IPO

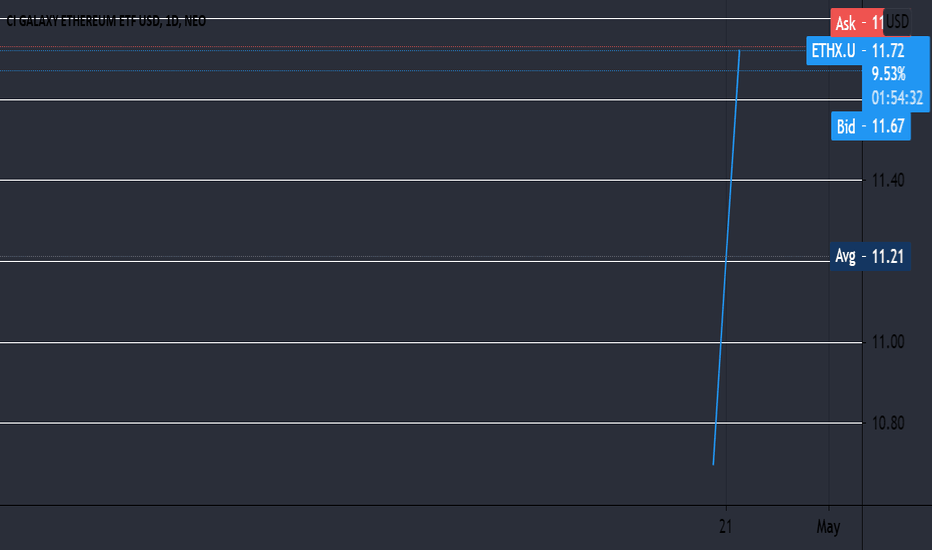

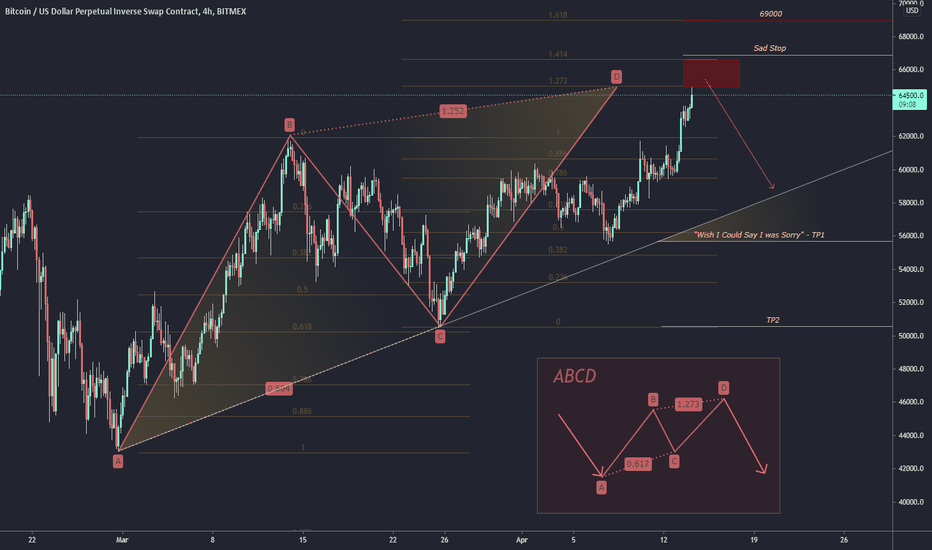

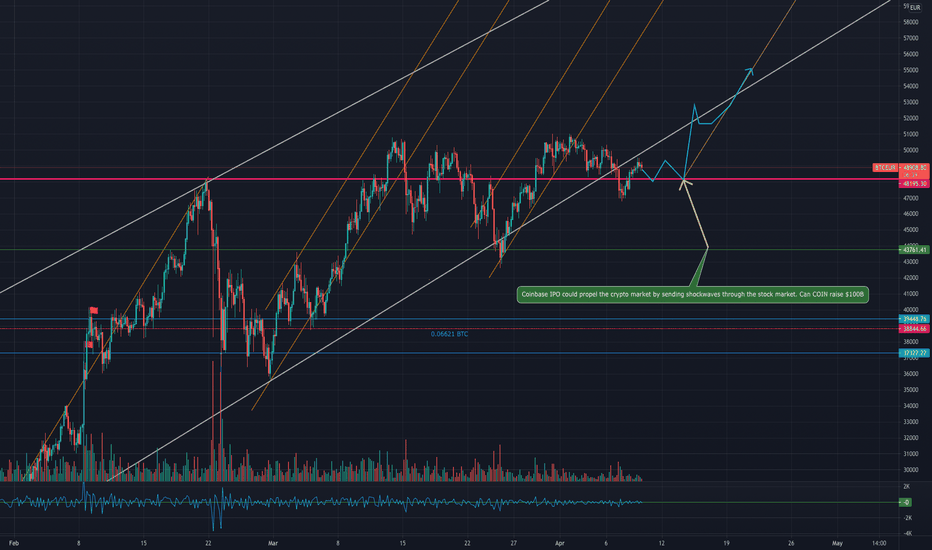

Coinbase IPO: Buy the Rumor Sell the News?Despite how bullish this crypto run has been; One can't help to question the possibility of the Coinbase IPO release marking an intermittent top. Looking back at the 2017 bull run, the CME Future release marked the top of the of the crypto market for some time; Post-futures release was then followed by several painful years of consolidation. It wasn't until 2020 that $BTC was finally able to re-claim its ATH crown. Though I do not expect a multi-year bear market after the IPO, I do expect some serious volatility.

Another Buy the Rumor Sell the News?

