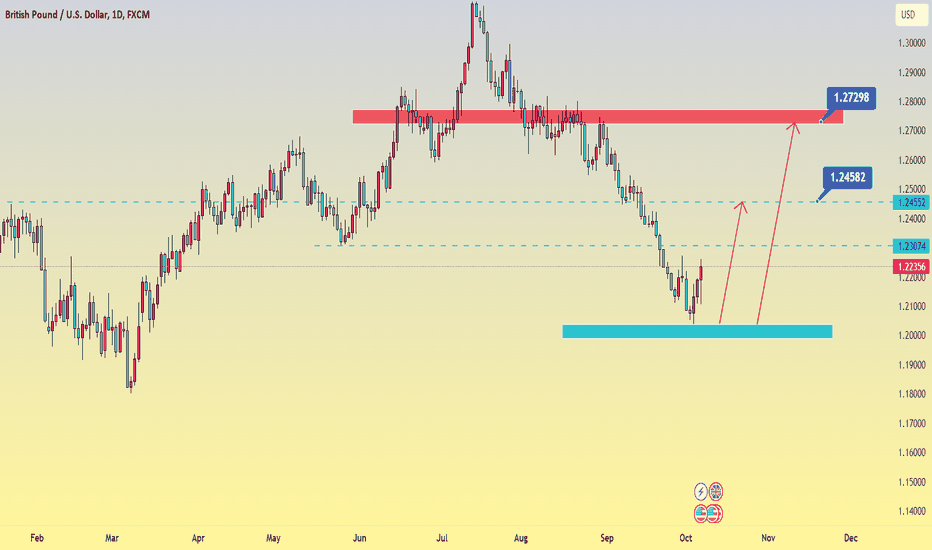

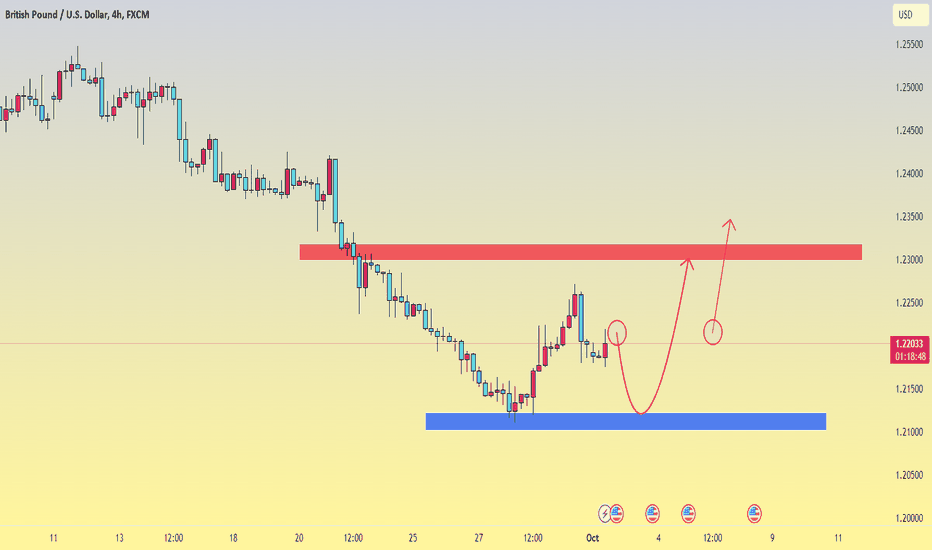

GBPUSD expands its increaseGreetings, valued traders!

At present, GBPUSD is capitalizing on its upward price trend following a decline from 1.206. It is evident that this currency pair is gradually tempering its downward momentum and extending its potential for price appreciation.

With the current exchange rate of 1,2235, this particular pairing has the potential to propel towards the resistance level of 1,2458 by surpassing the breakthrough point at 1,2307. Consequently, it can be inferred that this increase serves as a robust support level to further bolster this currency pair.

