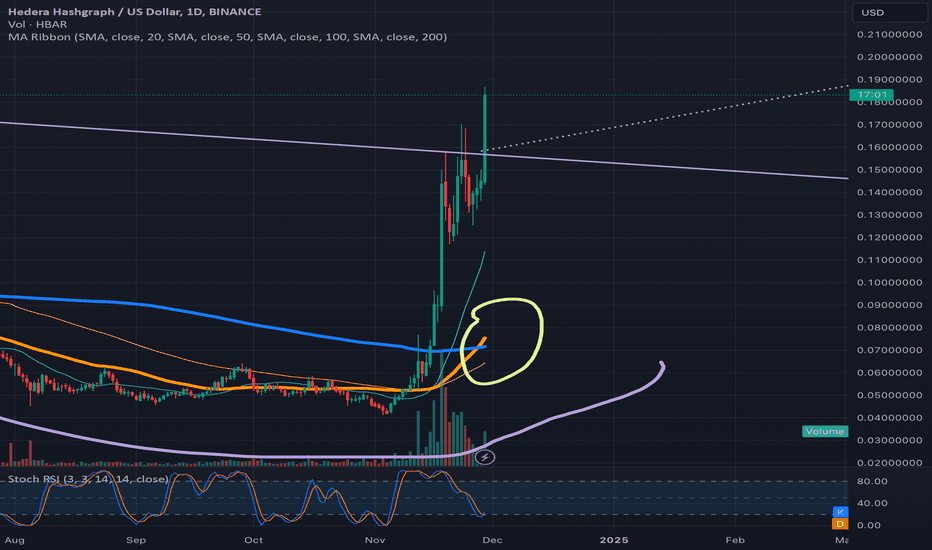

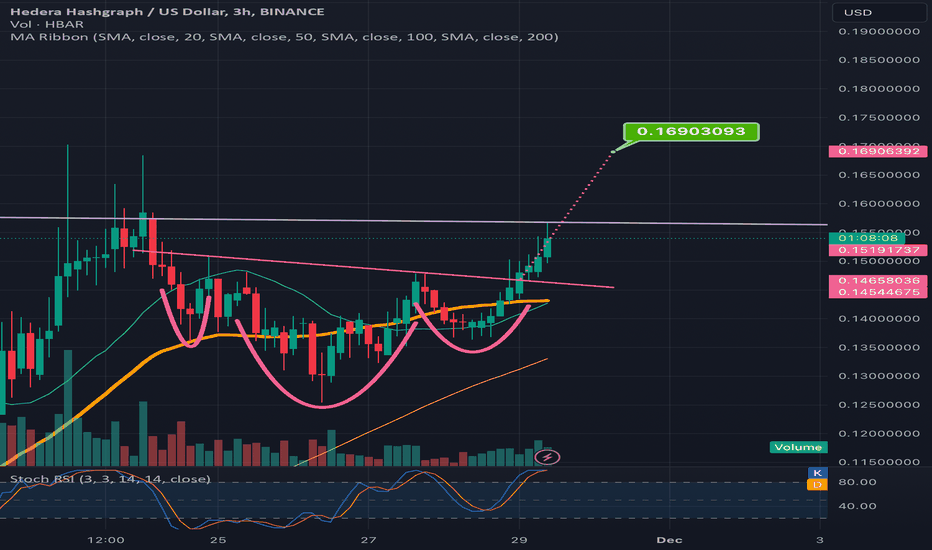

HBAR responding bullishly to its goldencross just like Algorand We can see here how Hbar is immediately responding to its golden cross and finally breaking above the inverse head and shoulder pattern it’s been consolidating in right at the moment of the golden cross. Here is the algorand goldencross for comparison:

Countless other charts have had this same reaction since the parabolic phase of the bull run and I wouldn’t be surprised if it continues. *not financial advice*

