Intradaytrade

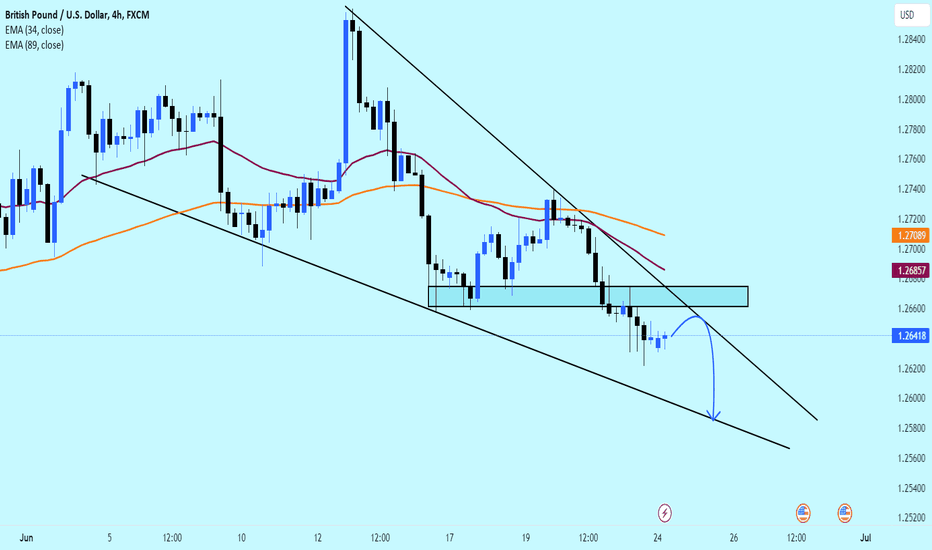

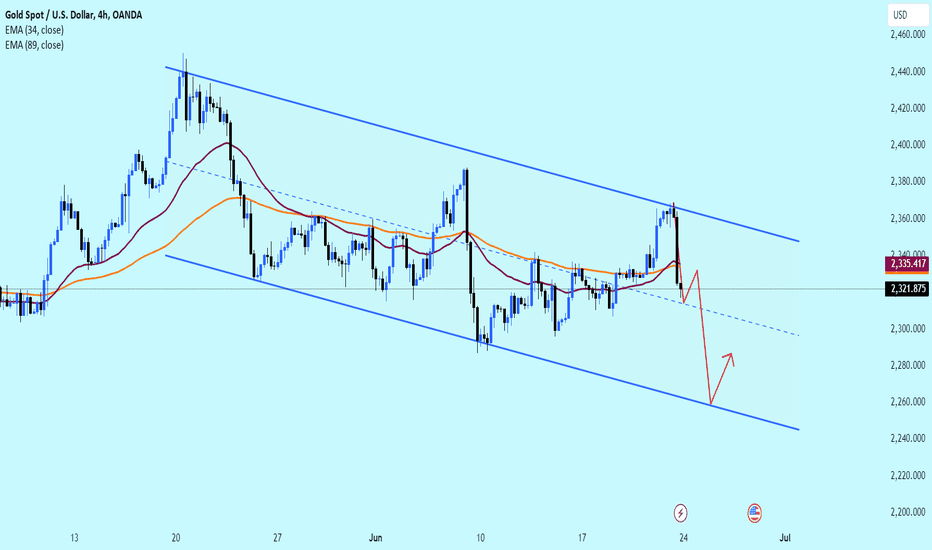

Gold prices still decreased again in the last day of the sessionHello everyone, yesterday the gold market dropped to its lowest level of the session. It was noted that at the time of writing, gold had decreased by more than 38 USD (equivalent to 1.62%) compared to the previous session and repeated the sharp decline like the last Friday of last week.

Accordingly, from the technical picture, gold is starting to fall again in the parallel price channel. If the upper limit is still not broken, gold may fall more in the near future as long as the falling price channel remains stable. .