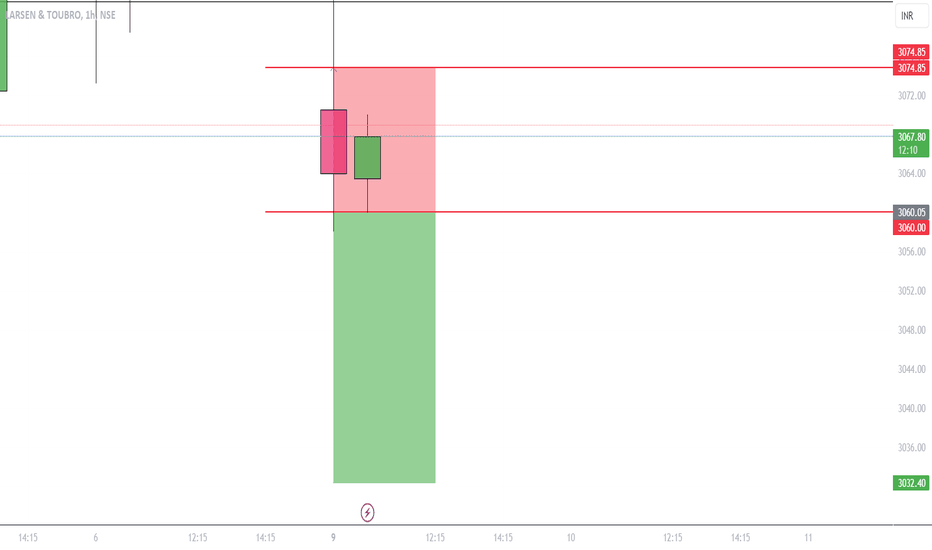

Intradaytrade

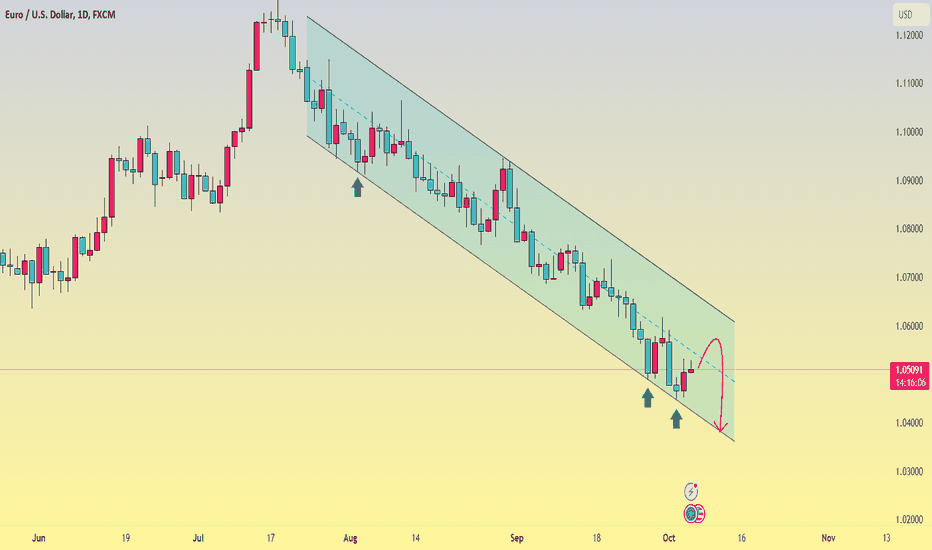

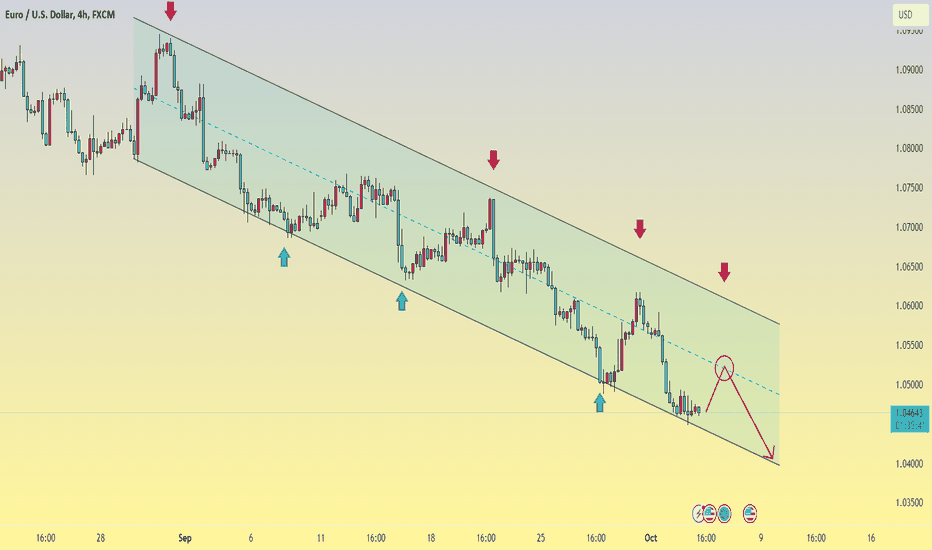

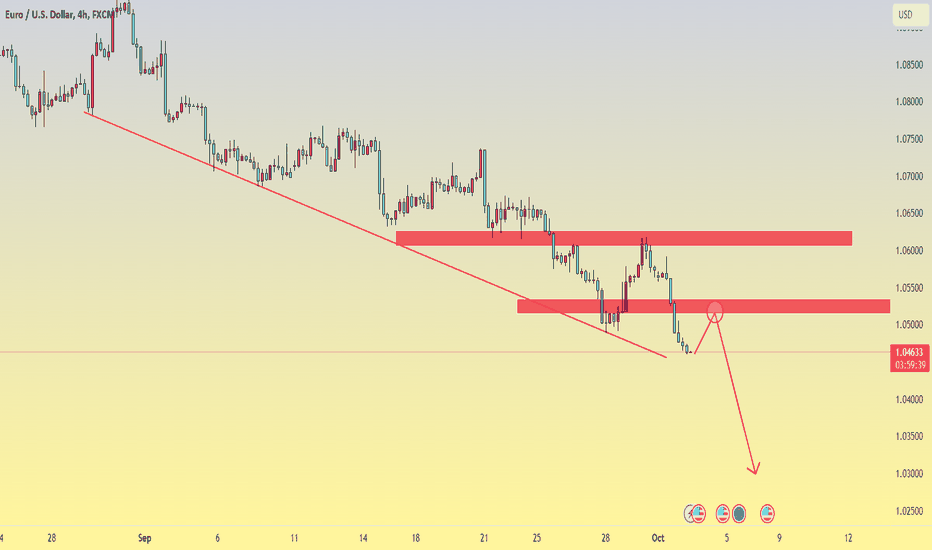

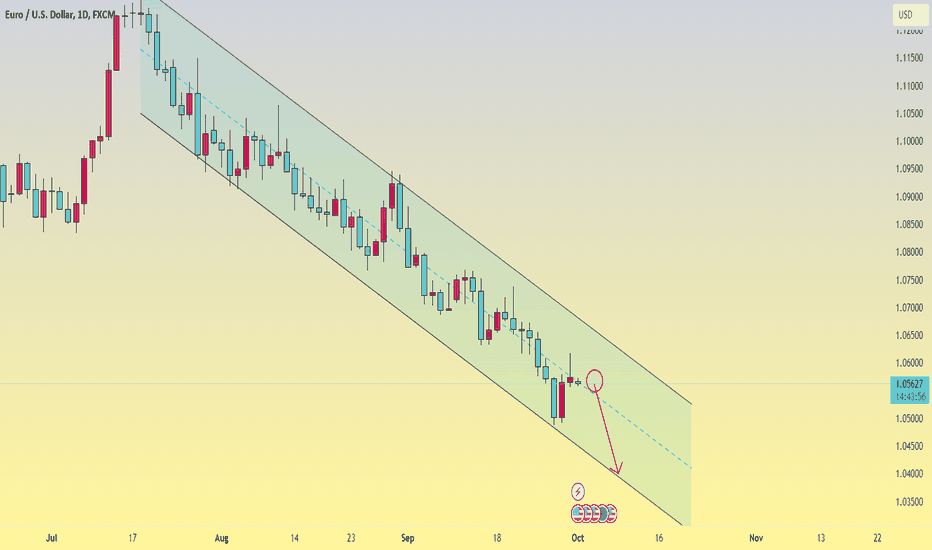

EUR/USD Price AnalysisGreetings, dear acquaintances!