Inverse Head and Shoulders

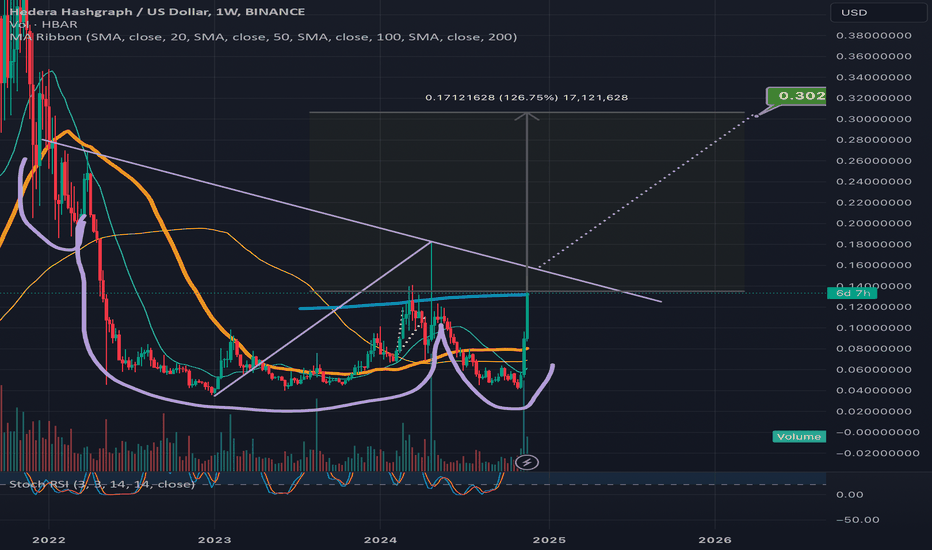

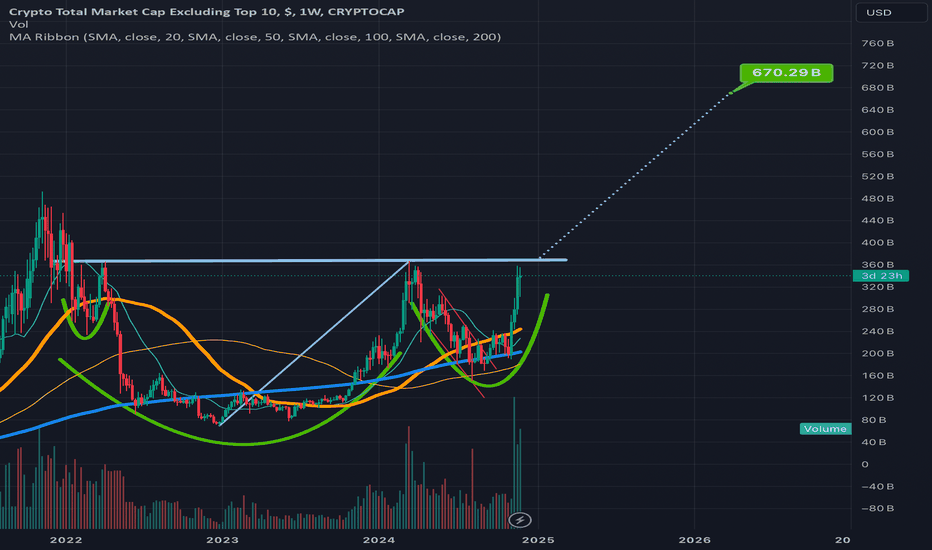

Plenty of upside left in HBARUSD even after massive 55% pump HBAR had a huge breakout today and shot way past the breakout target of the previous patter it had ust broken upward from. In doing so Price action is getting very close to completing the right shoulder of a much bigger inverse head and shoulders patter here. Should it trigger the breakout of this attern we ca see that the measured move target for it would be over 120% gains from where price currently is if it were to reach the full target. It may take it a second consolidating just below , or back &forth a little above and below the neckline of this pattern before it triggers the breakout since it just had such a massive pump, however it could just maintain the current momentum and plow right through that neckline without stopping for much of a rest. The most import support to watch for at the moment is the weekly 200ma(in blue) as long as it can flip that 200ma to solidified support then odds are good it will confirm the breakout from this invh&s pattern to too many candles after that. Also considering the total2 chart looks like it will confirm the long awaited breakout from its cup and handle patter soon, that increases the probability that this new bigger invh&s on HBAR wll be confirming its breakout too sooner rather than later. *not financial advice*