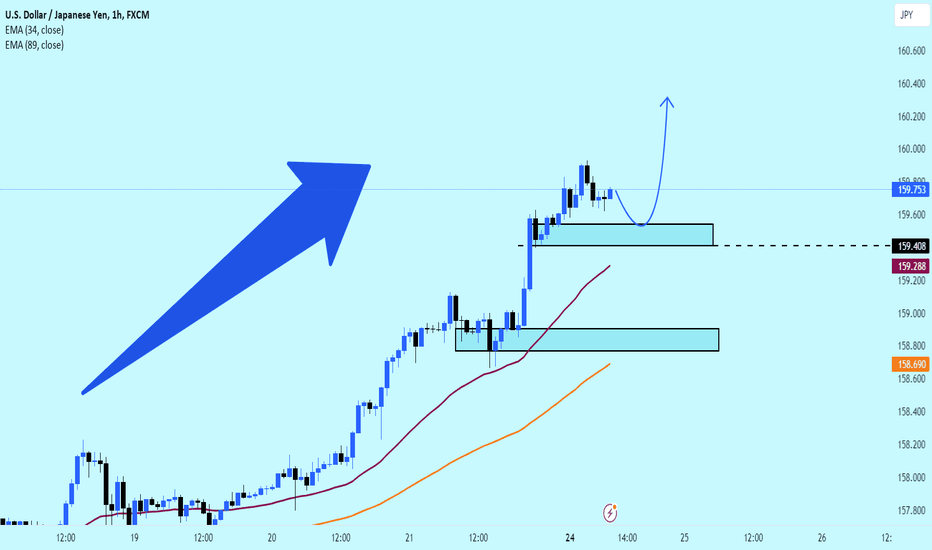

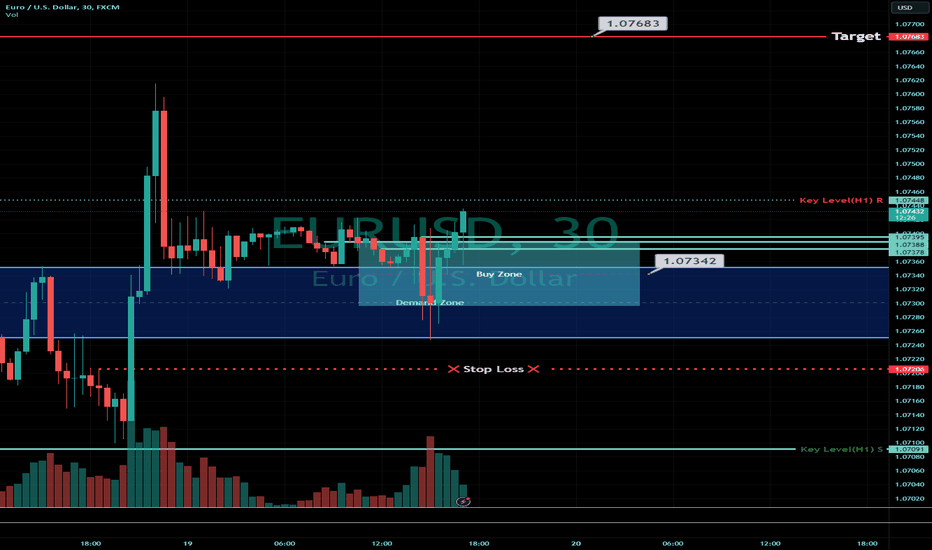

ICT Long setup London session EURUSD👋Hello Traders,

Our 🖥️ AI system detected that there is an H1 or higher timeframe ICT Long setup in EURUSD for session trade (a couple of hours)

Weekly chart is in down trend!! So that you couid wait for a reversal to downside as a Swing Short trade after this upward pulse alternatively!

Please refer to the details Stop loss, FVG(Buy Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