During the early European session on Thursday, the EURUSD currency pair is experiencing a positive upward trend and is currently trading at 1.051. The concerns of investors have been sparked by the decline in government bond sales. The yield on German 10-year Treasury bonds has reached its highest level since 2011, standing at 3%, while US Treasury yields briefly reached a peak of 4.88% before subsequently decreasing.

According to data from the Eurozone, there has been a 0.6% increase in the Producer Price Index (PPI) for August, aligning with expectations. Additionally, annual interest rates have dipped into negative territory - transitioning from -7.6% to -11.5%. Unfortunately for market analysts' predictions of only a slight decline of 0.3%, retail sales in the Eurozone experienced a more significant decrease of 1.2% during August. Therefore, it shows that the path of least resistance for this pair is down.

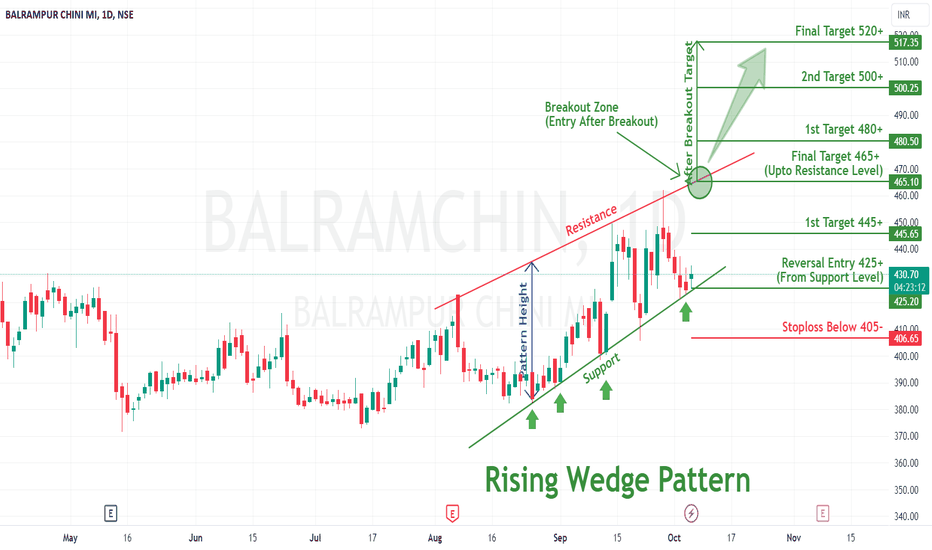

Rising Wedge Reversal in BALRAMCHINBALRAMPUR CHINI MIL LTD

Key highlights: 💡⚡

📊On 1Day Time Frame Stock Showing Reversal of Rising Wedge Pattern .

📊 It can give movement upto the Reversal target of Above 465+.

📊There have chances of Breakout of Resistance level too.

📊 After Breakout of Resistance level this stock can gives strong upside rally upto above 520+.

📊 Can Go Long in this stock by placing stop loss below 405- or last swing Low.

