Iost

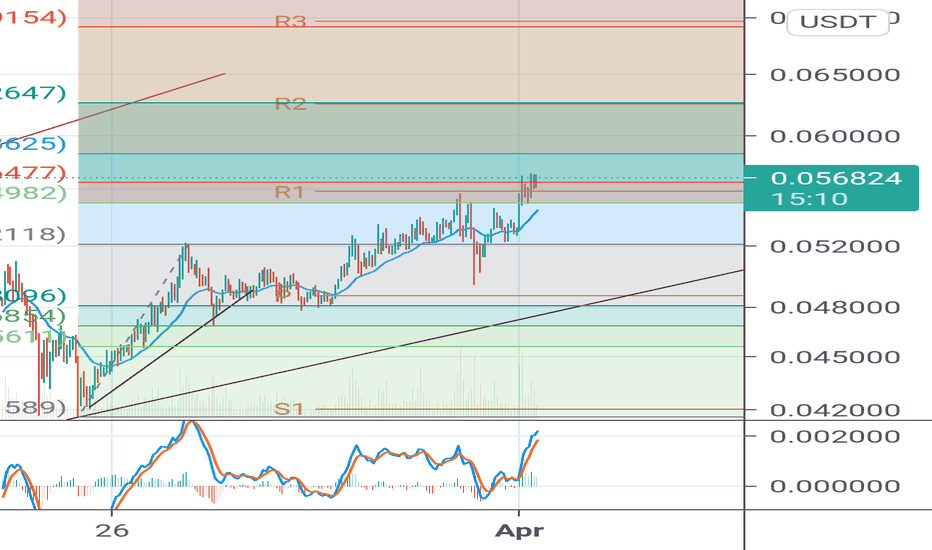

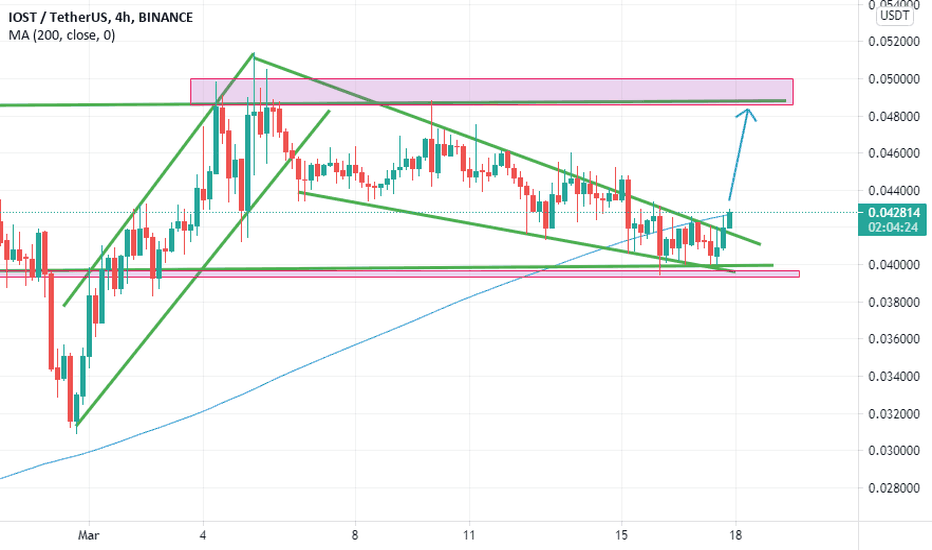

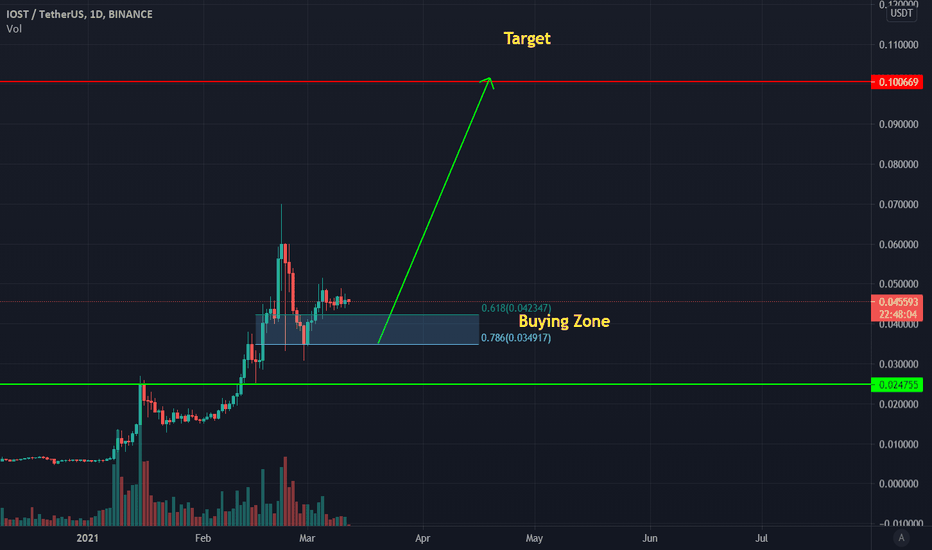

🆓IOST/USDT Analysis (29/3) #IOST $IOSTIOST is trying to conquer the 0.05$ zone, if successful, IOST will head to the 0.06$ zone. But if it is rejected again at this 0.05$ zone, it will move down to 0.035$ zone.

📅NEWS

👉Aug 1 : Monthly Airdrop Ends

📈BUY

-Buy: 0.035-0.035$. SL B

📉SELL

-Sell: 0.049-0.051$ if B. SL A

-Sell: 0.057-0.06$. SL A

♻️BACK-UP

-Sell: 0.035-0.037$ if B. SL A

-Buy: 0.029-0.031$. SL B

-Buy: 0.049-0.051$ if A. SL B

❓Details

Condition A : "If 1D candle closes ABOVE this zone"

Condition B : "If 1D candle closes BELOW this zone"