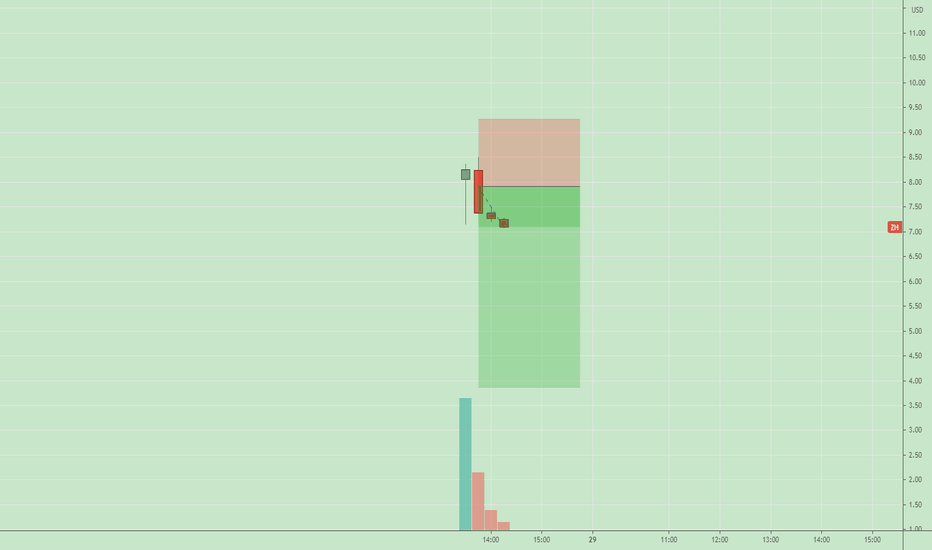

There is a tremendous amount of hype/evaluations around the Coinbase IPO which draws some concern. To support this, we are roughly 6.5 hours away from the $COIN release and we have a beautiful ABCD setup that just completed itself at $65,000. I have been trading the CD leg of this for the last several days and was personally hoping for this to hit 65k right around release. This early strike increases the probability of a blowing past resistance, but regardless the pattern is worth mentioning.

The ABCD:

ABCD Patterns are the simplest out of all the harmonics to trade. If if the BC retracement of the AB leg lands on the 0.618 we would likely find resistance at the 1.272 of the BC extension. If resistance is found and the pattern completes itself, Target 1 would be the extended trendline of AC leg while the second target would be point C. By placing a stop just over the .1414 would we have over a 1:4 trade to TP1 alone for over a 10% gain. If this would push down to TP2 we would be at around a 20% gain. All while 2-3% loss with fees. I do my best not to counter-trade; but this ratio seems too good to pass up.

I hope you all found this idea interesting and maybe even a little helpful. Cheers

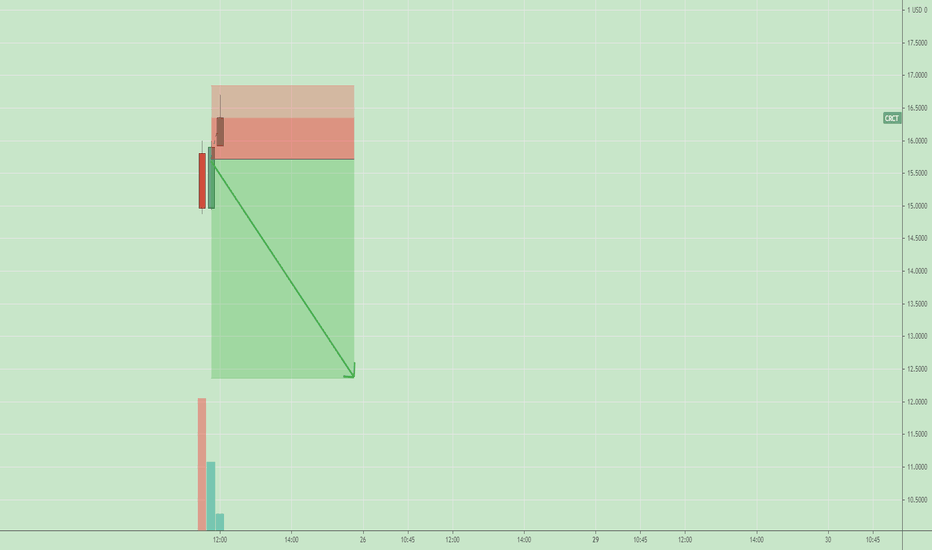

$PATH is giving a GREAT IPO LONG opportunity todayIPO intraday trading strategy idea

Uipath makes software that helps automate business tasks, and sets itself apart from rivals by allowing employees without coding experience to customize artificial-intelligence capabilities.

The share price is rising and gonna continue this trend today.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price today.

So I opened a long position from $66.70;

stop-loss — $63.95 ;

take-profit — 75.00/MOC price.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

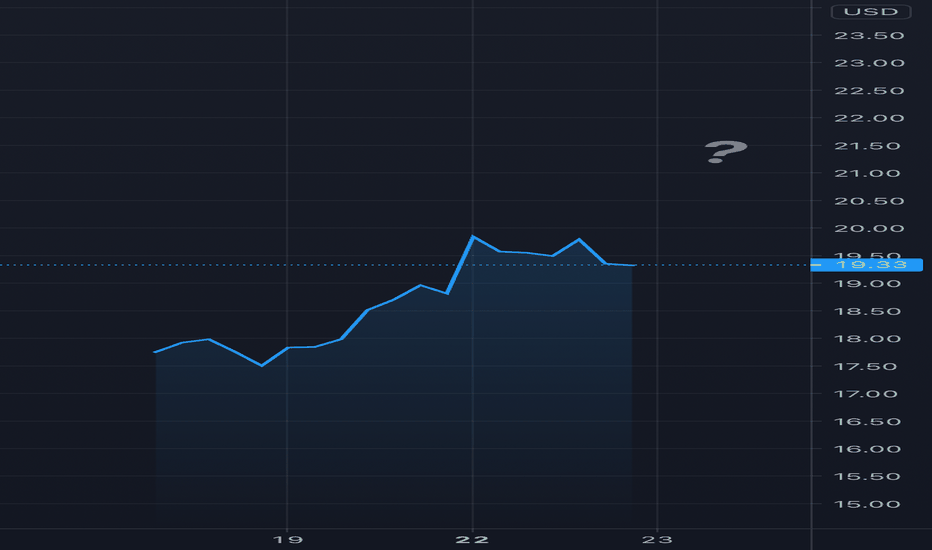

COINBASE - IPO HAS GREAT POTENTIAL (LONG-TERM) ✨Newly released IPO with great potential ahead!

- In a new crypto age, everyone is just catching on and for those who did before have generated mass amounts of wealth catching the train before it left.

While the majority make their money from investing and trading, coin-base is guaranteed revenue from fees.

