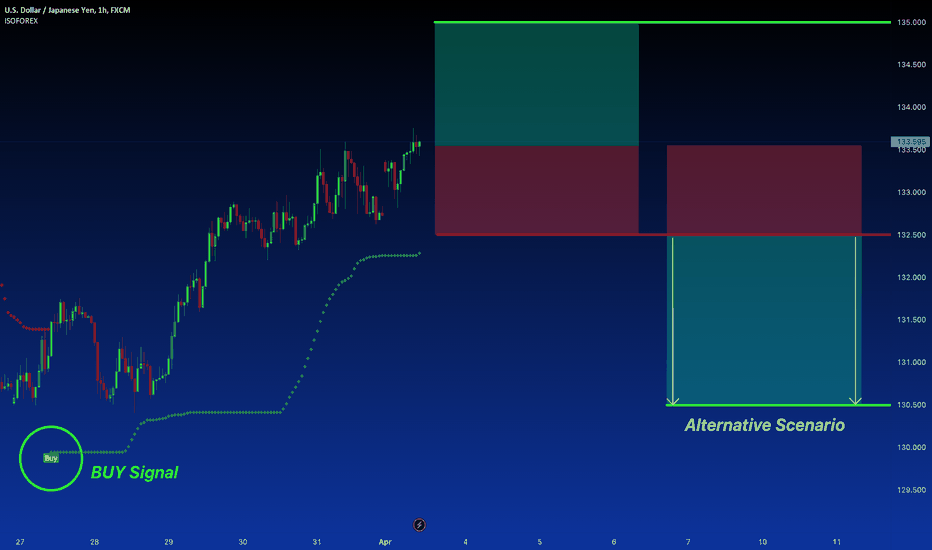

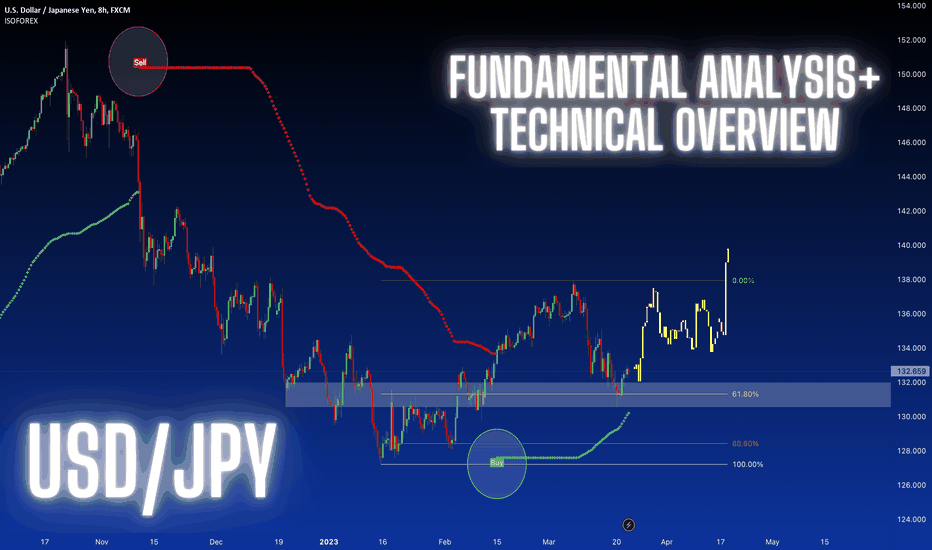

USD/JPY Rises Near Two-Week High Ahead of NFP ReportThe USD/JPY pair has surged to an intraday high near 133.50, close to the highest level in two weeks. The recent rise can be attributed to higher US Treasury bond yields and a stronger US dollar as the market anticipates the release of the crucial Nonfarm Payrolls (NFP) report on Friday. The recent challenges to market sentiment, mainly from the OPEC+ group's inflation worries, have also boosted the pair's rally. However, mixed domestic data and pre-NFP jitters have challenged the recent buyer sentiment.

The Bank of Japan's closely watched Tankan Large Manufacturing Index for Q1 2023 declined to 1.0 from the previous reading of 7.0 and an expected 3.0. Meanwhile, Japan's Jibun Bank Manufacturing PMI for March improved to 49.2 from 48.6, indicating a contraction in private manufacturing activities.