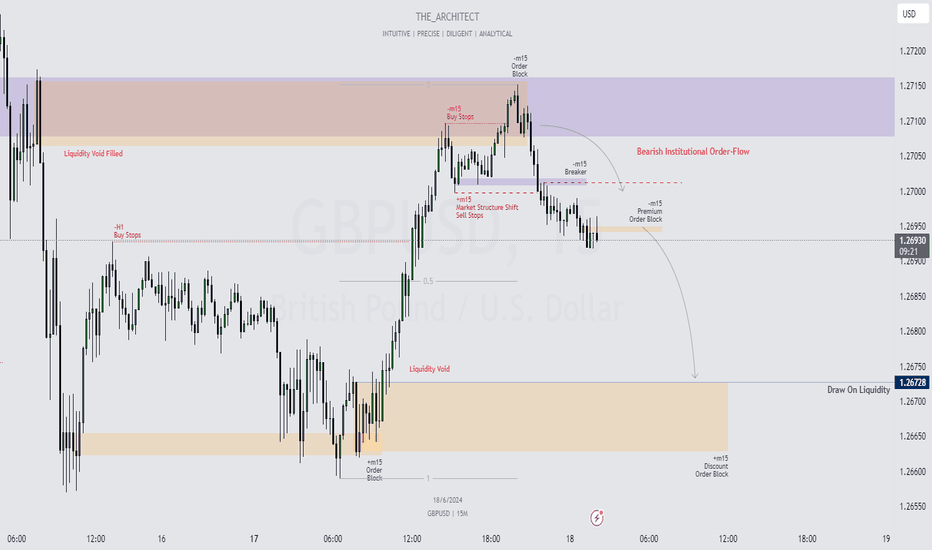

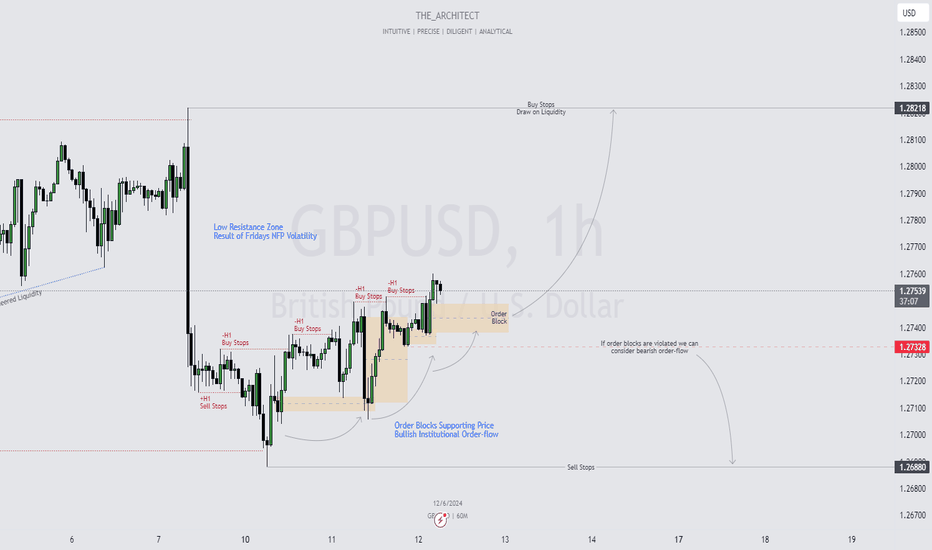

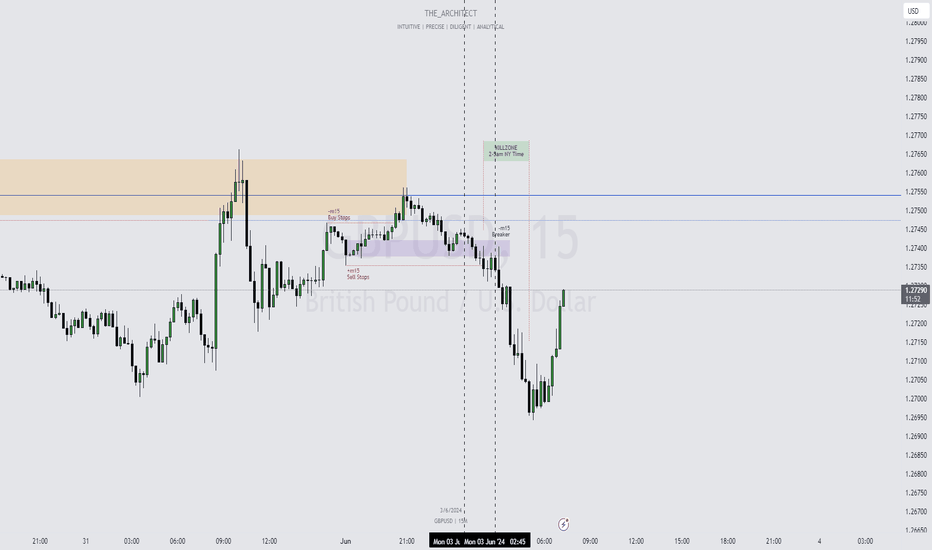

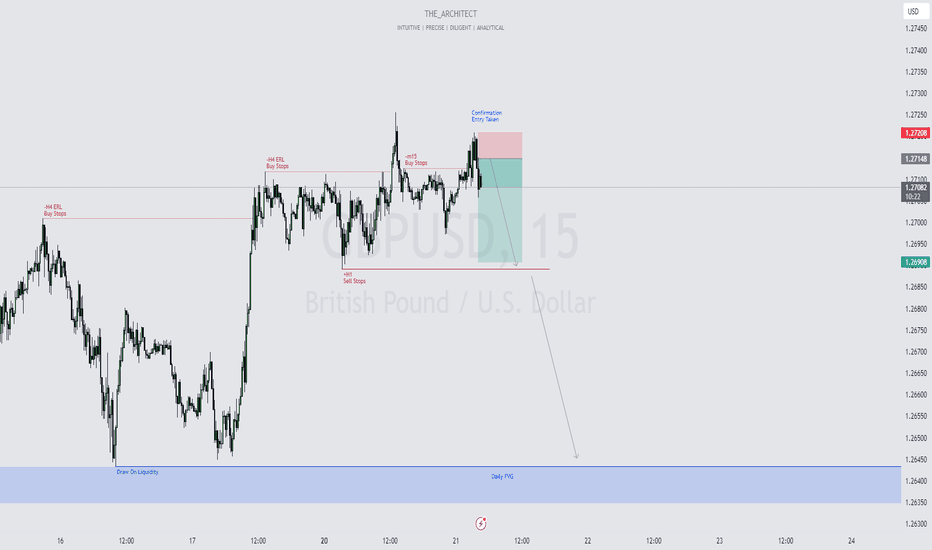

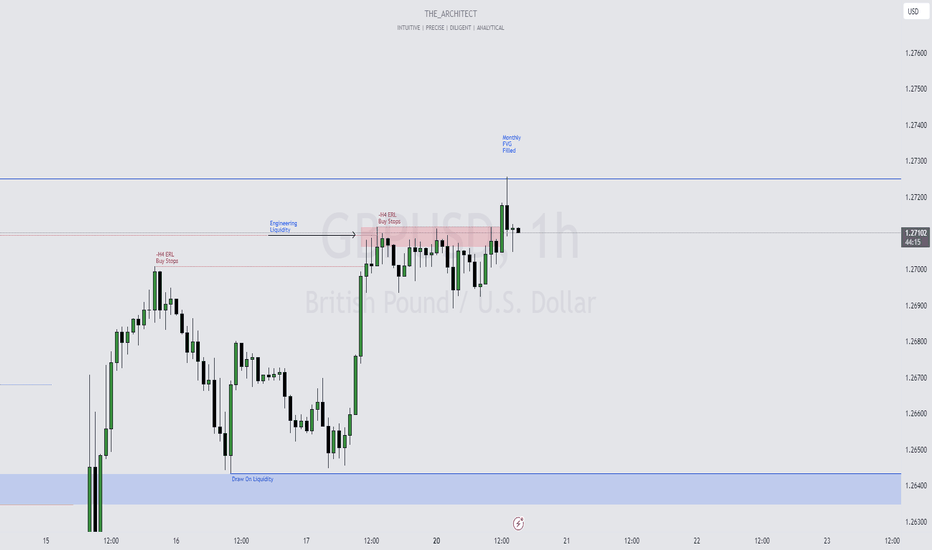

GBPUSD: Institutional Bearish Order Flow AnalysisGreetings Traders!

Current Market Analysis:

At present, GBPUSD is reacting to a strong institutional resistance point aligned with an M15 bearish order block. The strength of this order block is due to the inefficiency (liquidity void) preceding it. Additionally, this order block is in conjunction with an H4 breaker block, a significant institutional resistance level where smart money typically initiates new selling positions.

Key Observations:

Institutional Resistance: The M15 bearish order block, strengthened by the preceding liquidity void, has led to a downward price movement and a market structure shift. This shift indicates that the institutional order flow is now bearish.

Price Action: Following the market structure shift, the price has respected the breaker block, suggesting further selling pressure and a continuation of the bearish order flow.

Bearish Order Blocks as Resistance: Given the bearish order flow, we expect bearish order blocks to serve as effective resistance levels, guiding the price towards the downside.

Trading Strategy:

Premium and Discount Levels: We are currently operating within premium prices, making it logical to target discount arrays for profit booking. The focus is on selling at premium levels and aiming for discounted prices where we can realize profits.

Target: The primary target in the discount price range is the discount bullish order block, which also features an inefficiency (liquidity void). This presents a suitable draw on liquidity and an ideal profit-taking level.

Conclusion:

By understanding the current institutional order flow and leveraging key resistance and support levels, we can effectively anticipate and execute bearish trades on GBPUSD. The confluence of the M15 bearish order block, H4 breaker block, and liquidity voids strengthens our bearish outlook and guides our trading strategy towards targeting discounted arrays.

