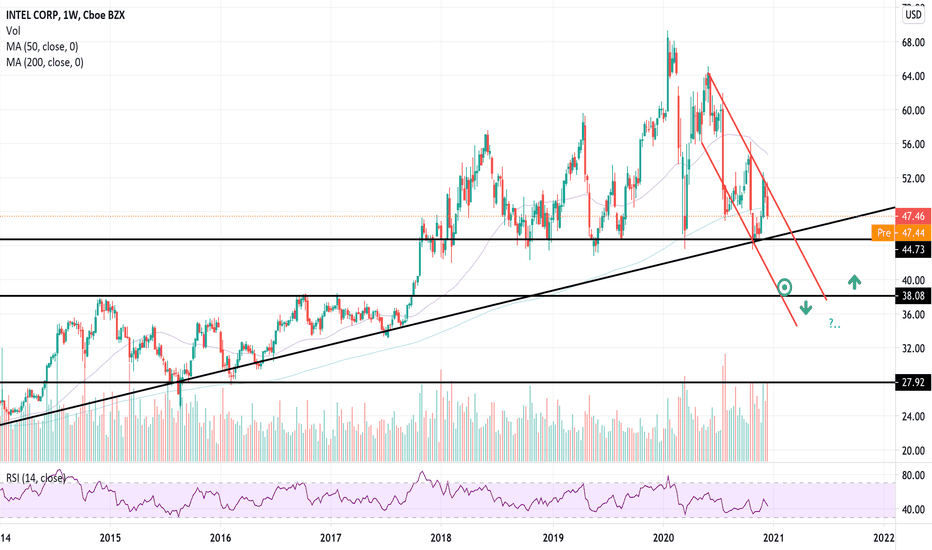

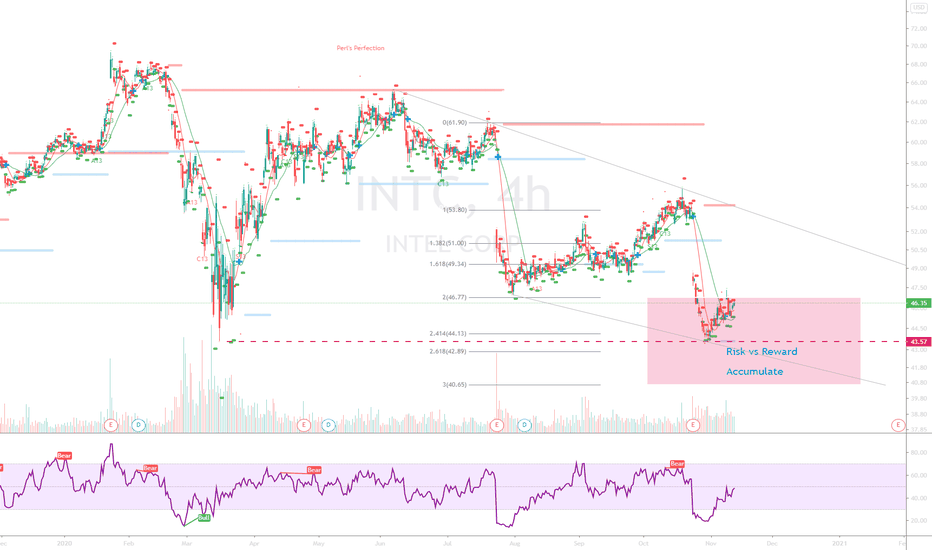

Will Intel go Nokia's way?#INTC is under pressure from AMD, NVIDIA and now Apple and Microsoft.