As the crypto world grows, so will the buyers and the interest so will the revenue for exchanges like coin-base however this one in particular is one of the biggest players in this game and is wildly popular across the United States.

- Technical analysis:

We have not seen much price action since this is a newly launched IPO, however with the current situation we can only work with what we have and the only way to see current price action clearly is by dropping to lower time fames like the 15m chart, due to this it lacks strength.

Our analysis is a sentiment for the upcoming week, month.

Use this as a weather forecast, you are the person that has to put on a jacket when it’s raining.

Trade this sentiment based off your own entry strategy at the right time.

Flow with the Devil 😈

Trade with the manipulation👾

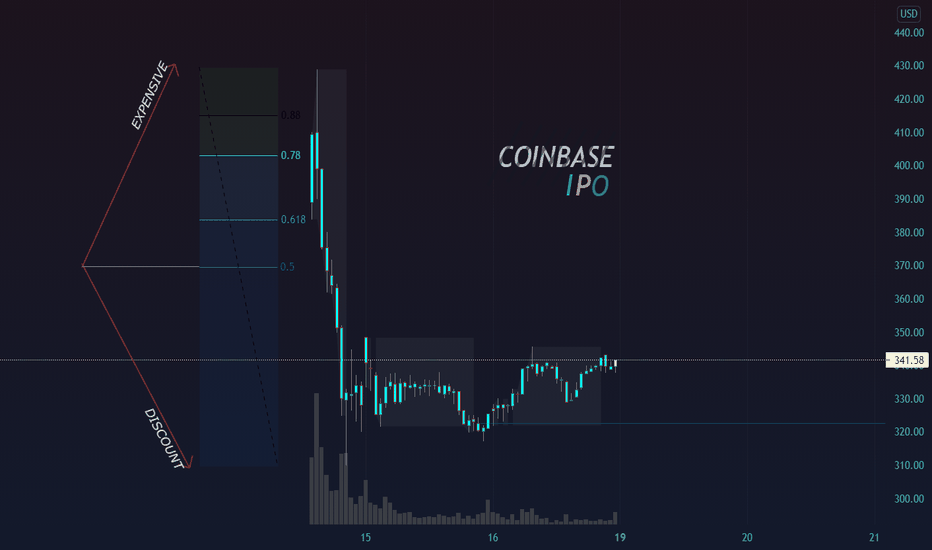

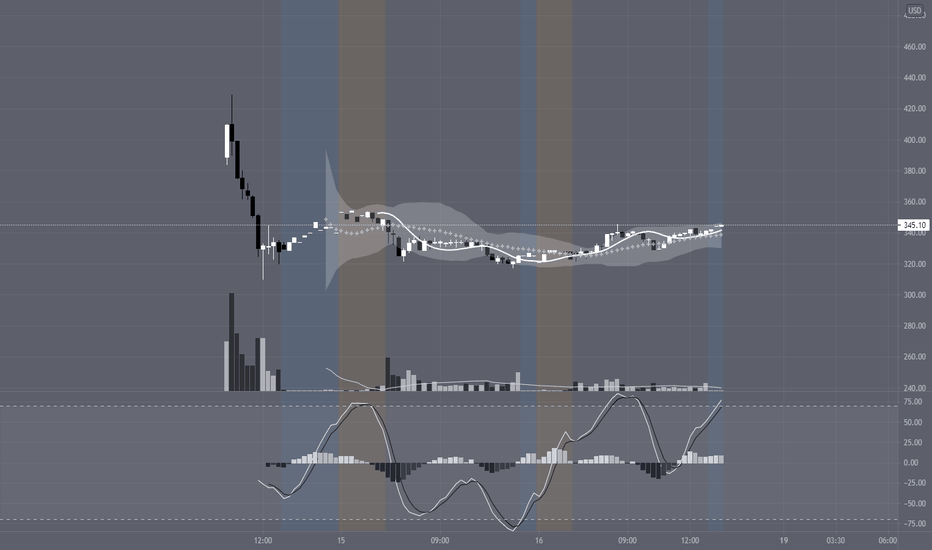

Direct Listings: An overview of opening day patternsOn 4/14/2021, Coinbase went public with the ticker NASDAQ:COIN . This was a pretty heavily-anticipated listing if for no other reason than that there aren't really any other crypto exchanges you can buy that are traded on a major US exchange. There are some OTC options, but when it comes to a symbol that trades on a US exchange this is a big milestone. Tons of people scrambled to buy into the listing right when it went live and ended up closing out the day reasonably red. Even people who are experienced traders jumped in and ended up closing out for a loss by the end of the day.

So what happened here? Why did the stock go down with so much hype, why are there so many insiders selling, and really what even is a direct listing?

What is a Direct Listing?

With a traditional IPO, a company works with an underwriter (typically a bank or large financial institution) to put together their initial stock offering. This usually involves a road show where the company's representatives will travel around drumming up investment from institutional investors prior to the stock going live. On IPO day, the underwriter facilitates the transfer of these pre-IPO shares to the institutional investors they snagged during the road show prior to the stock going live on secondary markets (where you, the retail investor can buy in). There is also a lockup period in an IPO that limits selling and hedging on the stock for specific holders until a set period of time has passed.

A direct listing is when the shareholders of a company decide to sell shares in the enterprise directly to secondary markets without the help of an underwriter. With a direct listing, none of the road show stuff happens and there's no real lockup period unless that's specifically negotiated internally at the company. The company sets a reference price for the stock and on listing day the stock is just listed straight to secondary markets.

With both a traditional IPO and direct listing, we're usually looking at around 10% of the company's stock being up for sale. With a traditional IPO, the underwriter often buy all the shares being offered directly from the issuer and then be responsible for selling those shares. With a direct listing, shareholders sell their shares to the market directly.

What happened with Coinbase?

What happened with the Coinbase direct listing isn't new or weird. It seems to happen more or less with every direct listing. I went back and got some charts for some of the big direct listings that have happened over the past year or so and it happens to varying degrees more or less every time.

