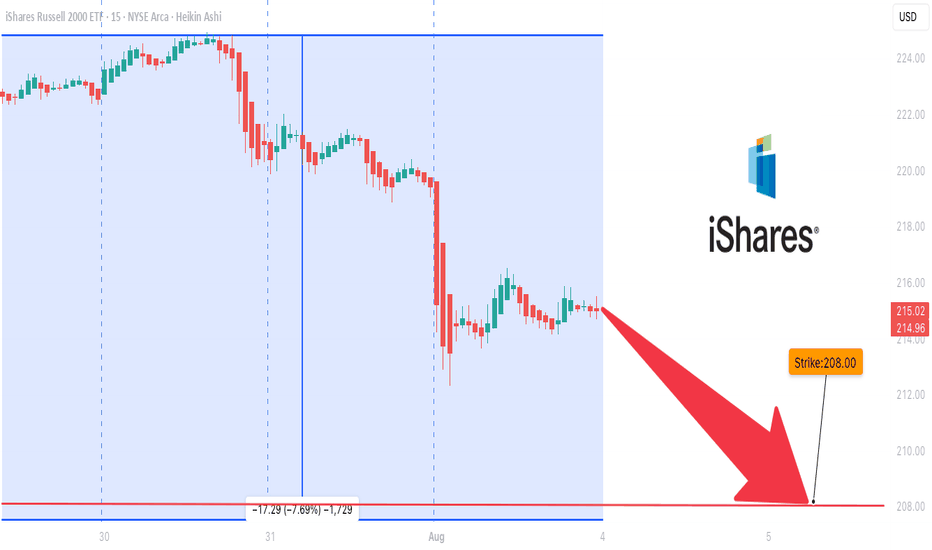

IWM is Overbought### ⚠️ \ AMEX:IWM Bearish Setup Alert — Weekly PUT Trade (Aug 3, 2025)

> **Momentum breakdown + institutional volume = high-probability short play**

📉 **Market Breakdown:**

* **📉 Daily RSI:** 34.9 → Bearish momentum under key 45 level

* **📊 Weekly RSI:** 53.0 → Neutral but slipping = trend weakening

* **📈 Volume Spike:** 1.4x → Institutional moves hint at potential sell-off

* **⚖️ Options Flow:** 1.00 C/P ratio → No bias = wait for price action

* **💀 Max Pain:** \$222.50 → Downward price magnet

* **🌪️ VIX:** 20.38 → Normal vol zone, good for option plays

---

### 💥 Trade Setup – 5D Weekly PUT

| Entry | 🎯 Target | 🛑 Stop Loss | ⚖️ R/R Ratio | 📅 Expiry |

| ------ | ------------- | ------------- | ------------ | ---------- |

| \$0.92 | \$1.35 (+50%) | \$0.45 (-50%) | 1:1.5 | 2025-08-08 |

🔻 **Strike:** \$208.00

💼 **Type:** Naked PUT

⏰ **Timing:** Enter at market open

📈 **Confidence:** 70%

🧠 **Logic:** Bearish RSI + volume surge + neutral flow = downside edge

---

### 🔍 Summary

> “IWM is losing grip. Momentum says down. Big players are already positioning.”

> 🔸 Short-term PUTs offer attractive R/R

> 🔸 Low volatility improves pricing

> 🔸 Weekly RSI still neutral → stay nimble

---

📊 **TRADE DETAILS**

🎯 Instrument: **IWM**

🔀 Direction: **PUT (SHORT)**

🎯 Strike: **\$208.00**

💵 Entry: **\$0.92**

🎯 Target: **\$1.35**

🛑 Stop Loss: **\$0.45**

📅 Expiry: **2025-08-08**

📈 Confidence: **70%**

🕒 Entry Timing: **Open**

---

### 💡 Tag It:

\#IWM #PutOptions #WeeklyTrade #BearishMomentum #RSIAlert #OptionsFlow #MaxPainTheory #VolatilityTrading #MarketOutlook #TradingView #OptionsAlert