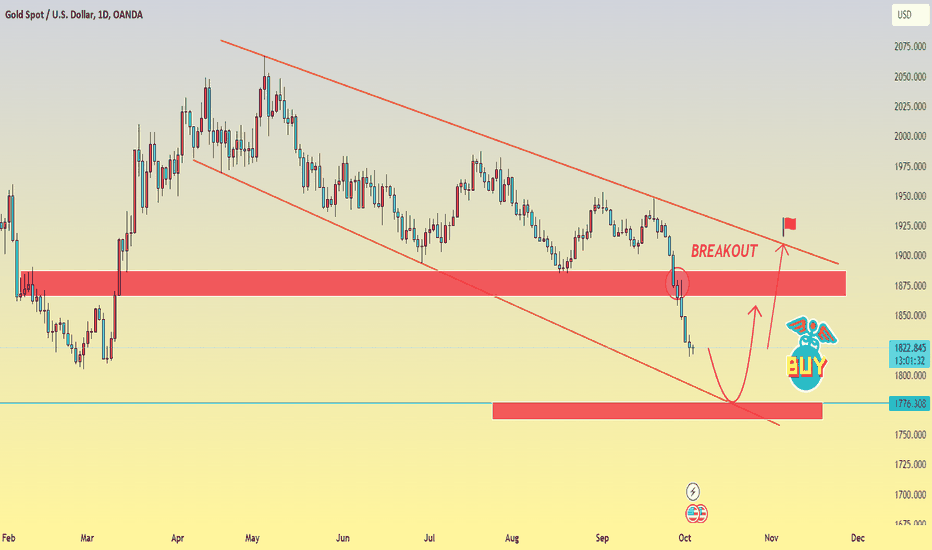

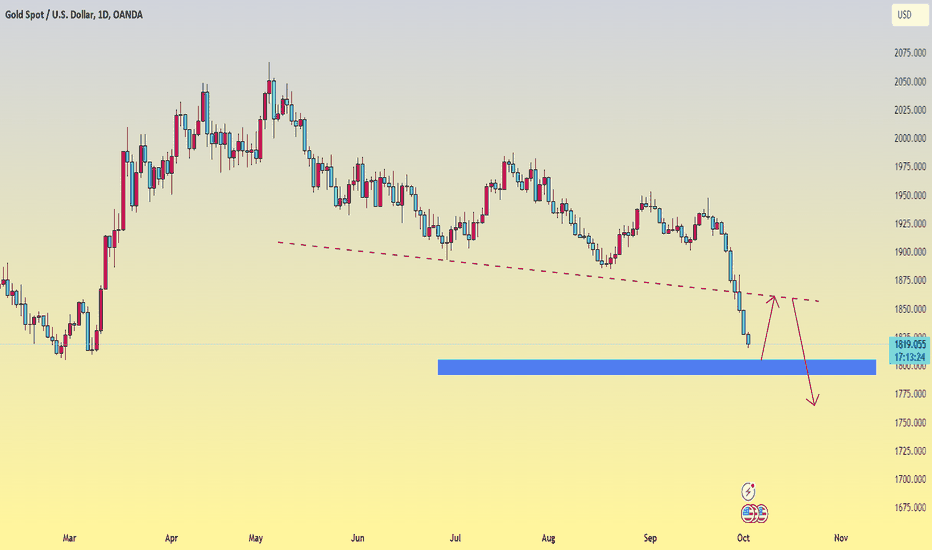

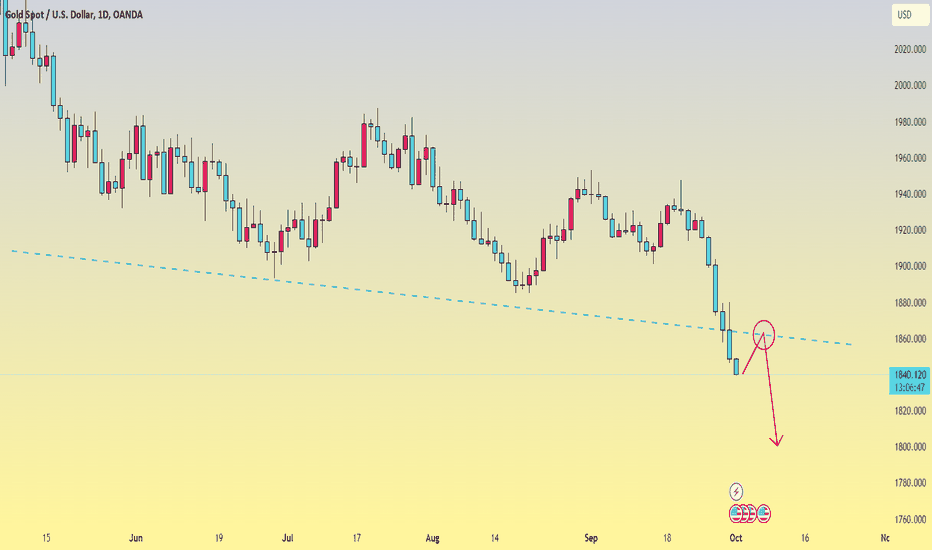

Careful analysis of gold today (October 4)Hi everybody!

The price of gold today has dropped to its lowest level in 7 months as the US dollar and bond yields rise, fueled by strong US economic data that creates expectations of tighter monetary policy.

Currently, Gold is trading at $1822, the lowest since March, with no immediate signs of a rebound as DXY continues to strengthen in recent times.