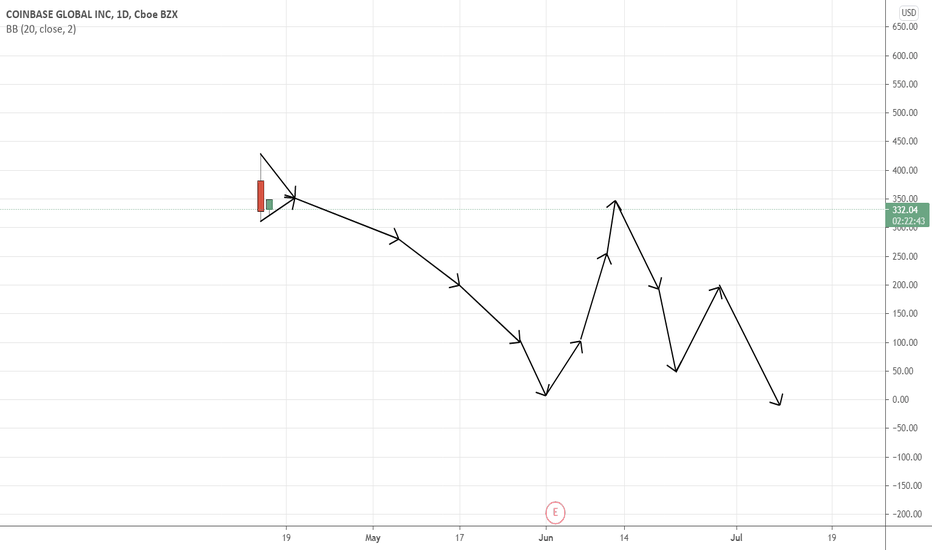

Here's NYSE:RBLX :

Here's NYSE:PLTR :

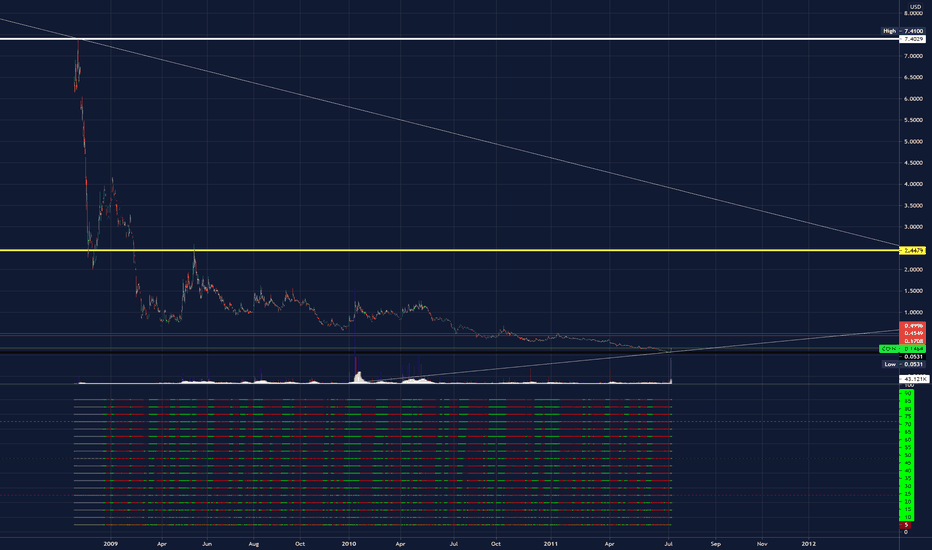

Here's NYSE:SPOT :

Here's NYSE:WORK :

Out of all of these, Roblox fared the best the fastest after going live but still had the same end of day drop as Coinbase. Slack had the worst performance and didn't bottom out for months.

So it's a pretty common phenomenon that direct listing stocks are probably a bad idea to buy into on the first day they list. The question becomes why.

Market Mechanics and Direct Listings

As I've said, with a direct listing the shares are coming directly from existing internal shareholders of the company. So in a market, there needs to be a willing buyer and a willing seller. In this case, there is an avalanche of selling that happens when the stock goes live and this has the kind of impact you would expect from a roughly 10% selloff of internal shares in a company. It makes the stock go down. Once the stocks are out in the market, it's up to the market to decide what they're worth. That could be more or less than the reference price set before going live. However, this selling has to happen by the very nature of what a direct listing is and this (among other technical factors) is a giant part of the reason why direct listings often end up red on the days they go live on the market.

So when you see stuff in the news about insiders selling some insane number of shares on the day the company does a direct listing, take it with a grain of salt. Chances are substantial that it's really just the normal kind of selling that is necessitated by this type of stock listing. I'm not saying that you should trust the CEO of Coinbase blindly and assume he'd never do wrong. But even in a world where this wasn't how direct listings work, the amount of heat it would bring down on him to just liquidate his entire ownership stake in a company he just brought public in some kind of "offloading the bags" scheme would be extreme. The incentives aren't there.

Summary

Based on averages alone, even if you knew nothing about the market mechanics of direct listings, it doesn't appear to be a smart move to buy into a directly listed stock on the day it starts trading. There is too much downward selling pressure involved and all the price discovery starts on opening day so volatility is expected.

If you're interested in following along with the other stuff I do outside of TradingView, definitely make sure to follow my Substack and my Twitter (details in my signature space at the bottom of this idea).

As with everything I write, remember that this is just my observations and that you should not assume that everything is perfect or works the same way every time. Trading is a risky thing to do and no matter what you're always taking risks when you trade, so keep that in mind.

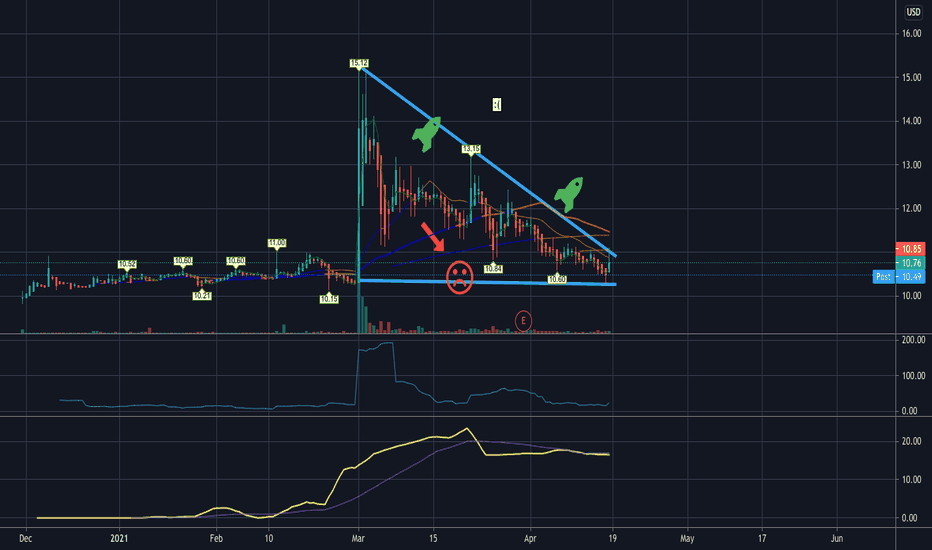

Vector Acquisition Corp (VACQ): Rocket Lab to the moon?Vector Acquisition Corp NASDAQ:VACQ

What a brutal drop! But I'm still holding on and in fact, accumulating more for the Rocket Lab IPO.