On the other hand, the US Core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve's preferred inflation gauge, fell to 4.6% YoY in February, below the market expectation of 4.7%. Core PCE inflation rose 0.3% on a monthly basis, lower than the market expectation of 0.4%.

The receding hawkish calls surrounding the Bank of Japan (BoJ) have also supported USD/JPY buyers. However, the market seems to have given little attention to the recent easing fears of a banking crisis and the Fed's hawkish moves.

Currently, Japan's Nikkei 225 is up 1.0% intraday to 28,041, while the S&P 500 Futures snapped a three-day uptrend. The US 10-year and two-year Treasury bond yields are trading with mild gains near 3.52% and 4.11%, respectively, after paring the latest losses.

Looking forward, USD/JPY is expected to continue its rebound amid firmer yields and a light calendar. However, any disappointment in the incoming PMIs and NFP may weigh on the US dollar prices, considering the receding hawkish bets on the Fed.

Isoforexbestindicator

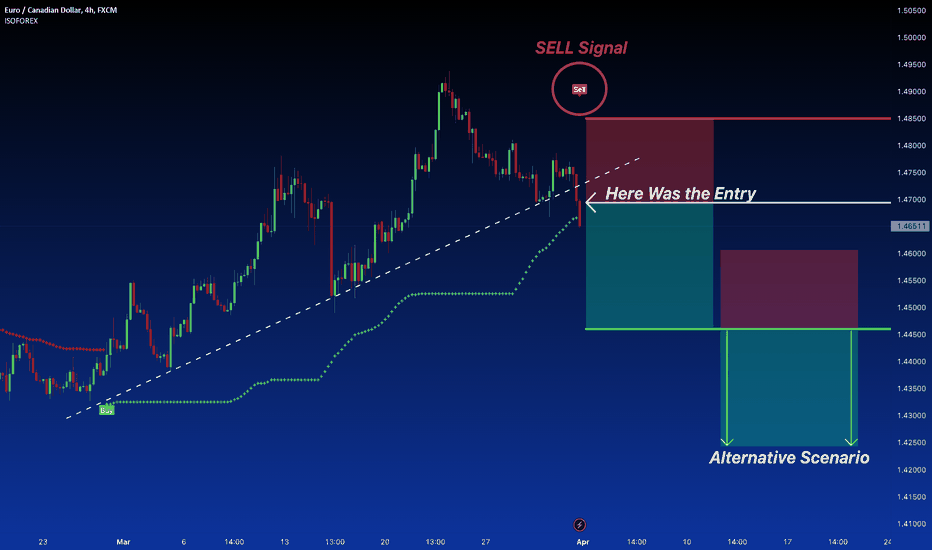

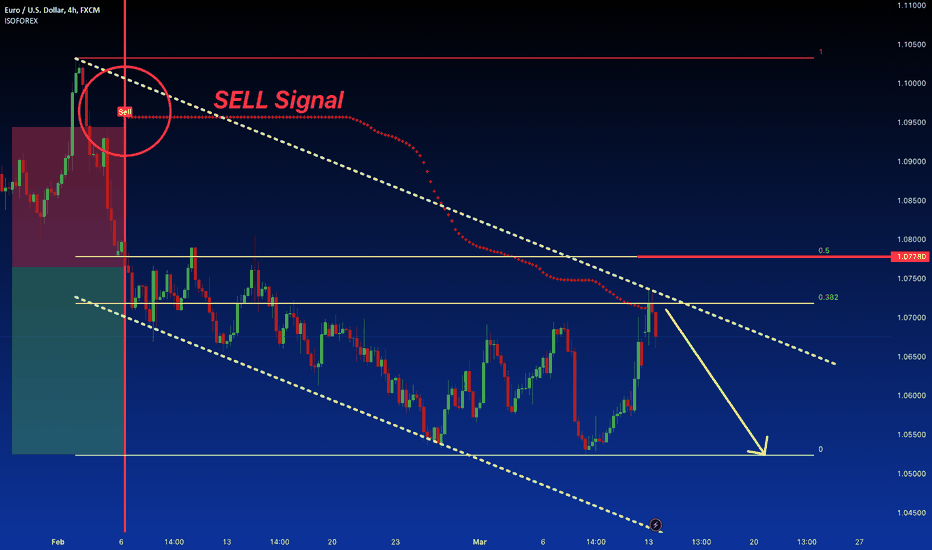

EUR/CAD: Possible Reversal MovementThere may be a potential reversal in the movements of EUR/CAD following the breaking of its dynamic trendline and testing the top at 1.4940. The negative correlation between EUR/CAD and EUR/USD suggests that an increase in EUR/USD and a decrease in EUR/CAD may occur. We are currently waiting for this to happen. Our indicator has already signaled a sell entry, which we have acted upon. There is a strong possibility of this trend continuing further.