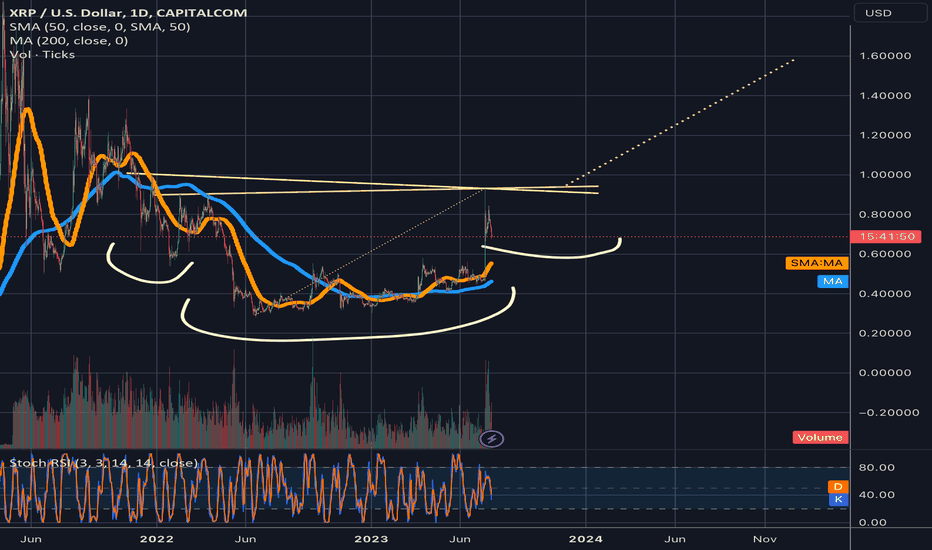

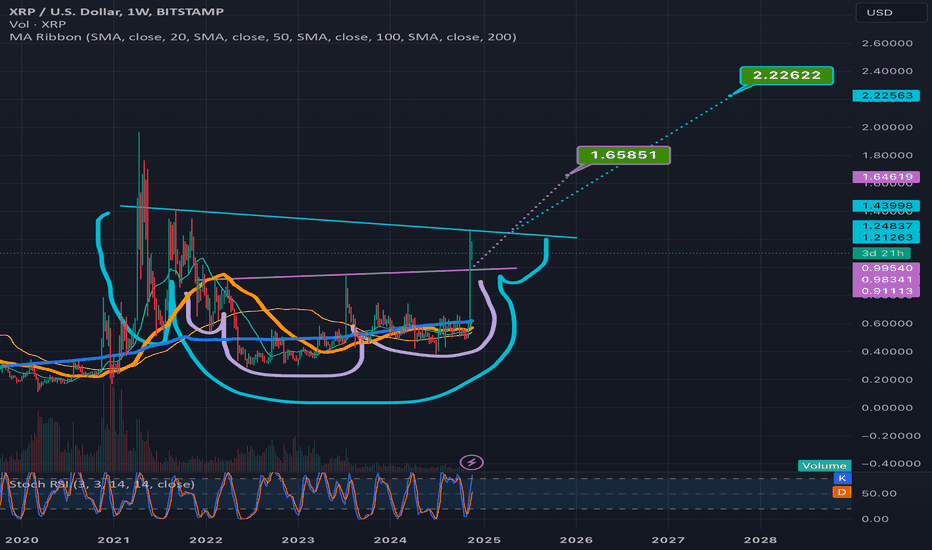

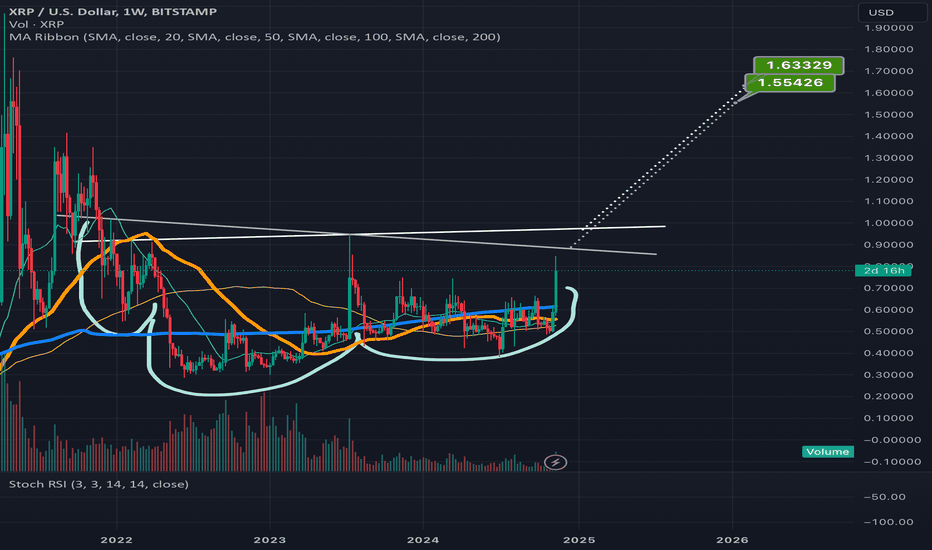

Current price retracement on xrpusd is creating right shoulderWe can see the current price retracement on xrpusd is starting to form the right shoulder of an inverse head and shoulders pattern.This means that once price bounces and gets firmly above 95 cents or so then maintains that level as support it could trigger a breakout from this inverse head and shoulders pattern. At that point the target would be around $1.55-$1.60 and if we can get tot hat level and maintain that level as strong support thats when the real fireworks can start to begin. Could take multiple weeks for this right shoulder to find its bottom and head back towards the neckline, but hopefully sooner rather than later. *not financial advice*