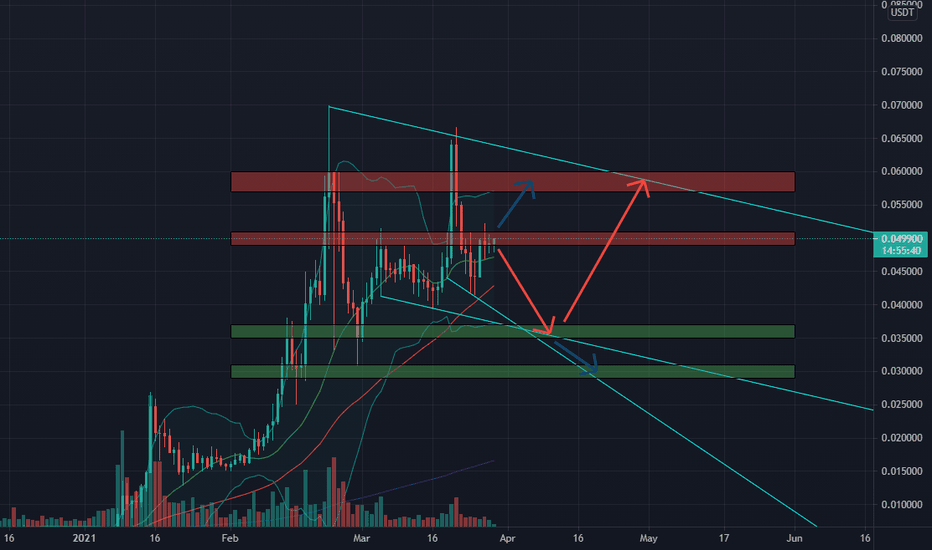

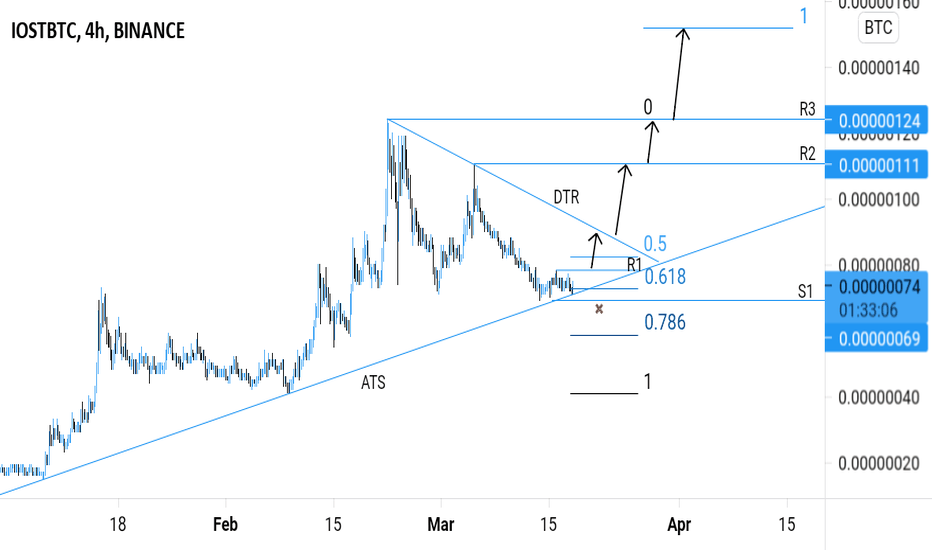

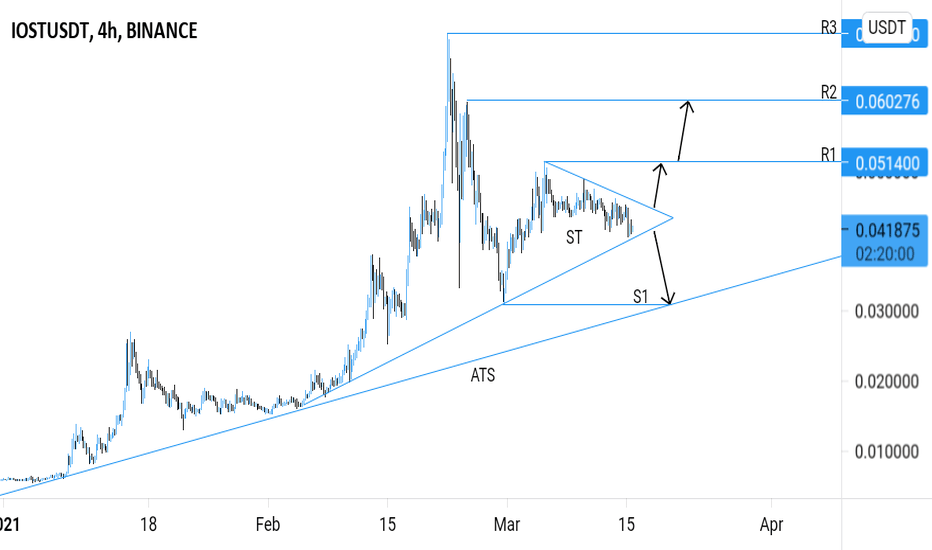

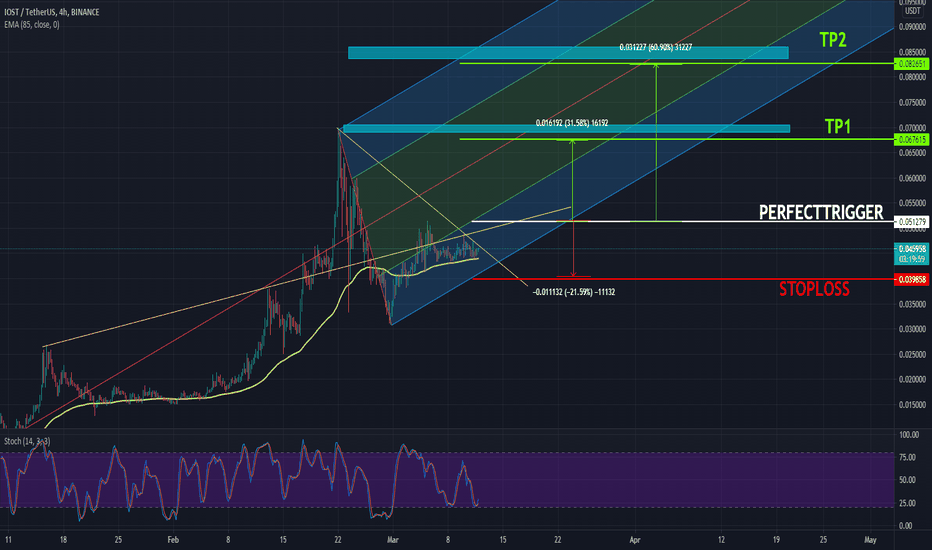

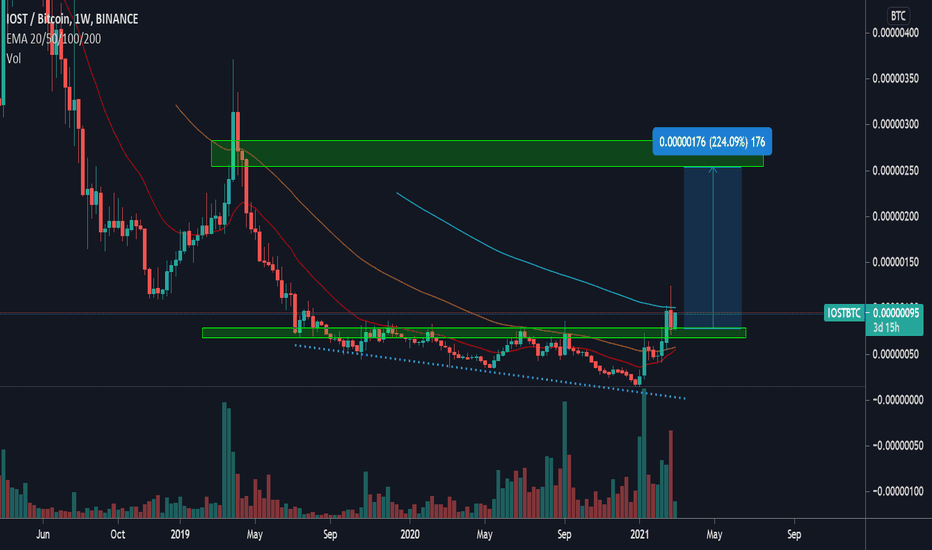

IOSTBTC (IOST) - POTENTIAL BUY ENTRY ANALYSIS 🔎

- IOSTBTC is supported by the ascending trendline support (ATS).

- The market hit a swing high and retraced.

- The retracement is resisted by the descending trendline resistance (DTR).

- Price is testing the ascending trendline support and key fibonacci retracement zone (0.5 - 0.618 - 0.786).

- There's a relatively high concentration of buyers at this zone.

- There's an uptrend continuation possibility.

BUY ENTRY ⬆️

- Aggressive entry : breakout above the horizontal resistance level (R1).

- Conservative entry : breakout above the descending trendline resistance (DTR).

TARGETS 🎯

- Horizontal resistance level (R2).

- Horizontal resistance level (R3).

- Fibonacci extension levels.

SETUP INVALIDATION ❌

- Breakdown below the ascending trendline support (ATS) and horizontal support level (S1).