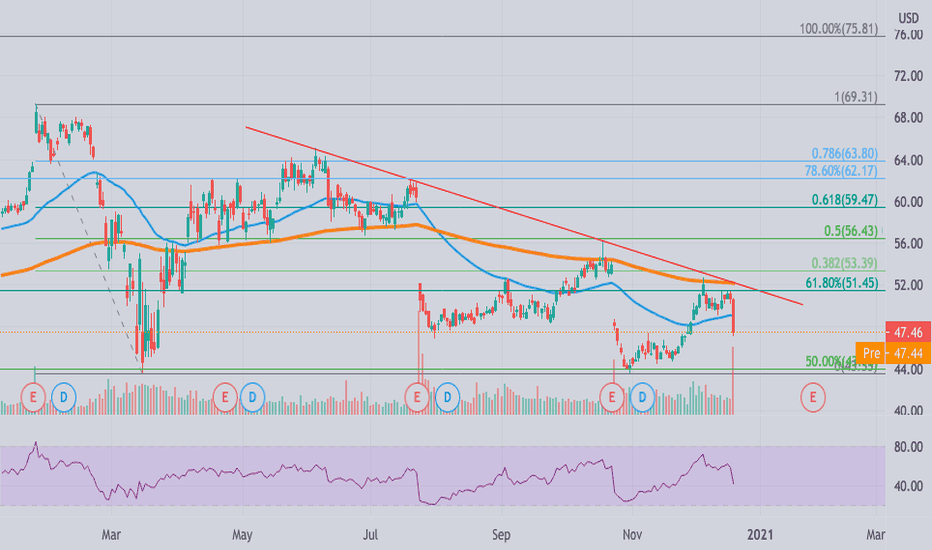

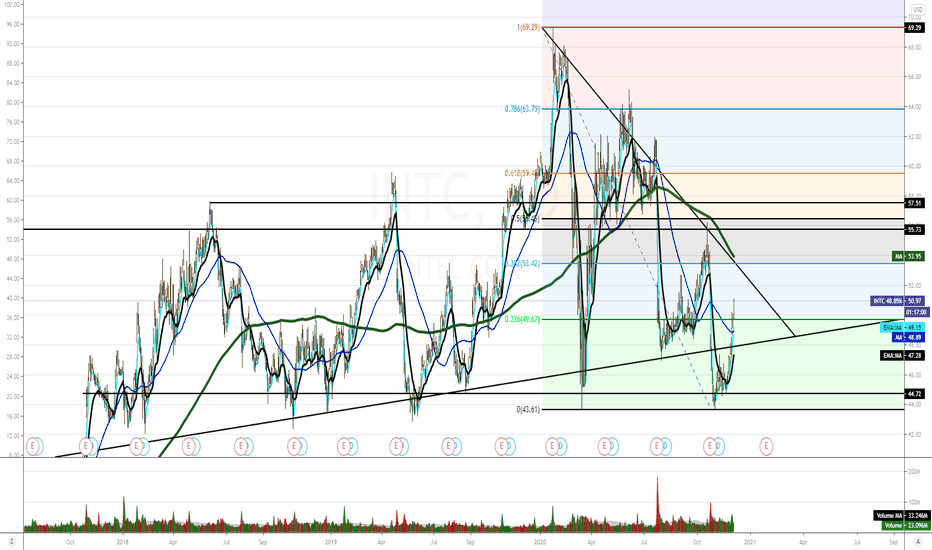

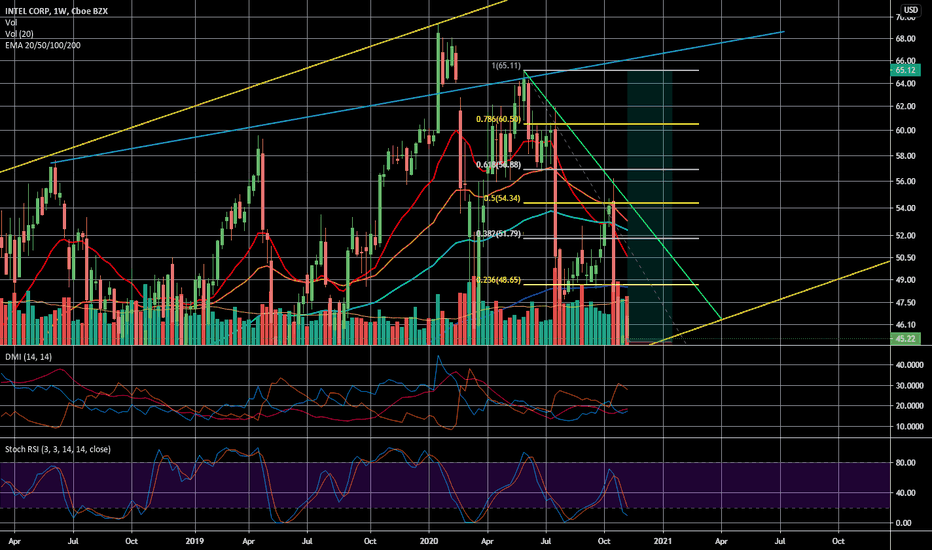

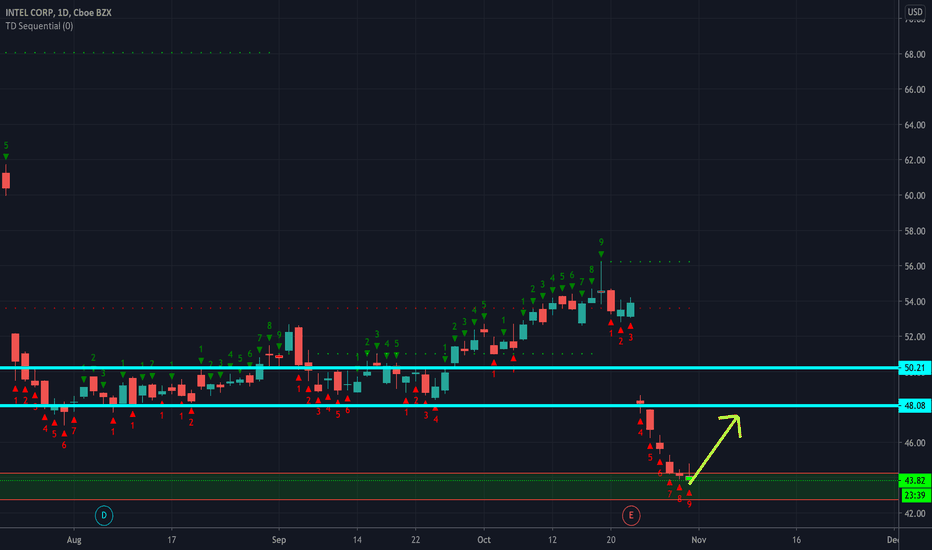

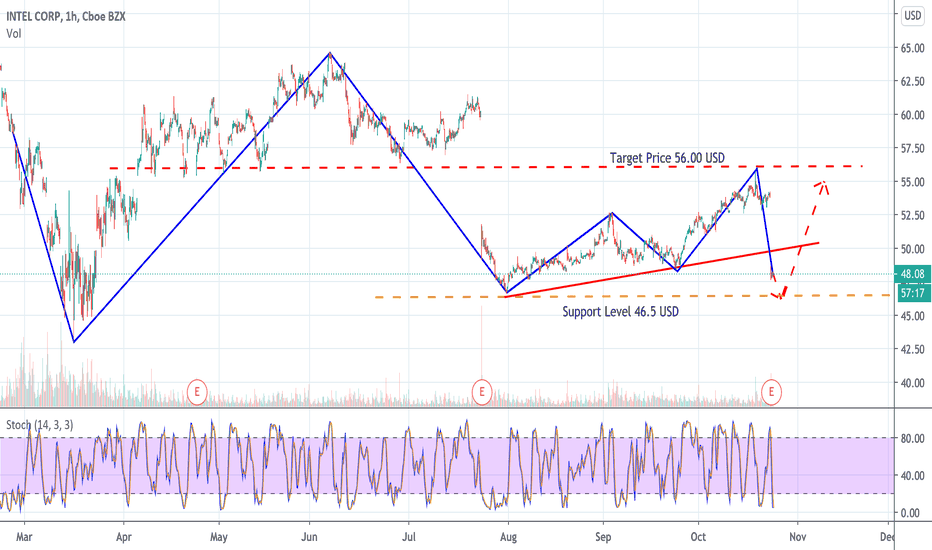

To start the uptrend #INTC needs to break the resistance line around $52.

If drops below 43,50 there is way down to 36,50 and 27 as seen on multi-year charts.

Would make sense to cautiously buy around 43,50 with stop at 41,50 in hopes for the better for Intel.

