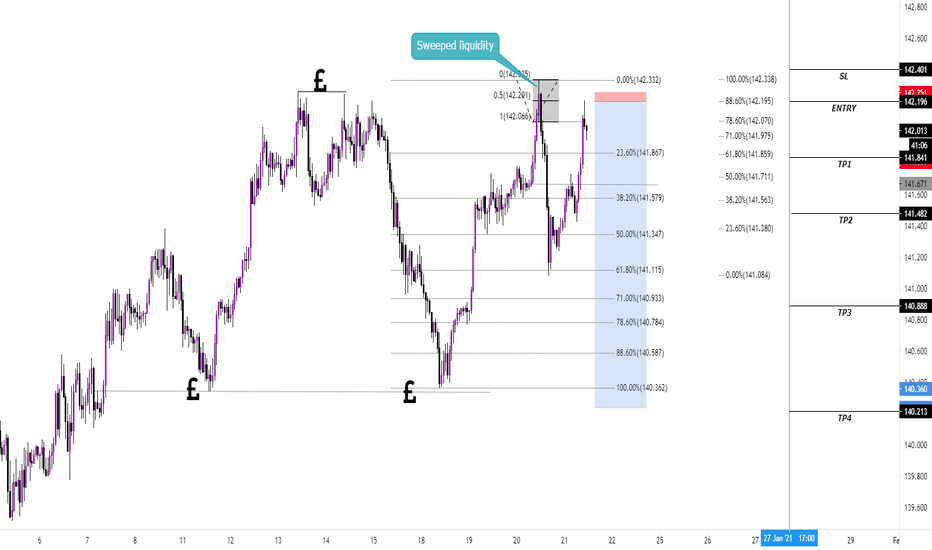

GBP/AUD Institutional TradingHello everyone!

I am sharing this possible next trend for the British Pound against the Australian Dollar.

We observe that there are many zones were liquidity has not been taken yet (at the bottom of

the wicks market with € ), while many of them were hit ( x ). This is why institution are probable to point towards that liquidity pool

in order to gain from other retailers stop losses.

Analysis were performed on the smaller timeframes as well.

Personally I am aiming for at least 3 clear entries as I reported on the charts with a very little stop loss .

Since we do not have all the tools that big institution have I advise you not to jump as soon in the trade, but wait indeed for confirmations .

FX:GBPAUD

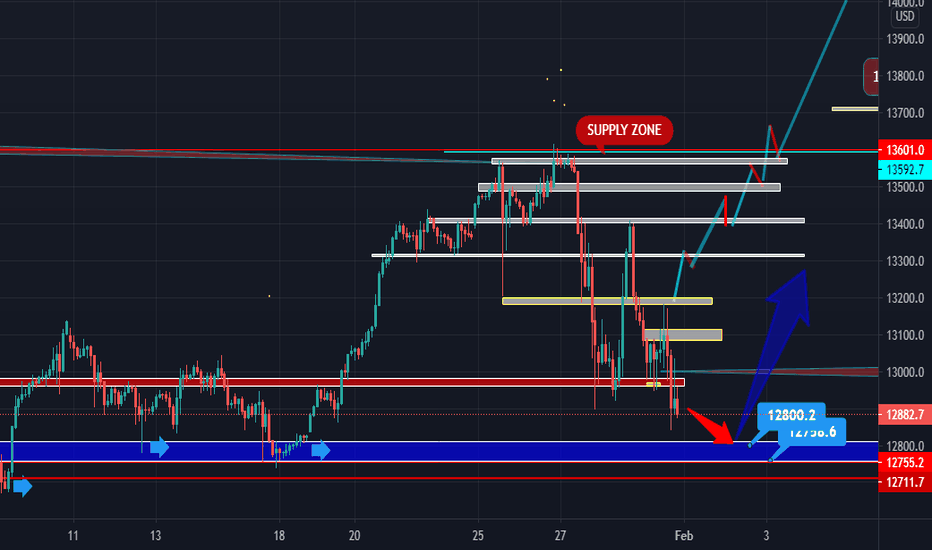

US30 > institutional tradingAs you know, institutions do manipulate the market. We can see that many times liquidity (retail traders stop losses, sell limit etc)

was hit before continuing the normal trend.

This might be a good entry point for a short position since the market after taking the liquidity returned to its previous high to then sell off at our

entry point.

