Revolve approaching a decision point tomorrowRevolve has formed a triangle chart pattern since its IPO a few days ago. On upside breakout, look for confirmation above $41.61 resistance level. On a downside breakout, look for confirmation below $36.74 resistance level.

Tomorrow is a historically bullish date for stocks, so perhaps Revolve will break out upward simply on seasonality. Citron, the only analyst to opine on Revolve, has set a price target of $50. Downward consolidation is the alternative. In that scenario, Look for a slow slide down toward secondary resistance at 30.65 as the price consolidates before its next upward gap.

IPO

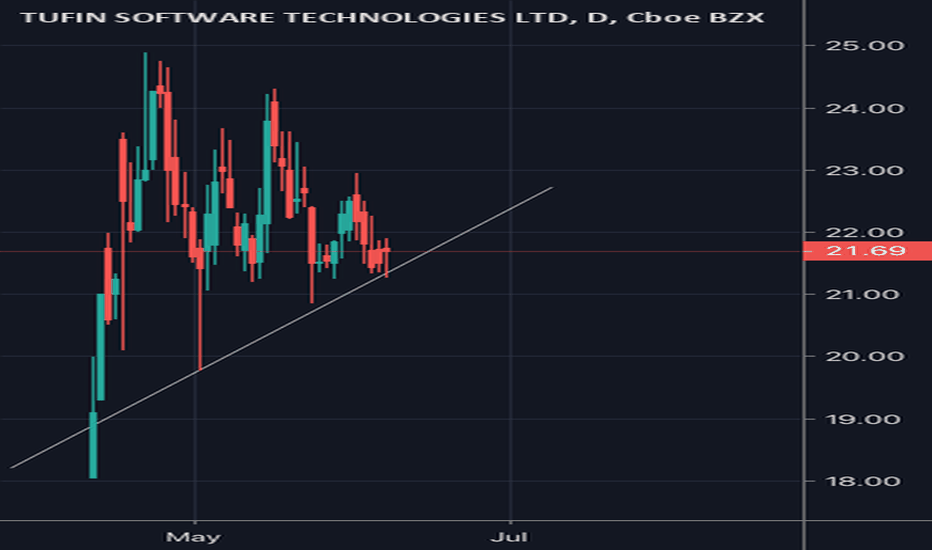

TUFN Q1 Earnings TUFN is a recent IPO that interest me. Revenues growing 30% Y/Y. Has captured 15% of Global 2000 companies. Retains 70%-75% of its customers and now has $100 million cash from the IPO. Last year 60% of revenue was from existing customers. Thinking they can really increase sales with new cash. Management team consist of a couple of guys from CHKP ($17b market cap). I don’t have a position but watching, Q1 earnings are Thursday. 2017-2018 Q/Q revenue growth 45%. As far as product, company has a few things it needs to workout. Cyber Security is a tough and TUFN seems to have internal pressure to perform which is normal for a growing company trying to capture a significant share of the market. May or may not try a small position this week but will be watching.

Side note: kinda has a tiny float so good earnings and fresh breakout over $25 could probably run to low $30s people love buying anything that is going up.

As always do your own research. Not investment advice.

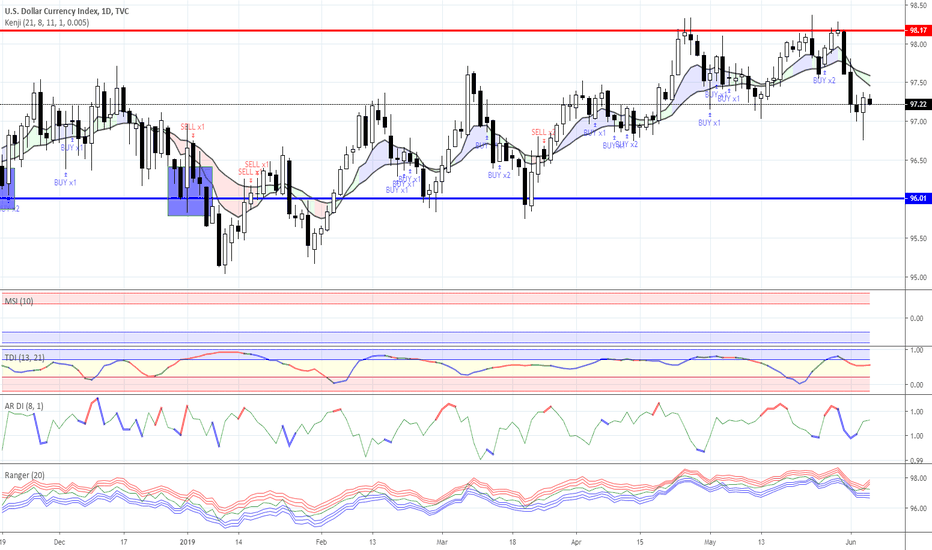

Failure data from ADP, ECB decision & BoA warnings Primarily the data on the US labor market from ADP was remembered yesterday. The number of jobs in private companies in the US in May increased by 27K (the forecast was + 180K). The figures are frankly failing and extremely alarming, given that official statistics from the US Department of Labor will be published on Friday.