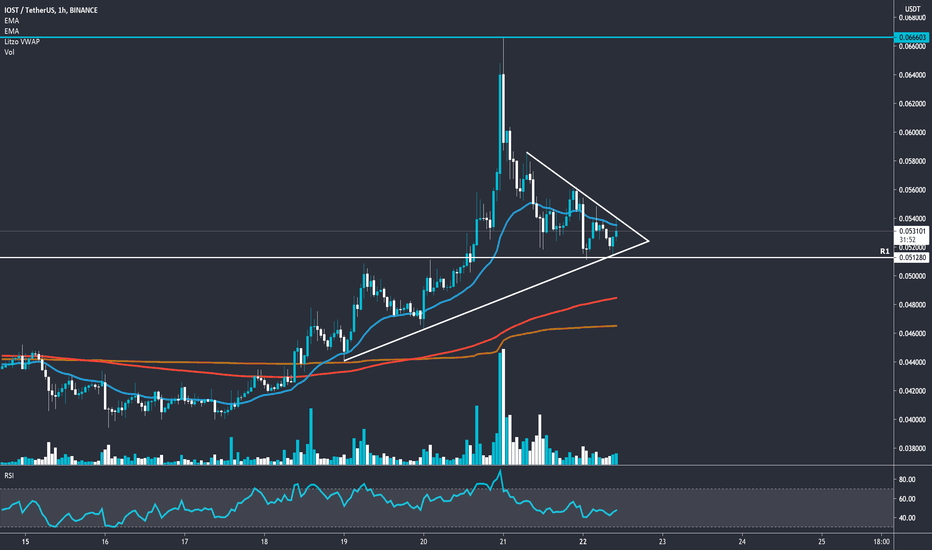

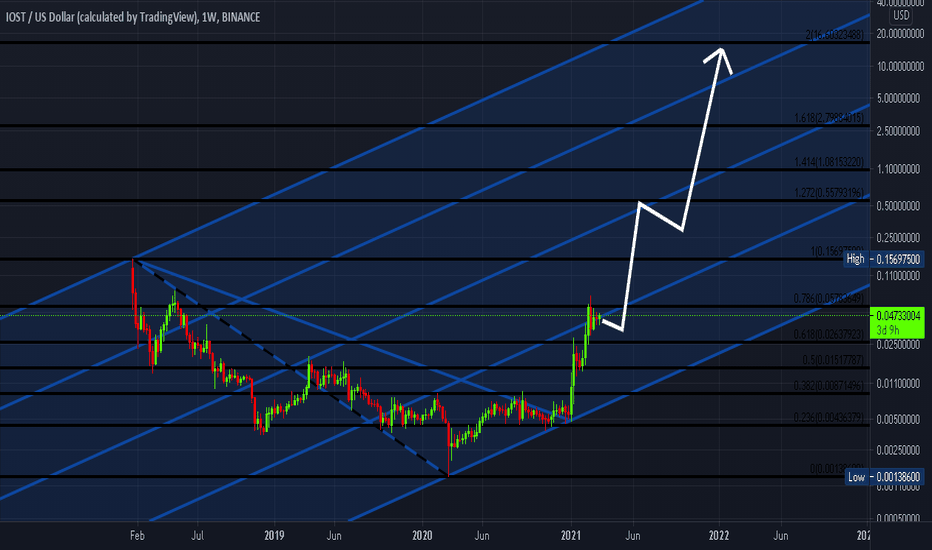

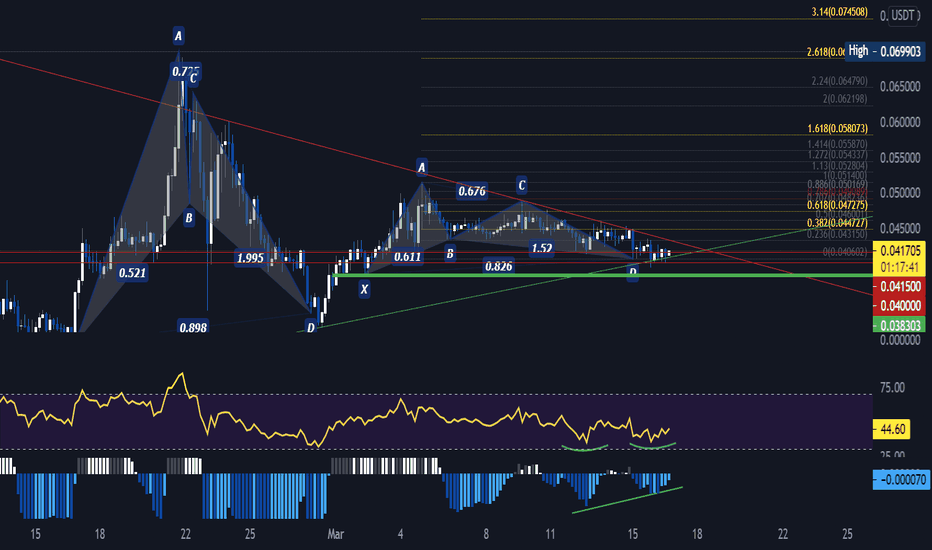

IOST back 2 back bullish harmonicsprice getting squeezed above ice lines from prev pattern with class C double bottom reversal divergence on the RSI and Classic divergence on the MACD oxygen may be needed for the potential elevation of this asset, also has continuation upside divergence on the daily. optimal price is green lateral support with stop below that. primary and secondary fib extensions are targets.