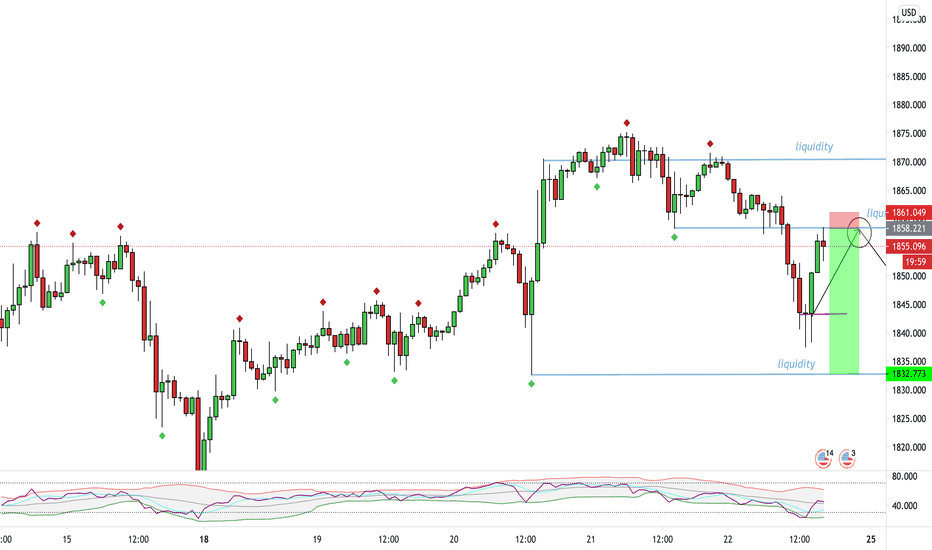

XAU/USD > intitutional tradingHello everyone!

As you know, institutions do manipulate the market. We can see that many times liquidity (retail traders stop losses, sell limit etc)

were hit before continuing the normal trend.

This might be a good entry point for a short position since the market after taking the liquidity returned to its previous high to then sell off at our

entry point.

OANDA:XAUUSD

www.colibritrader.com

XAUUSD SHORTPrice broke the previous uptrend without retesting aiming the previous support liquidity area, leaving an imbalance at 1906-1895.

After a period of consolidation price created a downtrend formed a new trend liquidity which then were swept by a single instututional candle before creating the recover

of the previous break. Now price is going to the imbalance area meanwhile retesting the break. I would not enter below 1970 for a sell as soon as the price arrives there, but would wait for everyone to enter on a sell and expect price to do the contrary, creating a stophunt. So basically i would enter only after this scenario.