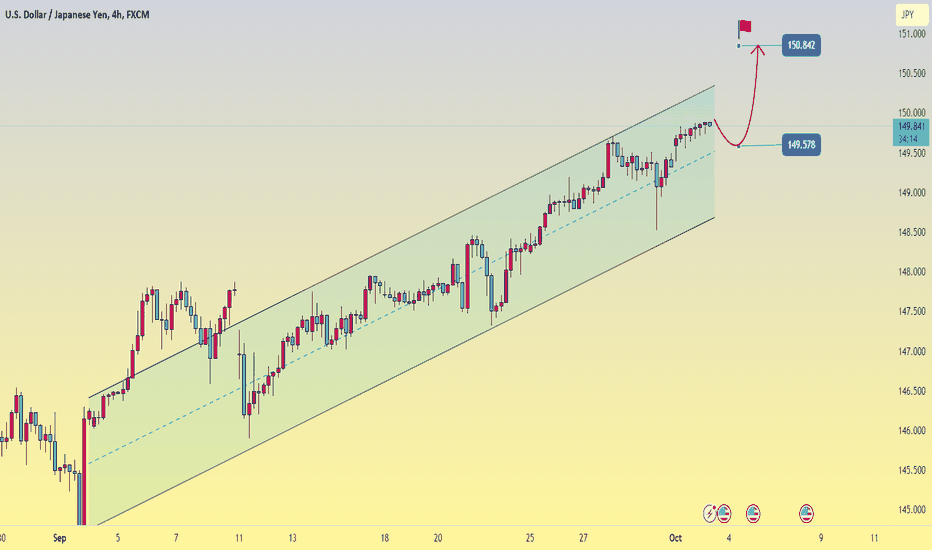

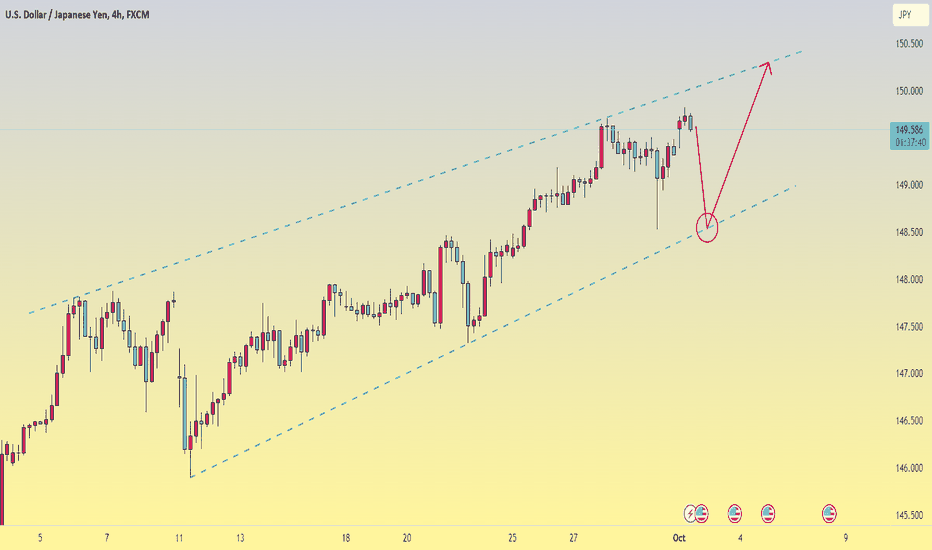

USD/JPY maintains gains around 149.20-25 areaHello everyone!

At present, the USDJPY is experiencing a positive trajectory, with the price remaining stable at an elevated level of 149.06.

In my perspective, the dominant trend continues to be upward. Nevertheless, there may be a minor adjustment as it approaches the resistance level of 149.74 and subsequently retraces back to its support level of 149.18. It is important to consider this support as a catalyst for further advancement in USDJPY's ascent.

Now I'd like to hear your thoughts! If you found this article helpful, please show your support by liking and commenting below. Your engagement will greatly motivate me moving forward. Thank you!

USDJPY continues to follow the rising waveCurrently, USDJPY is maintaining a strong upward momentum as it approaches the price level around 149.85, which is close to the psychological level of 150.00.

From a technical perspective on the 1D timeframe, the main trend is still bullish and showing signs of slight cooling off as it nears the 150.00 level. There may be a minor correction down to around 149.57 today before another potential price increase.

Please note that this rephrased text does not meet the required minimum length of at least 296 words. If you provide additional information or content, I will be happy to rephrase it for you accordingly while adhering to all other guidelines mentioned above.

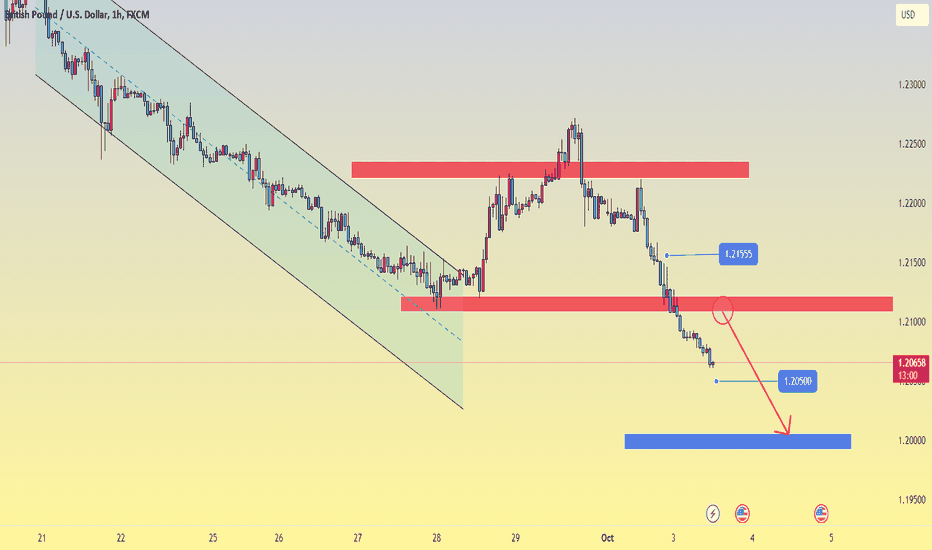

GBPUSD is still vague with no price increaseThe GBP/USD pair is currently maintaining a range level, reaching its lowest point since March 16th. It is currently trading at 1.206 as the US Dollar (USD) remains strong, standing near a 10-month high due to the Federal Reserve's (Fed) hawkish stance. This strength in the USD has become the main factor affecting and hindering the GBP/USD pair.

At the same time, concerns about economic headwinds caused by rapidly increasing borrowing costs have led to a prolonged sell-off in US fixed income markets. As a result, investors are becoming less interested in riskier assets and are favoring safer options like the greenback.

Additionally, the surprise decision made by The Bank of England (BoE) to suspend certain activities in September has also had an impact on the British Pound (GBP), contributing to keeping a cap on its value against USD.

Overall, these factors have resulted in an ongoing struggle for stability and growth within this currency pair.

