TradeCityPro | Bitcoin Daily Analysis #145👋 Welcome to TradeCity Pro!

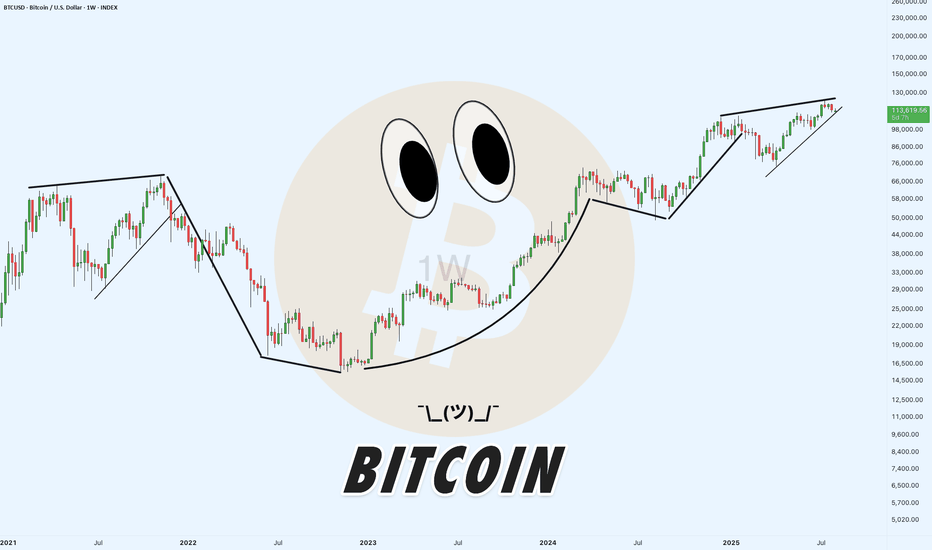

Let’s get into Bitcoin analysis. Yesterday, Bitcoin was rejected from the zone I had mentioned, and today it will probably begin its new downward move.

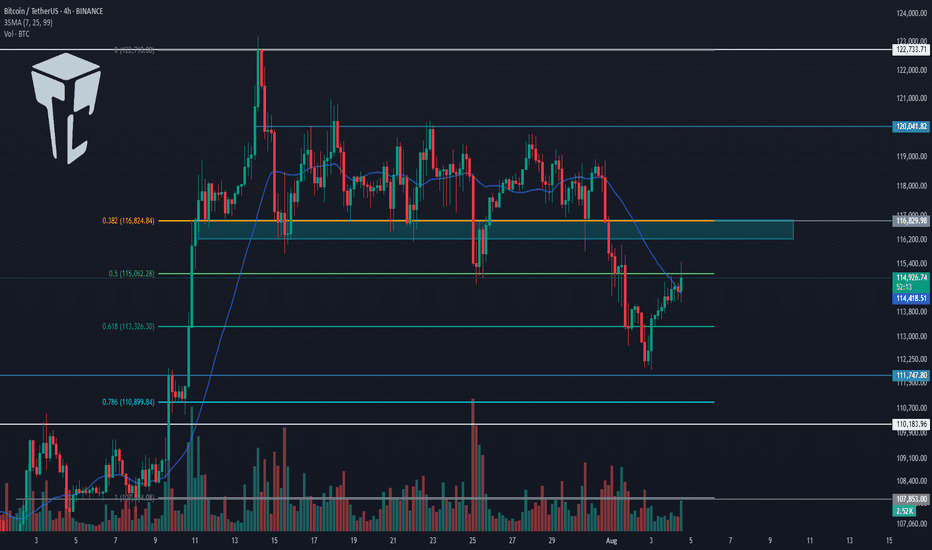

⏳ 4-Hour Timeframe

In yesterday’s analysis, I told you that a pullback to SMA25 and the 0.5 Fibonacci zone was possible. That happened, and now, given the current candle, the probability of a corrective scenario has increased.

✔️ I still won’t open any position on Bitcoin and am waiting for it to exit the box between 110000 and 116000. But if certain conditions occur in the market, I might open a position inside this box as well.

✨ First of all, Bitcoin is still above the 111747 support, which is a very important support zone. As the price reaches it, there’s a chance it gets stuck there again.

📊 On the other hand, seller strength is very high, and as you can see, the RSI has been rejected from the 50 ceiling, and a red engulfing candle with very high volume is forming — all of which indicate the power of sellers.

🔽 I still stand by my opinion that as long as the price is above 110000, I won’t open a short position. But for a long position, we can move to the 1-Hour timeframe to review the trigger that has formed.

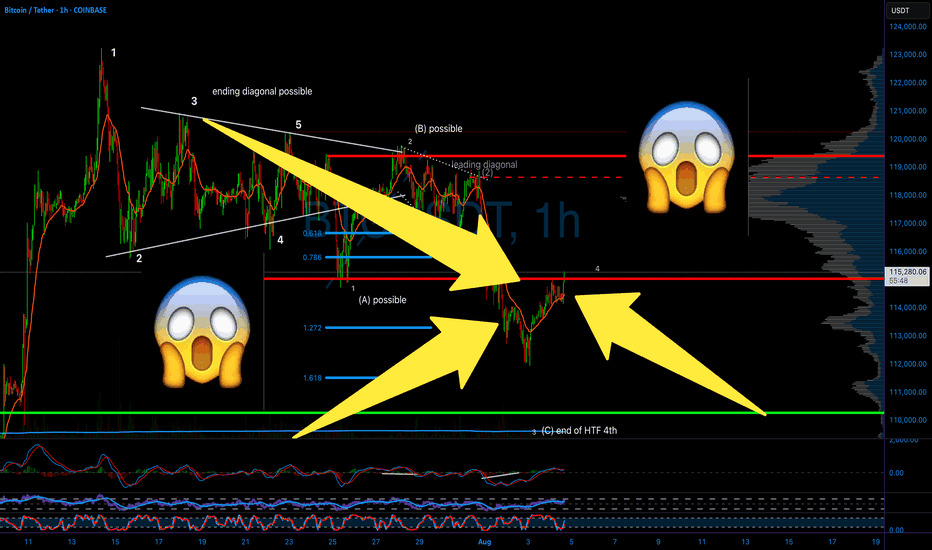

⏳ 1-Hour Timeframe

Before reviewing the triggers, there’s a very important point that explains why I currently prefer to remain without a position.

💫 Bitcoin in the HWC and MWC cycles has a very strong upward trend. Right now, in the LWC, it’s moving downward. So this Fibonacci drawn on the bearish leg doesn’t really mean much and won’t give us very strong and accurate resistances.

🔍 On the other hand, the LWC is moving against the higher cycles — meaning the higher cycles are stronger. That’s why shorting doesn’t make sense, since it’s against the main market cycle.

🔑 But also, since LWC has gained downward momentum, long positions — if not set with wide stop-losses — will likely get stopped out, because this momentum may cause small downward legs that hit stop-losses.

👀 So opening a long position is also difficult right now, and that’s why I say it’s better to wait for the price to move out of the 110000 to 116000 range, and then enter a position more comfortably.

🎲 If the price goes below 110000, we’ll receive the first sign of a trend reversal in the MWC, and then we can open short positions. And if it goes above 116000, LWC becomes bullish again and the continuation of the uptrend can begin.

Let’s now go to the triggers:

📈 The trigger we have for a long position is 115327 — an important ceiling that overlaps with the 0.5 Fibonacci level and has been touched several times.