Happy Trading,

The_Architect

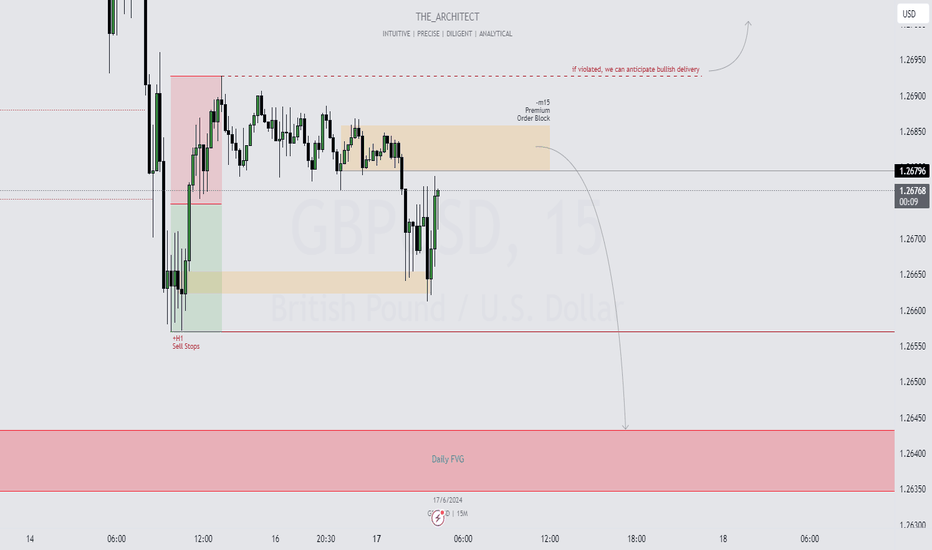

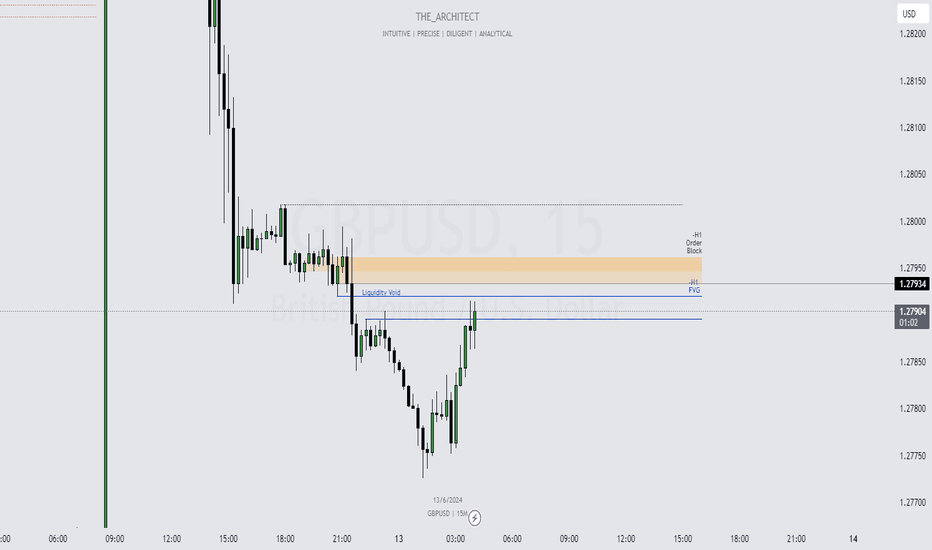

GBPUSD: Bearish Intraday Trade OpportunityGreetings Traders!

Current Market Analysis:

At the moment, GBPUSD is exhibiting a clear bearish institutional order flow. Our primary focus is to identify selling opportunities that align with this narrative. Here’s how we plan to approach the market today:

Key Observations:

Institutional Order Flow: We are entirely bearish, so our strategy is to find sell opportunities in premium price zones and aim to book profits at further discounted prices.

Premium and Discount Tool: Utilizing this tool, we have identified a premium array, specifically the M15 bearish order block, as our point of interest (POI). This is where we will be looking to initiate a sell trade.

Trading Strategy:

Entry Point: I will wait for the price to reach the identified M15 bearish order block. This POI represents a premium price level where we anticipate a strong selling opportunity.

Target: The primary target is the daily fair value gap. This is where we aim to book our profits, capitalizing on the bearish momentum.

Contingency Plan:

Reactive Trading: If the price does not reach the POI, I will adapt to the market's movements and make decisions based on the unfolding price action.

Invalidation Level: If the price breaks above the 1.26928 high, it may indicate a temporary shift in the internal structure to bullish. In this case, we will reassess our strategy accordingly.

Happy Trading,

The_Architect

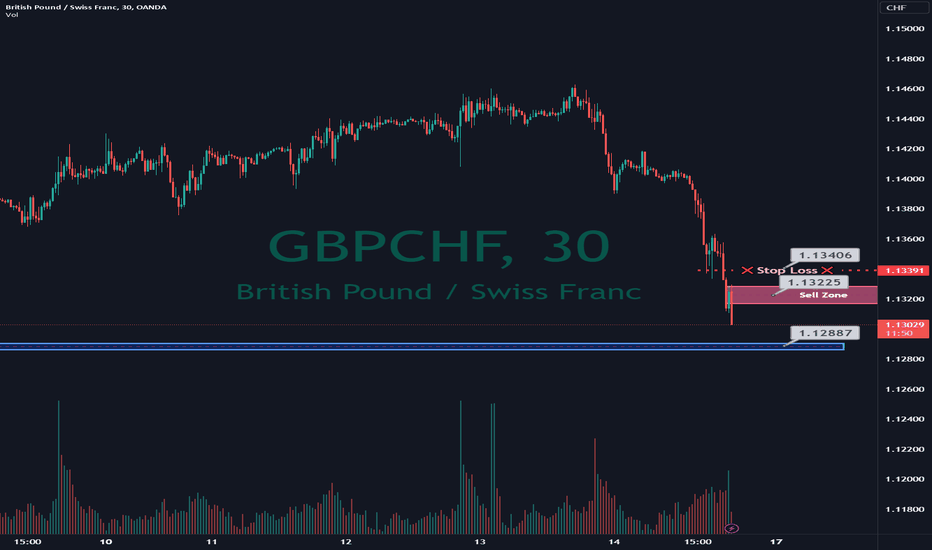

ICT Short setup GBPCHF, session trade👋Hello Traders,

Our 🖥️ AI system detected that there is an H4 or higher timeframe ICT Short setup in GBPCHF for Swing trade.