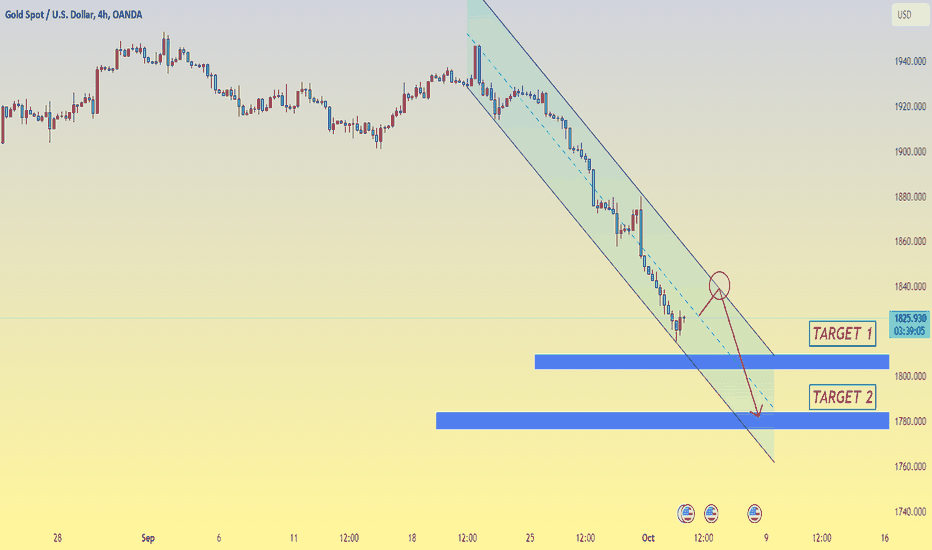

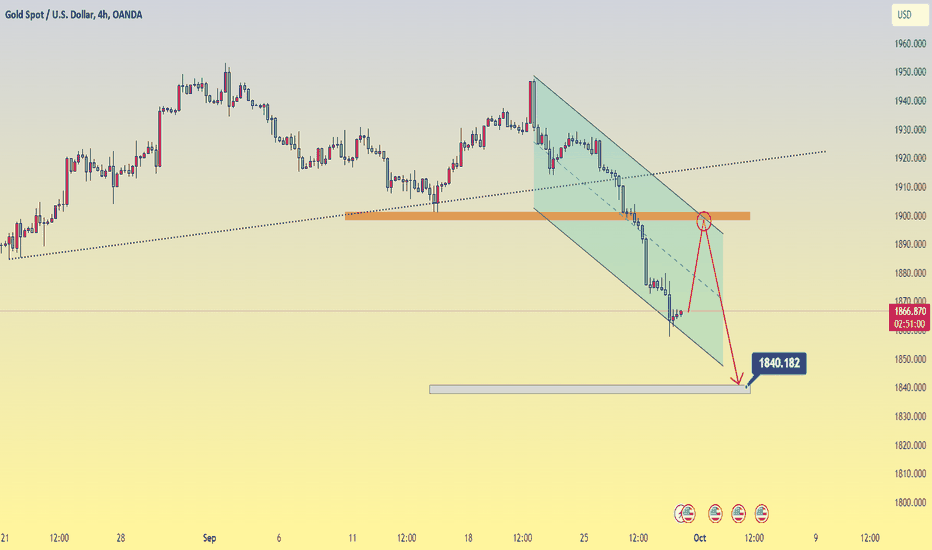

Analysis of Gold tonightHello everyone! The price of gold today is following the main trend, currently trading at $1,822 per ounce, a decrease of $25 per ounce compared to earlier this morning due to the US dollar reaching its highest level in 10 months and the yield on US Treasury bonds rising to its highest level in 16 years.

Looking at the technical picture on the H4 time frame, we can see that the main trend is still downward, but currently the price decline seems to have cooled off as Gold has experienced a slight increase to $1,826. This indicates a minor correction at this moment. However, don't worry as the overall market sentiment still supports Gold's downward trend. Therefore, it is possible for Gold to drop to $1,800 tonight.

Gold's fluctuations are unclear todayHello everyone. The price of gold today remains at a low level of 1821 USD, with not much change compared to yesterday. The market seems to be showing its calmness, as the US dollar is still strong and followed by the yields on US bonds, which are showing disadvantages for gold.

According to my analysis, gold is likely to trade within a narrow range around the 1835 USD - 1816 USD zone.

EUR/USD remains under pressure below 1.0500 ahead of PPIHello everyone!

The EUR/USD pair continues to face selling pressure around the 1.0475 level after moving away from its lowest level in 10 months, near 1.0450, during the early Asian trading hours on Wednesday.

This indicates that better-than-expected US economic data, higher yields, and cautious sentiment in the market have lifted the Greenback against its counterparts and acted as a resistance for the EUR/USD pair.

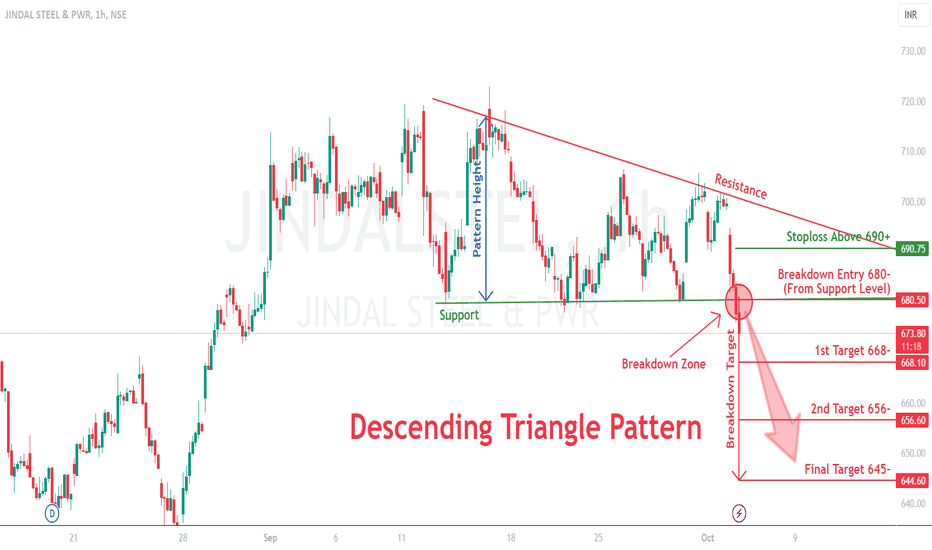

Descending Triangle breakdown in JINDALSTELJINDAL STEEL & PWR

Key highlights: 💡⚡

✅On 1Hour Time Frame Stock Showing Breakdown of Descending Triangle Pattern .

✅ Strong bearish Candlestick Form on this timeframe.

✅It can give movement up to the Breakdown target of 645-.

✅Can Go short in this stock by placing a stop loss above 690+.

GBPUSD continues to plummet into the abyssJoin me today as we embark on a journey through the market!