I'm definitely not a professional advisor and this is not professional advice.

Rocket Lab in the news:

Rocket Lab has now delivered a total of 104 satellites to Earth orbit.

www.space.com

Rocket Lab's next reusable rocket mission will test a new heat shield

www.engadget.com

spacenews.com

spacenews.com

$COIN The Most OverHyped and OverPriced Listing of the 21st CntyCoinbase's Direct Listing signifies what is wrong with the trading world on a grand scale as of late.

The new investor possibly with their stimulus check or worse their life savings throwing everything into every turd that is being FOMO'ed onto the public.

$COIN is no exception, besides the company taking advantage of new crypto investors be charging a ridiculous transaction fee for each trade.

The company itself really is in a bad position, financially and spatially in the sector. The balance sheet isn't anything to bat your eyes at, and the multitude of early investors before it even went public will gladly dump all their stock at these price levels as it is by far the most overhyped company trading right now. The real value for this turd imo? $10 and I wouldn't even throw much at it.

Call me jaded since I actually used the website when I first started trading crypto before switching, but this public listing will be the death of the current crypto run and we should see all the cryptos begin to fall like dominoes behind this tanking ticker.

PT in a few months around $100 and I wouldn't even buy it at those levels.

$APP is giving a GREAT IPO SHORT opportunity todayIPO intraday trading strategy idea

AppLovin provides tools for mobile app and game developers.

The share price is falling and gonna continue this trend today.

The demand for shares of the company still looks lower than the supply.

These and other conditions can cause a fall in the share price today.

So I opened a short position from $69,10;

stop-loss — $73,50

take-profit — $56,00/MOC price

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Some Facts About Coinbase and Its IPOI am pretty fascinated by the Coinbase IPO and watched it closely today. I did not trade it or buy or sell it. I just watched. The market is really something else today. AirBnB and Coinbase are $100 billion companies. They are suddenly 1/7th the size of Tesla or roughly 1/15th the size of Google. I have no doubt these are amazing companies, but the valuations are jaw-dropping.

Or maybe Google and Tesla are still undervalued? I tweeted this stat the other day:

"Dogecoin currently has a market cap of $14 billion. It's now the 13th largest cryptocurrency in the world. Its market cap is bigger than companies like GameStop $GME, Factset FDS, Davita DVA, Kohl's KSS, and Coors Light TAP. It's possible equity markets are TOO efficient compared to other markets." - Tweet here

So to answer that question and to dive in, here are some facts I found about Coinbase. Enjoy - by the way these facts come from a various list of sources and official documentation from Coinbase itself:

• 56 million users in the most recent quarter, which is compared to 32 million in 2019.

• The Coinbase IPO was a direct listing, actually not an IPO, which means there was no money raised.

• Coinbase gets 95%+ of its revenue from transaction fees and that needs to change

• The company wants to soon move into credit cards, which make up 50% of sales in the next 5-10 years

• Coinbase revenue has apparently climbed nine-fold from over the last 12 months to $1.8 billion

• Net income has jumped somewhere to $730 million and $800 million and only last year it was $32.

• Coinbase is larger than the NYSE and Nasdaq COMBINED.

So that's it.

Curious to hear your thoughts below. Thanks for reading.

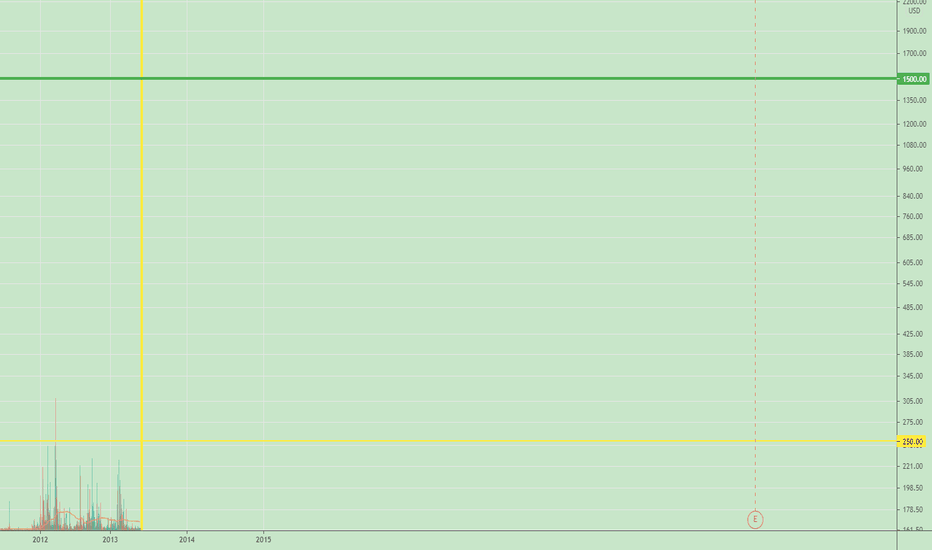

Coinbase goes to hit $1500IPO investing idea

Coinbase, Inc. is an American cryptocurrency exchange platform that operates remote-first without an official physical headquarters.

The reference price is $250, I suppose the price will rise much higher at 1 day and later. The market cap at $250 per share is $65bln.

Why?

Let's check some fundamentals.