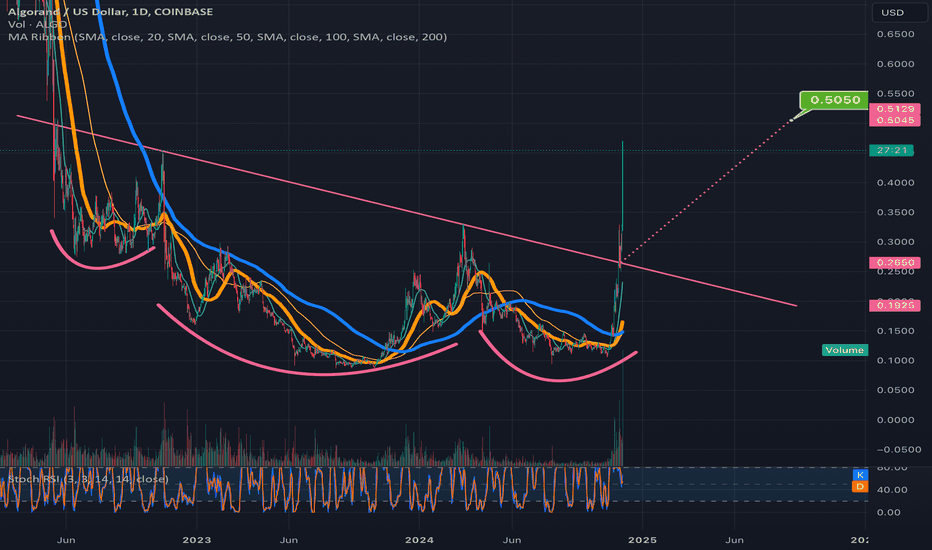

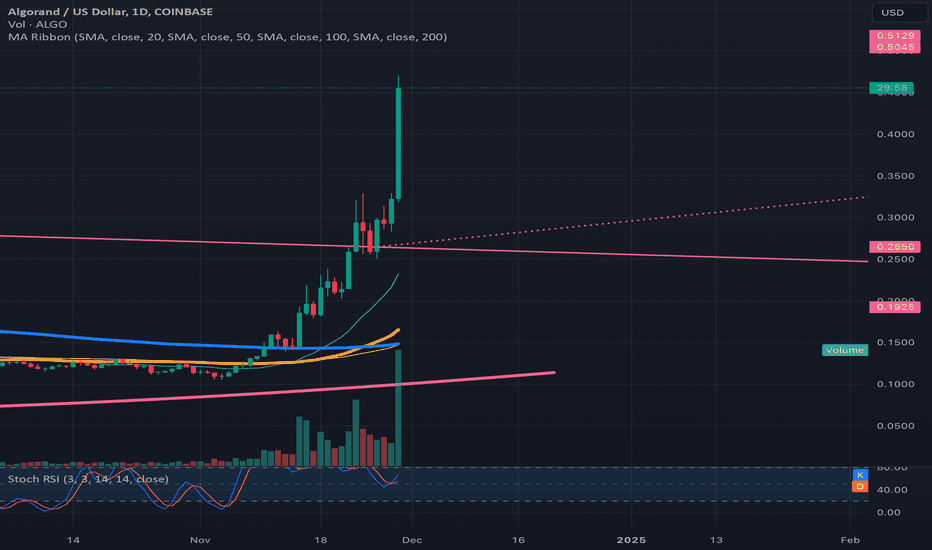

Algorand almost already to full invh&s breakout targetThe golden cross strikes again with an immediate blast off in algorand price as it is already getting very close to hitting the full inverse head and shoulder breakout target here. Zooming in here we ca more clearly see how the golden cross coincided with this blast off: *not financial advice*

Avalanche Inverse Head & Shoulders PatternThe price action is currently retesting the dotted measured move line for potential support. Always possible to do back below the neckline but if the measured move line holds support we might not. Either way I anticipate ths pattern reaching its full target in the near future *not financial advice*