Please refer to the details Stop loss, FVG(Sell Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

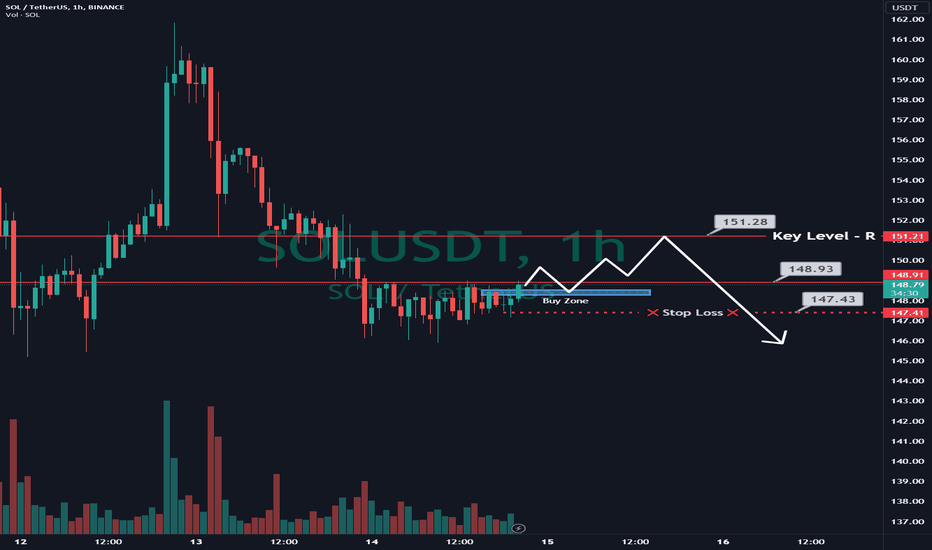

ICT Long setup intraday SOLUSDT👋Hello Traders,

Our 🖥️ AI system detected that there is an H1 or higher timeframe ICT Long setup in SOLUSDT for session trade (a couple of hours)

Weekly chart is in down trend!! So that you couid wait for a reversal to downside as a Swing Short trade after this upward pulse alternatively!

Please refer to the details Stop loss, FVG(Buy Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Since an important news about USD is coming, so small lot then small risk!

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

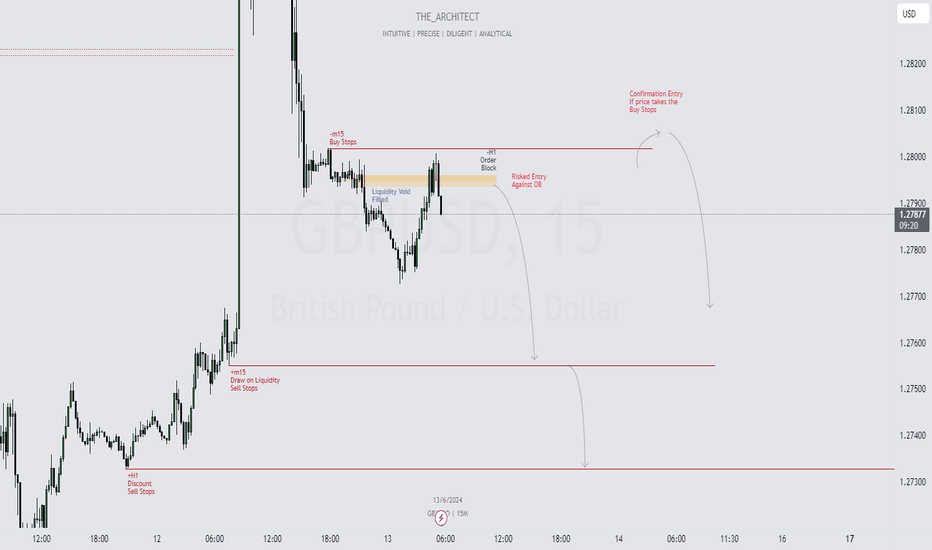

GBPUSD: Intraday Trade Alert - Potential Sell OpportunityGreetings Traders!

Analyzing Bearish Institutional Order Flow

At the moment, I am observing continuous bearish institutional order flow stepping into the market to reach sell-side objectives. I am selling price action off the M15 bearish order block, which is strong due to an inefficiency (FVG & liquidity void) resting below it. As price reached into the order block, it filled those inefficiencies and has now reached a balanced price range, which I expect to hold. Therefore, I am considering a risked entry on the order block to target the M15 sell stops.

Key Observations:

Bearish Momentum:

Order Block Resistance: Price is using the M15 bearish order block as resistance, indicating strong bearish momentum.

Targeting Sell Stops: The primary objective is the M15 sell stops. As well as the H1 Discount Sell Stops.

Buy Stop Bearish Scenario:

m15 Buy Stops: If price moves towards the M15 buy stops, I will look for a confirmation entry to sell price towards the downside.

Trading Strategy:

Primary Focus: Entering a risked sell entry on the M15 bearish order block to target the M15 sell stops.

Secondary Consideration: Monitoring the m15 buy stops, if they get taken I will look for confirmation entries to sell towards the bearish targets.

GBPUSD & DXY Video Analysis: Key Expectations and Trends Ahead!

If you'd like to further understand why I am anticipating a bearish draw towards the downside on GBPUSD, please watch my end-of-week outlook video on GBPUSD and the DXY through the link provided.

It's important to know how you will be approaching the market, so please conduct further analysis to make well-informed trading decisions.

Kind Regards,

The_Architect

GBPUSD & DXY Analysis: Key Expectations and Trends Ahead!Greetings, Traders!

Join me in today's video for an in-depth analysis of GBPUSD and DXY, where we'll explore key expectations for today's and tomorrow's trading sessions, as well as summarize this week's trends. This analysis is pivotal as it sets the tone for next week's trading. We've reached a critical juncture on both the DXY and GBPUSD charts, making it essential to understand the potential market movements ahead.

What do you think will be the major market mover going into next week?

Stay tuned for valuable insights, and don't hesitate to leave any questions or comments below.

Happy Trading,

The_Architect

GBPUSD: What Should We Expect from Today's CPI Release?Greetings Traders!

What to Expect in Today's CPI Release

At the moment, GBPUSD is showing a relationship with bullish order blocks. We observe that after buy stops (external range liquidity) have been taken, the market moves into bullish order blocks (internal range liquidity), and these order blocks are consistently supporting the price. This indicates that the current price action is being driven by bullish institutional order flow, which may continue further today.

Key Observations:

Bullish Momentum:

Order Blocks Support: Price is supported by bullish order blocks, indicating strong bullish momentum.

Targeting Buy Stops: The main liquidity draw is towards the buy stops at the high. There is minimal resistance in this direction due to the heavy downward moves during Friday's NFP release.

Potential Bearish Shift:

Market Shift: If there is a market shift towards the downside, or if the order flow from the bullish order blocks is broken, we may see a downward draw towards the sell stops.

Cautious Approach: While the current bias is towards bullishness, any invalidation of this bias will lead to a reassessment of trading opportunities.