The dollar was one of the first victims of such data. Such a negative reaction is due to two main factors. Firstly, the US economy clearly signals problems, and secondly, such data is a reason for the Fed to establish itself in the expediency of reducing rates. Naturally, both of these factors are extremely negative for the dollar.

Well, at the end of the day, the dollar managed to recover. One of the reasons was the publication of pretty good data on business activity indices. Secondly, there is, of course, a chance that Friday's labor market data will not disappoint. Nevertheless, we continue to recommend looking for points for dollar sales.

The key event will be the announcement of the ECB meeting decision. Monetary policy parameters are likely to remain unchanged, but forecasts for economic growth will be revised downwards. In addition, weak Eurozone inflation data, published this week, led to the fact that the markets no longer expected to tighten monetary policy in the foreseeable future, and now they are waiting for its further softening. In particular, traders assume a 0.1% reduction in the rate by July of next year.

This is definitely a bearish signal for the euro, so today we will refrain from recommending to buy euros. Well, or at least make it from very attractive points.

Meanwhile, analysts are continuing to analyze the of a trade war possible consequence. The Bank of America experts named a number of possible scenarios for the situation development (between the USA and China). In particular, China’s exit from US public debt, delisting of Chinese ADRs, the exodus of American investors from the Chinese market, which is fraught with stock and bond sales on the markets, Chinese IPOs could lose access to the American financial market, and finally, countries could start a full-fledged currency war. So to the question “Could the situation become worse?” The answer is unequivocal “could.”

Our position for today: we will continue to look for points for selling of the US dollar, sales of oil and the Russian ruble, as well as buying of gold and the Japanese yen. In addition, we will sell the Australian dollar against the US dollar.

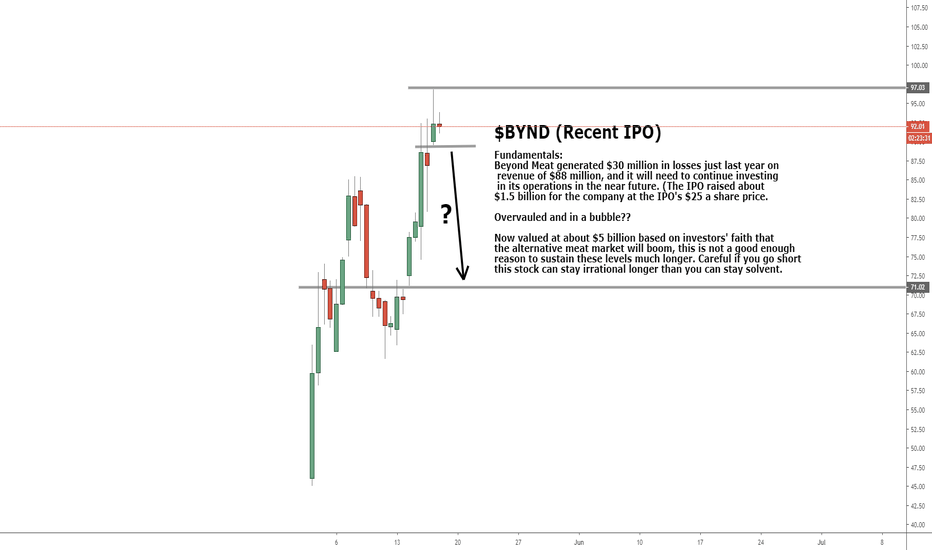

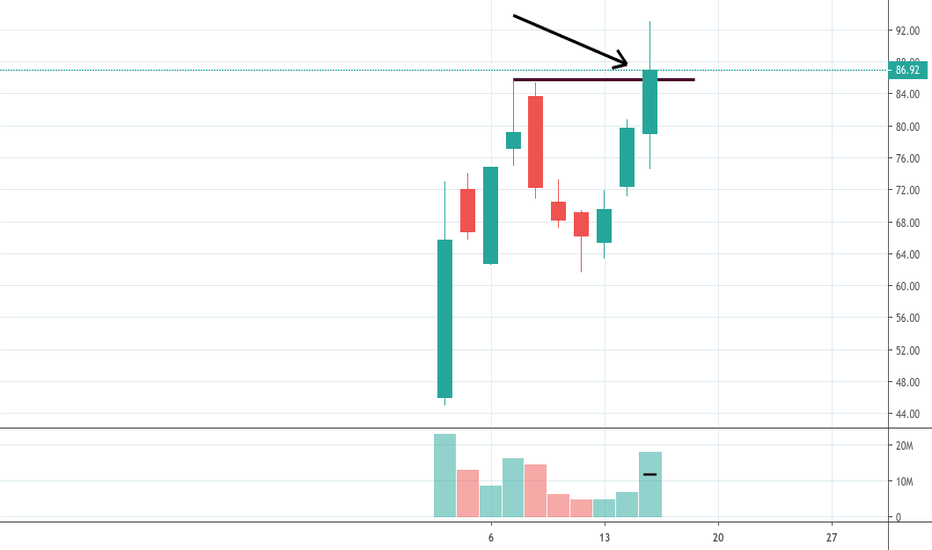

BYND IPO BUBBLE?Fundamentals:

Beyond Meat generated $30 million in losses just last year on

revenue of $88 million, and it will need to continue investing

in its operations in the near future. (The IPO raised about

$1.5 billion for the company at the IPO's $25 a share price.