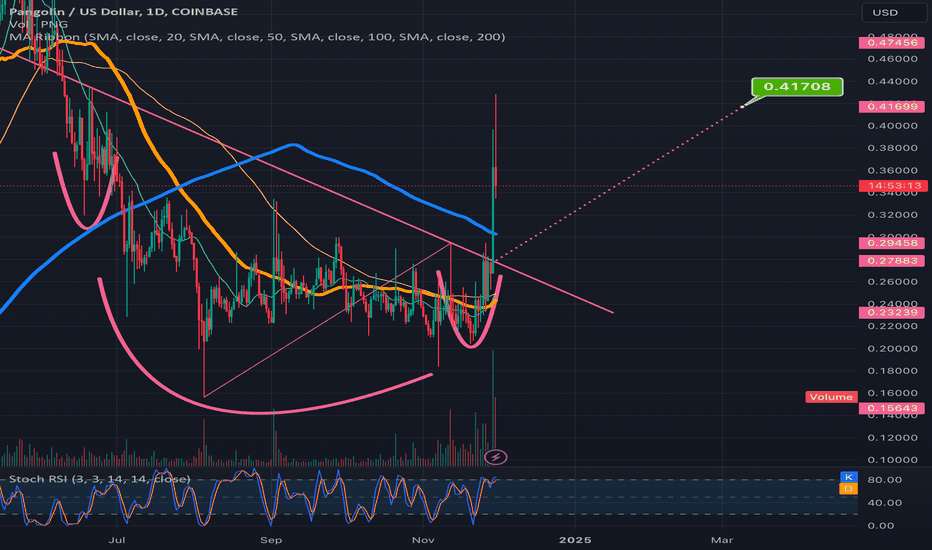

What’s potentially next for PNGUSDPangolin has corrected enough to at least form a small right shoulder o smaller time frames like 4hr chart and smaller. Still a good chance it could continue to consolidate below this neckline long enough to make a valid 1day chart shoulder as well so I figured it was worth drawing. Speculative right shoulder here n the 1 day chart. Should see soon enough how ths pans out.,t could decide to continue pumping right now but there would still be a valid shoulder to complete the h&s pattern on t he smaller time frames. *not financial advice*

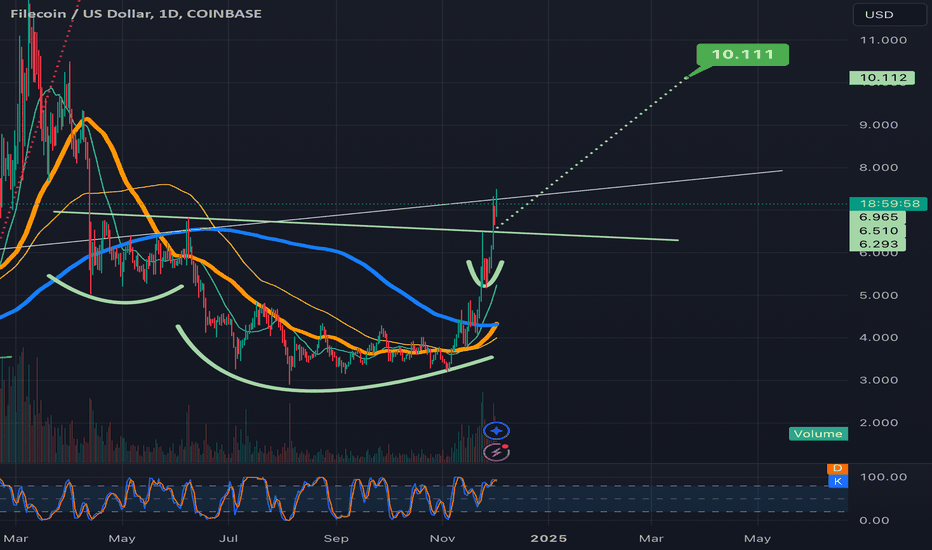

Filecoin firmly above invh&s as Goldencross occursPrice needs to flip the ascending white trendline to solidified support to be fully confident that price wont try to dip back below the inverse head and shoulders neckline again, and as of now that white line is still currently resistance, but with the golden cross just occurring and the way most alts have been bullishly responding to their golden crosses the same day as the cross, coupled with the fact that the white line has not had much strength behind any of its price rejections thus far, makes me believe we will see priceaction flip the ascending white trendline to solid support before too long. I will be looking for the dotted measured move line from the invh&s breakout to attempt to maintain support and if not then the next support below that is the inv h&s neckline. After that the final support is the thin bluish green colored 21 moving average. I anticipate one of these three supports will ultimately hold. *not financial advice*

2invh&s acting like Russian nesting dolls on XRPUSD chartNow that xrp has chosen to consolidate here for a few days it gives the chance for the potential blue inv h&s possiblity to form a right shoulder here, so I thought it was worth including, The smaller purple inner inverse head and shoulders patter is definitely legit and should have its breakout confirmed as soon as xrp has it’s next move to the upside. *not financial advice*

