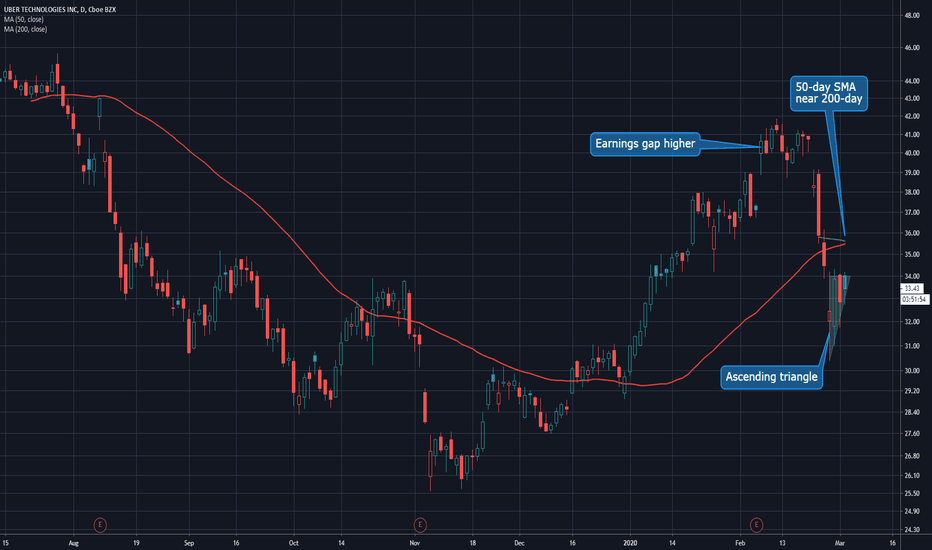

Uber Is About to Have a Golden CrossRide-sharing company Uber Technologies has had bad times and good times since its IPO last May. First, it had to cut its offer price. Then it fell all the way down to the mid-20s as investors worried about its profitability and sprawling operations.

But one by one, CEO Dara Khosrowshahi has moved to address those issues. He's exited non-core businesses and focused on making money. As a result, UBER was able to move forward its profitability goal the last time it reported earnings on February 6.

The stock gapped higher at the time, but then coronavirus came along and smashed it down to where it began 2020.

Meanwhile, enough time has passed for UBER's 200-day simple moving average (SMA) to appear. And guess what? Its 50-day SMA is about to rise up through the 200-day SMA. A "Golden Cross," could potentially occur in the next 1-2 sessions.

Another pattern on the chart is a tight ascending triangle since last Thursday. UBER's made incrementally higher lows while pushing against resistance at $34. That could be a potential trigger level for traders looking to hail a ride on the stock.