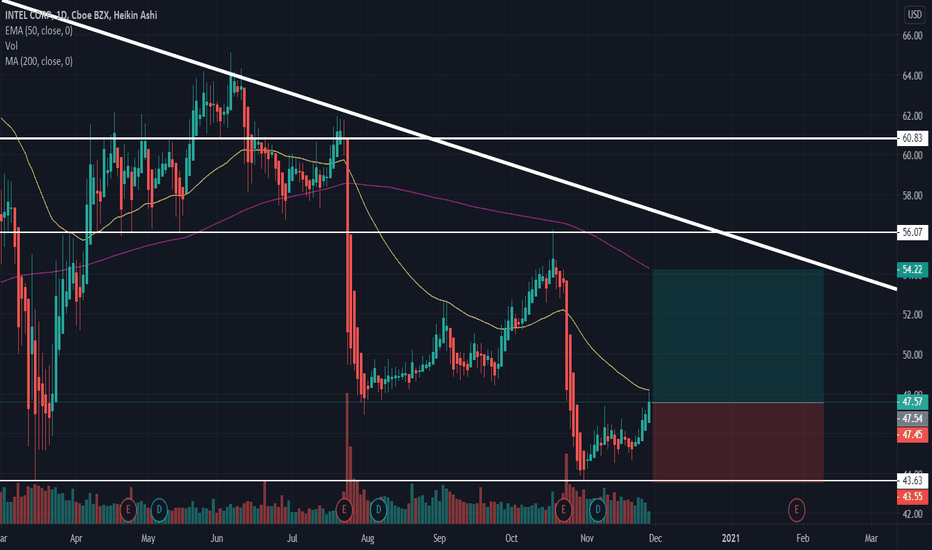

INTC

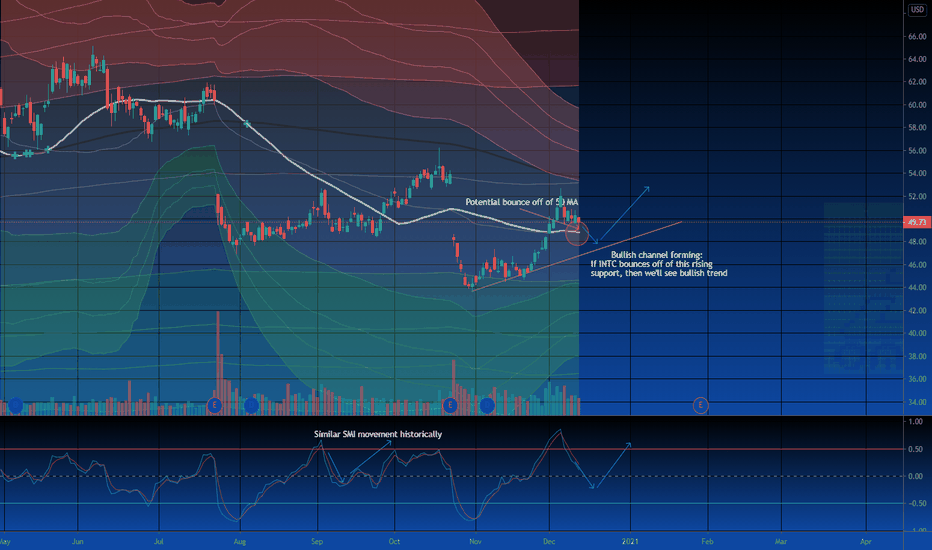

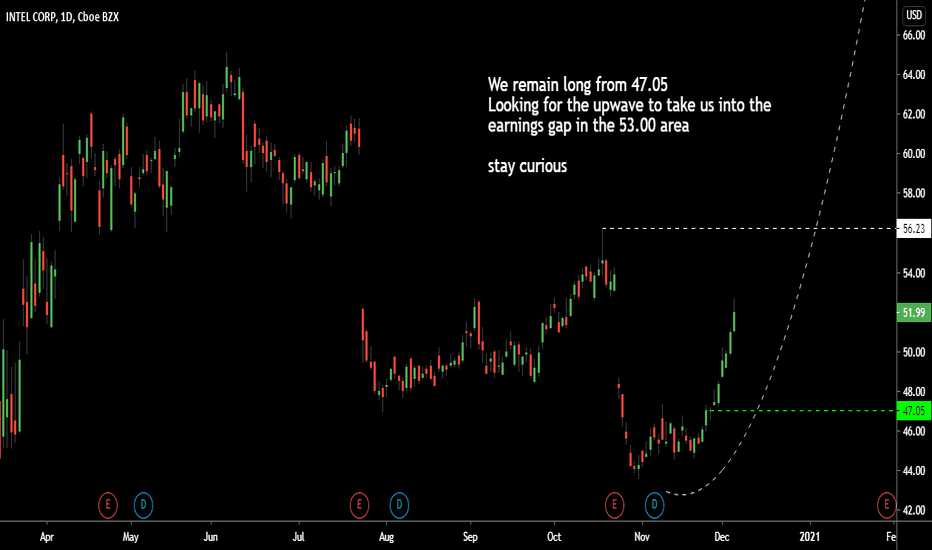

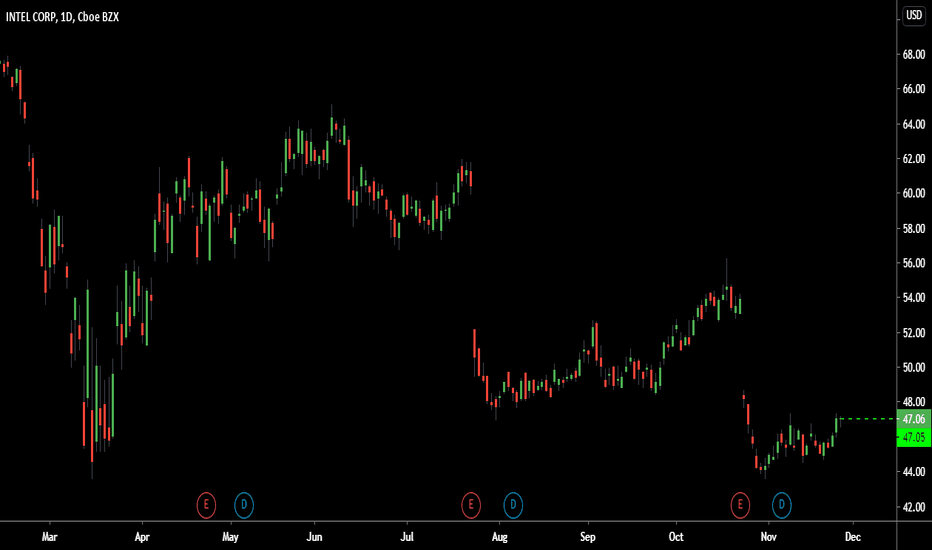

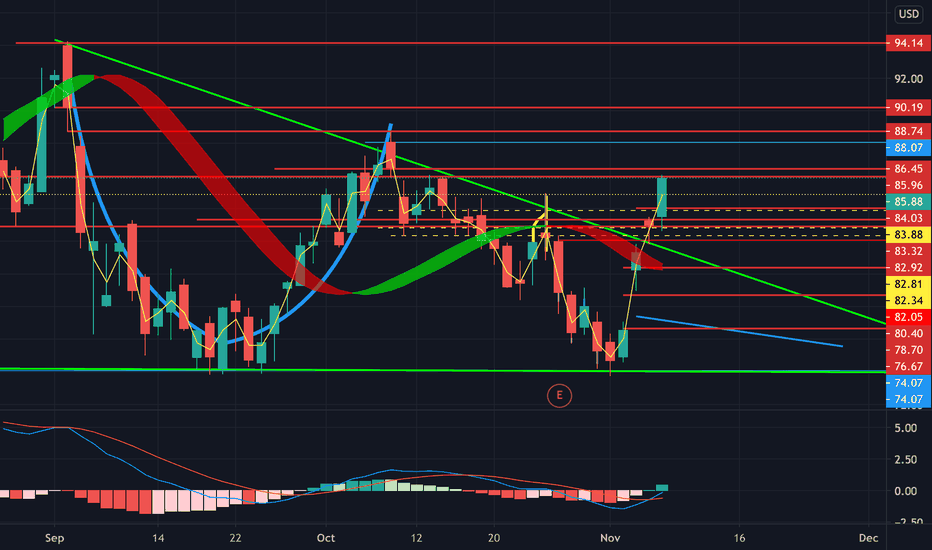

Can the run continue?When the model signaled buy late last month I will admit I didn't think it would be one of the better positions but to my surprise it has. We don't trade on narratives or fundamental analysis so we have no explanation for the move but the question is where from here? We would like to see it fill the earnings gap but nothing moves in a straight line. We can expect some chop potentially but as long has it holds $49 it will remain in the portfolio

Ingenuity Trading Model is an algorithm used in- Stock, Forex, Futures, and Crypto markets. The model is a Geometric Markov Model : Focuses on reversal and continuation wave structures

In probability theory, a Markov model is a stochastic model used to predict randomly changing systems. Markov Models are used in all aspects of life from Google search to daily weather forecast. The randomly changing systems we focus on are the equity, futures, and forex markets. The geometric element of the model is the fractal sine wave structure you can find on any chart you look at across any market and across all time dimensions.