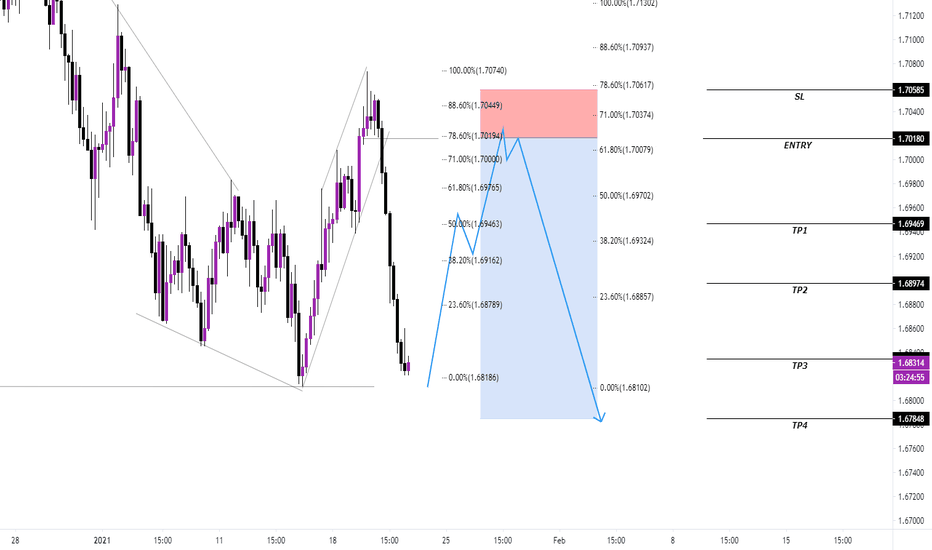

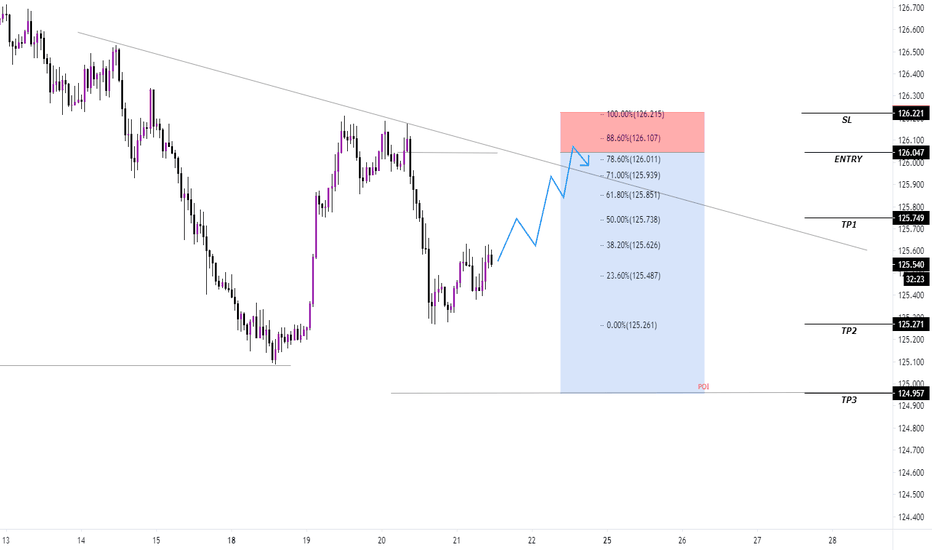

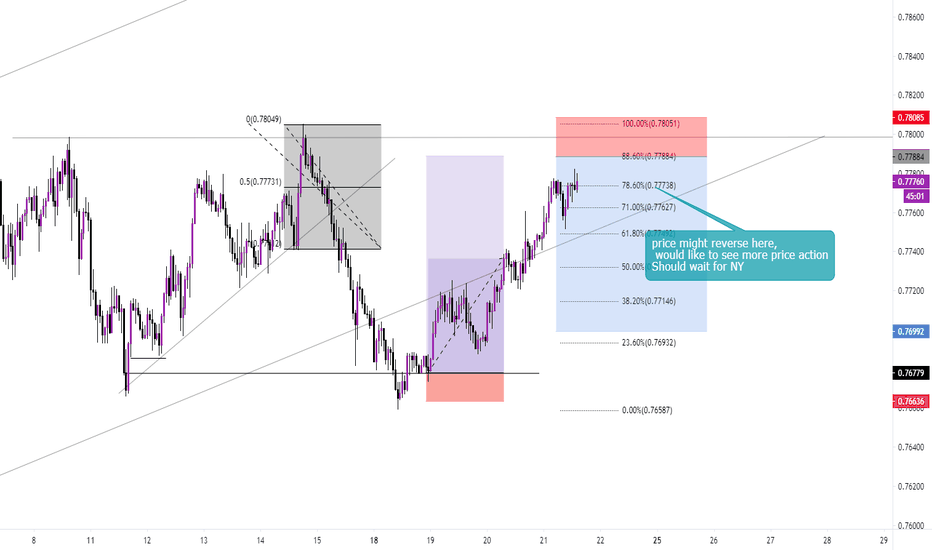

AUDUSD4hr structure price is creating lower lows

from the previous high we had POI , so we are basically waiting for the 50-55% retest of those institutional candles which is the area 88.60 on fibs.

Sl 20 pips because price might come to the liquidity area , swep it and then coming down. There i would go for a possible stophunt. Let's see the price action as soon as NY is open

$ETH - If You Dare To Short the Dreaded "Crash After ATH"This is what that short might look like. There's a bearish order block just above the Unbalanced Gap on Jan 19 at 2100 CST at the price of 1396.05

I'm leaving quite a bit of room to be in the red because I see a possibility that it could spike throught the high once again before the fall so I added an extra $10 to the high. But I've been saying it for two days that it would fall a little after the high, retrace about 80% amd then fall again. And the 80% just happened to the perfect moment to make the short. That's the MO we've been seeing in all the other crypto's.

I have marked out 4 take profit zones as I feel those are potential areas it could reach and possibly turn around and go back up with reaching the full 100% of the short trade that I'm calling for.

I still think 1145-1133 is an area to where it will spike really hard and turn around and go back the other way just because of the level of liquidity near 1150 and the bullish order block around 1133. The fact that the 150% Extension of this trade is right at the level that I've been calling to watch for it to go into liquidity and return bullish is what makes me believe this is very possible. Confluence is King. You can see my entire markings of the chart if you just move it around and you can find those areas I'm looking for. I believe it is overall bullish but it is in that area to where it wants to scare people with a fall so they will sell and so the institutions will buy back at a lower price.

My short Idea is more geared towards those playing the Futures or Contracts for Difference markets. And not the people that have a staking or equity account where your ethereum holds value. Don't touch those accounts. Don't try to sell where I say and try to buy back up where I say, that is not how this works. Again, the Idea is for those playing Futures or CFD's. If you don't know what either are, it's just best to ignore this idea :)

Just my two cents, at the same time we see ETH start to decline and have that scare, watch Bitcoin, I'm almost positive it will be on the rise. So if you're a trader, you might be in luck to also get a short out of ETH/BTC.

Good Luck and Happy Trading.

Tedzily aka Bodies X Wix

KRAKEN:ETHUSD