Overvauled and in a bubble??

Now valued at about $5 billion based on investors' faith that

the alternative meat market will boom, this is not a good enough

reason to sustain these levels much longer. Careful if you go short

this stock can stay irrational longer than you can stay solvent.

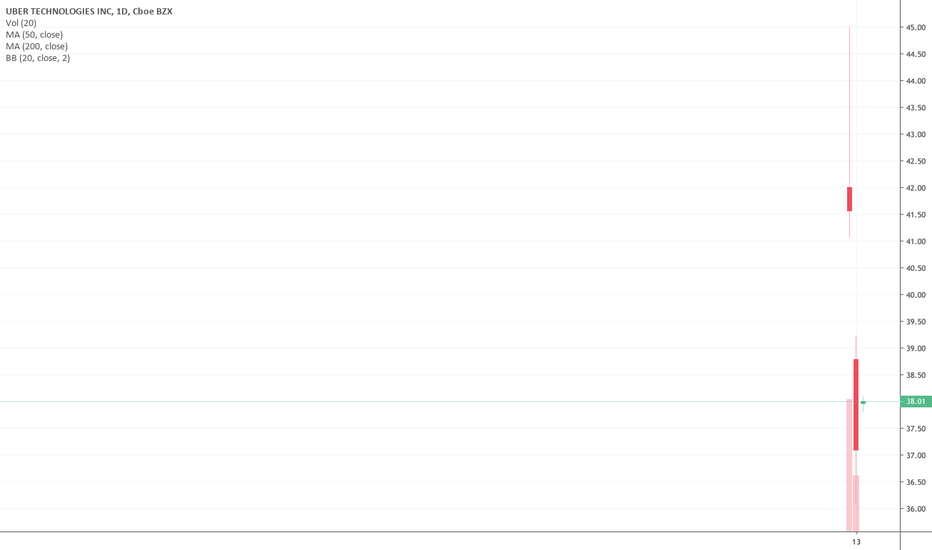

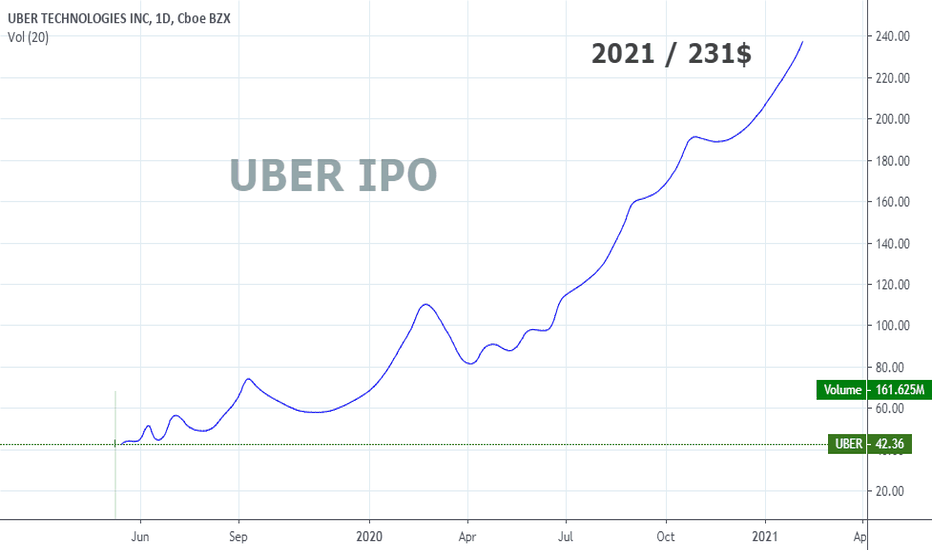

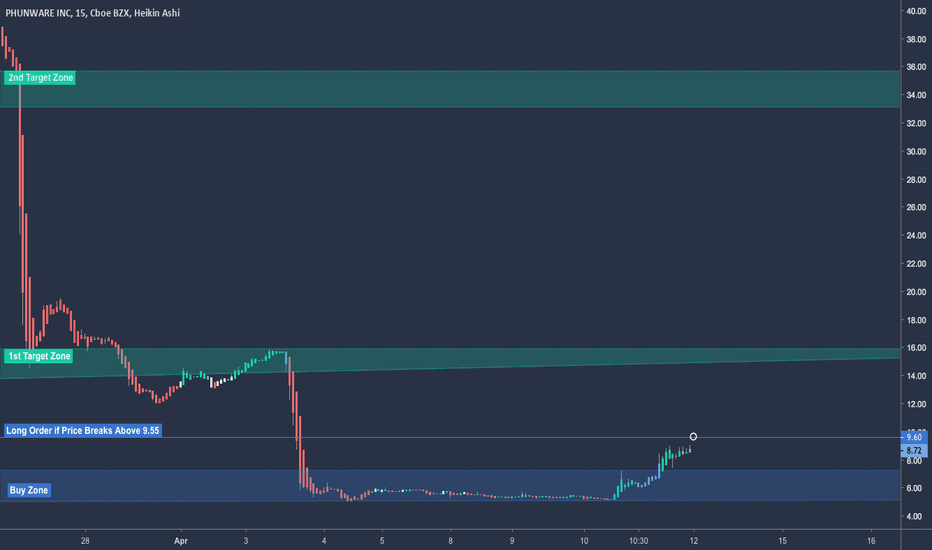

Picking a Buy Point for Uber (UBER)The IPO for Uber (UBER) has fallen out the bed. The company priced its IPO at $45, opened at $42, and closed at $41.57. UBER’s one-day total loss in value from the IPO price was apparently the largest in history. For a moment, UBER looked like it could stabilize around its poor first day. Unfortunately, the next trading day a major market sell-off helped take UBER down another 11.0% to close at $37.00.

{Uber (UBER) is two days old and has managed to sink 17.8% from its IPO price. This 15-minute chart shows the current persistence of selling.}

I believe retail investors have typically been left out of the big IPO cash machine of 2019 (like most successful IPOs). Yet, with 207M shares put out to market (180M from the company and 27M from selling stockholders), I strongly suspect too many retail investors got caught up in the UBER slide.

First of all, valuation is a tenuous metric for UBER. TechCrunch provided great coverage of the UBER S1 filing which threw into question the $90-$100B valuation at the time, down from a peak of around $120B. UBER is now valued at a $62B market cap. Here are some choice quotes which undermined any justification for premium pricing for UBER:

“…Those figures say show Uber’s growth slowing as it scaled. Still, at Uber’s revenue scale, growing 42 percent is impressive. However, the pace of deceleration from 2017’s over 100 percent figure could provide pause to some investors looking at Uber’s results from a growth perspective. And, when examined quarterly, the company’s revenue deceleration is even starker…a closer look at those quarterly results indicates that the company is growing at a rate much slower than that yearly total.”

“The company’s operating losses decreased year over year from $4.1 billion to $3.1 billion. Improving net loss is a positive for Uber, but $3.1 billion is still a huge figure, particularly within the context of slowing growth.”

In other words, UBER is NOT the kind of stock investors should rush to grant a premium. Still, UBER is now priced at 5.5x sales, just above the 5.1x for Grub Hub (GRUB) which competes directly with Uber Eats and also strongly relies upon a flexible labor force of non-professional drivers.

{Grubhub (GRUB) is well off its all-time highs but has not (yet?) reversed the big breakout from July, 2017.}

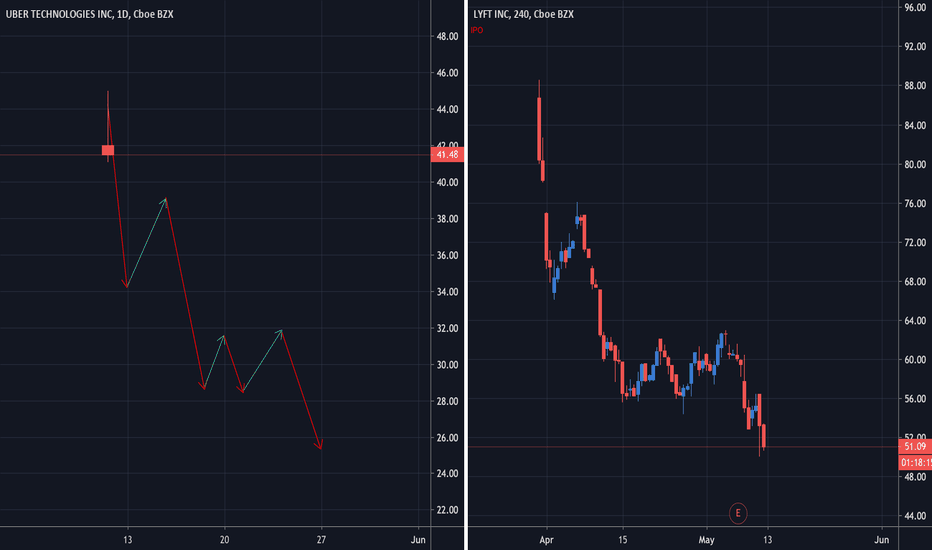

Based on this admittedly simplistic valuation exercise, I am going to hazard a guess that buying Uber around current levels is a good long-term bet assuming it proves to be a viable business. My preferred spot to buy UBER is around 5x sales or $33-$34 to account for more of the risk in the business and the stock.