☘️ If we get another touch to this level, I myself will likely try to open a long position, and I think it’s a good entry point that’s worth the risk to anticipate a breakout of 116000.

🔽 For a short position, a break below the 112205 low will start the continuation of the correction. I won’t open this position myself, but if you believe Bitcoin wants to reverse its trend, this is a very good trigger in terms of price level and you can open the position.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

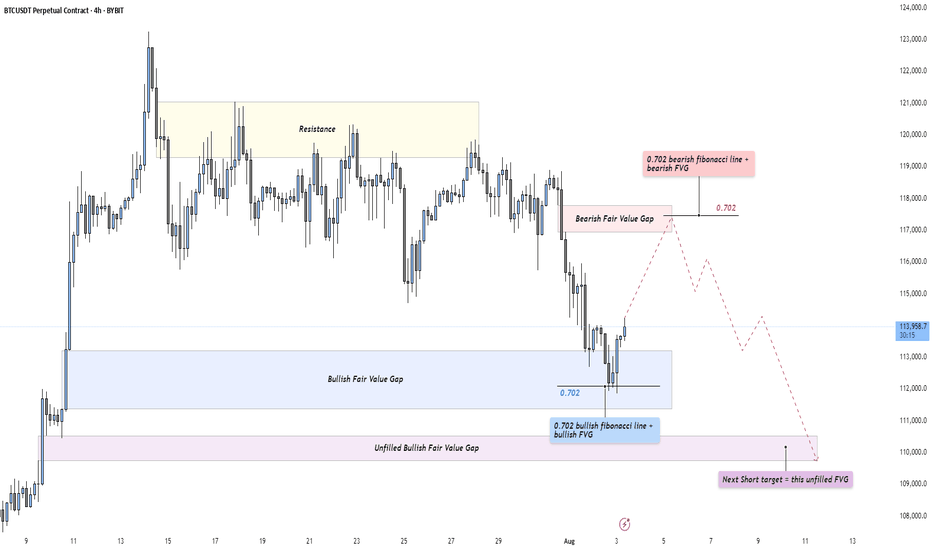

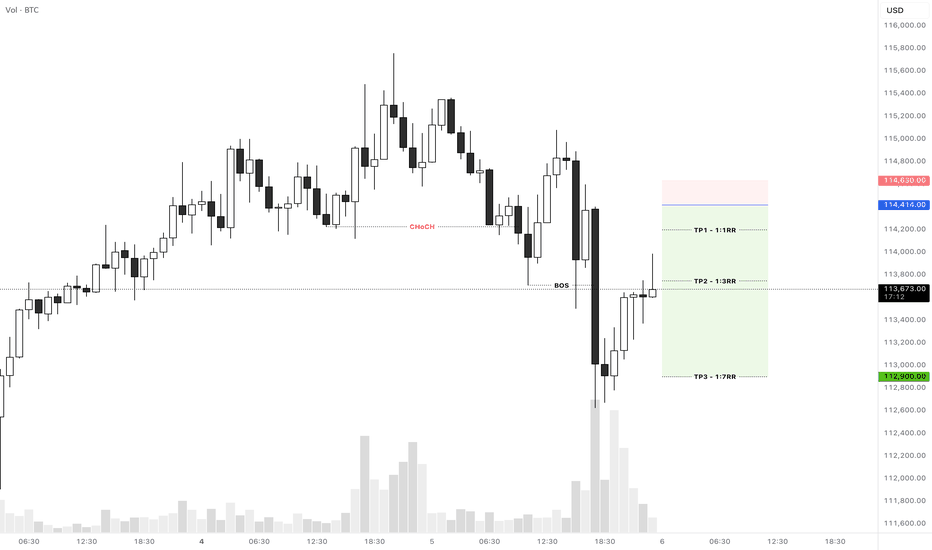

J-BTC

BTC - Short Setup at 0.702 Fibonacci & Fair Value GapMarket Context

Bitcoin recently rejected from a major resistance area and has since been retracing downward, finding temporary support inside a bullish Fair Value Gap. The market is currently in a corrective phase, with buyers attempting to defend lower levels while sellers look for optimal positions to reload shorts. This environment shows a classic tug-of-war between these two forces as price moves between supply and demand zones.

Consolidation and Current Phase

Although the prior consolidation has been broken, the current price action can still be described as corrective, with intraday structure forming lower highs. The bullish Fair Value Gap beneath price has been respected so far, creating a temporary base. However, the path remains complex, as the market has unfilled imbalances both above and below.

Bearish Retest Scenario

One key scenario involves a retracement toward the bearish Fair Value Gap near 117K, which also aligns with the 0.702 Fibonacci retracement level. This confluence makes it a high-probability area for sellers to step in again. A rejection from that zone would likely resume the downtrend, with the next logical target being the deeper unfilled bullish Fair Value Gap around 110K. This zone acts as a magnet for price due to the inefficiency left behind during the last rally.

Bullish Defense Scenario

For bulls to regain control, the current Fair Value Gap at 114K must hold, followed by a strong move that invalidates the lower-high structure. Such a move would need to break above the 117K bearish FVG with conviction. Only then could momentum shift back to the upside, opening the door for another challenge of the higher resistance zones.

Final Words

Patience and precision are key when dealing with setups like this. Let the market come to your level — and react with intent.

If you found this breakdown helpful, a like is much appreciated! Let me know in the comments what you think or if you’re watching the same zones.

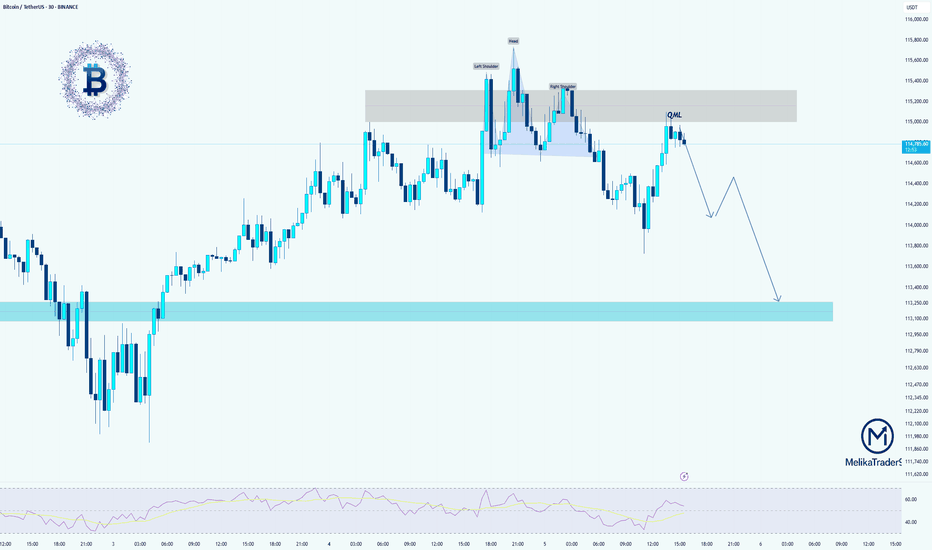

BTCUSDT: Head & Shoulders + QML SetupHello guys!

We have a clean Head & Shoulders pattern forming near a supply zone, with a nice QML (Quasimodo Level) rejection confirming the bearish bias. Price is struggling to break above 115K and has already reacted to the QML zone.

If this structure holds, we could see BTC start a new bearish leg 📉, first targeting 114K, and eventually reaching the demand zone around 112.8K–113.2K.

Watch for further confirmation with lower highs forming.

