Intel (INTC) Shares Drop Over 6% in a DayIntel (INTC) Shares Drop Over 6% in a Day

As shown on the Intel (INTC) chart, after Tuesday’s candle closed above $21, the price dropped sharply on Wednesday. INTC was the worst-performing stock of the day among the components of the S&P 500 index (US SPX 500 mini on FXOpen).

Why Did INTC Shares Fall?

The decline is linked to growing competitive pressure. According to media reports:

→ On one hand, AMD continues to rapidly expand its share of the server CPU market. A report by Mercury shows that the company already controls 40% of the segment and could match Intel as early as next year.

→ On the other hand, Nvidia is preparing to launch two accelerated processing units (APUs) for the consumer market, which will combine CPU and GPU capabilities in a single product.

Technical Analysis of the INTC Chart

In 2025, the price remains:

→ within a broad downward trend (marked in red);

→ supported by the $18.50–$20 zone.

Meanwhile, price fluctuations in May and June are forming a narrowing triangle (marked in black). Following the recent negative news, it is possible that INTC shares could fall towards the lower boundary of the triangle — or even retest the psychologically important $20 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Intcusd

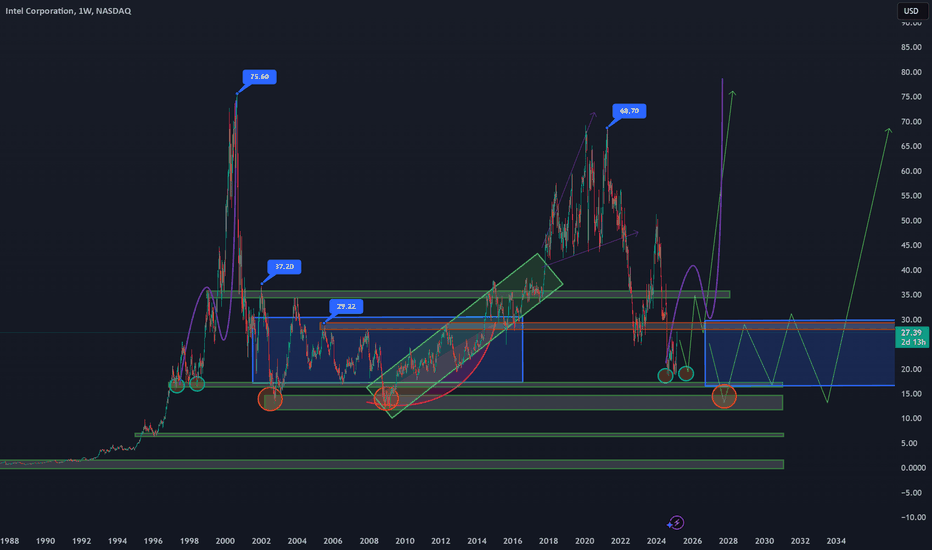

Intel (INTC): Bullish Signs Emerging, Eyes on $75 ATHIntel (INTC) has started to show strong bullish signals, confirming a reversal after refusing to drop below $18. The stock has since climbed to $27, signaling renewed investor confidence and a potential breakout in the coming months.

Key Resistance Levels: The Path to $75

$30: The first critical resistance level that Intel must break to continue its bullish momentum.

$37: A key milestone that, if surpassed, would strengthen the uptrend.

$75 (All-Time High): The ultimate long-term target.

If Intel successfully breaks above $37, it could trigger a sustained rally toward its ATH of $75, potentially supported by industry advancements and stronger financial performance.

Risk Scenario: Consolidation and Potential Drop to $12

If Intel fails to break $30, it could enter a multi-year consolidation phase.

A prolonged range between $12 and $30 could play out if bullish momentum fades.

In a worst-case scenario, Intel could hunt the $12 level, creating a long-term accumulation zone before attempting another breakout.

Summary: Bullish Structure with Key Levels to Watch

Intel’s refusal to drop below $18 and its climb to $27 signal growing bullish momentum.

Break Above $30: Signals continuation to $37, then a long-term push toward $75.

Failure at $30: Could lead to a multi-year consolidation, ranging between $12 and $30.

The next few months will be crucial in determining whether Intel resumes a strong uptrend or enters a long accumulation phase before the next major breakout.

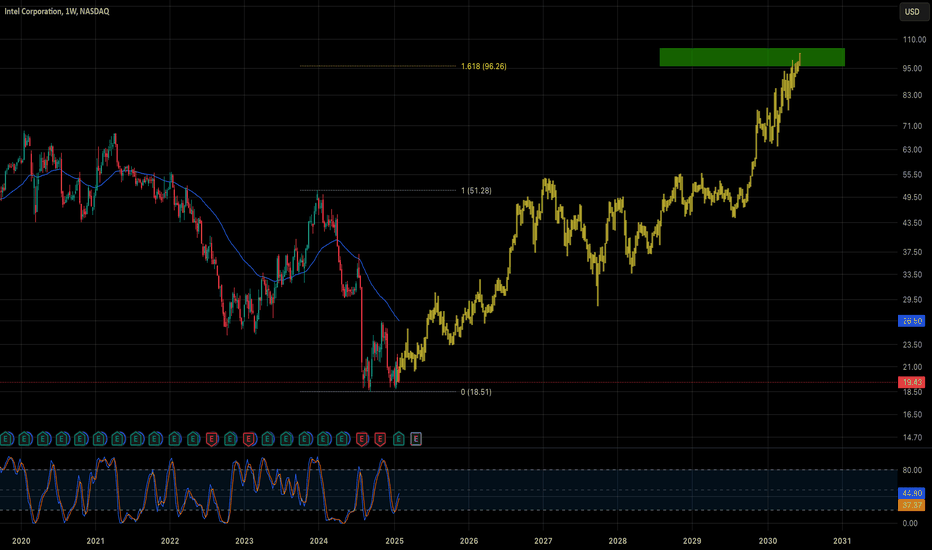

The Giant's Rebirth: Long-Term Prospects for INTCIn times when the market seems on the verge of falling, opportunities arise that only the most astute investors are able to recognize. We are now witnessing one of those rare moments with INTC. The events of the last few days, in which the CEO was forced to resign or be fired, mark not just a corporate reshuffle, but perhaps a historic turning point. History teaches us that such significant leadership changes are often harbingers of recovery and growth. Watching the price-to-sales drop to levels we've only seen in the darkest times of the past indicates that we may have hit bottom. This is not just a signal, it is a once-in-a-decade chance. INTC now offers us a unique opportunity for long-term investing with minimal risk. We are not talking about short speculation; this is an investment in the future of a company that is on the cusp of new growth. If we look at the patterns of past recoveries, we see that such situations often precede multi-year upturns. Looking at all aspects, I would rate this opportunity as having a tremendous probability of success. We are facing potential huge long-term profits. This is not just an investment; it is a bet on the revitalization of a company that is now at the bottom of its cycle, but with tremendous upside potential. This may be one of those rare occasions when we can buy at the very beginning of a recovery, when all market fears turn into strategic advantages for those willing to look beyond the current news.

Horban Brothers,

Alex Kostenich