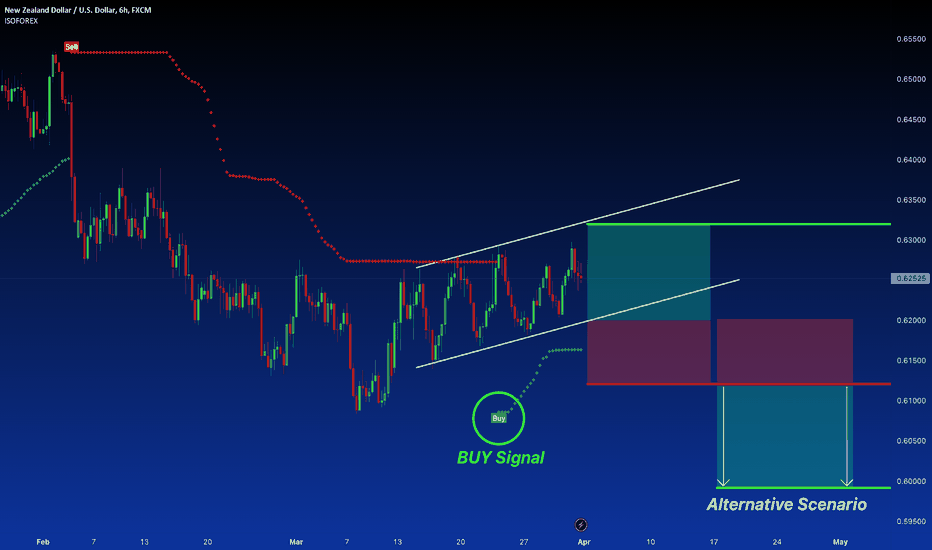

NZD/USD Climbs to Highest Level Since February 16The NZD/USD pair has climbed for two consecutive days and reached its highest level since February 16. The Kiwi, being sensitive to market risk, has benefited from the current risk-on environment, as the USD remains subdued. However, the bulls are wary and are looking for fresh impetus from the crucial US Core PCE Price Index.

The NZD/USD pair has gained positive momentum for two successive days and touched a peak not seen since February 16. However, the pair has encountered resistance near the 0.6300 mark, and the spot prices are currently trading within the range of 0.6270-0.6275 during the early European session.

The prevailing positive tone around equity markets has provided a significant boost to the risk-sensitive Kiwi, as investors' confidence is on the rise with the fears of a full-blown banking crisis diminishing. The hope for a robust economic recovery in China has added to the investors' optimism, and the official Chinese PMI data for March has shown the fastest growth in the services sector in 12 years. Though the growth in the manufacturing sector has slowed down, it is still higher than expected.

The uncertainty surrounding the Federal Reserve's rate-hike path has made it difficult for the USD to gain any traction. This has further increased the appeal of the NZD/USD pair. The Fed had recently signaled that it might pause the rate-hiking cycle due to the banking sector's turmoil. However, with the possibility of a widespread banking crisis averted, there are speculations that the US central bank might return to its inflation-fighting rate hikes. Moreover, three Fed officials have backed the case for more rate increases to lower high levels of inflation.

Despite the bullish sentiments for the NZD/USD pair, traders are hesitant to take aggressive bearish bets on the USD. They are waiting on the sidelines, anticipating the release of the US Core PCE Price Index, which is the Fed's preferred inflation gauge. This data is expected to play a crucial role in influencing market expectations about the next policy move, and it could drive demand for the USD in the near term. This, in turn, will determine the direction of the next move for the major.