Technicals should help refine the entry point. For technicals, I lean on my framework of stepping aside while sellers are getting busy and jumping in when buyers show strong interest: “Anatomy of A Bottom: Do Not Argue With Sellers – Celebrate With Buyers.” In Uber’s case, buyers prove nothing until they are able to at least breach Monday’s gap down. In the absolute best case scenario, I would buy at $39.50 and stop out below $36. I will be much more interested in applying the technical framework if (once?) UBER breaks $36.

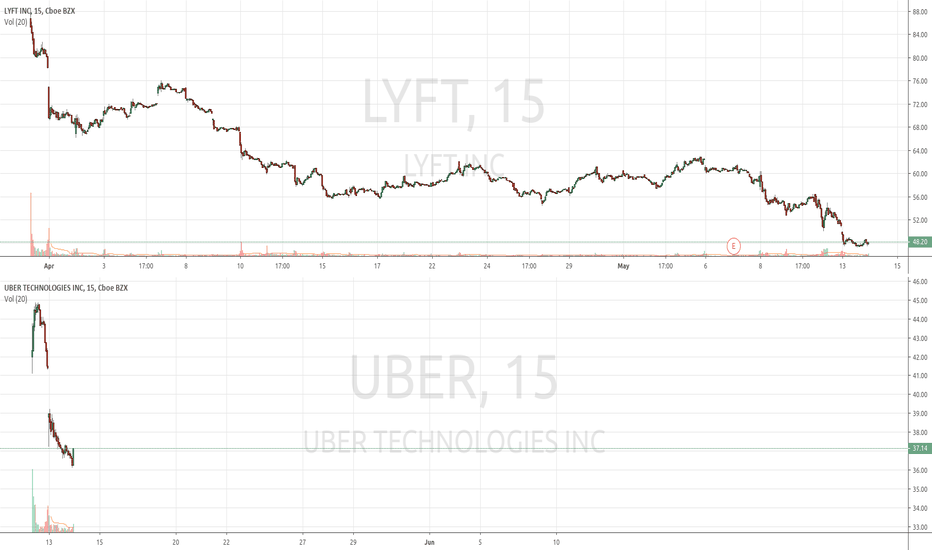

I will likely be slow to speculate on UBER because I got caught up using options to generate a lower entry price on Lyft (LYFT). At $48.15/share Lyft is well below the $55 strike price of the last put I sold (October expiration). Lyft is currently valued at 5.4x sales, but I used GRUB for UBER’s valuation yardstick because of its extended trading history.

{Lyft (LYFT) closed at a fresh all-time low after freshly breaking down last week.}

Options are not yet available for UBER. When they are trading, I will reach for selling puts before next picking a spot to buy shares.

Be careful out there!