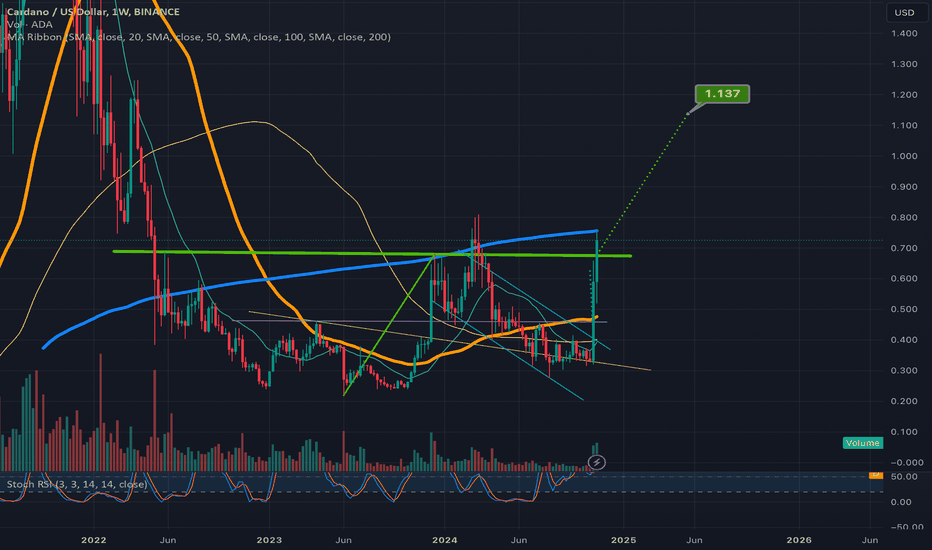

If ADA flips the 200ma to solidified support next target = $1.13Subject says it all.. I kept some of the previous channels’ trendlines on the chart just n case we see any sort of correction as potential supports. WIll like previous Cardano chart with pattern whose target just got hit below.. *not financial advice*

Something very peculiar is occurring with XRP dominanceUsually when the candles go upward on the xrp dominance chart, the btc dominance chart is going downward and the liquidity along the xrp dominance chart go up is coming from bitcoin liquidity. This time however something has changed. XRP dominance is rising substantially all while bitcoin dominance is also still rising. This suggests that the liquidity is no longer coming from btcoin but instead from other sources likely institutional investors. We can see the candle on the monthly has broken above the neckline of a large inverse head and shoulders pattern on the logarithmic chart. Will be interesting to see how well this plays out. Chart patterns don’t behave as they usually do when working with these kind of charts so it’s no guarantee what looks like a bullish breakout currently will behave like one. I will definitely be keeping an eye on this as it develops though *not financial advice*

Pangolin hits precise inverse head & shoulders breakout target Exact precision. You can see Pangolin pumped right up to the full target and then immediately had a significant correction on the very next candle. My guess i it will continue to correct /consolidate until its upcoming golden cross and then should see its next pump upward. Should present a good entry point when that happens *not financial advice*

The next potential invh&s pattern for XRPUSDDepending on which left shoulder is more legitimate we have a possible slightly descending neckline on this invh&s or a possible slightly ascending neckline on it. No idea when price will break above these necklines so obviously if it takes longer I will need to readjust the measured move lines for it. This is just an initial idea for now. *not financial advice*

Goldencross Once Again Having Immediate Impact;On Algo This TimeSo far my hypothesis that the golden cross responds immediately in the parabolic phase of the bull run is continuing to be proven correct as we see it happening again here now with algorand. Sending price already skyrocketing almost to the full inverse head and shoulders breakout target at .5050 *not financial advice*

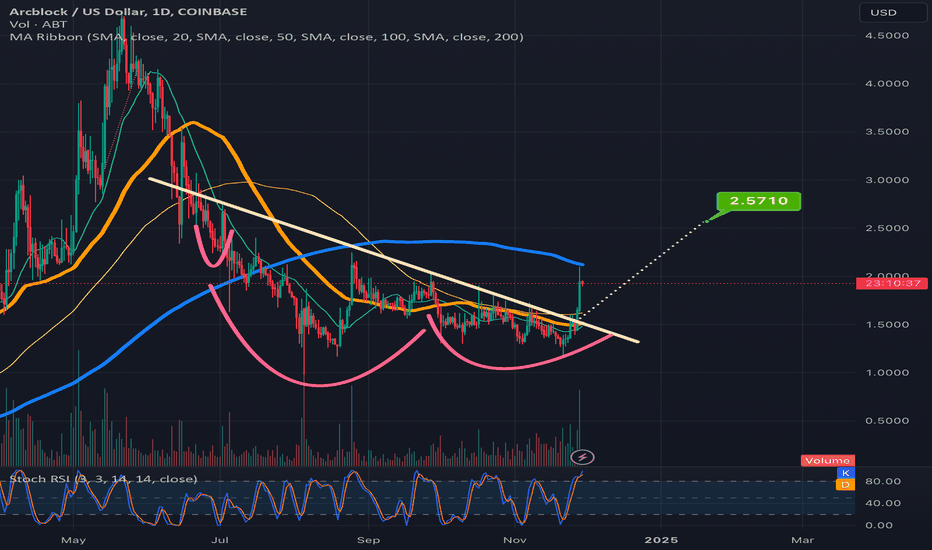

ABT working on an inverse head and shoulders breakout Arcblock seems to have broken firmly above the inverse head and shoulder pattern on the daily chart. In order to keep heading to the target it will need to overcome the current resistance of the 200 MA (in blue). Once it is able to do that and flip that resistance into solid support, it should reach the full target of $2.57 with relative ease. *not financial advice*