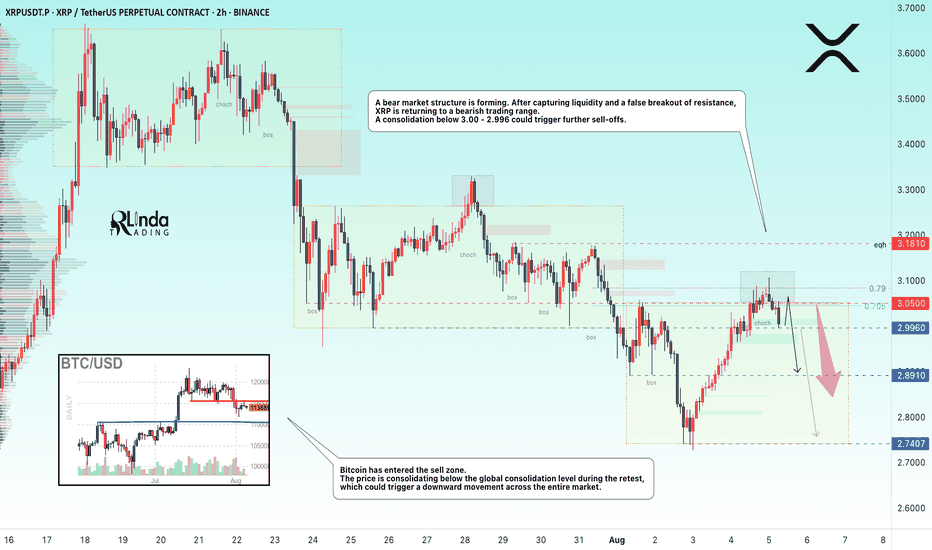

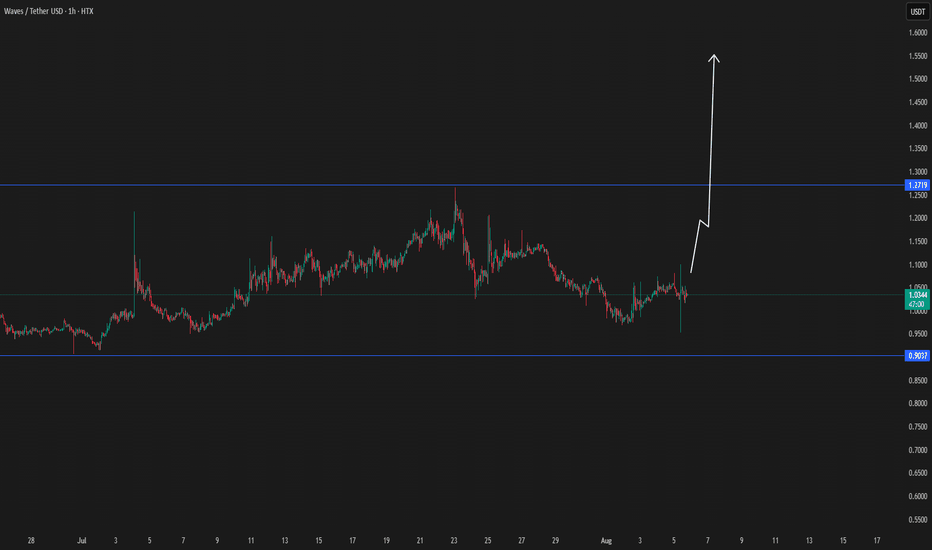

XRPUSDT → Hunting for liquidity ahead of a possible declineBINANCE:XRPUSDT.P is forming a downward market structure after a false breakout of global resistance. Bitcoin is in a correction phase and, after a slight rebound, may continue its movement...

Bitcoin has entered the sell zone. The price is consolidating below the global consolidation boundary of 115,500 during the retest, and if Bitcoin continues to decline, this could trigger a downward movement across the entire cryptocurrency market.

XRP is forming a bearish market structure. After capturing liquidity and a false breakout of resistance, the price is returning to a bearish trading range. There is no potential for continued growth at this time. A consolidation of the price below 3.00 - 2.996 could trigger further sell-offs.

Resistance levels: 2.996, 3.050, 3.181

Support levels: 2.996, 2.891, 2.74

The local bearish structure will be broken if the price starts to rise, breaks 3.050, and consolidates above it. In this case, XRP may test 3.181 before falling further.

At the moment, after a false breakout of resistance, the price is consolidating in the selling zone, and the downward movement may continue. I consider 2.74 - 2.655 to be the zone of interest in the medium term.

Best regards, R. Linda!