Full disclosure: short LYFT puts and long calls

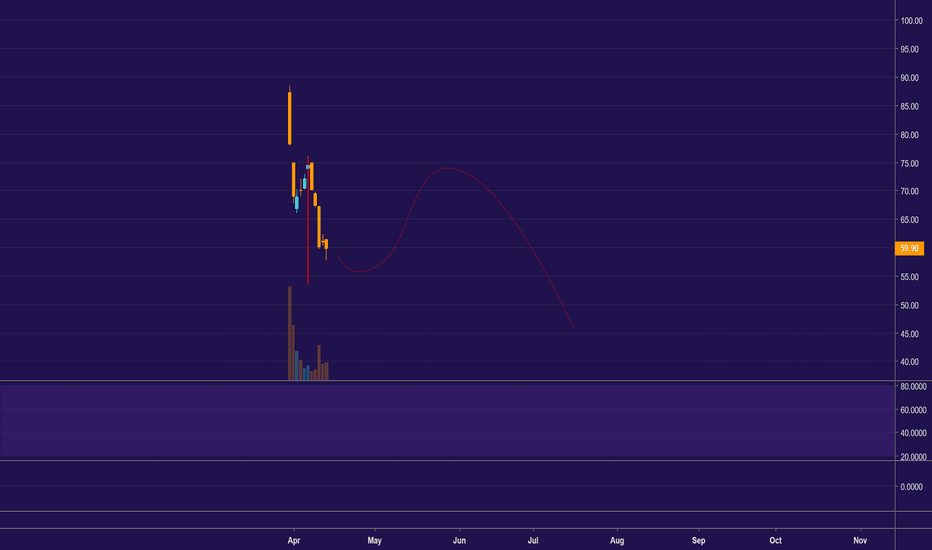

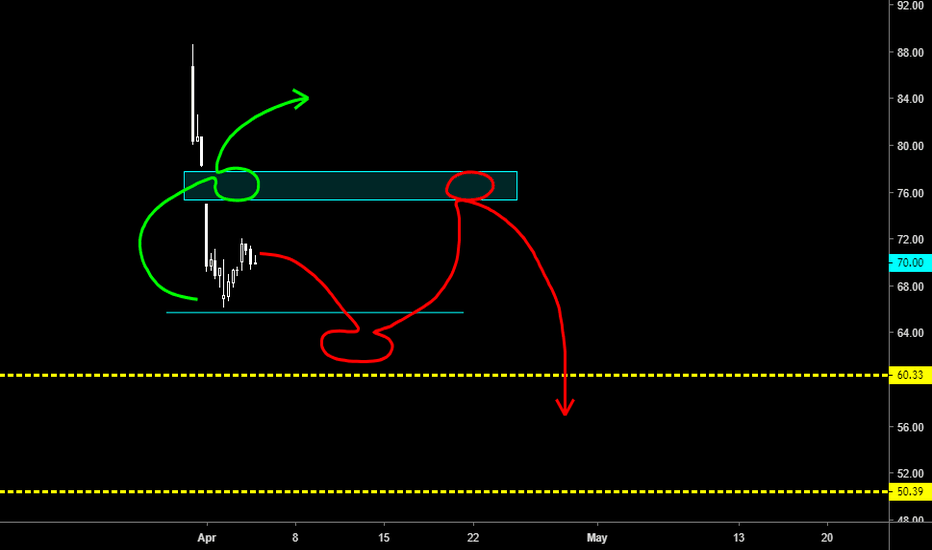

UBER and LYFT comparisonI am going to assume that UBER is going to exhibit similar behavior as LYFT after it's failed IPO.

Therefore I am looking for UBER to make a second deeper dip near the end of this month which will probably take it down to 30.

Here I would be willing to take up a first position.

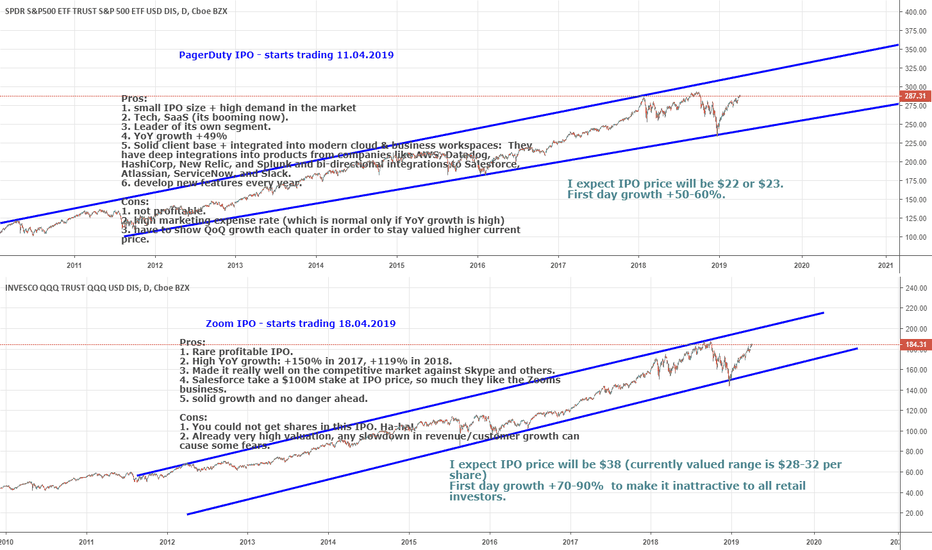

Pinterest IPOI like Pinterest as a product, but I don't participate in this IPO.

The main reason is the market doesn't like social networks IPOs:

Twitter, Snapchat.

My expectation is +30-40% in first trade day, maybe this will even hold strong at first quater, but then the financial result with estimates of -1.6 EPS will do the thing, -1.135 billion spending will make it move downwards.

I don't like their lack of users in US... users growth Worldwide is very good, but if they are bots from India and Pakistan, Russia and other countries which pay 0.01 per year and only watch ads.. thats not good for business, only for manipulating User amount data.

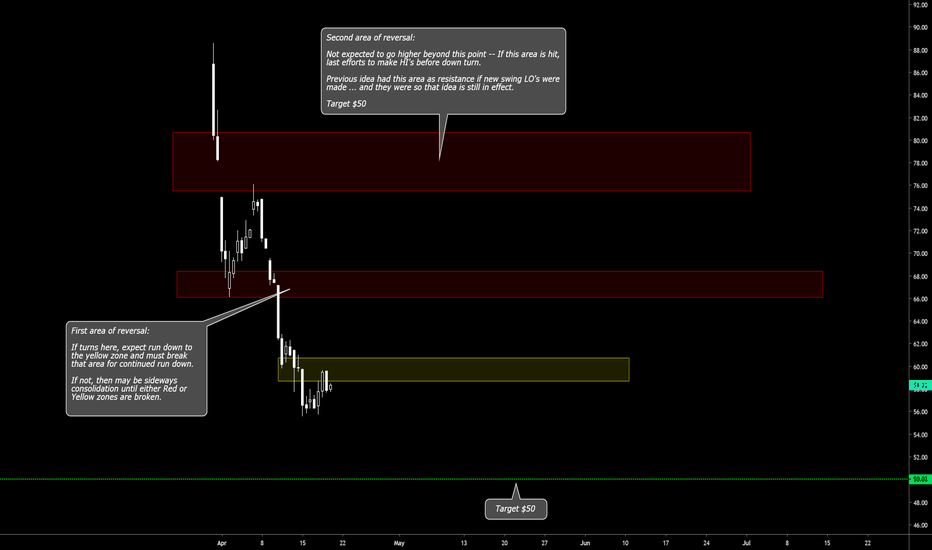

LYFT -- If you missed the short, couple places to reloadLYFT

Continuing with my previous plan (The GAP), this stock is still going to make attempts at $50.