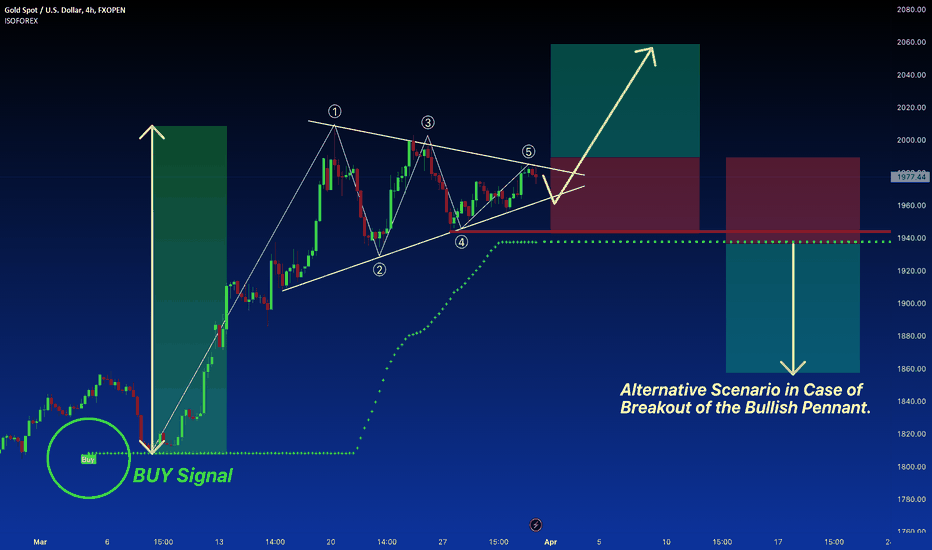

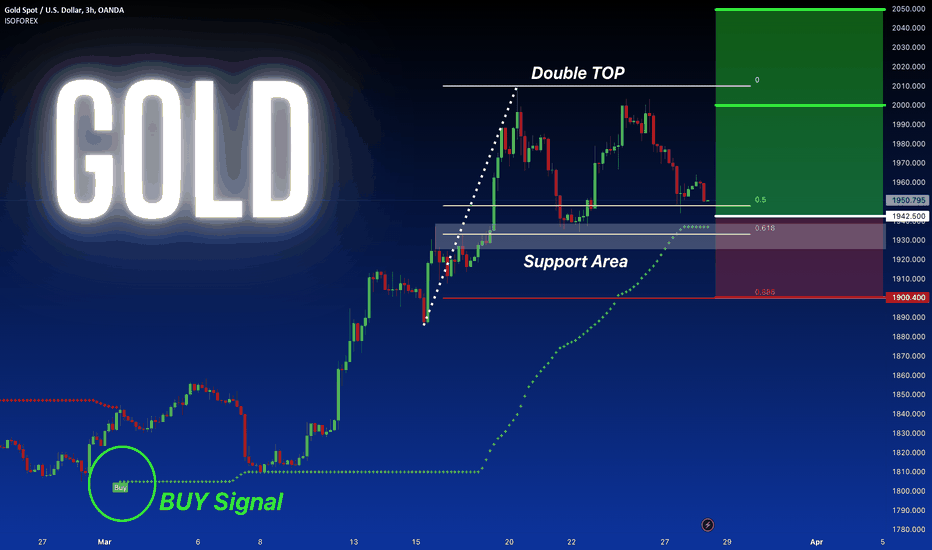

GOLD:Price Rises on Weak USDollar and Easing Banking Crisis FearThe price of gold is fluctuating within a bullish chart pattern that has been in place for the past two weeks. Recently, there has been a lack of momentum, but the decrease in concerns regarding a banking crisis, along with a weaker US Dollar, has led to an increase in demand for gold. This, combined with hopes of positive core inflation data from the Eurozone and the United States, and tensions between China and the US, has propelled the XAU/USD bulls.

During Friday's Asian session, the XAU/USD reached $1,980, reversing the previous week's losses ahead of key inflation data from both the United States and Eurozone. It is worth noting that despite concerns regarding further rate hikes by the Federal Reserve, the gold price is being driven by a risk-on mood and a lack of conviction in the Fed's stance.

The weak performance of the US Dollar is also contributing to the rise in the gold price, even though the hawkish Fed concerns and mostly positive US data are challenging buyers of XAU/USD. The increase in the XAU/USD could also be linked to quarter-end positioning of the US Dollar Index (DXY), which has been on a three-week downtrend, with bears pushing it to the 102.15 level.

Despite Federal Reserve Chairman Jerome Powell and three other Fed Officials backing further rate hikes, mixed US data has cast doubt on the hawkish rhetoric of Fed policymakers, thereby allowing the gold price to remain strong. This has been due to sluggish yields and hopes of a secure banking system.