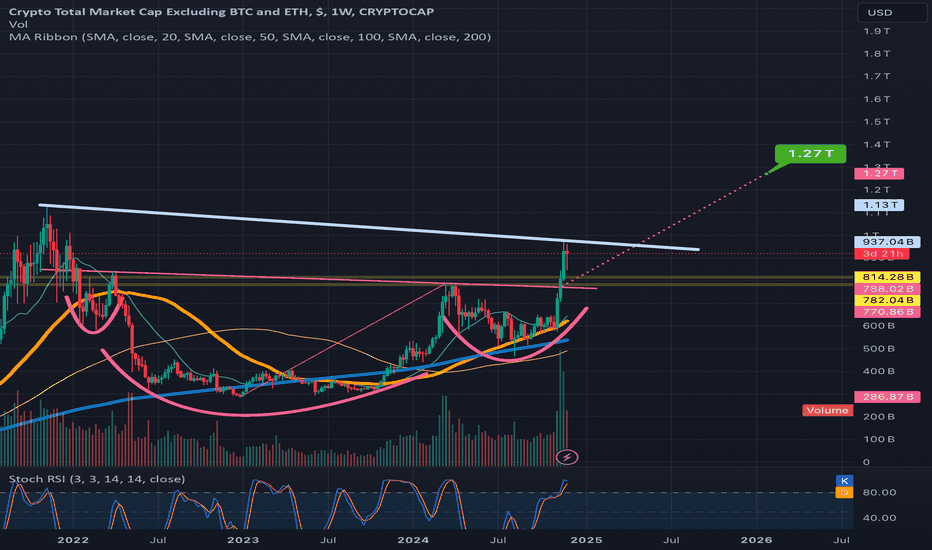

Total3 chart breaking up from inverse head & shoulders patternThis is the chart that is every altcoin except for ethereum. Bitcoin is also not factored in. We can see it appears to have broken upward from the inverse head and shoulders pattern and the breakout target should be around 1.27 trillion. We also currently have the potential for a cup and handle to be formed with an even bigger breakout, but I want to see an actual handle forming first before I post a target for anything like that. *not financial advice*

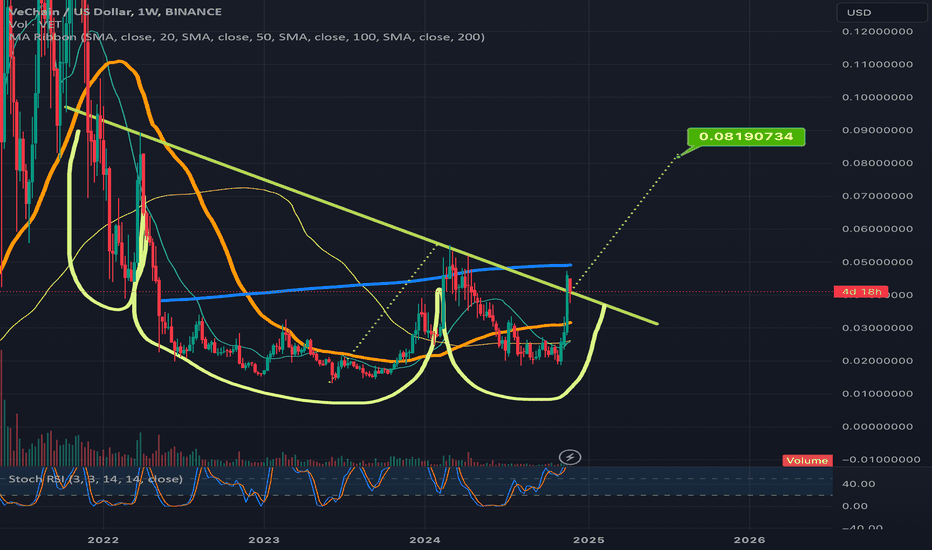

Vechain attempting to flip inverse h&s neckline to supportCan see here on the weekly timeframe chart how it’s already closed one weekly candl above the neckline.there have been many daily chart candles recently battling to main support on that neckline as well and also an impending golden cross on the daily chart time frame set to occur in tthe next 1-2 daily candles as seen here —-> blob:https://tradingview.sweetlogin.com/e00ebf4c-9780-485c-a37a-9d603aec6fd4blob:https://tradingview.sweetlogin.com/e00ebf4c-9780-485c-a37a-9d603aec6fd4 Since btcoin is still in the midst of it’s first correction since it has entered the parabolic phase of the bull run and we are so close to Black Friday which is often a time of year one can scoop up cryptos at a discount, this impending daily chart golden cross may be one of the few exceptions atelier where price action doesn’t immediately hav a big pump the same day as the cross. Vechain could always break apart from the pack though at that point as well and pump while most things are still correcting. Also a slight chance the market correction is over before Black Friday too. Whatever the situation may be, if we see Vechain correct here as well but also hold support on the daily timeframes 50ma,I will likely add a little bit to my Vechain stack *not financial advice*