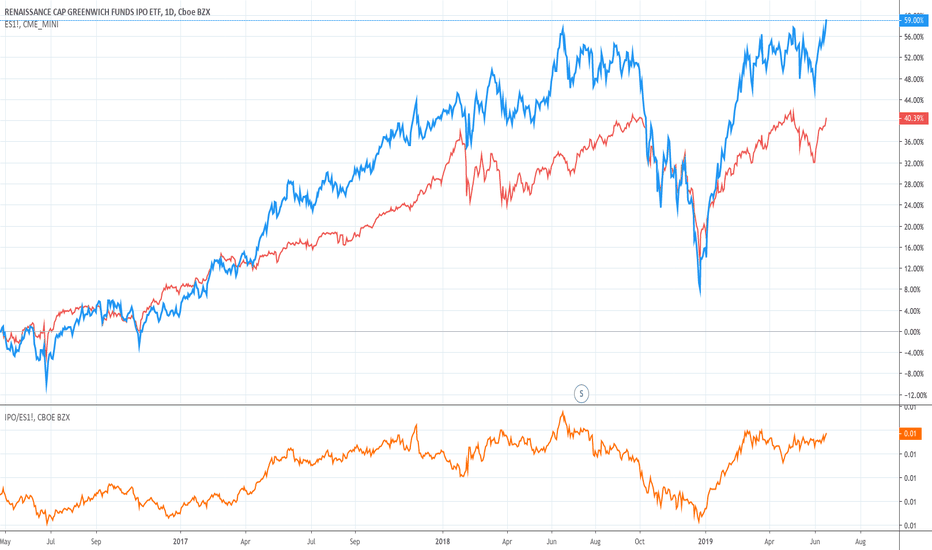

Ipo-stock

SNAP-CHAT "HOT" IPO : SHOULD YOU BUY ? EVERYONE IS BUYING THIS..IPO stands for initial public offering

but it also stands for: it's probably overpriced

:Imaginary Profits

:Insiders Private Opportunity

: Idiotic, Preposterous, and Outrageous

Buying IPO is a bad idea because it flagrantly violated one of the most fundamental rules: No matter how badly other people want to buy a stock, you should only buy if it's undervalued.

In the example above, IPO VA Linux's shares were valued at a total of $12.7 billion while company total worth was only $44 million. That IPO fell from $293 to $1.19 Per share.

Before Buying snap chat stock please do your analysis, look at their financial statements, their debt, earning etc. Do not jump in because it's a "hot" issue and everyone else in jumping. If your analysis shows that snap chat stock is undervalued then only buy it.

While there was a chance to become a billionaire by buying IPO's of a couple of companies like Microsoft, Apple, Coke there's was also a huge chance to get broke by buying IPO of thousands of companies like VA Linux.

References:

"The intelligent investor" by Benjamin Graham (book)

“Security Analysis” by Benjamin Graham (book)

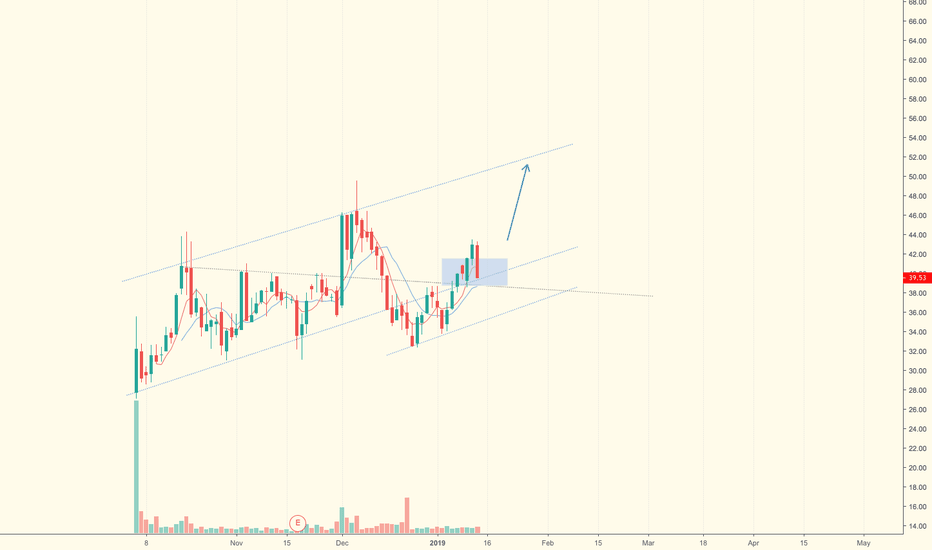

$BABA BABA staging a strong comeback like FB in 2012News from Alibaba ($BABA) spiked the stock higher. Some wonder if this is the time to short after all the stock has be up +140% since it's bottom back in 2016. However since the double bottom was put in last year, $BABA has been showing great signs of a stock ready to become the next big IPO that many will say in the future, "if only I had held on to my shares of ALIBABA back in 2017 when it first began going on. This is history in the market. Unless the stock closes below $120 in the next few months, this is a long term stock to add to any portfolio