In 1Q2021 Coinbase reported the next estimated results:

trading volume — $335bln volume

sales — $1.8bln

income — $760mln

Also let's check all the market volume data:

Volume MA30 in 2018: minimum was at 10bln per day, maximum -- 40bln per day

Volume MA90 at 1APR21 was 300bln per day

Maximum volume MA30 in 2021 was 360bln per day

Volume MA90 at 1JAN21 was 150bln per day

On 01.01.2020 volume MA365 was at 50

On 01.01.2021 volume MA365 was at 100

So, we have 4 scenarios of valuation

1) Pessimistic — the crypto hype will end in APR2021

If the hype ends, average volume will fall to 100bln per day at the end of 2021 (like in 2018 from 40bln to 10bln). And will be the same in 2022 and later.

So, yearly sales will be at $1.8bln, yearly net income — $760mln.

Using SPY P/E multiplier (42), we have market cap at 750mln*42 = $32bln, share price at $125.

Using TSLA P/S multiplier (25), we have market cap at 1.8bnl*25 = $45bln, share price at $170.

2) Current market — the market condition will be stable

On 01.01.2022 volume MA365 can be at 200 (like x2 from 2020 to 2021)

It means:

sales — $1.8bln*4*200/360 = 4bln

income — $760mln*4/1.8= 1.7bln

Using SPY P/E multiplier (42), we have market cap at 1.7bln*42 = $70bln, share price at $270 — almost as a reference price.

Using TSLA P/S multiplier (25), we have market cap at 4bnl*25 = $120bln, share price at $385.

3) Optimistic — the crypto hype will continue

Trading volume bill be 400bln per day

sales — $8bln

income — $3.4bln

Using SPY P/E multiplier (42), we have market cap at 3.4bln*42 = $143bln, share price at $550

Using TSLA P/S multiplier (25), we have market cap at 8bnl*25 = $200bln, share price at $770.

4) TOTHEMOON scenario

trading volume will twice every quarter in 2021.

We have 300+600+900+1200/4 = 750bln per day

sales — $8bln*750/400 = 15

income — $6.4bln

Using SPY P/E multiplier (42), we have market cap at 6.4bln*42 = $270bln, share price at $1000

Using TSLA P/S multiplier (25), we have market cap at 15bnl*25 = $375bln, share price at $1500.

So, a pessimistic scenario says it is better to wait for $125 and invest there.

In optimistic scenario says it is better to send MOO today, and set 3 targets:

650

1000

1500

So do I :)

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

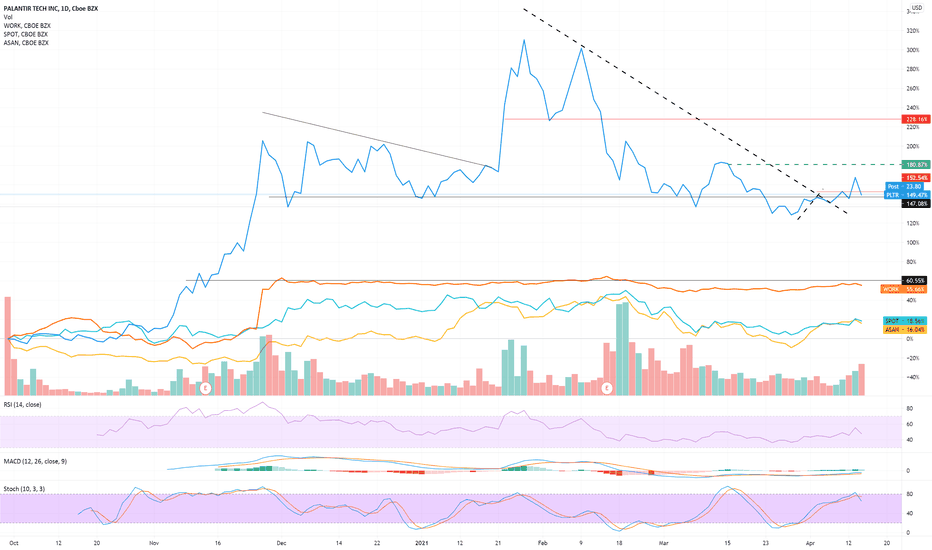

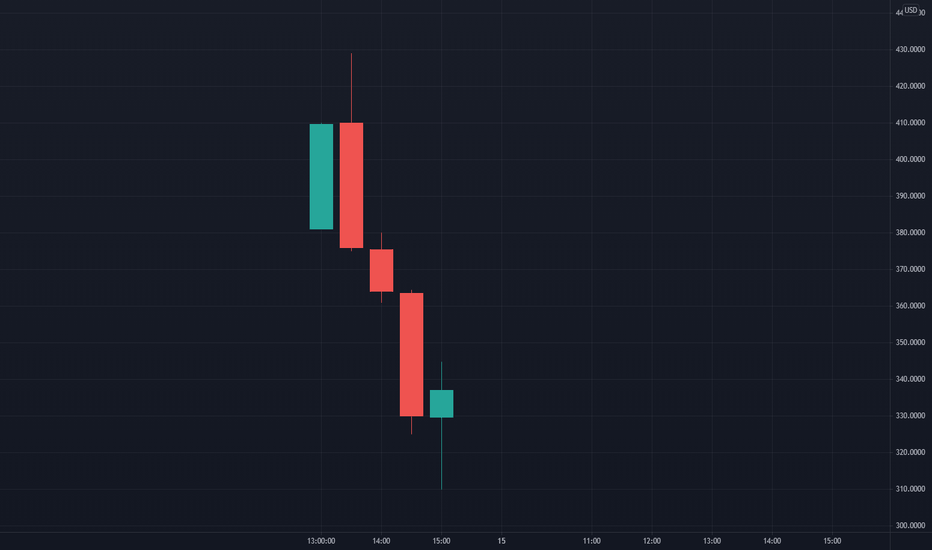

COIN - Direct IPO Listing Comparison PLTR, WORK, ASAN, SPOTCOIN opened up, then tanked quickly, so I went to see what direct listings typically do.

Here are 4 others.

PLTR is the exception

WORK/Slack got bought by Salesforce which drove the price up

I see declining interest and pricing in the direct IPOs of late.

I picked up some COIN on open at $386, then sold as it dropped back down at $387 and am out.

*NOT FINANCIAL ADVICE - NOT A FINANCIAL ADVISOR*

COINBASE - CoinBase Global Inc - coinbase IPO - BUY -I was warned about posting this - Expect extreme volatility at open Monday - Leading to investors to pour in from crypto and other tech stocks - expect nothing less than 6$ - MEDIA WILL TELL YOU IT'S OVER-VALUED HOWEVER THIS IS NOT TRUE.