Our model focuses on the current sine wave formation (current state)- geometric price formation along with its volume and volatility over a given time period and using that information to predict the future state- future price movement. For questions or more information feel free to contact me in the comment section or via private chat

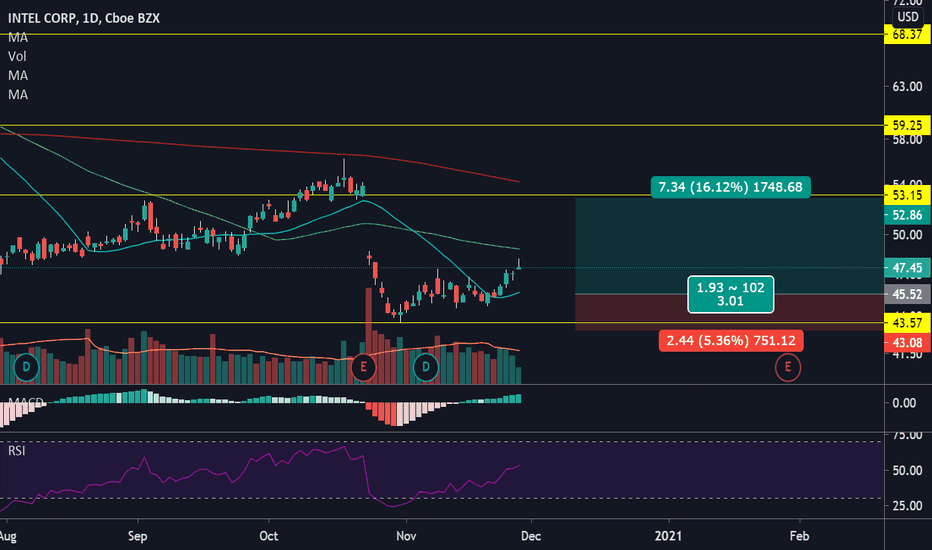

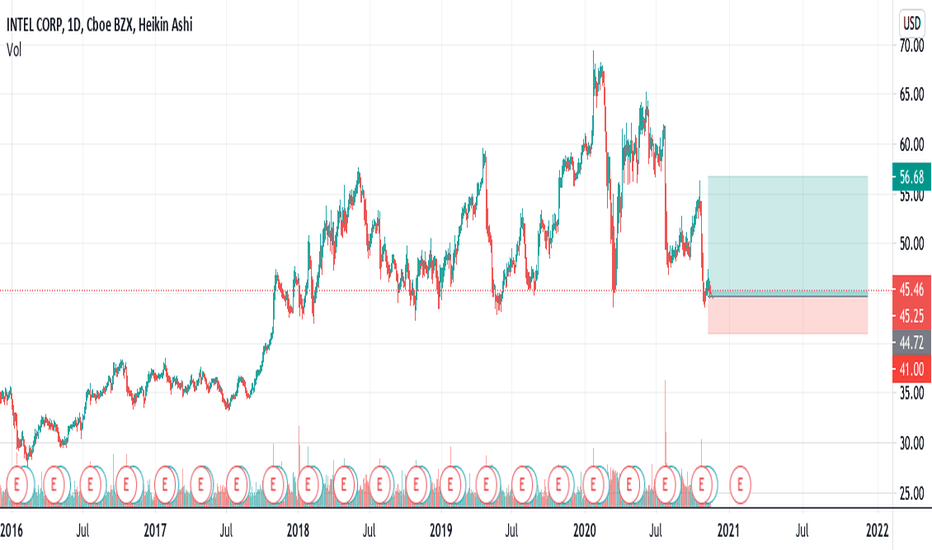

$INTC Daily MomentumJust thinking about it, what have more people been doing more than ever? Using the computer & internet and with that comes parts nessary for computers to work. Intel chips are found just about everywhere, computers, phones, cars, all sorts of things. So with that in mind more people now than ever are buying new tech in 2020. Its the mark of a decade & I know people want to upgrade or just get the latest and greatest. So with that in mind I have no doubt stocks like

$AMD $INTC $NVDA $MSFT $TTWO $CRSR $SNE will continue to see substantial growth in 2021.