Mixed US data and a risk-on mood have failed to strengthen the US 10-year Treasury bond yields, which remain under pressure at around 3.55%, while the two-year counterpart is on track for its first weekly gain in four, currently grinding higher around 4.12%. Hence, sluggish yields, mixed data, and a mostly positive sentiment have combined to allow the gold price to remain strong.

GOLD Prices Decline on First Citizens Bank's Acquisition of SVB The pace of the pullback in gold prices has intensified following the announcement that First Citizens Bank has acquired Silicon Valley Bank (SVB). The rise in US Treasury yields and reduced demand from India are adding further downward pressure on the price of gold. Despite the current uptrend, a double TOP formation is posing a threat with the neckline at a key level of $1,934. As of writing, XAU/USD is trading in the $1,950s, down by over 1.0% for the day. The ease in bank stress has lessened gold's safe-haven appeal, while rising US Treasury bond yields and a robust US dollar, along with reports of declining demand from India, have further exacerbated the decline in prices.

The announcement of the acquisition of defunct lender Silicon Valley Bank by First Citizens Bancshares Inc, the holding company of North-Carolina-based First Citizens Bank, has brought temporary relief to the markets on March 27, reducing the demand for gold as a safe-haven asset. According to a press release from the FDIC, First Citizens has acquired all of SVB's $119B deposits and loans and has purchased $72B of its assets at a $16.5B discount.

Although the deal has limited the damage caused by SVB's failure, it has not eliminated it entirely, with the bank's collapse estimated to have cost the FDIC $20B.

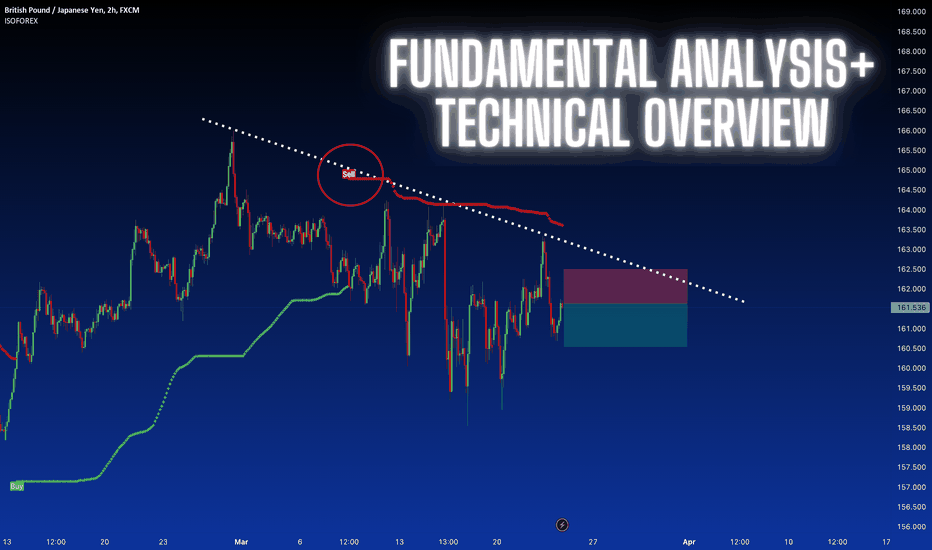

GBP/JPY Falls on Weak Treasury Yields - SHORTGBP/JPY is experiencing a decline from a one-week high and a fading corrective bounce off 160.80. The drop to 161.00 is in response to the decline of Treasury bond yields and the general weakness of the British Pound ahead of the Bank of England's monetary policy announcement on "Super Thursday."

Following the US Federal Reserve's and US Treasury's announcements, yields tumbled. The pessimistic outlook for big manufacturing firms in Japan according to the Reuters Survey also adds to the pressure on the GBP/JPY.

Despite the strong UK inflation data and the Brexit bill's passage through the House of Commons, the GBP/JPY buyers have not seen much success due to ongoing concerns about Brexit and banking fears.

The recent announcements by Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen triggered a brief corrective bounce in the bond market, but it was short-lived. Fed officials have indicated that they do not anticipate rate cuts for this year, and Yellen ruled out the consideration of "blanket insurance" for bank deposits.

The US 10-year and two-year Treasury bond yields are currently pressured at 3.45% and 3.96%, respectively, while the S&P 500 Futures show mild gains despite Wall Street's downbeat performance.