Trading Strategy:

Primary Focus: Anticipating upward movement towards buy stops based on current bullish order flow.

Secondary Consideration: Monitoring for any signs of a bearish market shift and avoiding sell-side trades if the bullish bias is invalidated.

Please conduct further analysis on your own to complement this overview and to make well-informed trading decisions.

Kind Regards,

The_Architect

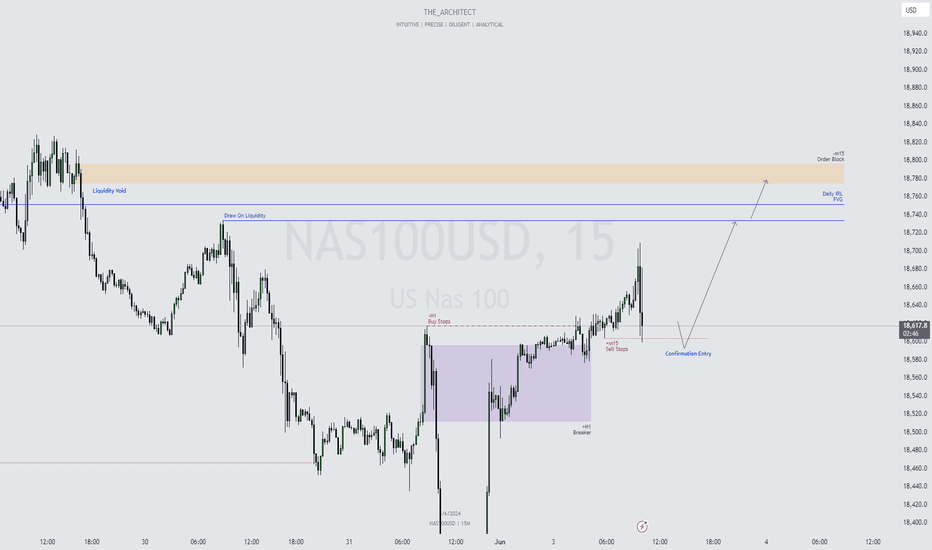

NAS100USD: Potential Buy Opportunity for NY SessionGreetings, Traders!

Brief Description🖊️:

Currently, institutional order flow on US100 is bullish, therefore we are looking for price to take sell stops in order for a turtle soup trade condition (false break).

Things I Have Seen👀:

Bullish Institutional Order Flow📈: Anticipating price to continue to the upside after sell stops have been taken. Smart money will look to order pair (buy against the sell-side liquidity).

Potential Sell Stops🔄: Price may take sell stops before buying, presenting a turtle soup condition (false break of structure). After sell stops have been taken, I will look to take a confirmation entry.

Bullish Targets📉:

Daily FVG: The primary target.

M15 Bearish Order Block: The secondary objective, with an expectation to fill the liquidity void there.

What's Important Now❗

Stay observant for price action around these key levels to confirm bullish continuation.

Best Regards,

The_Architect

June 03, DXY & GBPUSD: Trading Insights for the Week Ahead!Greetings, Traders!

Brief Description🖊️:

We are in the first week of June, a period marked by high-impact news, including the Non-Farm Payroll (NFP) report. In this video, I will provide an in-depth analysis of the DXY and GBPUSD pairs, offering valuable insights for the upcoming week in trading.

Things We Will Cover👀:

Lecture on Draw On Liquidity🧠:

Understanding how to analyze the market objectively.

Studying key concepts such as Fair Value Gaps (FVGs), order blocks, mitigation blocks, breakers, and more.

Market Analysis📉📈:

DXY and GBPUSD: Detailed analysis of these pairs to uncover potential trading opportunities for the week ahead.

Draw On Liquidity: Understanding what the draw on liquidity is for this week and how it impacts our trading strategies.

What's Important Now❗

Stay tuned to gain a comprehensive understanding of market analysis and to identify profitable trading opportunities in the upcoming week.

Best Regards,

The_Architect

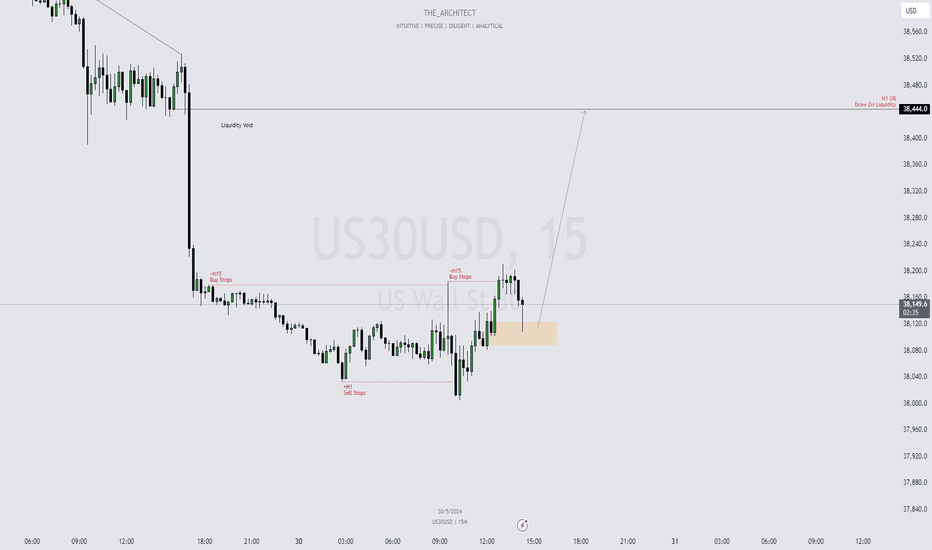

US30 Market Shift: Bullish Targets and Key Liquidity ZonesGreetings, Traders!

Brief Description🖊️:

Currently, US30 has presented a market structure shift (MSS). Before this shift, we observed the price taking H1 sell stops, indicating that smart money has paired orders. This MSS suggests the potential for bullish institutional order flow. The price has since pulled back into an M15 bullish order block.

Things I Have Seen👀:

Market Structure Shift🔄: The price has shifted, signaling potential bullish institutional order flow.

Order Block Support📈: The price has pulled back into an M15 bullish order block.