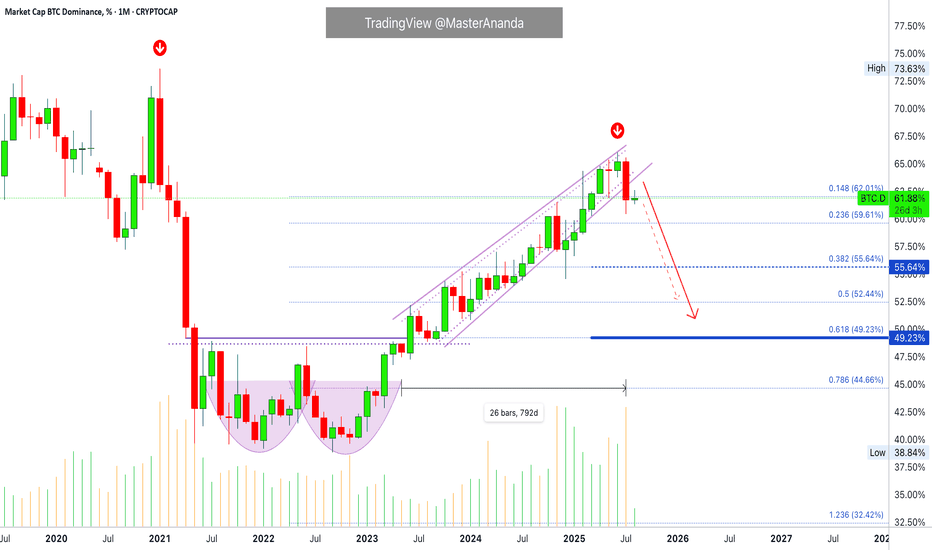

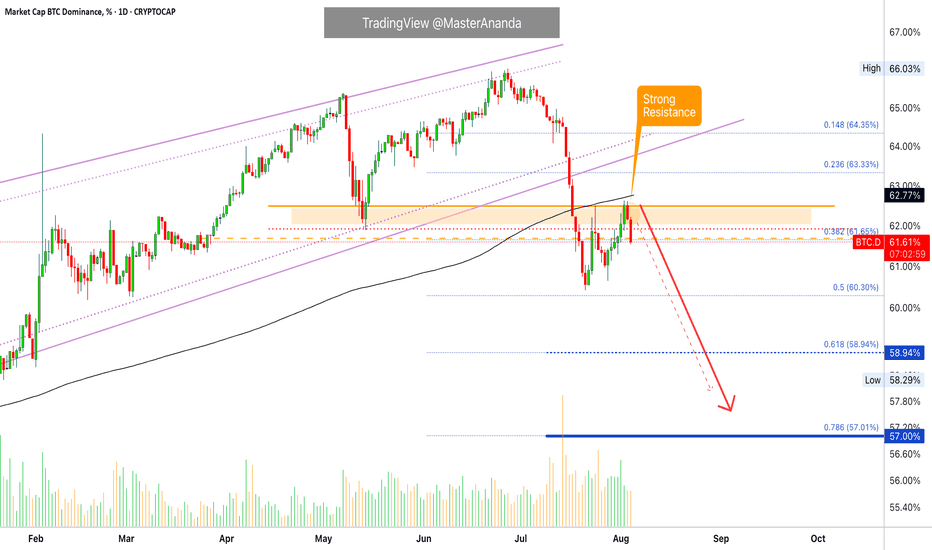

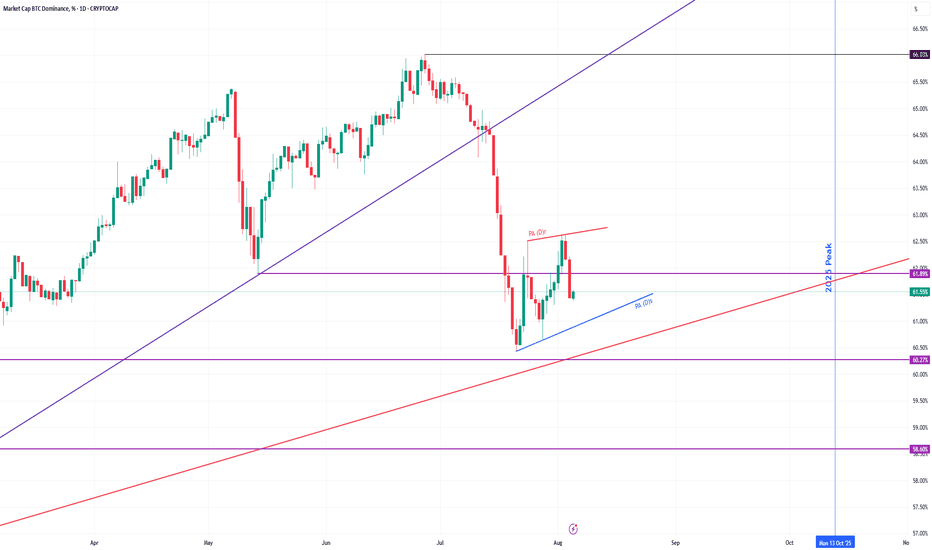

BTCD Bear Market Confirmed · Altcoins Bull Market ConfirmedThis is a rising wedge pattern and it broke for the first time after 792 days. We are looking at Bitcoin Dominance (BTC.D) on the monthly timeframe, super long-term.

A classic long-term double-bottom in 2022 launched a massive uptrend. This uptrend developed within a perfect rising wedge. Last month BTC.D broke this pattern with a full red candle and the highest volume since November 2024.

To add some perspective, the highest volume months were last month (red) and November 2024 (red). The highest volume before these two only happened during the climax of the 2021 bull market, so you can have an idea how strong the volume is this time around.

Since Bitcoin Dominance has an inverse relation with the growth in prices of the Cryptocurrency an Altcoins market, when Bitcoin Dominance was ultra bearish and crashing down, 2021, the Cryptocurrency market was ultra bullish and moving up. Seeing this major long-term signal, the highest bearish volume month to break a 792 days long uptrend, reveals the start of another major crash on this index. The major crash on this index is the confirmation of the late 2025 altcoins bull market.

Bitcoin and the altcoins market will continue growing on all terms.

Thanks a lot for your continued support.

If you agree, leave a comment.

Namaste.

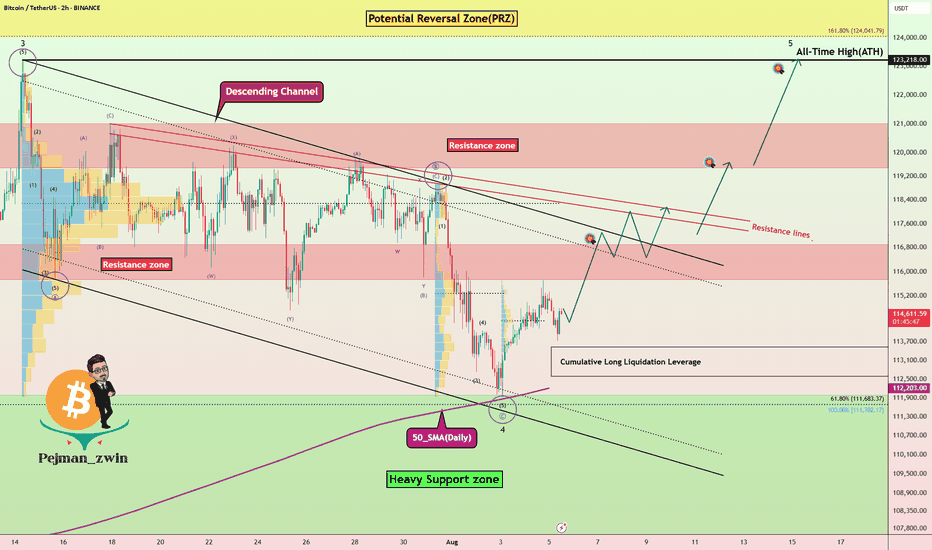

Bitcoin Bounces Back — Is $120K the Next Stop?!Bitcoin ( BINANCE:BTCUSDT ) reacted well to the 50_SMA(Daily) and the Heavy Support zone($112,000-$105,800 and started to rise again.

The question is, can Bitcoin reach $120,000 again and even create a new All-Time High(ATH)!?

In terms of Elliott Wave theory , it seems that Bitcoin has managed to complete the main wave 4 in the descending channel . To confirm the end of the main wave 4 , we must wait for the upper line of the descending channel to break. The structure of the main wave 4 is a Zigzag Correction(ABC/5-3-5) .

I expect Bitcoin to trend higher in the coming hours and attack the resistance area and the upper line of the descending channel(First Target: $117,490) .

Do you think Bitcoin's main correction has begun, or does Bitcoin still have a chance to create a new ATH?

Second target: $119,991

Cumulative Long Liquidation Leverage: $113,526-$112,591

Note: Stop Loss: $111,070

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bitcoin Dominance Update · Daily TimeframeThe rejection is happening right at "strong resistance." Notice that this is the same drawing from my previous update so it was drawn before the fact. Since resistance has been confirmed and the action is happening just as we expected, we can continue to follow our map as it is working.

The next logical move is a drop on Bitcoin Dominance Index (BTC.D), which translates into the resumption of the bullish wave for the altcoins, specially Ethereum and the big projects. It can also signal that Bitcoin will stop dropping and will either consolidate or move higher. This index reveals more than anything else the expected directions of the altcoins.

The retrace is over

The altcoins produced a retrace mainly between 21-July and the 2nd of August. In this period we saw many of the altcoins we are buying and holding move lower but only to produce a strong higher low. This higher low now will resolve into a very strong bullish wave, a bullish resumption.

Moving averages

Here MA200 daily has also been confirmed as resistance and trading below this indicator with a bearish bias, coming from a high point, gives out a very strong bearish signal. It means that long-term bearish action is now in place, the direction/trend. If the action was happening below MA200 but coming from a low point, this signal can have bullish connotations, right now it is bearish.

Bearish Bitcoin Dominance = Bullish Altcoins

The altcoins market will continue to grow, this is only the start. We are set to see growth long-term including now, next week, next month and until late 2025; maybe even for some portion of 2026, maybe even beyond.

Thank you for reading.

Namaste.

Next Volatility Period: Around August 13th (August 12th-14th)

Hello, fellow traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

(USDT 12M Chart)

A lot of money has been flowing into the coin market through USDT.

A decline in USDT indicates capital outflow from the coin market.

(USDT.D 12M chart)

As USDT continues to rise, its dominance naturally rises.