Expect this IPO to effect the Crypto Markets

(DATA FROZEN?)

NASDAQ:COIN

INDEX:BTCUSD

TVC:SPX

CAPITALCOM:UK100

TVC:NI225

GDP UP

USA

CHINA

JAPAN

INDIA

INDONESIA

KOREA

NIGERIA

RUSSIA

SAUDI ARABIA

TAIWAN

------------------

GDP DOWN

GERMANY

UNITED KINGDOM

FRANCE

ITALY

BRAZIL

CANADA

ARGENTINA

AUSTRALIA

BELGIUM

GREECE

IRELAND

MEXICO

NETHERLANDS

NORWAY

POLAND

PORTUGAL

SPAIN

SWEDEN

SWITZERLAND

TURKEY

A whacky idea based on the Coinbase IPOGoing all out here with a whacky prediction. I believe the Coinbase IPO is going to send shockwaves through the financial markets and may even break a new record for a new company listing, if this does turn out to be the spectacle we all hope for, expect a Tesla candle pushing us to €53k with a small push down for those hoping to short only for the bears to be pushed out the way with a price going straight up to €55k ATH. Its a crazy idea but I am having fun, I think the market will be calm over the weekend in anticipation. Good luck to all BTC family :)

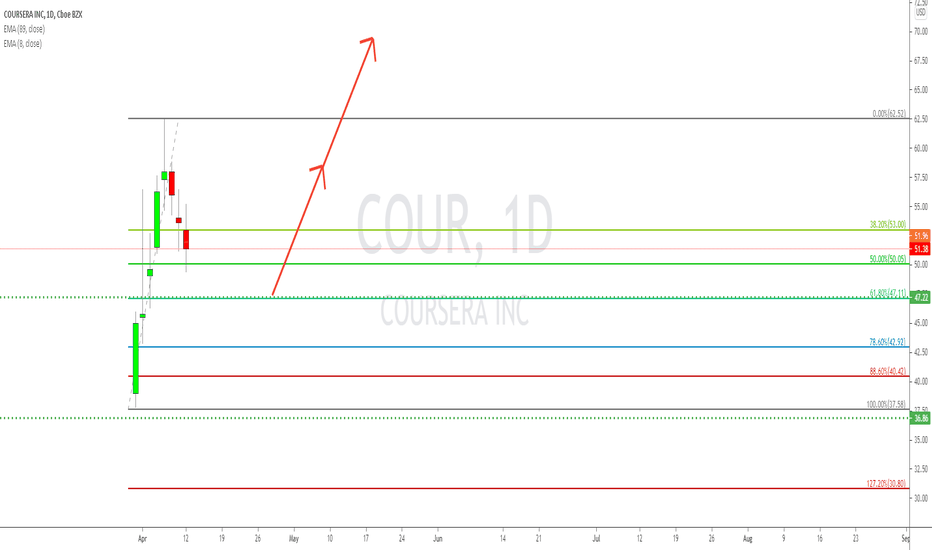

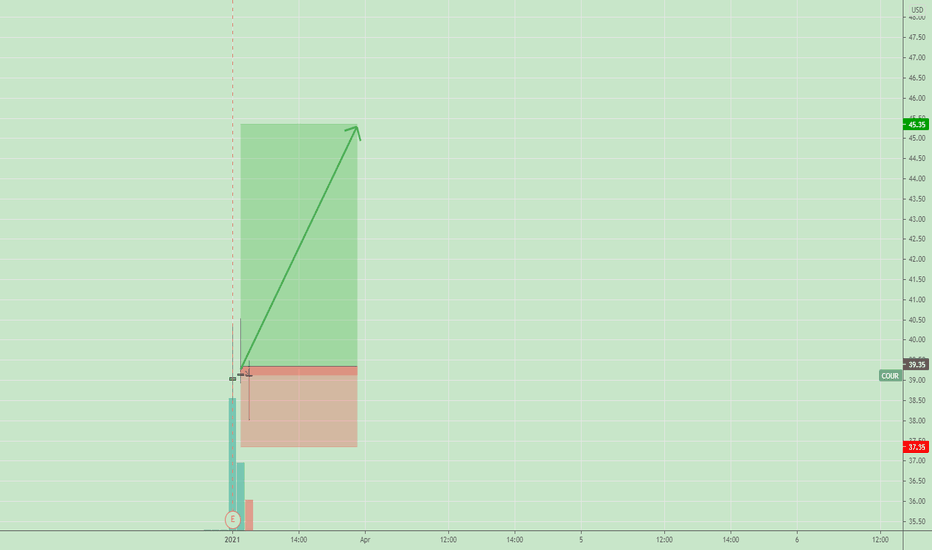

$COUR is giving a GREAT IPO LONG opportunity todayIPO intraday trading strategy idea

Coursera doesn't need any description :)

The share price is rising and gonna continue this trend today.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price today.

So I opened a long position from $39,35;

stop-loss — $37,35 ;

take-profit — 41,35/MOC price.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

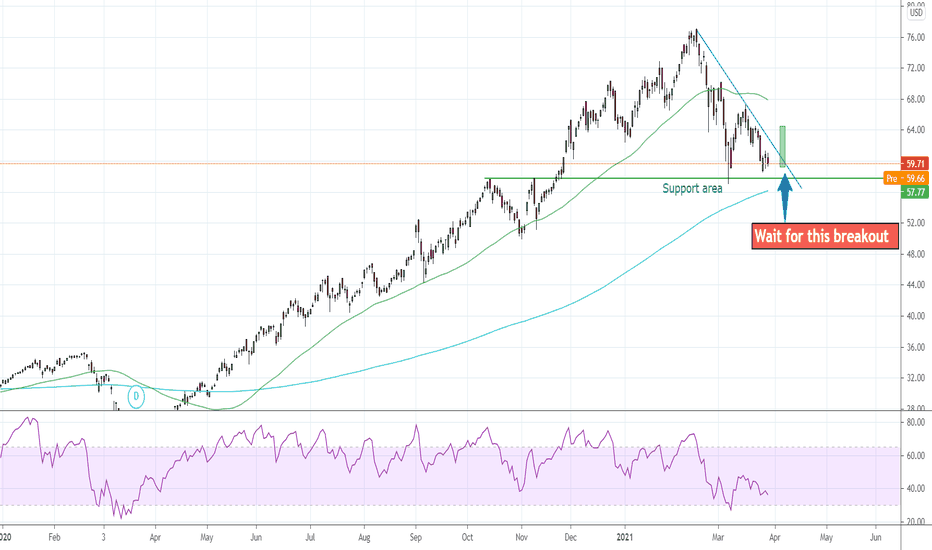

Renaissance IPO ETFAlong with the popularity of individual IPOs, the Renaissance IPO ETF—trading under the apt “IPO” ticker—has built a hype train of its own. The ETF had $40.5 million in assets under management on December 31, 2019 and ended 2020 with more than $740 million, a whopping 18x increase.