Here are some places where I am looking for a reload of either a shorter term play and/or more of a positional play, IF, the move doesn't just continue down to the original target LO of $50.

As much as I do not follow text book setups, sometimes they do match up my current thought process/strategy and this is one of those times...keeping it simple and staying patient.

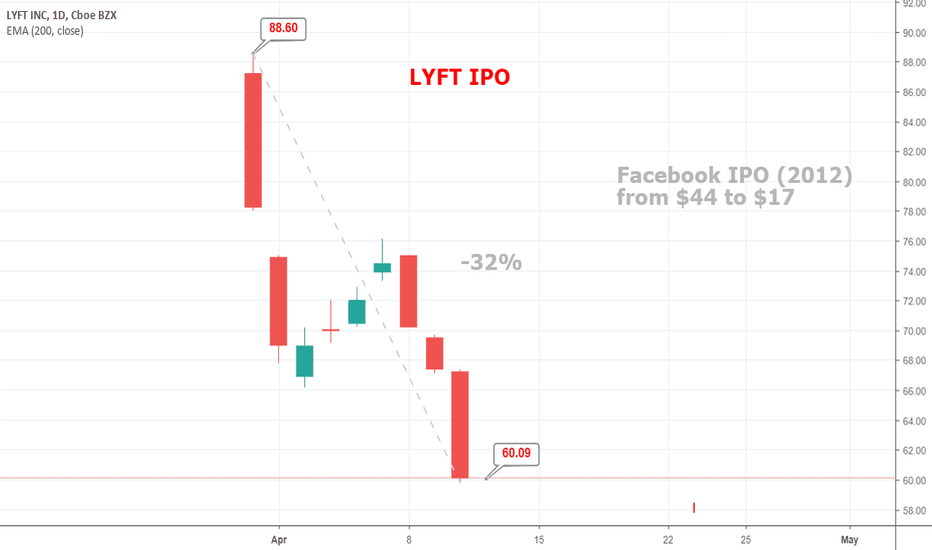

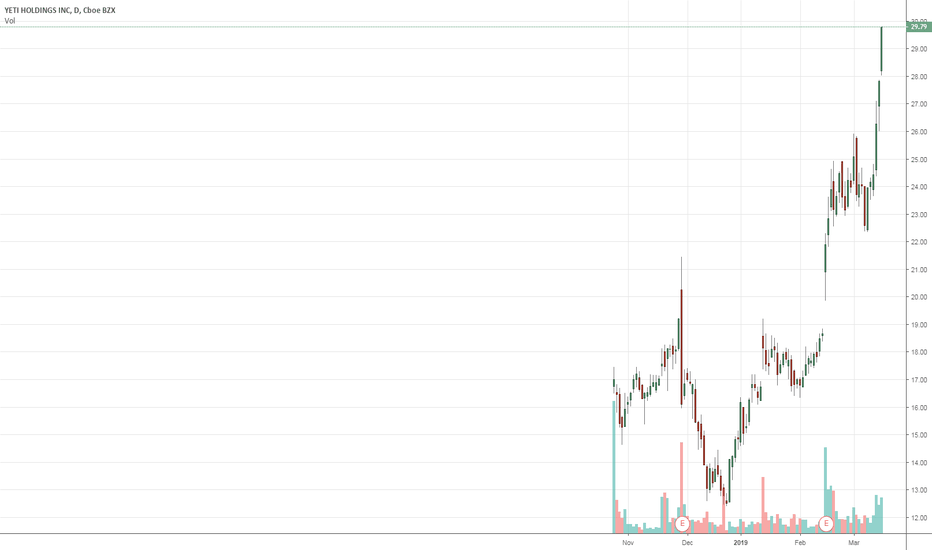

What can FB IPO teach you about LYFT IPOAnyone remember FB IPO? Just look at LYFT, both are classic pump and dump IPO's. So far they are like mirror images of each other and so could expect .

Before buying LYFT consider that FB only started basing after it finally started had a positive earnings report and a breakout above the 200sma.