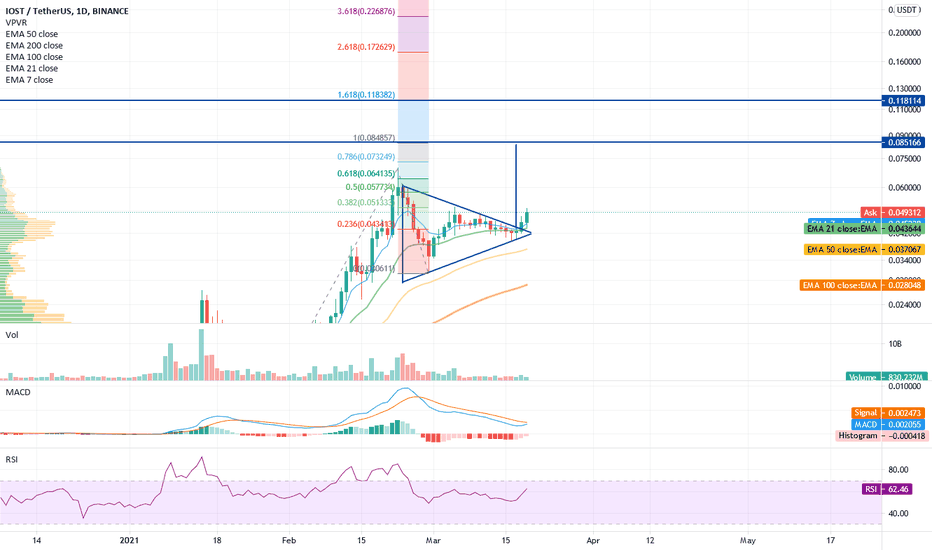

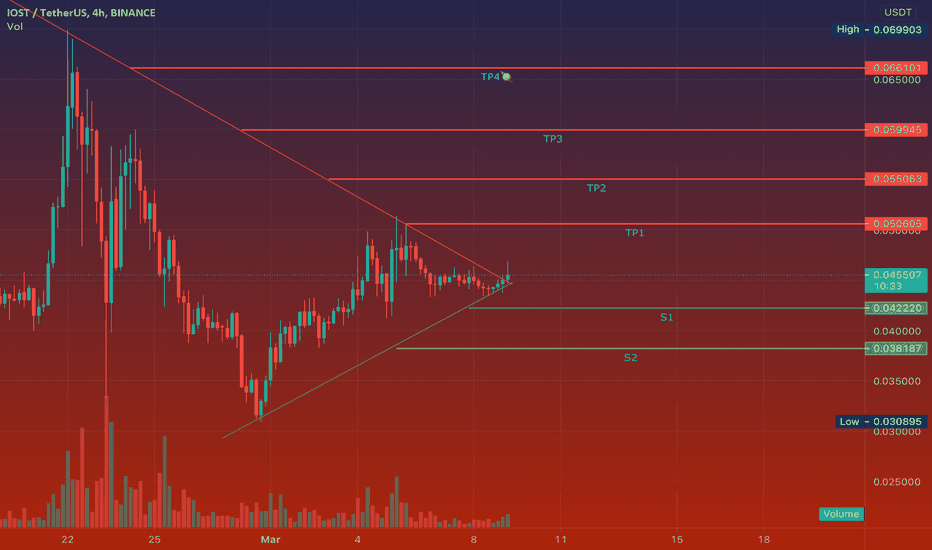

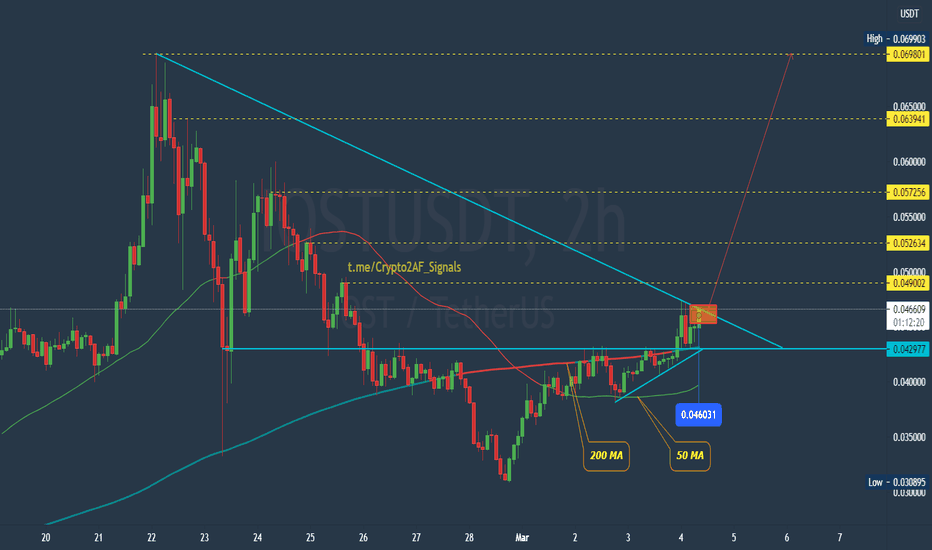

IOSTUSDT (IOST) - POSSIBLE PRICE ACTIONS ANALYSIS 🔎

- IOSTUSDT is consolidating in the symmetrical triangle (ST) pattern.

- A relatively big move is imminent.

POSSIBLE PRICE ACTIONS

- Uptrend ⬆️: breakout above the symmetrical triangle's inclined resistance.

- Downtrend ⬇️: breakdown below the symmetrical triangle's inclined support.

TARGETS 🎯

- Uptrend ⬆️: Horizontal resistance levels (R1, R2).