However, if USDT is used to purchase coins (tokens) in the coin market, its dominance will decline.

USDT dominance peaked in 2022 and is showing a downward trend.

This indicates that a significant amount of capital flowing into the coin market was used to purchase coins (tokens).

USDT dominance is expected to fall to around 2.84 this year before beginning an upward trend, marking the end of its three-year bull market.

I believe this trend will inject new vitality into the coin market.

For the coin market to maintain an upward trend, USDT dominance must remain below 4.91 or show a downward trend.

If this fails and the price rises above 4.91, the coin market is likely already in a downward trend.

A decline occurred on May 8, 2025, creating a reverse trend.

To maintain this reverse trend, we need to see if it can fall below 4.24.

If USDT dominance declines, the coin market is likely to show an upward trend.

------------------------------------------------------

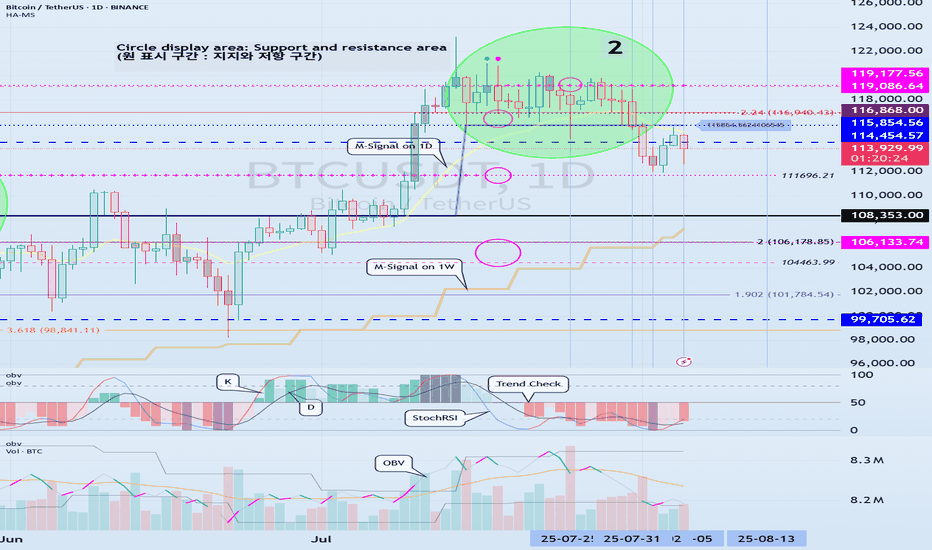

(BTCUSDT 1D chart)

As the new week begins, the HA-High indicator on the 1W chart is showing signs of forming a new level at 114454.57.

Accordingly, the key question is whether the price can rise after finding support in the 114454.57-115854.56 range.

The formation of the HA-High indicator means that the price has fallen from its high.

This also means that further declines are highly likely.

Therefore, if possible, the price should rise above the 114454.57-115854.56 range and maintain its upward momentum.

This period of volatility is expected to last until August 6th.

Therefore, the key question is whether the price can rise above the 114454.57-115854.56 range after the volatility period.

If not, we assume the price will decline until it meets the HA-Low indicator and consider countermeasures accordingly.

This is because the HA-Low and HA-High indicators are paired.

As the price declines, indicators such as the HA-Low or DOM(-60) may appear.

Therefore, if the price declines, you should monitor for the emergence of indicators such as the HA-Low or DOM(-60).

The basic trading strategy is to buy between the DOM(-60) and HA-Low ranges and sell between the HA-High and DOM(60) ranges.

-

If the price falls below the M-Signal indicator on the 1D chart, it is highly likely that the trend will be re-established upon meeting the M-Signal indicator on the 1W chart.

Therefore, if the price fails to rise to the 114454.57-115854.56 range, it is highly likely that the price will eventually meet the M-Signal indicator on the 1W chart.

At this time, a key support and resistance level is expected to be around 108353.0.

When new support and resistance levels are formed, they must remain horizontal for at least three candlesticks to function as support and resistance.

In other words, the HA-High indicator on the 1W chart is showing signs of forming, but it hasn't yet.

Therefore, if the current price holds this week, it will form next week.

Therefore, for the HA-High indicator to function properly as support and resistance, it must remain horizontal for three candlesticks, or three weeks.

This rule must be acquired through significant time and observation.

-

If you sold partially in the 115854.56-119177.56 range according to your basic trading strategy, you will find it easier to observe the current movement. If not, you will likely become anxious.

The key to trading is maintaining a stable psychological state.

If you begin to feel anxious, you should consider how to stabilize your psychological state.

Otherwise, you'll end up making the wrong trades.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

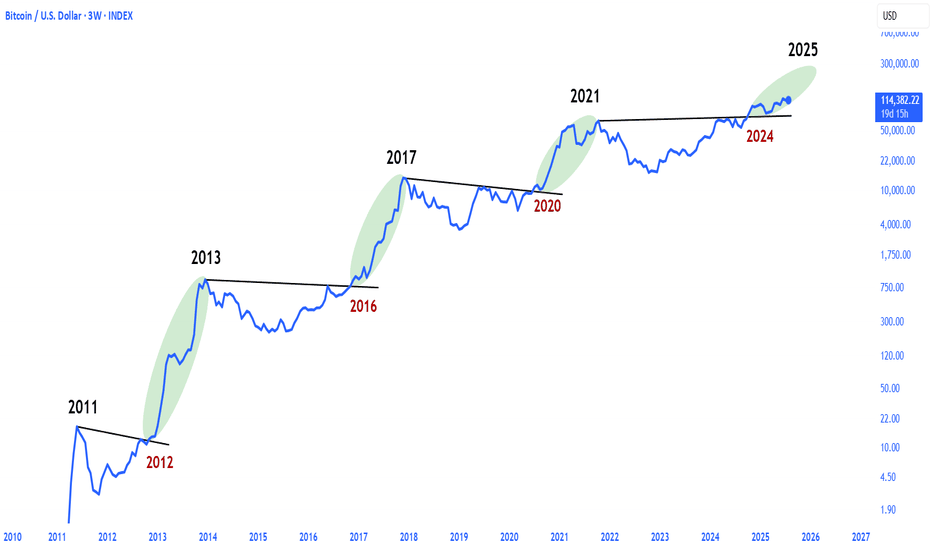

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I'll explain more in detail when the bear market begins.

------------------------------------------------------

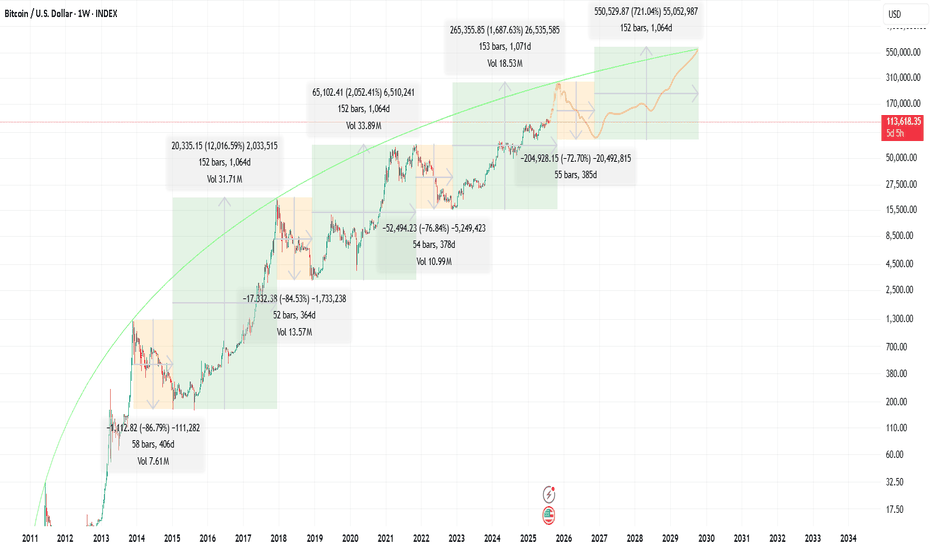

Updated chart: 1050 days of bull, 380 days of bearEach cycle fits quite neatly into ca. 1050 days of bull market and 375 days of bear. Sell in Sep/Oct 2025. Buy in Nov 2026.