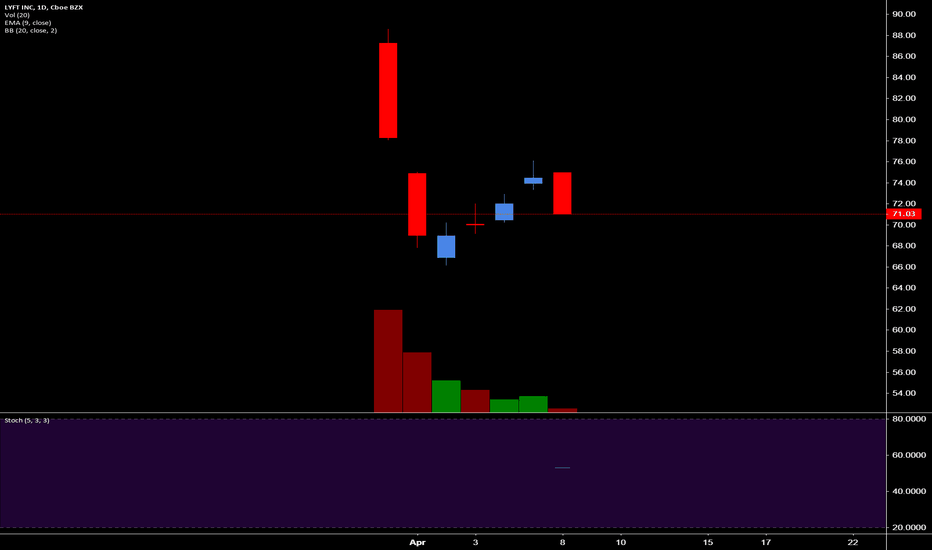

$LYFT - daily chart & trading analysis$LYFT - has been an awesome ticker to day trade the last week since its IPO on the 29th. Hit the short side the first couple days and nailed the red to green on day 4. Tickers like these that are moving irrelevant to the market conditions have had the most luck in follow through. Today we had another nice selling off action, with an ORB short setup at the open, along with nice follow throughs on the bear flags.

Easy trades are coming to an end with it trading in its range now. Waiting for a break of consolidation of either highs or lows for some more movement. $LYFT has also put the pressure on Uber to pick up their socks and continue their expansion to other regions (India & Asia), will be interesting to see how these two big dogs go head to head over this year.

Earnings season is approaching next week. For me, this signifies the market will be a little stale this week and have less follow through / momo names on our scans that previous weeks & months. Nonetheless, just taking smarter & cleaner setups, dialed down risk a bit as well as amount of day trades taken daily. Going to be looking to get hungry and aggressive next week for the remainder of the month.

Have a great day!

LYFT - $65 and the GAP Continuing with the IPO week for LYFT, here are a couple of new scenarios that may play out ...

Its my belief based on the chart / price action, that this recent LO will determine what happens at the GAP, should price reach it:

Either:

A. The current LO is in place, then a revisit to the GAP (and fill) may show as a pivotal resistance point, temporarily. And then make a valid attempt at the IPO day HI.

Or

B. A new LO ($65 or less) would have the GAP play out (if it tests it) as resistance, before seeing declines to prices of $60 and $50.

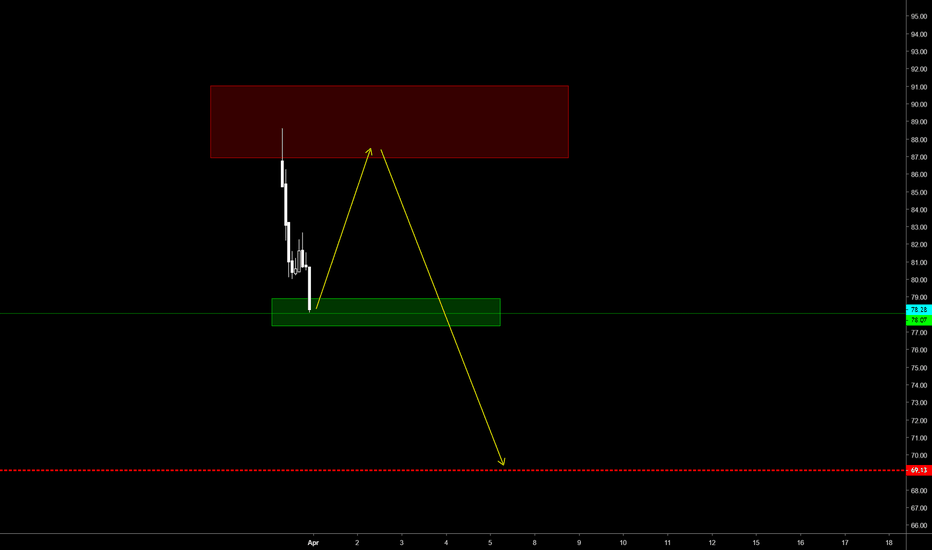

LYFT - Priced to fall 20% and lower ???After 1 day of trading, here is a forecast of potential trading action moving forward.

If LYFT catches a bid on its second day of trading, I'd expect a run to test IPO day HI and trap BULLS before a move lower to 70/69.

Otherwise, selling continues down to 69 or lower with any retraces only acting as stall points - 20%+ down from its HI's.