- Downtrend ⬇️: Horizontal support level (S1), Ascending trendline support (ATS)

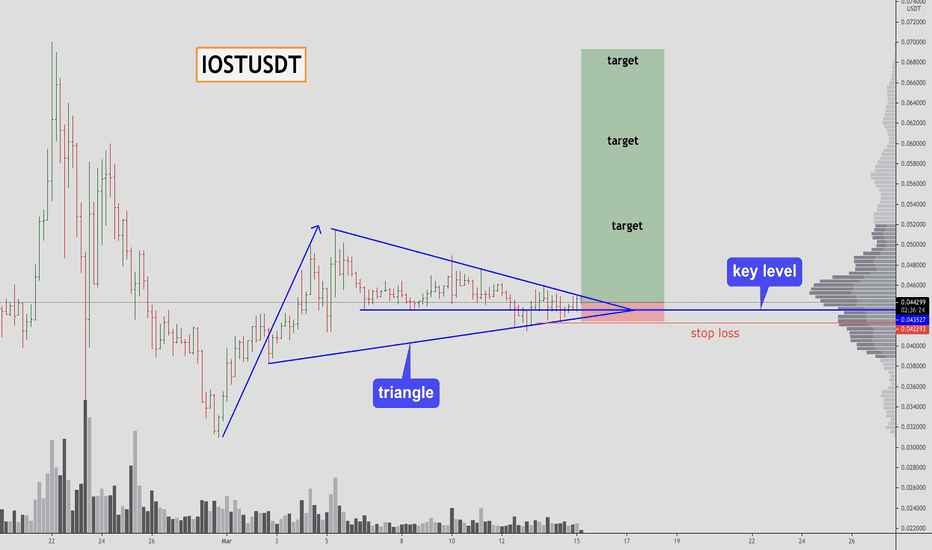

IOSTUSDT - accumulation in the trianglestop loss at the base of the figure.

entry now and you can add a position after the breakout. (If you are experienced).

The take profit was shown on the chart.

Preparing useful content for beginners

You will learn the best place where we can trade this instrument at low risk.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