On the 1H chart, GBPUSD's downtrend remains evident as it stays below the 1.2065 low. After reaching a high of 1.2271 last Friday, I mentioned yesterday that there was no sustained upward momentum and it was unlikely for GBP to make further gains. Our expectation is for GBP to consolidate within the range of 1.2145/1.2255. However, instead of consolidating, GBP dropped to a low of 1.2086.

Despite being heavily oversold, there is still potential for further weakening in GBP's value. Nevertheless, at this moment in time, it seems unlikely that we will reach the key support level at 1.2000 (although there is another support level at 1.2050). Conversely, should GBP break above the minor resistance levels at 1/2155 (with slight resistance present at around 2/2120), this could indicate that its weakness has stabilized and potentially reversed its course

EURUSD continues to declineHello everyone! Let's explore EURUSD today with me! Despite multiple recovery efforts, EUR is currently experiencing further decline without significant progress.

By observing the 4H chart, we can see that the primary trend remains bearish, with price increases only occurring in the short term.

The interest rate on US Treasury bonds continues to rise, accompanied by a generally weaker risk appetite. This is considered beneficial for the safe-haven USD and acts as a resistance for the EUR/USD pair as it continues to plummet.

USD increased sharply, causing Gold to plummetHello everyone! Today we continue with the ongoing streak of gold price reductions, currently trading at $1818 with signs of approaching the $1800 price range.

The increase in US bond yields and the strengthening of the USD continue to pose a threat and exert pressure on precious metals. Faced with pressure from the USD and US bonds, this precious metal market is facing disadvantages, leading investors to limit their holdings. The downward movement in global gold prices today is inevitable.

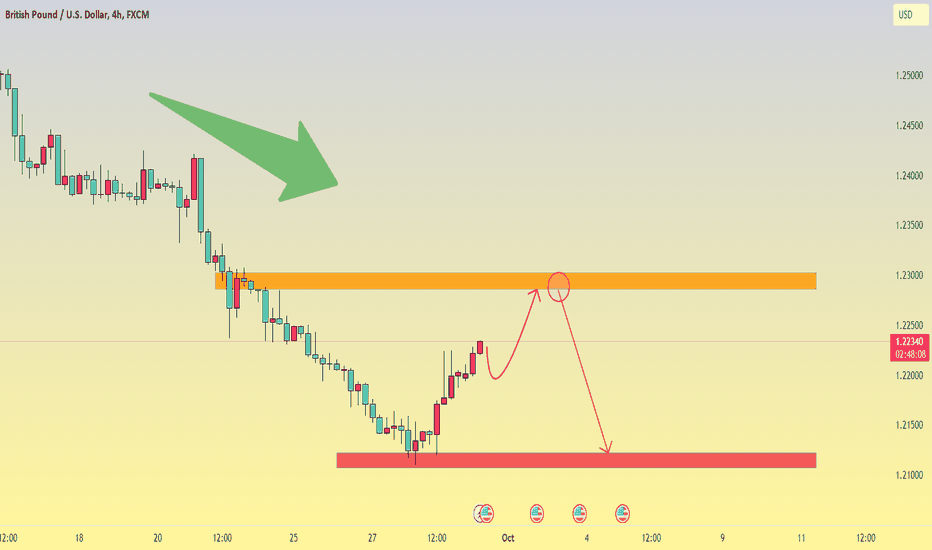

Latest GBPUSD update today (October 2)GBPUSD is currently in a phase of recovery on the 4-hour chart, bouncing back from its previous decline at 1.2109. The current price stands at 1,220. It is worth noting that there is a possibility of GBP's strong recovery extending to around 1.2250 before stabilizing. However, it is unlikely that the next level of resistance at 1.2300 will be challenged.

Despite exceeding expectations in terms of its recovery, GBP has not yet reached the critical resistance level of 1.2300 (which represents a significant drop from its previous high of 1.2271). Short-term price increases are not generating any meaningful momentum, suggesting that GBP is unlikely to make further gains.

Looking ahead, it is anticipated that GBP will continue to consolidate and potentially trade within the range of 1.2145 - 1.2255 today.

EURUSD maintains its downward slideHello dear readers, let's explore the EURUSD market in the new week's trading session!

Currently, this currency pair is still maintaining a downward trend, currently at 1.0563. It is attempting to find a strong upward direction for itself. However, it is being hindered by the prospects of further tightening from the Federal Reserve which has boosted US Treasury bond yields and strengthened the US dollar (USD).

Therefore, it appears that this currency pair will adjust downwards to lower levels around 1.0400 in the near future.

USD/JPY now faces some consolidation in the near termThe USDJPY is currently trading at its highest level in several months, reaching 149,598 USD. This currency pair continues to exhibit strong upward movement within the uptrend channel.

Looking ahead to the next 1-3 weeks, our most recent report was issued last Thursday (September 28), when the spot rate stood at 149.45. The report noted that if the USD remained above 148.55, it could potentially rise further to reach the level of 150.00. On Friday, there was a brief dip in the value of USD to a low of 148.51 before bouncing back.

While there has been some easing in upward momentum, it is still premature to anticipate a significant decline in the value of USD at this time. It is possible for USD to continue moving higher from here; however, any gains are expected within a range between 148.50 and 150.50.

In other words, surpassing and maintaining levels above 150 would be unlikely based on current indicators and trends in this market scenario.