Option ideas

.INTC210115C52.5

.INTC210115C55

.INTC220121C60

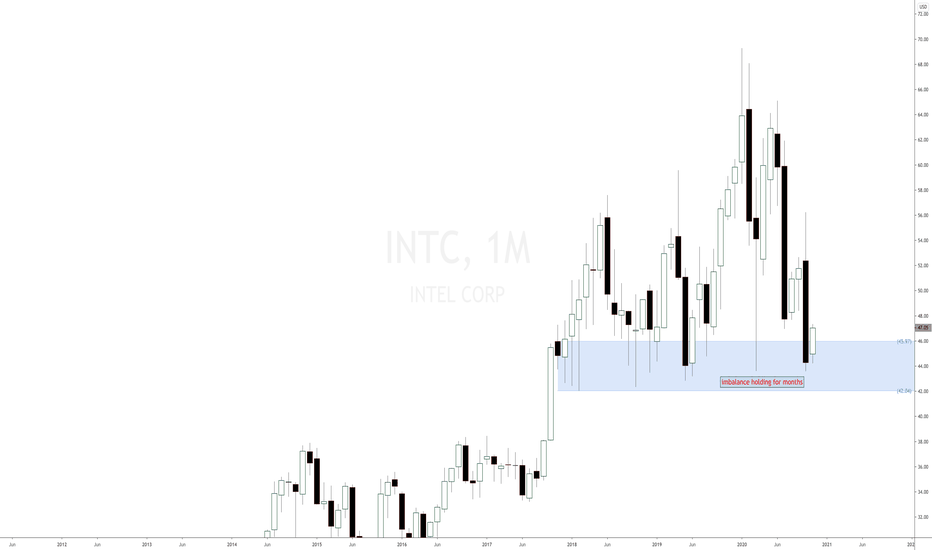

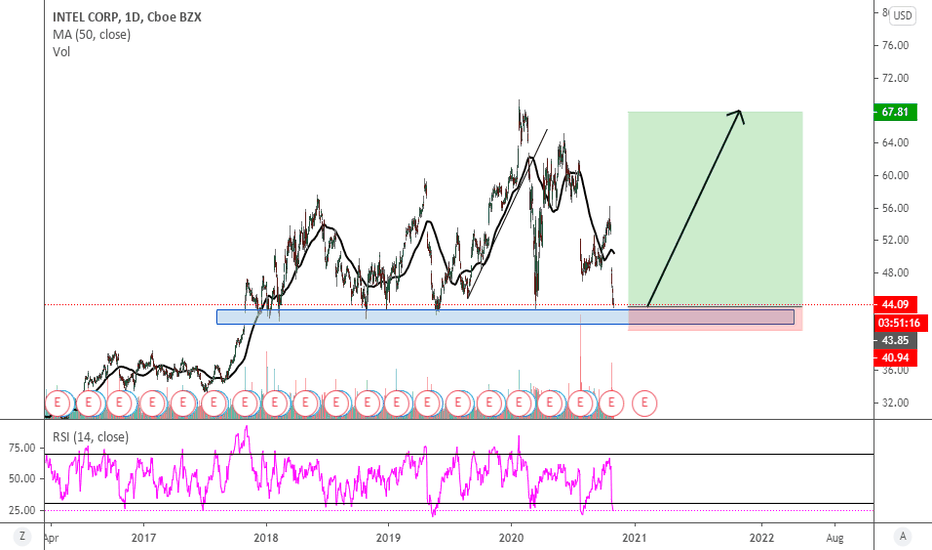

Intel stock price forecast 2020To many investors’ surprise, Intel stock has been beaten up badly in the past months. However, not too many traders will know why Intel stock cannot drop below the $42 price level. Many short-term and intraday day traders will think of potential short scenarios now that the momentum has “turned” against the company.

The momentum has turned against Intel stock? Well, if you think the momentum has turned against is because you are probably looking the smaller timeframes and you are only seen noise and chaos without any apparent direction. Direction trading on stocks is critical, if price action analysis and supply and demand is added as tools in your trading arsenal, you will see things in the stock market that have always been there but you were unaware of.

Although everything looks good for the company, as a dividend growth stock, it wasn’t appealing because of its combination of low dividend yield and relatively low dividend growth rate. That should be taken into account only if you are interested in buying shares of stock that provide a high dividend yield. Intel stock is one of those stocks to own because we like it or not, their processors are in most desktop PCs and Apple Mac.

What is a good price for Intel INTC? The imbalance created back in 2018 has been holding several pullbacks and it seems that Intel stock is about to rally again from that same price level and imbalance.

Find below a supply and demand stock analysis for Intel stock (NASDAQ:INTC). The attached chart is the monthly timeframe. The imbalance at $45.97 has been holding the stock price for a few years. Going short against it is suicidal. Only buying shares of Intel stock is possible. It’s not the clearest scenario, but no shorts at all.

INTEL - sleeping giant!Intel (INTC) Down 15.8% Since Last Earnings Report: Can It Rebound?

Zacks Equity Research

Sun, November 22, 2020, 12:30 AM GMT+8

It has been about a month since the last earnings report for Intel (INTC). Shares have lost about 15.8% in that time frame, underperforming the S&P 500.

Will the recent negative trend continue leading up to its next earnings release, or is Intel due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Buy Signal: 47.06 #stocksIngenuity Trading Model used in- Stock, Forex, Futures, and Crypto markets. For Stops and overall trade management join the club.

The model is a Geometric Markov Model :

In probability theory, a Markov model is a stochastic model used to predict randomly changing systems. Markov Models are used in all aspects of life from Google search to daily weather forecast. The randomly changing systems we focus on are the equity, futures, and forex markets. The geometric element of the model is the fractal wave structure you can find on any chart you look at across any market and across all time dimensions.