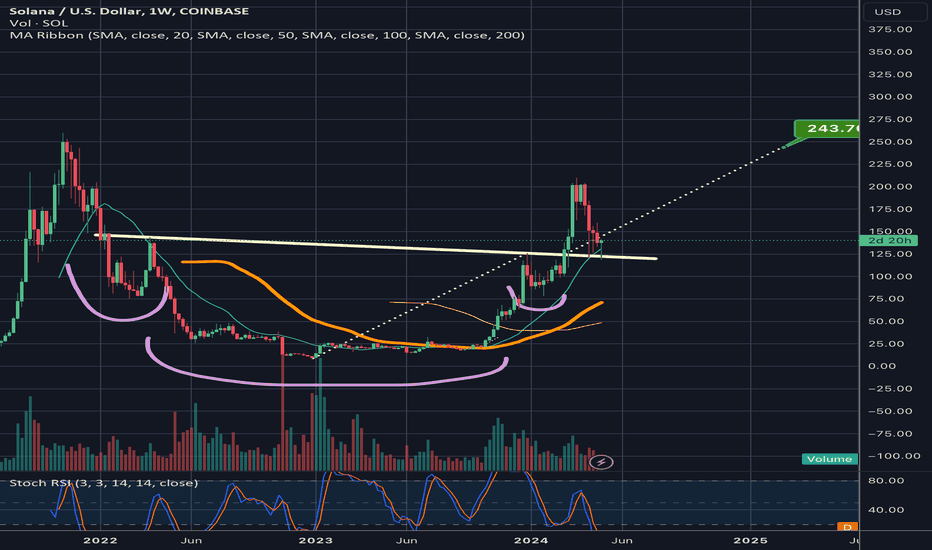

For now SOLUSD is retesting invh&s neckline as precise supportA good sign that the bottom could potentially be in. Of course there’s always the possibility of some sort of unexpected bald swan to dump the market much further, but even then that could be such a temporary occurrence that by the time the weekly candle closed it still closed the candle body above this neckline. At the bare minimum I get the vibe that at least the monthly candle body can maintain this neckline as support, but we will find out soon enough. *not financial advice*

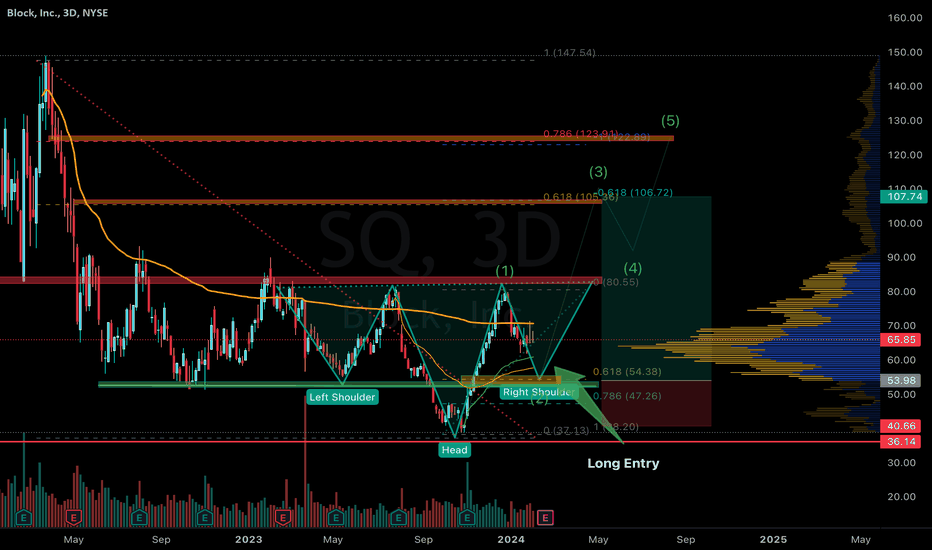

SQ - wait for discountSQ - pulling back into buy zone. Wait for around 50ish.

Earnings in couple of weeks, I bet this will reach the buy zone before that. If earnings beat with strong forecast, can push this higher.

Stop Loss - 40

Long entry - 50-54

Target # 1 - 100

Target # 2 - 130

Target # 3 - 150