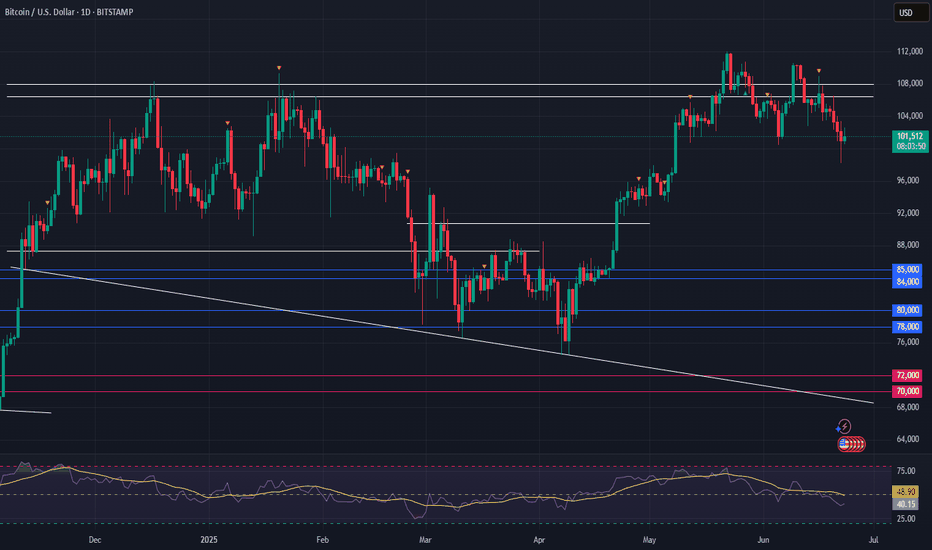

Bitcoin Tests Key Support-Healthy Correction Within Bull MarketHealthy Pullback, Strong Structure:

Bitcoin’s recent dip is a constructive correction within a broader bull trend, as it tests the critical $100,000–$105,000 support zone—a former resistance area from early 2025.

Institutional Demand Holds the Line:

Maintaining levels above the psychologically important $100,000 mark highlights continued institutional accumulation and reinforces the underlying strength of the trend.

Momentum Reset, Base Building:

This pullback has helped reset overbought conditions from the prior rally, laying the foundation for the next potential leg higher.

Key Levels to Watch:

Support: $100,000–$105,000

Breakout Trigger: A close above $108,000 would confirm uptrend continuation

Outlook: Bullish bias remains valid as long as support holds

Investor Opportunity:

With structure intact and downside contained, this consolidation presents a favorable risk-reward setup for long-term investors looking to position ahead of a potential breakout.

#Bitcoin #BTC #CryptoMarket #TechnicalAnalysis #SupportAndResistance #BullMarket #RiskReward #InstitutionalBuying #MarketOutlook #PriceAction

Institutionalbuying

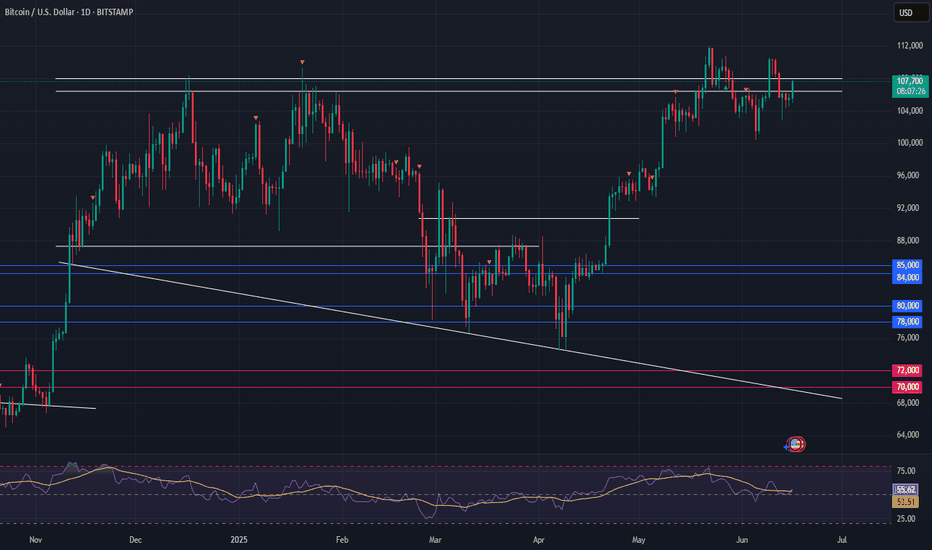

Bitcoin Consolidates Near Highs — Bullish Wedge Signals StrengthHolding Strong Amid Uncertainty:

Despite rising geopolitical tensions, Bitcoin remains resilient, trading near recent highs. This stability reflects strong institutional confidence and sustained accumulation by long-term holders.