Liquidity Void🕳️: Yesterday's price action left a significant inefficiency (liquidity void). Today's trading will aim to fill this inefficiency, with the draw on liquidity targeting the last point of efficiency, the H1 bearish order block.

Bullish Targets📉:

H1 Bearish Order Block: The primary target for filling the liquidity void.

What's Important Now❗

We need to observe today's price action to see if it fills the inefficiency and reaches the H1 bearish order block.

Best Regards,

The_Architect

ICT Long setup scalping BTCUSDT👋Hello Traders,

Our 🖥️ AI system detected that there is an ICT Long setup in BTCUSDT for scalping.

Please refer to the details Stop loss, FVG(Buy Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

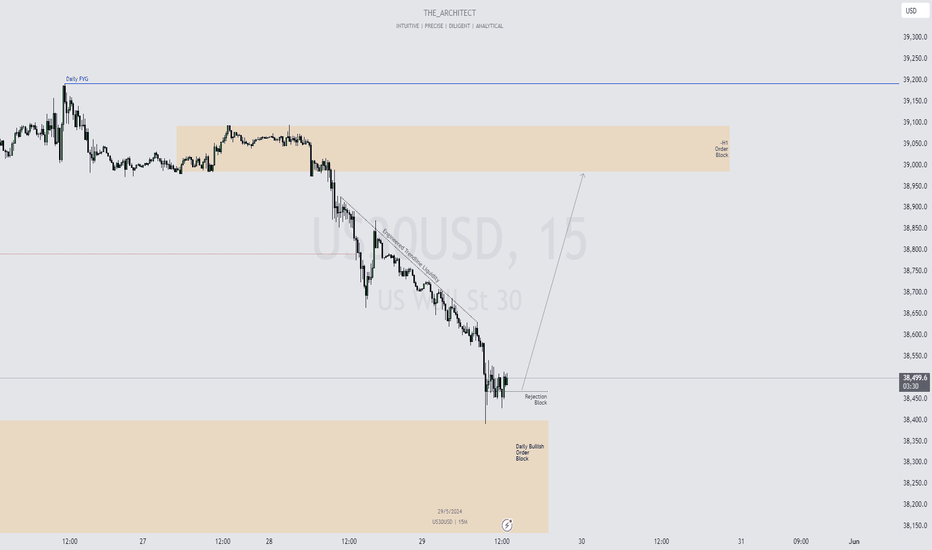

US30 Bullish Outlook: Key Targets and Order Flow InsightsGreetings, Traders!

Brief Description🖊️:

At the moment, I am expecting a bullish switch in institutional order flow for US30, which will push the price upwards. The price originates from a daily bullish order block, and I am looking for this to support the price, leading to a bullish draw upon confirmation.

Things I Have Seen👀:

Bullish Support Zone📈: The price is currently supported by a daily bullish order block, indicating a potential upward movement. Price may also look to respect the rejection block and use that as a support to continue the bullish narrative.

Engineered Liquidity🔄: Along the way, my anticipation is to absorb all the engineered trendline liquidity that has been presented.

Bullish Targets📉:

H1 Bearish Order Block: The primary target for this bullish move.

What's Important Now❗

To confirm the anticipated bullish draw, we need to observe the price action and look for supportive signals at the daily bullish order block. Stay tuned for real-time developments and further insights.

Kind Regards,

The_Architect

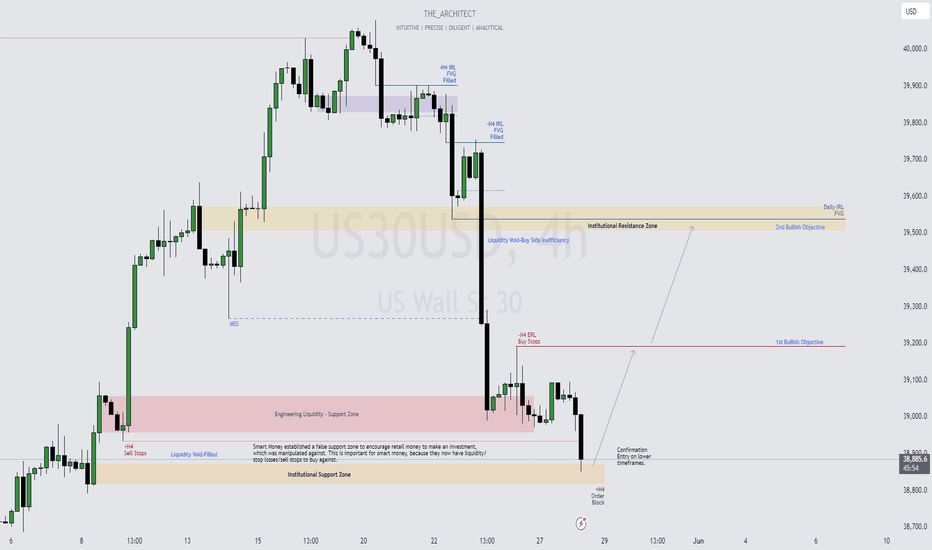

US30 Trading Outlook: Bullish Moves and Key Targets!Greetings, Traders,

Brief Description🖊️:

At the moment, I am seeing a potential draw towards minor bullish objectives, specifically the H4 buy stops, and a movement towards the institutional resistance point (reclaimed order block) to fully fill the daily timeframe FVG. This point is also aligned with a liquidity void, indicating a price inefficiency that may be filled in the future, adding more confluence to the possibility of reaching the reclaimed order block (institutional resistance zone).

Things I Have Seen👀:

Liquidity Engineering🔄: Yesterday, smart money engineered liquidity using a support zone, which was established to attract retail investments. These investments were manipulated so that smart money could buy against the liquidity presented as stop losses below the support zone, using those stop losses as willing sellers.

Current Price Action💹: The price may be supported by the order block. Upon confirmation on the lower timeframes, I will look to buy at that order block and continue doing so as a day trader until both objectives are reached.