An argument can be made that 2021 was a botched bull run. By the time we got to the second peak, Bitcoin was already running out of steam. One single peak would have topped around 100k. I blame SBF/Alameda.

People who are trying to extrapolate/do curve fitting through that 2021 peak will underestimate 2025.

2021 should be ignored as an exception.

BITCOIN Swing Long! Buy!

Hello,Traders!

BITCOIN went down from

The highs but a strong support

Level is below around 112k$

So after the retest we will be

Expecting a local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

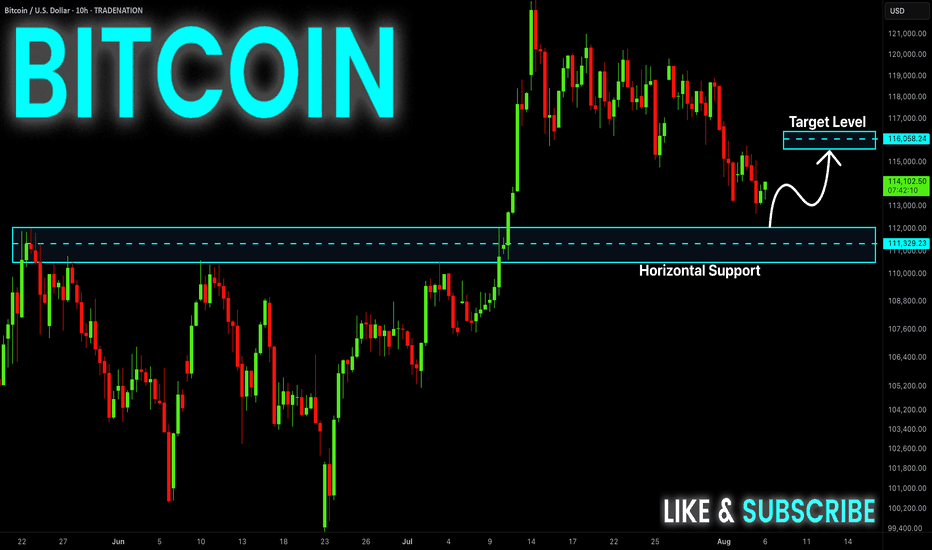

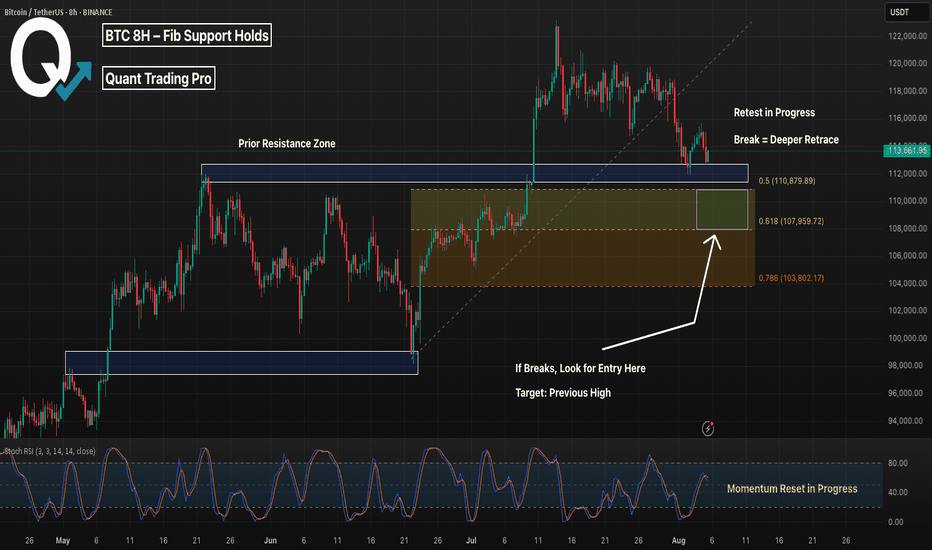

BTC 8H – Fib Support Holds, Will Bulls Defend This Reclaim Zone?Bitcoin is back at a key decision point on the 8H chart — retesting the exact zone it broke out from just two weeks ago. This former resistance has flipped to support, but with momentum cooling off, bulls need to step in fast to avoid a deeper retrace.

🔹 Structure & Levels

Price is hovering inside a reclaimed range (blue box), retesting it from above.

Just below sits the Golden Pocket (0.5–0.618) retracement zone from the July rally — a classic bounce zone if the reclaim fails.

The 0.5 level at $110,879 aligns with previous consolidation structure, adding extra confluence.

Further below lies the 0.786 at $103,802, which marks invalidation for most swing long setups.

🔹 Momentum Check

The Stoch RSI has started curling down from overbought, suggesting momentum may stall short term.

If bulls can’t defend the current reclaim zone, we could see a flush into the Fib pocket before trend continuation.

🔹 Bias & Trade Idea

Holding this level = bullish continuation toward $118K–$120K range highs.

Lose it cleanly = watch for signs of reversal inside the golden pocket.

Risk is defined, structure is clear — and BTC has a habit of reacting cleanly to these zones.

Are you buying the dip now — or waiting for a cleaner tag of the Fib levels?

Drop your thoughts 👇

BITCOIN PREDICTION: THIS Breaks - and BTC WILL CRASH TO HERE!!!!Yello Paradisers! I’m sharing my Bitcoin prediction with you. We’re using technical analysis on TradingView, specifically Elliott Wave theory.

On the ultra-high time frame, we noticed a Shooting star candlestick pattern. We’re analyzing the channel where the zigzag formation is occurring.

We’re also looking at bearish divergence on the ultra-high time frame chart and the zigzag on the high time frame chart. There’s a bullish divergence visible there. The Fibonacci level at $108,000 is also noteworthy, as is the volume, which shows that bears are still in control on the medium timeframe. We’re also analyzing the head and shoulders target plus bearish divergence on the low time frame. On the low time frame, we’re looking at the impulse of the flat C, which is an expanded flat and is currently creating its fourth wave.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

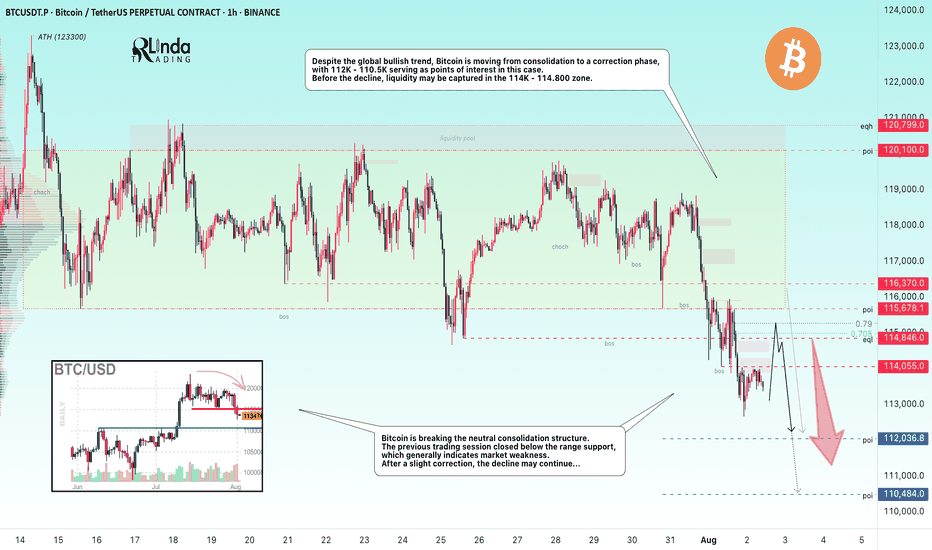

BITCOIN → From consolidation to distribution. Market weaknessBINANCE:BTCUSDT.P is moving from consolidation to a correction phase. The price broke through the support zone of 114.5–115.5, closing within the Friday trading session in the sell zone...