Bullish Technical Setup:

The ongoing consolidation between $100,000 and $110,000 is forming a wedge pattern—a classic bullish continuation structure. This suggests the market is coiling for its next major move.

Key Levels to Watch:

Immediate Resistance: $112,500

Support Zone: Holding above $100,000 keeps the bullish case intact

Measured Move Target: $130,000–$135,000

Outlook:

This tight consolidation signals a healthy pause in a strong uptrend, positioning Bitcoin for a potential breakout and continuation higher. All signs point to the bulls remaining firmly in control.

#Bitcoin #BTC #TechnicalAnalysis #BullishWedge #CryptoMarket #InstitutionalBuying #PriceAction #Geopolitics #SupportAndResistance #BullRun

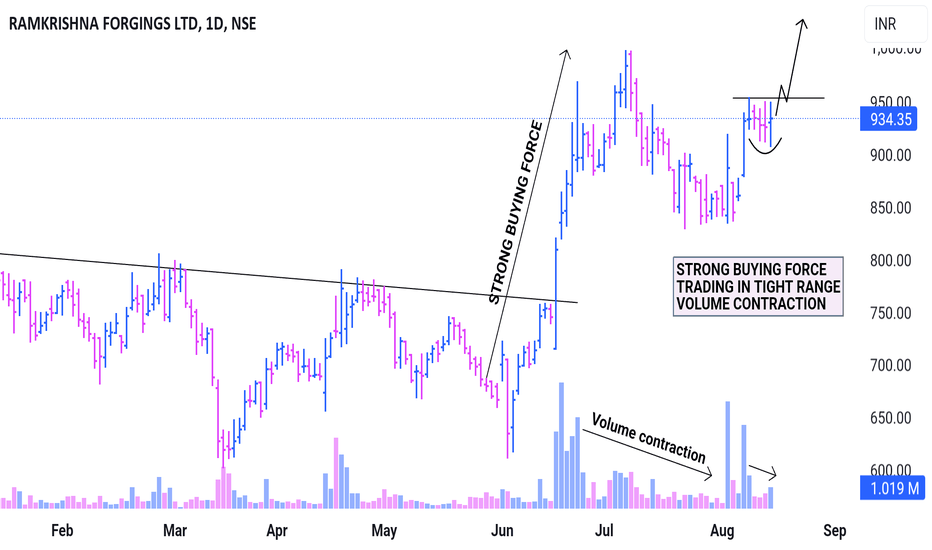

RKFORGE potential breakout POSITIVE POINTS:-

Strong buying Force.

Trading in a narrow range.

High relative strength.

Took support from 50EMA & now above 20EMA.

Volume contraction & institutional footprints visible.

NEGATIVE POINTS:-

Overall market condition is not favorable for breakout trading. Key indices are near 50EMA, there could be a potential break down in the coming days. No follow through moves were seen in last few days.

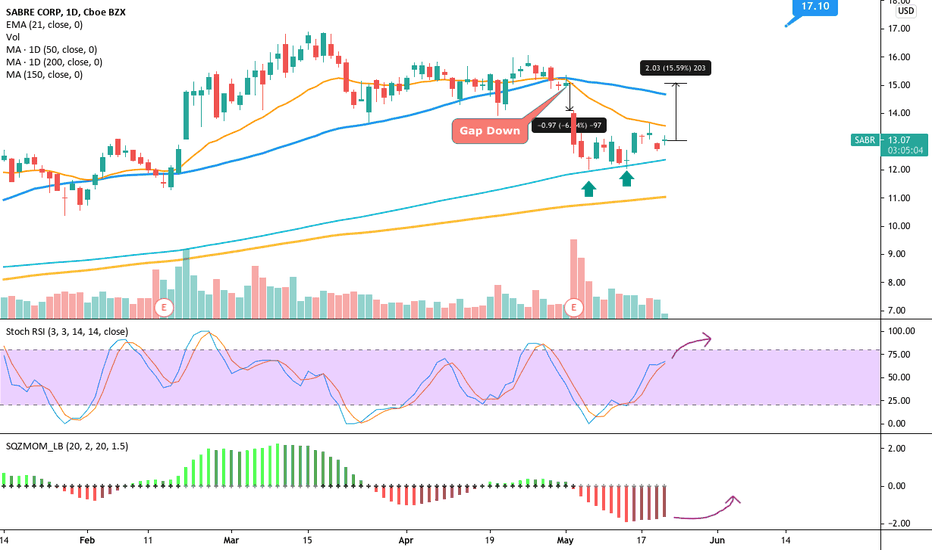

SABR looks poised to fill the gapSabre is involved with the travel business so it is a reopening play. Should be a good trade; I won't be in it long. It also popped up with institutional buying of the $14 strike calls.

Fair Value Estimate from Morningstar: $17.10

June Expiration; $14 strike Calls are the way to play it. The more time the better. Will roll the calls out to further expirations and higher strikes as it climbs towards its FVE of $17.10.