Iwmanalysis

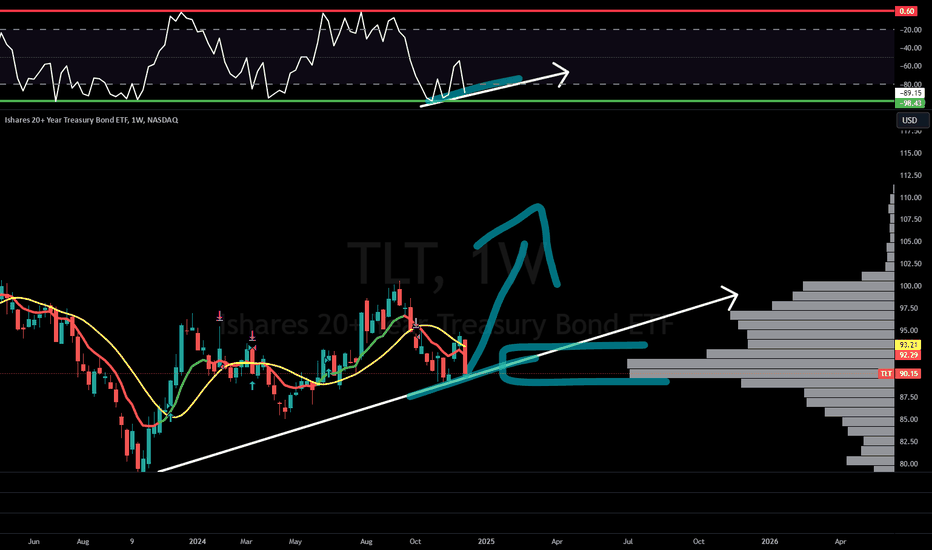

Epic Bounce Ahead! Why $IWM, $RTY, and $TLT Are Set to SoarIn this video, I will explain to you why I believe we are about to have an EPIC bounce in the AMEX:IWM CAPITALCOM:RTY NASDAQ:TLT

I've put out write ups on this topic but I wanted to get all my thoughts in one cohesive video analysis to give you the visuals you deserve for my BOUNCE prediction.

🔜🎯$259

⏳Before March2025

Not Financial Advice. Check it out here 👇

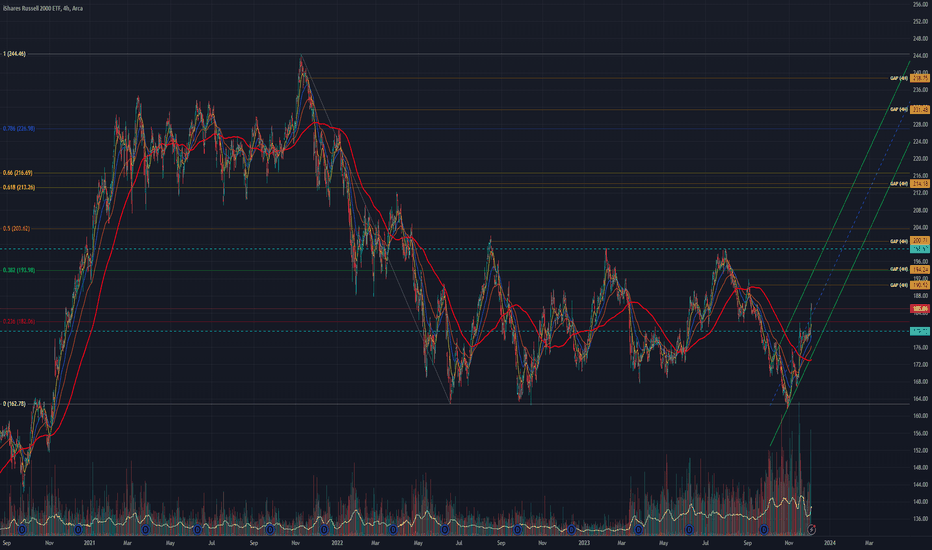

Russell 2000 ETF (IWM) ~ December 4H SwingAMEX:IWM chart analysis/mapping.

IWM ETF rally off late October lows on market expectations of the end to Fed rate hikes.

Trading scenarios:

Continuation rally #1 = multiple gap fill / 38.2% Fib / upper range of parallel channel (green) confluence zone.

Shallow pullback #1 = 23.6% Fib / horizontal line (light blue dashed) confluence zone.

Deeper pullback #1 = lower range of parallel channel (green) / 200MA confluence zone.

Capitulation #1 = re-test ~163 bottom.