Technically, it is in the bullish trend, price is sitting on the support level around 57.50, so we should wait till it breaks the correction line and then buy.

Write in the comments below which company you'd like to see in my next analysis.

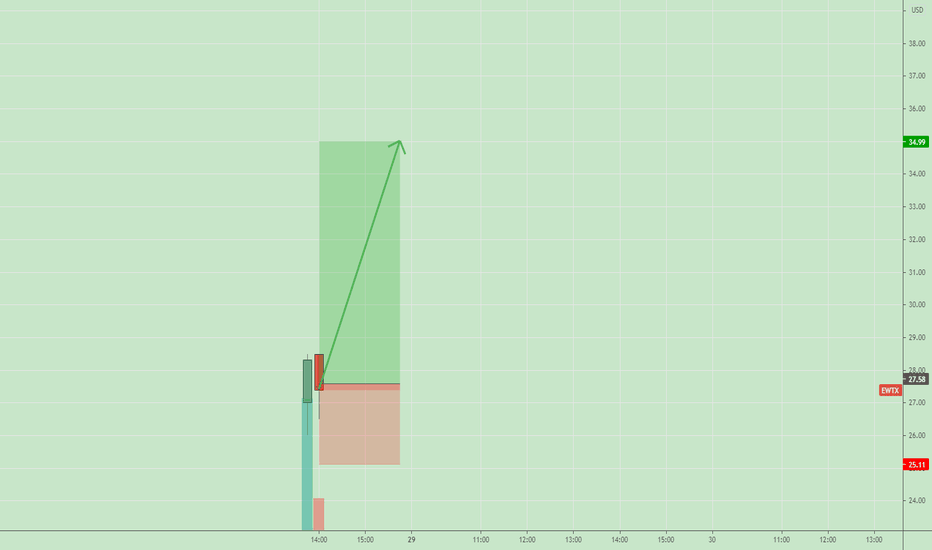

$EWTX is giving a GREAT IPO LONG opportunity todayIPO intraday trading strategy idea

Edgewise Therapeutics is a clinical-stage biopharmaceutical company focused on developing orally bioavailable, small molecule therapies for rare muscle disorders.

The share price is rising and gonna continue this trend today.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price today.

So I opened a long position from $27,58;

stop-loss — $25,11;

take-profit — 34,99/MOC price.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

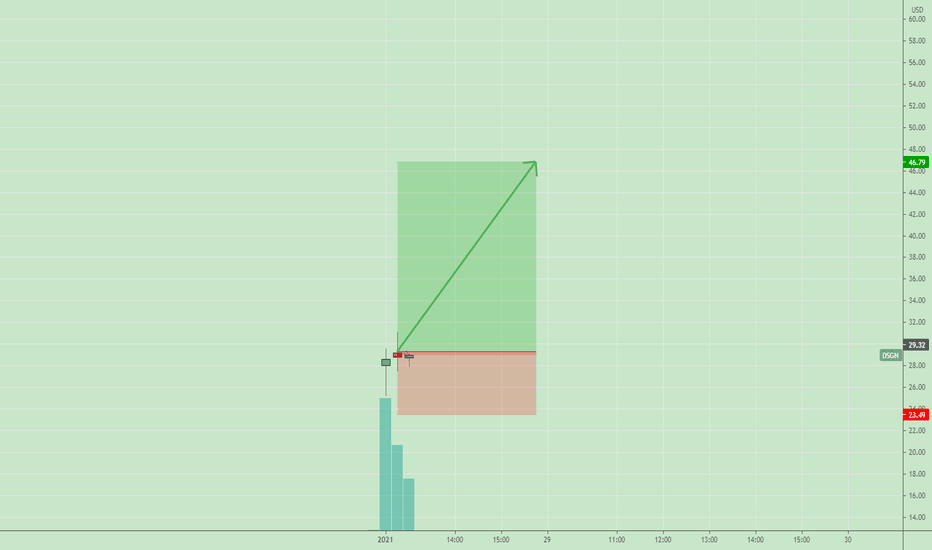

$DSGN is giving a GREAT IPO LONG opportunity todayIPO intraday trading strategy idea

Design Therapeutics is a biotechnology company developing a platform of gene targeted chimera (GeneTAC™) small molecules for the treatment of serious degenerative disorders caused by inherited nucleotide repeat expansions.

The share price is rising and gonna continue this trend today.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price today.

So I opened a long position from $29,32;

stop-loss — $19, 40 ;

take-profit — 23,49/MOC price.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

$ZH is giving a GREAT IPO SHORT opportunity todayIPO intraday trading strategy idea

Zhihu is the largest Q&A-inspired online community and one of the top five comprehensive online content communities in China, both in terms of average mobile MAUs and revenue in 2020, according to CIC.

The share price is falling and gonna continue this trend today.

The demand for shares of the company still looks lower than the supply.

These and other conditions can cause a fall in the share price today.

So I opened a short position from $7,91;

stop-loss — $9,26

take-profit — $3,86/MOC price

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

$CRCT is giving a GREAT IPO SHORT opportunity todayIPO intraday trading strategy idea

Cricut is a creative technology company that has brought a connected platform for making to over four million users worldwide.

The share price is falling and gonna continue this trend today.

The demand for shares of the company still looks lower than the supply.

These and other conditions can cause a fall in the share price today.

So I opened a short position from $15,72;

stop-loss — $16,84

take-profit — $12,36/MOC price

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.