Previous idea from July 22: BITCOIN → Consolidation and compression to 116K. Correction?

The fundamental background is shifting to neutral, the hype has temporarily ended, and there are no bullish drivers yet. And for the health of the market, a correction is needed. Bitcoin is breaking the neutral consolidation structure. The previous trading session closed below the support range, which generally indicates market weakness. Despite the global bullish trend, Bitcoin is moving from consolidation to a correction phase, with 112K - 110.5K serving as points of interest in this case. Before the fall, liquidity may be captured in the 114K - 114.800 zone.

Resistance levels: 114.05, 114.85, 115.67

Support levels: 112.03, 110.48

After a strong movement, the market may enter a correction or local consolidation, during which it may test the specified resistance zones before continuing its downward movement to the zone of interest and liquidity at 112 - 110.5.

Best regards, R. Linda!

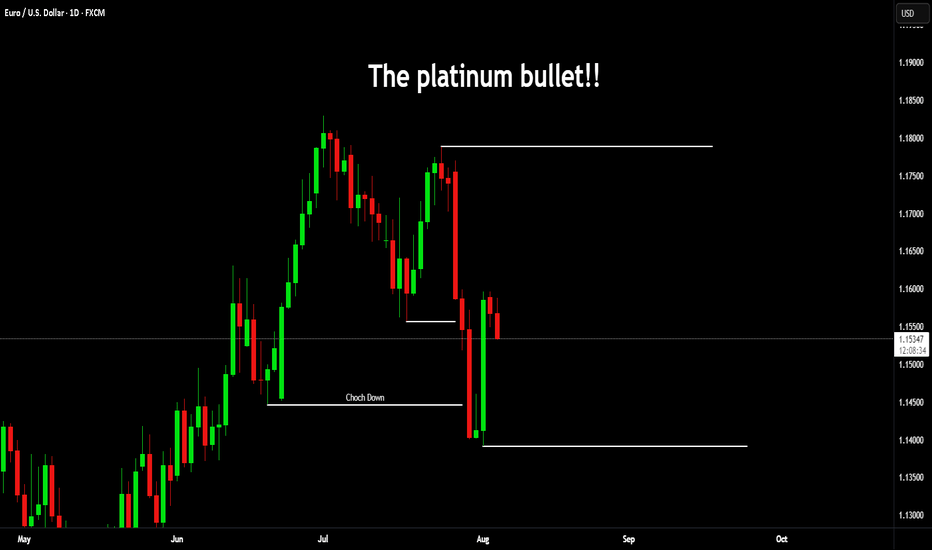

The Platinum BulletOver the years, I have posted a lot of educational content here on TradingView. Everything from Elliot waves to Wyckoff, psychology to Gann.

I have been lucky as a trader, 25 years doing this you pick up a thing or two. But above everything else, what you realise is that trading is a mindset game and not a technical one.

Many new traders try their luck. They are either experts in another field or simply successful in something else, or they come to the trading arena seeking wealth.

Both tend to get humbled quickly.

It is common for many new traders to put so much emphasis on the strategy, they overlook the psychology. You see, a strategy might work for someone, but you can't get it to work for you. This could simply be the time on the charts you lack, the timeframe or the instrument you are trading. The account balance or the fact you are not used to seeing 3-4 losses in a row.

When it comes to trading, less really is more!

Here's a simple one for you.

Take the mechanical range post I posted.

Now look at this;

On the larger timeframes we can see clearly the ranges and the supply/demand.

Then dropping down to the daily.

This is where, the technical aspect becomes less important and the psychology behind the move shows it's hand.

I have added volume and the AD line just to show how obvious this can be.

What do you see? Well as the price goes up, the volume goes down, we know we took liquidity to the upside.

So, if nothing else you would anticipate a pullback phase.

Then you get the clarity. Price drops and then pushes back, yet fails to make a new high. Almost like the volume told you it was about to happen.

Where did it pull back to?

Adding a simple volume profile too, from the swing high to the swing low. You can see the majority of the sell off (PoC) happened at a specific price point. Price pulled back to exactly that region before dropping.

The drop caused a local change in character and immediately took out the swing low - the last swing low of the leg up. (the real change in the trend).

There is obviously more to cover than this, but that is for another post.

Once you learn the way markets capitalise on the fear, the greed, the herd mindset, sentiment of the retail crowd. You can use the sentiment analysis in your favour.

You don't need 6 screens, fancy indicators, there is no silver bullet or 100% win rate strategies. And no a bot won't make you a Billionaire overnight.

If it was that easy, we would have no doctors, lawyers or firefighters; they would all be professional Bot traders.

Simplify your approach, put emphasis on the proper mindset, psychology and risk management and you will do alright!

Stay safe in the markets!

Some other recent posts;

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

TradeCityPro | Bitcoin Daily Analysis #144👋 Welcome to TradeCity Pro!

Let’s dive into Bitcoin analysis. Today is the first day of the week and Bitcoin has made a bullish move.

⏳ 4-Hour Timeframe

After the weekly candle closed, Bitcoin made an upward move and pulled back up to the 0.5 Fibonacci zone.

✔️ The long trigger I provided yesterday in the 1-Hour timeframe has been activated. If you opened a short-term position, it has likely already hit the target. If it was a long-term position with a larger stop, then it should still be open for now.

💫 The current 4-Hour candle has wicked into the 0.5 Fibonacci zone, which indicates a strong rejection from this area. If the candle closes red, the probability of starting the next bearish wave will increase significantly.

📊 Besides the resistance from the Fibonacci level, the SMA25 is also overlapping with this zone, so this upward move could also be seen as a pullback to the SMA25 before another drop begins.

✨ However, the candle hasn't closed yet, so it's too early to decide anything. In my opinion, Bitcoin has re-entered a choppy and sideways phase that doesn’t provide good and clean positions — most trades like yesterday’s need to be scalps.

🔍 If a deeper correction happens, our lower support levels are already identified (with the most important one being the 110000 zone). For shorts, I’ll look for entries below 110000. As for longs, I’ll wait for confirmation and stabilization above 116000. For now, I’m only observing this box between 110000 and 116000.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Will MNT/USDT 5x to 10x Potential Post BreakoutTSX:MNT Forming Bullish Structure – 5x to 10x Potential Post Breakout

#MNT is currently trading very close to a major resistance level at $0.82.

We’re waiting for a clean breakout above this zone. Once confirmed, price can potentially deliver a 5x–10x move in the coming days.