Our model focuses on the current wave formation (current state)- geometric price formation along with its volume and volatility over a given time period and using that information to predict the future state- future price movement. For questions or more information feel free to contact me in the comment section or via private chat

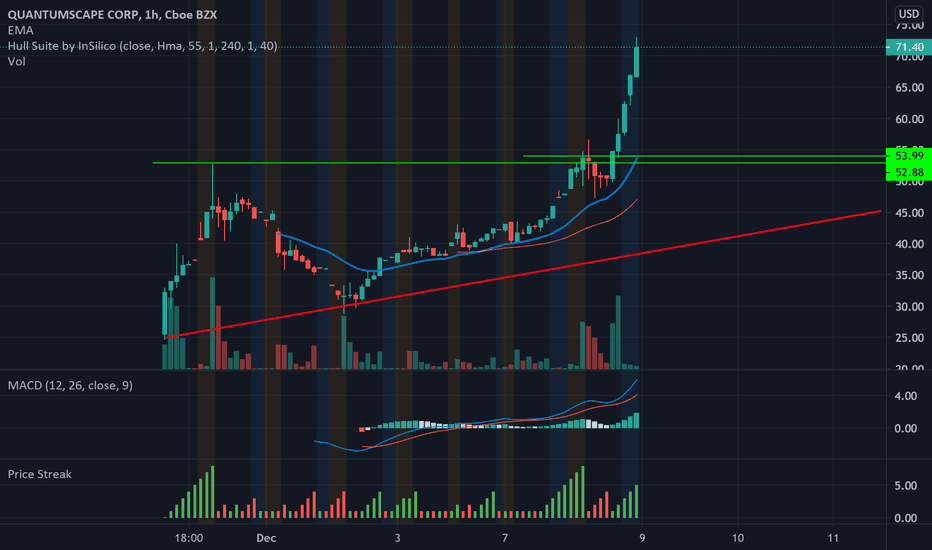

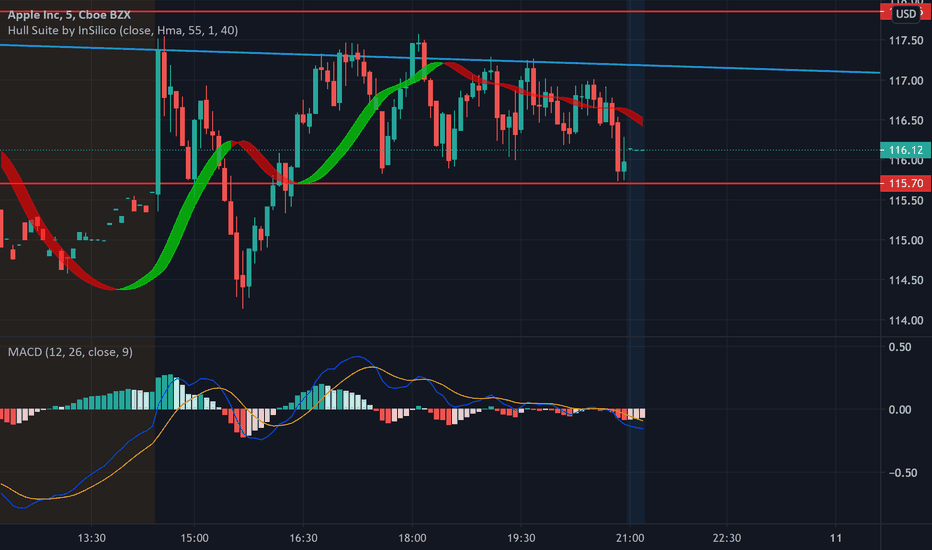

RECAP on $AAPL So as predicted again. WE got the consolidation under resistance on the daily and finished the day choppy and without a decision on where AAPL wants to go. That is represented in the Spinning Top Candle on the daily where buyers and sellers tried but no one won. We didnt get the usual AAPL pump but with so much overhead on the chart it couldn't be done without conviction. The probability of AAPL seeing downside relies heavily on the movements of SPY, but if we get a market wide pullback we could see outselfs at support quick. A break here would have us under the EMAs and my HULL indicator. We will see if anything yields from the bullish spinning top, Any upwards movments from SPY could send us over the daily resistance and up on a bullish trend! Happy trading!