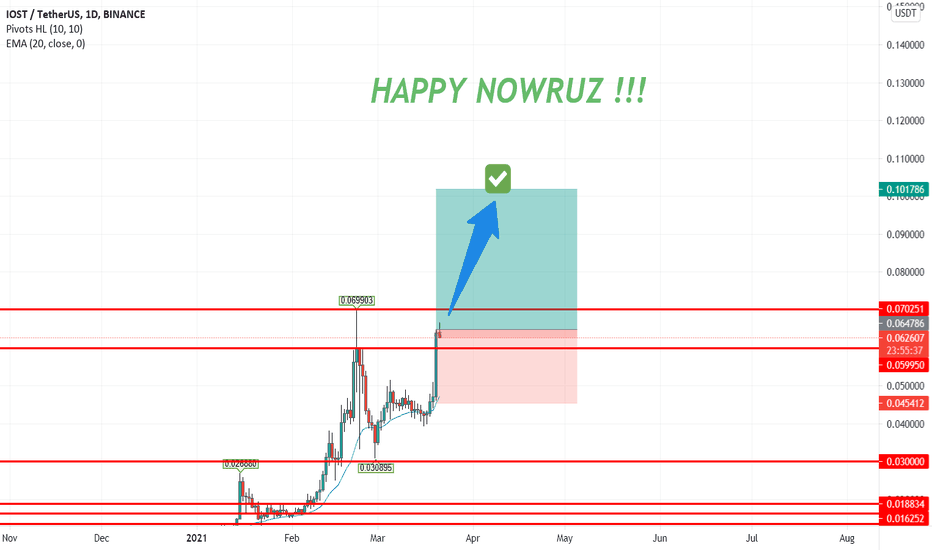

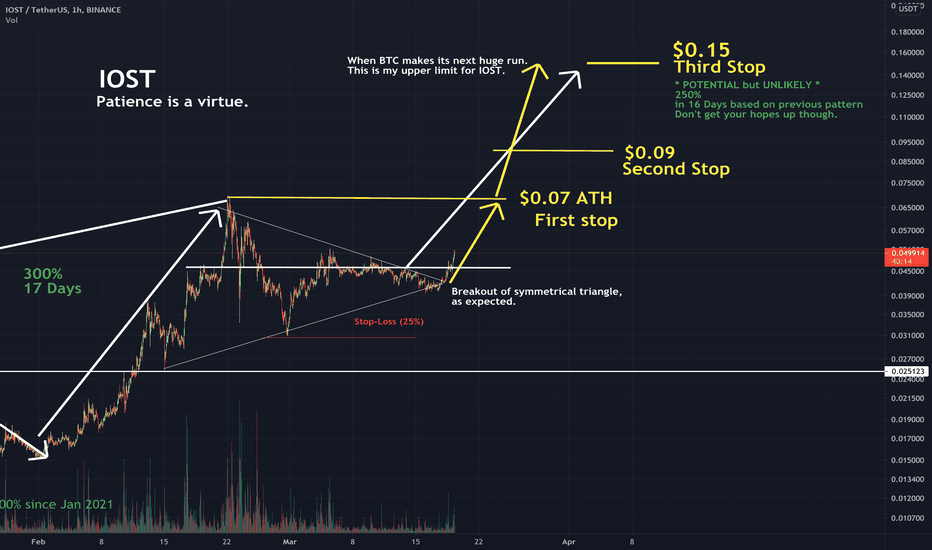

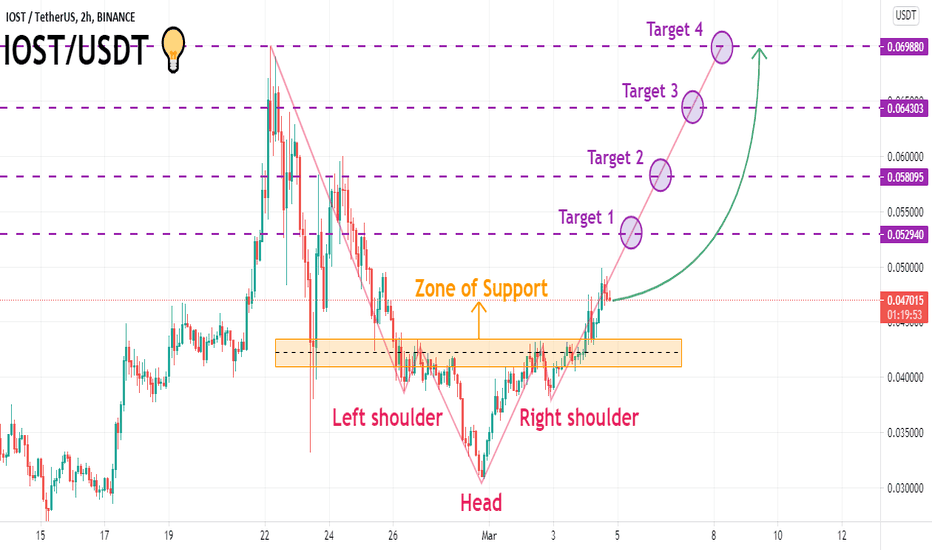

IOSTUSDTHello to you all. Mars Signals team wishes you high profits at all times.

The price has broken out of the triangle and has also made its pull-back. Now it is ready to go up toward its targets. But you need to keep an eye on Bitcoin too before deciding to make a move on IOST.

Warning: This is just a suggestion to you and we do not guarantee profits.

Wish you luck!