Although the GBP/JPY pair's recent losses ignore the negative results of the monthly Reuters survey, they are still significant. The survey shows that big Japanese manufacturers remain pessimistic about business conditions for the third consecutive month in March.

Please support me with LIKE and FOLLOW

USD/JPY Awaits FOMC Decision with Subdued Trading.The USD/JPY pair is experiencing a lack of clear direction on Wednesday and is trading within a narrow range. The subdued performance of the US dollar is holding back the pair, while a positive risk sentiment is providing some support. Traders seem hesitant and are waiting for the highly-anticipated FOMC decision.

The USD/JPY pair is struggling to build on the gains of over 150 pips from the previous day and is trading below the weekly high reached earlier in the day, hovering around the 132.55-132.60 area. Investors are eagerly awaiting the outcome of the FOMC monetary policy meeting, which is scheduled to be announced later during the US session. The Fed is expected to deliver a smaller 25 bps rate hike, and the focus will be on the accompanying monetary policy statement, updated economic projections, and Fed Chair Jerome Powell's post-meeting press conference remarks.

Investors will be looking for fresh cues on the future rate-hike path, which will play a key role in influencing the near-term US dollar price movements and providing a fresh directional impetus to the USD/JPY pair. The US dollar is currently trading near its lowest level since February 14, which is acting as a headwind for the major. However, the stable performance of equity markets is undermining the safe-haven Japanese Yen (JPY), which is providing some support to the pair.

The Fed recently unveiled an enhanced seven-day dollar swap to add liquidity into the monetary system, while the news that UBS will rescue Credit Suisse in a $3.24 billion deal has eased fears of a global banking crisis and boosted investors' confidence. These factors, along with the more dovish stance adopted by the Bank of Japan (BoJ), are likely to continue supporting the USD/JPY pair, at least in the short term.

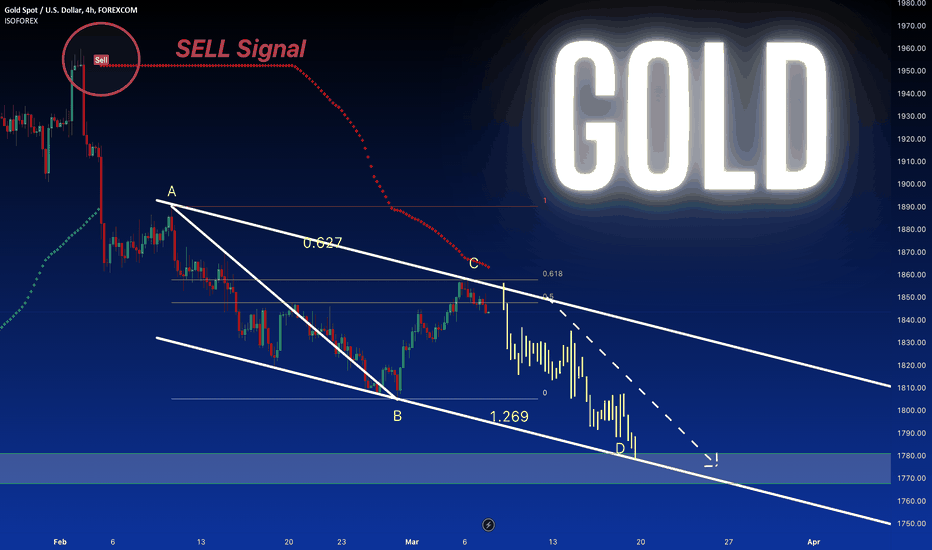

GOLD: Price Rebound on 61.8% FIBO AB=CD As PredictYesterday.Hey there! So, it looks like the price of gold has gone down a bit after reaching a three-week high. This might be because people are feeling cautious about upcoming events and data, and also because United States Treasury bond yields have gone up again. There are a few things that could impact the price of gold in the coming days, like some news from China and what Federal Reserve Chairman Jerome Powell has to say in his testimony before the Senate Banking Committee. Some people think his comments might be a little negative for gold prices, but others are feeling hopeful because the US dollar hasn't been doing great lately and some recent US data has been a bit mixed. All in all, it's a bit of a mixed bag!

As we described yesterday, the price could have a rebound on the 50% to 61.8% Fibonacci level for a new short setup, and this is what happened. A possible AB=CD pattern may cause a continuation of the short setup that we have started from the SELL signals of the ISOFOREX indicator. We are looking for a bearish trajectory