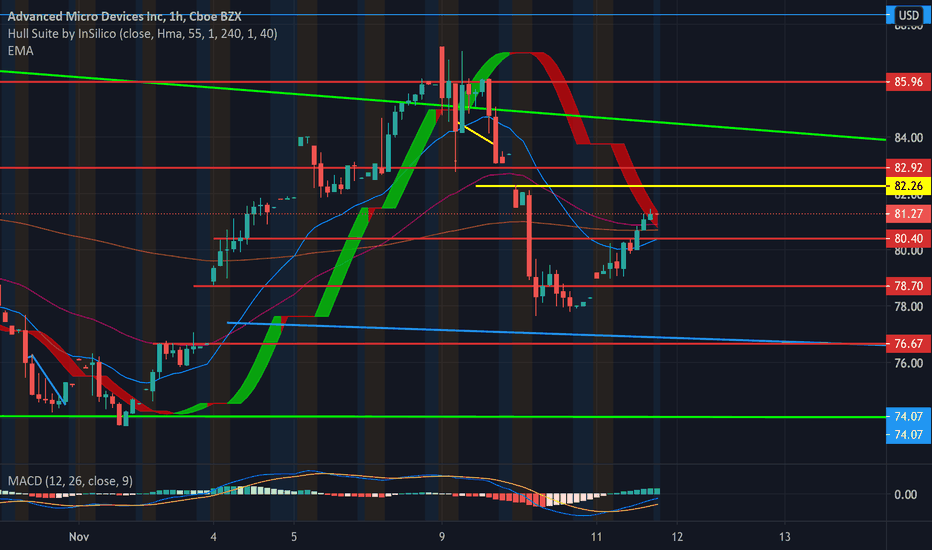

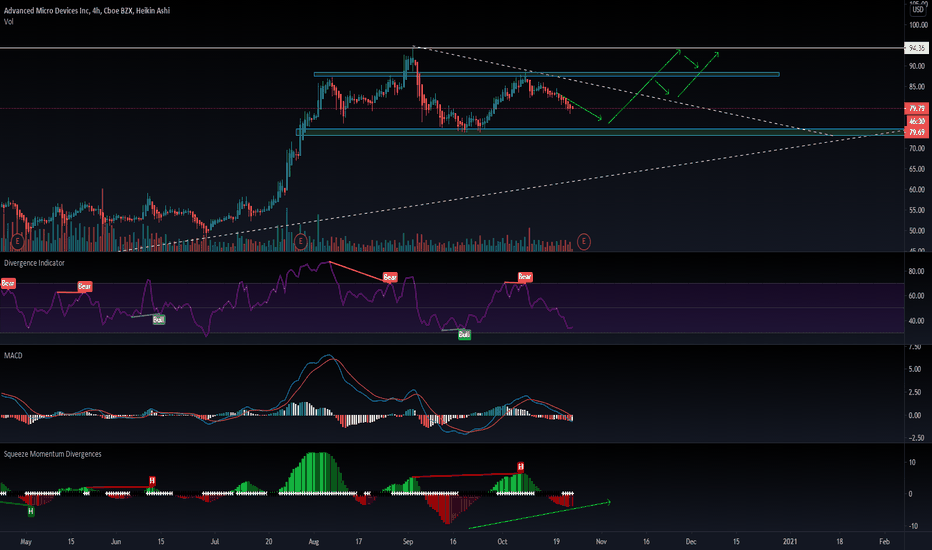

$AMD. A great buy!This stock has taken a beating since its event and purchase of $XNLX and it retested that support, bounced and broke resistance. My price targets I tried to mark out in this video, and alot of these are smaller so if you are scalping then pay attention to those big ones, and fill in on the smaller time frames. $AMD is a no brainer. Great CEO, profits, expansion, and good products. im long $AMD

AMD Earnings Play, Bull triangleAMD Bullish triangle forming, should run up for earnings and as consequence of INTC earnings today if disappointing. Ideally buy friday at close for the next week. Should also retest the lower structure before trying to breakout. Dont rush, needs to cool off red momentum, wait for a clear signal of reversal.

PT1: 88$ (feasible)

PT2: 94$ (extended).

Market is in a very precarious position, so be careful and watch for INTEL earnings results.

STOP if market crashes.

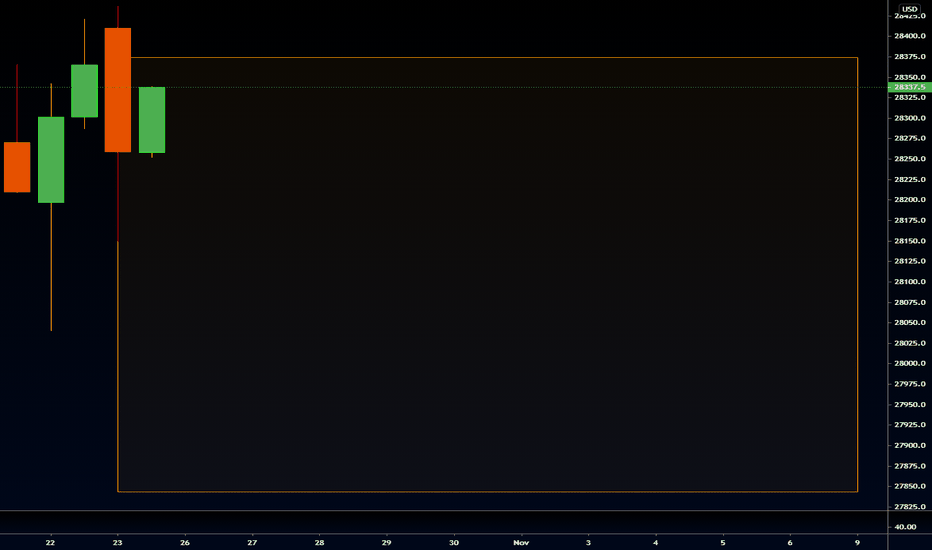

Descent in the DJI (October 26th-Nov 9th 2020)Dow Jones Industrial Average Index (DJIA) (October 26th through November 9th 2020)

Low: 27,843.7 points

High: 28,374.2 points

May have been way too ambitious with my last DJI projection, have now since adjusted for short term just to see where we are for my own learning purposes.

Thanks for tuning in :) Disclaimer, I am not responsible for any losses incurred while attempting to use my data, I hope this can prove to be some sort of learning tool for some and give insight as to how I personally come up with my own numbers. Take into full consideration this could be a completely bad forecast. Cheers

Intel Stock AnalysisBased on Technical analysis, just hold for now before going log as per tentative bullish trendline or channel theory.

Intel — Shares of the chipmaker lost more than 11% after Intel reported weaker-than-expected revenue for its data center unit during the third quarter. The company also reaffirmed the delay of its next generation chips. Intel’s overall earnings and revenue results were roughly in line with projections.

NASDAQ:INTC