Kind Regards,

The_Architect

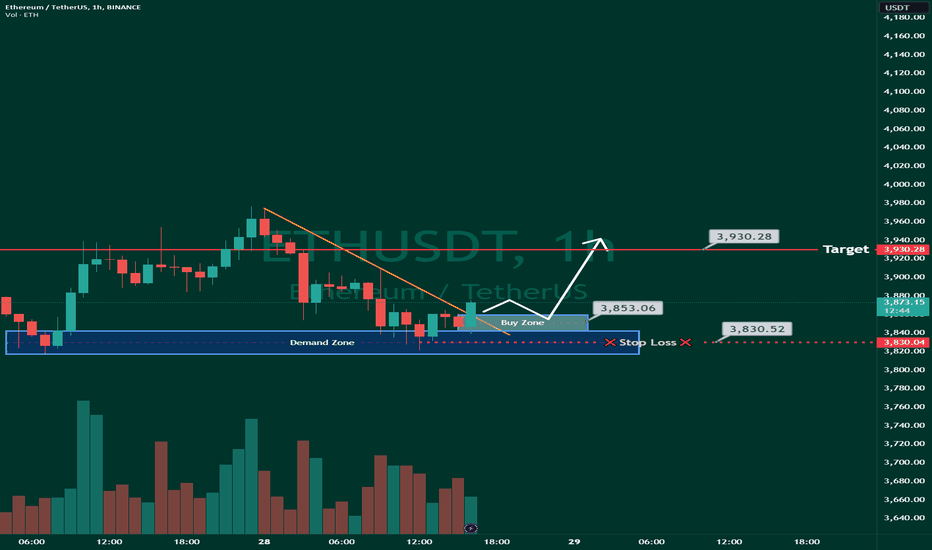

ICT Long setup ETHUSDT intraday and swing trade👋Hello Traders,

Our 🖥️ AI system detected that there is an ICT Long setup inETHUSDT for scalping.

Please refer to the details Stop loss, FVG(Buy Zone),open for take profit.

For more ideas, you are welcome to visit our profile in tradingview.

Have a good day!

Please give this post a like if you like this kind of simple idea, your feedback will bring our signal to next better level, thanks for support!

GBPUSD Sell Alert: Major Bearish Shift Ahead - Act Now!Currently, GBPUSD is signaling a potential reversal, indicating a shift towards bearish institutional order flow. We may see the price target sell-side objectives such as the H1 sell stops, with further movement towards the Daily Fair Value Gap (FVG) throughout the week.

For confirmation, I monitored the manipulation of the Asian session high during the London session. According to the Power of 3 strategy, London often sets the day's high when bearish momentum is expected, leading to a price distribution towards the downside.

In terms of take profits, you can distribute them as you see fit. I will be aiming for a 1:4 risk-to-reward ratio, but if your entry was a bit late, you might consider targeting the Daily Fair Value Gap (FVG).

To understand why I'm anticipating bearish momentum on GBPUSD, please watch this video for a comprehensive breakdown of this week's trading outlook.

Kind Regards,

The_Architect

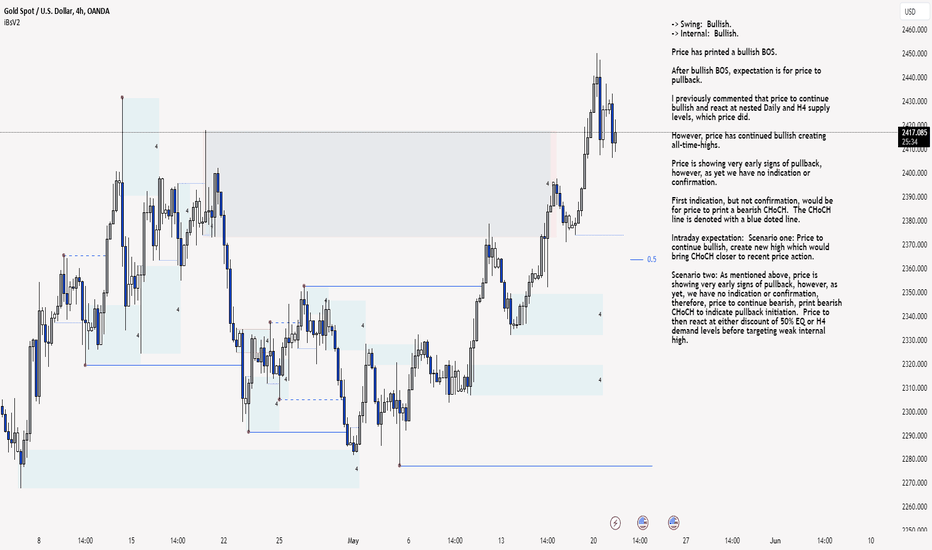

XAU/USD 21 May 2024 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed a bullish BOS.

After bullish BOS, expectation is for price to pullback.

I previously commented that price to continue bullish and react at nested Daily and H4 supply levels, which price did.

However, price has continued bullish creating all-time-highs.

Price is showing very early signs of pullback, however, as yet we have no indication or confirmation.

First indication, but not confirmation, would be for price to print a bearish CHoCH. The CHoCH line is denoted with a blue doted line.

Intraday expectation: Scenario one: Price to continue bullish, create new high which would bring CHoCH closer to recent price action.

Scenario two: As mentioned above, price is showing very early signs of pullback, however, as yet, we have no indication or confirmation, therefore, price to continue bearish, print bearish CHoCH to indicate pullback initiation. Price to then react at either discount of 50% EQ or H4 demand levels before targeting weak internal high.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Price has printed a bearish iBOS (Internal break of structure).

After iBOS price is expected to pull back.

First indication, but not confirmation of pullback initiation is for price to print a bullish CHoCH. Price has printed a bullish CHoCH which is denoted with a blue dotted line.

Intraday Expectation: Price to continue bullish. React at either premium of 50% EQ or M15 POI both of which are positioned closely before targeting weak internal low which is denoted with a blue dashed line.

M15 Chart:

May 20, DXY & GBPUSD: Key Insights for the Week Ahead!Greetings, Traders!

Welcome to an exciting and insightful video where we dive deep into the DXY and GBPUSD pairs. This week, both pairs have hit crucial junctures, making it the perfect time to analyze and adjust our trading strategies.

We'll explore significant retracements and pinpoint key points of interest, providing you with a comprehensive outlook on potential price movements. What trading opportunities lie ahead? Let's uncover the strategies that could make this week profitable for you.

April 29, Long-term Video Analysis (DXY & GBPUSD):

March 15, SMT Divergence (Educational Lecture Explaining how to use it):

Tomorrow's my birthday, happy trading, Traders!

The_Architect