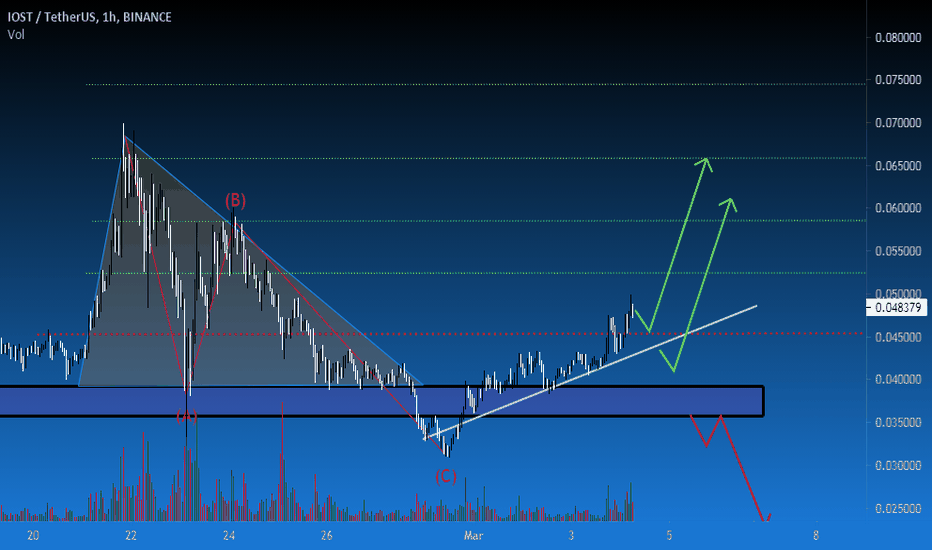

IOST/USDT - Ready to go Up 🚀Hello everyone, analyzed the IOST/ USDT pair

The price made a correction along the ABC waves

At the moment, the price is trading above the support line (white line)

Looking at a smaller timeframe, you can see an inverted head and shoulders.

Price Support Zone: $ 0.35-0.39

Also, the price is now higher than the previous resistance level, from which there was an uptrend

"This is just my opinion, trade with your trading system."

"Have a nice day everyone and come."