If price retraces, the best long-term entry zone would be around $0.70–$0.60 — right inside the accumulation box.

This bull run has strong structural support around $0.55–$0.50. As long as we stay above this zone, we remain highly confident in the upside move toward $5.

Key levels to watch:

Accumulation Zone: $0.60 – $0.70

Resistance: $0.82

Support: $0.50 – $0.55

Bull Run Targets: $1.42 / $3 / $5

NFA & DYOR

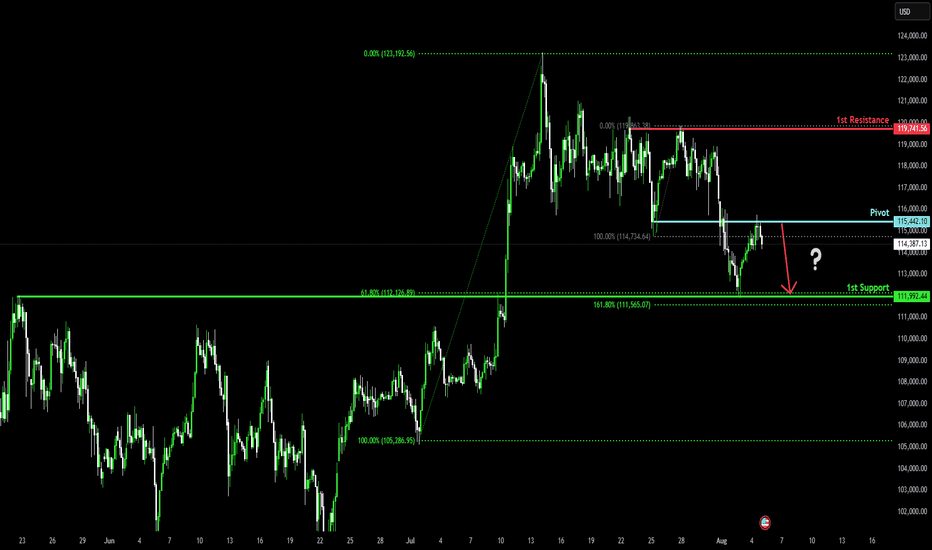

Bearish drop?Bitcoin (BTC/USD) has rejected off the pivot and could drop to the 1st support, which aligns with the 61.8% Fibonacci retracement.

Pivot: 115,442.10

1st Support: 111,992.44

1st Resistance: 119,741.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

BTC.DChart Overview (1D TF – BTC Dominance):

1. Pattern in Play: Rising Wedge (Bearish Bias)

The chart shows a rising wedge pattern forming with:

Support line (PA (D)s) in blue, sloping upwards.

Resistance line (PA (D)r) in red, also sloping up, but less steep.

This pattern typically has a bearish outcome, especially when formed during a downtrend as we see post-June.

Price is nearing the apex of the wedge, meaning a breakout (likely down) could be imminent.

2. Key Horizontal Support and Resistance Levels

Support at 60.27%: Price previously bounced from this level—very significant zone.

Resistance at 61.89%: Acting as a key ceiling; price got rejected here recently.

66.03% (Top Black Line): Major macro resistance and the 2025 peak trendline intersects near that level around October.

3. Trendlines and Long-Term Context

Macro Uptrend Support in red intersects around the 61.89%–62% zone in early October. If dominance holds this zone and bounces upward from the rising wedge, this trendline becomes crucial support.

Previous Uptrend Line (purple) was broken significantly in June, which triggered the sharp drop. BTC dominance lost momentum and is now in recovery/decision zone.

Interpretation:

Short-Term Bias: Neutral to Bearish

As price is within a rising wedge post-downtrend, the probability of breakdown is higher.

Failure to break above 61.89% again and maintain momentum suggests downside towards 60.27% or even 58.60%.

Medium-Term Possibility:

If price breaks down from the wedge, support zones are:

60.27%

Then 58.60%

If price breaks up, it will need to reclaim 61.89% cleanly, then test toward 64%–66%.

Macro Trendline Intersection (~Oct 13): Could be a major decision point aligning with fundamental crypto market catalysts. Dominance could break sharply above or below that time depending on broader crypto cycles.

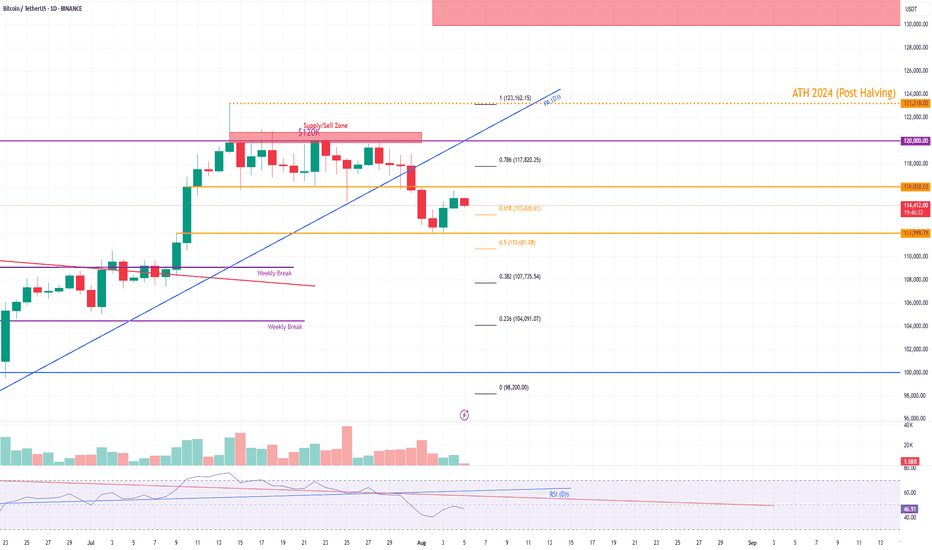

BTC PA📊 Price Action Analysis

Rejection at Major Supply Zone ($120K)

Price reached a strong supply/sell zone between $120K and $123K, marked in red.

$120,000: Psychological round number — major supply area.

Price got rejected after multiple days of consolidation under this level.

Support, Resistance Levels and Trendlines

$116,010: Horizontal S/R — acted as temporary support, now resistance.

$111,999.79: Key horizontal support.

Blue PA (D)s trendline has been broken bearishly — indicating a change in short-term market structure.

Momentum is currently in a pullback/retracement phase after strong rally from late June to mid-July.

Volume Analysis

Volume is declining during the pullback — typical of retracements and not full-blown reversals.

No major volume spike indicating panic selling.

Fibonacci Retracement Analysis (Recent Swing High to Swing Low)

Key levels:

0.786: $117,820.25 — Rejected here.

0.618: $113,626.61 — Currently testing this level, price slightly above.

0.5: $110,681.08 — Next support if rejection at 0.618 persists.

0.382: $107,735.54

0.236: $104,091.07

0%: $98,200.00 — Full retracement base.

Price is showing hesitation at the 0.618, which is a crucial level in Fibonacci theory. A break and hold below this could accelerate the drop toward $110.6K and beyond.

RSI Analysis (Daily)

RSI is around 46.46 — moving below midline (50), showing weakening momentum.

Bearish divergence confirmed: price made a higher high while RSI made a lower high → bearish reversal signal.

Bullish if:

BTC reclaims $116K, closes above $120K — invalidates rejection.

RSI bounces from current level with volume support.

Bearish Bias:

Currently, structure broke down.

Testing 0.618 Fib level; failure here likely brings price to: $110,681