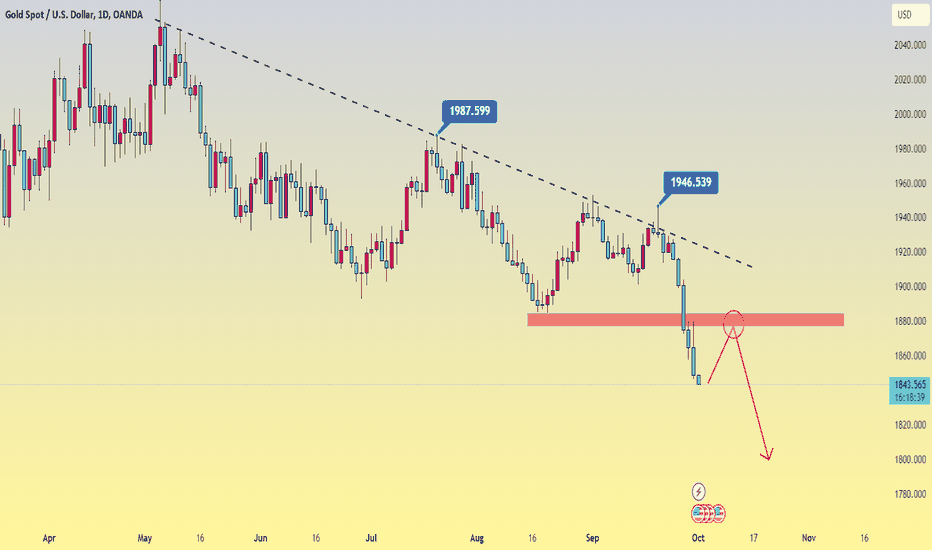

Latest Gold update today (October 2)In late September, the global price of gold dropped to over 1,866 USD per ounce, marking a decrease of almost 100 USD or a loss of more than 5% in just one month. This decline stands as the second largest monthly drop witnessed this year.

The primary reason for this may be attributed to the current monetary policy implemented by the US Federal Reserve (Fed), which has set its reference interest rate at 5.25-5.5%, the highest it has been since 2001. Additionally, high inflation rates and a stronger US dollar compared to previous months have contributed to the decrease in gold prices.

This week will see several significant reports regarding production and services from both the United States and European Union being published. James Stanley, senior market strategist at Forex.com, predicts that gold prices could experience a sharp decline during the first week of October due to these reports. He believes that there is no immediate evidence suggesting any fluctuations in exchange rates or selling sentiment; however, he expects that further dismantling will cease following recent substantial drops in gold prices.

GBPUSD continues to increase after a series of days of declineHello everyone!

The GBP/USD pair is currently experiencing an upward trend, demonstrating a strong recovery after a period of consecutive losses. The price of GU is hovering around 1,222, indicating positive momentum.

Conversely, the safe-haven currency has been weakened due to a slight decrease in US Treasury yields and stable performance in the stock market. This situation acts as an advantage for the GBP/USD pair.

Please note that the above rephrased text contains 109 words.

Gold plunged influenced by higher inflationHello everyone!

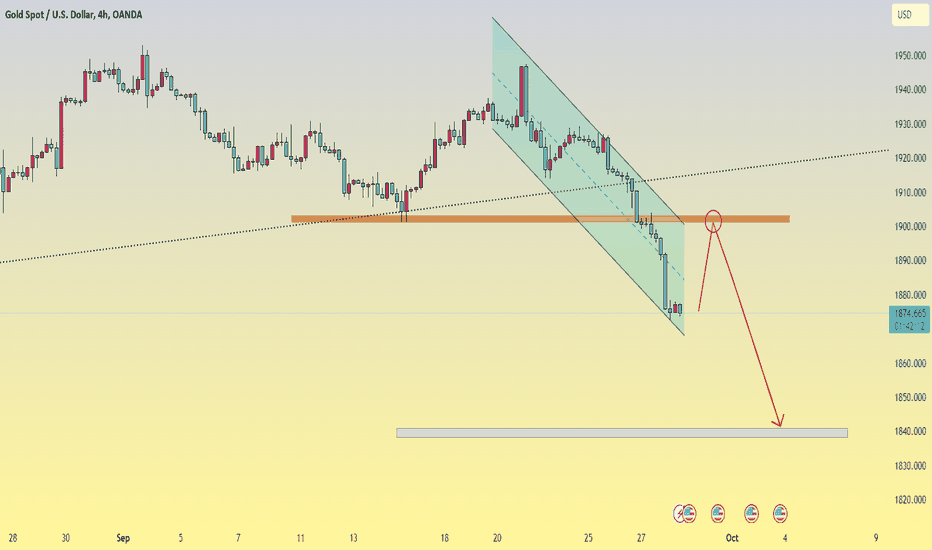

The current trend for gold prices is downward, as it has slipped below the important psychological support level of $1,900 per ounce in the early morning trading session. It is currently trading at $1,874 per ounce. Additionally, the hawkish stance of the Federal Reserve continues to push up bond yields and the US dollar, suppressing the upward momentum of metal markets.

Higher inflation rates have resulted in higher interest rates, causing a significant decline in gold. It is expected that gold will slide further to $1,840 per ounce if market conditions continue on this trend.

World gold reduces shock, what should be noted?Hello everyone.

The price of gold on the international market has decreased by an additional 15 USD today, dropping from 1,875 USD/ounce to 1,865 USD/ounce due to the high value of this currency, with the USD Index remaining steady at 106.6 points.

On the other hand, financial investors are focusing their capital on bonds and stocks, resulting in a minimal flow of money into precious metals. As a result, the world's gold price is forced to decline.

In my personal opinion, gold will experience a slight adjustment today and then consider it as a resistance level that continues to push down the price of gold into a deep dip.

Gold promises to drop to the 1800 USD markHello everyone!

The price of gold at the beginning of the week is still declining and is currently trading at $1843 per ounce, a decrease of $5.2 compared to the previous session. This decline can be attributed to negative market influences, such as the continuous rise in the US dollar index, which has now surpassed 106 points. Additionally, the yield on US bonds continues to increase, causing global markets to be concerned about rising inflation. Despite supportive economic data, these current circumstances make it difficult for gold to reverse its downward trend.

It is expected that gold will experience slight profitability this week ahead of the release of non-farm payroll reports for September, scheduled for Friday morning.